Adient PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

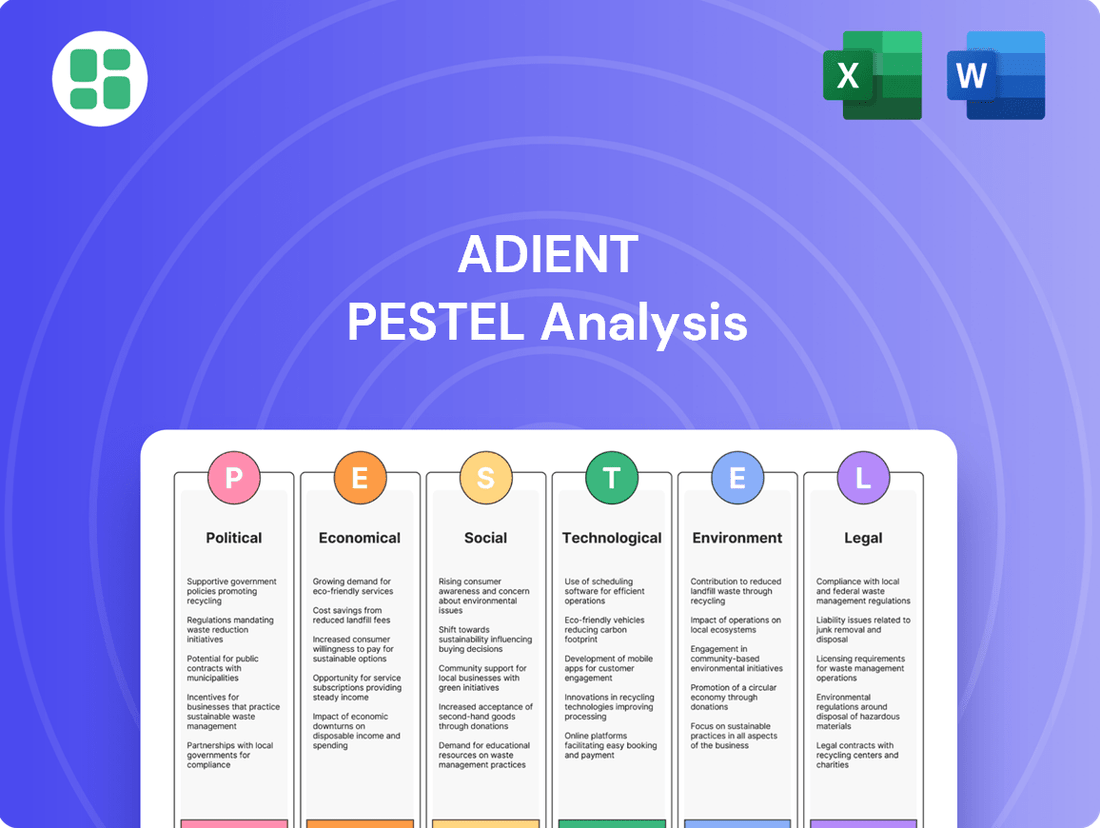

Unlock Adient's future by understanding the political, economic, social, technological, legal, and environmental forces shaping its journey. Our expertly crafted PESTLE analysis reveals critical external factors impacting the automotive seating giant. Gain a competitive edge and make informed strategic decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Changes in global trade agreements and the imposition of tariffs directly affect Adient's supply chain and overall cost structure, especially in its primary manufacturing hubs. For example, Adient's fiscal year 2025 projections highlight the ongoing challenges presented by tariffs, prompting strategic adjustments.

Adient is actively adapting to these shifts, aiming to capitalize on U.S. onshoring trends as a means to offset the financial pressures stemming from tariffs. This proactive approach seeks to build resilience against potential disruptions in the flow of essential goods and raw materials.

Government policies are a significant driver for the automotive industry, particularly concerning electric vehicles (EVs). Initiatives like production subsidies and tax credits directly influence Original Equipment Manufacturers (OEMs) to ramp up EV production. This, in turn, shapes the demand for components like Adient's seating systems.

While the pace of EV growth moderated in 2024, projections for 2025 indicate a sustained upward trend. This resurgence is anticipated to be fueled by advancements in battery technology and charging infrastructure, directly impacting automotive suppliers like Adient.

Adient's strategic investments, especially in the burgeoning Chinese market, underscore its commitment to electrification. These efforts are geared towards securing long-term growth opportunities within the rapidly evolving smart vehicle sector, anticipating a future where EVs are increasingly mainstream.

Geopolitical stability in key markets like Europe, North America, and Asia is crucial for Adient's operations. Disruptions from conflicts or strained international relations can halt production lines and dampen consumer demand for vehicles. For instance, the European automotive market is expected to shrink in fiscal year 2025, presenting a significant challenge for Adient.

Automotive Industry Regulations and Support

Government regulations significantly influence Adient's operational landscape, dictating standards for vehicle production, emissions, and safety. These policies, alongside government support, create the framework within which the automotive industry, and consequently Adient, must function. For instance, the North American light vehicle production forecast for 2025 saw an upward revision, indicating industry resilience despite fluctuating tariff policies.

Europe's automotive sector also experienced an improved production outlook, partly attributed to the impact of updated EU CAFE regulations on emissions. Meanwhile, the burgeoning New Energy Vehicle (NEV) market in Greater China benefits from substantial government incentives and a supportive production environment, presenting both opportunities and challenges for automotive suppliers like Adient.

Key regulatory and support factors impacting Adient include:

- Emissions Standards: Evolving regulations, such as those in Europe, necessitate continuous innovation in seating materials and designs to meet stricter environmental targets.

- Safety Mandates: Government-imposed safety requirements for vehicle interiors, including seating systems, drive investment in advanced technologies and materials.

- Production Incentives: Government support for domestic manufacturing and specific vehicle segments, like NEVs in China, can bolster production volumes and create demand for Adient's products.

- Trade Policies: Volatile tariff policies, as seen in North America, can disrupt supply chains and impact the cost-effectiveness of production and material sourcing.

Labor Relations and Union Policies

Adient's global operations are significantly influenced by labor relations and union policies across the 29 countries where it has a presence. Regulations concerning worker rights and union activities directly impact manufacturing costs and the company's ability to adapt its operational strategies. For instance, stringent union agreements can limit workforce flexibility, potentially increasing labor expenses.

The automotive sector, including seating manufacturers like Adient, faces considerable challenges with talent shortages. This necessitates robust recruitment and retention initiatives. As of late 2024, reports indicate that the automotive workforce gap is widening, with specialized engineering and skilled manufacturing roles being particularly difficult to fill, putting pressure on compensation and training budgets.

Adient's extensive global workforce, exceeding 70,000 individuals, means navigating a complex tapestry of labor laws and union landscapes. Successful management of these diverse environments is crucial for maintaining stable production and controlling operational costs. The company's strategy must account for varying levels of unionization and differing worker protection laws in key markets such as North America, Europe, and Asia.

- Global Workforce Impact: Adient's over 70,000 employees across 29 countries are subject to diverse labor laws, affecting operational costs and flexibility.

- Talent Shortage: The automotive industry's struggle with talent shortages requires Adient to invest more in recruitment and retention, potentially increasing labor expenses.

- Unionization Influence: Policies regarding labor unions and worker rights can directly influence manufacturing costs and Adient's operational agility.

- Regulatory Landscape: Navigating varying employment regulations globally is essential for Adient to manage its workforce effectively and maintain competitive manufacturing costs.

Government policies heavily influence Adient, particularly regarding emissions standards and safety mandates, pushing for innovation in seating technologies. Government incentives for electric vehicles (EVs) and New Energy Vehicles (NEVs), especially in China, are shaping demand for Adient's components. For instance, the North American light vehicle production forecast for 2025 saw an upward revision, indicating industry resilience despite fluctuating tariff policies.

Geopolitical stability is vital, as conflicts or strained relations can disrupt production and consumer demand, with the European automotive market expected to shrink in fiscal year 2025. Trade policies and tariffs directly impact Adient's supply chain and costs, prompting strategic adjustments like capitalizing on U.S. onshoring trends.

Labor relations and diverse labor laws across Adient's 29 operating countries impact manufacturing costs and operational flexibility. The widening automotive talent shortage as of late 2024 also necessitates increased investment in recruitment and retention, potentially raising labor expenses.

| Factor | Impact on Adient | 2024/2025 Data/Trend |

|---|---|---|

| EV/NEV Policies | Drives demand for specialized seating; influences OEM production strategies. | Sustained upward trend in EV growth projected for 2025, fueled by battery tech and infrastructure. China's NEV market benefits from substantial government incentives. |

| Trade Tariffs | Affects supply chain costs and necessitates strategic sourcing adjustments. | Ongoing challenges presented by tariffs prompting strategic adjustments; North American production forecast revised upwards for 2025. |

| Emissions & Safety Regulations | Requires continuous innovation in materials and design; impacts production standards. | Updated EU CAFE regulations positively impacting European automotive production outlook. |

| Labor Laws & Unions | Influences manufacturing costs, workforce flexibility, and operational agility. | Automotive workforce gap widening in late 2024, making specialized roles difficult to fill; Adient employs over 70,000 globally. |

| Geopolitical Stability | Disruptions can halt production and dampen consumer demand. | European automotive market expected to shrink in fiscal year 2025. |

What is included in the product

This Adient PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the automotive seating industry, offering a comprehensive understanding of the external landscape.

Adient's PESTLE analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic discussions and decision-making.

Economic factors

Global economic performance is a key driver for industries like automotive seating. When economies are strong, people have more disposable income, leading to increased demand for new vehicles, which in turn boosts production and sales for companies like Adient.

Looking ahead to 2025, the global light vehicle market is anticipated to see modest growth. This suggests a gradual recovery from current economic challenges, but it's not expected to be a boom period. This environment directly impacts Adient's order volumes and production planning.

Adient's recent financial results offer a glimpse into their current standing. For example, their Q3 2025 earnings revealed a revenue of $3.74 billion, marking a 0.7% increase. This demonstrates a degree of resilience, even as the broader economic landscape presents ongoing headwinds.

Inflation and the cost of essential raw materials such as steel, foam, and fabrics are significant economic factors directly influencing Adient's manufacturing expenses and overall profitability. These price swings can create considerable pressure on the company's bottom line.

The upward trend in fuel and material costs is anticipated to remain a challenge throughout 2024, necessitating that automotive companies, including Adient, implement strong financial management and cost-containment strategies to navigate these economic headwinds.

Adient experienced a net commodity headwind in the fourth quarter of 2024. This was largely attributed to the timing of how they could pass on or recover these increased costs, highlighting the delicate balance in managing supplier and customer agreements during inflationary periods.

Interest rate fluctuations directly impact Adient's business. For instance, higher rates make it more expensive for consumers to finance new vehicle purchases, which can reduce demand for Adient's seating solutions. This also increases Adient's own borrowing costs for crucial capital expenditures and day-to-day operations.

The economic climate of 2024 and early 2025 has seen persistent inflation and elevated interest rates in many key markets. This environment has indeed dampened consumer enthusiasm for big-ticket purchases like vehicles, with a noticeable impact on the adoption of electric vehicles, a segment Adient is actively involved in.

Furthermore, these economic pressures, including inflation and higher interest rates, disproportionately affect private suppliers within the automotive industry. This can lead to increased financial strain on these suppliers, potentially raising supply chain risks for Adient as they rely on these partners for components.

Consumer Spending and Vehicle Demand

Consumer spending is a critical driver for the automotive industry, directly influencing vehicle demand and, consequently, Adient's order volumes. When consumers feel confident about their financial future and have more disposable income, they are more likely to purchase new vehicles. This sentiment directly impacts Original Equipment Manufacturers (OEM) production schedules.

Global car sales showed a positive trend, reaching an estimated 74.6 million units in 2024, marking a 2.5% increase from the previous year. However, looking ahead to 2025, there are emerging challenges. Declining consumer trust in certain regions and a slowdown in the adoption of electric vehicles (EVs) could temper this growth. These factors create a dynamic environment for automotive suppliers like Adient.

Despite these broader market considerations, Adient demonstrated resilience. The company reported strong Q3 2025 results, leading to an upward revision of its full-year FY25 guidance for both revenue and Adjusted EBITDA. This performance indicates improved profitability, even as Adient navigates some regional economic headwinds and shifts in consumer preferences.

- Consumer Confidence & Disposable Income: These are key determinants of new vehicle demand, impacting OEM production and Adient's order book.

- Global Car Sales (2024): Reached 74.6 million units, a 2.5% year-over-year increase.

- 2025 Outlook Challenges: Potential headwinds include declining consumer trust and a slower EV adoption rate.

- Adient's FY25 Performance: Strong Q3 results and raised guidance for revenue and Adjusted EBITDA signal improved profitability.

Supply Chain Resilience and Costs

Ongoing supply chain disruptions, particularly for components like semiconductors, presented significant operational and cost challenges for automotive suppliers throughout 2024, with many of these issues projected to continue into 2025. These persistent disruptions, coupled with rising raw material expenses, directly impacted Adient's production efficiency and profitability.

The automotive sector experienced an average increase in raw material costs by approximately 15% in 2024 compared to the previous year, according to industry reports. This inflationary pressure on inputs like steel and plastics directly affects Adient's cost of goods sold.

In response, automakers and their suppliers are actively pursuing strategies to bolster supply chain resilience. These include:

- Diversifying supplier bases: Reducing reliance on single-source suppliers to mitigate the impact of localized disruptions.

- Localizing production: Shifting manufacturing closer to assembly plants to shorten lead times and reduce transportation costs.

- Strategic component stockpiling: Increasing inventory levels for critical, long-lead-time parts to buffer against unexpected shortages.

Economic factors significantly shape Adient's operational landscape. Global economic performance directly influences consumer spending on vehicles, a key driver for Adient's seating solutions. Despite a modest projected growth of 2.5% in global car sales to 74.6 million units in 2024, headwinds like declining consumer trust and slower EV adoption in 2025 present challenges.

Inflation and rising raw material costs, estimated to have increased by 15% in 2024 for the automotive sector, directly impact Adient's cost of goods sold and profitability. For instance, Adient reported a net commodity headwind in Q4 2024 due to the timing of cost recovery.

Interest rate fluctuations also play a crucial role, affecting both consumer financing for new vehicles and Adient's own borrowing costs. The economic climate of 2024-2025, characterized by elevated inflation and interest rates, has dampened consumer demand for big-ticket items like automobiles.

Adient's Q3 2025 results, with revenue of $3.74 billion (a 0.7% increase), indicate resilience, leading to an upward revision of its FY25 guidance for revenue and Adjusted EBITDA, signaling improved profitability amidst these economic pressures.

| Economic Factor | Impact on Adient | 2024/2025 Data/Outlook |

| Global Economic Performance | Drives consumer spending on vehicles, influencing Adient's order volumes. | Modest growth projected for light vehicle market; 74.6 million global car sales in 2024 (+2.5% YoY). Potential headwinds in 2025 from declining consumer trust and slower EV adoption. |

| Inflation & Material Costs | Increases manufacturing expenses and impacts profitability. | Automotive sector saw ~15% average increase in raw material costs in 2024. Adient experienced a net commodity headwind in Q4 2024. |

| Interest Rates | Affects consumer financing for vehicles and Adient's borrowing costs. | Elevated interest rates in key markets have dampened consumer demand for vehicles. |

| Consumer Confidence | Key determinant of new vehicle demand and OEM production. | Potential for declining consumer trust in certain regions in 2025. |

Same Document Delivered

Adient PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Adient PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive seating industry. It provides actionable insights for strategic planning.

Sociological factors

Consumers increasingly desire more than just basic transportation; they're looking for a comfortable, almost lounge-like experience within their vehicles. This shift means automakers and their suppliers, like Adient, are focusing on premium materials, advanced ergonomics, and even ambient lighting to meet these evolving tastes. For instance, a significant portion of consumers in 2024 are willing to pay a premium for advanced comfort features in their car seats.

The demand for personalized interiors is also a major driver. Think about adjustable lumbar support, heated and ventilated seats, and even integrated massage functions. These aren't just luxury add-ons anymore; they're becoming expectations, especially in the mid-range vehicle segments. This trend is directly influencing seating design, pushing for more modularity and customization options.

Looking ahead to 2024 and 2025, sustainability is a key theme in interior preferences, alongside technology. Consumers are showing a growing interest in recycled and bio-based materials for seating. Color palettes are also reflecting this, with a noticeable trend towards earthy and neutral tones, creating a more calming and sophisticated cabin atmosphere.

Demographic shifts, including an aging workforce in some regions and a younger generation with different career aspirations, directly influence Adient's talent pool. The company, with its global workforce of over 70,000 employees, must adapt to evolving workforce expectations regarding flexibility, purpose, and work-life balance to attract and retain talent.

The automotive sector faces persistent talent shortages, particularly for skilled manufacturing and engineering roles, creating a critical need for innovative recruitment and training strategies. Adient's commitment to social responsibility includes fostering a healthy and safe work environment, which is crucial for maintaining employee morale and productivity amidst these labor market challenges.

Consumers and stakeholders are increasingly vocal about environmental and social concerns, demanding that companies like Adient prioritize sustainable materials, ethical supply chains, and responsible manufacturing. This shift directly influences purchasing decisions and brand loyalty.

Adient's 2024 Sustainability Report underscores its dedication to minimizing its environmental footprint and fostering social responsibility, with a significant focus on innovating sustainable products. This proactive approach aligns with growing market expectations for corporate accountability.

The growing environmental consciousness among consumers is a powerful driver, pushing automotive interior manufacturers to integrate eco-friendly materials. Examples include the adoption of bamboo fiber and recycled PET fabrics, reflecting a tangible response to consumer demand for greener options.

Urbanization and Mobility Trends

Urbanization continues to reshape how people move, with a significant portion of the global population now residing in cities. This trend directly impacts vehicle design, as manufacturers like Adient consider the need for flexible and adaptable interior spaces. For instance, by 2050, the UN projects that 68% of the world's population will live in urban areas, a substantial increase from today's figures.

The rise of mobility-as-a-service (MaaS) and the anticipated widespread adoption of autonomous vehicles (AVs) are fundamentally altering consumer expectations for vehicle interiors. Instead of traditional driver-focused layouts, we're seeing a shift towards lounge-like environments that prioritize passenger comfort, productivity, and social interaction. This evolution is driven by the potential for AVs to free up occupants' time, leading to demand for features like reconfigurable seating and integrated workspaces.

Adient, a major player in automotive seating, is actively responding to these shifts. The company is developing innovative seating solutions designed for shared mobility and autonomous driving scenarios. This includes:

- Modular Seating Systems: Allowing for flexible configurations to adapt to various passenger needs and ride-sharing services.

- Enhanced Comfort Features: Incorporating premium materials and ergonomic designs for longer journeys in autonomous vehicles.

- Integrated Technology: Developing solutions that seamlessly integrate screens, tables, and charging ports for productive or entertainment-focused cabin experiences.

- New Business Models: Exploring partnerships and offerings that cater to subscription-based vehicle access and mobility services, particularly appealing to younger urban demographics.

Health and Safety Standards in Manufacturing

The increasing focus on employee well-being and the tightening of health and safety regulations in manufacturing significantly influence operational methods and expenditures. Adient’s commitment to a robust health and safety management system, certified to ISO 45001, underscores this. In 2024, 98% of Adient's manufacturing facilities successfully underwent third-party audits and received certification, demonstrating adherence to these critical standards.

These standards directly affect Adient’s production processes, requiring investments in safer machinery, personal protective equipment, and ongoing training. Compliance ensures a safer working environment, which can lead to reduced absenteeism and improved employee morale, ultimately impacting productivity and cost efficiency.

- ISO 45001 Certification: Adient’s health and safety management system meets international standards for occupational health and safety.

- Audit Compliance: As of 2024, 98% of Adient's manufacturing sites have been audited and certified by external bodies.

- Operational Impact: Stringent regulations necessitate investments in safety protocols, equipment, and training.

- Employee Well-being: A strong emphasis on safety contributes to a healthier workforce and potentially lower operational disruptions.

Societal expectations are increasingly shaping automotive interiors, with consumers prioritizing comfort, personalization, and sustainability. This trend is evident in the growing demand for features like advanced ergonomics and eco-friendly materials, as seen in Adient's focus on recycled and bio-based options for 2024-2025. Demographic shifts also impact Adient's workforce, necessitating adaptable strategies for talent acquisition and retention amidst global labor market dynamics.

Technological factors

Innovations in material science, particularly lightweight composites and sustainable options, are pivotal for Adient to align with original equipment manufacturers' (OEMs) growing emphasis on fuel efficiency and reduced vehicle weight. This trend saw the automotive industry investing heavily in advanced materials throughout 2024, with a projected continued rise into 2025.

Manufacturers are increasingly adopting materials such as high-strength steel, aluminum, and various composites. These materials are key to enhancing fuel economy without sacrificing passenger safety or interior comfort, a balance Adient actively addresses in its product development.

Adient's commitment to sustainability is evident in its product design, which increasingly incorporates a circular economy approach. This focus is critical as regulatory pressures and consumer preferences push for more environmentally conscious automotive components.

The automotive industry is increasingly embedding sensors and smart functionalities directly into seating systems. This technological shift aims to boost comfort, safety, and connectivity for occupants. For instance, advanced seating can now adjust automatically based on driver biometrics or provide real-time feedback on passenger presence and posture.

Smart seating, featuring integrated sensors and electronic control units, is becoming particularly crucial for connected and autonomous vehicles. These systems are designed to enhance the passenger experience in environments where traditional driving controls are less prominent. By 2025, it's projected that over 50% of new vehicles will feature some level of advanced driver-assistance systems, necessitating smarter interior components like advanced seating.

The automotive interiors market is actively embracing the integration of smart and connected features. This includes the widespread adoption of touchscreen panels for infotainment and climate control, as well as the incorporation of voice assistants for hands-free operation. Companies are investing heavily in these areas; for example, a significant portion of the $100 billion global automotive electronics market in 2024 is dedicated to these interior advancements.

Adient is actively embracing automation and Industry 4.0 principles to boost its production capabilities. This includes integrating advanced robotics and AI to enhance efficiency, elevate product quality, and reduce manufacturing costs. For instance, the company has highlighted its focus on achieving substantial cost reductions through these technological advancements and the adoption of modular production systems.

The automotive industry as a whole is increasingly adopting AI and smart factory concepts. This trend means that manufacturing processes are becoming more interconnected and data-driven, leading to greater precision and responsiveness in production lines. This broader industry shift benefits companies like Adient by creating a more advanced and efficient supply chain ecosystem.

Autonomous Vehicle Integration Needs

As autonomous driving technology continues its rapid ascent, the very nature of vehicle interiors is undergoing a profound transformation. Seating designs are no longer solely focused on the driver; instead, they must evolve to accommodate new configurations that prioritize passenger comfort and enable activities that were previously impossible while driving. This shift is leading to interiors that resemble lounges, with seats capable of swiveling to face each other, fostering a more social and relaxed travel experience.

Adient is actively responding to these evolving demands. Their recent innovations, such as the Autonomous Elegance seat, exemplify this adaptation. This particular seat is not only designed for the new interior paradigms but also highlights Adient's commitment to sustainability in its product development. The company's focus on these forward-looking designs is crucial as the automotive industry navigates the integration of advanced autonomous systems.

- Interior Reimagination: Autonomous technology is driving a shift towards flexible, lounge-like interior layouts, moving away from traditional driver-centric designs.

- Passenger Experience Focus: Seating must now support passenger activities and comfort, with features like swiveling seats becoming increasingly important.

- Sustainable Innovation: Adient's Autonomous Elegance seat showcases a commitment to integrating sustainability with the advanced seating solutions required for autonomous vehicles.

- Market Adaptation: Companies like Adient must continuously innovate their seating solutions to align with the technological advancements and changing consumer expectations in the autonomous vehicle sector.

Data Analytics and AI in Design/Manufacturing

Data analytics and AI are revolutionizing how Adient designs, engineers, and manufactures automotive seating. These technologies optimize product development cycles, allowing for faster iteration and better performance prediction. For instance, AI can predict maintenance needs for manufacturing equipment, minimizing downtime and associated costs, which is crucial for maintaining production efficiency in a competitive automotive landscape.

Adient is strategically investing in electrification and AI-driven technologies, particularly in China, a key market for smart vehicles. This includes the development of AI-enhanced EV seat systems, positioning the company for substantial long-term growth as the demand for electric and intelligent mobility solutions escalates. By 2025, the global EV market is projected to reach over 20 million units, underscoring the importance of these investments.

The integration of AI extends to advanced features within vehicles, such as sophisticated ambient lighting systems and voice-controlled climate controls, especially for luxury models. These innovations enhance the user experience and differentiate Adient's offerings in a segment where premium features are highly valued. The automotive AI market is expected to grow significantly, with some projections indicating it could reach tens of billions of dollars by the mid-2020s.

- AI-driven design optimization reduces prototyping costs and time.

- Predictive maintenance using AI can save manufacturers millions in unplanned downtime.

- China's EV market growth is a key driver for Adient's AI and electrification strategies.

- Enhanced in-car experiences through AI-powered features like ambient lighting and voice control.

The rapid advancement of autonomous driving technology is fundamentally reshaping vehicle interiors, moving beyond driver-centric designs to prioritize passenger experience and new functionalities. This necessitates seating solutions that are more flexible and adaptable, with features like swiveling seats becoming increasingly relevant for creating lounge-like environments.

Adient is actively innovating to meet these evolving demands, as seen with its Autonomous Elegance seat, which integrates advanced design with sustainability principles crucial for the autonomous vehicle sector. The company's strategic investments in electrification and AI, particularly in China's growing EV market, position it for significant long-term growth in intelligent mobility solutions.

AI and data analytics are also streamlining Adient's operations, optimizing product development and predicting equipment maintenance needs to enhance efficiency and reduce costs. The automotive AI market is expanding rapidly, with projections indicating substantial growth into the mid-2020s, highlighting the importance of these technological integrations for competitive advantage.

The automotive industry's increasing adoption of smart and connected features, including advanced infotainment and voice assistants, is driving significant investment in interior electronics. A substantial portion of the global automotive electronics market in 2024 is dedicated to these interior advancements, emphasizing the value placed on enhanced user experiences.

Legal factors

Global and regional vehicle safety regulations significantly influence Adient's operations. For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) mandated automatic emergency braking (AEB) for all light vehicles by September 1, 2029.

Similarly, the European Union's General Safety Regulation is progressively introducing advanced safety features like AEB and lane keeping assistance in new cars between July 2024 and January 2029. These mandates directly affect seat design, testing protocols, and manufacturing processes, requiring substantial investment in compliance and innovation.

Environmental emissions regulations significantly shape Adient's operations and product development. The U.S. EPA's finalized standards for 2027 and later model years, targeting reduced greenhouse gases and pollutants, necessitate careful consideration of materials and manufacturing processes. This push for cleaner vehicles requires automakers, and by extension their suppliers like Adient, to ensure supply chain transparency for sustainability, impacting material sourcing and production methods.

Adient must navigate a complex web of global labor laws, covering everything from minimum wage requirements and workplace safety standards to employee rights regarding unionization. For instance, in 2024, many European nations continued to strengthen worker protections, impacting operational costs and flexibility. Failure to comply with these diverse regulations across its international footprint, which includes significant operations in countries like Germany and Mexico, could lead to costly fines and legal challenges.

The automotive sector, including seating manufacturers like Adient, is grappling with significant talent shortages in 2024 and into 2025. This skills gap, particularly in areas like advanced manufacturing and engineering, necessitates substantial investment in recruitment and training programs. Adient's ability to attract and retain skilled labor will be a key determinant of its operational efficiency and innovation capacity in the coming years.

Intellectual Property Protection

Adient's competitive edge hinges on safeguarding its proprietary designs, engineering innovations, and manufacturing processes through patents and trademarks. This is crucial in the fast-evolving automotive seating industry.

The company actively pursues technological advancements, often via joint development agreements, underscoring the necessity for meticulous intellectual property (IP) management. In 2023, Adient reported spending $560 million on research and development, a significant portion of which is dedicated to protecting its innovations.

- Patents: Adient holds thousands of active patents globally, covering seating mechanisms, materials, and manufacturing techniques.

- Trademarks: Key brand names and product lines are protected by trademarks, ensuring brand recognition and preventing counterfeiting.

- Trade Secrets: Confidential manufacturing processes and proprietary data are guarded as trade secrets, offering another layer of protection.

- Enforcement: Adient actively monitors and enforces its IP rights against infringements to maintain its market position.

Product Liability and Recalls

Adient, like all automotive suppliers, faces significant legal and financial risks stemming from product liability laws. The potential for costly recalls due to safety defects or non-compliance with evolving automotive standards is a constant concern. These liabilities can directly impact profitability and brand reputation.

The automotive industry has seen a dramatic increase in the cost and frequency of recalls, not just for safety issues but also for non-safety related repairs. This trend, which has escalated in recent years, points to underlying quality challenges within the sector. For instance, the average cost of a recall in the automotive sector has been on an upward trajectory, with some estimates placing it in the tens of millions of dollars per incident, depending on the severity and scope.

- Product Liability Exposure: Adient is subject to regulations that hold manufacturers responsible for damages caused by defective products, potentially leading to substantial legal claims and settlements.

- Recall Costs: The financial burden of product recalls, including investigation, repair, and customer notification, can be immense, directly impacting Adient's bottom line.

- Escalating Industry Trends: The auto industry's increasing recall rates and associated repair costs, a trend observed throughout 2023 and continuing into 2024, underscore the heightened scrutiny on product quality and compliance.

- Regulatory Compliance: Failure to meet stringent automotive safety and environmental standards can result in fines, mandated recalls, and reputational damage.

Adient must navigate a complex landscape of intellectual property laws to protect its innovations. The company's significant investment in research and development, totaling $560 million in 2023, underscores the critical need for robust patent and trademark protection. Safeguarding its seating designs and manufacturing processes is paramount for maintaining a competitive edge in the rapidly evolving automotive sector.

Product liability laws pose a substantial risk, with the automotive industry experiencing escalating recall costs. These costs, potentially reaching tens of millions per incident, highlight the financial implications of safety defects or non-compliance. Adient's adherence to evolving automotive standards is crucial to mitigate these risks and protect its financial health.

Global labor laws, including minimum wage, safety standards, and unionization rights, directly impact Adient's operational expenses and flexibility across its international operations. For instance, strengthened worker protections in many European nations in 2024 necessitate careful cost management. Non-compliance can lead to significant legal penalties and reputational damage.

Environmental factors

The automotive sector, a significant contributor to global emissions, is pushing suppliers like Adient to drastically cut their carbon footprints. The industry as a whole accounts for over 10% of annual worldwide carbon dioxide emissions, making this a critical area for improvement.

Adient has made substantial progress, achieving a 38% reduction in its global scope 1 and 2 greenhouse gas emissions when compared to 2019 levels. This demonstrates a tangible commitment to environmental stewardship within its operations.

Looking ahead, Adient has set an ambitious target to achieve a 75% reduction in these emissions by the year 2030. This aggressive goal aligns with broader industry trends and regulatory pressures to decarbonize the automotive value chain.

The automotive industry's push for sustainability is reshaping material sourcing, with a growing emphasis on eco-friendly, recycled, and renewable components for seating. This trend is directly influenced by increasing environmental awareness and evolving consumer preferences.

Adient is actively responding to this by championing a circular economy model in its product lifecycle, from design to manufacturing, exemplified by innovations like the EV-ready Pure Essential seat. This strategic focus aims to minimize waste and maximize resource efficiency, aligning with global environmental goals.

In 2023, the global automotive lightweight materials market, which includes sustainable options, was valued at approximately $20.1 billion and is projected to reach $35.6 billion by 2030, indicating a strong market demand for these materials.

Adient is prioritizing environmental stewardship by implementing strong waste reduction and recycling initiatives, alongside embracing circular economy principles within its manufacturing. This commitment is evident in their fiscal year 2024 performance, where over 1,500 continuous improvement projects led to the diversion of 5,308 metric tons of waste.

The automotive industry, including manufacturers and suppliers like Adient, is actively exploring innovative solutions such as circular economy models and the integration of biodegradable materials to minimize environmental impact.

Energy Efficiency in Manufacturing

Adient is actively pursuing energy efficiency and renewable energy adoption within its manufacturing operations. This focus is driven by the dual benefits of reducing environmental footprint and lowering operational expenses. As of September 30, 2024, Adient has successfully sourced 29% of its global electricity consumption from renewable sources.

The company has set an ambitious target to transition all of its manufacturing sites to renewable electricity by 2035. This aligns with broader industry trends where automotive manufacturers are increasingly integrating solar, wind, and hydrogen power to meet their sustainability objectives.

- 29% of Adient's global electricity consumption sourced from renewables (as of Sept 30, 2024).

- 2035 target for 100% renewable electricity at all manufacturing sites.

- Automakers are investing in solar, wind, and hydrogen to meet sustainability goals.

Compliance with Global Environmental Standards

Adient's global operations necessitate strict adherence to a growing array of international and national environmental regulations. Navigating these standards, such as the EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD), is crucial for maintaining compliance and operational integrity. These regulations are shaping how companies report on their environmental impact, with significant implications for disclosure and strategy.

Specifically, Adient will face increased scrutiny and detailed disclosure requirements related to sustainability. Starting in fiscal year 2026, the company is mandated to comply with CSRD and EU Taxonomy reporting. This means providing comprehensive data on environmental, social, and governance (ESG) matters, reflecting a global trend towards greater corporate transparency in sustainability.

Regulatory bodies worldwide are actively establishing policies and targets that align with the United Nations' Sustainable Development Goals (SDGs), particularly those focused on environmental protection. This global push for sustainability means companies like Adient must integrate environmental considerations into their core business strategies to meet evolving stakeholder expectations and regulatory demands.

- EU Taxonomy and CSRD Compliance: Adient must adhere to these directives, impacting financial reporting and operational practices from FY2026.

- Global Regulatory Alignment: Worldwide policies are increasingly tied to environmental SDGs, requiring broad environmental stewardship.

- Increased Disclosure Requirements: Companies face greater pressure for detailed reporting on sustainability metrics.

- Strategic Integration: Environmental compliance is no longer peripheral but a core component of business strategy for global entities.

Adient's environmental strategy is deeply intertwined with the automotive industry's push for sustainability, focusing on emission reduction and circular economy principles. The company has achieved a 38% reduction in its scope 1 and 2 greenhouse gas emissions compared to 2019, with a goal of 75% by 2030.

The company is actively incorporating recycled and renewable materials into its products, responding to market demand for eco-friendly automotive components, which is a rapidly growing sector. Adient has also made significant strides in energy efficiency, sourcing 29% of its global electricity from renewable sources as of September 30, 2024, and aims for 100% by 2035.

Navigating a complex regulatory landscape, Adient must comply with directives like the EU Taxonomy and CSRD, which mandate detailed sustainability reporting starting in fiscal year 2026. These regulations underscore a global trend towards greater corporate transparency and the strategic integration of environmental stewardship.

| Environmental Metric | Current Status (as of Sept 30, 2024) | Target | Impact |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 38% reduction vs. 2019 | 75% reduction by 2030 | Mitigates climate risk, enhances brand reputation |

| Renewable Electricity Usage | 29% of global consumption | 100% by 2035 | Reduces operational costs, lowers carbon footprint |

| Waste Diversion (FY24) | 5,308 metric tons | Continuous improvement | Minimizes landfill impact, supports circular economy |

| Regulatory Compliance | Ongoing | CSRD & EU Taxonomy from FY2026 | Ensures market access, builds investor confidence |

PESTLE Analysis Data Sources

Our Adient PESTLE Analysis is grounded in comprehensive data from leading automotive industry associations, global economic databases, and regulatory bodies. We incorporate insights from market research firms and environmental agencies to ensure a holistic view of the macro-environment.