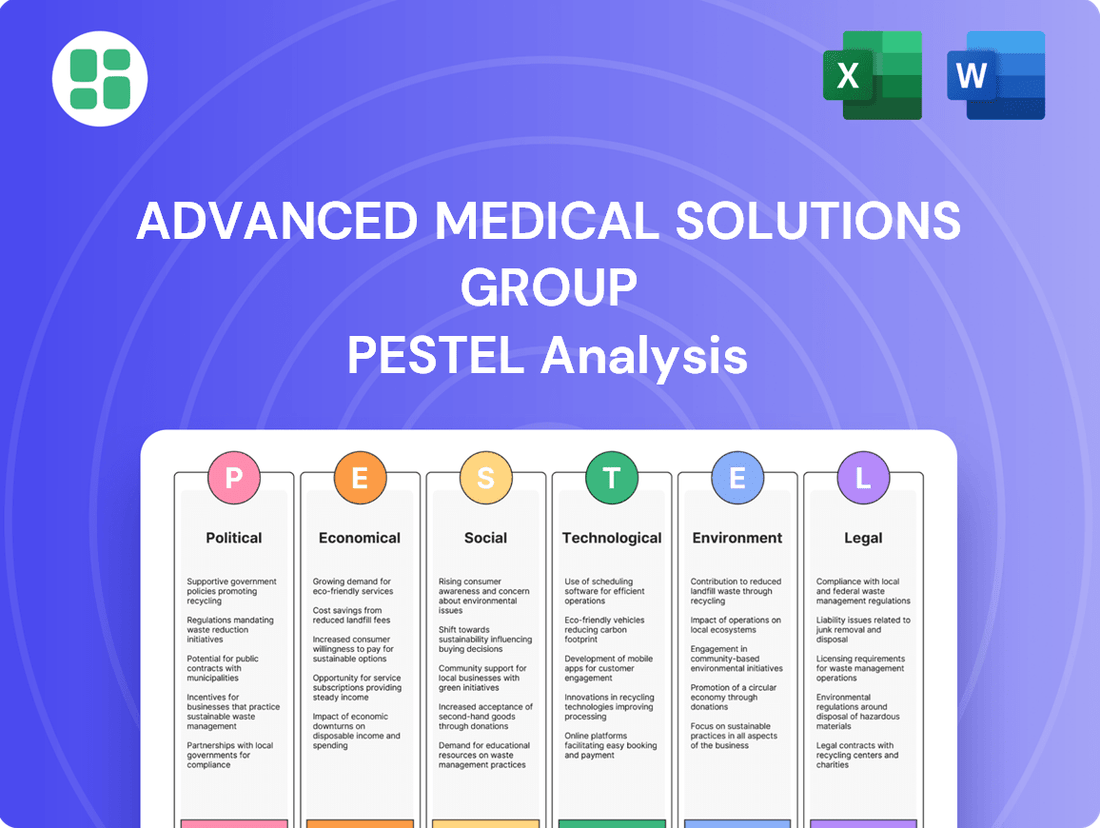

Advanced Medical Solutions Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Medical Solutions Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Advanced Medical Solutions Group's trajectory. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and identify strategic opportunities. Don't be left behind; download the full version now to gain a decisive competitive advantage.

Political factors

Government healthcare policies are a major driver for companies like Advanced Medical Solutions Group (AMS). Changes in how governments fund healthcare directly affect how much demand there is for medical devices and how much AMS can charge for them. For instance, in the United States, national health expenditures are expected to climb by 7.1% in 2025, which could open up more opportunities for AMS.

These policy shifts also influence how AMS products are bought. As healthcare systems increasingly focus on cost control and rewarding providers for good patient outcomes rather than just the services they perform, AMS will need to demonstrate the value and cost-effectiveness of its solutions to secure sales.

The regulatory landscape is a critical factor for Advanced Medical Solutions Group (AMS). New UK Post-Market Surveillance regulations, slated for June 2025, will demand rigorous adherence, potentially influencing product launches and sales strategies. Similarly, the ongoing implementation of the EU's Medical Device Regulation (MDR) continues to shape market access, requiring substantial investment in compliance and potentially extending approval timelines for new technologies.

Global trade agreements and potential tariffs directly influence Advanced Medical Solutions Group's (AMS) supply chain costs and the pricing of its medical devices in various international markets. For instance, changes in trade policies, like those seen in ongoing negotiations for new trade pacts or the imposition of tariffs on specific medical components, can significantly alter AMS's cost of goods sold.

AMS's extensive global footprint, with manufacturing and R&D facilities in countries like Germany, the United States, and Singapore, makes smooth international trade relations paramount. Disruptions to these relations, such as unexpected trade barriers or increased customs duties, could impede the efficient movement of raw materials and finished products, impacting AMS's distribution networks and overall operational efficiency.

The World Trade Organization (WTO) reported that global trade in goods saw a modest increase in 2024, projected to grow by 2.6% in 2025, but geopolitical tensions and protectionist policies remain a significant risk factor. For AMS, this means a careful monitoring of trade policies in key markets like the EU and North America is essential to mitigate potential cost increases or market access challenges.

Government Initiatives for Wound Care and Surgical Innovation

Government initiatives are increasingly focusing on advancing healthcare, which directly benefits companies like Advanced Medical Solutions Group (AMS). For instance, the UK government's commitment to increasing NHS productivity through technology adoption, as outlined in recent policy documents, creates a fertile ground for innovative wound care and surgical solutions. This focus translates into potential funding for research and development and increased adoption of advanced medical technologies.

These government efforts can manifest in several ways that positively impact AMS. Funding for research into novel biomaterials for wound healing or grants supporting the development of minimally invasive surgical tools can directly fuel innovation within the company. Furthermore, public health campaigns aimed at improving chronic wound management can boost demand for AMS's specialized product lines.

- Government Funding for R&D: Programs like the National Institute for Health and Care Research (NIHR) in the UK actively fund research into new medical technologies, potentially benefiting AMS's innovation pipeline.

- Healthcare Technology Adoption Incentives: Policies encouraging the adoption of digital health solutions and advanced medical devices within national health services can drive demand for AMS's products.

- Focus on Preventative Care: Initiatives that promote early intervention and better management of chronic conditions, such as diabetes-related foot ulcers, can increase the market for advanced wound care solutions.

Political Stability and Geopolitical Risks

Advanced Medical Solutions Group (AMS) operates in a global landscape where political stability is paramount. Disruptions in key manufacturing or distribution regions, such as potential unrest in parts of Europe or Asia where AMS has a presence, could directly impact their ability to produce and deliver vital medical products. For instance, if a major supplier's operations are halted due to political instability, it could lead to shortages and increased costs for AMS.

Geopolitical risks, including trade disputes or regional conflicts, pose significant threats to AMS's global strategy. The ongoing conflicts in Eastern Europe, for example, have already demonstrated how supply chains can be fractured, affecting raw material availability and logistics costs for many industries, including medical technology. This can translate into unpredictable market demand and economic uncertainty, directly challenging AMS's profitability and expansion plans.

- Supply Chain Vulnerability: Political instability in countries like Vietnam, where AMS has manufacturing facilities, could lead to production halts, impacting the availability of critical components.

- Market Access Challenges: Escalating trade tensions between major economic blocs could result in tariffs or restrictions, hindering AMS's access to lucrative markets in North America or Asia.

- Economic Volatility: Geopolitical events, such as the ongoing tensions in the Middle East, can trigger broad economic downturns, reducing healthcare spending and impacting demand for AMS's advanced wound care and surgical sealant products.

Government healthcare spending is a significant driver for Advanced Medical Solutions Group (AMS). The United States, for example, is projected to see national health expenditures rise by 7.1% in 2025, potentially creating more avenues for AMS's products. Furthermore, policy shifts toward value-based care necessitate that AMS demonstrate the cost-effectiveness of its advanced wound care and surgical solutions to secure sales within evolving healthcare systems.

Regulatory frameworks continue to shape AMS's market access and operational strategies. The upcoming UK Post-Market Surveillance regulations in June 2025, alongside the ongoing EU Medical Device Regulation (MDR) implementation, demand robust compliance efforts and can influence product approval timelines and market entry for new technologies.

Government initiatives promoting healthcare advancement directly benefit AMS. The UK government's focus on increasing NHS productivity through technology adoption, for instance, offers a supportive environment for innovative medical solutions. This can translate into increased demand and potential funding opportunities for research and development in areas like advanced wound care.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental influences on Advanced Medical Solutions Group, detailing how political, economic, social, technological, environmental, and legal factors present both challenges and strategic advantages.

It provides actionable insights for stakeholders by identifying current trends and future implications, enabling informed decision-making and proactive strategy development within the dynamic medical solutions sector.

Provides a concise version of the Advanced Medical Solutions Group PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to alleviate the pain of complex strategic reviews.

Economic factors

Global healthcare spending is on a significant upward trajectory, directly benefiting companies like Advanced Medical Solutions Group (AMS). For instance, U.S. national health expenditures are anticipated to climb by 7.1% in 2025, a rate that outpaces overall GDP growth. This robust expansion signals an increasingly lucrative market for medical devices, including the surgical and wound care solutions that AMS specializes in.

Economic downturns significantly impact healthcare budgets. For instance, in 2023, many global economies experienced high inflation and rising interest rates, leading to increased pressure on public health services and private insurance providers to control costs. This often translates into tighter spending on new medical technologies and devices.

During periods of economic contraction, national healthcare systems and private insurers may re-evaluate their expenditures. Advanced medical solutions, while beneficial, can face closer scrutiny regarding their cost-effectiveness compared to existing treatments. This could potentially slow down adoption rates or necessitate price adjustments for companies like Advanced Medical Solutions Group (AMS).

The financial resilience of healthcare providers during recessions is crucial. Reports from late 2023 and early 2024 indicated that hospital operating margins in several developed nations were under strain, making them more cautious about capital investments in high-cost medical equipment. This environment can directly affect the sales volumes and pricing power for AMS's innovative product portfolio.

Inflationary pressures significantly impact Advanced Medical Solutions Group (AMS) by increasing the costs of essential raw materials, manufacturing processes, and global logistics. For instance, the Producer Price Index (PPI) for medical equipment in the US saw a notable increase in late 2023 and early 2024, directly affecting AMS's input expenses.

The intricate nature of medical device supply chains, demanding rigorous sterility protocols and often relying on specialized global suppliers, amplifies AMS's vulnerability to escalating operational expenditures. Disruptions or cost hikes in sourcing critical components, such as specialized polymers or electronic parts, can directly translate to reduced profit margins for the company.

Currency Exchange Rate Fluctuations

Advanced Medical Solutions Group (AMS), as a global entity, faces inherent risks from currency exchange rate fluctuations. Significant shifts in the value of the British Pound against other major currencies, such as the US Dollar and the Euro, directly influence AMS's reported financial results. These movements can alter the sterling equivalent of revenues earned and expenses incurred in foreign markets, impacting both top-line figures and profitability.

For instance, a stronger Pound can make AMS's products more expensive for overseas buyers, potentially dampening demand or forcing price adjustments. Conversely, a weaker Pound can boost the sterling value of foreign earnings. In 2024, the Pound Sterling experienced volatility, trading within a range against the Euro and US Dollar, which would have directly affected AMS's reported international performance.

- Impact on Revenue: Fluctuations in exchange rates can lead to a divergence between reported revenue and actual sales volume in local currencies.

- Profit Margin Erosion: Unfavorable currency movements can reduce the profit margins on goods sold internationally if costs are denominated in stronger currencies.

- Hedging Strategies: AMS likely employs financial instruments to hedge against currency risks, aiming to stabilize its financial performance against exchange rate volatility.

- Competitive Landscape: Currency shifts can also affect the competitive positioning of AMS relative to rivals operating in different currency zones.

Private Equity and M&A Activity

Private equity firms are showing increased interest in the medical technology sector. For instance, Inflexion Private Equity was reportedly studying a potential takeover of Advanced Medical Solutions (AMS) Group in 2024. This heightened M&A activity signals a dynamic market, offering potential valuation opportunities for companies like AMS.

However, this trend also presents challenges. A takeover by a private equity firm could lead to significant ownership changes and strategic realignments within AMS. This might involve restructuring, divesting certain business units, or focusing on specific growth areas, potentially altering the company's long-term direction.

- Increased PE Interest: The medical technology sector is a key focus for private equity investment, with firms actively seeking opportunities.

- Valuation Opportunities: A robust M&A environment can lead to attractive valuations for target companies, potentially benefiting shareholders.

- Ownership & Strategy Shifts: Private equity involvement often brings new ownership and strategic objectives, which can reshape a company's operations and future path.

- Market Dynamics: The M&A landscape directly influences the competitive environment and potential for partnerships or consolidation within the industry.

Global healthcare spending continues its upward trend, with U.S. national health expenditures projected to rise by 7.1% in 2025, exceeding GDP growth. This economic expansion directly benefits companies like Advanced Medical Solutions Group (AMS) by indicating a growing market for surgical and wound care products.

However, economic slowdowns and inflation present significant headwinds. High inflation in 2023 and early 2024 increased input costs for AMS, as seen in the rise of the Producer Price Index for medical equipment. This also strains healthcare provider budgets, potentially leading to tighter spending on new technologies.

Currency fluctuations also impact AMS's financial performance. The volatility of the Pound Sterling against major currencies like the US Dollar and Euro in 2024 directly affected the sterling value of AMS's international earnings and expenses, influencing reported revenues and profitability.

The medical technology sector is attracting substantial private equity interest, with potential takeover targets like AMS being explored in 2024. While this signals valuation opportunities, it also introduces the possibility of strategic shifts and ownership changes within the company.

| Economic Factor | 2024/2025 Data Point | Impact on AMS |

|---|---|---|

| Global Healthcare Spending Growth | US Health Expenditures +7.1% (2025 est.) | Increased market demand for AMS products |

| Inflationary Pressures | US Medical Equipment PPI increase (late 2023/early 2024) | Higher raw material and operational costs for AMS |

| Currency Exchange Rate Volatility | GBP vs. USD/EUR volatility (2024) | Impacts reported international revenue and profit margins |

| Private Equity Interest | Reported PE interest in AMS (2024) | Potential for M&A activity, valuation opportunities, and strategic shifts |

Preview Before You Purchase

Advanced Medical Solutions Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Advanced Medical Solutions Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed understanding of the external forces shaping their strategic landscape.

Sociological factors

The global population is aging at an unprecedented rate, with projections indicating that by 2030, one in every six individuals will be aged 60 or over. This demographic shift directly fuels the demand for advanced wound care solutions and sophisticated surgical procedures, as older individuals are inherently more prone to developing chronic wounds and necessitate specialized medical attention.

This increasing prevalence of age-related health issues, including chronic wounds, translates into a substantial market opportunity for companies like Advanced Medical Solutions Group. The growing need for effective wound management and surgical interventions among the elderly population underscores the critical role of innovative medical technologies in addressing these escalating healthcare challenges.

The rising prevalence of chronic diseases like diabetes and obesity significantly fuels demand for advanced wound care solutions. These conditions often complicate healing, making specialized dressings and tissue-regeneration technologies essential. For instance, by 2025, the global diabetes population is projected to exceed 643 million, a substantial portion of whom will experience diabetic foot ulcers, a key market for AMS.

Patients today are far more informed and expect quicker recovery times, less invasive treatments, and better cosmetic results from medical procedures. This rising awareness directly fuels the demand for cutting-edge medical technologies.

Advanced Medical Solutions Group's commitment to developing advanced wound care products and tissue adhesives perfectly addresses this societal trend. For instance, the global wound care market was valued at approximately $22.5 billion in 2023 and is projected to reach over $35 billion by 2030, indicating a strong and growing patient desire for improved healing solutions.

Lifestyle Changes and Surgical Procedures

Modern lifestyles, characterized by increased disposable income and a greater focus on personal well-being, are driving a significant uptick in both elective and essential surgical procedures worldwide. This global trend directly supports Advanced Medical Solutions Group (AMS) as it specializes in crucial surgical products. For instance, the global surgical equipment market was valued at approximately $17.5 billion in 2023 and is projected to reach over $25 billion by 2028, indicating robust growth that aligns with AMS's product portfolio of sutures, tissue adhesives, and internal fixation devices.

The increasing accessibility and affordability of healthcare services across many regions further fuel this demand for surgical interventions. This means more patients are undergoing procedures that require high-quality medical supplies, directly benefiting companies like AMS. The demand for minimally invasive surgical techniques, which often utilize specialized adhesives and fixation devices, is also on the rise, creating further opportunities for AMS to expand its market share.

- Growing Demand for Elective Surgeries: Increased disposable income and a focus on aesthetics and quality of life are driving demand for procedures like cosmetic surgery and joint replacements.

- Advancements in Medical Technology: Innovations in surgical techniques, such as robotic surgery and minimally invasive procedures, require advanced medical supplies that AMS provides.

- Aging Global Population: As the global population ages, the incidence of age-related conditions requiring surgical intervention, such as cardiovascular and orthopedic issues, continues to rise.

Healthcare Workforce Shortages and Efficiency Needs

The healthcare sector is grappling with significant workforce shortages. For instance, the United States faced an estimated shortage of up to 124,000 physicians by 2034, according to the Association of American Medical Colleges (AAMC) 2023 report. This scarcity, coupled with increasing patient volumes and rising operational costs, creates an urgent demand for solutions that boost efficiency and shorten patient recovery periods.

Advanced Medical Solutions Group (AMS) is well-positioned to address these critical needs. Their innovative products, designed to accelerate wound healing and potentially reduce the incidence of complications, can directly contribute to more streamlined patient care pathways. By enabling faster recovery, AMS solutions can help alleviate the strain on overburdened healthcare facilities and their limited staff, improving overall system efficiency.

- Healthcare Staffing Gaps: Projections indicate a substantial shortfall in healthcare professionals, impacting service delivery and increasing workload on existing staff.

- Efficiency Imperative: Rising healthcare costs and workforce limitations necessitate solutions that optimize patient throughput and resource utilization.

- AMS's Role: Products promoting faster healing and reduced complications can enhance patient management efficiency and lessen the burden on healthcare systems.

- Economic Impact: Improved efficiency translates to potential cost savings for hospitals and better outcomes for patients, addressing a key societal concern.

Societal expectations for faster recovery and less invasive procedures are a significant driver for Advanced Medical Solutions Group (AMS). Patients are increasingly informed and demand better cosmetic outcomes, directly boosting the market for innovative wound care and surgical adhesives. The global wound care market, valued at approximately $22.5 billion in 2023, is expected to exceed $35 billion by 2030, reflecting this patient-driven demand.

Technological factors

The surgical robotics market is experiencing rapid growth, projected to reach $18.9 billion by 2028, driven by AI integration that enhances precision. Advanced Medical Solutions Group (AMS) can capitalize on this by developing products that seamlessly integrate with AI-driven robotic platforms, improving surgical outcomes and expanding their market reach.

Continuous innovation in wound care, particularly with bioactive and biodegradable materials, offers significant avenues for Advanced Medical Solutions Group (AMS) to expand its product offerings. The market for advanced wound care is projected to reach $16.5 billion by 2027, indicating substantial growth potential.

Research and development in these cutting-edge biomaterials are crucial for AMS to develop more effective and patient-friendly wound management solutions. Companies investing in these areas, like those focusing on hydrogels and alginates, are seeing increased market share, with the global wound care market expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2029.

The integration of 3D printing is revolutionizing personalized medicine, with custom implants and surgical aids becoming increasingly common. By 2024, the global 3D printing in healthcare market was valued at over $3.5 billion, with projections indicating substantial growth. Advanced Medical Solutions Group (AMS) could leverage this trend by developing specialized adhesives and biomaterials compatible with 3D printing technologies, enabling the creation of bespoke patient-specific solutions.

This technological advancement extends to bioprinting, where researchers are developing techniques to create functional tissues and organs. The potential for AMS materials to support these intricate bioprinting processes presents a significant opportunity for innovation and market expansion in the rapidly evolving field of regenerative medicine.

Digital Health and Remote Monitoring

The surge in digital health, including telemedicine and remote patient monitoring, is significantly reshaping wound care. Advanced Medical Solutions Group (AMS) must assess how its wound care products can integrate with these evolving digital platforms. This integration is crucial for enhancing patient follow-up, facilitating robust data collection, and enabling remote assessment of wound healing progress.

The global digital health market was valued at approximately $211 billion in 2023 and is projected to grow substantially, with remote patient monitoring alone expected to reach over $175 billion by 2030. This trend presents a clear opportunity for AMS to align its offerings with digital ecosystems.

- Telemedicine Adoption: Increased use of virtual consultations for wound assessment and management.

- Remote Monitoring Devices: Integration of smart devices for continuous wound data capture.

- Data Analytics: Leveraging collected data for personalized treatment plans and predictive analytics in wound healing.

- Patient Engagement: Digital platforms can improve patient adherence to treatment protocols and self-care.

Smart Manufacturing and Automation

Smart manufacturing, incorporating AI and the Internet of Things (IoT), is revolutionizing the medical manufacturing sector by boosting efficiency and minimizing errors. Advanced Medical Solutions Group (AMS) can leverage this trend through automation, real-time production monitoring, and predictive analytics. This will optimize output, strengthen quality assurance, and smooth out supply chain operations.

The adoption of Industry 4.0 technologies in medical device manufacturing is projected to grow significantly. For instance, the global smart manufacturing market, which includes medical applications, was valued at approximately $25.8 billion in 2023 and is expected to reach over $60 billion by 2028, with a compound annual growth rate (CAGR) of around 18.5%.

- Increased Efficiency: Automation in AMS's facilities can lead to a 15-20% increase in production throughput.

- Enhanced Quality Control: Real-time data monitoring powered by AI can reduce defect rates by up to 25%.

- Supply Chain Optimization: Predictive analytics can improve inventory management, potentially cutting warehousing costs by 10-15%.

- Reduced Operational Costs: Implementing IoT sensors for predictive maintenance can decrease equipment downtime by an estimated 30%.

Technological advancements in AI and robotics are transforming surgery, with the surgical robotics market expected to reach $18.9 billion by 2028, offering precision enhancements. Biomaterials innovation, particularly in bioactive and biodegradable options, fuels growth in advanced wound care, a sector projected to hit $16.5 billion by 2027. The integration of 3D printing in healthcare, valued over $3.5 billion in 2024, enables personalized medicine and custom implants.

| Technology Area | Market Projection (USD Billion) | Key Impact for AMS |

|---|---|---|

| Surgical Robotics (AI Integration) | 18.9 (by 2028) | Develop AI-compatible products for enhanced surgical precision. |

| Advanced Wound Care Materials | 16.5 (by 2027) | Expand product lines with bioactive and biodegradable wound management solutions. |

| 3D Printing in Healthcare | >3.5 (in 2024) | Create specialized adhesives and biomaterials for 3D printed patient-specific devices. |

Legal factors

Advanced Medical Solutions Group (AMS) navigates a complex regulatory landscape, with strict adherence to global medical device regulations being a critical factor. The EU Medical Device Regulation (MDR) and similar frameworks in the UK and US dictate product development, clinical evidence requirements, and post-market surveillance, directly influencing market access and ongoing compliance expenses.

The MDR, fully implemented in 2021, has significantly increased the burden of proof for medical device manufacturers, requiring more robust clinical data and rigorous conformity assessments. For AMS, this translates to substantial investment in clinical trials and quality management systems to maintain market access in key regions, with compliance costs for some companies reportedly rising by 10-20% or more.

Advanced Medical Solutions Group (AMS) operates under strict product liability laws, demanding rigorous adherence to patient safety standards for all its medical devices and solutions. Failure to meet these benchmarks can result in significant financial penalties and severe damage to the company's reputation.

In 2024, the medical device industry continued to see substantial litigation costs. For instance, recalls and lawsuits related to device malfunctions can run into millions, impacting profitability. AMS's commitment to quality control and proactive risk management is therefore critical to mitigating these legal and financial exposures.

Intellectual property rights, particularly patent protection, are paramount for Advanced Medical Solutions Group (AMS) to safeguard its innovative tissue-healing technologies. This includes patents covering their advanced wound dressings, novel tissue adhesives, and specialized surgical devices, which form the bedrock of their competitive edge.

Robust legal frameworks for intellectual property ensure that AMS can indeed capitalize on its significant research and development investments. These protections are vital for preventing competitors from unauthorized replication of their patented technologies, thereby securing their market position and future revenue streams.

Anti-Corruption and Ethical Business Practices

Advanced Medical Solutions Group (AMS) must navigate a complex web of anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, which carry significant penalties for violations. Maintaining robust ethical business practices is paramount, particularly given AMS's international reach and dealings with healthcare professionals and government agencies. Compliance not only shields the company from legal repercussions but also safeguards its valuable reputation in the highly regulated medical technology sector.

The financial implications of non-compliance can be severe. For instance, companies found guilty of FCPA violations can face hefty fines; in 2023, a medical device company paid $30 million to settle FCPA charges related to improper payments in various countries. AMS's commitment to ethical conduct directly impacts its ability to secure contracts and maintain trust with stakeholders, influencing its long-term financial performance and market access.

- Global Enforcement Trends: Increased scrutiny and enforcement actions against companies in the healthcare sector for bribery and corruption are expected to continue through 2024 and 2025.

- Reputational Risk: A single proven instance of corruption can lead to significant reputational damage, impacting sales and investor confidence, as demonstrated by past cases where stock prices dropped considerably.

- Compliance Investment: Companies like AMS are investing heavily in compliance programs, training, and due diligence to mitigate these risks, with global spending on compliance expected to rise.

- Ethical Sourcing and Partnerships: Ensuring ethical practices extend to third-party vendors and partners is a growing focus, with due diligence costs increasing to verify compliance.

Data Privacy and Cybersecurity Regulations

Advanced Medical Solutions Group (AMS) faces increasing scrutiny regarding data privacy and cybersecurity. The digitization of healthcare data and the connected nature of modern medical devices necessitate strict adherence to regulations like GDPR and HIPAA. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher.

The legal landscape is constantly evolving, demanding continuous adaptation from AMS. Protecting sensitive patient information from breaches and ensuring device integrity against cyber threats is no longer optional but a core legal requirement. For instance, the US Department of Health and Human Services reported over 500 healthcare data breaches affecting more than 300 million individuals in 2023 alone, highlighting the pervasive risk.

- Data Protection Compliance: AMS must ensure all data handling practices align with global privacy laws such as GDPR and CCPA.

- Cybersecurity Standards: Adherence to industry-specific cybersecurity frameworks (e.g., NIST) is crucial for protecting connected medical devices.

- Breach Notification Laws: Understanding and implementing procedures for timely notification in case of data breaches is a legal obligation.

- Device Security Mandates: Regulations increasingly require manufacturers to build security into medical devices from the design phase.

The evolving legal framework for medical devices, including the EU MDR, imposes stringent requirements on Advanced Medical Solutions Group (AMS) for clinical evidence and post-market surveillance, impacting market access and compliance costs. Product liability laws necessitate unwavering adherence to patient safety, with litigation for device malfunctions posing significant financial and reputational risks, as evidenced by substantial recall-related lawsuits in 2024. Intellectual property protection is vital for AMS to safeguard its innovations, ensuring market exclusivity and return on R&D investment by preventing unauthorized replication of patented technologies.

| Legal Factor | Impact on AMS | 2024/2025 Data/Trend |

|---|---|---|

| Regulatory Compliance (MDR, FDA) | Increased clinical data requirements, higher compliance costs. | MDR compliance costs for some firms rose 10-20%+. Continued focus on post-market surveillance. |

| Product Liability | Need for robust quality control, risk of significant financial penalties and reputational damage. | Medical device litigation costs remain high; recalls can cost millions. |

| Intellectual Property | Protection of core technologies, essential for competitive advantage and revenue. | Strong patent portfolios are critical for market exclusivity and deterring competitors. |

| Anti-Corruption Laws (FCPA, UK Bribery Act) | Requirement for strict ethical practices, particularly with international dealings. | Increased global enforcement; a medical device firm paid $30M in 2023 for FCPA violations. |

| Data Privacy & Cybersecurity | Mandatory adherence to GDPR, HIPAA; risk of substantial fines for breaches. | Over 500 healthcare data breaches reported in the US in 2023, affecting 300M+ individuals. |

Environmental factors

Growing environmental concerns and increasingly stringent regulations worldwide are compelling medical device manufacturers like Advanced Medical Solutions Group (AMS) to adopt more sustainable manufacturing practices. This shift is driven by a desire to reduce ecological impact and comply with evolving legal frameworks.

AMS must actively integrate eco-friendly materials into its product lines, focusing on biodegradable options for disposable devices, which represent a significant portion of medical waste. For instance, the global biodegradable medical plastics market was valued at approximately USD 3.5 billion in 2023 and is projected to grow substantially, indicating a strong market demand for such innovations.

Furthermore, the company should invest in energy-efficient production processes and robust waste reduction strategies. Implementing closed-loop systems for water and material recycling can significantly cut operational costs and environmental footprint. In 2024, many leading medical device companies reported a 10-15% reduction in energy consumption by adopting advanced manufacturing technologies.

Developing recyclable packaging solutions is also crucial. The healthcare industry's packaging waste is a major concern, and AMS can gain a competitive edge by offering sustainable packaging that meets both regulatory requirements and customer expectations for environmental responsibility.

The medical sector, including companies like Advanced Medical Solutions Group (AMS), faces growing pressure regarding its environmental footprint, especially concerning waste from single-use items and product packaging. In 2024, the global healthcare waste market was valued at approximately $40 billion, highlighting the scale of this issue.

AMS needs to implement comprehensive recycling initiatives and explore remanufacturing options for its products. Furthermore, developing responsible disposal methods for products at their end-of-life is crucial, especially as regulations tighten.

Regulatory bodies globally are intensifying scrutiny on the carbon footprint of medical manufacturers, pushing companies like Advanced Medical Solutions Group (AMS) to actively reduce Scope 1 and 2 emissions. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) requires detailed reporting on environmental impacts, influencing AMS's operational strategies.

To meet these evolving environmental compliance standards, AMS is increasingly focused on adopting green energy transitions. This includes exploring investments in renewable energy sources like solar power for its facilities, aiming to decrease reliance on fossil fuels. Furthermore, optimizing transport and logistics efficiency is a key initiative to lower emissions associated with its supply chain.

Supply Chain Environmental Responsibility

Advanced Medical Solutions Group (AMS) faces increasing scrutiny on its supply chain's environmental impact. This necessitates collaboration with logistics and disposal partners committed to reducing CO2 emissions and implementing sustainable practices. For example, in 2024, the global logistics industry saw a push towards electric vehicles and optimized routing, with companies like Maersk investing heavily in green fuels. AMS must ensure its partners align with these evolving environmental standards.

Ethical sourcing of raw materials with demonstrably low carbon footprints is also becoming a critical factor for AMS. Consumers and regulators are demanding greater transparency regarding the origin and environmental cost of components. Reports from 2024 indicate a significant rise in consumer preference for products from companies with strong environmental, social, and governance (ESG) credentials, directly impacting purchasing decisions.

Key environmental considerations for AMS's supply chain include:

- Carbon Footprint Reduction: Partnering with logistics providers actively investing in low-emission fleets and sustainable transportation methods.

- Waste Management: Ensuring disposal partners adhere to strict environmental regulations and promote circular economy principles for medical waste.

- Sustainable Sourcing: Prioritizing raw material suppliers who can demonstrate reduced environmental impact and ethical labor practices.

- Regulatory Compliance: Staying ahead of evolving environmental legislation globally that affects manufacturing and distribution of medical devices.

Climate Change and Resource Scarcity

Long-term environmental trends, including climate change and potential resource scarcity, pose a significant risk to Advanced Medical Solutions Group (AMS). Fluctuations in weather patterns and increased frequency of extreme events could disrupt supply chains, impacting the availability and cost of essential raw materials crucial for medical device manufacturing. For instance, a global shortage of specific rare earth minerals, exacerbated by climate-related mining disruptions, could directly affect the production of advanced diagnostic equipment.

Proactive strategies focusing on resource efficiency and adaptation to climate-related disruptions are becoming paramount for AMS's business resilience. This includes exploring alternative materials, optimizing manufacturing processes to reduce waste, and investing in supply chain diversification. By 2024, companies globally are increasingly allocating budgets towards sustainability initiatives, with an estimated 40% of major corporations reporting increased investment in climate adaptation measures, according to a recent industry survey.

- Supply Chain Vulnerability: Climate change impacts, such as droughts or floods, can affect agricultural output, potentially limiting the supply of bio-based materials used in some medical products.

- Rising Operational Costs: Increased energy costs due to climate policies or scarcity of fossil fuels could raise manufacturing expenses for AMS.

- Regulatory Pressures: Growing global regulations aimed at mitigating climate change may necessitate changes in AMS's sourcing and production methods, potentially increasing compliance costs.

- Demand for Sustainable Products: A shift in consumer and healthcare provider preference towards environmentally friendly medical solutions could create both challenges and opportunities for AMS.

Environmental regulations are tightening globally, pushing companies like Advanced Medical Solutions Group (AMS) towards sustainable practices. This includes using eco-friendly materials, with the biodegradable medical plastics market reaching approximately USD 3.5 billion in 2023, and adopting energy-efficient production, which saw leading firms achieve 10-15% energy reduction in 2024.

AMS must also address packaging waste, a significant concern in the healthcare sector. The company is investing in green energy and supply chain sustainability, with a focus on reducing carbon footprints through partnerships and ethical sourcing. Consumer preference for ESG-compliant products is rising, influencing purchasing decisions.

Climate change poses risks like supply chain disruptions and increased operational costs. AMS is adapting by focusing on resource efficiency and supply chain diversification, with many corporations increasing sustainability investments by 2024.

| Environmental Factor | 2024/2025 Data/Trend | Impact on AMS |

|---|---|---|

| Biodegradable Plastics Market | Valued at approx. USD 3.5 billion (2023), growing demand. | Opportunity for product innovation and market share. |

| Energy Efficiency in Manufacturing | Companies reporting 10-15% energy reduction (2024). | Potential for cost savings and reduced operational footprint. |

| Healthcare Waste Market | Valued at approx. USD 40 billion (2024). | Drives need for improved waste management and recycling solutions. |

| Corporate Sustainability Reporting Directive (CSRD) | EU directive increasing environmental impact reporting. | Requires enhanced data collection and compliance strategies. |

| Green Logistics Investment | Companies like Maersk investing in green fuels (2024). | Necessitates collaboration with sustainable logistics partners. |

| Consumer Preference for ESG | Significant rise in preference for ESG-credentialed products (2024). | Enhances brand reputation and market competitiveness. |

| Corporate Investment in Climate Adaptation | Estimated 40% of major corporations increasing investment (2024). | Indicates a strategic shift towards business resilience. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Advanced Medical Solutions Group is meticulously constructed using data from reputable sources, including government health agencies, international economic bodies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the medical solutions sector.