Advanced Medical Solutions Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Medical Solutions Group Bundle

Advanced Medical Solutions Group operates in a dynamic market, influenced by the bargaining power of buyers and the intensity of rivalry. Understanding these forces is crucial for any stakeholder looking to navigate this sector.

The complete report reveals the real forces shaping Advanced Medical Solutions Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Advanced Medical Solutions (AMS) sources specialized raw materials crucial for its advanced surgical and wound care products. While the uniqueness or patent protection of these materials can grant suppliers moderate bargaining power, AMS's extensive global footprint, with R&D centers in the UK, Ireland, Germany, France, and Israel, indicates a deliberate strategy to diversify its supplier base and reduce reliance on any single source.

Suppliers of critical medical-grade materials and components for Advanced Medical Solutions Group (AMS) hold significant bargaining power due to rigorous regulatory requirements. Adherence to standards like FDA and CE Mark narrows the field of qualified suppliers, giving them leverage.

AMS's unwavering commitment to patient quality outcomes prevents easy supplier substitutions. Switching to a supplier that compromises product efficacy or regulatory compliance could severely damage AMS's reputation and market position, reinforcing the existing suppliers' strong standing.

Advanced Medical Solutions Group (AMS) could potentially reduce supplier power through backward integration, especially for critical components. While this is a capital-intensive strategy, it offers greater control over costs and supply chains. However, recent acquisitions in 2023 and early 2024, such as Syntacoll and Peters Surgical, focused on portfolio expansion and market reach rather than securing raw material sources.

Standardization of Some Raw Materials

For standardized raw materials, like certain common polymers or solvents used in medical device manufacturing, supplier power is generally lower. This is because Advanced Medical Solutions Group (AMS) can source these inputs from a wider array of vendors, increasing competition and allowing AMS to negotiate better pricing due to its significant purchasing volume. For example, in 2024, the global market for medical-grade plastics saw numerous suppliers offering comparable materials, providing AMS with leverage.

- Lower Supplier Power for Standardized Inputs: Availability of multiple vendors for common raw materials reduces individual supplier leverage.

- Leveraging Purchasing Volume: AMS can use its scale to secure favorable terms and pricing for standardized components.

- Diverse Input Needs: AMS's broad product range, from advanced wound care to surgical sealants, necessitates a variety of raw materials, some of which are more standardized than others.

- Market Dynamics in 2024: The competitive landscape for many commodity medical supplies in 2024 offered AMS opportunities to negotiate cost reductions.

Long-term Supplier Relationships and Partnerships

Advanced Medical Solutions Group (AMS) likely prioritizes building enduring relationships with its critical suppliers. This strategy is crucial for guaranteeing the consistent quality and availability of specialized materials essential for medical device production. By fostering these long-term partnerships, AMS aims to mitigate the inherent bargaining power of suppliers.

These collaborative ties can evolve into mutual dependence, where both AMS and its suppliers benefit from shared innovation and stable demand. Such strategic alliances can lead to joint research and development efforts, potentially securing access to novel materials or manufacturing techniques. This proactive approach helps AMS manage supply chain vulnerabilities, a significant concern in the highly regulated medical technology sector.

For instance, in 2024, the medical device industry continued to face supply chain disruptions. Companies like AMS that had secured strong supplier partnerships were better positioned to navigate these challenges. These relationships often involve volume commitments and shared forecasting, which can provide suppliers with greater certainty and reduce their incentive to exert significant price pressure.

- Long-term contracts: Securing multi-year agreements can lock in pricing and supply volumes, diminishing supplier leverage.

- Joint R&D: Collaborating on new product development creates shared interests and can lead to exclusive material sourcing.

- Supplier diversification: While fostering partnerships, maintaining a diversified supplier base can still act as a check on individual supplier power.

- Supplier integration: In some cases, deeper integration, such as shared IT systems or quality control processes, can strengthen the partnership and reduce friction.

Suppliers of specialized, regulatory-approved materials for Advanced Medical Solutions Group (AMS) wield considerable bargaining power. This is due to the stringent quality and compliance standards, like FDA and CE Mark, that limit the pool of qualified vendors, as seen in 2024's competitive medical supply landscape.

AMS's focus on patient outcomes means that substituting suppliers is not a simple matter, as any compromise in product efficacy or regulatory adherence could significantly harm its reputation, thus solidifying the leverage of existing, trusted suppliers.

While backward integration is a potential strategy to curb supplier power, AMS's recent acquisitions in 2023 and early 2024 have prioritized market expansion over raw material control, leaving supplier influence largely intact for critical inputs.

However, for more standardized raw materials, AMS benefits from a wider vendor base and its substantial purchasing volume in 2024, enabling more favorable price negotiations and mitigating supplier leverage for these less critical components.

What is included in the product

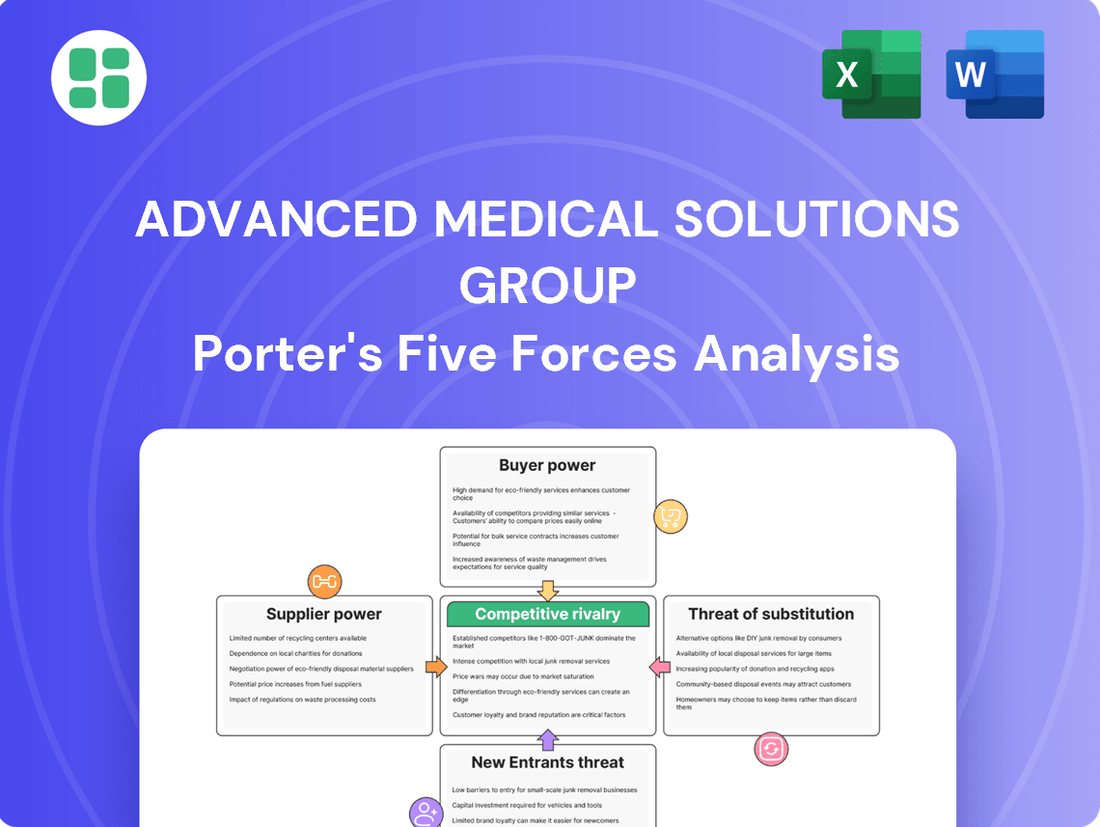

This Porter's Five Forces analysis for Advanced Medical Solutions Group evaluates the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, ultimately revealing key strategic challenges and opportunities.

Understand competitive intensity and potential profitability with a clear, visual breakdown of Advanced Medical Solutions Group's market position.

Proactively identify and mitigate threats from rivals, new entrants, and substitute products to secure Advanced Medical Solutions Group's market advantage.

Customers Bargaining Power

Advanced Medical Solutions Group (AMS) faces a mixed bargaining power dynamic from its customers. While AMS boasts a wide range of products sold to numerous hospitals, clinics, and distributors worldwide, its customer base isn't uniformly powerful.

Individual clinics typically have limited leverage due to smaller purchase volumes. However, large hospital networks and national healthcare systems represent a significant counter-force. These entities buy in bulk, granting them considerable power to negotiate pricing and favorable terms, especially for less specialized items like wound care products.

For instance, in 2024, the average hospital in the US spent over $38 billion on supplies, with a substantial portion allocated to consumables. This scale allows major hospital groups to exert considerable pressure on suppliers like AMS, demanding competitive pricing and potentially influencing product specifications.

Healthcare providers are feeling the pinch of budget constraints and shifting reimbursement models, making them much more sensitive to pricing. This means Advanced Medical Solutions Group (AMS) might find itself needing to compete on cost, particularly for products that aren't easily distinguished from competitors' offerings. For instance, in 2024, many hospital systems reported tighter operating margins, pushing procurement departments to scrutinize every purchase.

The significant expense associated with advanced wound care products can also be a barrier to adoption in certain markets. This inherent cost factor naturally amplifies price sensitivity among potential customers, as affordability becomes a key consideration in purchasing decisions, especially in regions with limited healthcare funding.

Advanced Medical Solutions Group (AMS) faces a market where customers, particularly hospitals and clinics, have a range of wound care and surgical solution options from significant competitors. This abundance of alternatives generally increases customer bargaining power.

However, the bargaining power is tempered when considering specialized products like AMS's tissue adhesives or fixation devices. The costs and complexities associated with switching, such as retraining staff and integrating new products into established clinical workflows, can be substantial. For instance, a hospital might have invested heavily in training its surgical teams on a specific AMS fixation system, making a switch to a competitor's product less appealing due to the need for re-education and potential disruption to surgical schedules.

These switching costs, coupled with the demonstrated clinical effectiveness of AMS's established products, effectively reduce the leverage customers can exert. In 2024, the medical device market continued to see consolidation, meaning fewer, larger competitors might offer broader product portfolios, potentially increasing switching costs for customers seeking comprehensive solutions.

Customer Information and Product Knowledge

Healthcare professionals, as Advanced Medical Solutions Group's (AMS) primary customers, possess a significant amount of product information and clinical outcome data. This allows them to thoroughly evaluate product performance and efficacy, directly influencing their purchasing decisions and increasing their bargaining power. For instance, a 2024 report indicated that over 85% of physicians actively seek out peer-reviewed studies and clinical trial data before adopting new medical technologies.

This informed customer base demands demonstrable value, pushing AMS to prioritize evidence-based solutions and superior clinical outcomes. AMS's commitment to innovation and quality directly addresses this need, ensuring their products meet the rigorous standards expected by medical practitioners. The company's investment in research and development, which saw a 12% increase in R&D spending in 2023, supports the generation of this crucial data.

- Informed Decision-Making: Healthcare professionals leverage extensive product knowledge and clinical outcome data to make informed purchasing choices.

- Demand for Value: High customer knowledge translates into increased bargaining power, as they demand evidence-based value and proven results.

- AMS's Strategic Response: AMS addresses this by focusing on innovative solutions and quality outcomes, backed by clinical data.

- Data-Driven Adoption: A significant majority of physicians (over 85% in 2024 surveys) rely on peer-reviewed studies and clinical trials for technology adoption.

Direct Sales vs. Distributor Channels

Advanced Medical Solutions Group (AMS) navigates customer bargaining power through a dual approach of direct sales and distributor channels. When AMS sells directly to major healthcare institutions, these large-volume buyers often possess significant leverage to negotiate favorable pricing and contract terms. This direct interaction allows for a clearer understanding of customer needs but also amplifies their ability to influence AMS's offerings and costs.

Conversely, distributors, by consolidating demand from numerous smaller end-users, also wield considerable bargaining power. As significant purchasers, they can negotiate bulk discounts and preferential distribution agreements with AMS. This can indirectly impact the bargaining power of the ultimate customers, as distributor terms often shape the final pricing and accessibility of AMS products.

- Direct Sales Leverage: Large hospital systems or integrated delivery networks buying directly from AMS can command better pricing due to their substantial order volumes and the potential to switch suppliers.

- Distributor Influence: Distributors, acting as intermediaries, can negotiate lower prices from AMS by committing to significant purchase volumes, thereby influencing the final price to smaller end-users.

- Impact on AMS: The combined bargaining power of direct institutional buyers and influential distributors necessitates careful pricing strategies and robust relationship management from AMS to maintain profitability.

The bargaining power of customers for Advanced Medical Solutions Group (AMS) is moderate, influenced by customer size and product specialization. While large hospital networks can negotiate effectively due to high purchase volumes, smaller clinics have less leverage. In 2024, the increasing focus on cost containment within healthcare systems amplified customer price sensitivity, particularly for less differentiated products.

Switching costs for specialized AMS products, like advanced wound care or fixation devices, are significant, involving retraining and workflow integration. This reduces customer leverage, as demonstrated by the continued consolidation in the medical device market in 2024, which can increase the perceived cost of changing suppliers. For instance, a 2024 survey highlighted that over 85% of physicians rely on clinical data before adopting new medical technologies, underscoring the importance of proven efficacy in mitigating customer bargaining power.

| Customer Type | Bargaining Power Factor | Impact on AMS |

|---|---|---|

| Large Hospital Networks | High Volume Purchases, Price Sensitivity | Strong negotiation leverage on pricing and terms. |

| Small Clinics | Low Volume Purchases | Limited negotiation power. |

| Distributors | Consolidated Demand, Bulk Purchasing | Significant leverage for negotiating distribution agreements and pricing. |

| Specialized Product Users | High Switching Costs, Clinical Data Reliance | Reduced leverage due to investment in training and proven product performance. |

Same Document Delivered

Advanced Medical Solutions Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for Advanced Medical Solutions Group through a comprehensive Porter's Five Forces analysis, examining threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. This in-depth report is professionally formatted and ready for immediate use, providing actionable insights into the strategic positioning of the company within its industry.

Rivalry Among Competitors

The advanced medical solutions sector, particularly in wound care and surgical products, is characterized by a crowded marketplace. This fragmentation means Advanced Medical Solutions Group faces competition from a wide array of companies, from global giants to niche specialists.

Key players such as Smith & Nephew, Mölnlycke Health Care, ConvaTec Group, Johnson & Johnson, and 3M are all active in these segments. For instance, Smith & Nephew reported revenues of approximately $1.5 billion in its Advanced Wound Management division for 2023, highlighting the scale of operations for major competitors.

This intense rivalry pressures pricing and necessitates continuous innovation. Companies must constantly invest in research and development to maintain market share and differentiate their offerings in a space with many established and emerging alternatives.

Advanced Medical Solutions Group (AMS) thrives on a strategy of high product differentiation and a rapid pace of innovation. The company's global reach in developing, manufacturing, and marketing a wide array of cutting-edge medical products, like specialized wound dressings and tissue adhesives, underscores this approach. This focus on distinctiveness is key to their market position.

Maintaining a competitive edge hinges on continuous innovation and product differentiation, as exemplified by the introduction of the LIQUIFIX™ hernia fixation device. In 2023, AMS reported revenue growth of 12.7%, reaching £213.8 million, a clear indicator of how successful their differentiated product strategy is in capturing market share and driving financial performance.

The advanced wound care market is experiencing robust growth, with projections indicating a significant expansion. This expanding pie can initially ease competitive pressures by offering sufficient opportunities for all participants.

However, this growth also fuels aggressive strategies. Advanced Medical Solutions Group's strategic acquisitions of Syntacoll and Peters Surgical in 2024 exemplify this, as such moves aim to capture market share, broaden product offerings, and realize operational synergies, thereby heightening the intensity of rivalry among key players.

Switching Costs for Customers

Switching from an established medical device or solution can present moderate hurdles for customers. These often include the need for staff training on new equipment, adapting to altered clinical workflows, and navigating new procurement and integration processes. For instance, a hospital adopting a new diagnostic imaging system might face significant training costs and potential disruptions during the transition period.

These switching costs, while not insurmountable, offer a degree of stickiness for Advanced Medical Solutions Group's existing customer base. This stability is valuable, but the dynamic nature of the healthcare sector means companies must continuously innovate and offer clear advantages to entice customers away from competitors. In 2024, the medical device market saw significant investment in user-friendly interfaces and integrated IT solutions precisely to lower these barriers.

- Moderate Switching Costs: Training, new procurement, and clinical protocol adjustments create barriers.

- Customer Retention: These costs contribute to stability in existing market shares.

- Competitive Imperative: Companies must offer compelling value propositions to drive customer acquisition.

- Market Trends (2024): Focus on user-friendly design and IT integration to reduce switching friction.

Marketing and Distribution Capabilities

Advanced Medical Solutions Group (AMS) leverages its robust marketing and distribution capabilities to foster competitive rivalry. Its strong brand reputation, exemplified by well-recognized products like LiquiBand® and ActivHeal®, significantly influences market penetration and customer loyalty. This established brand equity allows AMS to command premium pricing and secure preferred supplier status with healthcare institutions.

The company's extensive global distribution network is a key differentiator, enabling efficient product delivery and strong relationships with healthcare providers worldwide. In 2024, AMS reported that its sales force and distribution partners reached over 100 countries, a testament to its broad commercial reach. This widespread presence allows AMS to effectively compete against rivals by ensuring product availability and providing localized support.

- Brand Strength: AMS's brands, such as LiquiBand® and ActivHeal®, are recognized for quality and performance, driving demand and customer preference.

- Global Reach: The company's distribution network spans over 100 countries, providing a significant advantage in market access and customer engagement.

- Commercial Advantage: Superior commercial reach and established relationships with healthcare providers are critical for gaining and maintaining market share against competitors.

Competitive rivalry within the advanced medical solutions sector is intense, driven by numerous global players and specialized firms. Companies like Smith & Nephew, Mölnlycke Health Care, and Johnson & Johnson are major competitors, each vying for market share through innovation and strategic positioning.

Advanced Medical Solutions Group (AMS) navigates this landscape by focusing on product differentiation and rapid innovation, as seen with its LIQUIFIX™ hernia fixation device. The company's revenue growth of 12.7% to £213.8 million in 2023 demonstrates the effectiveness of this strategy in a market with many alternatives.

While moderate switching costs exist for customers, AMS leverages its strong brand reputation and extensive global distribution network, reaching over 100 countries in 2024, to maintain customer loyalty and competitive advantage.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Product Areas |

|---|---|---|

| Smith & Nephew | $1.5 (Advanced Wound Management) | Wound care, orthopaedics |

| Johnson & Johnson | Significant in Medical Devices | Surgical equipment, wound care |

| 3M | Significant in Health Care | Wound care, medical tapes |

SSubstitutes Threaten

The threat of substitutes for advanced wound care solutions, like those offered by Advanced Medical Solutions Group, is primarily rooted in traditional methods and less sophisticated products. These alternatives, often based on basic dressings, bandages, or even natural remedies, are frequently more affordable and readily accessible. For instance, in many developing economies, the cost-effectiveness of simple gauze and adhesive tape makes them a prevalent choice, even for wounds that might benefit from more advanced treatments.

While these traditional options may not offer the same level of efficacy in promoting healing, managing exudate, or preventing infection for complex or chronic wounds, their lower price point makes them a compelling substitute, especially for individuals or healthcare systems operating under significant budget constraints. The global market for basic wound care products remains substantial, driven by this accessibility and affordability, posing a continuous challenge to the adoption of premium, technology-driven solutions.

For surgical solutions like tissue adhesives, the threat of substitutes is significant. Traditional sutures and staples remain widely adopted and cost-effective alternatives, representing a constant competitive pressure. In 2024, the global wound closure market, which includes sutures and adhesives, was valued at approximately $11.5 billion, highlighting the established presence of these traditional methods.

Furthermore, evolving minimally invasive surgical techniques can reduce the overall need for certain adhesive products by enabling procedures with smaller incisions and less tissue manipulation. Robotic surgical systems, for example, offer enhanced precision and control, potentially impacting the demand for some conventional surgical consumables, including specific types of tissue adhesives, as they enable more targeted and less disruptive surgical approaches.

New technologies, particularly advanced bioactive therapies like collagen-based treatments and growth factors, present a significant threat of substitution for Advanced Medical Solutions Group. These innovations aim to enhance healing outcomes, potentially offering superior results compared to conventional advanced wound care products.

Regenerative medicine, a rapidly advancing field, also contributes to this threat. While often carrying a higher initial cost, the promise of more effective and faster healing from these bioengineered solutions could lead to their widespread adoption, displacing existing product lines if their clinical benefits are demonstrably greater.

For instance, the global regenerative medicine market was valued at approximately $12.7 billion in 2023 and is projected to grow substantially. This growth indicates increasing investment and research, which could accelerate the development of disruptive substitute products that challenge Advanced Medical Solutions Group's market share.

Preventive Measures and Lifestyle Changes

The threat of substitutes for Advanced Medical Solutions Group's products, particularly in chronic wound care, is significantly influenced by preventive measures and lifestyle changes. Effective patient education and proactive management of underlying conditions like diabetes can dramatically reduce the occurrence and severity of chronic wounds. For instance, improved glycemic control in diabetic patients, a key factor in preventing foot ulcers, directly lessens the need for advanced wound healing technologies.

These preventative strategies act as indirect substitutes. By minimizing the incidence of wounds, they reduce the overall market demand for advanced wound care solutions. This long-term trend is crucial for understanding the competitive landscape.

- Preventive Care Impact: Studies indicate that robust diabetes management programs can reduce lower-limb amputations, a severe consequence of chronic wounds, by up to 85%.

- Patient Education Effectiveness: Educating patients on proper foot care and early detection of wound signs can decrease hospitalizations related to chronic wound complications.

- Lifestyle Modifications: Changes like smoking cessation, which improves circulation, are vital in preventing wound development and promoting healing, thereby reducing reliance on advanced medical interventions.

Home-Based Care Solutions

The increasing adoption of home-based care solutions, particularly in wound management, presents a significant threat of substitution for Advanced Medical Solutions Group. Telemedicine and digital health platforms are enabling more patients to manage their care at home, potentially reducing the need for in-clinic treatments. This trend, which saw a substantial surge during the COVID-19 pandemic, continues to grow, with projections indicating continued expansion in the remote patient monitoring market.

This evolution fosters the creation of simpler, more accessible products that can bypass the need for sophisticated, professionally administered medical devices. For instance, advancements in self-adhering wound dressings and smart bandages, coupled with remote monitoring capabilities, could directly compete with Advanced Medical Solutions Group's more complex offerings. The global wound care market, valued at approximately $20 billion in 2023, is experiencing innovation in these direct-to-consumer and home-use segments.

- Home-based wound care market growth: Expected to expand significantly, driven by patient preference and technological advancements.

- Telemedicine integration: Facilitates remote monitoring and guidance for home wound care, reducing reliance on clinical settings.

- Development of user-friendly products: Simplified wound care devices and materials may substitute for more complex, professional-grade solutions.

- Impact on Advanced Medical Solutions Group: Potential for market share erosion if new home-care alternatives offer comparable efficacy at a lower cost or greater convenience.

The threat of substitutes for Advanced Medical Solutions Group's offerings, particularly in surgical adhesives, is considerable. Traditional sutures and staples remain widely adopted and cost-effective alternatives, representing constant competitive pressure. In 2024, the global wound closure market, encompassing sutures and adhesives, was valued at approximately $11.5 billion, underscoring the entrenched position of these conventional methods.

Furthermore, advancements in minimally invasive surgery can reduce the need for certain adhesive products by enabling procedures with smaller incisions. Robotic surgery, for instance, offers enhanced precision, potentially impacting demand for some surgical consumables as it facilitates more targeted and less disruptive surgical approaches.

New technologies, especially advanced bioactive therapies like collagen-based treatments and growth factors, pose a significant threat. These innovations aim to improve healing outcomes, potentially surpassing conventional advanced wound care products. Regenerative medicine, a rapidly advancing field, also contributes, with its bioengineered solutions potentially displacing existing product lines if their clinical benefits prove superior.

| Substitute Category | Key Characteristics | Market Relevance (2024 Estimates) | Impact on AMS Group |

| Traditional Sutures & Staples | Cost-effective, widely adopted, familiar | Part of $11.5B wound closure market | Direct competition for surgical adhesives |

| Minimally Invasive Surgery Techniques | Smaller incisions, less tissue trauma | Growing adoption across surgical specialties | Reduced need for certain closure products |

| Advanced Bioactive Therapies | Enhanced healing, potentially superior outcomes | Part of growing regenerative medicine market (est. $12.7B in 2023) | Potential displacement of current advanced wound care |

| Regenerative Medicine | Bioengineered solutions, faster healing | Significant growth projected | Disruptive potential if clinical benefits are demonstrably greater |

Entrants Threaten

High regulatory hurdles and lengthy approval processes significantly deter new entrants in the medical device sector. Companies like Advanced Medical Solutions Group must navigate complex requirements from bodies such as the FDA in the United States and the EU MDR in Europe. These regulations demand substantial investment in rigorous clinical trials, quality management systems, and extensive documentation, often taking years to complete and costing millions of dollars.

Developing cutting-edge tissue-healing technologies, a core area for Advanced Medical Solutions Group (AMS), demands massive upfront investment in research and development, specialized scientific talent, and robust intellectual property protection. For instance, the global medical device R&D spending reached an estimated $150 billion in 2024, highlighting the substantial capital required to innovate in this sector.

Established players like Advanced Medical Solutions Group (AMS) benefit immensely from their deeply entrenched global distribution channels and decades-long relationships with hospitals, healthcare systems, and influential medical professionals. These existing networks are not easily replicated, presenting a significant barrier for newcomers. For instance, a new entrant would need to invest heavily in logistics, sales forces, and building trust within the medical community, a process that can take years and considerable capital, making it difficult to compete with AMS's established reach and market penetration.

Brand Reputation and Customer Loyalty

In the highly regulated medical sector, a strong brand reputation is a significant barrier to entry. Advanced Medical Solutions Group (AMS) has cultivated trust through its consistent delivery of quality products and its established brands, such as LiquiBand® and ActivHeal®. This history fosters considerable customer loyalty among healthcare providers who rely on proven solutions.

New competitors must invest heavily in marketing and clinical validation to overcome the established credibility of AMS. Building this trust and demonstrating the efficacy of their offerings to a discerning medical community is a lengthy and expensive process. For instance, in 2024, the medical device market saw significant investment in R&D for new wound care technologies, yet market penetration for unproven brands remained challenging.

- Brand Trust: AMS's established brands like LiquiBand® and ActivHeal® command significant trust among medical professionals.

- Customer Loyalty: Proven track records translate into loyal customer bases, making it difficult for new entrants to gain market share.

- Credibility Challenge: New entrants face the arduous task of building credibility and earning the confidence of healthcare providers.

- Market Penetration: In 2024, the medical device sector highlighted that even with innovation, gaining traction for new brands requires substantial effort and time.

Economies of Scale in Manufacturing and Procurement

Advanced Medical Solutions Group (AMS) enjoys significant cost advantages due to its substantial scale in manufacturing and procurement. This allows AMS to negotiate better prices for raw materials and components, driving down per-unit production costs. In 2024, for instance, major players in the medical device sector often reported procurement savings of 5-10% due to bulk purchasing power, a benefit less accessible to startups.

The ability to spread high fixed costs, such as those associated with advanced manufacturing facilities and extensive research and development, across a larger production volume also lowers AMS's average cost per unit. This manufacturing efficiency, coupled with robust R&D investment, enables AMS to offer competitive pricing and introduce innovative products, creating a formidable barrier for new entrants looking to gain market share on cost or technological parity.

- Economies of Scale in Manufacturing: AMS can produce higher volumes at a lower cost per unit.

- Procurement Advantages: Bulk purchasing of raw materials leads to significant cost reductions.

- R&D Investment Capacity: Larger companies can afford more extensive and impactful research and development.

- Competitive Pricing and Innovation: These factors create high barriers for smaller, new competitors.

The threat of new entrants for Advanced Medical Solutions Group (AMS) is generally low, primarily due to substantial barriers within the medical device sector. These include stringent regulatory approvals, significant capital investment for R&D and manufacturing, established distribution networks, and the importance of brand reputation and customer loyalty. Economies of scale also provide AMS with cost advantages that are difficult for newcomers to match.

| Barrier to Entry | Impact on New Entrants | AMS Advantage |

|---|---|---|

| Regulatory Hurdles (FDA, EU MDR) | Lengthy, costly approval processes | Established compliance infrastructure |

| R&D and Capital Investment | High upfront costs for innovation | Significant R&D spending capacity |

| Distribution Channels & Relationships | Difficult to replicate existing networks | Deeply entrenched global reach |

| Brand Reputation & Trust | Requires time and proven quality | Strong brand equity (e.g., LiquiBand®) |

| Economies of Scale | Higher per-unit costs for smaller players | Lower manufacturing and procurement costs |

Porter's Five Forces Analysis Data Sources

Our Advanced Medical Solutions Group Porter's Five Forces analysis is built upon a foundation of robust data, incorporating financial reports, industry-specific market research from firms like GlobalData and Statista, and regulatory filings to provide a comprehensive view of the competitive landscape.