Adient Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

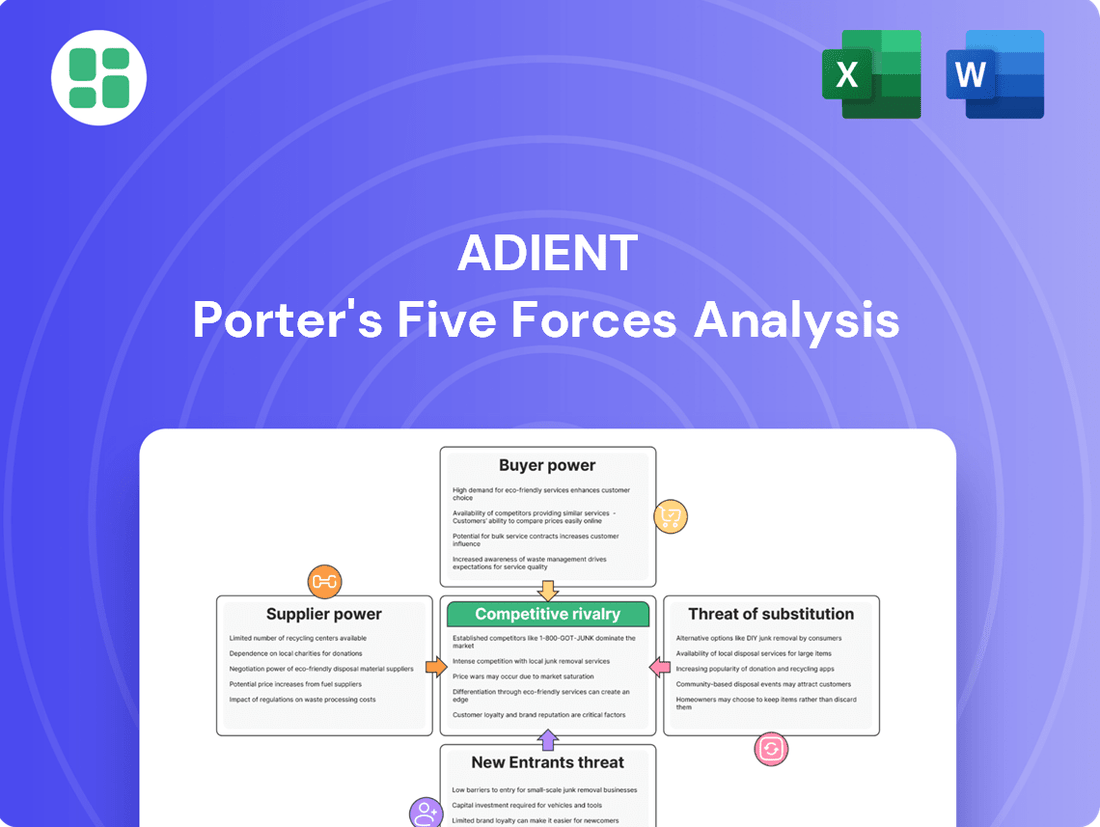

Adient's competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating the automotive seating industry.

The complete report reveals the real forces shaping Adient’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive seating industry, including companies like Adient, often depends on a relatively small number of suppliers for crucial materials such as high-strength steel, specialized foam compounds, and intricate electronic control units. This concentration means that if a few key suppliers decide to increase prices or reduce availability, it can significantly impact Adient's production costs and schedules.

When suppliers possess proprietary technologies or control unique materials with few substitutes, their bargaining power intensifies. For instance, a supplier holding patents for advanced ergonomic foam technology might command higher prices, as Adient would have limited options to source similar quality materials elsewhere.

Recent years have underscored the amplified power of suppliers due to global supply chain volatility. For example, disruptions in the supply of specialized metals or advanced polymers, which were prevalent in 2023 and continued into early 2024, created scarcity. This scarcity allowed suppliers to dictate terms, leading to extended lead times and increased component costs for automotive manufacturers.

Adient's core products, such as automotive seating frames, mechanisms, foam, and fabric, are intricate assemblies that rely heavily on specialized and often tailored input materials. For instance, in 2023, Adient reported that its cost of revenue was approximately $13.2 billion, a significant portion of which is directly attributable to the procurement of these raw materials and components.

The quality and consistent, on-time delivery of these inputs are absolutely critical for Adient to meet the stringent specifications set by Original Equipment Manufacturers (OEMs) and maintain its production timelines. A delay or a defect from a crucial supplier can have a cascading effect, disrupting Adient's manufacturing operations and potentially damaging its relationships with major automotive clients.

Switching suppliers in the automotive sector is a costly affair. It involves extensive qualification, re-engineering, and rigorous testing, all of which can disrupt production. For Adient, this means that if a supplier is deeply integrated into their specific seating programs, the cost and complexity of changing that supplier are substantial.

Adient's long-term contracts and the deep integration of its supply chain for particular seating programs create significant switching barriers. This effectively locks Adient into its current suppliers, limiting its flexibility to seek out alternatives. Consequently, existing suppliers hold considerable leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into assembly operations, essentially becoming competitors, is generally low for Adient. While a specialized component supplier might theoretically possess the capability to assemble seating systems, the significant capital investment, advanced engineering know-how, and established relationships with Original Equipment Manufacturers (OEMs) required make this a formidable barrier. Most of Adient's suppliers operate in segments where the complexity and scale of automotive seating production present a substantial hurdle to such a move.

- Low Likelihood: The intricate nature of automotive seating assembly and the need for deep OEM integration make forward integration by suppliers a rare occurrence.

- High Barriers to Entry: Significant capital expenditure, specialized engineering talent, and established automotive supply chain relationships are critical for forward integration, deterring most suppliers.

- Adient's Position: Adient's expertise in system integration and its strong OEM partnerships provide a defensive moat against this threat.

Uniqueness/Differentiation of Supplier Products

Adient's reliance on suppliers providing highly differentiated or proprietary materials and technologies significantly enhances supplier bargaining power. For instance, if a supplier offers advanced lightweight alloys crucial for Adient's automotive seating frames, or specialized foam formulations that directly impact passenger comfort and safety, these suppliers hold considerable leverage. This is particularly true when these unique inputs are integral to Adient's product performance and its ability to differentiate itself in the competitive automotive seating market.

The uniqueness of these components means Adient has fewer alternatives, directly increasing the supplier's ability to dictate terms. In 2024, the automotive industry continued to see a strong demand for innovative materials, with suppliers of advanced composites and specialized electronic components for smart seating systems commanding higher prices. This trend underscores the critical role of supplier differentiation in shaping the bargaining landscape for companies like Adient.

- Proprietary Materials: Suppliers of unique lightweight alloys and advanced foam formulations for seating.

- Innovative Technologies: Providers of specialized electronic components for smart seating systems.

- Performance Impact: Inputs that significantly contribute to Adient's product differentiation and performance.

- Limited Alternatives: Scenarios where Adient has few substitute suppliers for critical components.

The bargaining power of suppliers for Adient is significant due to the specialized nature of many automotive seating components and the potential for supply chain disruptions. Companies like Adient often rely on a concentrated group of suppliers for critical materials such as high-strength steel, advanced foam compounds, and sophisticated electronic control units, which can lead to increased leverage for these suppliers.

When suppliers control proprietary technologies or unique materials with limited substitutes, their ability to influence pricing and terms escalates. For instance, a supplier with exclusive rights to a novel ergonomic foam technology would likely command higher prices, as Adient would face challenges sourcing comparable quality materials elsewhere.

Global supply chain volatility, evident throughout 2023 and continuing into early 2024, has amplified supplier power. Disruptions in the availability of specialized metals or advanced polymers created scarcity, enabling suppliers to dictate terms, extend lead times, and increase component costs for automotive manufacturers like Adient.

Adient's dependence on suppliers for differentiated materials, such as advanced lightweight alloys for seating frames or specialized foam for comfort, directly enhances supplier leverage. In 2024, demand for innovative automotive materials meant suppliers of advanced composites and smart seating electronics could charge premium prices, impacting Adient's procurement costs.

| Key Factor | Impact on Adient | Supporting Data/Example (2023-2024) |

| Supplier Concentration | Increased leverage for fewer suppliers | Reliance on a limited number of providers for specialized metals and electronics. |

| Proprietary Technology/Materials | Higher pricing power for suppliers | Suppliers of unique ergonomic foam or advanced lightweight alloys. |

| Supply Chain Volatility | Scarcity leads to favorable supplier terms | Disruptions in advanced polymer supply increased lead times and costs. |

| Switching Costs | Deters Adient from changing suppliers | Extensive qualification and re-engineering required for new component integration. |

What is included in the product

This analysis delves into the five competitive forces impacting Adient, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive seating industry.

Instantly identify and address competitive threats by visualizing the intensity of each Porter's Five Force on Adient's market position.

Customers Bargaining Power

Adient's customer base is dominated by a few massive global Original Equipment Manufacturers (OEMs), including giants like Ford, General Motors, Stellantis, and Toyota. These automotive powerhouses demand automotive seating systems in colossal quantities, positioning them as highly concentrated and formidable buyers.

The sheer volume of Adient's sales to these select OEMs means that these customers hold considerable sway. For instance, in fiscal year 2023, Adient's top five customers accounted for approximately 65% of its net sales, underscoring the significant bargaining power these large buyers wield.

OEMs face significant switching costs when changing seating suppliers for existing vehicle platforms. These costs stem from the intricate integration of design, engineering, and manufacturing, coupled with rigorous testing and validation requirements. For instance, a mid-cycle refresh might necessitate substantial retooling and recertification, making a switch prohibitively expensive.

However, for entirely new vehicle programs, OEMs possess greater flexibility. This allows them to foster competition among seating suppliers, potentially negotiating more favorable terms. In 2024, the automotive industry saw continued pressure on component costs, with OEMs actively seeking cost reductions across their supply chains, including seating solutions.

Automotive original equipment manufacturers (OEMs) often have substantial financial backing and the technical know-how to produce their own seating systems. This capability, while not always exercised, creates a latent threat that influences supplier pricing and performance.

For instance, major OEMs like Toyota and Volkswagen have vast capital reserves, with Toyota reporting over $250 billion in cash and equivalents as of early 2024. This financial muscle means they could, in theory, invest in the specialized tooling and expertise required for seating production, thereby reducing their reliance on suppliers like Adient.

This potential for backward integration serves as a powerful negotiating tool for OEMs. It compels seating suppliers, including Adient, to remain highly competitive in terms of cost, product quality, and technological advancement to retain their business.

Price Sensitivity of OEMs

Original Equipment Manufacturers (OEMs) in the automotive sector face fierce competition, driving a relentless pursuit of cost reduction. This makes them highly sensitive to the prices of critical components like seating systems, which are a substantial part of a vehicle's overall cost. For instance, in 2024, the average cost of materials for a new vehicle can represent a significant percentage of its MSRP, making component pricing a key battleground for OEMs.

This intense price pressure directly affects suppliers like Adient, as OEMs leverage their purchasing power to negotiate lower prices. The bargaining power of customers is amplified by the sheer volume of vehicles they produce and their ability to switch suppliers if pricing or terms are not met. In 2023, major automotive OEMs reported substantial cost-saving initiatives, with many targeting a percentage reduction in their supply chain expenditures.

- OEMs' Competitive Landscape: The automotive industry's high competition forces OEMs to prioritize cost efficiency in all aspects of vehicle production.

- Component Cost Significance: Seating systems are a major cost driver for OEMs, making their pricing a critical negotiation point.

- Price Sensitivity Impact: High OEM price sensitivity directly translates into pressure on Adient's profit margins.

- Volume-Driven Bargaining: The large production volumes of OEMs give them significant leverage in supplier negotiations.

Product Differentiation of Adient's Offerings

While the fundamental role of an automotive seat is largely uniform, Adient distinguishes its products through sophisticated features. These advancements include weight reduction for fuel efficiency, ergonomic designs for enhanced comfort, and integrated smart functionalities such as heating, cooling, massage, and even health monitoring. The adoption and perceived necessity of these innovations by Original Equipment Manufacturers (OEMs) directly impact Adient's pricing power.

The bargaining power of customers, particularly OEMs, is influenced by the perceived uniqueness of Adient's seating solutions. While the basic seat is a commodity, Adient's commitment to innovation in areas like lightweighting and smart seating technology can shift this dynamic. For instance, in 2024, the automotive industry's focus on electric vehicles (EVs) amplified the demand for lightweight components to offset battery weight, giving Adient’s lightweighting solutions greater leverage.

- Standardized Core Function: The basic function of an automotive seat remains largely the same across manufacturers.

- Adient's Differentiation: Innovations in lightweighting, ergonomics, smart features (heating, cooling, massage, health monitoring), and sustainable materials.

- OEM Perception: The degree to which OEMs value these differentiating features directly affects Adient's pricing flexibility.

- Market Trend Impact: In 2024, the EV push highlighted the importance of lightweighting, enhancing Adient's bargaining position on these specific offerings.

Adient's customers, primarily major automotive OEMs, possess significant bargaining power due to their substantial purchase volumes and the competitive nature of the auto industry. This power is amplified by OEMs' ability to threaten backward integration, as demonstrated by their considerable financial reserves, such as Toyota's over $250 billion in cash and equivalents in early 2024. Furthermore, the commoditized nature of basic seating functions means OEMs can exert pressure on pricing, especially as they actively pursue cost reductions, with many targeting specific percentage cuts in supply chain expenditures in 2023.

| Customer Type | Bargaining Power Factors | Impact on Adient | Supporting Data (2023-2024) |

|---|---|---|---|

| Major Automotive OEMs | High Purchase Volume, Price Sensitivity, Threat of Backward Integration, Industry Competition | Pressure on pricing and profit margins, need for continuous cost optimization | Top 5 customers accounted for ~65% of net sales (FY23); OEMs focused on cost savings in supply chains (2023); Toyota's cash reserves >$250B (early 2024) |

Same Document Delivered

Adient Porter's Five Forces Analysis

This preview showcases the complete Adient Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the automotive seating industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You are viewing the final, professionally formatted report, ready for immediate download and application to your strategic decision-making.

Rivalry Among Competitors

The automotive seating industry is dominated by a handful of significant global manufacturers. Key players like Adient, Lear Corporation, Magna International, and Forvia (which acquired Hella and is now a major force) vie for dominance. This creates a concentrated market where intense competition for original equipment manufacturer (OEM) contracts is the norm.

The global automotive seating market is expected to see a compound annual growth rate (CAGR) of approximately 3.5% to 4.3% between 2025 and 2035. This steady, rather than explosive, growth means that companies like Adient are primarily competing for existing market share, which naturally fuels intense rivalry among them.

This moderate growth environment pushes established players and new entrants to vie aggressively for customer preference and contracts. Key drivers for this growth include the increasing adoption of electric vehicles (EVs), the integration of advanced autonomous driving features, and a persistent consumer demand for enhanced comfort and premium seating experiences.

While the core of automotive seating can be seen as a commodity, leading companies like Adient actively pursue differentiation. They achieve this through cutting-edge design, the use of advanced materials such as sustainable and lightweight options, and the incorporation of innovative features like smart seating technology and massage functions. This focus on unique, technologically advanced solutions is a key driver for maintaining a competitive edge in the market.

High Fixed Costs and Exit Barriers

The automotive seating industry is characterized by significant capital investment, with companies like Adient facing substantial fixed costs. These include expenses for research and development, state-of-the-art manufacturing plants, highly specialized production equipment, and complex global supply chain operations. For instance, establishing and maintaining advanced seating manufacturing facilities can cost hundreds of millions of dollars.

These high fixed costs, combined with the long-term contractual agreements typically in place with Original Equipment Manufacturers (OEMs) and the specialized nature of the assets, create formidable exit barriers. This means that companies are often compelled to continue operating and competing aggressively, even when market conditions are unfavorable or during economic downturns, to try and recoup their investments.

- High Capital Intensity: The automotive seating sector demands significant upfront investment in R&D, advanced manufacturing technologies, and global infrastructure.

- OEM Contract Lock-in: Long-term contracts with major automakers create a commitment that makes it difficult and costly to withdraw from the market.

- Specialized Assets: The machinery and facilities are highly specific to automotive seating production, limiting their resale value or alternative use, thus increasing exit barriers.

- Competitive Pressure: The presence of high fixed costs encourages incumbent firms to maintain production and market share, intensifying rivalry as they aim to spread these costs over a larger volume.

Switching Costs for Customers (OEMs)

Original Equipment Manufacturers (OEMs) experience substantial switching costs once a seating supplier is chosen for a specific vehicle platform. This is due to the deep integration of seating systems into vehicle design and the rigorous validation processes required, which can take years and significant investment. For instance, in 2023, the automotive industry saw continued high levels of R&D spending, with major players investing billions to develop new platforms and technologies, underscoring the long-term commitment involved in supplier selection.

These high switching costs create significant customer loyalty, or 'stickiness,' for established suppliers like Adient. Once a supplier is embedded in a vehicle's Bill of Materials (BOM) and production line, the cost and complexity of changing providers for that platform become prohibitive. This 'stickiness' is a crucial factor, as it means that while competition is fierce during the initial bidding for new vehicle programs, the incumbent supplier enjoys a protected position for the duration of that model's lifecycle.

- Deep Integration: Seating systems are not standalone components; they are integral to vehicle safety structures, interior ergonomics, and electrical systems, necessitating extensive co-development.

- Validation Hurdles: Automotive suppliers must pass numerous safety, durability, and performance tests, a process that can cost millions and take over two years to complete for a new supplier.

- Production Line Setup: OEMs invest heavily in tooling and configuring their assembly lines for specific supplier components, making a change disruptive and expensive.

- Long-Term Contracts: Typical automotive supply contracts can span 5-7 years, aligning with the lifecycle of a vehicle platform, reinforcing the commitment and thus the switching costs.

Competitive rivalry in the automotive seating industry is intense, driven by a concentrated market with major players like Adient, Lear, and Magna. This rivalry is fueled by moderate market growth, pushing companies to aggressively pursue market share through innovation in design, materials, and technology, such as advanced smart seating features. The high capital intensity and specialized assets required for production, coupled with significant OEM switching costs, also compel existing companies to compete fiercely to recoup their substantial investments.

| Competitor | Approximate 2024 Revenue (USD Billions) | Key Market Focus |

|---|---|---|

| Adient | ~13.0 | Global seating systems, diverse vehicle segments |

| Lear Corporation | ~22.0 | Seating systems, E-Systems |

| Magna International | ~43.0 | Broad automotive supplier, including seating |

| Forvia (Faurecia + Hella) | ~25.0 | Seating, Clean Mobility, Interior Systems, Lighting |

SSubstitutes Threaten

The most significant long-term threat to Adient comes from alternative transportation modes that decrease individual car ownership. Think about expanded public transportation networks, the growing popularity of ride-sharing services, and the potential future of autonomous mobility-as-a-service, which could lead to radically different vehicle interior designs.

A reduction in personal car ownership directly translates to lower demand for traditional automotive seating systems, Adient's core product. For instance, in 2024, urban areas are seeing increased investment in public transit infrastructure, with cities like New York aiming to expand subway services and improve bus routes, potentially impacting car usage for daily commutes.

The rise of fully autonomous vehicles (Level 4/5) presents a significant threat of substitution for traditional automotive seating. These advanced vehicles could fundamentally alter interior design, moving away from fixed, forward-facing seats.

Imagine interiors that transform into mobile lounges or adaptable spaces; this shift could render conventional seat structures largely obsolete. For instance, concepts featuring reconfigurable modules or integrated entertainment systems might replace the need for standard seating arrangements, impacting companies like Adient which specialize in these components.

While Adient primarily serves original equipment manufacturers (OEMs), a minor substitute threat arises from aftermarket seating solutions and extensive DIY interior modifications. However, the automotive industry's rigorous safety standards, intricate integration requirements, and performance demands make these alternatives largely impractical for mass-market vehicles.

Material Substitutions within Seats

While a complete seat substitute is unlikely, innovations in materials can replace traditional components within a seat. For instance, lightweight composites and bio-based foams are emerging as alternatives to conventional materials in seat construction. Adient, a major player, is already integrating these advanced and sustainable materials, aligning with broader industry shifts rather than facing a direct substitute threat.

These material advancements offer opportunities for enhanced performance and sustainability. For example, the automotive industry is increasingly exploring recycled fabrics and advanced polymers to reduce vehicle weight and environmental impact. Adient's commitment to incorporating such materials reflects a proactive approach to evolving material science within the automotive seating sector.

- Lightweight Composites: Offer improved fuel efficiency and performance characteristics.

- Bio-based Foams: Provide sustainable alternatives to petroleum-based foams, reducing environmental footprint.

- Recycled Fabrics: Contribute to circular economy principles by utilizing post-consumer materials.

- Advanced Polymers: Enable novel designs and structural integrity while reducing overall material usage.

Functional Alternatives for Seating Features

While advanced features like integrated entertainment screens or advanced climate control within seating might be mimicked by personal devices or separate vehicle systems, the fundamental role of the seat in providing occupant safety and basic comfort presents a significant barrier to direct substitution. The core necessity of a secure and ergonomic seating structure remains paramount for vehicle manufacturers.

For instance, while a passenger might use their own tablet for entertainment, the seat's primary function of crash protection, as mandated by stringent automotive safety regulations, cannot be easily replaced by external technology. In 2024, automotive safety standards continue to emphasize integrated occupant restraint systems, making the seat an indispensable component.

- Safety Mandates: Vehicle safety regulations globally require integrated seating for occupant protection, limiting the appeal of substitutes for this core function.

- Comfort Integration: While personal devices offer entertainment, the seat's role in ergonomic support and climate regulation, though potentially augmented, is difficult to fully substitute.

- Cost-Effectiveness: For manufacturers, integrating features into the seat often proves more cost-effective and streamlined than relying on disparate, aftermarket, or personal solutions.

- Brand Experience: Automotive brands curate the in-cabin experience, and integrated seating features contribute significantly to brand perception and customer satisfaction.

The threat of substitutes for Adient's automotive seating products is primarily driven by shifts in transportation paradigms rather than direct component replacement. The increasing adoption of ride-sharing, enhanced public transportation, and the future potential of autonomous mobility-as-a-service could reduce overall vehicle ownership, thereby decreasing demand for traditional seating systems. For example, by 2024, cities are investing heavily in public transit, with some projecting significant increases in ridership, which could influence car purchasing decisions.

Entrants Threaten

The automotive seating industry demands substantial upfront capital. Companies need to invest heavily in research and development, sophisticated design processes, rigorous prototyping, and extensive testing to meet stringent safety and quality standards. For instance, establishing a global manufacturing presence, as Adient does, involves significant expenditure on plants, machinery, and supply chain infrastructure.

These considerable financial hurdles act as a strong deterrent for potential new players. Building the necessary production capacity and achieving economies of scale, crucial for competitiveness, requires billions of dollars. This high barrier to entry effectively limits the number of new companies that can realistically challenge established players like Adient.

Established players like Adient leverage substantial economies of scale in procurement, production, and worldwide logistics, achieving cost advantages that are difficult for new entrants to replicate. For instance, Adient's extensive global manufacturing footprint allows for bulk purchasing of raw materials, driving down per-unit costs significantly.

The deep-seated experience curve, honed over years in design, engineering, and operational refinement, presents a formidable barrier. Newcomers face a steep learning curve in developing the intricate product knowledge and efficient processes that Adient has cultivated, impacting their ability to compete on quality and cost from the outset.

Established relationships with automotive Original Equipment Manufacturers (OEMs) act as a formidable barrier to new entrants in the automotive seating industry. Companies like Adient invest years, even decades, in cultivating these partnerships, which often begin with early-stage vehicle design and engineering collaboration. For instance, in 2023, Adient reported that over 80% of its revenue was derived from its top 10 customers, highlighting the depth of these OEM integrations.

Proprietary Technology and Intellectual Property

Adient and its main rivals possess a significant portfolio of patents and proprietary technologies covering everything from seat frames and adjustment mechanisms to foam compositions and advanced safety features, including integrated smart systems. For instance, Adient's investment in R&D was approximately $500 million in fiscal year 2023, highlighting the substantial resources needed to innovate in this space.

The sheer scale of investment required for research and development, coupled with the lengthy time needed to develop comparable or even superior technologies, creates a substantial hurdle for any new company looking to enter the automotive seating market. This technological moat is a key factor in limiting new entrants.

Key areas where proprietary technology acts as a barrier include:

- Advanced seating structures and lightweight materials

- Patented foam formulations for comfort and durability

- Proprietary safety mechanisms and airbag integration

- Smart seating technologies, including sensor integration and connectivity

Regulatory Hurdles and Safety Standards

The automotive sector is burdened by rigorous global safety regulations, demanding crash test standards, and evolving environmental compliance. For instance, in 2024, the U.S. National Highway Traffic Safety Administration (NHTSA) continued to enforce strict Federal Motor Vehicle Safety Standards (FMVSS). New companies entering the automotive seating market would face substantial capital expenditures to design and manufacture products that meet these complex and frequently updated requirements, significantly raising the barrier to entry.

- Stringent Global Safety Regulations: Compliance with standards like FMVSS in the US or UNECE regulations in Europe requires significant R&D and testing.

- High Capital Investment for Compliance: Meeting these standards necessitates advanced manufacturing processes and materials, demanding considerable upfront investment.

- Evolving Environmental Standards: Adherence to emissions and material recyclability mandates adds further complexity and cost for new entrants.

The threat of new entrants into the automotive seating market is significantly mitigated by the immense capital requirements for establishing production facilities and achieving necessary economies of scale. New players must contend with the billions of dollars needed for advanced manufacturing, global supply chains, and the sheer volume to be cost-competitive. This financial barrier, coupled with the need to replicate established players' procurement advantages, makes entry a daunting prospect.

Porter's Five Forces Analysis Data Sources

Our Adient Porter's Five Forces analysis is built upon a foundation of robust data, including Adient's annual reports, industry-specific market research from firms like IHS Markit, and publicly available financial data from sources such as Bloomberg.