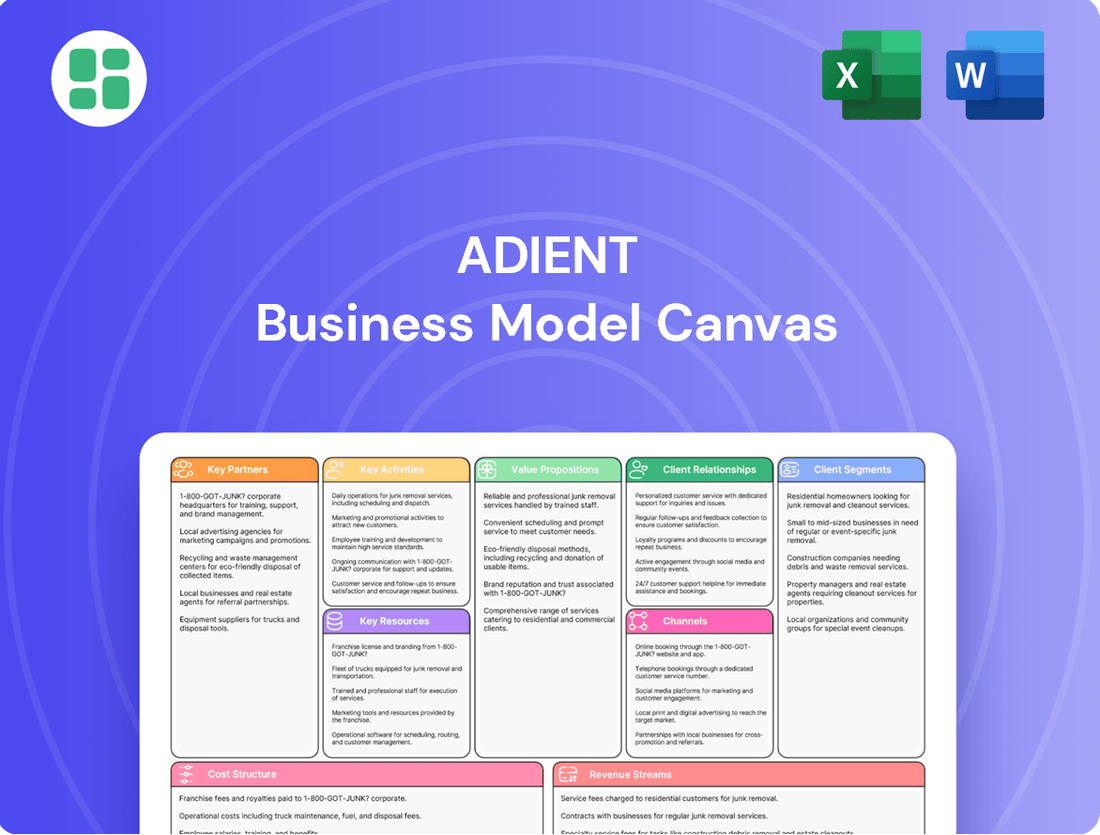

Adient Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adient Bundle

Unlock the core of Adient's operational genius with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful lens for strategic analysis. Download the full canvas to gain a competitive edge and refine your own business strategies.

Partnerships

Adient's core partners are major global automotive Original Equipment Manufacturers (OEMs). These collaborations are vital, with Adient working hand-in-hand on the design, engineering, and production phases to seamlessly integrate their seating solutions into new vehicle models. For example, in 2024, Adient continued to supply seating systems for a significant portion of Ford's F-150 production, a testament to these deep-rooted OEM relationships.

Adient's key partnerships with raw material suppliers are foundational to its global automotive seating operations. These include crucial relationships with providers of steel, aluminum, polyurethane chemicals, fabrics, leather, and vinyl, which are the building blocks of their seating solutions.

Maintaining robust supplier partnerships is vital for navigating the inherent volatility in commodity prices, a challenge Adient, like many in the automotive supply chain, constantly faces. For instance, fluctuations in steel prices, a primary component in seat frames, can significantly impact cost structures.

These collaborations also ensure a consistent and reliable supply of high-quality materials, preventing production disruptions. Furthermore, Adient actively works with these partners to integrate sustainable materials, aligning with industry trends and customer demands for eco-friendly automotive interiors.

Adient collaborates with technology and automation firms, like Paslin, through joint development agreements. These partnerships are crucial for advancing manufacturing processes and fostering product innovation within Adient's operations.

A key focus of these collaborations is the development of sophisticated automated systems, such as robotic sewing cells and advanced assembly lines. These innovations are specifically designed to support Adient's new product portfolios, directly contributing to enhanced operational efficiency and overall business performance.

Joint Ventures (JVs) with OEMs

Adient actively pursues joint ventures with Original Equipment Manufacturers (OEMs), a strategy particularly prominent in the crucial Chinese market. These collaborations are designed to unlock new avenues for growth and solidify Adient's presence in diverse automotive landscapes.

Key partnerships include joint ventures with major Chinese automakers such as Guangzhou Automobile Group, Beijing Automobile Group, and FAW Group Corporation. These alliances are instrumental in expanding Adient's market reach within China, enabling them to better cater to the specific demands of regional automotive consumers.

These joint ventures offer significant advantages by allowing Adient to:

- Expand Market Reach: Access new customer segments and geographical areas through established OEM networks.

- Share Risks: Mitigate financial and operational risks by distributing them among JV partners.

- Leverage Local Expertise: Benefit from the deep understanding of local market dynamics, regulations, and consumer preferences that OEM partners possess.

Research and Development Collaborators

Adient actively collaborates with universities and research centers to push the boundaries of automotive seating technology. These partnerships are crucial for developing next-generation seating solutions, particularly those supporting advanced driver-assistance systems (ADAS) and autonomous driving systems (ADS).

For instance, in 2024, Adient continued its engagement with leading engineering schools to explore novel materials and manufacturing processes for lighter, more sustainable seating. This focus on eco-friendly design is a key driver for the automotive industry, with a growing demand for recycled and bio-based materials in vehicle interiors.

- Innovation Hubs: Partnerships with specialized research institutions foster the development of cutting-edge seating features.

- Future Mobility: Collaborations focus on seating concepts for electric vehicles (EVs) and autonomous platforms.

- Sustainability Focus: Joint projects aim to integrate advanced sustainable materials and manufacturing techniques.

- Industry Synergies: Working with other automotive suppliers and technology companies enhances integrated solutions.

Adient's key partnerships are crucial for its operational success and market expansion. These include deep relationships with major automotive OEMs, ensuring seamless integration of seating solutions into new vehicle models. For example, Adient's 2024 supply agreements for Ford's F-150 highlight the significance of these OEM collaborations.

What is included in the product

This Adient Business Model Canvas outlines the company's core strategy for designing, manufacturing, and marketing automotive seating for all major OEMs, detailing customer relationships and revenue streams.

It comprehensively maps Adient's key resources, activities, and partnerships, alongside cost structure and value propositions for the global automotive industry.

Adient's Business Model Canvas acts as a pain point reliever by offering a clear, visual map of their complex automotive seating operations, simplifying strategic understanding and identifying areas for improvement.

It provides a structured framework to address the pain of managing diverse customer needs and intricate supply chains within the automotive seating industry.

Activities

Adient's design and engineering activities are central to its business, focusing on creating complete automotive seating systems and individual components. This involves a deep dive into ergonomics, material science, and manufacturing feasibility to meet the evolving demands of the automotive industry.

In 2024, Adient continued to invest heavily in R&D, with a significant portion of its resources dedicated to developing next-generation seating technologies. This includes advancements in lightweight materials and integrated smart features, aiming to enhance occupant comfort and safety while reducing vehicle weight.

Collaboration with Original Equipment Manufacturers (OEMs) is a critical design and engineering activity. Adient works hand-in-hand with automakers from the early stages of vehicle platform development, ensuring seating solutions are seamlessly integrated and meet specific performance and aesthetic targets.

Adient's core operations revolve around the high-volume manufacturing and assembly of automotive seating components. They run a vast network of over 200 plants worldwide, producing essential parts like frames, mechanisms, foam, trim, and fabric. This extensive global footprint allows them to serve a wide range of automotive manufacturers efficiently.

A key activity is the implementation of standardized manufacturing processes. This standardization is crucial for maintaining consistent, high-quality output across all their facilities. It also helps in minimizing production waste and achieving economies of scale, which are vital for cost competitiveness in the automotive supply chain.

Adient's supply chain management is paramount, focusing on the intricate global flow of raw materials and components for automotive seating. This involves strategic sourcing of materials like foam, fabrics, and steel, alongside managing relationships with a vast network of suppliers worldwide.

Key activities include optimizing logistics to navigate international shipping routes and managing inventory levels to balance availability with carrying costs, especially crucial given fluctuating commodity prices. For instance, in fiscal year 2023, Adient reported that its cost of sales was approximately $12.8 billion, highlighting the significant scale of its procurement and supply chain operations.

Research and Development (R&D)

Adient's commitment to Research and Development (R&D) is a cornerstone of its business model, fueling innovation in automotive seating. This continuous investment is crucial for staying ahead in seating technology, exploring advanced materials, and refining manufacturing processes. For instance, in fiscal year 2023, Adient reported R&D expenses of $344 million, underscoring its dedication to future product development.

The company actively pursues the creation of next-generation seating solutions designed for evolving automotive trends. This includes a strong focus on seating for electric vehicles (EVs), which often require different design considerations due to battery placement and vehicle architecture, as well as for increasingly sophisticated smart cars. Adient is also exploring circular economy principles in product design, aiming for more sustainable and recyclable seating components.

- Innovation in Seating Technology: Adient invests heavily in R&D to pioneer new seating features and comfort enhancements.

- Materials Science Exploration: Research into lightweight, durable, and sustainable materials is a key focus to improve vehicle efficiency and environmental impact.

- EV and Smart Car Solutions: Development efforts are directed towards specialized seating for electric and connected vehicles, addressing unique design and functional requirements.

- Circular Economy Integration: Adient is exploring how to incorporate circularity into its product lifecycle, from design to end-of-life management.

Quality Control and Assurance

Adient's commitment to quality control and assurance is a cornerstone of its operations, particularly vital in the demanding automotive sector. This dedication ensures that every product meets the exceptionally high standards expected by global original equipment manufacturers (OEMs).

The company employs stringent processes across all phases of product development, from initial design and engineering through to the final manufacturing stages. This comprehensive approach guarantees that Adient's seating solutions consistently adhere to the rigorous quality benchmarks required by the automotive industry.

In 2023, Adient reported a significant focus on quality initiatives, with investments aimed at further refining its manufacturing processes and product reliability. For instance, the company's continuous improvement programs are designed to minimize defects and enhance customer satisfaction, a critical factor in retaining partnerships with major automotive brands.

- Product Integrity: Adient maintains rigorous quality checks at multiple points in the production cycle to ensure the integrity and durability of its automotive seating systems.

- OEM Compliance: The company's quality assurance protocols are specifically designed to meet and exceed the stringent specifications and performance requirements set by global automotive OEMs.

- Continuous Improvement: Adient actively engages in process optimization and data analysis to identify and address potential quality issues proactively, fostering a culture of ongoing enhancement.

- Customer Feedback Integration: Feedback loops are established to incorporate customer insights and performance data, driving further improvements in product design and manufacturing excellence.

Adient's key activities encompass the entire lifecycle of automotive seating, from initial concept to final production and delivery. This involves not only the physical manufacturing of seating components but also the crucial design, engineering, and quality assurance processes that ensure their products meet the exacting standards of the automotive industry.

In fiscal year 2023, Adient's commitment to innovation was evident with $344 million invested in R&D, focusing on next-generation seating for EVs and smart cars. Their manufacturing operations span over 200 plants globally, producing a wide array of seating parts, with supply chain management being critical, as indicated by their $12.8 billion cost of sales in the same year.

These activities are underpinned by a strong emphasis on quality control, ensuring compliance with OEM specifications and driving continuous improvement through customer feedback and process optimization. This integrated approach allows Adient to maintain its position as a leading global automotive seating supplier.

| Key Activity | Description | Fiscal Year 2023 Data/Facts |

|---|---|---|

| Design & Engineering | Creating complete automotive seating systems and components, focusing on ergonomics, materials, and manufacturability. | Investment in next-generation seating technologies for EVs and smart cars. |

| Manufacturing & Assembly | High-volume production of seating parts (frames, mechanisms, foam, trim) across a global network of over 200 plants. | Operates a vast global manufacturing footprint. |

| Supply Chain Management | Strategic sourcing of raw materials and components, managing global logistics and inventory. | Cost of Sales: Approximately $12.8 billion. |

| Research & Development | Pioneering new seating features, exploring advanced materials, and refining manufacturing processes. | R&D Expenses: $344 million. |

| Quality Control & Assurance | Ensuring products meet stringent OEM specifications and performance requirements through rigorous testing and process adherence. | Focus on process refinement and product reliability initiatives. |

Full Document Unlocks After Purchase

Business Model Canvas

The Adient Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to seamlessly integrate it into your strategic planning and operations.

Resources

Adient's global manufacturing footprint is a cornerstone of its business model, featuring over 200 plants strategically located in 29 countries. This expansive network allows Adient to serve major automotive original equipment manufacturers (OEMs) on a global scale, ensuring localized production and efficient supply chains.

This extensive reach is critical for delivering complex seating systems to clients like Ford, General Motors, and Stellantis, who operate numerous assembly plants worldwide. In 2023, Adient reported approximately $13.7 billion in revenue, underscoring the scale and importance of its manufacturing capabilities in meeting global automotive demand.

Adient's intellectual property, particularly its extensive portfolio of patents covering seating systems, mechanisms, foam, and trim technologies, forms a core component of its value proposition. These proprietary innovations are not just technical achievements; they are critical enablers of the company's competitive edge in the automotive seating market. For instance, Adient's advancements in lightweight materials and ergonomic design, protected by patents, directly translate into fuel efficiency benefits for automakers and enhanced comfort for consumers.

The company's design expertise, intrinsically linked to its patent strategy, allows Adient to develop highly differentiated and innovative seating solutions. This is vital in an industry where vehicle interiors are increasingly becoming a key selling point. Adient's ability to secure and leverage these intellectual assets means they can offer unique features and functionalities that competitors find difficult to replicate, thereby commanding premium pricing and fostering strong customer loyalty. As of fiscal year 2023, Adient reported significant investment in research and development, underscoring the ongoing importance of its patent-backed innovation pipeline.

Adient's skilled workforce, exceeding 70,000 employees globally, is a critical asset, with a substantial portion dedicated to engineering and technical roles. This deep pool of talent is essential for their innovation in automotive seating. In 2023, Adient reported a significant investment in its workforce, underscoring the importance of these human resources.

Long-Standing OEM Relationships

Adient's long-standing relationships with major global automotive Original Equipment Manufacturers (OEMs) are a cornerstone of its business. These deep-rooted connections translate into consistent order flow and a significant competitive advantage. For instance, by 2024, Adient continued to solidify its position as a preferred supplier for leading automakers, underscoring the trust and reliability built over decades. These partnerships are not merely transactional; they often involve co-development initiatives, allowing Adient to stay at the forefront of seating innovation and integrate new technologies seamlessly into vehicle platforms.

These established OEM relationships are crucial for several reasons:

- Customer Loyalty and Repeat Business: Strong OEM ties ensure a steady stream of orders, as manufacturers tend to stick with trusted, proven suppliers.

- Collaborative Development: Early involvement in OEM design and development processes allows Adient to influence seating architecture and integrate advanced features.

- Market Position: Being a preferred supplier to multiple major OEMs provides significant market share and resilience against economic fluctuations.

- Operational Efficiency: Long-term partnerships facilitate better forecasting and production planning, leading to improved efficiency and cost management.

Advanced Manufacturing Technologies

Adient's access to and ongoing development of advanced manufacturing technologies, such as sophisticated automation and robotics, are critical resources. These investments directly translate into tangible benefits for the company's operations and product offerings.

These technologies are instrumental in boosting production efficiency, a factor that directly impacts cost management and throughput. Furthermore, they play a vital role in elevating product quality, ensuring that Adient's seating solutions meet stringent automotive industry standards. The implementation of advanced manufacturing also unlocks the potential for creating innovative seating features that differentiate Adient in a competitive market.

- Production Efficiency: Automation and robotics streamline assembly processes, reducing cycle times and labor costs. For instance, in 2024, Adient continued to leverage robotic welding and automated material handling systems across its global facilities, aiming for a 10% improvement in assembly line speed for key product lines.

- Product Quality Enhancement: Precision automation minimizes manufacturing defects, leading to higher consistency and reliability in seating components. This focus on quality is crucial for meeting the demanding specifications of automotive OEMs.

- Innovation Enabler: Advanced manufacturing techniques facilitate the integration of complex features, such as advanced lumbar support systems and integrated heating/cooling elements, into seating designs. This capability allows Adient to offer differentiated products that appeal to evolving consumer preferences.

Adient's key resources include its extensive global manufacturing footprint, a robust portfolio of patents for seating technologies, and a highly skilled workforce. These are complemented by strong, long-standing relationships with major automotive OEMs and significant investments in advanced manufacturing technologies. The company's intellectual property, particularly in areas like lightweight materials and ergonomic design, provides a distinct competitive advantage.

In 2023, Adient's revenue reached approximately $13.7 billion, demonstrating the scale of its operations. The company's commitment to innovation is reflected in its substantial research and development investments. Furthermore, Adient's workforce, numbering over 70,000 employees, includes a significant proportion of technical and engineering talent crucial for product development.

Adient's strategic partnerships with OEMs are vital, ensuring consistent order flow and facilitating co-development opportunities. By 2024, these relationships continued to solidify Adient's position as a preferred supplier. The company's adoption of advanced manufacturing, such as robotics in assembly, aims to improve efficiency and product quality, with a target of a 10% increase in assembly line speed for key product lines in 2024.

| Key Resource | Description | Impact/Data Point |

| Global Manufacturing Footprint | Over 200 plants in 29 countries | Enables serving major OEMs globally; supports localized production. |

| Intellectual Property (Patents) | Innovations in seating systems, mechanisms, foam, and trim | Drives competitive edge, enables premium pricing, and fosters customer loyalty. |

| Skilled Workforce | Over 70,000 employees, with many in technical roles | Essential for innovation in automotive seating; significant investment in 2023. |

| OEM Relationships | Long-standing partnerships with global automotive OEMs | Ensures consistent order flow, facilitates co-development, and provides market resilience. |

| Advanced Manufacturing Technologies | Automation, robotics, sophisticated assembly systems | Boosts production efficiency and product quality; target of 10% assembly speed increase in 2024. |

Value Propositions

Adient delivers integrated, high-quality seating systems, encompassing everything from frames and mechanisms to foam, trim, and fabric. This end-to-end capability means they provide Original Equipment Manufacturers (OEMs) with a complete, cohesive solution for vehicle interiors.

Their deep expertise across the entire seat manufacturing process ensures that each component works seamlessly together, resulting in a superior final product. For instance, Adient's commitment to quality is reflected in their significant investment in advanced manufacturing techniques, aiming to reduce defects and enhance durability in their seating solutions.

Adient's global footprint, spanning 29 countries and boasting over 200 manufacturing facilities, allows it to effectively serve original equipment manufacturers (OEMs) on a worldwide basis. This extensive network is crucial for maintaining consistent product delivery and ensuring responsiveness to the unique demands of regional markets.

This expansive operational scale is complemented by a commitment to localized support, enabling Adient to tailor supply chain solutions to specific geographic needs. For instance, in 2023, Adient reported revenue of $13.7 billion, underscoring its significant global reach and operational capacity to manage complex international supply chains while providing on-the-ground assistance.

Adient's commitment to innovation in design and technology is a cornerstone of its value proposition, offering automotive manufacturers cutting-edge seating solutions. These solutions address critical industry demands for enhanced comfort, superior safety features, and the integration of sustainable materials, reflecting a forward-thinking approach to vehicle interiors. For instance, Adient's focus on lightweight materials contributed to significant fuel efficiency improvements across various vehicle platforms in 2024, a key driver for automakers navigating stricter emissions regulations.

The company is actively shaping the future of mobility by developing next-generation seating designed for autonomous vehicles and evolving passenger experiences. This includes exploring advanced ergonomics and integrated technology, ensuring Adient remains at the forefront of automotive interior advancements. Their investment in research and development for these future concepts saw a notable increase in 2024, underscoring their dedication to pioneering solutions for the evolving automotive landscape.

Operational Excellence and Efficiency

Adient drives operational excellence through standardized manufacturing processes and a relentless pursuit of continuous improvement. This focus on efficiency directly impacts their cost structure, enabling them to offer competitive pricing to Original Equipment Manufacturers (OEMs).

This dedication to streamlining operations ensures reliable delivery schedules, a critical factor for automotive clients. For instance, Adient's global manufacturing footprint, with operations in numerous countries, allows for localized production and reduced lead times.

- Standardized Processes: Adient implements consistent manufacturing protocols across its facilities worldwide, ensuring quality and predictability.

- Continuous Improvement: Ongoing projects target waste reduction and productivity gains, contributing to a leaner operational model.

- Cost Management: A keen eye on the cost structure allows Adient to maintain competitive pricing in the demanding automotive supply chain.

- Reliable Delivery: Efficiency translates into dependable delivery, a key value proposition for OEM partners.

Sustainability and ESG Commitment

Adient's dedication to sustainability offers a compelling value proposition, particularly for original equipment manufacturers (OEMs) prioritizing Environmental, Social, and Governance (ESG) criteria. This commitment translates into tangible environmental benefits for their partners.

The company's efforts include concrete achievements in reducing its environmental footprint. For instance, Adient reported a significant reduction in Scope 1 and Scope 2 greenhouse gas emissions, aiming for a 25% decrease by 2030 compared to a 2019 baseline. Furthermore, they are actively increasing their use of renewable energy sources across their operations, demonstrating a proactive approach to decarbonization.

- Reduced Environmental Impact: Adient's focus on lowering greenhouse gas emissions provides OEMs with a partner actively contributing to a cleaner automotive industry.

- Greener Supply Chain: By increasing renewable energy usage, Adient offers a more sustainable supply chain solution, aligning with OEM ESG mandates.

- Meeting OEM ESG Goals: Adient's sustainability initiatives directly support automotive manufacturers in achieving their own ambitious environmental targets.

Adient offers comprehensive, end-to-end seating solutions, integrating all aspects of seat manufacturing from frames to trim. Their expertise ensures seamless component integration for a superior final product, backed by significant investments in advanced manufacturing to enhance durability and reduce defects.

With a global presence in 29 countries and over 200 facilities, Adient provides worldwide support to OEMs, ensuring consistent delivery and market responsiveness. This expansive network, coupled with localized supply chain solutions, highlights their operational capacity, as evidenced by their $13.7 billion revenue in 2023.

Innovation is key, with Adient developing cutting-edge seating for comfort, safety, and sustainability, including lightweight materials that improved fuel efficiency in 2024. They are also pioneering next-generation seating for autonomous vehicles, increasing R&D investment in these future concepts.

Operational excellence, driven by standardized processes and continuous improvement, allows Adient to offer competitive pricing and reliable delivery to OEMs. Their commitment to efficiency is demonstrated by ongoing projects focused on waste reduction and productivity gains.

Adient's sustainability efforts are a core value proposition, supporting OEM ESG goals through reduced environmental impact and increased renewable energy usage. The company aims for a 25% reduction in Scope 1 and 2 GHG emissions by 2030 from a 2019 baseline.

| Value Proposition | Key Features | Impact for OEMs |

|---|---|---|

| Integrated Seating Solutions | End-to-end manufacturing (frames, mechanisms, foam, trim) | Complete, cohesive vehicle interior solutions |

| Global Reach & Local Support | 200+ facilities in 29 countries | Consistent worldwide delivery, tailored regional solutions |

| Innovation in Design & Technology | Advanced ergonomics, sustainable materials, autonomous vehicle seating | Cutting-edge comfort, safety, and fuel efficiency |

| Operational Excellence | Standardized processes, continuous improvement | Competitive pricing, reliable delivery schedules |

| Sustainability Commitment | GHG emission reduction targets, renewable energy use | Support for OEM ESG goals, reduced environmental footprint |

Customer Relationships

Adient actively engages in collaborative development with Original Equipment Manufacturers (OEMs), integrating with their engineering teams from the initial phases of vehicle platform design. This partnership ensures seating solutions are not just components, but integral parts of the vehicle's overall architecture.

This co-creation process allows Adient to tailor seating systems precisely to the unique specifications and performance demands of each OEM's new vehicle models. For instance, in 2024, Adient's advanced seating technologies were integrated into several new electric vehicle platforms, showcasing this deep collaboration.

Adient prioritizes building lasting connections with its clients through dedicated account management. This approach ensures consistent support and proactive problem-solving, fostering trust and loyalty throughout the partnership.

These specialized teams act as a direct liaison, understanding each customer's unique requirements and providing tailored solutions. For instance, in 2024, Adient's customer retention rate remained robust, a testament to the effectiveness of its dedicated account management strategy in addressing client needs and ensuring satisfaction across their automotive seating solutions.

Adient's customer relationships are built on the foundation of providing critical just-in-time (JIT) and in-sequence delivery of complete seating systems directly to Original Equipment Manufacturer (OEM) assembly lines. This highly synchronized logistical ballet ensures that the right seating components arrive at the precise moment they are needed.

This meticulous coordination significantly benefits customers by drastically reducing their inventory holding costs, a key factor in managing operational expenses. For example, in 2024, the automotive industry continued to grapple with supply chain complexities, making Adient's JIT capabilities even more valuable. Their efficient delivery model directly supports the streamlined and uninterrupted flow of vehicle production, a crucial element for meeting market demand.

Technical Support and After-Sales Service

Adient provides robust technical support and after-sales service to ensure their automotive seating systems perform optimally. This includes expert assistance for installation, troubleshooting, and ongoing maintenance, minimizing downtime for their automotive manufacturing clients.

Their commitment to quality assurance and addressing post-production needs is critical for maintaining strong relationships with automakers. For instance, Adient's focus on rapid response for any potential issues with their seating solutions directly impacts vehicle production schedules and customer satisfaction.

- Seamless Integration: Ensuring Adient's seating systems are easily integrated into vehicle assembly lines.

- Performance Optimization: Providing support to maintain the highest standards of seating functionality and comfort.

- Post-Production Support: Addressing any unforeseen issues or modifications required after the initial sale.

- Quality Assurance: Implementing rigorous checks and offering solutions to guarantee product reliability.

Performance Monitoring and Feedback Loops

Adient actively monitors its performance through robust systems, including a Global Comprehensive Supplier Scorecard. This scorecard not only tracks supplier efficiency but also directly reflects Adient’s dedication to ensuring high levels of customer satisfaction. For instance, in 2024, Adient's focus on supplier performance contributed to a reported 98% on-time delivery rate for key automotive components.

- Supplier Scorecard Implementation: Adient utilizes a detailed Global Comprehensive Supplier Scorecard to evaluate and manage its supply chain partners, ensuring alignment with customer expectations.

- OEM Feedback Integration: Regular feedback sessions with Original Equipment Manufacturers (OEMs) are crucial for identifying areas of improvement in product quality and service delivery.

- Continuous Improvement Initiatives: Based on performance monitoring and feedback, Adient implements targeted initiatives to enhance its offerings, aiming for greater customer loyalty and market competitiveness.

Adient cultivates deep partnerships with OEMs through collaborative development, ensuring seating is integral to vehicle design, exemplified by its 2024 integration into new EV platforms. Dedicated account management and robust technical support further solidify these relationships, prioritizing client needs and satisfaction.

The company's commitment to just-in-time and in-sequence delivery directly benefits customers by reducing inventory costs, a critical advantage in the complex automotive supply chain of 2024. Adient's focus on quality assurance and responsive after-sales service maintains operational flow and client trust.

Performance monitoring, including the Global Comprehensive Supplier Scorecard, underscores Adient's dedication to customer satisfaction, contributing to a strong 2024 on-time delivery rate. Integrating OEM feedback and continuous improvement initiatives are central to fostering loyalty and market competitiveness.

Channels

Adient's core business model revolves around direct sales and supply to Original Equipment Manufacturers (OEMs) globally. This is their primary and most significant channel for revenue generation.

This direct engagement means Adient works closely with the purchasing, engineering, and design teams within automotive manufacturers. They collaborate on developing seating solutions for new vehicle programs and ensure a consistent supply for ongoing production lines.

In fiscal year 2023, Adient reported net sales of $13.4 billion, with a substantial portion attributed to these direct OEM relationships. This channel is crucial for securing long-term contracts and maintaining a strong position in the automotive supply chain.

Adient's global manufacturing and assembly plants, numbering over 200 worldwide, are a critical component of its business model. This vast network acts as a primary distribution channel, ensuring seating systems and components reach automotive original equipment manufacturers (OEMs) efficiently.

These facilities are strategically located to support OEM assembly lines across diverse geographic regions, facilitating just-in-time delivery. In 2023, Adient reported approximately $13.5 billion in revenue, underscoring the scale and operational capacity of its manufacturing footprint.

Adient strategically utilizes joint venture networks, notably in China, to penetrate key automotive markets and streamline product distribution. These partnerships serve as vital localized channels for both sales and manufacturing operations, enhancing market access and operational efficiency.

In 2024, Adient's joint ventures, such as its significant collaboration in China, continued to be a cornerstone of its global strategy. These ventures allow Adient to navigate complex local regulations and consumer preferences, thereby improving its competitive standing in these crucial regions.

Technical and Engineering Support Teams

Adient's technical and engineering support teams are vital channels, offering pre-sales consultation and design integration directly to Original Equipment Manufacturers (OEMs). These teams ensure seamless product implementation and optimal performance by working closely with OEM engineering departments, either on-site or remotely.

Their post-sales support is equally critical, addressing any functional challenges and ensuring customer satisfaction. For instance, in 2024, Adient reported a significant increase in customer inquiries related to advanced seating technologies, underscoring the demand for expert technical guidance in integrating these innovations.

- Pre-Sales Consultation: Providing expertise during the initial design and selection phases.

- Design Integration: Collaborating with OEM engineers to ensure Adient products fit seamlessly into vehicle architectures.

- Post-Sales Support: Offering troubleshooting and technical assistance after product delivery.

- On-site and Remote Engagement: Flexibility in supporting OEM teams wherever they are located.

Industry Trade Shows and Conferences

Adient leverages industry trade shows and conferences as a crucial channel to directly engage with the automotive ecosystem. These events provide a prime platform to unveil cutting-edge seating technologies and demonstrate their value proposition to Original Equipment Manufacturers (OEMs). For instance, Adient's presence at major events like CES or the IAA Mobility showcases their commitment to innovation in areas such as sustainable materials and advanced comfort features.

Participation is strategic for fostering relationships and securing new business. By networking with key decision-makers from existing and prospective OEM clients, Adient can better understand evolving market demands and tailor their offerings. This direct interaction is vital for building strong partnerships and solidifying their position as a preferred supplier in the competitive automotive seating market.

Furthermore, these gatherings serve as a powerful tool for brand building and highlighting Adient's comprehensive capabilities. Showcasing their expertise in design, engineering, and manufacturing reinforces their image as a leader in automotive seating solutions. In 2024, Adient continued to emphasize its role in shaping the future of vehicle interiors through active participation in these influential industry forums.

- Showcasing Innovation: Adient presents new seating technologies and sustainable solutions at key automotive events.

- Customer Engagement: Direct interaction with OEM customers to understand needs and build relationships.

- Brand Promotion: Reinforcing Adient's position as a leading global automotive seating supplier.

Adient's channels primarily consist of direct sales to automotive OEMs, leveraging its extensive global manufacturing footprint for efficient distribution. Joint ventures, particularly in key markets like China, act as localized sales and manufacturing channels, enhancing market access.

Technical and engineering support teams serve as crucial pre- and post-sales channels, assisting OEMs with product integration and addressing technical challenges. Industry trade shows and conferences are vital for showcasing innovation, engaging with customers, and building brand presence.

| Channel Type | Description | Key Activities | Fiscal Year 2023/2024 Relevance |

|---|---|---|---|

| Direct OEM Sales | Primary revenue driver through direct supply agreements. | Collaboration on design, engineering, and production supply. | Secured long-term contracts, contributing to $13.4 billion in net sales (FY23). |

| Global Manufacturing Network | Over 200 plants worldwide acting as distribution hubs. | Just-in-time delivery to OEM assembly lines. | Supported $13.5 billion in revenue (FY23) through operational capacity. |

| Joint Ventures | Strategic partnerships for market penetration and operations. | Navigating local regulations, tailoring offerings. | Strengthened competitive standing in crucial regions like China (2024). |

| Technical & Engineering Support | Expert consultation and post-sales assistance. | Pre-sales consultation, design integration, troubleshooting. | Increased customer inquiries for advanced seating technologies (2024). |

| Trade Shows & Conferences | Industry events for showcasing technology and networking. | Unveiling innovations, fostering relationships, brand promotion. | Active participation in forums like CES and IAA Mobility (2024). |

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent Adient's primary customer base. This segment includes all major worldwide car and truck makers who rely on Adient for comprehensive seating solutions and individual components for their diverse vehicle lines, from sedans to heavy-duty trucks.

In 2024, the automotive industry continued its recovery, with global vehicle production expected to reach approximately 90-92 million units, a significant increase from the challenging years prior. Adient's deep integration with these OEMs means they are a critical partner in delivering the advanced seating technologies and high-quality craftsmanship demanded by consumers.

Luxury and premium vehicle manufacturers represent a crucial customer segment for Adient, demanding exceptional comfort, superior materials, and highly customizable design elements. These automakers, including brands like Mercedes-Benz and BMW, are focused on creating an elevated in-cabin experience for their discerning clientele. Adient's ability to deliver innovative features, such as advanced mechanical massage seating, directly addresses this segment's need for sophisticated and differentiating comfort solutions.

The burgeoning electric vehicle (EV) market presents a significant opportunity for Adient, with a growing roster of manufacturers like Rivian, NIO, Xpeng Motors, BYD, and Xiaomi Motors actively seeking innovative seating solutions. These companies are pushing the boundaries of automotive design, and Adient's ability to tailor seating to the specific needs of EV interiors, such as lightweight construction and integrated technology, is paramount. BYD, for instance, saw its revenue surge by 42% in 2023, reaching approximately $83.5 billion, underscoring the rapid expansion of this customer segment.

Commercial Vehicle Manufacturers

Adient's commercial vehicle segment focuses on delivering durable and functional seating for trucks and light commercial vehicles. These manufacturers demand solutions that withstand rigorous use and prioritize driver comfort for long hauls. In 2024, the global commercial vehicle market saw continued demand, with projections indicating growth driven by e-commerce and logistics sector expansion.

Key considerations for Adient in serving this segment include:

- Durability and Longevity: Seats must endure high usage cycles and harsh operating conditions.

- Ergonomics and Driver Comfort: Features that reduce fatigue and improve driver well-being are crucial.

- Customization for Specific Applications: Tailoring seating to the unique needs of different truck types, from long-haul to vocational.

- Cost-Effectiveness: Balancing advanced features with competitive pricing for manufacturers.

Emerging Market OEMs

Emerging market Original Equipment Manufacturers (OEMs) are a key customer segment for Adient. These companies, prevalent in regions like Southeast Asia and Latin America, are increasingly demanding localized and affordable seating solutions. Adient's extensive global network and established joint ventures allow it to effectively serve these markets, offering seating tailored to regional price points and consumer preferences.

For instance, the automotive market in India, a significant emerging economy, saw production of over 5.8 million passenger vehicles in 2023, highlighting the scale of opportunity. Adient's ability to provide cost-competitive seating, often developed through local partnerships, directly addresses the needs of OEMs targeting these high-growth, price-sensitive regions.

- Cost-Effective Solutions: Adient can offer competitive pricing by leveraging local manufacturing and supply chains in emerging markets.

- Regional Adaptation: Seating designs can be modified to meet specific local tastes, regulations, and material availability.

- Joint Venture Synergies: Partnerships enable Adient to navigate local business landscapes and share development costs.

- Market Growth Potential: Emerging automotive markets are experiencing rapid expansion, offering substantial volume opportunities.

Adient serves a diverse range of automotive manufacturers, from global giants to specialized EV startups and commercial vehicle makers. This broad customer base requires tailored seating solutions, from luxury comfort to rugged durability and cost-effective designs for emerging markets.

The company's ability to innovate and adapt to evolving automotive trends, such as the shift to electric vehicles and the demand for advanced features, is crucial for maintaining strong relationships with these varied customer segments.

In 2024, Adient's focus on these distinct customer groups reflects the dynamic nature of the automotive industry, where specialization and adaptability are key to success.

| Customer Segment | Key Characteristics | 2024 Market Context/Data |

| Global OEMs | Major car and truck manufacturers worldwide | Global vehicle production projected at 90-92 million units |

| Luxury/Premium OEMs | Demand for exceptional comfort, premium materials, customization | Focus on elevated in-cabin experience, advanced features |

| EV Manufacturers | Need for lightweight, integrated, innovative seating solutions | Rapid growth in EV market, companies like BYD showing strong revenue growth (42% in 2023) |

| Commercial Vehicle OEMs | Requirement for durability, ergonomics, cost-effectiveness | Growth driven by e-commerce and logistics sector expansion |

| Emerging Market OEMs | Demand for localized, affordable, and regionally adapted seating | India's passenger vehicle production exceeded 5.8 million in 2023 |

Cost Structure

Adient's cost structure is heavily influenced by the purchase of essential raw materials. These include significant volumes of steel, aluminum, polyurethane chemicals, and various textiles like fabrics and leather, which are fundamental to seat manufacturing.

The global commodity markets directly affect Adient's profitability, as price swings in materials like steel and aluminum can substantially alter procurement expenses. For instance, in fiscal year 2023, Adient reported that its cost of goods sold was approximately $12.9 billion, a figure heavily weighted by raw material inputs.

Adient's extensive global manufacturing footprint, encompassing over 200 plants worldwide, necessitates significant investment in manufacturing and labor. These costs, including direct labor wages, factory overhead like rent and equipment depreciation, essential utilities such as electricity and water, and ongoing maintenance, represent a core component of the company's cost structure. In 2023, Adient reported cost of sales of $13.1 billion, highlighting the scale of these operational expenses.

To manage and mitigate these substantial manufacturing and labor expenses, Adient frequently engages in restructuring initiatives. These actions are strategically designed to optimize operational efficiency, reduce waste, and improve overall cost competitiveness. For instance, in fiscal year 2023, the company continued its efforts to streamline its manufacturing network, a common practice aimed at aligning production capacity with market demand and enhancing profitability.

Adient's cost structure heavily features significant investments in Research and Development (R&D). These expenditures are vital for developing innovative seating solutions, improving existing product lines, and driving technological advancements within the automotive industry. For instance, in fiscal year 2023, Adient reported R&D expenses of $246 million, underscoring their commitment to staying at the forefront of automotive seating technology and design.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are crucial for Adient's operations, encompassing vital corporate functions. These include the costs associated with executive leadership, financial management, information technology infrastructure, and the essential sales and marketing efforts that drive revenue. Adient is committed to optimizing these expenditures.

The company actively pursues strategies to control and reduce SG&A costs. This focus on efficiency translates into tangible actions such as moderating compensation expenses for administrative staff and implementing tighter controls on general administrative spending across the organization. For fiscal year 2023, Adient reported SG&A expenses of $1.1 billion, representing a slight decrease from the prior year.

- Executive and Corporate Functions: Costs related to leadership, finance, legal, and HR.

- Sales and Marketing: Expenses for promoting products and managing customer relationships.

- Information Technology: Investment in systems and support for business operations.

- Administrative Overhead: General office expenses and support staff costs.

Logistics and Supply Chain Costs

Adient's global footprint and commitment to just-in-time delivery necessitate significant expenditures in logistics, freight, and overall supply chain management. These costs are integral to ensuring that automotive seating components reach manufacturers precisely when needed, minimizing production line stoppages.

In 2024, Adient, like many global manufacturers, faced ongoing pressures on logistics costs due to fluctuating fuel prices and capacity constraints in shipping. The company's strategy to mitigate these substantial expenses hinges on continuous optimization of both inventory levels and transportation routes.

- Global Network Management: Adient operates a complex network of manufacturing facilities and distribution centers worldwide, requiring substantial investment in managing inbound and outbound logistics.

- Freight and Transportation: Costs associated with shipping raw materials to plants and finished goods to automotive OEMs represent a major component of their cost structure. For instance, in its fiscal year 2023, Adient reported significant freight expenses as part of its cost of sales, reflecting the global nature of its operations.

- Inventory Optimization: Maintaining optimal inventory levels across its supply chain is crucial to balance the need for readily available parts with the cost of holding excess stock.

- Technology and Route Planning: Investment in advanced logistics software and data analytics is vital for identifying the most efficient transportation routes and modes, thereby reducing transit times and costs.

Adient's cost structure is dominated by its substantial investments in raw materials, manufacturing operations, and global logistics. These core expenses are directly impacted by market volatility, as seen in the $13.1 billion cost of sales reported for fiscal year 2023, which includes significant material and labor outlays. The company actively manages these costs through operational efficiencies and restructuring efforts to maintain competitiveness.

| Cost Category | FY 2023 (Approximate) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (Materials & Labor) | $13.1 billion | Steel, aluminum, chemicals, textiles, direct labor, factory overhead |

| Research & Development | $246 million | Innovation in seating technology and design |

| Selling, General & Administrative (SG&A) | $1.1 billion | Executive, finance, IT, sales, and marketing functions |

Revenue Streams

Adient's core revenue generation hinges on selling fully assembled automotive seating systems directly to original equipment manufacturers (OEMs). These intricate systems are not off-the-shelf items; rather, they are meticulously designed, engineered, and produced to meet the precise specifications and unique needs of each vehicle model and platform. For instance, in fiscal year 2023, Adient reported net sales of $13.7 billion, with a significant portion derived from these complete seating system sales, underscoring its position as a critical supplier in the automotive industry.

Adient generates revenue by selling individual seating components like frames, mechanisms, foam, trim, and fabric. This approach caters to Original Equipment Manufacturers (OEMs) and other Tier 1 suppliers who may require specific parts rather than complete seat assemblies. This flexibility allows Adient to serve a broader market and adapt to diverse customer specifications.

Adient offers specialized engineering and design services, working closely with Original Equipment Manufacturers (OEMs) during the vehicle development process. This collaboration is crucial for integrating Adient's seating solutions seamlessly into new vehicle platforms.

While a portion of the research and development expenses incurred during these design phases are often reimbursed by OEMs, the true value lies in the implicit revenue generated. The deep integration and tailored solutions developed through these services directly contribute to securing future, large-scale production contracts for Adient's seating systems.

For instance, in fiscal year 2023, Adient reported that approximately 70% of its revenue was derived from existing production programs, highlighting the importance of these early-stage design and engineering engagements in building a robust pipeline of future business.

Aftermarket and Replacement Parts

Adient's aftermarket and replacement parts segment likely contributes a steady, albeit smaller, revenue stream. This supports the continued use and longevity of their seating solutions in vehicles already on the road, demonstrating a commitment to their product lifecycle.

This aftermarket business is crucial for maintaining customer loyalty and ensuring the ongoing functionality of Adient's seating systems. It taps into the need for repairs and part replacements that naturally arise over a vehicle's lifespan.

While specific figures for this segment are not always broken out, it's a common practice for automotive component suppliers to generate revenue from replacement parts. For instance, in 2023, the global automotive aftermarket was valued at over $400 billion, indicating a substantial market for such services.

- Aftermarket Revenue: A consistent, though often smaller, revenue generator for Adient.

- Product Longevity: Supports the extended usability of Adient's seating solutions.

- Market Size: The broader automotive aftermarket is a significant global industry.

- Customer Support: Enhances customer satisfaction through available replacement components.

Joint Venture Equity Income

Adient generates revenue through equity income derived from its significant joint venture (JV) partnerships, primarily with major original equipment manufacturers (OEMs) across crucial global automotive markets. These collaborations are integral to Adient's financial health.

For example, Adient's substantial stake in its Chinese joint ventures, such as Shanghai Adient, contributes significantly to its overall earnings. In fiscal year 2023, Adient's equity income from unconsolidated affiliates, which includes these JVs, was reported as $295 million. This demonstrates the tangible financial impact of these strategic alliances.

- Equity Income Source: Revenue stream from Adient's ownership stakes in various joint ventures.

- Key Partners: Primarily major automotive OEMs in global markets, especially China.

- Financial Contribution: Joint ventures like Shanghai Adient are vital for Adient's overall profitability.

- FY2023 Impact: Equity income from unconsolidated affiliates reached $295 million in fiscal year 2023.

Adient's primary revenue comes from selling complete automotive seating systems to car manufacturers, a business that generated $13.7 billion in net sales in fiscal year 2023. They also profit from selling individual components like frames and foam to OEMs and other suppliers, offering flexibility in their product offerings.

Engineering and design services represent another revenue avenue, where Adient collaborates with OEMs on new vehicle development, securing future production contracts. The aftermarket segment, though smaller, provides ongoing revenue through replacement parts, tapping into a global market valued over $400 billion in 2023.

Furthermore, Adient earns significant revenue through equity income from its joint ventures, particularly in China, which contributed $295 million in fiscal year 2023. These partnerships are crucial for Adient's financial performance.

| Revenue Stream | Description | FY2023 Impact (Approx.) |

|---|---|---|

| Seating Systems Sales | Fully assembled seating systems sold to OEMs. | Majority of $13.7 billion net sales. |

| Component Sales | Individual seating parts sold to OEMs and Tier 1 suppliers. | Contributes to overall sales mix. |

| Engineering & Design Services | Collaborative vehicle development, securing future contracts. | Implicit revenue through secured production. |

| Aftermarket & Replacement Parts | Parts for existing vehicles on the road. | Leverages global aftermarket >$400 billion (2023). |

| Equity Income from JVs | Income from ownership stakes in joint ventures. | $295 million from unconsolidated affiliates. |

Business Model Canvas Data Sources

Adient's Business Model Canvas is informed by a robust blend of financial disclosures, internal operational data, and extensive market research. These sources provide the foundation for understanding customer needs, value propositions, and revenue streams.