ADENTRA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADENTRA Bundle

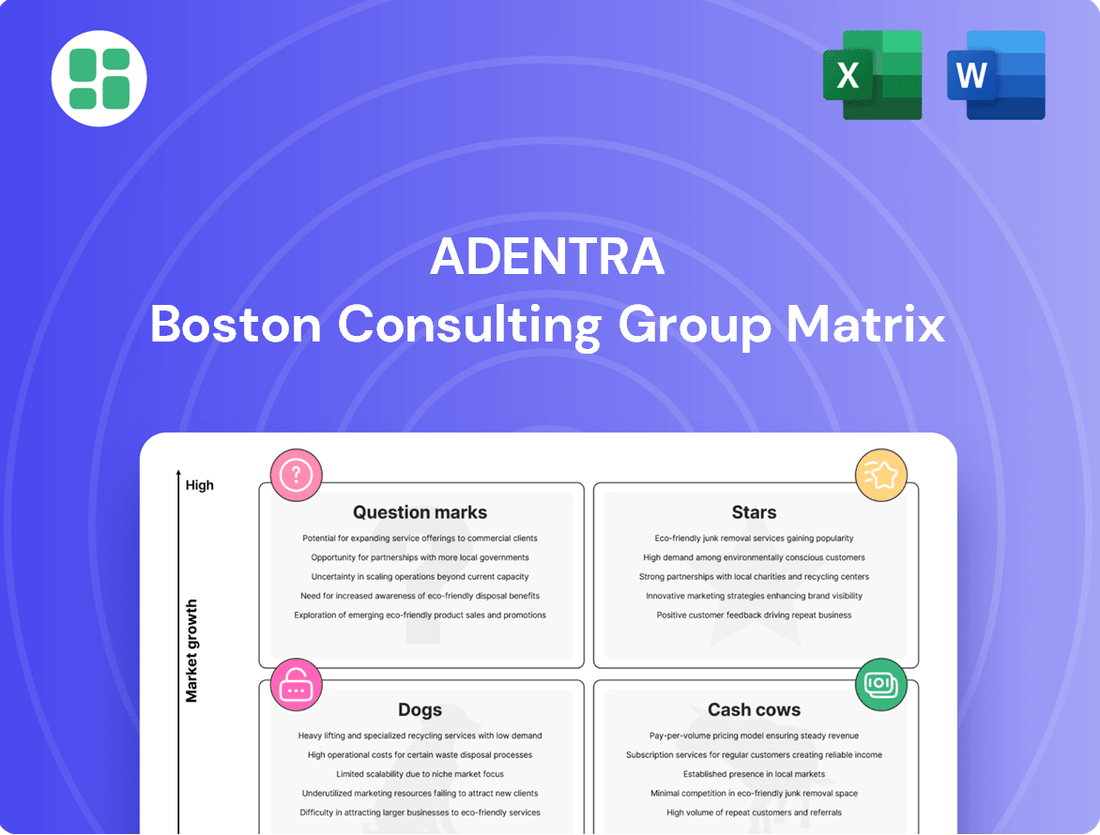

Unlock the strategic power of the ADENTRA BCG Matrix to understand your product portfolio's potential. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in today's dynamic market. Purchase the full BCG Matrix for actionable insights and a clear path to optimizing your investments and product development.

Stars

The market for sustainable building materials is booming, particularly in North America, which is a leading region for this sector. ADENTRA is well-positioned to benefit from this trend, given its dedication to environmental responsibility, including FSC certification for many of its facilities and its ongoing efforts to incorporate more eco-friendly products into its offerings.

This growing demand for green construction solutions presents a significant opportunity for ADENTRA to increase its market presence. For instance, the global green building materials market was valued at approximately $290 billion in 2023 and is projected to reach over $600 billion by 2030, demonstrating a compound annual growth rate of over 10%.

The global decorative panels market is poised for substantial expansion, with projections indicating a robust compound annual growth rate (CAGR) between 2025 and 2032. This surge is fueled by increasing investments in construction and a growing demand for sophisticated interior design solutions. For ADENTRA, if its decorative surfaces segment is capturing a significant market share or demonstrating aggressive expansion in high-value, innovative product categories, it strongly positions this business unit as a Star.

The commercial construction market is buzzing with adaptive reuse projects, especially in cities where old office buildings are being transformed into homes or mixed-use spaces. This trend is fueled by the need for smarter, more sustainable buildings. ADENTRA, as a distributor of architectural products, is well-positioned to capitalize on this, offering specialized materials for these high-growth renovation projects.

Strategic Acquisitions in High-Growth Regions/Product Lines

ADENTRA's strategic acquisitions, like the Woolf Distributing Company purchase in 2024, are designed to bolster its presence in high-growth sectors and regions. This proactive approach aims to quickly increase market share in areas exhibiting robust expansion within the construction industry.

These acquisitions are crucial for ADENTRA's growth strategy, particularly when targeting segments with above-average market expansion. For instance, the construction market in certain regions of Canada saw significant growth in 2024, making acquisitions there particularly valuable.

- Woolf Distributing Company acquisition in 2024

- Focus on high-growth geographic regions and product lines

- Strategy to rapidly scale market share through integration

- Investment in complementary businesses to expand footprint

Digital Solutions and E-commerce Platforms for Contractors

Digital Solutions and E-commerce Platforms for Contractors represent a significant growth opportunity within the construction sector. The industry's increasing embrace of technologies like Building Information Modeling (BIM) underscores a broader trend toward digital integration and efficiency improvements. For ADENTRA, investing in or expanding these digital offerings positions the company to capture a rapidly growing segment of the market.

In 2024, the global construction technology market was valued at approximately $3.5 billion, with digital solutions for contractors being a key driver. This market is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2028, indicating strong demand for platforms that streamline procurement, project management, and collaboration.

- Market Growth: The construction technology market, particularly digital solutions for contractors, is experiencing robust expansion, driven by the need for enhanced project efficiency and digital transformation.

- Technology Adoption: Increased adoption of BIM and other digital tools by contractors signals a readiness for integrated platforms that offer greater control and visibility.

- ADENTRA's Opportunity: Developing or expanding digital platforms and e-commerce capabilities tailored for contractors allows ADENTRA to tap into high-growth areas and gain significant market share.

- Investment Focus: Companies like ADENTRA focusing on these digital solutions are well-positioned to benefit from the industry's ongoing shift towards technology-driven operations.

Stars in the ADENTRA BCG Matrix represent business units or product lines that operate in high-growth markets and hold a significant market share. These are typically areas where ADENTRA is a leader and the market itself is expanding rapidly, offering substantial potential for increased revenue and profit. Focusing resources on these segments is crucial for sustained growth.

For ADENTRA, a Star would be a segment like sustainable building materials, where market growth is projected to exceed 10% annually. If ADENTRA is a dominant player in this niche, it would qualify as a Star. Similarly, if its decorative panels business is gaining substantial market share in a rapidly expanding interior design market, it also fits the Star profile.

The company's strategic acquisitions, such as Woolf Distributing Company in 2024, are designed to bolster its position in these high-growth areas. By acquiring companies that are already performing well in expanding markets, ADENTRA aims to consolidate its leadership and accelerate growth in its Star segments.

The digital solutions for contractors segment also presents a Star opportunity. With the construction technology market growing at over 15% annually, and ADENTRA investing in e-commerce platforms, this unit is poised for significant expansion and market leadership.

| BCG Category | Market Growth | ADENTRA's Market Share | Example Segment | Strategic Focus |

|---|---|---|---|---|

| Stars | High | High | Sustainable Building Materials | Invest for Growth, Maintain Leadership |

| Stars | High | High | Decorative Panels (Innovative Designs) | Expand Capacity, Innovate Further |

| Stars | High | High | Digital Solutions for Contractors | Develop and Scale Platforms |

What is included in the product

Strategic guidance for managing a company's product portfolio by categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

ADENTRA BCG Matrix: One-page overview placing each business unit in a quadrant.

ADENTRA BCG Matrix: Clean, distraction-free view optimized for C-level presentation.

Cash Cows

ADENTRA's core traditional building materials distribution stands as a solid Cash Cow within its portfolio. Its vast distribution network across North America, serving contractors, home centers, and OEMs, ensures a consistent demand for essential architectural products.

Despite a generally modest growth rate in the overall construction materials market, ADENTRA's significant market share and operational efficiencies allow this segment to generate substantial and reliable cash flow. For instance, in 2023, ADENTRA reported strong performance in its architectural products segment, contributing significantly to its overall profitability.

Standard Doors and Millwork Distribution represents ADENTRA's established strength, a category with enduring demand across construction and renovation. This segment is a reliable generator of cash flow due to ADENTRA's significant market share and efficient distribution networks.

The consistent need for these fundamental building materials translates into predictable revenue streams. For instance, in 2024, the North American door and window market alone was valued at over $40 billion, highlighting the sheer scale of this sector.

ADENTRA's established position means less need for aggressive marketing or product development, allowing profits to be readily channeled to other business areas. This mature market segment functions as a true cash cow, funding growth initiatives elsewhere within the company.

ADENTRA's established relationships with home centers and professional dealers form a cornerstone of its Cash Cows. This segment leverages a vast network of facilities across the U.S. and Canada, catering to a mature market where the company enjoys a significant market share.

These channels benefit from consistent repeat business and highly efficient logistics, contributing to robust cash flow generation. In 2024, ADENTRA's distribution segment, which includes these established relationships, reported strong performance, reflecting the stability and profitability of these mature markets.

High-Volume Commodity Building Products

ADENTRA's distribution of high-volume, commodity building materials forms a bedrock of its business, showcasing its strength in mature markets. The company effectively utilizes its substantial scale and purchasing clout to secure consistent revenue streams from these essential products. Although individual product margins might be modest, the sheer volume and ADENTRA's adept supply chain management translate into reliable and predictable cash flow, a vital component of the company's financial stability.

These commodity building products act as ADENTRA's cash cows within the BCG matrix. Their stable demand, even in fluctuating economic conditions, allows the company to generate consistent profits. For instance, in 2024, ADENTRA reported robust performance in its distribution segment, which is heavily weighted towards these high-volume items, contributing significantly to its overall earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Dominant Market Share: ADENTRA holds a significant position in the distribution of commodity building materials, benefiting from economies of scale.

- Predictable Revenue: The consistent demand for these products ensures a steady and reliable revenue stream for the company.

- Efficient Operations: ADENTRA's expertise in supply chain management and logistics optimizes costs and maximizes profitability in this segment.

- Financial Contribution: This segment consistently generates substantial cash flow, supporting other areas of the business and overall corporate strategy.

Well-Optimized Canadian Operations

ADENTRA's well-optimized Canadian operations are a prime example of a Cash Cow within its business portfolio. Despite experiencing modest sales growth, which in 2024 saw a slight dip of 1.2% year-over-year, these operations benefit from a stable market position.

The Canadian segment, characterized by some price deflation in lumber products, still generates consistent cash flow. This is largely due to ADENTRA's established infrastructure and a loyal customer base, indicating a high market share in a mature sector.

- Mature Market Stability: The Canadian market offers predictable revenue streams.

- Efficient Operations: Strong operational efficiency underpins consistent cash generation.

- Established Network: ADENTRA's existing distribution and customer relationships are key assets.

- Positive Financial Contribution: Despite modest growth, these operations remain a reliable source of funds for the company.

ADENTRA's core building materials distribution, particularly architectural products and standard doors, represents its established Cash Cows. These segments benefit from consistent demand and ADENTRA's significant market share, leading to predictable and substantial cash flow generation.

The company's operational efficiencies and established distribution networks across North America further bolster the profitability of these mature markets. For example, in 2024, ADENTRA's distribution segment, heavily reliant on these product categories, demonstrated strong EBITDA performance, underscoring its role as a reliable cash generator.

These segments require minimal investment for growth, allowing profits to be reinvested in other areas of the business. The sheer scale of the North American market for these products, with the door and window market alone exceeding $40 billion in 2024, highlights the enduring financial strength of ADENTRA's Cash Cows.

| ADENTRA Cash Cow Segments | Market Characteristics | ADENTRA's Position | Financial Contribution (Illustrative) | 2024 Data Point |

| Architectural Products Distribution | Mature, stable demand | High market share, efficient logistics | Consistent, strong cash flow | Strong performance in architectural products segment |

| Standard Doors and Millwork Distribution | Enduring demand, essential products | Significant market share, established network | Reliable revenue streams | North American door/window market > $40 billion |

| Commodity Building Materials Distribution | High volume, stable demand | Economies of scale, adept supply chain | Predictable profits, supports other areas | Robust distribution segment EBITDA |

Delivered as Shown

ADENTRA BCG Matrix

The ADENTRA BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a professionally formatted and analysis-ready strategic tool. You can confidently assess the quality and content, knowing that the purchased file will be exactly as presented, ready for immediate integration into your business planning and decision-making processes. This ensures a seamless and efficient experience, allowing you to leverage the insights of the BCG Matrix without any further editing or preparation.

Dogs

Underperforming legacy product SKUs represent a significant challenge for ADENTRA, often found in the Dogs quadrant of the BCG matrix. These are products, perhaps older types of lumber or hardware, that have seen demand dwindle as architectural styles and material science advance. For instance, a specific line of pre-finished oak flooring, once popular, might now be overshadowed by newer, more sustainable, or aesthetically distinct options.

These legacy items typically occupy a low market share within a contracting market segment. Consider that in 2024, the market for certain traditional building materials may have contracted by as much as 5-7% year-over-year, according to industry reports. This means ADENTRA's older SKUs are not only selling poorly but are also in a market that is shrinking, making recovery unlikely and tying up valuable capital in slow-moving inventory.

In stagnant rural construction markets, ADENTRA's distribution presence might be categorized as Dogs. These areas often exhibit consistently low construction activity and limited growth, meaning ADENTRA's market penetration is likely low, while operational costs remain high relative to revenue. For instance, regions experiencing significant out-migration or economic decline might see construction starts fall by 10-15% year-over-year, making it difficult for distributors to achieve profitability.

Certain highly specialized architectural products, perhaps custom-designed façade elements or unique interior finishes, might serve a very limited customer base. If ADENTRA offers these but doesn't hold a significant market share and faces challenges in expanding production or sales efficiently, they fall into the Dogs category. These products often yield minimal profits and demand considerable management focus relative to their low return on investment.

Segments Heavily Reliant on Struggling Multifamily Residential Construction

Segments heavily reliant on struggling multifamily residential construction could be classified as Dogs within ADENTRA's BCG Matrix. This sector faces headwinds from increasing vacancy rates and restricted access to financing, leading to projected contractions in construction activity. For instance, in early 2024, the U.S. multifamily vacancy rate hovered around 6.5%, a notable increase from previous years, signaling a softening demand.

If ADENTRA has a significant portion of its sales concentrated in product lines serving this contracting segment, and if its market share within this niche is low, it would strongly indicate a Dog. Such a scenario implies that ADENTRA's offerings are not competitive enough to gain traction in a shrinking market.

Consider these points for ADENTRA's position:

- Declining Market Demand: The multifamily construction sector is experiencing a slowdown, with projections indicating continued contraction through 2025.

- High Concentration Risk: If ADENTRA's revenue is disproportionately tied to this specific, underperforming segment.

- Low Market Share: A weak competitive position within this struggling sector exacerbates the Dog classification.

- Profitability Challenges: Reduced construction volumes and pricing pressures in this segment would likely lead to lower margins for ADENTRA's products.

Inefficient or Redundant Warehouse Facilities

Inefficient or redundant warehouse facilities represent potential Dogs within ADENTRA's portfolio. These sites might be underutilized, leading to high per-unit operating costs, or located in mature markets with limited growth prospects and intense competition, hindering ADENTRA's ability to gain significant market share. Such facilities can become a drain on capital and operational resources.

These underperforming assets would likely exhibit low sales volume relative to their operational costs and square footage. For instance, a facility with a high fixed cost base, such as property taxes and utilities, but consistently low throughput, would fall into this category. The ongoing investment required to maintain these spaces, without a corresponding return, negatively impacts overall profitability.

- Low Capacity Utilization: Facilities operating significantly below their optimal capacity, potentially less than 50% of their theoretical maximum throughput, are prime candidates for being classified as Dogs.

- High Operating Costs per Unit: When the cost to store and handle a single unit of inventory at a particular warehouse exceeds the average for the network, it signals inefficiency. For example, if the average cost per unit handled across ADENTRA is $5, but a specific facility incurs $8 per unit, it's a red flag.

- Weak Market Share in Saturated Markets: Warehouses serving regions where ADENTRA holds a minimal market share, perhaps less than 5% in a market dominated by larger competitors, and where market growth is stagnant, are likely Dogs.

- Negative Contribution to Profitability: Facilities that consistently fail to cover their direct operating expenses, let alone contribute to overhead or profit, are clear indicators of a Dog.

Products categorized as Dogs within ADENTRA's portfolio are those with low market share in slow-growing or declining markets. These items often require significant capital to maintain but generate minimal returns, tying up resources that could be better allocated elsewhere. For ADENTRA, this might include older product lines like specific types of traditional lumber or hardware where demand has significantly decreased due to evolving construction trends and material preferences.

In 2024, ADENTRA's distribution presence in stagnant rural markets could also be considered Dogs. These areas often experience consistently low construction activity and limited economic growth, resulting in low market penetration for ADENTRA and high operational costs relative to revenue. For example, regions with significant out-migration might see construction starts fall by 10-15% year-over-year, making profitability a challenge.

The multifamily residential construction segment, facing headwinds from increasing vacancy rates and financing challenges, presents another potential area for Dogs. With U.S. multifamily vacancy rates hovering around 6.5% in early 2024, a notable increase, ADENTRA's offerings in this sector, if holding a low market share, would likely fall into the Dog category, indicating a weak competitive position in a shrinking market.

Inefficient or underutilized warehouse facilities also represent potential Dogs. These sites might have high per-unit operating costs due to low capacity utilization, potentially operating below 50% of their theoretical maximum throughput, and weak market share in saturated regions, such as holding less than 5% in a market dominated by larger competitors.

| Product/Segment Category | Market Growth | ADENTRA Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Legacy Lumber SKUs | Declining (-5% to -7% in 2024) | Low | Dog | Divest or minimize investment |

| Rural Distribution Markets | Stagnant (low single digits) | Low | Dog | Evaluate exit or cost reduction |

| Multifamily Construction Products | Contracting (-5% projected 2024-2025) | Low | Dog | Reduce exposure, seek niche opportunities |

| Underutilized Warehouses | Market Dependent (often low growth) | Low | Dog | Optimize, consolidate, or divest |

Question Marks

The market for advanced modular and prefabricated construction components is experiencing robust expansion, with projections indicating substantial growth. This trend is driven by the inherent efficiency and sustainability advantages these methods offer. For instance, the global modular construction market was valued at approximately $105.5 billion in 2023 and is expected to reach $211.7 billion by 2030, growing at a CAGR of 10.5%.

ADENTRA's potential involvement in distributing components for this sector positions them in a high-growth area. However, as a new entrant or explorer, their current market share is likely minimal. Building expertise and establishing reliable supply chains are key priorities for ADENTRA to capitalize on this evolving construction landscape.

North American cities are channeling significant investment into smart infrastructure, creating a booming demand for advanced building materials and integrated technology systems. ADENTRA is likely exploring this high-growth sector, positioning specialized products for new smart city initiatives where its market share is still developing.

For instance, smart streetlights with integrated sensors and connectivity, or advanced, sustainable concrete formulations designed for longevity and environmental impact, represent key product categories. The smart city market in North America was valued at approximately $25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, indicating substantial potential for ADENTRA's new offerings.

While many commercial real estate sectors are navigating economic uncertainties, the entertainment and hospitality industries are showing robust signs of recovery and anticipated growth. For ADENTRA, this presents a prime opportunity to strategically expand into these previously underserved, high-potential niche segments.

ADENTRA's focus on these rebounding sectors, such as entertainment venues and hospitality properties, suggests a calculated move to capture market share in areas with strong projected demand. This expansion is characterized by a low initial penetration, meaning ADENTRA is entering these markets with a relatively small existing presence, aiming to build from the ground up.

For instance, the global hospitality market was valued at approximately $5.9 trillion in 2023 and is expected to grow significantly, with some projections indicating a CAGR of over 7% through 2030. Similarly, the entertainment sector, encompassing everything from live events to digital content, is experiencing a resurgence, driven by pent-up consumer demand and innovative business models.

Direct-to-Consumer (DTC) E-commerce Expansion for Renovation Materials

ADENTRA's potential expansion into a direct-to-consumer (DTC) e-commerce model for specific renovation materials positions it within a dynamic segment of the robust residential repair and remodel market. This market continues to be fueled by shifting lifestyle preferences. The DTC channel represents a high-growth opportunity, especially given the increasing consumer demand for convenient online purchasing. However, building brand awareness and the necessary logistics infrastructure in this competitive space would likely result in a relatively low initial market share for ADENTRA.

The residential repair and remodeling market was projected to reach $450 billion in 2024, indicating significant consumer spending on home improvements. Investing in a DTC e-commerce strategy for renovation materials could tap into this demand. For instance, the online home improvement sector saw substantial growth in 2023, with many consumers preferring the ease of online research and purchase. ADENTRA's move into DTC could capture a portion of this expanding digital market, though initial brand recognition and logistical capabilities will be key challenges to overcome for market penetration.

- Market Growth: The U.S. home improvement market is expected to grow, with online sales channels playing an increasingly vital role.

- DTC Potential: A direct-to-consumer e-commerce approach offers a high-growth avenue for renovation material sales.

- Brand Building: Establishing a strong brand presence and efficient logistics are critical for success in the DTC e-commerce space.

- Initial Share: Expecting a low initial market share is realistic due to the need to build brand recognition and operational capacity.

Proprietary or Exclusive High-Innovation Building Material Brands

ADENTRA’s portfolio includes proprietary and exclusive high-innovation building material brands that offer significant differentiation in the market. These products, such as advanced insulation materials or smart windows, cater to emerging construction needs and represent a strong potential for future growth. However, their current market share is relatively low as they navigate the path to widespread adoption.

These exclusive brands are key to ADENTRA's strategy for capturing niche, high-value segments within the building materials sector. For instance, a new line of self-healing concrete, which entered the market in early 2024, has seen initial adoption in specialized infrastructure projects, demonstrating the innovative edge. While early sales figures for such products are modest, they are projected to grow as awareness and demand for sustainable and advanced construction solutions increase.

- Exclusive Distribution Rights: ADENTRA secures exclusive or semi-exclusive rights to innovative building materials, creating a competitive advantage.

- Emerging Market Needs: These materials address evolving demands for energy efficiency, smart home integration, and sustainable construction practices.

- High Growth Potential: Despite currently low market share, these products are positioned for significant future growth as adoption accelerates.

- Early Adoption Challenges: Widespread market acceptance and scaling remain key hurdles for these nascent, high-innovation offerings.

Question Marks represent areas of ADENTRA's business with high market growth potential but currently low market share. These are strategic opportunities where ADENTRA is investing to build its presence and capture future demand.

These ventures require significant investment in market development, brand building, and establishing robust supply chains. Success hinges on ADENTRA’s ability to effectively navigate nascent markets and overcome initial adoption challenges.

The focus is on long-term growth, aiming to transform these Question Marks into Stars or Cash Cows as market penetration increases and ADENTRA solidifies its competitive position.

For instance, ADENTRA's foray into advanced modular construction components for smart cities exemplifies a Question Mark. The global modular construction market was valued at approximately $105.5 billion in 2023 and is projected to grow substantially. Similarly, the North American smart city market, valued at around $25 billion in 2023, is expanding rapidly. ADENTRA's market share in these specific niches is currently minimal, necessitating strategic investment to build awareness and distribution.

BCG Matrix Data Sources

Our ADENTRA BCG Matrix leverages a robust blend of internal financial statements, detailed market research reports, and expert industry analysis to provide a comprehensive view of our product portfolio.