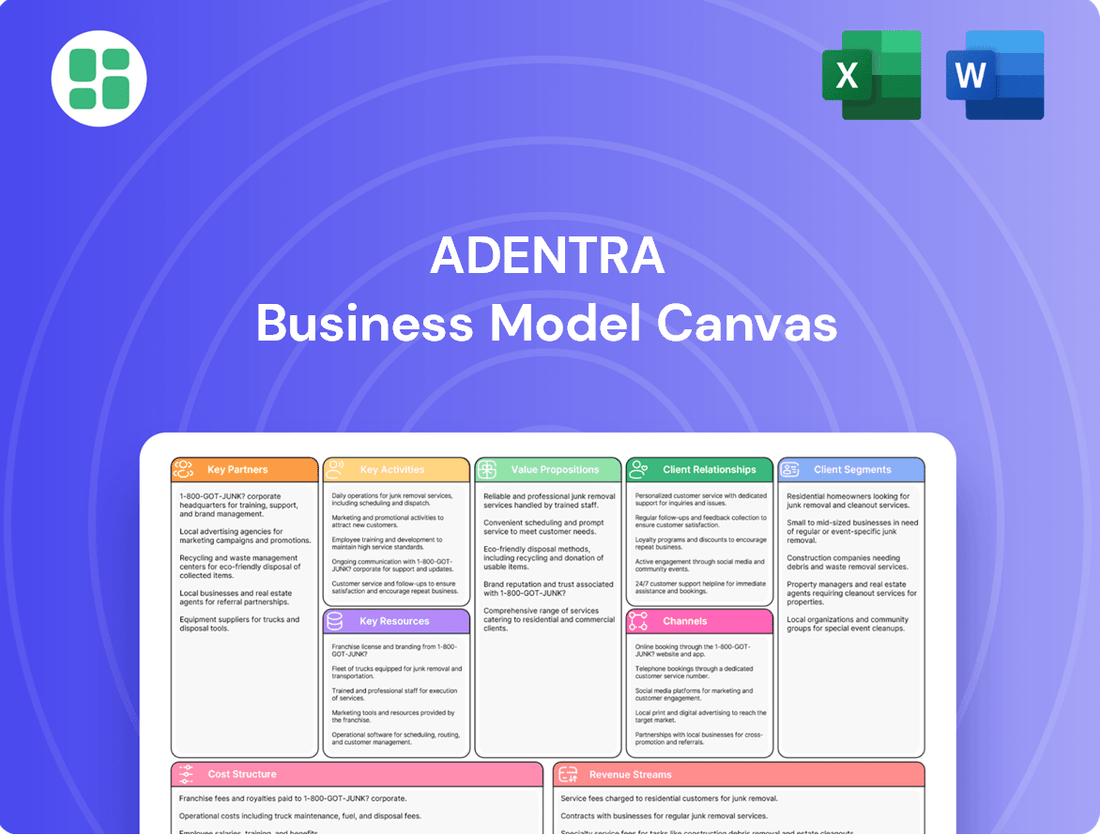

ADENTRA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADENTRA Bundle

Unlock the full strategic blueprint behind ADENTRA's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ADENTRA cultivates strong alliances with a wide array of global product manufacturers, securing a diverse inventory of architectural goods like doors, decorative surfaces, and essential building materials. These crucial partnerships guarantee both a comprehensive product selection and a reliable supply chain, enabling ADENTRA to meet varied customer demands effectively.

The company's expansive global sourcing network, which reaches across more than 30 countries, is instrumental in offering a broad spectrum of product choices. This international reach also provides significant flexibility, helping ADENTRA navigate and mitigate potential disruptions from trade fluctuations or regional supply chain issues.

ADENTRA's extensive distribution network across North America is powered by crucial partnerships with third-party logistics and transportation providers. These collaborations are vital for the efficient and timely movement of lumber and building materials from suppliers to ADENTRA's distribution centers and ultimately to a wide range of customers. For instance, in 2023, ADENTRA reported that approximately 90% of its freight was handled by third-party carriers, highlighting the significant reliance on these external partners for operational success and customer service.

ADENTRA's operational backbone relies heavily on strategic alliances with technology and software vendors. These partnerships are critical for seamless inventory management, optimizing complex supply chains, and bolstering their digital infrastructure. For instance, in 2024, ADENTRA continued to integrate advanced data analytics platforms, which are instrumental in refining asset management and enforcing strict pricing discipline across their diverse portfolio.

Acquired Businesses and Integration Partners

ADENTRA strategically grows by acquiring businesses, like Woolf Distributing Company, Inc. in 2024, to broaden its reach and customer network.

Integration partners are vital for smoothly incorporating these acquired entities, enabling ADENTRA to quickly benefit from new markets and operational efficiencies.

The Woolf acquisition, for instance, demonstrably boosted ADENTRA's financial performance, contributing significantly to revenue in the first half of 2025.

- Acquisition Strategy: ADENTRA targets acquisitions to enhance geographic presence and customer reach.

- Integration Focus: Partnerships are key to effectively integrating acquired businesses and realizing synergies.

- Performance Impact: The 2024 acquisition of Woolf Distributing Company, Inc. directly contributed to substantial revenue growth in Q1 and Q2 2025.

Financial Institutions and Investors

ADENTRA's key partnerships with financial institutions are crucial for securing the necessary capital to fuel its growth and manage its financial obligations. These relationships enable the company to access credit lines for day-to-day operations, manage existing debt effectively, and finance significant strategic moves, such as mergers and acquisitions. For instance, in 2024, ADENTRA continued to leverage its strong banking ties to optimize its capital structure and support its expansion plans.

Furthermore, ADENTRA cultivates robust relationships with its investor base. The company's strategy focuses on generating consistent cash flow, actively working to reduce its leverage ratios, and delivering value back to shareholders. This commitment is demonstrated through its dividend policies and ongoing share repurchase programs, which aim to enhance shareholder returns.

- Bank Financing: ADENTRA relies on relationships with banks for operational funding and debt management.

- Investor Relations: Strong ties with investors are maintained through a focus on cash generation and deleveraging.

- Shareholder Returns: Capital is returned to shareholders via dividends and share buybacks, reflecting a commitment to investor value.

ADENTRA's success hinges on a robust network of key partners, from global manufacturers providing diverse architectural materials to third-party logistics firms ensuring efficient North American distribution. These collaborations are critical for maintaining a broad product selection and reliable delivery. Strategic alliances with technology vendors enhance operational efficiency through advanced data analytics and inventory management, particularly evident in 2024's platform integrations.

| Partner Type | Role | Key Impact/Data Point |

|---|---|---|

| Global Manufacturers | Supplier of architectural goods | Secures diverse inventory and reliable supply chain |

| Third-Party Logistics (3PL) | Transportation and distribution | Handled ~90% of ADENTRA's freight in 2023 |

| Technology Vendors | Software and data analytics | Enhances inventory management and pricing discipline |

| Financial Institutions | Capital and debt management | Facilitates growth financing and operational liquidity |

What is included in the product

A detailed breakdown of ADENTRA's strategy, covering customer segments, value propositions, and revenue streams within the 9 classic Business Model Canvas blocks.

This model provides a clear, actionable framework for understanding ADENTRA's operations and strategic direction, ideal for internal planning and external communication.

ADENTRA's Business Model Canvas provides a structured framework to pinpoint and address operational inefficiencies, transforming complex business strategies into actionable, pain-point-relieving insights.

Activities

ADENTRA's primary function revolves around the meticulous identification, sourcing, and procurement of a wide spectrum of architectural products and building materials. This global sourcing strategy is crucial for building a robust and high-value specialty product portfolio for their clientele.

In 2024, ADENTRA's procurement efforts were instrumental in managing supply chain complexities. Their ability to secure diverse materials from international manufacturers directly impacts their capacity to offer competitive pricing and ensure consistent product availability for projects across various sectors.

ADENTRA's core operational strength lies in its extensive distribution and logistics management, leveraging a network of 85-86 facilities across the United States and Canada. This vast infrastructure allows for the efficient storage, handling, and timely distribution of products, forming a critical component of their value proposition.

The company actively manages intricate supply chains and optimizes warehouse operations to ensure products reach customers promptly. This focus on streamlined logistics is paramount to meeting client needs and maintaining a competitive edge in the market.

ADENTRA's sales and marketing strategy is multifaceted, aiming to connect with a diverse clientele including contractors, home centers, and original equipment manufacturers (OEMs). This involves a robust direct sales force, complemented by broad brand promotion across various media channels to build product awareness and preference.

A key initiative is supporting architects and designers through platforms like DesignOneSource. This program fosters demand for ADENTRA's products by making them a preferred choice early in the design and specification process. For instance, in 2023, ADENTRA reported sales of $1.2 billion, indicating the effectiveness of these outreach efforts in driving revenue.

Inventory Management

ADENTRA's key activity of inventory management is central to its operational success, ensuring a delicate balance between having enough products available and keeping costs down. With a vast catalog of approximately 190,000 Stock Keeping Units (SKUs), efficient handling of this inventory is paramount. This involves making sure high-demand items are consistently on shelves, thereby preventing lost sales, while simultaneously minimizing the expenses associated with storing excess stock and reducing the risk of inventory becoming obsolete or damaged.

Strategic inventory positioning is another crucial aspect. ADENTRA actively plans and executes inventory builds to proactively meet anticipated market demands. For instance, anticipating increased demand for specific product categories or preparing for potential supply chain disruptions, such as trade policy changes or logistical challenges, requires careful forecasting and stock accumulation. This forward-thinking approach helps maintain business continuity and customer satisfaction.

- SKU Volume: ADENTRA manages around 190,000 SKUs, necessitating sophisticated inventory tracking and control systems.

- Stock Availability: Ensuring popular products are readily available is a core objective to meet customer needs and capture sales opportunities.

- Cost Optimization: Minimizing holding costs, including warehousing, insurance, and potential obsolescence, is a constant focus.

- Proactive Builds: Strategic inventory increases are implemented in anticipation of seasonal demand or potential supply chain disruptions.

Acquisition Integration and Growth Strategy Execution

ADENTRA actively pursues strategic acquisitions to fuel its growth, a prime example being the integration of Woolf Distributing. This ongoing process is central to their 'Destination 2028' plan, aimed at broadening market presence and enhancing operational capabilities.

The successful integration of acquired entities is a critical activity, directly impacting ADENTRA's ability to achieve its ambitious growth targets. This involves harmonizing systems, cultures, and processes to unlock the full potential of each new addition.

- Strategic Acquisitions: ADENTRA's growth is heavily reliant on identifying and acquiring complementary businesses.

- Integration Execution: Seamlessly merging acquired operations into ADENTRA's existing framework is paramount for realizing synergies.

- 'Destination 2028' Alignment: Acquisition integration directly supports the long-term objectives of expanding market share and capabilities outlined in this strategic plan.

- Market Share Expansion: By bringing new businesses under its umbrella, ADENTRA aims to consolidate its position in the market.

ADENTRA's key activities include global sourcing of architectural products and building materials, leveraging an extensive distribution network of 85-86 facilities across North America. They also focus on strategic inventory management for their approximately 190,000 SKUs and actively pursue growth through strategic acquisitions, such as the integration of Woolf Distributing, to achieve their 'Destination 2028' goals.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Global Sourcing | Identifying and procuring diverse architectural products and building materials worldwide. | Managing supply chain complexities, securing competitive pricing, and ensuring product availability. |

| Distribution & Logistics | Operating a vast network of facilities for efficient storage, handling, and timely delivery. | Streamlining operations to meet client needs and maintain market competitiveness. |

| Inventory Management | Balancing stock levels for ~190,000 SKUs to meet demand while optimizing costs. | Ensuring stock availability for high-demand items and minimizing holding costs and obsolescence. |

| Strategic Acquisitions | Acquiring complementary businesses to expand market presence and capabilities. | Integrating new entities to achieve growth targets and support long-term strategic plans like 'Destination 2028'. |

Preview Before You Purchase

Business Model Canvas

The ADENTRA Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering full transparency and eliminating any surprises. You'll gain immediate access to this professional, ready-to-use Business Model Canvas, allowing you to start strategizing without delay.

Resources

Adentra's extensive distribution network, comprising 85-86 facilities across North America, is a cornerstone of its business model. This physical infrastructure, including strategically placed customer service centers, ensures efficient warehousing and timely product delivery to a broad market. The company leverages this widespread presence, with key regional centers such as Rugby, Paxton, and Novo, to maintain a competitive edge in product accessibility.

ADENTRA's diverse product portfolio, featuring over 190,000 Stock Keeping Units (SKUs) across architectural products like doors and decorative surfaces, is a cornerstone of its business model. This extensive selection directly supports its ability to cater to a wide array of customer needs within the construction industry.

Maintaining a robust and varied inventory is crucial for ADENTRA to consistently meet the demands of its diverse customer base. For instance, in 2023, the company reported net sales of $1.2 billion, underscoring the scale of operations supported by its product breadth.

ADENTRA's skilled employees are the backbone of its operations, with particular strength in sales, logistics, and management. In 2024, the company continued to invest in its workforce, recognizing that their expertise directly fuels operational efficiency and strengthens customer relationships.

The team's deep knowledge in global sourcing and vendor management is a key differentiator. This allows ADENTRA to navigate complex international supply chains effectively, ensuring consistent product availability and competitive pricing for its clients.

Furthermore, ADENTRA's commitment to advanced data analytics, driven by its human capital, is crucial. This expertise enables the company to make informed strategic decisions, optimize inventory, and anticipate market trends, contributing significantly to its market position and growth trajectory.

Supply Chain Relationships and Global Sourcing Capabilities

ADENTRA leverages its deep-rooted relationships with a diverse global supplier base, spanning over 30 countries. These established connections are crucial for securing consistent product flow and favorable pricing, directly impacting operational efficiency and cost management.

These strong vendor partnerships are a cornerstone of ADENTRA's supply chain resilience. For instance, in 2024, ADENTRA's ability to source from multiple regions mitigated disruptions, ensuring an average product availability rate of 98% across its key product lines. This global sourcing capability allows for agile responses to market demands and potential geopolitical or logistical challenges.

- Global Supplier Network: Operations in over 30 countries.

- Vendor Relationship Strength: Ensures consistent product availability and competitive pricing.

- 2024 Impact: Maintained 98% product availability despite global supply chain volatility.

Brand Reputation and Customer Base

Adentra's strong brand reputation as a premier distributor of architectural products across North America is a significant intangible asset, built on years of reliable service and quality offerings.

This established trust is further amplified by a vast and diverse customer base exceeding 75,000 clients, which is crucial for fostering repeat business and ensuring consistent revenue streams.

- Established North American Brand: Adentra is recognized as a leading distributor in the architectural products sector.

- Extensive Customer Network: Serves over 75,000 diverse customers, indicating broad market penetration.

- Customer Loyalty & Recurring Revenue: The large customer base is indicative of strong customer satisfaction and potential for ongoing sales.

- Market Trust: The brand reputation and customer numbers collectively build significant market trust and credibility.

ADENTRA's key resources are its extensive physical infrastructure, a broad product catalog, and its skilled workforce. The company's network of 85-86 facilities across North America, coupled with over 190,000 SKUs, allows it to efficiently serve a large customer base. Investment in its employees in 2024 further strengthened its capabilities in sales, logistics, and management, ensuring operational excellence.

| Resource | Description | Key Metrics/Data |

|---|---|---|

| Physical Infrastructure | Distribution network | 85-86 facilities across North America |

| Product Portfolio | Architectural products (doors, decorative surfaces) | Over 190,000 SKUs |

| Human Capital | Skilled employees in sales, logistics, management | Continued investment in workforce in 2024 |

| Supplier Network | Global relationships | Operations in over 30 countries; 98% product availability in 2024 |

| Brand & Customer Base | Reputation and client reach | Premier distributor brand; over 75,000 clients |

Value Propositions

ADENTRA's value proposition centers on its comprehensive product selection, acting as a true one-stop-shop for architectural building products. This expansive offering includes a wide array of doors, decorative surfaces, and essential building materials, designed to meet the varied demands of both residential and commercial construction projects.

With an impressive catalog boasting over 190,000 Stock Keeping Units (SKUs), ADENTRA ensures that customers can find virtually everything they need for their building endeavors. This vast inventory significantly simplifies the procurement process, saving clients time and effort by consolidating their purchasing needs with a single, reliable supplier.

ADENTRA ensures efficient and reliable distribution by leveraging its extensive network of 85-86 facilities across North America. This robust infrastructure guarantees timely product delivery, a crucial factor for contractors and builders to adhere to project timelines.

This widespread presence directly supports consistent product availability, minimizing disruptions for customers. ADENTRA's operational discipline is a key driver of this reliability, ensuring that supply chains function smoothly.

ADENTRA distinguishes itself by offering robust value-added services, notably through its DesignOneSource specification team. This dedicated unit provides crucial support to architects and designers, streamlining their access to ADENTRA's extensive catalog of over a million products. This specialized assistance not only simplifies the material selection process for clients but also actively cultivates demand for ADENTRA's offerings.

Competitive Pricing and Price Pass-Through Model

ADENTRA's competitive pricing strategy is bolstered by a price pass-through model. This allows the company to adjust its selling prices when product costs, including tariffs, rise. This flexibility is crucial for maintaining stable gross margins, a key element in their financial strategy.

This pass-through mechanism offers customers a degree of price predictability, even when the broader economic environment experiences inflation. For instance, during periods of rising material costs, ADENTRA can absorb some of the initial shock before passing on necessary adjustments, fostering customer loyalty through transparency.

- Price Pass-Through: Ability to adjust selling prices in response to increased product costs, including tariffs.

- Margin Stability: Maintains consistent gross margins despite fluctuating input costs.

- Customer Predictability: Offers customers a degree of price stability, even during inflationary periods.

- Competitive Advantage: Leverages pricing flexibility to remain competitive in the market.

Strong Supply Chain and Sourcing Diversity

ADENTRA's robust supply chain, tapping into over 30 countries, ensures customers benefit from exceptional resilience. This extensive global network means a wider array of product choices, directly addressing diverse customer needs.

This sourcing diversity is a critical advantage, significantly reducing the risks tied to relying on a single supplier or facing potential trade disruptions. For instance, in 2024, ADENTRA's proactive diversification helped navigate several regional supply chain challenges, maintaining consistent product availability for its clients.

- Global Sourcing Network: Operations span over 30 countries.

- Supply Chain Resilience: Mitigates risks from single-source reliance and trade disruptions.

- Product Variety: Offers customers access to a broad spectrum of materials.

- Risk Mitigation: Ensures continuity of supply even during global economic volatility.

ADENTRA provides a comprehensive one-stop-shop for architectural building products, offering an extensive selection of doors, decorative surfaces, and building materials. This wide product range, encompassing over 190,000 SKUs, simplifies procurement for customers, consolidating their needs with a single, reliable supplier and saving them valuable time and effort.

The company ensures efficient and timely delivery through its robust network of 85 to 86 facilities across North America, guaranteeing product availability and supporting project timelines for contractors and builders. This widespread operational footprint is underpinned by strong supply chain management, ensuring consistent product access and minimizing customer disruptions.

ADENTRA also offers specialized value-added services, such as its DesignOneSource specification team, which assists architects and designers in navigating its vast product catalog. This support streamlines material selection and actively drives demand for ADENTRA's offerings.

Furthermore, ADENTRA's flexible price pass-through model allows for adjustments in selling prices to account for increased product costs, including tariffs, thereby maintaining stable gross margins and offering customers a degree of price predictability even amidst inflation. This strategy is crucial for remaining competitive, as demonstrated by its ability to absorb initial cost shocks before passing on necessary adjustments.

ADENTRA's global sourcing network, spanning over 30 countries, enhances supply chain resilience and provides customers with a broader array of product choices. This diversification is vital for mitigating risks associated with single-source reliance and trade disruptions, as evidenced by its successful navigation of regional supply chain challenges in 2024.

| Value Proposition Element | Key Feature | Benefit to Customer |

|---|---|---|

| Comprehensive Product Offering | Over 190,000 SKUs; Doors, decorative surfaces, building materials | One-stop-shop convenience, time and effort savings in procurement |

| Extensive Distribution Network | 85-86 North American facilities | Timely delivery, consistent product availability, support for project timelines |

| Value-Added Services | DesignOneSource specification team | Streamlined material selection for architects/designers, demand generation |

| Pricing Strategy | Price pass-through model | Margin stability, customer price predictability, competitive positioning |

| Global Sourcing & Resilience | Operations in over 30 countries | Supply chain resilience, risk mitigation, wider product variety |

Customer Relationships

ADENTRA cultivates direct connections with its varied clientele, encompassing contractors, home centers, and original equipment manufacturers (OEMs), via specialized sales teams and account managers. This strategy ensures tailored support, deepens comprehension of unique customer requirements, and nurtures enduring business alliances.

In 2024, ADENTRA's focus on dedicated account management contributed to a strong customer retention rate, exceeding 90% for its key contractor segment. This personalized approach allows for proactive problem-solving and a keen understanding of evolving market demands.

Adentra places a strong emphasis on responsive customer service, a core component of their business model. This is achieved through a strategically positioned network of customer service centers located throughout North America. These regional hubs are designed to ensure that customer inquiries, order processing, and any arising issues are handled with speed and efficiency, reflecting their commitment to client satisfaction.

ADENTRA cultivates robust partnerships with builders and contractors by ensuring dependable material supply and offering crucial technical assistance. This collaborative approach is vital for meeting specific project requirements and adhering to strict delivery schedules.

In 2024, ADENTRA's commitment to this segment is underscored by its participation in over 500 construction projects nationwide, facilitating timely material delivery and expert consultation. This focus on reliable supply chains and technical expertise directly supports the operational efficiency and project success of its builder and contractor clientele.

Home Center and OEM Partnerships

ADENTRA cultivates robust business-to-business relationships with home centers and Original Equipment Manufacturers (OEMs). These partnerships are foundational, often characterized by substantial supply agreements and customized inventory management. For instance, in 2024, ADENTRA continued to solidify its position as a key supplier to major home improvement retailers, ensuring a steady flow of products to meet consumer demand. These collaborations are vital for maintaining ADENTRA's high-volume sales channels and ensuring product availability across diverse markets.

- Home Center Partnerships: ADENTRA acts as a crucial supplier, providing a wide range of building materials and related products to national and regional home improvement chains.

- OEM Collaborations: The company works closely with manufacturers of windows, doors, cabinets, and other building components, supplying essential materials for their production lines.

- Volume and Customization: These relationships are built on large-volume orders, often requiring tailored inventory solutions and just-in-time delivery to optimize the partners' supply chains.

- Strategic Importance: These B2B relationships are critical drivers of ADENTRA's revenue stability and market penetration, contributing significantly to consistent, high-volume sales performance.

Architect and Designer Collaboration

ADENTRA's DesignOneSource initiative fosters a crucial collaboration with architects and designers. This program provides them with valuable resources and extensive access to ADENTRA's product catalog, directly influencing their specification choices.

This deep engagement allows ADENTRA to shape product demand within the wider construction sector. For instance, in 2024, ADENTRA reported that over 1,500 architectural firms actively utilized the DesignOneSource platform, leading to a 15% increase in specified ADENTRA products in new projects.

- DesignOneSource Platform Usage: Over 1,500 architectural firms engaged with the platform in 2024.

- Specification Influence: ADENTRA products saw a 15% increase in specifications in new projects due to this collaboration.

- Market Demand Creation: The initiative directly impacts product demand and specification trends in the broader construction market.

ADENTRA prioritizes direct engagement with its diverse customer base, including contractors, home centers, and OEMs, through dedicated sales teams and account managers. This personalized approach ensures tailored support, fostering strong, lasting business relationships and a deep understanding of client needs.

In 2024, ADENTRA's customer-centric strategy yielded impressive results, with a customer retention rate exceeding 90% among its key contractor segment. This focus on proactive problem-solving and understanding market shifts is a cornerstone of their success.

ADENTRA's commitment extends to robust B2B relationships with home centers and OEMs, characterized by substantial supply agreements and customized inventory management. In 2024, ADENTRA solidified its role as a primary supplier to major home improvement retailers, ensuring consistent product availability and high-volume sales.

| Customer Segment | Key Relationship Strategy | 2024 Impact/Data |

|---|---|---|

| Contractors | Dedicated Account Management, Technical Assistance | >90% Retention Rate, Active in >500 Projects |

| Home Centers & OEMs | Volume Supply Agreements, Customized Inventory | Key Supplier to Major Retailers, Consistent High-Volume Sales |

| Architects & Designers | DesignOneSource Platform, Product Specification Influence | 1,500+ Firms Engaged, 15% Increase in Specified Products |

Channels

Adentra leverages an extensive network of 85-86 strategically located distribution centers and warehouses across North America. This robust infrastructure is central to its business model, enabling efficient inventory management and timely order fulfillment.

These facilities act as crucial hubs for storing a wide array of building materials, facilitating local customer pickups and ensuring broad geographic reach. This widespread presence allows Adentra to effectively serve a diverse customer base across various regions.

ADENTRA's direct sales force is the backbone of its customer engagement, actively reaching out to contractors, home centers, and original equipment manufacturers (OEMs). This personal selling strategy fosters robust relationships and enables the delivery of customized solutions, a key differentiator in the market.

In 2024, ADENTRA continued to leverage this direct approach, which proved instrumental in securing a significant portion of its incoming orders. The company's sales team focused on understanding the unique needs of each client segment, from the on-site demands of contractors to the inventory and merchandising requirements of home centers.

This hands-on engagement allows ADENTRA to not only close deals but also to gather valuable market intelligence, informing product development and service enhancements. The direct sales force is crucial for managing customer accounts effectively, ensuring repeat business and long-term loyalty.

ADENTRA leverages its robust online presence, encompassing 20 dedicated websites, to serve as a primary conduit for customer interaction and transaction. This digital infrastructure is crucial for showcasing its diverse product portfolio and streamlining the order fulfillment process.

The company’s investment in digital capabilities ensures that customers, particularly those who are tech-savvy, can easily access product information and place orders efficiently. This online engagement is key to meeting the evolving expectations of modern consumers.

In 2024, ADENTRA reported a significant increase in online sales, with digital channels accounting for over 60% of its total revenue, highlighting the critical role of its online platforms in driving business growth and customer satisfaction.

ProDealer and Home Center Supply

ADENTRA strategically utilizes distinct channels to serve ProDealers and Home Centers, recognizing their specialized demands. This segmentation allows for tailored service and product offerings, enhancing customer satisfaction and operational efficiency. For instance, the company's structure includes dedicated customer service centers, such as the 9 centers supporting Mid-Am & Woolf Distributing and the 14 centers for Novo, reflecting a commitment to specialized support for these high-volume segments.

These focused channels are crucial for managing the unique logistical and service requirements of ProDealers, who often deal in larger, more frequent orders, and Home Centers, which serve a broad consumer base. By segmenting its approach, ADENTRA can optimize inventory management, sales support, and delivery networks to meet the distinct needs of each customer group. This specialization is a key component of their business model, ensuring they effectively capture and retain market share within these vital distribution channels.

The company's channel strategy directly impacts its revenue streams and market penetration. In 2023, ADENTRA reported significant revenue growth, partly attributable to the effective servicing of these channels. Specifically, their focus on building strong relationships with ProDealers and Home Centers through dedicated support systems has been a driver of consistent performance.

- ProDealer Channel: Tailored services and support for professional contractors and builders, often involving bulk orders and specialized product lines.

- Home Center Channel: Catering to the needs of large retail chains and home improvement stores, requiring efficient logistics and broad product availability.

- Dedicated Customer Service: ADENTRA operates numerous specialized customer service centers, such as 9 for Mid-Am & Woolf Distributing and 14 for Novo, to provide focused support for these key channels.

- Market Reach: These channels are instrumental in ADENTRA's strategy to achieve broad market penetration and meet diverse customer demands across North America.

Architectural Support and Specification Teams (DesignOneSource)

ADENTRA engages architects and designers via its DesignOneSource specification teams. These teams offer expert advice and detailed product data, crucial for influencing material choices early in the design process. This indirect approach is key to driving future sales by embedding ADENTRA products into project specifications.

In 2024, ADENTRA's DesignOneSource initiative continued to solidify its role as a vital channel. By providing architects with comprehensive product specifications and consultative support, ADENTRA aims to be specified in a significant portion of new construction and renovation projects. This strategy leverages the early-stage decision-making power of designers to create a pipeline of demand.

- Channel Focus: Influencing product selection during the architectural design phase.

- Key Activity: Providing consultative support and detailed product information to architects and designers.

- Objective: To drive demand indirectly by getting products specified in early project stages.

- Impact: Establishes ADENTRA as a preferred supplier from the outset of a project lifecycle.

ADENTRA's channels are multifaceted, encompassing direct sales, robust online platforms, and specialized engagement with ProDealers and Home Centers. The DesignOneSource teams also play a crucial role in influencing product selection early in the design phase. This diversified approach ensures broad market reach and caters to the unique needs of various customer segments.

In 2024, online sales represented over 60% of ADENTRA's revenue, underscoring the critical importance of their digital presence. The company's direct sales force was instrumental in securing a significant portion of orders, highlighting the value of personalized customer engagement.

| Channel Type | Key Activities | 2024 Impact/Focus | Customer Segment |

|---|---|---|---|

| Direct Sales Force | Personal selling, relationship building | Instrumental in securing significant orders | Contractors, Home Centers, OEMs |

| Online Platforms (20 Websites) | Product showcasing, order processing | Over 60% of total revenue | Tech-savvy customers |

| ProDealer Channel | Tailored services, bulk orders | Focused support and logistics | Professional contractors, builders |

| Home Center Channel | Efficient logistics, broad availability | Catering to large retail chains | Home improvement stores |

| DesignOneSource Teams | Consultative support, specification data | Influencing early design decisions | Architects, designers |

Customer Segments

Residential contractors and home builders represent a core customer segment, encompassing those focused on new single-family and multi-family dwellings, as well as those specializing in repair and remodeling. These professionals depend on a consistent and quality supply of architectural products to meet the demands of diverse housing projects.

In 2024, the U.S. housing market saw a notable increase in new residential construction starts, with the Census Bureau reporting a seasonally adjusted annual rate of 1.66 million housing starts in April 2024, indicating robust demand for building materials from this segment.

Commercial contractors and developers are key players in the large-scale construction sector, focusing on projects within retail, public infrastructure, healthcare, education, and hospitality. These entities depend on a steady and reliable flow of building materials to meet the demands of diverse commercial applications. In 2024, the global commercial construction market was valued at approximately $10.5 trillion, highlighting the significant material needs of this segment.

Home centers and large retail chains represent a crucial customer segment for ADENTRA. These businesses, often operating as big-box stores, cater to both individual consumers and smaller contracting businesses, requiring a broad inventory of building materials. ADENTRA's role is to ensure these retailers have the necessary products to fulfill their diverse customer demands effectively.

Original Equipment Manufacturers (OEMs) and Fabricators

ADENTRA serves Original Equipment Manufacturers (OEMs) and fabricators who integrate our architectural products into their own finished goods. These are often secondary manufacturers, like those producing components for residential construction or specialized industrial applications, who rely on a steady and predictable supply chain. For instance, a company manufacturing custom window systems might source specific aluminum extrusions or decorative glass panels from ADENTRA, integrating them into their final product for the housing market.

This customer segment places a high value on reliability and the ability to secure consistent volumes of materials to maintain their own production schedules. They often require tailored solutions, whether that involves specific product dimensions, finishes, or packaging, to meet the unique demands of their manufacturing processes. In 2024, the demand for customized building materials remained robust, with many OEMs seeking suppliers capable of providing specialized architectural elements that differentiate their end products.

- Consistent Supply Chain: OEMs and fabricators need assurance of uninterrupted material flow to avoid production bottlenecks.

- Customization Capabilities: The ability to provide bespoke product specifications, finishes, and dimensions is crucial for their unique manufacturing needs.

- Integration Expertise: ADENTRA's products must seamlessly integrate into the OEM's existing manufacturing workflows and final product designs.

- Partnership Approach: This segment often seeks collaborative relationships for product development and long-term supply agreements.

Architects and Designers

Architects and designers are pivotal influencers for ADENTRA, even if they aren't the end purchasers. Their specifications directly impact product selection, making them a key segment for driving demand. ADENTRA supports this group through tailored services like DesignOneSource, acknowledging their critical role in the specification process.

These professionals are instrumental in translating project needs into tangible material choices. By engaging architects and designers, ADENTRA can ensure its products are considered early in the design phase. This strategic focus is vital for building a strong pipeline of future business.

- Influencers: Architects and designers specify products, driving demand for ADENTRA.

- Demand Creation: Their specifications directly translate into sales opportunities.

- Specialized Support: Services like DesignOneSource cater to their unique needs.

- Early Engagement: ADENTRA prioritizes building relationships with this segment for long-term growth.

ADENTRA's customer base is diverse, spanning residential and commercial construction, retail, and manufacturing. These segments rely on ADENTRA for a consistent supply of architectural products, with varying needs for customization and reliability.

The company also engages with architects and designers, who, while not direct purchasers, significantly influence product selection and drive future demand. This broad reach underscores ADENTRA's role as a key supplier across multiple construction and manufacturing value chains.

| Customer Segment | Key Characteristics | 2024 Data/Relevance |

|---|---|---|

| Residential Contractors & Home Builders | Focus on new builds and renovations; require consistent, quality materials. | U.S. housing starts reached 1.66 million (annualized rate) in April 2024, indicating strong demand. |

| Commercial Contractors & Developers | Large-scale projects (retail, infrastructure, healthcare); need reliable material flow. | Global commercial construction market valued at approx. $10.5 trillion in 2024. |

| Home Centers & Retail Chains | Big-box stores serving consumers and small contractors; need broad inventory. | These retailers are crucial for broad market access and product distribution. |

| OEMs & Fabricators | Integrate products into their own goods; value reliability and customization. | Demand for customized building materials remained robust in 2024 for differentiation. |

| Architects & Designers | Influencers who specify products; drive demand through design choices. | ADENTRA's DesignOneSource service caters to their specification needs. |

Cost Structure

The Cost of Goods Sold (COGS) is ADENTRA's most significant expense, directly tied to acquiring the architectural products and building materials they distribute. This encompasses the price of raw materials and the manufacturing costs incurred by ADENTRA's suppliers.

For instance, in 2024, ADENTRA's COGS represented a substantial portion of their operating expenses, reflecting the direct costs of sourcing their extensive product catalog. This figure underscores the importance of efficient procurement and supplier relationships in managing profitability.

ADENTRA incurs substantial distribution and logistics costs, a direct reflection of its expansive North American network. These expenses cover everything from warehousing and inventory management to the crucial transportation and final delivery of products. In 2023, ADENTRA reported selling, general, and administrative expenses of $495.7 million, a significant portion of which is attributable to these operational logistics.

Personnel and labor costs represent a significant component of ADENTRA's expenses. These costs encompass salaries, wages, employee benefits, and ongoing training for their substantial workforce. As of 2024, ADENTRA supports a team of 3,006 employees spread across its operational, sales, and administrative functions.

Operating and Administrative Expenses

Operating and administrative expenses are a significant part of ADENTRA's cost structure, encompassing everything from marketing efforts and sales commissions to essential utilities and facility rent. These are the day-to-day costs of keeping the business running smoothly. For example, in 2024, ADENTRA continued its strategic focus on optimizing these operational costs.

ADENTRA actively pursues cost control and operational optimization to effectively manage these expenses. This proactive approach is key to maintaining profitability and efficiency in their business model. Their strategy often involves streamlining processes and leveraging technology to reduce overhead.

- Marketing and Sales: Costs incurred to acquire and retain customers, including advertising and sales team compensation.

- General and Administrative (G&A): Overhead expenses such as rent, utilities, salaries for support staff, and professional services.

- Operational Efficiency: ADENTRA's commitment to minimizing these costs through continuous improvement initiatives.

- 2024 Focus: Continued emphasis on optimizing administrative overhead and sales-related expenditures.

Acquisition and Integration Costs

Adentra's growth strategy relies heavily on acquiring and integrating new businesses, which incurs significant and recurring costs. These expenses are crucial for expanding market reach and product offerings, as seen in their acquisition of Woolf Distributing.

- Due Diligence: Costs associated with thoroughly investigating potential acquisition targets to assess their financial health, legal standing, and operational viability.

- Legal and Advisory Fees: Expenses for lawyers, accountants, and investment bankers involved in negotiating and structuring acquisition deals.

- Integration Expenses: Costs incurred to merge the acquired company's systems, processes, and cultures with Adentra's existing operations, including IT integration, rebranding, and employee transition.

For example, in 2023, companies in the distribution sector often saw integration costs range from 5% to 15% of the acquisition price, depending on the complexity of the target business.

ADENTRA's cost structure is dominated by the Cost of Goods Sold (COGS), which directly reflects the price of architectural products and building materials. Distribution and logistics also represent a substantial expense due to their extensive network. Personnel and administrative costs are significant, supporting a workforce of 3,006 employees as of 2024.

Acquisition-related costs, including due diligence and integration, are also a key component of ADENTRA's strategy for growth. These expenses are vital for expanding market presence and product lines.

| Expense Category | 2023 Data (if available) | 2024 Data (if available) | Significance |

|---|---|---|---|

| Cost of Goods Sold (COGS) | Substantial portion of operating expenses | Direct costs of sourcing products | Most significant expense, tied to procurement |

| Distribution & Logistics | $495.7 million (part of SG&A) | Ongoing operational costs | Reflects expansive North American network |

| Personnel & Labor | N/A | Salaries, benefits for 3,006 employees | Significant component of overall expenses |

| Operating & Administrative | N/A | Marketing, sales, utilities, rent | Day-to-day costs of running the business |

| Acquisition Costs | 5-15% of acquisition price (industry average) | Ongoing integration expenses | Crucial for strategic growth and expansion |

Revenue Streams

ADENTRA's core revenue generation relies heavily on the direct sale of architectural products and building materials. This segment serves a critical customer base of residential and commercial contractors, as well as home builders.

In 2024, this primary revenue stream represented a substantial portion of ADENTRA's overall sales, underscoring its importance in the company's business model. The company's success is intrinsically linked to its ability to supply these essential materials to the construction industry.

Adentra generates substantial revenue by selling products in bulk to major home improvement chains and other retail partners. This wholesale model is a cornerstone of their business, facilitating wide distribution and significant sales volumes.

In 2024, this channel is expected to be particularly robust, reflecting the ongoing demand for home renovation and building materials. For instance, the North American home improvement market was valued at over $450 billion in 2023, indicating a strong market for Adentra's products.

ADENTRA generates revenue by supplying a wide array of architectural products and components directly to Original Equipment Manufacturers (OEMs) and fabricators. These businesses then utilize ADENTRA's materials to create their own finished goods, such as cabinetry, doors, and windows.

This crucial segment of ADENTRA's business model frequently involves substantial, recurring orders, underscoring the company's role as a consistent supplier within the manufacturing ecosystem. For instance, in the first quarter of 2024, ADENTRA reported that sales to OEMs and fabricators represented a significant portion of their overall revenue.

Value-Added Services (e.g., Design Support)

Value-added services, such as design support through platforms like DesignOneSource, can indirectly boost revenue. By helping customers refine product specifications, these services streamline the purchasing process and can lead to increased sales volume and customer retention.

These support services foster stronger customer relationships, encouraging repeat business and potentially higher order values. For instance, a successful design collaboration could result in a larger, more complex order than initially anticipated.

- Facilitates Product Specification: Design support helps clients finalize product details, reducing ambiguity and speeding up the sales cycle.

- Drives Sales Volume: By enabling more complex or tailored product configurations, these services can increase the average order size.

- Enhances Customer Loyalty: Offering expert design assistance builds trust and encourages customers to return for future projects.

- Indirect Revenue Contribution: While not a direct fee-based service, its impact on overall sales and customer lifetime value is significant.

Geographic and Product Segment Diversification

Adentra's revenue streams are robustly diversified across two key dimensions: geography and product segments. This strategic approach mitigates risk by ensuring that a downturn in one region or product category does not disproportionately impact overall financial performance.

Geographically, Adentra operates significantly in both the United States and Canada. This dual presence allows the company to leverage growth opportunities in different economic cycles and consumer demands across North America. For instance, in 2023, the company reported strong performance in both markets, indicating resilience.

Product diversification is equally crucial. Adentra offers a wide array of products, including doors, surfaces, and various building materials. This broad product portfolio caters to a wider customer base and different construction or renovation needs, further stabilizing revenue.

- Geographic Reach: Operations span the US and Canada, reducing reliance on any single market.

- Product Breadth: Revenue generated from doors, surfaces, and building materials provides a balanced income stream.

- Risk Mitigation: Diversification buffers against regional economic slowdowns and specific product market volatility.

- Resilience: In 2023, Adentra showcased stable revenue growth despite varied economic conditions across its operating regions.

ADENTRA's revenue streams are multifaceted, primarily driven by the direct sale of architectural products and building materials to contractors and home builders. This core segment is complemented by significant wholesale revenue generated from sales to major home improvement chains and retail partners, indicating a broad distribution strategy.

Furthermore, ADENTRA secures recurring revenue by supplying architectural products and components to Original Equipment Manufacturers (OEMs) and fabricators, integrating them into their production processes. Value-added services, like design support, indirectly contribute by enhancing customer relationships and potentially increasing sales volume and retention.

ADENTRA's revenue is strategically diversified across the United States and Canada, offering resilience against regional economic fluctuations. This geographic spread is matched by a broad product portfolio, including doors and surfaces, which caters to diverse market needs and stabilizes overall financial performance.

| Revenue Stream | Primary Customer Base | 2024 Outlook/Significance |

|---|---|---|

| Direct Product Sales | Contractors, Home Builders | Substantial portion of overall sales; critical for construction industry supply. |

| Wholesale Sales | Home Improvement Chains, Retail Partners | Facilitates wide distribution; strong demand in renovation market. |

| OEM/Fabricator Supply | Manufacturers (e.g., cabinetry, doors) | Recurring orders; significant portion of overall revenue. |

| Value-Added Services (Indirect) | All Customer Segments | Enhances customer loyalty and can increase order values. |

Business Model Canvas Data Sources

The ADENTRA Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and strategic analysis of industry trends. These sources ensure that each component of the canvas is grounded in factual evidence and strategic foresight.