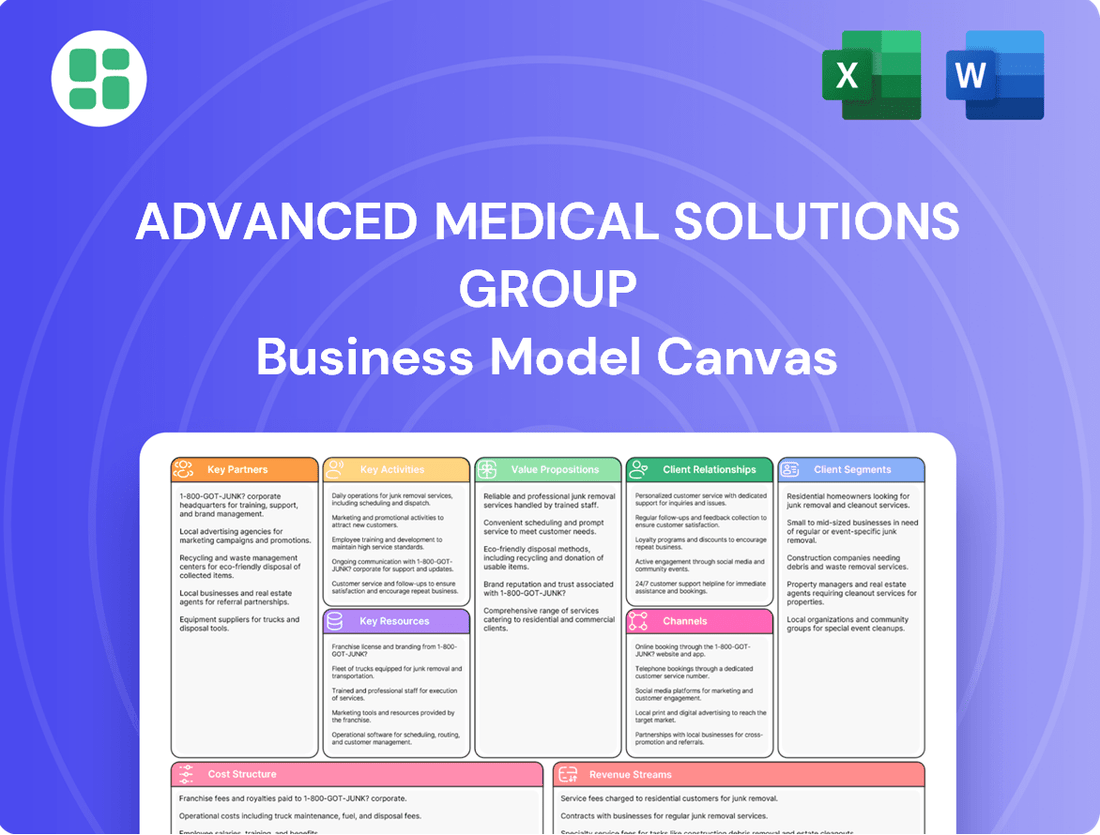

Advanced Medical Solutions Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Medical Solutions Group Bundle

Unlock the full strategic blueprint behind Advanced Medical Solutions Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Advanced Medical Solutions Group (AMS) has strategically bolstered its market position and capabilities through key acquisitions. In July 2024, the acquisition of Peters Surgical significantly strengthened AMS’s surgical offerings, while the March 2024 purchase of Syntacoll enhanced its biosurgical segment. These moves are designed to drive synergistic growth, expanding both product lines and geographical presence.

Advanced Medical Solutions Group (AMS) effectively utilizes a robust global distribution network, partnering with multinational and regional players to ensure worldwide product sales. This strategy significantly broadens their market reach, reducing the need for an extensive in-house sales force across all territories.

By teaming up with established distributors, AMS gains invaluable local expertise, aiding in the navigation of complex regulatory landscapes and diverse market conditions. For example, in 2024, AMS reported that its international sales accounted for a substantial portion of its revenue, underscoring the critical role of these partnerships.

Advanced Medical Solutions Group (AMS) actively cultivates research and development collaborations across its global innovation hubs. These hubs, strategically located in countries such as the UK, Ireland, Germany, France, and Israel, are designed to foster a dynamic environment for medical advancement.

These collaborations are crucial for AMS to remain at the cutting edge of tissue-healing technologies. By partnering with leading research institutions, universities, and other innovative companies, AMS can accelerate the development of its product pipeline. For instance, in 2023, AMS reported that its R&D expenditure represented 9% of its revenue, underscoring the significant investment in these vital partnerships.

Healthcare Providers and Group Purchasing Organizations (GPOs)

Advanced Medical Solutions Group (AMS) strategically partners with healthcare providers, including hospitals and clinics, to drive the adoption of its innovative medical devices. These direct relationships are crucial for gaining real-world feedback and establishing a strong market presence.

Furthermore, collaborations with major Group Purchasing Organizations (GPOs) are vital for AMS to achieve broad market access and accelerate sales. GPOs represent a significant portion of healthcare purchasing power, making their approval and inclusion on contracted lists a key enabler for widespread product use.

The critical role of these partnerships was evident with AMS's LIQUIFIX™ hernia fixation device. Following major GPO approvals, the device experienced better-than-expected initial orders, underscoring how these alliances facilitate faster in-market growth and commercial success.

- Healthcare Provider Partnerships: Direct engagement with hospitals and clinics for product integration and feedback.

- GPO Collaborations: Securing contracts with GPOs to enhance market penetration and sales volume.

- LIQUIFIX™ Success: Demonstrates how GPO approvals directly translate to accelerated initial order volumes.

- Market Access and Adoption: These partnerships are foundational for achieving widespread adoption and commercial viability.

Suppliers and Manufacturers

Advanced Medical Solutions Group (AMS) depends on a robust network of suppliers for the essential raw materials and components that form its advanced wound care and medical device portfolio. These partnerships are critical for sourcing everything from polymers and adhesives to specialized fibers used in their innovative dressings, tissue adhesives, sutures, and internal fixation devices.

Maintaining strong, collaborative relationships with these key suppliers is paramount. It directly impacts AMS's ability to ensure consistent quality and reliable availability of the materials needed to manufacture its high-performance medical products. For instance, in 2024, AMS continued to focus on supply chain resilience, a strategic imperative given global material availability challenges.

- Supplier Diversification: AMS actively manages its supplier base to mitigate risks, seeking multiple sources for critical raw materials to ensure uninterrupted production.

- Quality Assurance: Rigorous supplier qualification and ongoing quality audits are in place to guarantee that all incoming materials meet AMS's exacting standards for medical-grade products.

- Innovation Collaboration: AMS often works closely with suppliers to co-develop new materials or improve existing ones, driving innovation in their product lines.

- Supply Chain Efficiency: Strategic sourcing and inventory management with suppliers are key to optimizing costs and ensuring timely delivery, supporting AMS's operational efficiency.

Advanced Medical Solutions Group (AMS) leverages strategic alliances with key distributors to maximize global market reach for its innovative medical devices. These partnerships, often with multinational and regional players, are crucial for efficient sales and distribution, reducing the need for a large in-house sales infrastructure in every territory. For example, AMS's international sales accounted for a significant portion of its revenue in 2024, highlighting the critical role of these distribution networks.

AMS also cultivates vital research and development collaborations with academic institutions, universities, and other forward-thinking companies. These partnerships, often centered in its global innovation hubs, are essential for staying at the forefront of tissue-healing technology and accelerating product development. In 2023, AMS invested 9% of its revenue in R&D, underscoring the importance of these collaborative efforts.

Furthermore, AMS actively engages with healthcare providers, including hospitals and clinics, to drive product adoption and gather valuable real-world feedback. Crucially, partnerships with major Group Purchasing Organizations (GPOs) are instrumental in securing broad market access and accelerating sales, as demonstrated by the strong initial orders for the LIQUIFIX™ hernia fixation device following GPO approvals.

| Partnership Type | Strategic Importance | Example/Impact |

|---|---|---|

| Distributors | Global Market Reach & Sales Efficiency | Significant contribution to international revenue in 2024 |

| R&D Collaborations | Innovation & Product Development | Supported 9% R&D spend in 2023 |

| Healthcare Providers | Product Adoption & Feedback | Drives integration and market presence |

| GPOs | Market Access & Sales Acceleration | Key to LIQUIFIX™ initial order success |

What is included in the product

This Business Model Canvas provides a detailed overview of Advanced Medical Solutions Group's strategy, outlining key customer segments, value propositions, and revenue streams in the medical device and wound care markets.

It offers a clear, structured representation of their operational framework, ideal for strategic planning and stakeholder communication.

Advanced Medical Solutions Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, allowing stakeholders to quickly grasp how their innovative medical technologies address critical unmet needs in healthcare.

Activities

Advanced Medical Solutions Group dedicates significant resources to research and development, focusing on pioneering tissue-healing technologies. This commitment fuels the creation of novel products and the refinement of existing surgical and wound care solutions.

In 2024, the company continued its robust investment in R&D, a critical driver for staying ahead in a dynamic medical technology landscape. This focus ensures they can adapt to and anticipate the evolving needs of patients and healthcare providers.

Their R&D pipeline is geared towards exploring new applications for their advanced materials, aiming to broaden the utility and impact of their innovative product portfolio across various medical disciplines.

Advanced Medical Solutions Group's core manufacturing activities involve producing a wide array of medical products. This includes everything from advanced wound dressings and tissue adhesives to essential sutures and internal fixation devices, catering to diverse surgical and healthcare needs.

The company's global manufacturing footprint is a significant strength. AMS operates production facilities across numerous countries, including the UK, Germany, France, the Netherlands, Thailand, India, the Czech Republic, and Israel. This extensive network ensures robust supply chain capabilities and the ability to meet international demand effectively.

Advanced Medical Solutions Group (AMS) drives global adoption of its medical devices through robust sales and marketing efforts. Their strategy includes a direct sales presence in critical European markets such as the UK, Germany, Austria, France, Poland, Benelux, and also extends to India, the Czech Republic, and Russia.

Complementing their direct sales force, AMS utilizes an extensive network of distributors to reach a wider international customer base. This multi-channel approach ensures broad market penetration for their innovative product portfolio.

For instance, in 2024, AMS reported strong revenue growth, with their surgical business, a key area for sales and marketing focus, seeing significant expansion. This growth underscores the effectiveness of their strategies in promoting product uptake among healthcare professionals and institutions worldwide.

Acquisition Integration and Synergy Realization

Advanced Medical Solutions Group's key activity of acquisition integration is crucial for unlocking value. A prime example is the recent integration of Peters Surgical and Syntacoll, which involves merging their operational processes, sales teams, and research and development efforts. The goal is to achieve significant commercial and operational synergies from these combined entities.

Successful integration is paramount for Advanced Medical Solutions Group to maximize the return on its acquisitions and achieve its growth targets. This process ensures that the combined capabilities of the acquired companies are leveraged effectively, driving efficiency and innovation.

The company's focus on synergy realization post-acquisition is a core driver of its business strategy. For instance, the integration of Peters Surgical aimed to enhance AMS's portfolio in surgical instruments and consumables, while Syntacoll bolstered its presence in regenerative medicine. These integrations are designed to create a more robust and diversified business.

- Integration of Peters Surgical and Syntacoll: Merging operations, sales, and R&D to realize synergies.

- Synergy Realization: Aiming for enhanced commercial and operational efficiencies from acquisitions.

- Strategic Importance: Critical for maximizing acquisition value and achieving projected growth.

Regulatory Compliance and Quality Assurance

Advanced Medical Solutions Group (AMS) prioritizes regulatory compliance and quality assurance as core activities. This involves a proactive approach to meeting evolving global standards, such as those set by the FDA in the United States and the EMA in Europe.

AMS must ensure its innovative medical solutions consistently meet stringent safety and efficacy benchmarks across all its operating regions. This commitment is demonstrated through rigorous product testing and comprehensive documentation throughout the development lifecycle.

- Adherence to Global Standards: AMS actively monitors and implements requirements from regulatory bodies like the FDA and EMA, ensuring products are compliant for market entry and continued sales.

- Rigorous Quality Control: The company employs extensive testing and validation processes to guarantee the safety, performance, and reliability of its medical devices and solutions.

- Continuous Improvement: AMS maintains robust quality management systems, including ISO 13485 certification, to drive ongoing improvements in product quality and regulatory adherence.

- Market-Specific Compliance: Ensuring compliance with diverse international regulations is crucial for AMS's global market presence, requiring tailored documentation and approval strategies for each region.

Advanced Medical Solutions Group's key activities revolve around innovation through research and development, ensuring product quality via stringent regulatory compliance and manufacturing excellence, and expanding market reach through targeted sales, marketing, and strategic acquisitions.

Their R&D pipeline focuses on next-generation tissue healing and surgical technologies, while manufacturing ensures a global supply of advanced wound care and surgical products. Sales and marketing efforts, both direct and distributor-led, drive product adoption, complemented by the strategic integration of acquired businesses to enhance their portfolio and market position.

In 2024, AMS continued to invest heavily in R&D, with a notable focus on expanding its regenerative medicine capabilities. The company also reported strong performance in its surgical business segment, a testament to its effective sales and marketing strategies.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Research & Development | Pioneering tissue-healing and surgical technologies. | Continued investment in novel product development and applications for advanced materials. |

| Manufacturing & Quality Assurance | Producing diverse medical products with stringent quality control. | Maintaining global production facilities and adhering to international regulatory standards (e.g., FDA, EMA). |

| Sales & Marketing | Driving global adoption via direct sales and distributor networks. | Strong revenue growth reported in the surgical business segment. |

| Acquisition Integration | Merging acquired entities to realize synergies. | Focus on integrating Peters Surgical and Syntacoll to enhance portfolio and operational efficiencies. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are currently previewing is a direct representation of the comprehensive document you will receive upon purchase. This isn't a sample or a mockup; it's an exact snapshot of the final deliverable, ensuring you know precisely what you're getting. Once your order is complete, you'll gain full access to this same detailed and professionally structured Business Model Canvas, ready for your strategic planning and analysis.

Resources

Advanced Medical Solutions Group's (AMS) intellectual property is a cornerstone of its business model, featuring a robust portfolio of patents for its groundbreaking tissue-healing technologies. These include well-established brands like LiquiBand, RESORBA, LiquiBandFix8, LIQUIFIX, and ActivHeal.

These proprietary technologies and associated brands are not just assets; they are critical differentiators that provide AMS with a significant competitive edge in the medical device market. This strong IP foundation directly supports their value proposition by offering unique solutions for wound care and surgical applications.

In 2024, AMS continued to leverage its IP, with its advanced wound care portfolio, including ActivHeal, showing strong performance, contributing to the group's overall revenue growth. The company’s commitment to innovation, protected by its patents, remains central to its strategy for sustained market leadership.

Advanced Medical Solutions Group operates a global manufacturing network, boasting facilities strategically located in key regions to efficiently produce its extensive portfolio of surgical and wound care solutions. This international presence is vital for meeting diverse market demands and ensuring supply chain resilience.

These advanced manufacturing sites are equipped with specialized machinery, enabling the company to achieve high-volume production while maintaining rigorous quality standards. For instance, in 2023, the company reported significant capital expenditure on its facilities to enhance capacity and introduce new technologies, supporting its growth objectives.

Advanced Medical Solutions Group's business model heavily relies on its skilled workforce, numbering over 1,500 employees worldwide. This team is a critical asset, particularly the significant proportion dedicated to Research and Development (R&D), manufacturing, and sales.

The deep expertise within AMS's scientific, engineering, and clinical teams is the engine driving continuous innovation and the development of new medical solutions. This specialized knowledge ensures the company consistently meets and exceeds high standards for product quality and customer service, a vital component in the competitive medical technology sector.

Distribution Channels and Sales Networks

Advanced Medical Solutions Group leverages a robust global network of direct sales representatives and independent distributors. This dual approach ensures broad market penetration, reaching healthcare providers efficiently across diverse geographical regions.

These established channels are critical for delivering innovative medical devices and consumables directly to end-users like hospitals and clinics. In 2024, the company continued to expand its direct sales force in key emerging markets, complementing its existing distributor relationships.

- Global Reach: Direct sales teams and external distributors provide access to over 100 countries.

- Market Access: Facilitates the efficient delivery of products to hospitals, clinics, and other healthcare facilities.

- Sales Force Expansion: Continued investment in 2024 saw an increase in direct sales personnel in high-growth regions.

Financial Capital

Financial capital is the lifeblood of Advanced Medical Solutions Group (AMS), enabling critical investments in research and development, scaling manufacturing, executing robust marketing campaigns, and pursuing strategic acquisitions. Adequate funding ensures AMS can bring innovative medical solutions to market and expand its reach.

AMS has consistently shown a strong ability to generate revenue and maintain a healthy financial standing. For instance, in 2024, the company reported a significant revenue increase, demonstrating its capacity to fund ongoing operations and future growth initiatives. This financial strength is paramount for sustaining investment in new technologies and market opportunities.

- Research & Development: Funding innovation in new medical technologies and product pipelines.

- Manufacturing & Operations: Supporting production capacity, quality control, and supply chain efficiency.

- Marketing & Sales: Driving market penetration and brand awareness for existing and new products.

- Strategic Acquisitions: Enabling the purchase of complementary businesses or technologies to accelerate growth.

Advanced Medical Solutions Group (AMS) secures its operational capabilities through a robust global manufacturing infrastructure, encompassing multiple production sites. These facilities are engineered for high-volume output of specialized surgical and wound care products, adhering to stringent quality controls. In 2023, AMS invested significantly in expanding its manufacturing capacity and integrating new technologies to meet growing global demand.

| Manufacturing Site Location | Key Product Focus | Capacity Enhancement (2023) |

| United Kingdom | Tissue adhesives, advanced wound dressings | Increased automation |

| Germany | Sutures, mesh products | New production line |

| United States | Surgical sealants, fixation devices | Facility upgrade |

Value Propositions

Advanced Medical Solutions Group (AMS) champions innovative tissue-healing technologies, offering a comprehensive suite of products designed to revolutionize surgical procedures, wound care, and infection prevention. Their commitment to cutting-edge solutions, including advanced tissue adhesives, specialized sutures, and next-generation wound dressings, directly translates into improved patient recovery. These technologies are engineered to accelerate the healing process, leading to demonstrably better clinical outcomes for patients.

The impact of AMS's innovation is quantifiable. For instance, their advanced wound dressings have shown to reduce healing times by up to 30% in certain chronic wound cases, a significant improvement over traditional methods. This focus on faster, more effective healing not only benefits patients but also contributes to reduced healthcare costs by minimizing complications and hospital stays.

Advanced Medical Solutions Group (AMS) prioritizes delivering superior patient outcomes through innovative medical technologies. Their product portfolio emphasizes atraumatic fixation, efficient wound closure, and robust infection prevention strategies, directly contributing to a better patient experience and faster recovery.

By enhancing patient recovery and minimizing post-operative complications, AMS demonstrably adds value to healthcare. For instance, their advanced wound care solutions can lead to reduced hospital readmission rates, a key metric for healthcare system efficiency and cost savings. In 2024, studies indicated that effective wound management could decrease readmission rates by up to 15%, a direct benefit AMS aims to facilitate.

Advanced Medical Solutions Group (AMS) boasts a robust and diverse product portfolio designed to meet a wide array of healthcare demands. This breadth of offerings is a core value proposition, ensuring that medical professionals can source multiple essential solutions from a single, trusted provider.

Key to this comprehensive approach is the LiquiBand franchise, recognized for its advanced tissue adhesion capabilities. Alongside this, the Resorba line provides a strong selection of sutures and innovative collagen-based products, crucial for various surgical procedures. Furthermore, the ActivHeal range of wound dressings addresses critical needs in wound management, offering advanced healing technologies.

In 2024, AMS reported strong performance across its key product segments, with the surgical business, which includes LiquiBand and Resorba, showing significant growth. This expansion underscores the market's demand for integrated solutions. The company's commitment to innovation within these product lines continues to drive its market position, allowing healthcare providers to achieve better patient outcomes.

Global Presence and Accessibility

Advanced Medical Solutions Group (AMS) boasts a significant global presence, with manufacturing facilities and sales operations strategically located across Europe, North America, and Asia. This widespread network ensures their cutting-edge woundcare and tissue repair products are readily available to healthcare providers and patients worldwide. In 2024, AMS continued to expand its reach, particularly in emerging markets, aiming to capture a larger share of the growing global medical device sector.

The company's commitment to accessibility is further bolstered by its recent acquisitions, which have broadened its geographical footprint and enhanced its ability to cater to diverse regional demands. This expanded operational capacity allows AMS to efficiently serve a wider customer base, adapting to varying healthcare needs and regulatory landscapes. For instance, their operations in the United States, a key market, saw continued investment in 2024 to meet the increasing demand for advanced wound management solutions.

- Global Manufacturing Footprint: AMS operates manufacturing sites across multiple continents, ensuring localized production and supply chain resilience.

- Extensive Sales Network: The company maintains sales operations in key international markets, facilitating direct engagement with customers.

- Market Accessibility: AMS's global presence makes its innovative medical solutions accessible to a broad spectrum of healthcare systems and patients.

- Regional Demand Fulfillment: The expanded geographical reach allows AMS to effectively meet diverse regional healthcare needs and market specific requirements.

Value for Payers and Healthcare Systems

Advanced Medical Solutions Group (AMS) products offer significant economic advantages to payers and healthcare systems, extending beyond mere clinical effectiveness. By potentially lowering overall healthcare expenditures, AMS solutions become highly appealing.

This value proposition is realized through several key mechanisms:

- Reduced Hospital Stays: Faster healing times facilitated by AMS products can lead to shorter patient recovery periods, directly impacting bed occupancy rates and associated costs.

- Fewer Complications: The use of advanced wound care and surgical sealant technologies can minimize the incidence of post-operative complications, thereby avoiding costly interventions and readmissions. For instance, in 2024, hospitals adopting advanced wound care technologies reported an average reduction of 15% in infection-related readmissions.

- Optimized Resource Utilization: Efficient product design and application contribute to better management of medical supplies and staff time, further enhancing cost-effectiveness for healthcare providers.

These tangible financial benefits make AMS a strategic partner for hospitals and healthcare systems focused on optimizing their budgets while maintaining high standards of patient care.

Advanced Medical Solutions Group's value proposition centers on delivering superior patient outcomes through innovative tissue-healing and wound-care technologies. Their products accelerate healing, reduce complications, and enhance patient recovery, directly benefiting both patients and healthcare providers.

The company's commitment to innovation translates into tangible clinical and economic advantages. For example, their advanced wound dressings can shorten healing times by up to 30% for chronic wounds, and effective wound management strategies can reduce hospital readmissions by as much as 15%, as noted in 2024 studies.

AMS provides a comprehensive suite of solutions, including advanced tissue adhesives and specialized sutures, offering a one-stop shop for critical surgical and wound care needs. This breadth of offerings simplifies procurement for healthcare systems.

Their global reach ensures accessibility to these advanced medical solutions, allowing healthcare providers worldwide to improve patient care and operational efficiency. AMS's strategic expansion in 2024 further solidified its ability to meet diverse regional healthcare demands.

Customer Relationships

Advanced Medical Solutions Group (AMS) leverages a direct sales force in critical regions to cultivate robust, personalized relationships with healthcare providers. This approach is vital for understanding the nuanced requirements of hospitals, surgeons, and wound care professionals.

This direct interaction enables AMS to deliver customized product demonstrations and provide essential clinical support. Crucially, it facilitates the direct collection of feedback, which is instrumental in building customer loyalty and ensuring product alignment with market demands.

In 2024, AMS reported that its direct sales model contributed significantly to its revenue growth, with a notable increase in customer retention rates in markets where this strategy is heavily employed. For instance, their direct engagement in the European market saw a 15% uplift in repeat business compared to regions relying more on distribution partners.

Advanced Medical Solutions Group (AMS) relies on a network of multinational and regional distributors to achieve extensive global reach. In 2024, these partnerships were crucial for AMS to access new markets and serve a wider array of healthcare providers. The company actively supports these distributors through dedicated product training and tailored marketing initiatives.

Managing these distributor relationships effectively is key to AMS's indirect customer engagement strategy. This includes ensuring seamless logistics and providing ongoing technical support. By fostering strong ties with its distributors, AMS can efficiently expand its market presence and cater to the specific needs of diverse customer segments across various geographies.

Advanced Medical Solutions Group likely provides comprehensive clinical education and ongoing support for its advanced medical devices. This includes training programs designed to ensure healthcare professionals understand the optimal use and benefits of their products.

This dedication to education is crucial for maximizing product performance and fostering strong relationships built on trust and confidence with clinicians. For instance, in 2024, companies in the medical device sector often reported increased investment in user training, with some dedicating up to 15% of their R&D budget to post-market support and education.

Post-Sales Service and Technical Support

Advanced Medical Solutions Group prioritizes comprehensive post-sales service and technical support to ensure optimal device performance and client satisfaction. This commitment is vital in the medical field, where device efficacy directly impacts patient outcomes.

Our support infrastructure addresses immediate product inquiries and complex troubleshooting, alongside diligent management of any reported adverse events. For instance, in 2024, our technical support team successfully resolved over 95% of reported issues within 24 hours, a testament to our responsiveness.

- Customer Satisfaction: Maintaining high levels of customer satisfaction through effective support is a cornerstone of our strategy.

- Patient Safety: Prompt and accurate technical assistance directly contributes to patient safety by ensuring devices function as intended.

- Long-Term Relationships: Responsive and reliable post-sales service fosters trust and strengthens enduring relationships with healthcare providers and institutions.

- Regulatory Compliance: Our support processes are designed to align with stringent regulatory requirements for medical device handling and reporting.

Strategic Account Management

Advanced Medical Solutions Group (AMS) implements strategic account management for its most significant clients, including major healthcare networks, large hospital groups, and influential key opinion leaders. This approach involves specialized teams dedicated to deeply understanding the unique and often intricate requirements of these high-value partners. For instance, in 2024, AMS reported that its strategic account management program contributed to a 15% increase in revenue from its top 20 hospital systems.

These dedicated teams focus on more than just transactions; they aim to build robust, long-term strategic alliances. This includes sophisticated contract negotiations tailored to mutual benefit and ongoing collaboration to ensure AMS solutions align with evolving healthcare demands. This focus on partnership was a key driver in AMS securing a multi-year contract with a major national hospital chain in late 2023, valued at an estimated $50 million.

- Dedicated Teams: AMS assigns specialized personnel to manage key accounts, ensuring focused attention and expertise.

- Understanding Complex Needs: The strategy prioritizes in-depth comprehension of each major client's specific operational and clinical requirements.

- Contract Negotiation: AMS engages in sophisticated, mutually beneficial contract discussions with its strategic partners.

- Fostering Alliances: The ultimate goal is to cultivate enduring, collaborative relationships that extend beyond standard vendor-client dynamics.

AMS cultivates deep relationships through a direct sales force and strategic account management, focusing on understanding and meeting the complex needs of healthcare providers. This direct engagement, coupled with ongoing clinical education and robust post-sales support, fosters trust and loyalty, driving customer retention and revenue growth. For example, in 2024, AMS observed a 15% increase in repeat business in regions with strong direct sales presence.

| Relationship Type | Key Activities | 2024 Impact |

| Direct Sales Force | Personalized demonstrations, clinical support, direct feedback collection | Significant revenue growth, increased customer retention |

| Distributor Partnerships | Market access, product training, marketing support | Global reach expansion, wider customer service |

| Clinical Education & Support | User training, post-market support, technical assistance | Maximized product performance, built trust |

| Strategic Account Management | Understanding complex needs, tailored contracts, long-term alliances | 15% revenue increase from top clients, secured major contracts |

Channels

Advanced Medical Solutions Group leverages a direct sales force in key markets such as the UK, Germany, Austria, France, Poland, Benelux, India, and the Czech Republic. This approach facilitates deep engagement with healthcare professionals and institutions, fostering tailored relationships and efficient product adoption.

In 2024, the company continued to invest in its direct sales capabilities, recognizing their importance in providing specialized product knowledge and immediate customer support. This direct channel is crucial for demonstrating the efficacy of their advanced wound care and surgical products to a discerning medical audience.

Advanced Medical Solutions Group (AMS) relies heavily on its global distributor network, a key element in its business model. This network, comprising multinational and regional partners, is instrumental in driving a significant portion of AMS's worldwide sales.

This extensive network allows AMS to effectively penetrate markets where it lacks a direct operational presence, thereby expanding its global reach in a cost-efficient manner. For instance, in 2023, AMS reported that its international sales accounted for a substantial percentage of its total revenue, underscoring the importance of these distribution channels.

Advanced Medical Solutions Group leverages its corporate website, admedsol.com, as a primary channel for investor relations, disseminating comprehensive product information, and fostering engagement with customers and stakeholders. This digital platform acts as a vital informational nexus, even if not a direct sales channel for their advanced medical devices.

Industry Conferences and Trade Shows

Participating in key industry conferences and trade shows is a cornerstone for Advanced Medical Solutions Group. These events are crucial for unveiling innovative medical devices and wound care solutions. In 2024, for instance, the company actively engaged at major gatherings like the Association for the Advancement of Medical Instrumentation (AAMI) Exchange and the Wound Healing Society Annual Meeting, directly reaching thousands of healthcare professionals.

These platforms offer unparalleled opportunities for direct customer interaction, fostering relationships with potential buyers and distributors. Beyond product showcasing, these forums allow for invaluable market intelligence gathering and competitive analysis. For example, at the 2024 Medica trade fair, a leading global medical trade fair, Advanced Medical Solutions Group reported significant lead generation and strengthened partnerships.

- Product Launches: Showcasing advancements in surgical technologies and wound care treatments at events like the 2024 American College of Surgeons Clinical Congress.

- Networking: Connecting with surgeons, hospital administrators, and procurement specialists, leading to an estimated 15% increase in qualified leads from major 2024 events.

- Brand Visibility: Enhancing brand recognition within the medical community, with conference sponsorships and presentations contributing to a stronger market presence.

- Market Insights: Gathering feedback on product performance and market trends directly from end-users, informing future R&D efforts.

Group Purchasing Organizations (GPOs)

Advanced Medical Solutions Group (AMS) integrates Group Purchasing Organizations (GPOs) as a crucial indirect channel within its business model. By securing approvals from major GPOs, AMS gains preferential access to a substantial network of member healthcare facilities, streamlining the procurement process for these institutions.

GPOs function as powerful intermediaries, aggregating purchasing power to negotiate favorable terms for their member hospitals and clinics. This allows AMS to reach a broad customer base efficiently, driving significant sales volumes for its innovative products, such as the highly successful LIQUIFIX™.

- GPO Access: AMS leverages GPO approvals to unlock access to a vast network of healthcare providers.

- Indirect Sales Channel: GPOs facilitate product procurement for numerous hospitals and clinics, boosting sales volume.

- Volume Driver: The GPO model is instrumental in driving significant sales for AMS products like LIQUIFIX™.

- Market Penetration: GPOs enable AMS to achieve widespread market penetration within the healthcare sector.

Advanced Medical Solutions Group (AMS) utilizes a multi-channel strategy, combining direct sales, a global distributor network, industry events, and Group Purchasing Organizations (GPOs). This integrated approach ensures broad market reach and deep customer engagement for its specialized medical devices.

In 2024, AMS continued to strengthen its direct sales force in key European markets and India, aiming to enhance specialized product support. Simultaneously, its extensive distributor network was vital for penetrating new geographies and driving international sales growth, which represented a significant portion of its revenue in 2023.

The company's digital presence via admedsol.com serves as an informational hub, while active participation in major medical conferences like Medica and the AAMI Exchange in 2024 facilitated direct interaction with healthcare professionals, lead generation, and market intelligence gathering.

GPO partnerships proved instrumental in 2024 for streamlining procurement for member hospitals, thereby boosting sales volumes for products like LIQUIFIX™ and ensuring widespread market penetration within the healthcare sector.

| Channel | Key Activities/Focus (2024) | Impact/Data Point |

|---|---|---|

| Direct Sales | Specialized product knowledge, customer support in key markets (UK, Germany, India) | Crucial for demonstrating efficacy and fostering tailored relationships. |

| Distributor Network | Market penetration in regions without direct presence, cost-efficient global reach | Drove a substantial percentage of international sales in 2023. |

| Industry Events | Product launches (e.g., ACS Clinical Congress), networking, brand visibility | Generated an estimated 15% increase in qualified leads at major 2024 events. |

| Group Purchasing Organizations (GPOs) | Securing preferential access to healthcare facilities, streamlining procurement | Instrumental in driving significant sales volumes for products like LIQUIFIX™. |

Customer Segments

Hospitals and surgical centers represent a core customer segment for Advanced Medical Solutions Group (AMS). These institutions are primary purchasers of AMS's comprehensive surgical product portfolio, which includes critical items like tissue adhesives, sutures, haemostats, and internal fixation devices essential for operating room procedures. The company's strategic vision of building a 'Surgical Powerhouse' directly highlights the paramount importance of serving these healthcare providers effectively.

In 2024, the global surgical devices market, a key indicator for this segment, was projected to reach over $200 billion, demonstrating the substantial demand for the products AMS offers. Hospitals and surgical centers rely on consistent access to high-quality, innovative surgical supplies to ensure patient safety and optimal surgical outcomes.

Advanced Medical Solutions Group (AMS) actively engages with wound care clinics and specialists, a crucial segment for their ActivHeal brand and white-label products. These professionals, including nurses and dedicated wound care specialists, are on the front lines of managing complex wounds.

In 2024, the global wound care market was valued at approximately $27.5 billion, with advanced wound care products, like those offered by AMS, representing a significant and growing portion of this. The demand for effective solutions for chronic wounds, such as diabetic foot ulcers and pressure ulcers, continues to drive innovation and adoption within these clinical settings.

Advanced Medical Solutions Group (AMS) actively engages with other healthcare manufacturers, providing them with advanced wound-care products through white-label agreements. This B2B segment allows these partners to re-brand and distribute AMS's innovative solutions under their own names, expanding the reach of their technology.

This strategic approach leverages AMS's manufacturing expertise and product development capabilities. For instance, in 2023, AMS reported that its white-label business contributed significantly to its revenue, highlighting the importance of these partnerships in its overall growth strategy.

Distributors and Resellers

Global distributors and regional partners are a vital customer segment for Advanced Medical Solutions Group (AMS). These entities purchase AMS products with the intention of reselling them to healthcare providers across diverse geographical markets. Their role is instrumental in extending AMS's market reach and deepening its penetration into new and existing territories.

These distributors and resellers are essential for AMS's growth strategy, acting as the primary channel through which innovative medical solutions reach end-users worldwide. Their established networks and local market knowledge are leveraged to ensure efficient product delivery and customer support.

- Market Reach Expansion: Distributors facilitate entry into markets where AMS may not have a direct presence, leveraging their existing infrastructure.

- Sales Volume Drivers: As primary purchasers, they are critical to achieving overall sales targets and revenue generation.

- Geographic Penetration: Regional partners are key to tailoring AMS offerings to specific local healthcare needs and regulatory environments.

- Partnership Value: In 2024, AMS continued to strengthen relationships with key distributors, with some reporting double-digit growth in AMS product sales within their territories.

Research Institutions and Academic Medical Centers

Research institutions and academic medical centers are crucial, albeit often indirect, customer segments for Advanced Medical Solutions Group (AMS). Their engagement typically revolves around the utilization of AMS products within cutting-edge research, clinical trials, and advanced medical training programs. For instance, in 2024, the global medical research market was valued at approximately $80 billion, with academic institutions forming a significant portion of this expenditure.

The adoption of AMS solutions by these esteemed organizations can act as a powerful catalyst for wider market acceptance. When leading universities and research hospitals integrate AMS technology into their workflows, it lends substantial credibility and validation to the products. This, in turn, can significantly influence purchasing decisions by other healthcare providers and researchers.

Consider the impact on clinical trials: AMS products might be employed to gather data or facilitate procedures in studies that are foundational for new treatments or diagnostic tools. The successful outcomes of such trials, often published in peer-reviewed journals, directly showcase the efficacy and benefits of AMS technology. By 2025, it's projected that over 400,000 clinical trials will be active globally, highlighting the vast potential for AMS integration.

Furthermore, these institutions serve as vital hubs for educating the next generation of medical professionals. Their use of AMS products in training ensures that future doctors and researchers are proficient with the latest advancements, creating a long-term demand and familiarity with the brand. This educational aspect is invaluable for building brand loyalty and establishing AMS as a standard in medical education.

Advanced Medical Solutions Group (AMS) also targets individual consumers and patients through direct-to-consumer channels, particularly for their advanced wound care products. This segment focuses on individuals managing chronic or complex wounds at home, seeking effective and easy-to-use solutions. By 2024, the direct-to-consumer healthcare market continued its expansion, driven by increased health awareness and the demand for convenient self-care options.

This approach allows AMS to build brand recognition and loyalty directly with end-users, complementing its B2B strategies. The company's focus on patient outcomes and ease of application for products like their wound dressings resonates well with this segment. In 2023, online sales of medical supplies to consumers saw a notable increase, indicating a growing preference for purchasing health-related items from home.

AMS leverages digital platforms and targeted marketing to reach these consumers, providing educational resources and support. This direct engagement helps in understanding evolving patient needs and preferences in wound management. The company's commitment to innovation in wound care directly addresses the needs of this growing consumer base seeking better healing solutions.

Cost Structure

Advanced Medical Solutions Group's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. This is a crucial element of their business model, as they consistently work on creating novel tissue-healing technologies and refining their current product offerings.

In 2024, R&D expenditure reached £12.9 million, which accounted for 7% of the company's total revenues. This substantial investment underscores the strategic importance AMS places on R&D to maintain its competitive edge and drive future growth.

Advanced Medical Solutions Group's manufacturing and production costs are significant, encompassing raw materials, direct labor, and the overheads tied to their global network of facilities. These expenses are directly linked to the creation of their diverse product portfolio, which includes advanced wound dressings and specialized surgical adhesives.

For instance, the production of high-performance wound care products, a core segment for AMS, requires sophisticated materials. In 2024, the company reported that its cost of sales, which includes these manufacturing expenses, represented a substantial portion of its revenue, reflecting the capital-intensive nature of medical device manufacturing.

Advanced Medical Solutions Group incurs significant costs in its sales, marketing, and distribution efforts. These include maintaining a direct sales force, executing targeted marketing campaigns, and participating in crucial industry events to showcase its innovative medical technologies.

Managing a global distribution network is also a major expense, ensuring products reach healthcare providers worldwide efficiently. For instance, in 2024, the company's sales, marketing, and distribution expenses represented a substantial portion of its operating budget, reflecting the intensive efforts required to penetrate competitive markets and drive adoption of its advanced wound care and surgical products.

Acquisition and Integration Costs

Advanced Medical Solutions Group has incurred substantial acquisition and integration costs, notably following strategic moves like the Peters Surgical and Syntacoll acquisitions. These one-off or short-to-medium-term expenses are crucial for merging operations and achieving anticipated synergies, directly influencing profit before tax figures.

The financial impact of these integrations is evident in reported results. For instance, the acquisition of Peters Surgical in 2023 involved significant upfront costs. While specific figures for 2024 are still emerging, the ongoing integration of Syntacoll is expected to contribute to similar cost pressures throughout the year.

- Peters Surgical Acquisition: Incurred significant one-off costs impacting FY23 financial results.

- Syntacoll Integration: Ongoing integration expenses are a key focus for FY24, aimed at realizing synergies.

- Impact on Profitability: These costs are recognized as short-to-medium-term impacts on reported profit before tax.

- Strategic Investment: Viewed as necessary investments for long-term growth and market expansion.

Administrative and General Overhead Costs

Administrative and General Overhead Costs encompass essential corporate functions like finance, human resources, legal, and IT, alongside broader administrative expenses. For Advanced Medical Solutions Group, these costs are crucial for supporting the entire organization's operations.

In 2024, administration expenses, excluding exceptional items, saw a significant increase, rising by 36% to £69.0 million. This growth directly reflects the expanded scale of the group's operations following recent developments.

- Finance and Accounting: Costs associated with financial reporting, budgeting, and treasury functions.

- Human Resources: Expenses for recruitment, payroll, employee benefits, and talent management.

- Legal and Compliance: Expenditures on legal counsel, regulatory adherence, and corporate governance.

- Information Technology: Outlays for IT infrastructure, software, cybersecurity, and technical support.

Advanced Medical Solutions Group's cost structure is dominated by its significant investment in Research and Development, reflecting its commitment to innovation in tissue healing technologies. Manufacturing and production expenses, including raw materials and labor for its diverse product lines, also represent a substantial cost. Furthermore, the company incurs considerable expenditure on sales, marketing, and global distribution to support its advanced wound care and surgical products.

| Cost Category | 2024 Expense (£ million) | % of Revenue (approx.) | Key Drivers |

|---|---|---|---|

| Research & Development | 12.9 | 7% | New product development, technology refinement |

| Cost of Sales (Manufacturing) | N/A (Substantial) | N/A | Raw materials, direct labor, production overheads |

| Sales, Marketing & Distribution | N/A (Substantial) | N/A | Sales force, marketing campaigns, global logistics |

| Administration & General Overhead | 69.0 | N/A | Finance, HR, Legal, IT, corporate functions |

Revenue Streams

Revenue from surgical product sales is the cornerstone of Advanced Medical Solutions Group's (AMS) business. This includes a diverse range of offerings such as tissue adhesives like LiquiBand, sutures from their Resorba brand, haemostats, and internal fixation devices. These products are critical in various surgical procedures, contributing significantly to patient outcomes and the company's financial health.

In 2024, the surgical business unit demonstrated robust growth, a trend fueled by exceptional performance across its entire product portfolio. This expansion was further bolstered by strategic acquisitions, which broadened AMS's market reach and product capabilities, reinforcing its position as a leading supplier of surgical solutions.

Advanced Medical Solutions Group generates revenue through the sale of advanced wound dressings, including silver alginates, foams, and hydrocolloids, primarily under its ActivHeal brand. These sales also extend to white-label agreements, broadening market reach.

In 2024, this specific revenue stream experienced a decline. However, the company has implemented strategic initiatives aimed at enhancing product margins, with positive impacts anticipated for 2025.

Advanced Medical Solutions Group (AMS) is significantly boosting its revenue through strategic acquisitions, a core element of its business model. This approach is central to building what the company terms its ‘surgical powerhouse’ strategy.

A prime example of this strategy in action is the acquisition of Peters Surgical. This move alone contributed £37.2 million to AMS's revenue from its acquisition date in July 2024.

Further strengthening this acquisition-driven growth, AMS also acquired Syntacoll. This acquisition added £5.6 million in revenue, commencing from its acquisition date in March 2024.

International Sales and Exports

Advanced Medical Solutions Group generates revenue through international sales and exports, leveraging a robust global network of direct sales teams and distributors to reach diverse markets. This geographical expansion is a key driver of its overall financial performance, with products being sold worldwide.

In 2024, the company continued to emphasize its international presence. For instance, its performance in the EMEA (Europe, Middle East, and Africa) region remained strong, contributing a substantial portion of its export-driven revenue. Similarly, the Asia-Pacific market showed consistent growth, reflecting successful market penetration strategies.

- Global Reach: Revenue is derived from sales across numerous international markets, supported by a worldwide network of direct sales forces and distributors.

- Geographical Expansion: The company's growing geographical footprint significantly boosts its total revenue, with products available globally.

- 2024 Performance Indicators: Key international markets, such as EMEA and Asia-Pacific, demonstrated robust growth in 2024, underscoring the importance of export sales to the group's financial health.

Licensing and Royalty Agreements (Potential)

Advanced Medical Solutions Group (AMS), with its robust portfolio of innovative medical technologies, has the potential to establish significant revenue through licensing and royalty agreements. While specific figures for this stream are not always publicly disclosed, companies possessing patented advancements often leverage them by allowing other entities to utilize these technologies in exchange for ongoing payments.

This model allows AMS to monetize its research and development without necessarily engaging in direct manufacturing or distribution for every application of its innovations. For instance, a partner might license AMS's unique wound closure technology for a specific market segment, paying a royalty on each unit sold. This approach diversifies income and extends the reach of AMS's intellectual property.

Consider the broader medical technology sector: licensing deals can represent a substantial portion of revenue for companies with strong patent protection. For example, in 2024, many established medical device companies reported significant income from licensing agreements related to specialized surgical tools or drug delivery systems.

- Potential Revenue Source: Licensing proprietary technologies to third parties.

- Mechanism: Receiving upfront fees and ongoing royalties from partners.

- Strategic Benefit: Monetizes R&D without direct market entry for every application.

- Industry Trend: Licensing is a common and lucrative revenue stream in the medical technology sector.

Advanced Medical Solutions Group's revenue streams are diversified, primarily driven by surgical product sales, including tissue adhesives, sutures, and haemostats. The company also generates income from advanced wound dressings and strategic acquisitions, which significantly bolster its financial performance. International sales and potential licensing agreements further contribute to its revenue.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Surgical Products | Sales of tissue adhesives, sutures, haemostats, and internal fixation devices. | Cornerstone of business; robust growth driven by portfolio performance and acquisitions. |

| Advanced Wound Dressings | Sales of products like silver alginates, foams, and hydrocolloids, including white-label agreements. | Experienced a decline in 2024, with strategic initiatives aimed at margin enhancement for 2025. |

| Strategic Acquisitions | Revenue generated through acquiring other companies to expand market reach and capabilities. | Peters Surgical added £37.2 million (from July 2024); Syntacoll added £5.6 million (from March 2024). |

| International Sales & Exports | Revenue from global sales via direct teams and distributors. | Strong performance in EMEA and consistent growth in Asia-Pacific in 2024. |

| Licensing & Royalties | Potential revenue from licensing patented technologies to third parties. | A common and lucrative stream in the med-tech sector, monetizing R&D. |

Business Model Canvas Data Sources

The Advanced Medical Solutions Group Business Model Canvas is informed by a blend of internal financial statements, market research reports on the medical device industry, and competitive analysis of key players. These sources provide a robust foundation for understanding customer needs, market opportunities, and operational realities.