Adient SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

Adient, a global leader in automotive seating, faces a dynamic market. Understanding their core strengths in innovation and global reach, alongside potential threats from supply chain disruptions and evolving consumer preferences, is crucial for strategic success.

Want the full story behind Adient’s competitive edge, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Adient stands as a dominant force in the automotive seating industry, holding roughly one-third of the global market. This leadership position, as of early 2024, translates into significant advantages, allowing the company to benefit from substantial economies of scale in its design, engineering, and manufacturing processes. Its vast operational network, spanning over 200 facilities across 29 countries, ensures it can effectively cater to the needs of major automotive manufacturers worldwide.

Adient boasts a truly comprehensive product portfolio, offering everything from complete seating systems to individual components such as frames, mechanisms, foam, trim, and fabric. This extensive range demonstrates deep expertise across the entire seating value chain. For instance, in fiscal year 2023, Adient's seating segment generated significant revenue, underscoring the market's demand for their integrated solutions.

Adient's strength lies in its deep-rooted partnerships with all major original equipment manufacturers (OEMs) worldwide. This extensive network provides a stable foundation and a significant competitive edge, ensuring consistent business flow.

The company has shown impressive operational performance, leading to improved margins in crucial markets like the Americas and Asia. This execution excellence is a testament to their strategic focus and ability to drive profitability.

Recent successes, including the provision of advanced mechanical massage seats for GAC-Trumpchi's new plug-in hybrid electric vehicle and the establishment of a dedicated assembly facility for Rivian, underscore Adient's capacity to win new contracts and adapt to emerging automotive trends and technologies.

Commitment to Sustainability and Innovation

Adient demonstrates a strong commitment to sustainability, a key strength for the company. Their 2024 Sustainability Report details significant progress, including a 38% reduction in global Scope 1 and 2 greenhouse gas emissions compared to 2019 levels. This aligns with their ambitious target of a 75% reduction by 2030, showcasing a forward-thinking approach to environmental responsibility.

Innovation in sustainable materials is another core strength. Adient is actively incorporating materials like green steel and recyclable polyester into their seat designs, reflecting a dedication to reducing their environmental footprint throughout the product lifecycle. This focus on eco-friendly components positions them well for future market demands.

Beyond materials, Adient is pushing boundaries in seating technology, particularly in areas of comfort, health, and wellness. Their development of new mechanical massage seat solutions highlights a strategic move to enhance user experience and cater to evolving consumer preferences for more advanced and health-conscious automotive interiors.

- Sustainability Commitment: Achieved a 38% reduction in global Scope 1 and 2 GHG emissions since 2019, with a 2030 goal of 75% reduction.

- Material Innovation: Utilizing green steel and recyclable polyester in seat manufacturing.

- Product Advancement: Developing new mechanical massage seat solutions for enhanced comfort and wellness.

Improved Financial Performance and Capital Discipline

Adient's financial performance has notably improved, with the company returning to profitability in Q3 2025, reporting a substantial increase in net income. This financial resurgence is a direct result of the company's commitment to capital discipline.

The company has actively engaged in capital allocation strategies, including share repurchases and a concerted effort to reduce outstanding debt. These actions underscore a management focus on enhancing shareholder value and strengthening the balance sheet.

Strategic initiatives, such as the divestiture of non-core assets and effective mitigation of tariff impacts, have been instrumental in Adient's positive financial trajectory. These measures have contributed to a more robust operational and financial outlook for the company.

- Return to Profitability: Adient achieved profitability in Q3 2025, a key indicator of improved operational efficiency.

- Disciplined Capital Allocation: Share repurchases and debt reduction demonstrate a strategic approach to capital management.

- Strategic Initiatives Success: Asset sales and tariff mitigation have positively impacted financial results.

Adient's market leadership, holding approximately one-third of the global automotive seating market as of early 2024, provides significant economies of scale. Its extensive global footprint, with over 200 facilities in 29 countries, ensures robust supply chain capabilities and proximity to major automotive manufacturers. The company's comprehensive product portfolio, covering everything from complete seating systems to individual components, showcases deep expertise across the entire value chain.

Adient's strong relationships with all major original equipment manufacturers (OEMs) offer a stable revenue base and a significant competitive advantage. Recent contract wins, such as supplying advanced seating for GAC-Trumpchi's new plug-in hybrid electric vehicle and establishing a facility for Rivian, highlight its ability to secure new business and adapt to evolving automotive trends.

The company's commitment to sustainability is a key strength, evidenced by a 38% reduction in global Scope 1 and 2 greenhouse gas emissions since 2019, targeting a 75% reduction by 2030. Innovations in materials like green steel and recyclable polyester, alongside advancements in comfort and wellness features like mechanical massage seats, position Adient favorably for future market demands.

Adient's return to profitability in Q3 2025, coupled with disciplined capital allocation strategies including share repurchases and debt reduction, demonstrates improved financial health. Successful divestitures of non-core assets and effective mitigation of tariff impacts further bolster its financial performance.

| Key Strength | Description | Supporting Data/Fact |

| Market Leadership | Dominant global position in automotive seating. | Holds ~33% of the global automotive seating market (as of early 2024). |

| Global Operations | Extensive manufacturing and supply chain network. | Operates over 200 facilities in 29 countries. |

| OEM Relationships | Strong, long-standing partnerships with all major automakers. | Consistent business flow from all major automotive OEMs. |

| Sustainability Focus | Commitment to environmental responsibility and eco-friendly materials. | Achieved 38% reduction in Scope 1 & 2 GHG emissions (vs. 2019), targeting 75% by 2030. Utilizes green steel and recyclable polyester. |

| Financial Recovery | Return to profitability and disciplined capital management. | Achieved profitability in Q3 2025. Active in share repurchases and debt reduction. |

What is included in the product

Delivers a strategic overview of Adient’s internal and external business factors, highlighting its competitive advantages and potential vulnerabilities in the automotive seating industry.

Adient's SWOT analysis acts as a pain point reliever by offering a clear roadmap to navigate industry challenges and capitalize on emerging opportunities.

Weaknesses

Adient's significant reliance on the automotive industry makes it susceptible to the cyclical nature of vehicle production and sales. For instance, in fiscal year 2023, the company's revenue was directly tied to the global automotive production volumes, which experienced fluctuations due to supply chain issues and economic headwinds.

Economic pressures, such as elevated interest rates and increasing vehicle prices throughout 2024, are dampening consumer demand for new automobiles. This slowdown in consumer purchasing directly translates to lower sales volumes for Adient, impacting its overall business performance.

Consequently, any downturn in the automotive sector or significant shifts in consumer preferences, like a move towards different vehicle types or ownership models, can have a pronounced negative effect on Adient's financial results, highlighting a key vulnerability.

Adient's reliance on key materials like steel and aluminum makes it vulnerable to price swings. For instance, steel prices saw significant increases in late 2021 and early 2022, impacting manufacturing costs across industries. This volatility directly affects Adient's cost of goods sold, potentially squeezing profit margins if these increases cannot be passed on to customers.

The automotive seating sector is incredibly crowded, with many Tier 1 suppliers competing fiercely for business from car manufacturers. This intense rivalry, even for a market leader like Adient, can squeeze profit margins, particularly as automakers continually push for lower costs. Data suggests that automotive suppliers have generally seen slimmer profit margins than OEMs since 2020, a trend that continues to challenge the industry.

Supply Chain Disruptions

Ongoing global supply chain disruptions, such as semiconductor chip shortages and logistical hurdles, continue to impact automotive manufacturing. These issues directly affect original equipment manufacturers (OEMs), leading to production delays that subsequently alter Adient's demand and delivery timelines.

The inherent fragility of worldwide supply chains mandates persistent adaptation and strategic investments in building more resilient operational frameworks. For instance, in early 2024, many automotive manufacturers reported extended lead times for essential electronic components, directly influencing production volumes.

- Component Shortages: Persistent shortages of semiconductors and other critical electronic parts continue to constrain automotive production volumes globally.

- Logistical Bottlenecks: Port congestion and elevated shipping costs remain significant challenges, impacting the timely delivery of raw materials and finished goods.

- Production Delays: OEM production stoppages or slowdowns directly reduce demand for Adient's seating systems, creating revenue uncertainty.

- Increased Costs: Expedited shipping and the need to secure alternative suppliers can drive up operational costs for Adient.

Restructuring Costs and Profitability Challenges

Adient has grappled with profitability issues since its separation from Johnson Controls. While restructuring initiatives are designed to boost efficiency, they come with considerable upfront expenses. For instance, in fiscal year 2025, Adient reported significant restructuring and impairment charges, which directly affected its bottom line during that period.

These ongoing structural adjustments within the dynamic automotive sector present a persistent hurdle for Adient in achieving stable profitability. The company's ability to navigate these challenges and translate restructuring gains into consistent financial performance is key.

- Restructuring Expenses: Adient incurred approximately $250 million in restructuring and impairment charges in fiscal year 2025, impacting net income.

- Profitability Volatility: The company's net income has shown fluctuations, with a reported net loss of $180 million in Q3 FY2025, partly attributable to these restructuring costs.

- Market Dynamics: Adapting to evolving automotive industry demands while managing internal operational changes remains a complex balancing act for sustained profitability.

Adient's substantial dependence on the automotive sector exposes it to the inherent cyclicality of vehicle production and sales. For example, in fiscal year 2023, the company's revenue was directly linked to global automotive production volumes, which experienced volatility due to ongoing supply chain disruptions and broader economic challenges. This makes Adient vulnerable to market downturns and shifts in consumer preferences, such as a move towards different vehicle types or ownership models, which can negatively impact its financial results.

The company faces intense competition within the automotive seating sector, with numerous Tier 1 suppliers vying for business from car manufacturers. This fierce rivalry, even for a market leader, tends to compress profit margins, especially as automakers consistently push for cost reductions. Industry data indicates that automotive suppliers have generally experienced thinner profit margins compared to original equipment manufacturers (OEMs) since 2020, a trend that continues to challenge Adient.

Adient's profitability has been affected by ongoing restructuring efforts since its separation from Johnson Controls. While these initiatives aim to improve efficiency, they involve significant upfront costs. For instance, Adient reported substantial restructuring and impairment charges in fiscal year 2025, which directly impacted its net income during that period, contributing to profitability volatility.

| Weakness | Impact | Example/Data Point |

|---|---|---|

| Automotive Industry Dependence | Vulnerability to production cycles and demand fluctuations | FY2023 revenue tied to fluctuating global automotive production volumes. |

| Intense Competition | Pressure on profit margins due to cost demands from automakers | Automotive suppliers generally have slimmer profit margins than OEMs since 2020. |

| Restructuring Costs & Profitability | Impact on bottom line from efficiency initiatives | FY2025 restructuring and impairment charges of approximately $250 million. |

| Supply Chain Disruptions | Constraints on production and delivery timelines | Persistent semiconductor shortages impacting OEM production volumes globally. |

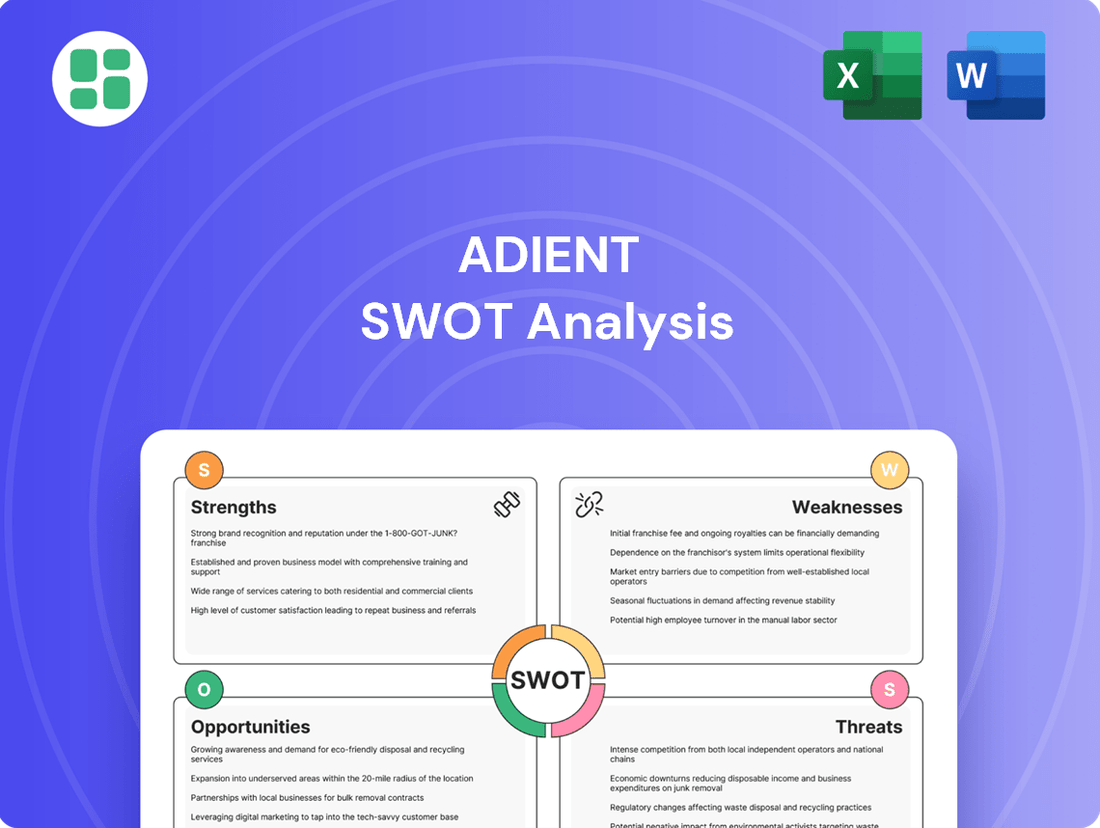

Preview the Actual Deliverable

Adient SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The accelerating adoption of electric vehicles (EVs) and the burgeoning field of autonomous driving represent substantial growth avenues for Adient. EVs necessitate innovative seating solutions, focusing on lightweight materials to offset battery mass and the seamless integration of sophisticated in-car technology.

Autonomous vehicles are poised to redefine interior spaces, driving demand for highly adaptable and technologically integrated seating. This includes features like seats that can swivel or recline, creating a more lounge-like or productive cabin environment.

For instance, the global EV market is projected to reach over 30 million units sold annually by 2024, a significant increase from previous years, highlighting the expanding opportunity for specialized seating components. Furthermore, the autonomous vehicle market is expected to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars in value by the early 2030s, underscoring the long-term potential for Adient's advanced seating systems.

Consumers are increasingly prioritizing comfort and advanced features in their vehicle seating. This trend is evident in the growing demand for elements like heating, ventilation, and even massage functions, alongside health-focused innovations such as biometric sensors. Adient is well-positioned to capitalize on this shift, having demonstrated innovation in mechanical massage and advanced climate control systems, directly addressing these evolving consumer preferences.

While Adient experienced some volume declines in Europe, the Middle East, and Africa (EMEA) and China, the Asia Pacific region is a significant growth engine, driving demand and technological advancements in automotive seating. Adient's strong foothold in Asia, including its joint ventures in China, positions it well to capitalize on the expanding production of both traditional and electric vehicles in these dynamic markets.

Leveraging Sustainability for Competitive Advantage

Adient's robust commitment to sustainability, including ambitious emissions reduction targets and a strong emphasis on recyclable materials, positions it favorably for competitive advantage. This dedication directly addresses the growing demand from Original Equipment Manufacturers (OEMs) for environmentally conscious supply chains. For instance, Adient has publicly committed to reducing its Scope 1 and 2 greenhouse gas emissions by 40% by 2030 compared to a 2019 baseline, a significant undertaking in the automotive sector.

This alignment with evolving industry and regulatory pressures, such as the increasing focus on circular economy principles in automotive manufacturing, can unlock new business opportunities and bolster Adient's brand image. As OEMs integrate ESG (Environmental, Social, and Governance) criteria more deeply into their supplier selection processes, Adient's proactive stance offers a tangible benefit. The company's reported progress in increasing the use of recycled content in its seating components further solidifies this advantage.

- Emissions Reduction: Adient aims for a 40% reduction in Scope 1 and 2 GHG emissions by 2030 (vs. 2019 baseline).

- Recyclable Materials: Increased use of recycled content in seating components is a key focus.

- OEM Demand: Growing preference among automotive manufacturers for suppliers with strong sustainability credentials.

- Brand Enhancement: Sustainability initiatives contribute to a positive corporate reputation and attract environmentally conscious partners.

Strategic Partnerships and Diversification

Adient can pursue strategic partnerships to diversify beyond its core automotive seating business. For instance, replicating its successful joint venture with Boeing for aircraft seating could unlock new revenue streams in the aerospace sector. This move would leverage Adient's manufacturing expertise in a high-value market.

Exploring adjacent opportunities within the evolving mobility landscape presents another avenue for growth. This could involve developing components for emerging mobility solutions like autonomous vehicles or electric scooters, or expanding aftermarket services for existing vehicle fleets. These diversifications can broaden Adient's market reach and revenue base.

- Aerospace Expansion: Building on the Boeing partnership, Adient could target other aerospace manufacturers for seating solutions, capitalizing on the projected growth in global air travel. The commercial aircraft seating market alone was valued at approximately $7.1 billion in 2023 and is expected to grow.

- New Mobility Components: Adient could invest in R&D for specialized seating and interior components suited for electric vehicles and autonomous driving systems, a market segment that is rapidly expanding.

- Aftermarket Services: Developing robust aftermarket service offerings for automotive seating, including repair, refurbishment, and replacement parts, can provide a stable and recurring revenue stream.

Adient's strategic focus on the burgeoning electric and autonomous vehicle markets presents a significant opportunity for growth, as these sectors demand innovative and adaptable seating solutions. The company is also well-positioned to capitalize on the increasing consumer demand for enhanced comfort and advanced features in vehicle interiors. Furthermore, Adient's strong presence in the Asia Pacific region, particularly in China, offers a robust platform for expanding its market share amidst rising vehicle production. The company's commitment to sustainability, including emissions reduction and the use of recyclable materials, aligns with OEM preferences and regulatory trends, potentially creating a competitive advantage.

Adient can also explore diversification beyond its core automotive seating business by leveraging its expertise in sectors like aerospace, potentially replicating its successful collaboration with Boeing. Additionally, expanding into aftermarket services for vehicle seating can generate stable, recurring revenue streams. Investing in components for new mobility solutions, such as electric scooters or specialized autonomous vehicle interiors, further broadens Adient's market reach and revenue potential.

| Opportunity Area | Key Drivers | Adient's Position/Action |

|---|---|---|

| EV & Autonomous Vehicles | Growing EV adoption, demand for integrated tech, redefined cabin spaces | Developing lightweight, tech-integrated seating solutions |

| Consumer Comfort & Features | Demand for heated, ventilated, massage seats; biometric integration | Innovating mechanical massage and climate control systems |

| Asia Pacific Growth | Expanding vehicle production, particularly EVs, in key markets | Leveraging strong foothold and joint ventures in China and APAC |

| Sustainability Alignment | OEM demand for ESG, regulatory focus on circular economy | Reducing emissions (40% by 2030 vs 2019), increasing recycled content |

| Diversification (Aerospace) | Growth in air travel, need for specialized seating | Exploring partnerships beyond Boeing for aircraft seating |

| New Mobility & Aftermarket | Emerging mobility solutions, demand for service and refurbishment | Investing in components for e-scooters, autonomous pods; developing aftermarket services |

Threats

Global economic uncertainties, such as the lingering effects of high inflation and elevated interest rates in 2024, pose a significant threat by dampening consumer demand for new vehicles. This slowdown directly impacts automotive manufacturers, leading to reduced production schedules.

A decrease in overall vehicle production, a trend observed in certain markets throughout late 2023 and projected into early 2024 due to these economic pressures, directly translates to lower demand for Adient's automotive seating systems. This reduction in volume can negatively affect Adient's sales and profitability.

The automotive seating sector is seeing a surge in competition, with established giants like Magna International and Lear Corporation facing new challenges. Emerging Asian competitors are particularly noteworthy, potentially disrupting market dynamics with aggressive pricing strategies and accelerated innovation cycles.

These new players could significantly impact Adient's market share and profitability by offering compelling alternatives. For instance, in 2023, the global automotive seating market was valued at approximately $70 billion, and increased competition could put pressure on margins for all participants.

The automotive sector's swift evolution, driven by electric vehicles (EVs) and autonomous driving, demands substantial research and development outlays. Adient must invest heavily to stay at the forefront of these advancements.

Failing to adapt to innovations in lightweight materials, smart seating technologies, and adaptable interior designs could render Adient's offerings outdated, eroding its market position. For instance, the increasing demand for advanced seating solutions that integrate with in-car entertainment systems requires continuous innovation.

Emerging technologies also pave the way for new, non-traditional players to enter the automotive supply chain, potentially disrupting established market dynamics and challenging Adient's existing competitive landscape.

Geopolitical Instability and Trade Tariffs

Geopolitical instability and the specter of trade tariffs pose significant threats to Adient's global operations. For instance, escalating trade tensions between major economic powers could trigger new tariffs, directly impacting the cost of raw materials and finished goods, thereby increasing Adient's production expenses.

Adient's extensive international manufacturing presence makes it particularly vulnerable to these disruptions. A sudden imposition of tariffs, like those seen in recent years impacting automotive components, could significantly raise operational costs and compress profit margins.

- Supply Chain Disruptions: Tariffs can reroute or halt the flow of critical automotive components, leading to production delays and increased logistics costs.

- Increased Input Costs: For example, if tariffs are placed on steel or aluminum, key materials for seating components, Adient would face higher manufacturing expenses.

- Reduced Profitability: Higher operational costs due to tariffs and supply chain issues directly impact Adient's bottom line, potentially leading to reduced profitability.

Regulatory Changes and Compliance Costs

Adient faces increasing regulatory pressures, particularly concerning environmental standards like CO2 emissions targets. For instance, by 2030, the European Union aims for a 55% reduction in CO2 emissions compared to 1990 levels, impacting automotive component suppliers. These evolving mandates necessitate ongoing investment in cleaner manufacturing processes and the development of lighter, more sustainable materials for seating systems.

The company must also navigate varying safety feature regulations across global markets, which can add complexity and cost to product development. Adapting to new mandates for advanced driver-assistance systems (ADAS) integrated into seating, for example, requires significant R&D expenditure. These continuous adaptations can strain financial resources and require agile adjustments to supply chains and manufacturing capabilities to maintain compliance and competitiveness.

Key regulatory challenges include:

- Stricter Emissions Standards: Adherence to global CO2 reduction targets requires investment in sustainable materials and manufacturing.

- Evolving Safety Mandates: Integrating new safety features into seating systems demands continuous R&D and design modifications.

- Regional Compliance Variations: Differing regulations across key markets increase complexity and compliance costs for global operations.

Intensified competition from established players and emerging Asian manufacturers presents a significant threat, potentially eroding Adient's market share and profitability. For instance, the global automotive seating market, valued at approximately $70 billion in 2023, is becoming increasingly crowded.

The rapid technological shifts towards electric vehicles and autonomous driving necessitate substantial R&D investments to avoid product obsolescence. Adient must innovate in areas like lightweight materials and smart seating to remain competitive.

Geopolitical instability and trade tariffs can disrupt Adient's global supply chains and increase operational costs. For example, tariffs on key materials like steel could directly impact manufacturing expenses, as seen with recent component tariffs.

Increasingly stringent environmental and safety regulations worldwide, such as the EU's CO2 reduction targets by 2030, demand continuous investment in sustainable materials and advanced safety features, adding complexity and cost to product development.

| Threat Category | Specific Concern | Potential Impact |

|---|---|---|

| Competition | New Asian entrants, aggressive pricing | Market share erosion, margin pressure |

| Technological Change | EVs, autonomous driving demands | Product obsolescence, R&D cost increase |

| Geopolitics/Trade | Tariffs, supply chain disruption | Increased input costs, production delays |

| Regulatory Landscape | Emissions, safety standards | Compliance costs, R&D investment needs |

SWOT Analysis Data Sources

This Adient SWOT analysis is built upon a robust foundation of data, drawing from Adient's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a clear and accurate picture of the company's internal capabilities and external market positioning.