Adient Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

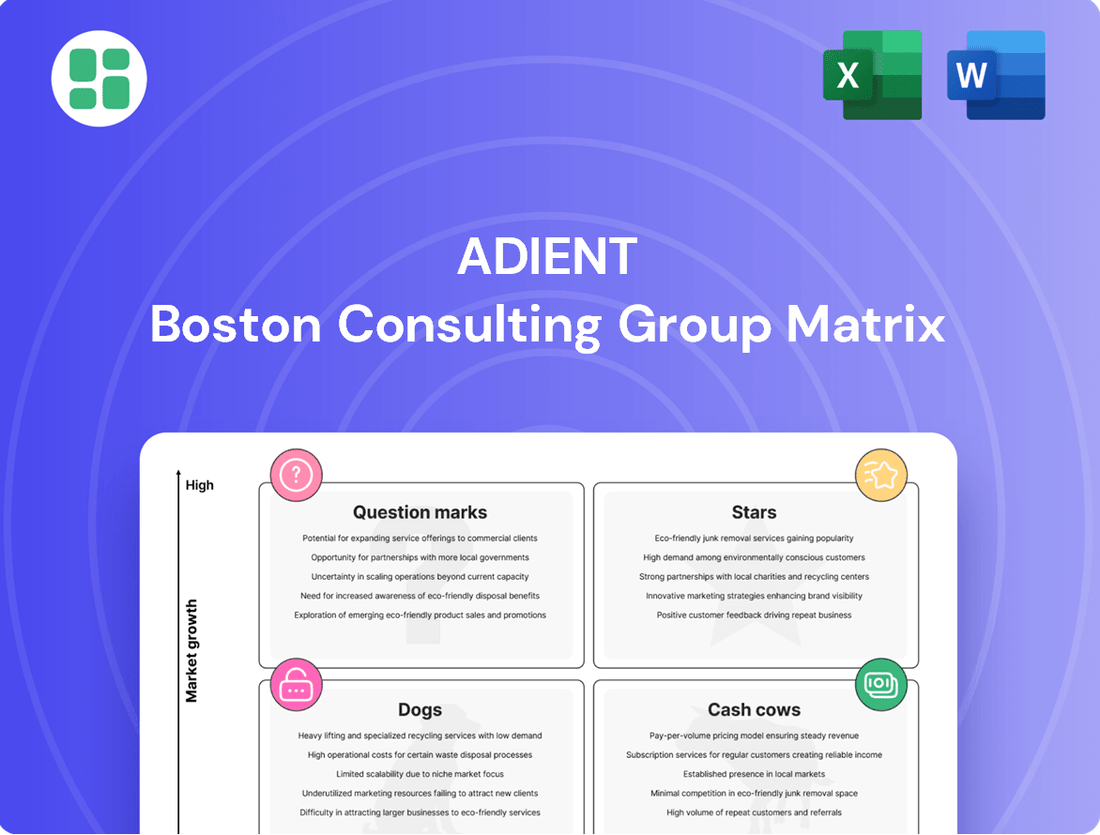

Curious about Adient's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete BCG Matrix, which provides a comprehensive breakdown and actionable strategic insights to guide your investment decisions.

Stars

Adient's EV-Ready Seating Solutions are a prime example of a "Star" in the BCG matrix, given the booming electric vehicle market. The company has secured substantial contracts, like supplying complete seat assemblies for Rivian, a key player in the EV space. This positions Adient to capitalize on the high-growth trajectory of electric vehicles, leveraging its existing manufacturing prowess.

The company's commitment to innovation in seating for electric and autonomous vehicles further solidifies its "Star" status. Adient is investing in new technologies that accommodate evolving vehicle architectures and increased electronic integration, anticipating future demands. For instance, in fiscal year 2023, Adient reported a 10% increase in revenue, partially driven by new EV programs.

Adient's advanced comfort and wellness seating innovations, like the mechanical massage seating debuted in the GAC-Trumpchi M8 PHEV, represent a significant move into the premium automotive segment. This technology caters to a rising consumer desire for more sophisticated in-car experiences.

This innovation is particularly strong in markets like China, where consumer spending on advanced vehicle features is robust. The potential for over-the-air updates further enhances its appeal, suggesting a long-term value proposition for luxury and upper-mid-tier vehicles.

Adient's dedication to sustainable product design is clearly demonstrated in their 2024 Sustainability Report. Innovations like the ProX IsoDynamic Seat and Pure Essential seat highlight their commitment to environmentally friendly solutions. This focus directly addresses the growing demand from Original Equipment Manufacturers (OEMs) for lighter, more resource-efficient seating.

By prioritizing lightweight materials and reduced energy consumption in manufacturing, Adient is aligning with OEM goals to lower carbon footprints. This strategic approach to circularity and minimizing environmental impact positions them favorably in a high-growth market segment. Industry regulations and evolving consumer preferences are significant drivers for these sustainable initiatives.

Strategic Growth with Chinese OEMs

Adient is strategically targeting Chinese original equipment manufacturers (OEMs) to drive growth, aiming for 60% of its China customer base to be local firms by fiscal year 2027, a significant increase from the low-40 percent range in fiscal 2025. This pivot capitalizes on the rapid expansion and increasing investment in advanced seating by Chinese automotive brands.

The company's commitment to this segment is underscored by its investments in the China Technical Center. These investments are geared towards enhancing automation and developing sustainable materials specifically for the Chinese market, aligning with local demand and regulatory trends.

- Strategic Shift: Adient aims for 60% of its China customer mix to be Chinese OEMs by FY2027, up from low-40% in FY2025.

- Market Opportunity: This targets the high-growth segment of rapidly expanding local brands investing in advanced seating.

- Technical Investment: Investments in the China Technical Center support automation and sustainable materials for local market needs.

Automation & Manufacturing Efficiency Solutions

Adient's strategic focus on automation and manufacturing efficiency is evident in its joint development agreement with Paslin, targeting innovative solutions for sewing operations. This collaboration, coupled with investments in artificial intelligence for quality inspection, highlights Adient's commitment to leveraging advanced technology. For instance, in 2024, Adient reported a significant increase in its investment in advanced manufacturing technologies, aiming to reduce production cycle times by an average of 15% across key facilities.

These advancements are crucial for enhancing overall efficiency and elevating product quality. By streamlining production, Adient is better positioned to meet market demands that increasingly favor technologically sophisticated and cost-effective manufacturing. The company's pursuit of operational excellence in manufacturing directly supports the growth potential of its high-demand product lines.

- Joint Development with Paslin: Focuses on automating complex sewing processes, a critical area for automotive seating.

- AI for Inspection: Implementing artificial intelligence to improve the accuracy and speed of quality control checks.

- Efficiency Gains: Aiming for a 15% reduction in production cycle times through these technological upgrades in 2024.

- Market Competitiveness: Enhancing ability to capture market share by meeting demand for streamlined, high-quality production.

Adient's EV-ready seating solutions, particularly those for electric vehicles, are strong "Stars" due to the booming EV market. The company's substantial contracts, such as supplying Rivian, and its investment in new technologies for evolving vehicle architectures solidify this position. In fiscal year 2023, Adient's revenue saw a 10% increase, partly fueled by these new EV programs.

The company's advanced comfort and wellness seating, like the mechanical massage seating, targets the premium segment and growing consumer demand for sophisticated in-car experiences, especially in markets like China. This innovation, combined with a focus on sustainable product design as highlighted in their 2024 Sustainability Report, aligns Adient with OEM goals for lighter, more resource-efficient seating, further strengthening its Star status by addressing market trends for reduced environmental impact.

Adient's strategic focus on automation and manufacturing efficiency, including its joint development with Paslin for sewing operations and AI for quality inspection, is key. These initiatives aim to reduce production cycle times by an average of 15% across facilities, as targeted in 2024, enhancing competitiveness in a market that values technologically advanced and cost-effective production.

| Category | Adient's Offering | Market Trend | Growth Potential | BCG Status |

|---|---|---|---|---|

| EV Seating | Complete seat assemblies for EVs (e.g., Rivian) | Rapid EV market expansion | High | Star |

| Advanced Comfort | Mechanical massage seating, over-the-air updates | Consumer demand for premium in-car experiences | High | Star |

| Sustainable Design | Lightweight materials, reduced energy consumption | OEMs' focus on lower carbon footprints, regulatory pressure | High | Star |

| Manufacturing Automation | AI for quality inspection, automated sewing | Need for efficiency and quality in production | High | Star |

What is included in the product

The Adient BCG Matrix categorizes business units by market share and growth, guiding strategic investment decisions.

Adient's BCG Matrix provides a clear, visual guide to strategically allocate resources, alleviating the pain of uncertainty in business unit investment.

Cash Cows

Adient's global automotive seating systems are its undisputed cash cow, forming the bedrock of its operations. This core business, supplying complete seating solutions to major car manufacturers worldwide, consistently generates significant revenue and cash flow.

With a commanding global market share hovering around one-third, Adient benefits from high-volume production and a deeply entrenched market position. This dominance translates directly into predictable and robust cash generation, a hallmark of a strong cash cow.

The inherent 'stickiness' of automotive seating contracts further solidifies this segment's cash cow status. Once a seating system is integrated into a vehicle program, switching suppliers becomes a complex and costly endeavor for automakers, ensuring a steady stream of recurring business for Adient.

Adient's traditional frames and mechanisms production represents a classic cash cow within its portfolio. This segment benefits from a mature market, high production volumes, and Adient's established strength, ensuring steady cash generation with minimal need for extensive R&D.

These fundamental components are vital across all vehicle segments, providing a stable revenue stream. In 2023, Adient reported that its seating systems, which heavily rely on these components, generated over $13.5 billion in revenue, underscoring the segment's significance.

The company's global manufacturing footprint in this area allows for substantial economies of scale and cost efficiencies, further solidifying its position as a consistent cash generator. This operational advantage is crucial for maintaining profitability in a competitive automotive supply chain.

Adient's established OEM customer relationships are a prime example of a Cash Cow. Their long-standing partnerships with major global automakers, evidenced by receiving GM Supplier of the Year awards for four consecutive years, guarantee a consistent flow of business.

These deep-rooted connections, forged through trust and reliable delivery of quality seating solutions, translate into predictable revenue from mature vehicle platforms. Automakers value supplier continuity and global quality assurance, solidifying these relationships as a significant cash generator for Adient.

North American Operations

North American operations, representing a significant portion of Adient's business, are characterized by robust performance and strategic advantages within the BCG Matrix. The Americas segment consistently delivers strong adjusted EBITDA margins, bolstered by improved net sales. This positive trend is directly linked to the strength of U.S. vehicle production and Adient's adept cost management strategies.

Adient's substantial production footprint in the U.S., accounting for 75% of its North American output, positions it favorably to capitalize on OEM onshoring trends. This strategic advantage solidifies its cash generation capabilities within this mature market. The established infrastructure and agile supply chains further contribute to the reliable profitability of these operations.

- Strong Adjusted EBITDA Margins: The Americas segment consistently demonstrates healthy profitability.

- Beneficiary of Onshoring: 75% U.S. production footprint positions Adient to gain from OEM onshoring.

- Mature Market Cash Generation: Established infrastructure supports reliable cash flow from North America.

- Effective Cost Management: Improved net sales are partly driven by successful cost control measures.

Foam and Trim Production

Adient's foam and trim production is a classic cash cow within its portfolio. This segment is a cornerstone of the automotive seating industry, generating substantial and consistent revenue. In 2024, Adient continued to leverage its global manufacturing scale to produce these essential components, benefiting from mature, predictable demand.

The stability of foam and trim production is a key strength. These are not high-growth areas, but their consistent demand provides a reliable source of cash for Adient. This allows the company to fund other, more dynamic parts of its business.

- Stable Revenue Generation: Foam and trim components are fundamental to all vehicle seating, ensuring consistent sales volumes.

- Low Investment Needs: Unlike R&D-intensive segments, this area requires less capital expenditure for innovation, maximizing cash flow.

- Global Manufacturing Advantage: Adient's extensive production network optimizes costs and ensures reliable supply for these high-volume parts.

- Predictable Demand: The essential nature of these components means demand is relatively insulated from short-term market fluctuations.

Adient's global automotive seating systems represent its primary cash cow, consistently generating substantial revenue and cash flow. This core business, supplying complete seating solutions to major car manufacturers, benefits from Adient's commanding global market share, which hovers around one-third, leading to high-volume production and a deeply entrenched market position. The inherent 'stickiness' of automotive seating contracts further solidifies this segment's cash cow status, ensuring a steady stream of recurring business for Adient due to the complexity and cost involved in switching suppliers.

Adient's traditional frames and mechanisms production is another classic cash cow. This segment benefits from a mature market, high production volumes, and Adient's established strength, ensuring steady cash generation with minimal need for extensive R&D. These fundamental components are vital across all vehicle segments, providing a stable revenue stream. In 2023, Adient reported that its seating systems, which heavily rely on these components, generated over $13.5 billion in revenue, underscoring the segment's significance. The company's global manufacturing footprint in this area allows for substantial economies of scale and cost efficiencies, further solidifying its position as a consistent cash generator.

The company's established OEM customer relationships are a prime example of a Cash Cow. Their long-standing partnerships with major global automakers, evidenced by receiving GM Supplier of the Year awards for four consecutive years, guarantee a consistent flow of business. These deep-rooted connections, forged through trust and reliable delivery of quality seating solutions, translate into predictable revenue from mature vehicle platforms. Automakers value supplier continuity and global quality assurance, solidifying these relationships as a significant cash generator for Adient.

Adient's foam and trim production is a classic cash cow within its portfolio. This segment is a cornerstone of the automotive seating industry, generating substantial and consistent revenue. In 2024, Adient continued to leverage its global manufacturing scale to produce these essential components, benefiting from mature, predictable demand. The stability of foam and trim production is a key strength, providing a reliable source of cash for Adient to fund other, more dynamic parts of its business.

| Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| Global Automotive Seating Systems | Cash Cow | High market share, established contracts, economies of scale. | Significant revenue contributor, stable cash flow. |

| Frames and Mechanisms | Cash Cow | Mature market, high volume, low R&D needs. | Consistent revenue stream, reliable cash generation. |

| OEM Customer Relationships | Cash Cow | Long-standing partnerships, predictable revenue from mature platforms. | Guaranteed business flow, stable income. |

| Foam and Trim Production | Cash Cow | Essential components, stable demand, global manufacturing advantage. | Substantial and consistent revenue, predictable cash. |

Preview = Final Product

Adient BCG Matrix

The Adient BCG Matrix document you're previewing is the identical, fully formatted, and analysis-ready report you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises—just the comprehensive strategic tool designed for clear business planning. You'll gain instant access to this professionally crafted matrix, ready for immediate application in your business strategy, presentations, or competitive analysis.

Dogs

Adient is strategically phasing out underperforming legacy programs, a move critical for boosting financial health. These older platforms often carry low profit margins, consuming valuable capital and resources without generating adequate returns.

This divestment strategy is a core component of Adient's restructuring efforts, aiming to streamline operations and improve overall efficiency. For instance, in fiscal year 2023, Adient reported a net loss of $139 million, highlighting the impact of such underperforming assets.

Certain EMEA operations within Adient are currently positioned as Dogs in the BCG Matrix. This is primarily due to significant challenges leading to a $333 million goodwill impairment recorded in fiscal Q3 2025, reflecting underperformance in specific business units or assets within the region.

These underperforming segments are likely operating in markets characterized by low growth and are subject to persistent macroeconomic pressures and program delays. Such conditions suggest these operations may be cash traps, demanding continued investment without generating adequate returns.

Adient's aging product lines, particularly those lacking significant innovation, are categorized as Dogs in the BCG Matrix. These are often commoditized seating components or basic systems that haven't kept pace with evolving automotive trends. For instance, older seat frame designs or standard foam cushioning technologies that offer little differentiation fall into this group.

These Dog products typically face intense price competition due to their lack of unique selling propositions. Adient might see these offerings generate just enough revenue to cover their costs, or even operate at a loss, as seen with some of their legacy interior trim components. In 2024, the automotive industry's push towards lightweight materials and integrated smart features means older, un-innovated components are particularly vulnerable.

Segments Heavily Impacted by Declining Traditional Vehicle Production

Adient's presence in vehicle segments with declining traditional production, such as certain mid-size sedans, could represent a challenge. For instance, if Adient has substantial content in models that are seeing reduced sales volume due to consumer preference shifts towards SUVs, these product lines might exhibit low growth. In 2023, the global sedan market share continued its downward trend, with SUVs accounting for a larger portion of new vehicle sales, impacting the demand for traditional seating solutions in those specific categories.

Segments heavily impacted by declining traditional vehicle production would likely be categorized as Question Marks or Dogs in the BCG Matrix, depending on their market share. For Adient, this could translate to specific seating platforms designed for outgoing combustion engine vehicle architectures that are not easily adaptable to new EV platforms. The company's strategic focus on evolving seating solutions for the growing EV market is crucial to mitigate risks associated with these declining segments.

- Low Growth Prospects: Vehicle segments experiencing secular decline, like certain traditional sedans, offer limited opportunities for revenue expansion.

- Diminishing Market Share: As overall production in these segments shrinks, Adient's share within them may also contract if not actively managed.

- Potential Cash Traps: Continued investment in product lines tied to declining vehicle types could drain resources without commensurate returns.

- Strategic Re-evaluation: These segments necessitate careful assessment, potentially leading to divestment or a strategic pivot to more relevant automotive trends.

Non-Strategic or Divested Joint Ventures

Non-strategic or divested joint ventures in Adient's portfolio can be categorized as 'dogs' if they were underperforming or no longer aligned with the company's core business objectives. Following the sale of its significant joint venture in China during fiscal 2021, along with other portfolio adjustments, certain former JV interests or less critical partnerships likely fell into this 'dog' category.

These businesses, which were ultimately divested, were probably characterized by low growth and low market share, necessitating their removal from Adient's strategic focus. For instance, if a divested JV in a mature automotive market segment experienced declining sales or profitability, it would fit the 'dog' profile.

The strategic decision to divest these ventures, while a positive move for future growth, highlights the prior underperformance of the underlying assets. This is a common occurrence when companies prune their portfolios to concentrate on more promising 'stars' and 'cash cows'.

- Underperforming Assets: Businesses with low growth and profitability, often divested to improve overall company performance.

- Strategic Divestitures: The sale of these ventures, like the China JV in fiscal 2021, represents a strategic move to streamline operations.

- Portfolio Rationalization: Adient's actions indicate a focus on shedding non-core or underperforming segments to enhance financial health.

Adient's 'Dogs' represent product lines or business units with low market share in low-growth industries, often requiring significant investment without substantial returns. These segments, like certain legacy seating components for declining vehicle types, are characterized by intense price competition and a lack of innovation. For example, older seat designs for traditional sedans that face reduced consumer demand are prime examples of Adient's 'Dogs'.

The company's strategic divestment of underperforming assets, such as certain EMEA operations that incurred a $333 million goodwill impairment in fiscal Q3 2025, directly addresses these 'Dog' categories. This move aims to streamline operations and reallocate capital towards more promising growth areas. In 2024, the automotive industry's shift towards EVs and advanced features further marginalizes un-innovated, commoditized seating solutions.

Adient's fiscal year 2023 net loss of $139 million underscores the financial drag these 'Dog' segments can impose. By phasing out legacy programs and divesting non-strategic joint ventures, Adient actively manages its 'Dog' portfolio. This strategic pruning is essential for improving overall financial health and focusing resources on areas with higher potential, such as seating solutions for the growing EV market.

The company's presence in vehicle segments with declining traditional production, such as certain mid-size sedans, contributes to the 'Dog' classification. With SUVs dominating new vehicle sales, as seen in 2023's market trends, traditional seating platforms for sedans face diminished demand and thus lower growth prospects.

Question Marks

Adient's advanced seating for highly autonomous vehicles falls into the question mark category within the BCG matrix. While the company is investing heavily in these innovative solutions, the market for fully autonomous vehicles is still in its early stages and carries significant uncertainty.

Adient currently has a small foothold in this emerging sector, but the potential for growth is substantial as autonomous driving technology advances and novel interior layouts become the norm. This segment demands considerable R&D expenditure with no assurance of swift returns.

Adient's foray into new geographic markets, particularly those exhibiting high growth potential but where its current footprint is minimal, represents a classic "Question Mark" scenario in the BCG Matrix. These markets demand significant upfront capital for establishing infrastructure and brand recognition, aiming to displace entrenched local players. For instance, Adient's expansion into Southeast Asia, a region projected for robust automotive sector growth through 2024-2025, exemplifies this strategy, requiring substantial investment to gain traction against established regional suppliers.

Adient's exploration into integrating non-traditional vehicle interior technologies like health monitoring sensors or advanced infotainment controls into seating systems positions these as potential Stars or Question Marks within its BCG Matrix. While these areas represent high-growth opportunities, Adient's current market share in these specific integrations is likely nascent, requiring strategic investment to capture market leadership.

Luxury and Highly Customized Niche Seating Solutions

Luxury and highly customized niche seating solutions represent a significant question mark for Adient within the BCG matrix. While the company's new mechanical massage seat aims for the mid-to-high-end market, a strategic push into ultra-luxury or bespoke seating segments could unlock substantial high-margin growth. However, Adient may currently hold a comparatively smaller market share in these specialized niches when measured against established luxury suppliers.

To capitalize on this potential, Adient would need to strategically invest in building brand recognition and developing advanced design and manufacturing capabilities tailored to the discerning demands of ultra-luxury consumers. This competitive landscape requires a focused approach to differentiate its offerings and capture a more significant share of this lucrative market. For instance, the global luxury automotive market, a key segment for such seating, was projected to reach approximately $650 billion in 2024, indicating the scale of the opportunity.

- High Margin Potential: Ultra-luxury seating commands premium pricing, offering significantly higher profit margins than mass-market solutions.

- Growth Opportunity: The demand for personalized and exclusive automotive interiors continues to rise, particularly in emerging markets.

- Competitive Landscape: Specialized luxury interior suppliers already have established brand loyalty and bespoke manufacturing processes.

- Investment Needs: Adient would require targeted R&D and marketing investments to establish a strong presence and brand equity in this niche.

Circular Economy Seating Solutions at Scale

Adient's commitment to circular economy principles in seating, focusing on material recycling and reuse, taps into a burgeoning market influenced by stricter environmental rules and growing consumer preference for sustainability. While this area shows significant potential for growth, the practical implementation of full circularity, such as seat-to-seat recycling, is still nascent.

This positions circular economy seating solutions as a 'question mark' within Adient's strategic portfolio. Significant capital expenditure will be necessary to develop advanced recycling technologies, explore innovative material science, and build robust, circular supply chains capable of scaling these solutions across the automotive industry.

- Market Growth: The global automotive seating market is projected to reach over $70 billion by 2027, with sustainability initiatives representing a key growth driver.

- Investment Needs: Developing true seat-to-seat recycling loops requires substantial R&D, potentially involving partnerships and new manufacturing processes.

- Regulatory Tailwinds: Increasing governmental mandates for recycled content in vehicles, such as those in the EU, are creating a favorable environment for circular solutions.

- Consumer Demand: Surveys indicate a growing percentage of consumers, particularly younger demographics, are willing to pay a premium for sustainably manufactured automotive components.

Adient's ventures into advanced seating for autonomous vehicles and the integration of novel interior technologies like health sensors represent classic "Question Marks." These areas demand substantial investment with uncertain future returns, as the markets are still developing. For instance, the company's focus on new geographic markets, such as Southeast Asia, where automotive growth is strong but Adient's presence is minimal, also falls into this category, requiring significant capital to gain market share.

The company's exploration into ultra-luxury and highly customized niche seating solutions also fits the Question Mark profile. While these segments offer high-margin potential, Adient's current market share is likely small, necessitating strategic R&D and marketing investments to compete with established luxury suppliers. The global luxury automotive market, a key target, was projected to be around $650 billion in 2024.

Adient's commitment to circular economy principles in seating, focusing on material recycling and reuse, is another significant Question Mark. Developing true seat-to-seat recycling requires substantial investment in new technologies and supply chains, though regulatory tailwinds and consumer demand for sustainability are strong drivers. The global automotive seating market is expected to exceed $70 billion by 2027, with sustainability being a key factor.

| Business Area | BCG Category | Key Characteristics | Market Potential | Investment Needs |

|---|---|---|---|---|

| Autonomous Vehicle Seating | Question Mark | High R&D, uncertain market adoption | Significant long-term potential | High |

| Integrated Interior Tech (e.g., health sensors) | Question Mark | Nascent market share, high growth opportunity | Growing demand for enhanced cabin experience | Moderate to High |

| Expansion into Emerging Markets (e.g., Southeast Asia) | Question Mark | Low current market share, high regional growth | Robust automotive sector growth projected | High |

| Ultra-Luxury/Niche Seating | Question Mark | Small current share, high-margin potential | Global luxury auto market ~$650B (2024 est.) | Targeted R&D, marketing |

| Circular Economy Seating Solutions | Question Mark | Nascent implementation, strong sustainability drivers | Global seating market >$70B by 2027 | Advanced recycling tech, supply chain development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Adient's financial reports, automotive industry market research, and competitor analysis to accurately position each business unit.