Advanced Medical Solutions Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Medical Solutions Group Bundle

Curious about Advanced Medical Solutions Group's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand where their "Stars" are shining and which "Cash Cows" are fueling innovation.

Unlock the full strategic potential by purchasing the complete BCG Matrix report. Gain detailed quadrant placements, data-driven insights into their "Dogs" and "Question Marks," and actionable recommendations for optimizing their market position.

Don't miss out on the comprehensive analysis that will empower your investment and product development decisions. Secure your copy of the Advanced Medical Solutions Group BCG Matrix today for unparalleled strategic clarity.

Stars

US LiquiBand® has shown impressive growth in 2024, with expectations to continue gaining market share in FY 2025. This surge is largely attributed to a revamped route-to-market strategy initiated in late 2023, which has successfully boosted end-user adoption and made it a priority for sales partners.

The product's strong performance in the substantial and expanding US market solidifies its role as a critical revenue generator for Advanced Medical Solutions Group.

LIQUIFIX™ Hernia Fixation Device is a promising new entrant in the surgical market, having recently launched in the US. Initial order volumes have surpassed expectations, signaling strong market reception.

The device is poised for even faster growth in 2025, especially after securing approvals from major Group Purchasing Organizations (GPOs). This positions LIQUIFIX™ as a significant high-growth opportunity for Advanced Medical Solutions Group, aiming to capture substantial market share.

As the only atraumatic hernia fixation device of its kind available in the US, LIQUIFIX™ enjoys a distinct competitive edge. This innovation is particularly impactful in the expanding hernia repair segment, a market that continues to see increased demand for advanced surgical solutions.

Advanced Medical Solutions Group's surgical adhesives, bolstered by the July 2024 acquisition of Peters Surgical, represent a significant strategic move. This expansion, particularly in glues, positions AMS to capitalize on cross-selling synergies and an enhanced global presence within the robust surgical sealants and adhesives market.

The surgical sealants and adhesives sector is experiencing considerable expansion, with forecasts indicating a compound annual growth rate of 10.39% between 2024 and 2031. This upward trend underscores the strategic importance of AMS's augmented surgical adhesives offering, aligning it with a high-demand and growing medical segment.

Biosurgical Devices (Post-Acquisition of Syntacoll)

The acquisition of Syntacoll in March 2024 has been a game-changer for Advanced Medical Solutions Group's (AMS) Biosurgical Devices segment. This strategic move significantly bolstered their portfolio by incorporating innovative products like drug-eluting collagens, synthetic bone substitutes, and bio-absorbable screws.

This enhanced offering directly translated into impressive financial performance. In 2024, the Biosurgical Devices segment experienced a substantial 38% revenue increase, which rose to 42% when measured at constant currency. This robust growth underscores the high demand and AMS's strong position within this specialized, technologically advanced market.

The successful integration of Syntacoll not only expands AMS's product capabilities but also provides the necessary capacity to support future growth initiatives. This strategic enhancement positions the Biosurgical Devices segment for continued expansion and market leadership.

- Acquisition Impact: Syntacoll acquisition in March 2024 added drug-eluting collagens, synthetic bone substitutes, and bio-absorbable screws to AMS's Biosurgical Devices portfolio.

- 2024 Revenue Growth: The segment achieved a 38% revenue increase in 2024, or 42% at constant currency, highlighting strong market performance.

- Market Position: The growth reflects AMS's success in a specialized and technologically advanced market segment.

- Future Outlook: Enhanced capacity and capabilities from the integration support further expansion and development within the Biosurgical Devices business.

Peters Surgical Suture Portfolio

The Peters Surgical suture portfolio, integrated into Advanced Medical Solutions Group (AMS) following its acquisition in July 2024, represents a significant addition to AMS's offerings. This acquisition immediately bolstered AMS's presence in the surgical supply market, particularly with Peters Surgical's established expertise in cardiovascular sutures, a segment known for its high value and specialized demand.

The expanded suture range from Peters Surgical allows AMS to cater to a wider array of surgical needs, enhancing its competitive edge and market share potential within this critical healthcare sector. This strategic move aligns with AMS's goal of increasing its specialty focus and capturing greater value from its product lines.

Early performance indicators for Peters Surgical's continuing product lines post-acquisition are highly encouraging, suggesting strong growth prospects. This robust performance signals the portfolio's potential to be a star performer within the AMS business, contributing significantly to overall revenue and market position.

- Acquisition Date: July 2024

- Key Product Focus: Cardiovascular sutures (high-value)

- Strategic Impact: Expanded portfolio, increased specialty focus, market share growth

- Performance Indicator: Strong continuing product performance post-acquisition

The US LiquiBand® is a star performer, showing impressive growth in 2024 and expected to gain further market share in FY 2025. This success is driven by a strategic market approach that has boosted user adoption and sales partner engagement.

LIQUIFIX™ Hernia Fixation Device is also a star, having exceeded initial order expectations upon its US launch. With major GPO approvals secured, it's positioned for accelerated growth in 2025 due to its unique atraumatic design in a growing hernia repair market.

The Peters Surgical suture portfolio, acquired in July 2024, is demonstrating strong initial performance, particularly in high-value cardiovascular sutures. This acquisition enhances AMS's specialty focus and market share potential, indicating it's on track to become a star performer.

| Product | 2024 Performance | 2025 Outlook | Key Drivers |

|---|---|---|---|

| US LiquiBand® | Impressive growth, market share gains | Continued market share expansion | Revamped route-to-market strategy |

| LIQUIFIX™ Hernia Fixation Device | Exceeded initial order volumes | Accelerated growth, GPO approvals | Unique atraumatic design, expanding market |

| Peters Surgical Suture Portfolio | Strong initial performance | Potential star performer | Acquisition synergies, specialty focus |

What is included in the product

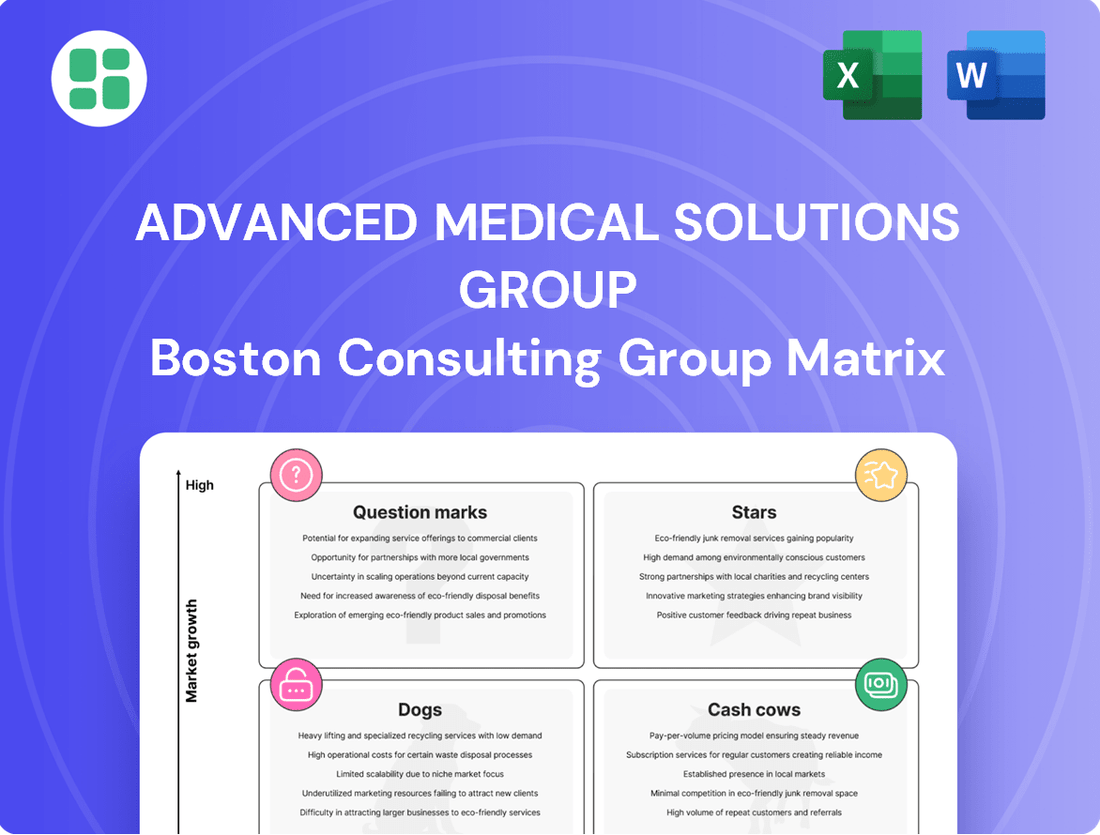

This BCG Matrix overview analyzes Advanced Medical Solutions Group's product portfolio to identify Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visual, showcasing Advanced Medical Solutions Group's portfolio, simplifies strategic decisions.

This visual tool identifies growth opportunities and resource allocation needs, easing portfolio management.

Cash Cows

ActivHeal® Wound Dressings, particularly its established foam and alginate products, function as a cash cow for Advanced Medical Solutions Group. This mature product line benefits from a stable, albeit slower-growing, segment of the wound care market, allowing for consistent revenue generation with reduced investment in research and development. For instance, in 2024, AMS reported that its wound care division, which prominently features ActivHeal®, contributed significantly to overall revenue, underscoring the brand's dependable performance.

RESORBA® Traditional Sutures represent a cornerstone of Advanced Medical Solutions Group's (AMS) portfolio, firmly positioned as a Cash Cow within their business strategy. These sutures, encompassing both absorbable and non-absorbable varieties, boast a long-standing presence and are widely utilized across general and specialized surgical procedures.

The RESORBA® line demonstrates robust and consistent growth, with a particularly strong performance noted in its primary German market and other established territories. This sustained demand is driven by the ongoing adoption of its reliable surgical solutions by hospitals worldwide.

With a mature market position and predictable demand, RESORBA® sutures reliably generate significant cash flow for AMS. This consistent revenue stream necessitates less substantial investment compared to products in nascent markets, allowing AMS to allocate resources strategically.

White label wound care products represent a significant cash cow for Advanced Medical Solutions Group (AMS). AMS leverages its manufacturing capabilities to supply wound care dressings to other companies under their own brands, securing a stable and predictable revenue stream from these established partnerships. This business model benefits from reduced marketing and sales expenditures, as the brand-building efforts are handled by the white label clients. In 2024, AMS reported that its white label segment continued to be a bedrock of its financial performance, contributing significantly to overall profitability through consistent, high-volume sales driven by established distribution networks.

General Purpose Tissue Adhesives (Non-LiquiBand® US)

Beyond the high-growth US market for LiquiBand®, Advanced Medical Solutions Group (AMS) maintains a robust offering of general-purpose tissue adhesives. These products cater to a broad and mature market, addressing wound closure and tissue sealing needs across diverse clinical environments.

The established utility and widespread adoption of these general-purpose adhesives translate into consistent demand and predictable revenue streams. This reliability solidifies their position as a core component of AMS's surgical product portfolio, contributing significantly to the group's overall financial stability.

In 2024, AMS reported that its wound care segment, which includes these general-purpose adhesives, continued to be a strong performer. While specific figures for the non-LiquiBand® general-purpose tissue adhesives are not always broken out separately from the broader wound care segment, the segment's overall contribution to revenue underscores the importance of these foundational products.

- Established Market Presence: These adhesives serve a mature market with consistent demand for wound closure solutions.

- Reliable Revenue Generation: Their widespread use ensures steady cash flow, acting as a stable contributor to AMS's financial performance.

- Portfolio Foundation: They represent a crucial and foundational element within AMS's broader surgical product offerings.

Older Generation Haemostats

Older generation haemostats, while not the focus of Advanced Medical Solutions Group's (AMS) cutting-edge tissue-healing technologies, represent a significant and stable segment of their product portfolio. These established products are mainstays in many surgical procedures, benefiting from widespread adoption and a mature market. Their consistent demand translates into predictable revenue streams and healthy profit margins, largely because the heavy investment in research and development has already been made.

These haemostats function as reliable cash cows for AMS. They contribute steadily to the company's overall financial health, providing a solid foundation that supports investment in newer, more innovative product lines. The predictable cash flow generated by these mature products is crucial for funding future growth initiatives.

- Stable Market Presence: Older haemostats benefit from high market penetration in routine surgical settings.

- Consistent Revenue Generation: Their widespread use ensures a reliable and predictable income stream for AMS.

- Strong Profit Margins: Minimal ongoing R&D costs allow for robust profitability on these established products.

- Foundation for Innovation: The cash generated supports investment in AMS's newer, high-growth technologies.

Advanced Medical Solutions Group (AMS) benefits from several established product lines that act as reliable cash cows. These products, while not experiencing rapid growth, generate consistent revenue with minimal additional investment, providing a stable financial foundation for the company. In 2024, AMS continued to see strong contributions from these mature segments, allowing for strategic allocation of capital towards innovation.

| Product Line | BCG Category | 2024 Contribution | Key Characteristics |

|---|---|---|---|

| ActivHeal® Wound Dressings | Cash Cow | Significant revenue contributor to wound care division | Mature market, stable demand, reduced R&D needs |

| RESORBA® Traditional Sutures | Cash Cow | Robust and consistent growth driver | Long-standing presence, widespread surgical use, established markets |

| White Label Wound Care Products | Cash Cow | Bedrock of financial performance | Leverages manufacturing, reduced marketing costs, high-volume sales |

| General-Purpose Tissue Adhesives | Cash Cow | Strong performer within wound care segment | Mature market, consistent demand, broad clinical application |

| Older Generation Haemostats | Cash Cow | Steady contributor to overall financial health | High market penetration, predictable revenue, strong profit margins |

Preview = Final Product

Advanced Medical Solutions Group BCG Matrix

The preview you are currently viewing is the exact Advanced Medical Solutions Group BCG Matrix document you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate strategic application, containing no watermarks or demo content. Rest assured, what you see is precisely what you will download, offering a clear and actionable analysis of the company's product portfolio.

Dogs

Within Advanced Medical Solutions Group's portfolio, discontinued or low-demand niche fixation devices represent a classic 'Dog' in the BCG matrix. These are products that once served a purpose but now face declining relevance due to market shifts or the emergence of superior alternatives like AMS's own high-growth LIQUIFIX™ and LiquiBandFix8®.

Products in this category likely exhibit a low market share and minimal growth potential, potentially contributing to a negative cash flow as they continue to incur development, manufacturing, or marketing costs without generating substantial revenue. For instance, if a niche fixation device saw its market shrink by 5% annually in 2024, and its market share dropped to below 2%, it would fit this classification.

Advanced Medical Solutions Group's legacy wound care products, particularly those lacking differentiation or competing in mature, slow-growth markets, are likely experiencing underperformance. Despite efforts to boost margins, these products may see declining market share and minimal profit contributions, signaling a need for strategic review. For instance, in 2024, the company continued its focus on streamlining its portfolio, indicating a potential move away from less competitive legacy offerings within its wound care segment.

Advanced Medical Solutions Group (AMS) has strategically expanded through acquisitions such as Peters Surgical and Syntacoll. While these moves generally foster synergy, certain acquired product lines within these entities may exhibit limited alignment with AMS's core growth objectives. These could represent potential 'Dogs' in the BCG matrix if they operate in stagnant markets or struggle to gain significant market share.

For instance, if an acquired product line from Syntacoll operates in a mature, low-growth segment of the wound care market, its contribution to AMS’s overall growth trajectory might be minimal. Should these specific product lines fail to demonstrate substantial integration benefits or market penetration, they risk becoming candidates for divestment, impacting AMS's strategic focus and resource allocation.

Outdated Topical Wound Treatments

In the dynamic advanced wound care sector, treatments that haven't kept pace with innovation are increasingly vulnerable. Outdated topical wound treatments within Advanced Medical Solutions Group's (AMS) portfolio, lacking significant differentiation or a compelling cost advantage, would likely fall into the 'Dog' category of the BCG matrix.

These products would face considerable challenges in capturing market share against newer, more efficacious alternatives. For instance, the global advanced wound care market was valued at approximately USD 10.5 billion in 2023 and is projected to grow significantly. Products that don't align with this growth trajectory due to obsolescence are prime candidates for divestment or strategic repositioning.

Considerations for these 'Dog' products include:

- Low Market Share: These treatments likely possess a minimal share of the rapidly growing advanced wound care market.

- Low Growth Potential: The market is shifting towards bio-engineered dressings and active biologics, leaving older formulations with limited upside.

- Lack of Competitive Edge: Without unique selling propositions or demonstrable superior outcomes compared to newer solutions, they struggle to compete.

- Resource Drain: Continued investment in marketing or production for these products may divert resources from more promising areas within AMS's portfolio.

Specific White Label Contracts with Low Profitability

Specific white label contracts within Advanced Medical Solutions Group (AMS) can become problematic if their profitability is exceptionally low. While typically considered cash cows, certain highly competitive agreements or those involving products with declining market demand can significantly dilute overall returns. For instance, if a white label contract for a mature medical device component, which previously enjoyed strong margins, now faces intense price pressure from multiple manufacturers, AMS might find its return on investment shrinking considerably. In 2024, such contracts could represent a drain on resources that could be better allocated to higher-growth or higher-margin areas of the business.

These arrangements can tie up valuable capital and operational capacity for minimal financial gain, essentially acting as anchors rather than engines for growth. AMS needs to actively monitor the performance of these specific white label agreements. A thorough review process is crucial to identify contracts that are no longer strategically or financially beneficial. For example, if a particular white label contract generated only a 3% gross profit margin in Q1 2024, compared to the company's average of 25% for similar products, it warrants immediate attention.

- Low-Margin Contracts: Agreements with gross profit margins below 5% in 2024 are flagged for review.

- Declining Demand Products: White label sales for products experiencing over 10% year-over-year volume decline are scrutinized.

- Resource Allocation: Contracts consuming significant production capacity or R&D resources with negligible profit impact are prioritized for potential exit.

- Competitive Pressure: Specific contracts where AMS faces more than five direct white label competitors are assessed for viability.

Products classified as 'Dogs' within Advanced Medical Solutions Group's portfolio are characterized by low market share and minimal growth prospects. These are often legacy products or those in declining market segments, such as older fixation devices or mature wound care treatments that have been overshadowed by newer innovations. For example, a fixation device with less than a 2% market share in a shrinking market segment would be considered a Dog.

These underperforming assets can consume valuable resources without delivering commensurate returns, potentially leading to negative cash flow. The company's strategic focus on streamlining its portfolio, as evidenced by its efforts in 2024 to move away from less competitive legacy offerings, highlights the ongoing assessment of such products.

Advanced Medical Solutions Group's strategic acquisitions, while generally beneficial, can also introduce 'Dog' products if acquired lines do not align with core growth objectives or operate in stagnant markets. For instance, an acquired wound care product line that fails to gain traction in a mature market segment, despite integration efforts, could become a candidate for divestment.

The company's approach to managing these 'Dogs' likely involves a critical evaluation of their continued viability, considering potential divestment or strategic repositioning to optimize resource allocation towards higher-potential products within its innovative segments like its advanced wound care solutions.

Question Marks

SEAL-G®, an innovative internal biological sealant from Advanced Medical Solutions Group, is positioned as a Question Mark in the BCG Matrix. Its potential lies within the expanding surgical sealants and adhesives market, a sector projected for robust growth.

Currently, SEAL-G® is in a pancreatic study, with interim results anticipated around mid-2025. This developmental stage means its market share is minimal, necessitating substantial investment to navigate clinical trials and achieve market penetration.

Advanced Medical Solutions Group (AMS) is investing heavily in its next-generation LIQUIFIX™ device, a product poised to revolutionize hernia fixation by eliminating the need for external gas supply connections and regulators. This innovation targets a rapidly expanding market segment, promising a significantly enhanced user experience for medical professionals.

While the LIQUIFIX™ device represents a substantial technological leap with substantial market potential, its current market share stands at zero as it remains in the development phase. AMS's commitment to this project is underscored by significant research and development expenditures necessary to bring this advanced medical solution to fruition and establish a strong market presence.

Following its 2024 510(k) approvals, Connexicon US adhesives are poised for significant growth in the American surgical adhesives market. This expansion represents a strategic move for Advanced Medical Solutions Group (AMS) into a dynamic sector.

The US surgical adhesives market presents a substantial opportunity, with projections indicating continued robust growth. However, Connexicon's relatively new presence in this specific geography means AMS will need to make substantial investments in marketing and sales efforts. This is crucial to effectively penetrate the market and secure a meaningful share against established competitors.

Novel Bioengineered Skin and Dermal Substitutes

Novel bioengineered skin and dermal substitutes represent a promising area for Advanced Medical Solutions Group (AMS). This market is experiencing robust growth, with projections indicating a compound annual growth rate exceeding 9.4% through 2028.

If AMS possesses early-stage research or products in this high-growth segment, they would likely be classified as a "Question Mark" in the BCG matrix. This means they have low current market share but significant potential for future expansion.

- Market Growth: The global bioengineered skin substitutes market was valued at approximately $1.2 billion in 2023 and is anticipated to reach over $2.5 billion by 2028, driven by increasing prevalence of chronic wounds and burns.

- AMS Position: Early-stage products in this category would fit the Question Mark profile, requiring substantial investment to capture market share.

- Strategic Consideration: AMS would need to evaluate its R&D pipeline and potential competitive advantages to determine if continued investment in bioengineered skin is a viable long-term strategy.

Products leveraging AI/Machine Learning in Wound Care

Advanced Medical Solutions Group (AMS) is likely categorizing its AI/ML-powered wound care products, such as smart bandages that monitor wound healing and adjust treatment, as Stars or Question Marks within the BCG matrix. These innovations represent a significant investment in a high-growth segment of the advanced wound care market. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 37% from 2024 to 2030, indicating substantial future potential for these advanced solutions.

Products leveraging AI/Machine Learning in wound care are positioned to capitalize on the increasing demand for personalized and data-driven treatment approaches. Stakeholders are actively investing in these technologies, with the smart bandages market alone expected to reach $1.2 billion by 2027, growing at a CAGR of 15.5% during the forecast period. AMS's commitment to these areas signifies a strategic move towards capturing a larger share of this expanding market.

- Smart Bandages: These devices integrate sensors to monitor key wound parameters like moisture, temperature, and pH, transmitting data for analysis and potential treatment adjustments.

- AI-driven Diagnostics: Machine learning algorithms analyze wound images and patient data to predict healing trajectories and identify potential complications earlier.

- Personalized Treatment Platforms: AI enables the tailoring of wound care regimens based on individual patient needs and real-time wound status, optimizing outcomes.

Question Marks within Advanced Medical Solutions Group's portfolio represent products with low market share in high-growth markets, requiring significant investment. These are typically new or developing technologies where the company is still establishing its position. The strategic challenge is to determine which of these Question Marks have the potential to become Stars.

For instance, SEAL-G® and the LIQUIFIX™ device are classic examples of Question Marks. SEAL-G® is in clinical trials with limited market presence, while LIQUIFIX™ is still in development, meaning both have minimal current market share but operate in expanding market segments. Connexicon US adhesives, post-510(k) approval in 2024, also fit this profile as they enter a growing US market with an existing competitor base.

The success of these Question Marks hinges on strategic investment in R&D, marketing, and sales to gain traction. The company must carefully assess the competitive landscape and the product's unique selling propositions to justify continued resource allocation.

Novel bioengineered skin substitutes, if in early-stage development by AMS, also fall under the Question Mark category, given the market's robust growth and the need for significant investment to build market share. Similarly, AI/ML-powered wound care solutions, while in a high-growth segment, are likely considered Question Marks if their market share is not yet dominant.

| Product/Technology | Market Growth | Current Market Share | Investment Need | Potential |

|---|---|---|---|---|

| SEAL-G® | High (Surgical Sealants & Adhesives) | Minimal (In clinical trials) | High (Clinical trials, market penetration) | High (If successful in trials and adoption) |

| LIQUIFIX™ | High (Hernia Fixation) | Zero (In development) | High (R&D, market launch) | High (Revolutionary tech, enhanced user experience) |

| Connexicon US Adhesives | High (US Surgical Adhesives) | Low (New entrant post-2024 approvals) | High (Marketing, sales, market penetration) | Moderate to High (Depends on competitive response) |

| Bioengineered Skin Substitutes | High (>9.4% CAGR through 2028) | Low (Early-stage research) | High (R&D, clinical validation) | High (Addressing chronic wounds, burns) |

| AI/ML Wound Care | Very High (>37% CAGR for AI in Healthcare) | Low to Moderate (Emerging segment) | High (R&D, data integration, market adoption) | Very High (Personalized, data-driven care) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Advanced Medical Solutions Group's financial statements, market share data, and industry growth projections, to accurately position each business unit.