ADENTRA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADENTRA Bundle

ADENTRA's current SWOT analysis reveals a dynamic market position, highlighting key strengths in their operational efficiency and a growing market presence. However, understanding the full scope of their competitive landscape and potential vulnerabilities is crucial for informed decision-making.

Want the full story behind ADENTRA's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ADENTRA boasts an impressive distribution network, with 85 to 86 facilities strategically located throughout the United States and Canada. This extensive footprint solidifies its standing as one of North America's leading distributors of architectural building products.

This widespread presence enables ADENTRA to efficiently cater to a diverse customer base spanning residential, repair and remodel, and commercial construction sectors. The sheer volume of facilities translates into significant logistical advantages and deep market penetration across the continent.

Adentra's strength lies in its remarkably diversified product portfolio, encompassing a vast array of architectural products. With an impressive catalog of 190,000 Stock Keeping Units (SKUs), the company provides everything from doors and decorative surfaces to a wide spectrum of building materials. This extensive offering allows Adentra to serve a broad customer base and various market segments effectively.

This significant product diversification acts as a crucial buffer against market volatility. By not being overly reliant on any single product category, Adentra enhances its resilience. Should demand falter for one type of material, the company can still draw strength from sales in other areas, ensuring greater stability and reducing overall business risk.

ADENTRA has showcased impressive financial health, highlighted by robust cash flow from operations. In 2024, the company generated $142.8 million from its operating activities, with a further $33.9 million reported in the second quarter of 2025. This consistent cash generation is a testament to efficient operations and effective financial management.

The company's strategic deployment of capital is a key strength. ADENTRA has actively worked to reduce its leverage ratio, indicating a commitment to financial prudence and a stronger balance sheet. Simultaneously, it has returned value to its shareholders through consistent dividend payments and strategic share repurchases, demonstrating a balanced approach to capital allocation.

This strong financial discipline and consistent cash flow generation provide ADENTRA with significant stability and the flexibility to pursue future strategic investments. It positions the company well to capitalize on growth opportunities and navigate market fluctuations effectively.

Strategic Acquisitions and Growth Initiatives

ADENTRA's strength lies in its consistent strategy of growth through targeted acquisitions. A prime example is the 2024 acquisition of Woolf Distributing Company, which directly fueled significant sales increases in both the first and second quarters of 2025. This strategic M&A approach is crucial for expanding the company's reach into new geographic areas and broadening its customer base, especially within vital market segments.

The company's M&A pipeline is designed to achieve double-digit returns and accretive growth. By consolidating players within a fragmented market, ADENTRA positions itself for enhanced profitability and market share gains. This disciplined approach to integration and synergy realization is a core component of its long-term value creation strategy.

- Proven Acquisition Strategy: Demonstrated by the successful integration of Woolf Distributing Company in 2024.

- Sales Growth Driver: Woolf Distributing contributed significantly to ADENTRA's sales in Q1 and Q2 2025.

- Market Consolidation: ADENTRA actively pursues consolidation in a fragmented industry.

- Accretive Growth Target: Focus on achieving double-digit returns through strategic acquisitions.

Resilient Business Model and Operational Efficiency

ADENTRA's business model demonstrates notable resilience, even when facing difficult market environments. The company has maintained stable gross margins, a testament to its focus on cost control and operational efficiency. For instance, in the first quarter of 2024, ADENTRA reported gross margins of 26.2%, indicating a consistent ability to manage its cost of goods sold effectively.

The company's strategic pricing adjustments in response to market shifts, coupled with disciplined working capital management, are key strengths. This approach helps protect ADENTRA's balance sheet and ensures it can weather economic downturns. Their inventory turnover ratio, which stood at 6.1 times in Q1 2024, reflects efficient management of its assets.

- Stable Gross Margins: Maintained 26.2% gross margin in Q1 2024 despite market volatility.

- Operational Efficiency: Achieved an inventory turnover of 6.1 times in Q1 2024, showcasing effective asset management.

- Adaptable Pricing Strategy: Ability to adjust prices to counter market fluctuations.

- Disciplined Working Capital: Safeguards the balance sheet through careful management of current assets and liabilities.

ADENTRA's extensive distribution network, comprising 85 to 86 facilities across North America, is a significant strength. This vast footprint allows for efficient service to diverse customer segments in residential, repair and remodel, and commercial construction.

The company's diversified product portfolio, featuring 190,000 SKUs, offers a wide range of architectural products, from doors to building materials. This broad offering enhances resilience against market volatility by reducing reliance on any single product category.

ADENTRA demonstrates strong financial health, evidenced by robust operating cash flow, with $142.8 million generated in 2024 and $33.9 million in Q2 2025. Strategic capital deployment includes leverage reduction and shareholder returns through dividends and repurchases.

The company's proven acquisition strategy, exemplified by the 2024 Woolf Distributing Company purchase, drives sales growth and market consolidation. ADENTRA targets double-digit returns and accretive growth by integrating fragmented market players.

| Metric | Q1 2024 | Q2 2025 | 2024 |

|---|---|---|---|

| Distribution Facilities | ~85-86 | ~85-86 | ~85-86 |

| SKUs | 190,000 | 190,000 | 190,000 |

| Operating Cash Flow | N/A | $33.9 million | $142.8 million |

| Gross Margin | 26.2% | N/A | N/A |

| Inventory Turnover | 6.1x | N/A | N/A |

What is included in the product

Analyzes ADENTRA’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

ADENTRA's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

ADENTRA's financial health is closely tied to the residential construction sector, which has been experiencing a slowdown. This softness is largely driven by higher US mortgage rates, making homeownership less affordable for many. For instance, the Mortgage Bankers Association reported that the average rate for a 30-year fixed mortgage hovered around 6.5% to 7.5% throughout much of late 2023 and early 2024, impacting demand.

While the broader North American construction market might show resilience, ADENTRA's significant exposure to residential projects means it feels these specific pressures acutely. This segment is crucial to their revenue streams, and any prolonged downturn directly affects their top-line performance.

The outlook for residential construction remains cautious. Persistent high interest rates, coupled with ongoing challenges in housing supply, could continue to limit the number of potential homebuyers. This environment poses a direct risk to ADENTRA's sales volumes and overall market position in the coming periods.

Adentra faced product price deflation in 2024, which directly impacted its organic sales figures. This trend continued with lower sales volumes observed in early 2025, presenting a headwind to revenue expansion.

While there are signs of price stabilization, the ongoing decline in organic sales volumes remains a significant concern for future revenue growth. This sensitivity to market shifts in pricing and volume is a key weakness for the company.

ADENTRA has experienced a notable rise in operating expenses, a situation exacerbated by the integration of recently acquired entities, such as Woolf Distributing. This expansion, while strategically important for growth, brings with it the challenge of managing higher operational costs, particularly within warehouse functions.

For instance, the company's operating expenses increased by 12.5% in the first quarter of 2024 compared to the same period in 2023, reaching $150 million. This surge is directly linked to the costs associated with integrating new businesses and the increased overhead from expanded warehouse facilities. While these acquisitions are intended to bolster market position, the effective control of these escalating expenses is paramount for preserving profit margins and ensuring the overall financial health of the company.

Potential Impact of Trade Policies and Tariffs

ADENTRA's operations could be indirectly impacted by evolving trade policies and potential tariff increases on construction materials, even with limited direct exposure. For instance, a 10% tariff on imported lumber, a key construction input, could increase costs for builders and developers, potentially slowing demand for ADENTRA's products.

Broader economic consequences of trade disputes, such as heightened inflation, pose a significant risk. For example, if tariffs lead to a general rise in construction material prices, this could dampen overall market activity, affecting ADENTRA's sales volumes. Navigating these complexities necessitates agile strategies for sourcing and pricing to mitigate potential cost increases and maintain competitiveness.

- Trade Policy Volatility: Increased uncertainty due to fluctuating US trade policies and potential tariffs on construction inputs.

- Indirect Economic Impact: Broader inflationary pressures stemming from trade disputes could affect market demand.

- Sourcing and Pricing Flexibility: The need for adaptable strategies to manage supply chain costs and pricing in a dynamic environment.

Dependence on Economic Stability and Consumer Affordability

ADENTRA's reliance on a stable economic environment presents a significant weakness. Fluctuations in interest rates, inflation, and consumer purchasing power directly impact demand for building materials and renovation services. For instance, if mortgage rates remain elevated, as seen in early 2024 with rates hovering around 6-7%, it can dampen new home construction and renovation projects, directly affecting ADENTRA's sales volume.

Persistent affordability issues for consumers, coupled with a slower-than-expected decrease in mortgage rates, could further constrain market demand. This economic sensitivity means that a substantial economic downturn, which could see reduced disposable income and tighter credit conditions, would likely lead to a severe slowdown in both new construction and renovation activities, impacting ADENTRA's revenue streams.

- Economic Sensitivity: ADENTRA's business model is inherently tied to the health of the broader economy.

- Interest Rate Impact: Higher interest rates, like those experienced in 2023-2024, directly reduce consumer affordability for housing and renovations.

- Downturn Risk: A significant economic recession could lead to a sharp decline in construction and renovation spending, negatively affecting ADENTRA.

ADENTRA's significant exposure to the residential construction sector makes it vulnerable to market downturns. For example, the slowdown in new home starts, driven by elevated mortgage rates in 2023-2024, directly impacts their sales volumes. This reliance on a single, cyclical market segment is a key vulnerability.

The company also faces challenges from product price deflation and declining organic sales volumes, observed through 2024 and into early 2025. This trend indicates a weakening demand environment for their offerings, hindering revenue growth potential.

Rising operating expenses, particularly following acquisitions like Woolf Distributing, present another weakness. The 12.5% increase in Q1 2024 operating expenses, reaching $150 million, highlights the cost of expansion and integration, potentially squeezing profit margins if not managed effectively.

| Weakness | Description | Impact | Data Point |

| Residential Construction Dependence | Heavy reliance on the residential building market. | Vulnerability to housing market slowdowns. | Mortgage rates averaged 6.5%-7.5% in late 2023/early 2024. |

| Price Deflation & Volume Decline | Experiencing lower product prices and sales volumes. | Headwind to revenue growth and market share. | Organic sales declined in early 2025. |

| Rising Operating Expenses | Increased costs due to acquisitions and expansion. | Pressure on profit margins. | Q1 2024 operating expenses rose 12.5% to $150 million. |

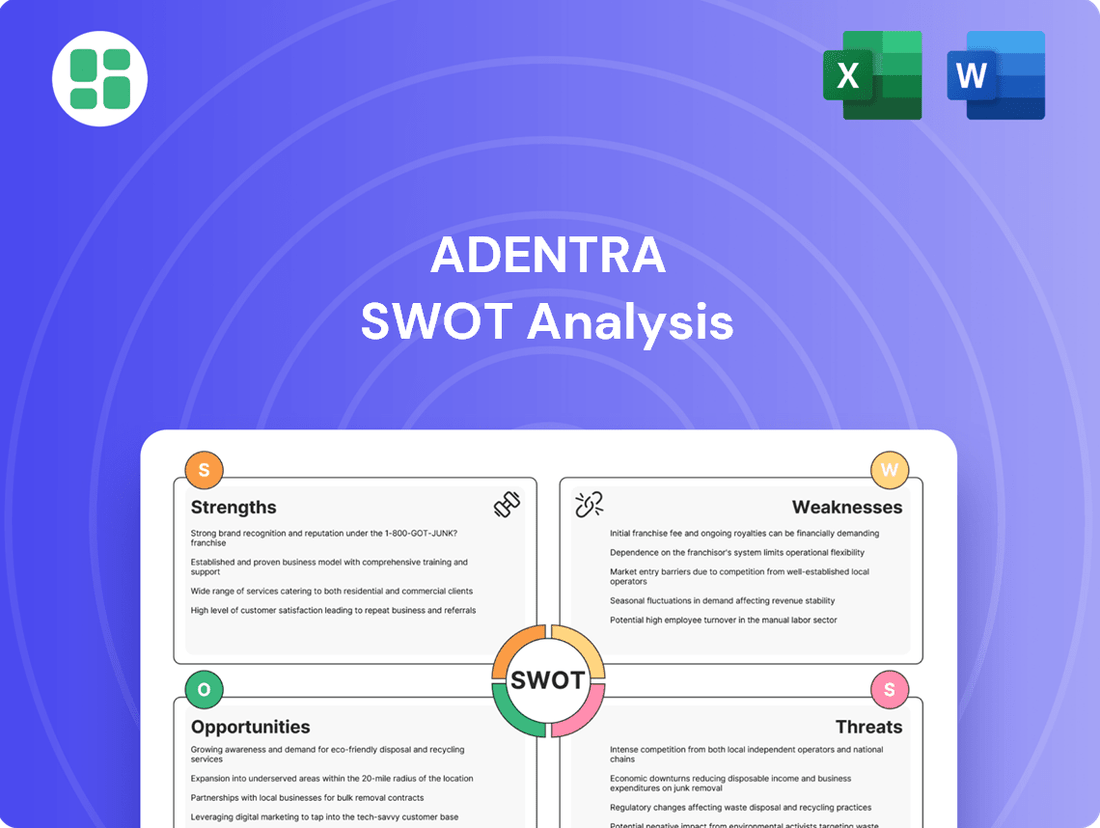

Preview the Actual Deliverable

ADENTRA SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the clear structure and insightful points that will help you understand ADENTRA's strategic position.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of ADENTRA's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the ADENTRA SWOT analysis, ready for your strategic planning.

Opportunities

The North American construction market is poised for sustained growth, with projections indicating a steady upward trend through 2028. This positive outlook is underpinned by persistent housing shortages, favorable demographic shifts, and the ongoing need to address an aging housing inventory. For ADENTRA, this translates into a robust and enduring demand for its products and services.

Further bolstering this market strength are significant government initiatives. Investments in critical infrastructure upgrades and the burgeoning clean energy sector are creating substantial new project pipelines. These macro-level drivers provide a solid and predictable foundation for ADENTRA's long-term strategic planning and growth trajectory.

The building products distribution sector is notably fragmented, a situation that ADENTRA can leverage for growth. This fragmentation creates a fertile ground for strategic acquisitions, allowing ADENTRA to broaden its geographical footprint, enhance its product portfolio, and enlarge its customer base.

ADENTRA's strategic blueprint, 'Destination 2028,' explicitly outlines a commitment to expansion through mergers and acquisitions. The company has set ambitious annual M&A targets, aiming to integrate businesses valued between $50 million and $150 million. This focused M&A strategy is designed to fuel substantial accretive growth for the company.

The market is experiencing a significant upswing in demand for sustainable building solutions, fueled by heightened environmental awareness and the growing importance of certifications like LEED. ADENTRA, by emphasizing renewable, recyclable resources and offering FSC-certified products, is strategically aligned to benefit from this trend.

This growing customer segment actively seeks environmentally responsible materials, making ADENTRA's current product portfolio a strong advantage. Further expanding its range of green building materials presents a clear opportunity to capture a larger share of this expanding market.

Leveraging Digital Capabilities and Data Analytics

ADENTRA's strategic focus on digital capabilities and data analytics presents significant opportunities for growth and efficiency. By investing in these areas, the company can unlock new avenues for revenue and operational improvement. For instance, a robust digital transformation strategy can streamline processes, enhance customer interactions, and provide deeper insights into asset performance.

Leveraging advanced data analytics allows ADENTRA to make more informed decisions, optimize resource allocation, and identify emerging market trends. This data-driven approach is crucial for maintaining a competitive edge in the evolving logistics and real estate sectors. The company's commitment to digital engagement and e-commerce platforms is expected to yield tangible benefits.

- Enhanced Operational Efficiency: Data analytics can pinpoint bottlenecks and inefficiencies in ADENTRA's operations, leading to cost savings and faster service delivery.

- Improved Customer Experience: Digital platforms and data insights enable personalized customer interactions and more responsive service, boosting satisfaction and loyalty.

- Optimized Asset Management: Predictive analytics can forecast maintenance needs and optimize the utilization of ADENTRA's real estate and logistics assets, maximizing returns.

- New Revenue Streams: Developing innovative digital services and e-commerce solutions can create entirely new revenue opportunities for the company.

Increased Renovation and Remodel (R&R) Activity

The current economic climate, characterized by elevated mortgage rates, is compelling many homeowners to invest in their existing properties rather than move. This trend is a significant tailwind for the repair and remodel (R&R) segment. For instance, the Joint Center for Housing Studies of Harvard University projected that homeowner spending on R&R would continue to grow through 2024 and into 2025, driven by this "stay-and-improve" mentality.

Furthermore, the aging nature of the U.S. housing stock is a persistent driver of renovation demand. Many homes built decades ago require substantial updates to meet modern standards for energy efficiency, comfort, and aesthetics. This demographic factor ensures a consistent need for R&R services, benefiting companies like ADENTRA that cater to this market.

ADENTRA is well-positioned to capitalize on sustained R&R activity. This segment is anticipated to constitute a substantial portion of overall residential construction spending. In 2024, R&R spending was estimated to account for over 50% of total residential construction expenditures, a figure expected to hold steady through 2025.

- Homeowner Retention: High mortgage rates encourage homeowners to stay put, boosting spending on renovations and upgrades.

- Aging Infrastructure: A significant percentage of existing homes require modernization, fueling consistent demand for R&R projects.

- Market Share: The repair and remodel segment is projected to remain a dominant force in residential construction, representing a substantial opportunity for ADENTRA.

- Projected Growth: Homeowner R&R spending was expected to see continued, albeit moderate, growth through 2024 and into 2025.

ADENTRA's strategic focus on expanding its product offerings to include more green building materials presents a significant opportunity. The market's increasing demand for sustainable solutions, driven by environmental consciousness and certifications like LEED, aligns perfectly with this initiative. By catering to this growing segment, ADENTRA can capture a larger market share and enhance its brand reputation.

The company's commitment to digital transformation and data analytics offers substantial avenues for growth and operational improvement. Leveraging these capabilities allows ADENTRA to optimize its processes, enhance customer engagement, and make more informed strategic decisions, ultimately driving efficiency and unlocking new revenue streams.

The sustained demand within the repair and remodel (R&R) sector, fueled by high mortgage rates and an aging housing stock, provides a consistent and lucrative market for ADENTRA. This segment, which accounted for over 50% of residential construction expenditures in 2024 and was projected to continue its growth into 2025, represents a core opportunity for the company.

ADENTRA's M&A strategy, targeting businesses valued between $50 million and $150 million annually, is a key opportunity for accretive growth. This approach allows the company to expand its geographical reach, diversify its product portfolio, and increase its customer base within the fragmented building products distribution market.

| Opportunity Area | Description | Market Trend/Data Point | ADENTRA's Position |

|---|---|---|---|

| Green Building Materials | Expanding product lines to include sustainable and eco-friendly options. | Growing demand for LEED-certified and renewable resources. | Strategically aligned with current product offerings and market preferences. |

| Digital Transformation & Data Analytics | Investing in digital capabilities and data-driven decision-making. | Enhances operational efficiency, customer experience, and identifies new revenue streams. | Key to maintaining a competitive edge and optimizing resource allocation. |

| Repair and Remodel (R&R) Market | Capitalizing on increased homeowner investment in existing properties. | R&R spending represented over 50% of residential construction in 2024, projected steady growth into 2025. | Well-positioned to benefit from sustained R&R activity due to aging housing stock and homeowner retention trends. |

| Mergers and Acquisitions (M&A) | Executing strategic acquisitions to broaden market presence and capabilities. | Fragmented building products distribution sector allows for consolidation. | 'Destination 2028' strategy targets annual M&A of $50M-$150M for accretive growth. |

Threats

ADENTRA faces significant headwinds from volatile economic conditions, especially with interest rates remaining elevated. For instance, in late 2023 and continuing into 2024, mortgage rates have hovered around 7% or higher, significantly dampening housing demand. This directly translates to lower sales volumes for ADENTRA, as affordability becomes a major concern for potential buyers and developers alike.

The construction sector's sensitivity to interest rate hikes means that a prolonged period of high borrowing costs can stifle new projects. This credit crunch, coupled with reduced consumer spending power due to inflation, poses a substantial threat to ADENTRA's revenue streams and overall growth prospects throughout 2024 and potentially into 2025.

ADENTRA faces significant competitive pressures, with numerous regional and national distributors vying for market share. This intense rivalry is amplified by ongoing consolidation within the building products distribution sector, as larger players actively engage in mergers and acquisitions. For instance, in early 2024, Builders FirstSource, a major competitor, continued its acquisition strategy, further concentrating market power and potentially creating more formidable rivals for ADENTRA.

The building materials sector has grappled with significant supply chain disruptions and fluctuating material costs, a situation amplified by recent geopolitical events and global economic shifts. For ADENTRA, while their supplier base is diversified, a sudden interruption in supply or a steep rise in raw material prices, such as lumber which saw significant price swings in 2021 and 2022, could compress their gross margins and challenge their pricing stability.

Labor Shortages in the Construction Industry

Ongoing labor shortages within the North American construction sector present a significant hurdle. This scarcity of skilled workers can directly translate into project delays and escalating costs for construction firms, which are a key segment of ADENTRA's clientele.

These project delays and cost overruns can indirectly dampen demand for building materials, a core product category for ADENTRA. Furthermore, a slower pace of overall construction activity could impact the company's sales volume and revenue streams.

- Skilled Worker Deficit: The U.S. Bureau of Labor Statistics projected a need for 546,000 additional construction workers in 2022 alone, highlighting the persistent demand.

- Project Delays: A 2023 survey by the Associated General Contractors of America found that 70% of construction firms reported project delays due to labor shortages.

- Increased Labor Costs: The tight labor market has driven up wages, with average hourly earnings for construction workers increasing by approximately 5.5% year-over-year as of early 2024.

Potential for New Tariffs and Trade War Escalation

The specter of new tariffs and escalating trade wars presents a considerable threat to ADENTRA. Renewed inflationary pressures and economic uncertainty stemming from these trade disputes, especially concerning key commodities like timber, lumber, iron, steel, cement, and gypsum, could significantly impact the construction and building materials sector.

While ADENTRA operates with a pricing pass-through model, meaning they can adjust their prices to reflect increased input costs, this strategy has its limits. In an already price-sensitive market, substantial price hikes driven by tariffs could lead to a noticeable reduction in demand for their products and services. For instance, if tariffs on lumber increase by 25%, as seen in past trade disputes, the cost of construction projects could rise sharply, deterring new builds and renovations.

- Tariff Risk: Potential for new tariffs on imported materials like lumber, steel, and cement.

- Inflationary Impact: Escalating trade disputes could reignite inflationary pressures, increasing ADENTRA's input costs.

- Demand Sensitivity: The construction market is price-sensitive, and higher costs due to tariffs may dampen demand.

- Economic Uncertainty: Trade wars create broader economic uncertainty, potentially slowing down overall construction activity.

ADENTRA faces significant threats from a challenging macroeconomic environment, including persistently high interest rates that dampen housing demand. For instance, mortgage rates remained around 7% or higher throughout much of 2024, impacting affordability. This economic sensitivity means that a downturn in construction activity, driven by higher borrowing costs and reduced consumer spending due to inflation, could directly impact ADENTRA's sales volumes and revenue growth into 2025.

Intensified competition within the building products distribution sector, marked by ongoing consolidation through mergers and acquisitions by larger players, presents another substantial threat. This trend, exemplified by continued acquisition activity from competitors like Builders FirstSource in early 2024, could lead to greater market concentration and more formidable rivals for ADENTRA.

Supply chain volatility and fluctuating material costs, exacerbated by geopolitical events and global economic shifts, pose a risk to ADENTRA's margins. While the company benefits from a diversified supplier base, sudden disruptions or sharp increases in raw material prices, such as lumber, could compress gross margins and challenge pricing stability.

The persistent shortage of skilled labor in the North American construction sector, with the U.S. Bureau of Labor Statistics projecting a need for hundreds of thousands of additional workers annually, directly impacts ADENTRA's customer base. This labor deficit leads to project delays and increased costs for construction firms, potentially reducing their demand for building materials and impacting ADENTRA's sales performance.

Potential new tariffs and escalating trade disputes represent a significant threat, potentially reigniting inflationary pressures on key commodities like lumber, steel, and cement. Even with a pricing pass-through model, substantial cost increases could lead to reduced demand in the price-sensitive construction market, impacting ADENTRA's revenue streams.

SWOT Analysis Data Sources

This ADENTRA SWOT analysis is built upon a robust foundation of data, drawing from ADENTRA's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic assessment.