ADENTRA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADENTRA Bundle

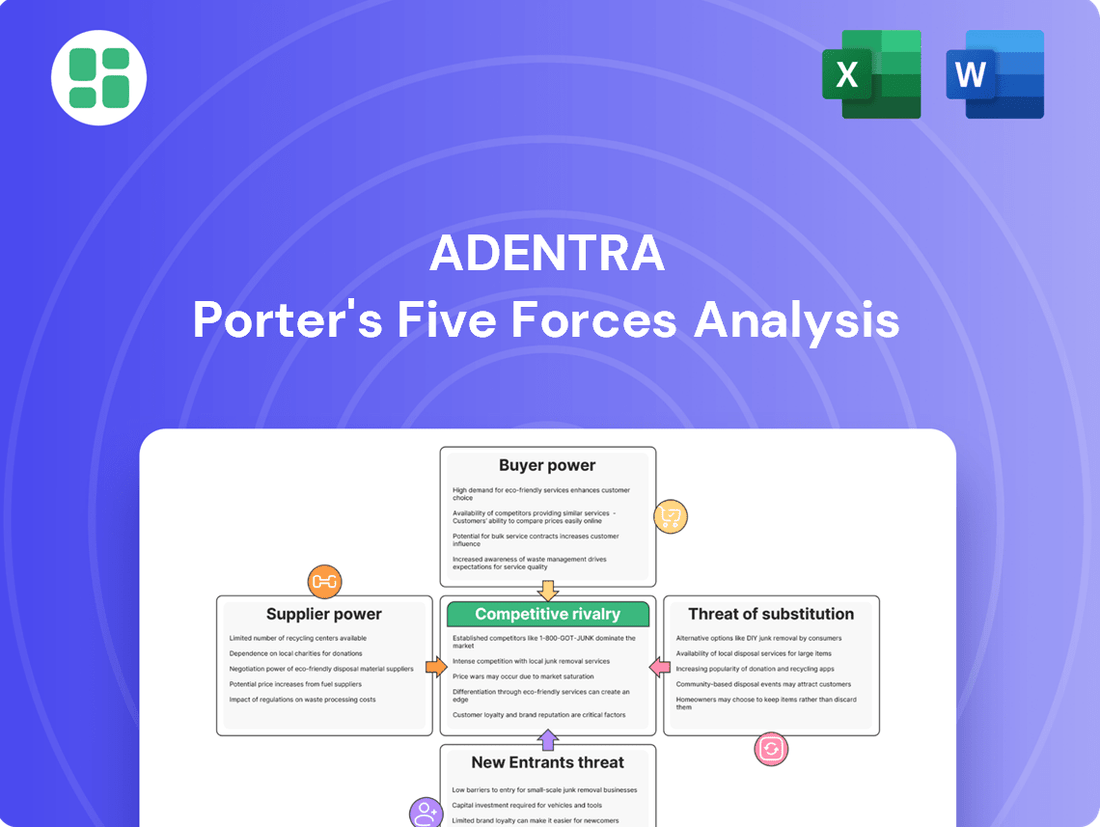

ADENTRA operates within a dynamic market shaped by the interplay of five key competitive forces. Understanding these forces is crucial for navigating its industry landscape effectively. This brief overview highlights the core elements, but the real strategic advantage lies in a comprehensive grasp of these pressures.

The complete Porter's Five Forces Analysis for ADENTRA delves into the intricate details of each force, revealing the true competitive intensity and strategic positioning. Unlock actionable insights that go beyond the surface-level understanding and empower your decision-making.

Ready to move beyond the basics? Get a full strategic breakdown of ADENTRA’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

ADENTRA sources architectural products like doors and decorative surfaces from various manufacturers. If a few dominant players control the supply of high-demand or specialized items, their bargaining power increases significantly, allowing them to influence pricing and terms. In 2023, the global market for architectural doors was estimated to be worth over $70 billion, with significant consolidation in certain segments.

The uniqueness of the architectural products ADENTRA sources significantly influences supplier bargaining power. When suppliers offer proprietary designs, patented materials, or highly specialized components, their ability to dictate terms and prices increases because ADENTRA has limited alternative options. For instance, if a key supplier for a unique, high-performance building material used in 2024 projects has no direct competitors, ADENTRA's reliance on them strengthens their position.

Switching from one supplier to another can incur significant costs for ADENTRA. These can include the expense of re-establishing relationships, the time and resources needed for re-certifying products to meet quality standards, and the potential disruption to logistics and inventory management systems as new processes are integrated.

If these switching costs are substantial, suppliers naturally gain more bargaining power. ADENTRA would face considerable disruption and financial expense to change its sourcing, making it more inclined to stick with existing, albeit potentially less favorable, supplier arrangements.

This dynamic is particularly pronounced in industries with highly integrated supply chains or where ADENTRA operates under long-term supply contracts. For instance, if ADENTRA relies on specialized components or bespoke manufacturing processes from a supplier, the effort and cost to find and onboard an alternative could be prohibitive, strengthening the supplier's hand.

Threat of Forward Integration by Suppliers

Suppliers might threaten ADENTRA by moving into distribution themselves, directly selling to contractors or home improvement stores. This would allow them to bypass ADENTRA's existing network.

While it's less likely for major manufacturers to replicate ADENTRA's extensive distribution capabilities, a significant supplier choosing to establish its own channels could indeed increase competitive pressure and shift power towards them. For instance, a large lumber producer could invest in its own logistics to serve builders directly.

ADENTRA's robust distribution infrastructure and strong relationships with its customer base serve as a significant deterrent against such forward integration. The company's scale and market reach make it difficult for individual suppliers to effectively compete on distribution alone.

The threat of forward integration by suppliers is a factor, though ADENTRA's established logistics and customer loyalty mitigate this risk. For example, in 2024, the building materials distribution sector saw continued consolidation, making it harder for individual suppliers to absorb the costs of building out their own nationwide distribution networks.

Importance of ADENTRA to Supplier's Business

The significance of ADENTRA to its suppliers' business directly influences the suppliers' bargaining power. If ADENTRA constitutes a substantial portion of a supplier's total sales, that supplier is less likely to exert strong pricing or terms pressure, fearing the loss of a major customer. Conversely, if ADENTRA is a smaller client for a large manufacturer, the supplier's leverage increases.

ADENTRA's position as a leading North American distributor, with reported revenues exceeding CAD 3.5 billion in 2023, provides it with considerable counter-leverage against many suppliers. This scale allows ADENTRA to negotiate favorable terms and pricing due to the volume of goods it purchases. For instance, in 2023, ADENTRA's significant purchasing power likely translated into better cost structures compared to smaller, regional distributors.

- Supplier Dependence: If ADENTRA represents a significant portion of a supplier's sales, the supplier's bargaining power is reduced.

- ADENTRA's Scale: As a major distributor, ADENTRA's large purchase volumes grant it considerable leverage.

- Supplier Diversification: If ADENTRA is one of many customers for a supplier, the supplier has more power.

ADENTRA's bargaining power with its suppliers is influenced by several factors, including the concentration of suppliers, the uniqueness of products, and switching costs. High supplier concentration, especially for specialized architectural products, can empower suppliers to dictate terms. In 2023, the global market for architectural doors was valued at over $70 billion, with some segments experiencing notable consolidation, potentially increasing supplier leverage.

The cost and complexity involved in switching suppliers, encompassing re-certification, relationship rebuilding, and logistical adjustments, can be substantial for ADENTRA. If these switching costs are high, suppliers gain leverage, making ADENTRA more inclined to maintain existing, even if less favorable, supplier relationships. This is particularly true for bespoke components or integrated supply chains.

ADENTRA's significant purchasing volume, with reported revenues exceeding CAD 3.5 billion in 2023, provides considerable counter-leverage. This scale allows for negotiation of better pricing and terms, as ADENTRA represents a substantial portion of many suppliers' sales, reducing the suppliers' incentive to exert strong pricing pressure. Conversely, if ADENTRA is a minor client for a supplier, the supplier's power increases.

| Factor | Impact on Supplier Bargaining Power | ADENTRA's Position (2023/2024) |

|---|---|---|

| Supplier Concentration | High concentration increases power | Varies by product segment; some consolidation noted in architectural doors market. |

| Product Uniqueness/Switching Costs | High uniqueness/costs increase power | Significant for specialized, proprietary items; costs include re-certification and logistics. |

| ADENTRA's Purchase Volume | High volume decreases power | ADENTRA's revenues > CAD 3.5 billion (2023) provide strong leverage. |

| Supplier Dependence on ADENTRA | Low dependence increases power | ADENTRA's scale likely makes it a key customer for many suppliers, reducing their leverage. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to ADENTRA's specific position in the market.

Instantly identify and prioritize competitive threats with a comprehensive yet digestible overview of all five forces.

Customers Bargaining Power

Adentra's customer base is diverse, encompassing contractors, home centers, and original equipment manufacturers (OEMs). This broad reach is a key factor in understanding customer bargaining power.

Large national home centers represent a significant portion of Adentra's sales volume. In 2024, these major accounts often demanded lower prices and more favorable terms due to their substantial purchasing power, directly impacting Adentra's profit margins.

While individual small contractors may not wield much influence, their collective purchasing decisions can still impact Adentra. A shift in preference among a large number of smaller clients towards competitors could force Adentra to adjust its pricing or service offerings.

Customers generally face low switching costs when moving between building material distributors. This is largely because many products are standardized, meaning a specific type of lumber or drywall from one supplier is very similar to that from another. With numerous alternative distributors readily available in most markets, customers can easily compare prices and service levels.

This ease of switching significantly enhances customer bargaining power. If ADENTRA's pricing isn't competitive or its service falls short, customers can readily shift their business to a competitor. For instance, in 2024, the average customer acquisition cost for distributors in the construction materials sector was estimated to be around 15% of the first year's revenue, highlighting the expense associated with losing a customer due to high switching costs.

To counter this, ADENTRA must prioritize building strong customer relationships through value-added services and consistently competitive pricing. Offering superior logistics, expert advice, or tailored solutions can create stickiness, even if the core products are similar. This focus on differentiation becomes crucial in a market where switching is a simple decision for the buyer.

Customers in construction, particularly for standard building materials, are keenly aware of price. This is because material costs are a significant factor in their overall project budgets and directly affect their profit margins. For instance, in 2024, fluctuations in lumber prices, a key commodity for ADENTRA, can significantly alter a builder's cost structure, making them more inclined to seek the lowest possible price.

This heightened price sensitivity naturally translates into greater bargaining power for customers. They are more likely to switch suppliers if a competitor offers a better deal, compelling ADENTRA to focus on competitive pricing strategies and operational efficiency to hold onto its customer base. The economic climate plays a crucial role; during economic downturns, this price sensitivity intensifies as businesses strive to cut costs wherever possible.

Availability of Alternative Distributors

The North American architectural products distribution landscape is quite crowded, with many companies vying for business. This means customers, whether they are builders, contractors, or architects, have a wealth of choices when it comes to sourcing their materials. They aren't limited to just one supplier, which naturally gives them more leverage.

The existence of numerous large-scale distributors alongside smaller, regional players amplifies this customer power. It becomes straightforward for buyers to shop around, comparing not only prices but also the quality of service and delivery times offered by different companies. This ease of comparison puts pressure on distributors like ADENTRA to remain competitive.

In 2023, the North American building materials distribution market was estimated to be worth over $300 billion, highlighting the significant number of participants and the competitive environment ADENTRA operates within.

ADENTRA counters this by focusing on its strengths:

- Extensive Distribution Network: ADENTRA's broad reach across North America allows it to serve a wide customer base efficiently.

- Diverse Product Portfolio: Offering a comprehensive range of architectural products reduces the need for customers to source from multiple vendors.

- Value-Added Services: Beyond just product supply, services like logistics, technical support, and customized solutions differentiate ADENTRA.

Threat of Backward Integration by Customers

The threat of backward integration by customers, especially large ones like home centers or major contractors, poses a significant factor in ADENTRA's operating environment. These powerful buyers possess the financial wherewithal to consider establishing their own direct sourcing and distribution channels, thereby bypassing intermediaries like ADENTRA.

While the capital investment and logistical complexities involved in such a move are substantial, the mere possibility of backward integration significantly bolsters the bargaining power of these key customers. This leverage allows them to negotiate more favorable terms, pricing, and service agreements with ADENTRA.

However, ADENTRA's established and specialized distribution infrastructure, coupled with its extensive network of relationships with a wide array of manufacturers, presents a considerable barrier to direct backward integration for most customers. This specialized capability is a key differentiator that mitigates the direct threat.

- Customer Bargaining Power: Large customers, such as major home improvement retailers or significant construction firms, can exert considerable pressure on suppliers.

- Backward Integration Potential: These customers might consider establishing their own manufacturing or sourcing operations to gain more control and potentially reduce costs.

- ADENTRA's Defense: ADENTRA's complex distribution network and diverse supplier relationships make it difficult and costly for customers to replicate these capabilities.

- Mitigating Factors: The specialized nature of ADENTRA's business model and its established logistical expertise serve as a deterrent to direct customer integration.

The bargaining power of Adentra's customers is significant, driven by low switching costs and high price sensitivity, especially among large buyers like national home centers. These major accounts, representing a substantial sales volume, often leverage their purchasing power to negotiate lower prices and more favorable terms, directly impacting Adentra's profitability in 2024.

While individual contractors have less sway, their collective purchasing decisions can influence Adentra, particularly if a large segment shifts to competitors. The ease with which customers can switch between building material distributors, due to standardized products and numerous alternatives, further amplifies their leverage. In 2024, the estimated customer acquisition cost in this sector was around 15% of first-year revenue, underscoring the financial impact of customer retention.

The North American architectural products distribution market, valued at over $300 billion in 2023, is highly competitive with many distributors, giving customers ample choices and driving price comparisons. Adentra counters this by emphasizing its extensive distribution network, diverse product portfolio, and value-added services like logistics and technical support.

| Factor | Impact on Adentra | 2024 Data/Trend |

| Low Switching Costs | Increases customer leverage, easy to move to competitors. | Standardized products, numerous distributors available. |

| Price Sensitivity | Customers actively seek lower prices, impacting margins. | Material costs are a major budget component for builders. |

| Customer Concentration | Large accounts (home centers) have significant negotiation power. | Major accounts demand lower prices and favorable terms. |

| Backward Integration Threat | Potential for large customers to source directly, reducing Adentra's role. | Financial capability exists for some large buyers, though complex. |

Full Version Awaits

ADENTRA Porter's Five Forces Analysis

This preview showcases the complete ADENTRA Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive instantly after purchase, ensuring full transparency and immediate access to this valuable strategic tool. You can be confident that the detailed insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry are all present and ready for your immediate use.

Rivalry Among Competitors

The North American architectural products distribution market features a dynamic mix of large national players, such as ADENTRA, alongside a substantial number of smaller, regional competitors. This creates a highly fragmented and competitive environment where companies of varying sizes and specializations actively compete for market share.

This diversity in competitors, ranging from broad-line distributors to niche specialists, intensifies rivalry across both residential and commercial construction sectors. ADENTRA's considerable scale offers a degree of competitive advantage, but the persistent presence of strong local and regional distributors means that localized competition remains a significant factor in market dynamics.

The construction and renovation market's growth rate significantly shapes competitive rivalry. During robust growth phases, such as the post-pandemic surge in home improvement, competition can be more collaborative as ample opportunities exist for all participants. For instance, in 2022, the US residential renovation and repair market was valued at approximately $485 billion, indicating strong demand.

However, when growth slows or contracts, as seen with the impact of rising interest rates on housing affordability in 2023 and early 2024, the competitive landscape intensifies. Companies like Adentra may face increased pressure to secure market share, potentially leading to more aggressive pricing strategies and a heightened focus on differentiation to capture a larger portion of a more limited customer base.

ADENTRA faces a challenge with product differentiation because many of its architectural products, like standard building materials, are essentially commodities. This makes it hard to stand out based on the product itself, as competitors often offer very similar items.

Instead, ADENTRA's competitive edge largely stems from non-product related factors. These include the quality of their customer service, how quickly they can deliver products, the variety of items they keep in stock, their presence in different locations, and the strength of their relationships with clients.

The limited ability to differentiate products means that competition can easily shift to price wars, which naturally increases the intensity of rivalry among companies in the sector. For instance, in 2024, the building materials distribution sector saw an average gross profit margin of around 22%, indicating that price pressures are a significant factor.

Exit Barriers

High exit barriers can trap companies, like ADENTRA, in a market even when they are not profitable. This is often due to substantial investments in fixed assets, such as warehouses and logistics infrastructure, which are difficult to divest. For instance, ADENTRA's extensive network represents a significant fixed cost that makes exiting the market a challenging proposition.

These high exit barriers can lead to prolonged overcapacity. When unprofitable firms cannot easily leave, they often continue to operate, contributing to an excess supply of goods or services. This situation can force companies to engage in aggressive pricing strategies to move inventory, thereby intensifying competitive rivalry within the industry.

- ADENTRA's extensive network of warehouses and logistics infrastructure represents a significant fixed asset base, acting as a substantial exit barrier.

- Specialized inventory and long-term contracts with customers and suppliers further increase the difficulty and cost of exiting the market for companies like ADENTRA.

- The presence of unprofitable firms that are unable to exit due to these barriers can lead to market overcapacity, driving down prices and intensifying competition.

Market Share and Acquisition Activity

Competitive rivalry within the building materials distribution sector is intensified by companies actively pursuing market share gains through strategic acquisitions. ADENTRA, for instance, has consistently expanded its reach and customer base via acquisitions, such as its 2023 purchase of Woolf Distributing, which bolstered its presence in the U.S. market.

This ongoing consolidation and strategic acquisition activity underscores a highly dynamic and competitive landscape where companies like ADENTRA are constantly maneuvering to strengthen their positions. For example, ADENTRA reported a 12.6% increase in revenue for the first quarter of 2024 compared to the same period in 2023, partly driven by contributions from recent acquisitions.

- Market Share Focus: Companies are aggressively seeking to capture larger portions of the market.

- Acquisition as a Strategy: Mergers and acquisitions are key tactics for growth and competitive advantage.

- Industry Consolidation: The building materials distribution sector is experiencing significant consolidation.

- ADENTRA's Growth Pattern: ADENTRA's acquisition history, including Woolf Distributing, exemplifies this trend.

Competitive rivalry in the architectural products distribution market is fierce due to a fragmented landscape of large and small players, where differentiation is challenging, often leading to price-sensitive competition. ADENTRA's strategy involves non-product factors like service and logistics, but the industry's commodity nature and high exit barriers, stemming from significant fixed assets, trap firms and fuel overcapacity, intensifying rivalry.

| Competitor Type | Market Share Focus | Key Strategies | 2024 Impact |

|---|---|---|---|

| Large National Players (e.g., ADENTRA) | Market share expansion via acquisition | Strategic acquisitions, service, logistics | 12.6% Q1 2024 revenue growth (ADENTRA) |

| Regional/Niche Competitors | Local market dominance | Specialization, customer relationships | Intensified localized competition |

| Industry Dynamics | Consolidation, price competition | Acquisitions, managing overcapacity | ~22% average gross profit margin |

SSubstitutes Threaten

The threat of substitutes for ADENTRA's distributed products is significant, stemming from alternative materials and construction methods that can serve similar functional or aesthetic needs. For instance, the development of advanced synthetic lumber or composite materials could directly compete with traditional wood products, potentially impacting ADENTRA's market share. In 2024, the global market for engineered wood products, a key area for ADENTRA, was valued at approximately $120 billion, but the growth of alternative materials like recycled plastics and advanced composites is a growing concern.

Furthermore, innovations in building science are continuously introducing new substitution threats. Modular and prefabricated construction, for example, can reduce the demand for individually distributed components that ADENTRA supplies, as these methods often utilize integrated systems. The construction technology market is projected to grow substantially, with a CAGR of over 7% expected through 2028, indicating a strong push towards more efficient, and potentially substitute-heavy, building solutions.

Large customers, such as major construction firms or original equipment manufacturers (OEMs), have the potential to bypass distributors like ADENTRA by sourcing materials directly from producers or even engaging in direct import operations. This bypass strategy, while demanding substantial logistical infrastructure and high-volume commitments, presents a viable alternative to the traditional distribution channel.

The threat of direct sourcing is amplified when customers possess the necessary scale and expertise to manage procurement, inventory, and delivery efficiently. For example, a large contractor in 2024 might leverage its purchasing power to negotiate bulk discounts directly with lumber mills or steel manufacturers, effectively cutting out the intermediary.

ADENTRA counters this threat by emphasizing its core value proposition: providing unparalleled efficiency, a comprehensive product range, and convenient one-stop-shop solutions. This integrated service model, which includes logistics, technical support, and credit, often proves more cost-effective and less complex for many customers than establishing their own direct sourcing operations.

The rise of DIY and self-installation presents a significant threat of substitutes for ADENTRA. Many consumers are increasingly undertaking home renovation projects themselves, bypassing professional contractors who typically rely on distributors like ADENTRA. This trend is fueled by readily available retail options and accessible online tutorials.

For instance, in 2024, the home improvement market saw continued strong consumer engagement in DIY projects. Data from industry reports indicated that a substantial portion of home renovation spending was directly attributed to DIY consumers purchasing materials from big box retailers, bypassing traditional distribution channels. This directly impacts ADENTRA’s business model, which often serves home centers and professional installers.

A stronger shift towards DIY could diminish demand for the specialized products and bulk quantities ADENTRA supplies to its professional client base. If consumers increasingly opt for direct retail purchases for their projects, ADENTRA may see reduced order volumes from its existing customer segments, forcing a strategic re-evaluation of its product sourcing and distribution strategies.

Changes in Building Codes or Design Preferences

Changes in building codes, such as stricter energy efficiency mandates or new fire safety regulations, can significantly impact material demand. For instance, a push towards net-zero buildings might render traditional insulation materials less competitive against advanced, high-performance alternatives. In 2024, many regions saw updated codes emphasizing recycled content and low-VOC emissions, directly affecting material choices.

Evolving design preferences also pose a threat. A growing consumer demand for natural, sustainable materials like reclaimed wood or bamboo could reduce reliance on manufactured products if ADENTRA’s offerings don’t align. For example, the popularity of biophilic design, incorporating natural elements, has surged, potentially substituting for conventional construction materials.

- Shifting Regulatory Landscape: Building codes are increasingly incorporating sustainability and safety standards, influencing material selection.

- Consumer Design Trends: Preferences for natural, eco-friendly, or aesthetically distinct materials can displace traditional options.

- Material Obsolescence Risk: ADENTRA faces substitution if its product portfolio does not adapt to new code requirements or design trends.

Cost-Performance Trade-offs of Substitutes

The threat of substitutes for ADENTRA hinges significantly on the cost-performance trade-offs available in the market. If alternative materials or solutions can deliver comparable or superior performance at a lower price point, ADENTRA's market position is challenged. For instance, in the building materials sector where ADENTRA operates, the development of new composite materials or advanced manufacturing techniques for existing materials could present a significant substitute threat if they offer better insulation or durability at a reduced cost.

ADENTRA needs to stay vigilant regarding innovations that improve the cost-effectiveness of substitutes. For example, if the cost of engineered wood products, a potential substitute for some of ADENTRA's offerings, decreases due to more efficient production processes, this would directly increase the threat. In 2024, the global construction materials market saw continued volatility, with raw material costs fluctuating, making the price comparison between traditional and substitute materials a critical factor for customers.

- Cost-Performance Ratio: Substitutes offering a more favorable cost-performance ratio directly impact ADENTRA's pricing power and market share.

- Innovation in Substitutes: Advances in alternative material science or production technology can rapidly alter the competitive landscape.

- Market Monitoring: Continuous analysis of emerging materials and their pricing is crucial for ADENTRA to maintain its value proposition.

- Customer Sensitivity: High price sensitivity among ADENTRA's customer base amplifies the threat posed by cost-competitive substitutes.

The threat of substitutes for ADENTRA is substantial, driven by alternative materials, construction methods, and direct sourcing by large clients. Innovations in building science and evolving consumer preferences, like the DIY trend, further amplify this risk. ADENTRA's strategy relies on highlighting its efficiency, product breadth, and integrated services to counter these pressures.

| Threat Category | Description | 2024 Market Insight/Data | Impact on ADENTRA |

| Alternative Materials | New synthetics, composites, or natural materials replacing traditional ones. | Global engineered wood market valued at ~$120 billion, but growth in alternatives is a concern. | Potential market share erosion if ADENTRA's portfolio isn't diversified. |

| Construction Methods | Modular, prefabricated, or integrated systems reducing demand for individual components. | Construction technology market expected CAGR >7% through 2028. | Reduced need for ADENTRA's distributed products if clients adopt these methods. |

| Direct Sourcing | Large customers bypassing distributors to buy directly from manufacturers. | Large contractors leverage purchasing power for bulk discounts, cutting out intermediaries. | Loss of sales volume and margin if key clients shift to direct procurement. |

| DIY Trend | Consumers undertaking projects themselves, buying materials from retail. | Significant portion of home renovation spending attributed to DIY consumers bypassing traditional channels. | Decreased demand from professional installers and home centers. |

| Regulatory/Design Shifts | New codes (energy efficiency, safety) or design trends (natural materials) favoring alternatives. | Regions updated codes in 2024 emphasizing recycled content and low-VOC emissions; biophilic design surged. | Risk of material obsolescence if ADENTRA's offerings don't align with new standards or aesthetics. |

Entrants Threaten

Entering the architectural products distribution space, particularly to compete with established players like ADENTRA, demands significant upfront capital. Think about the costs involved: acquiring or leasing large warehouse facilities, stocking a diverse inventory of building materials, maintaining a fleet of delivery vehicles, and investing in robust IT systems for logistics and customer management. These aren't small figures.

For instance, a new distributor looking to establish even a modest regional presence might need to invest millions in inventory alone, especially if they aim to offer a broad range of products. ADENTRA's own capital expenditures in 2023, for example, were substantial, reflecting the ongoing need to maintain and upgrade its infrastructure to support its extensive operations. This high barrier effectively discourages many potential new entrants who simply cannot muster the necessary financial resources to get off the ground.

Adentra's significant advantage lies in its established distribution networks and logistics. Operating 84-86 facilities across North America, the company has built a robust infrastructure that would be incredibly costly and time-consuming for any new entrant to replicate. This extensive reach allows for efficient product delivery and inventory management, a critical factor in the building materials sector.

Newcomers face a steep barrier in matching Adentra's logistical capabilities. The sheer scale of Adentra's operations, coupled with its developed supply chain management, provides a substantial competitive moat. This established efficiency and broad market coverage make it exceedingly difficult for new players to gain traction and compete effectively on operational grounds.

ADENTRA benefits from strong brand loyalty and deep-rooted customer relationships, particularly with contractors, home centers, and original equipment manufacturers (OEMs). These relationships are built on years of consistent service and trust within the construction sector, making it difficult for newcomers to replicate.

The construction industry's reliance on established trust means new entrants face a substantial barrier. They must invest significant time and resources to build their own reputation and cultivate similar long-standing connections, a process that typically takes years to achieve.

Economies of Scale

As a major player in the distribution sector, ADENTRA leverages significant economies of scale. This advantage is particularly evident in its purchasing power, enabling it to secure more favorable pricing from suppliers compared to smaller competitors. For instance, in 2024, large-scale distributors often negotiate discounts of 5-10% on bulk orders, a margin difficult for new entrants to achieve.

These scale efficiencies extend to logistics and operational overhead, allowing ADENTRA to spread fixed costs over a larger volume of sales. This translates to lower per-unit costs, making it challenging for new entrants to compete on price without compromising profitability. A new distributor would need substantial upfront investment to build a comparable distribution network and achieve similar cost efficiencies.

- Purchasing Power: ADENTRA secures better terms from suppliers due to its high order volumes.

- Logistical Efficiency: Larger operations reduce per-unit transportation and warehousing costs.

- Operational Overhead: Fixed costs are spread across a wider sales base, lowering per-unit expenses.

- Barriers to Entry: New entrants face significant cost disadvantages in matching ADENTRA's scale.

Regulatory Hurdles and Industry Expertise

The building materials industry presents substantial regulatory hurdles. New entrants must meticulously adhere to a complex web of building codes, stringent certifications, and crucial safety regulations. For instance, in 2024, the International Code Council (ICC) continued to update and enforce various building standards, requiring significant investment in compliance for any new player.

Beyond regulatory compliance, deep industry expertise is paramount. This includes a nuanced understanding of regional market specificities, such as local building practices and material preferences, and the ability to effectively manage diverse and often complex product lines. Companies like Saint-Gobain, a global leader, demonstrate this through decades of accumulated knowledge in product development and supply chain management, a significant barrier for newcomers.

- Regulatory Complexity: Navigating building codes, certifications, and safety standards requires significant upfront investment and expertise.

- Industry Knowledge Gap: Understanding regional market nuances and managing complex product portfolios is critical for success.

- Compliance Costs: The learning curve and ongoing compliance requirements act as a substantial deterrent for inexperienced entrants.

- Established Player Advantage: Incumbents benefit from existing relationships with regulators and a proven track record of compliance.

The threat of new entrants for ADENTRA is generally low due to several significant barriers. High capital requirements for inventory, facilities, and logistics, coupled with established distribution networks and customer loyalty, make it difficult for newcomers to compete effectively. Furthermore, regulatory complexities and the need for deep industry expertise deter many potential entrants.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for inventory, facilities, and logistics. | High barrier, requiring substantial funding to establish operations. |

| Distribution Network & Logistics | ADENTRA's extensive network of 84-86 facilities across North America. | Costly and time-consuming for new entrants to replicate. |

| Customer Relationships & Brand Loyalty | Long-standing trust with contractors, home centers, and OEMs. | New entrants need considerable time and resources to build similar relationships. |

| Economies of Scale | ADENTRA's purchasing power leads to better supplier terms and lower per-unit costs. | New entrants face cost disadvantages, impacting price competitiveness. |

| Regulatory & Expertise Hurdles | Navigating building codes, certifications, and requiring deep market knowledge. | Significant investment in compliance and expertise is necessary. |

Porter's Five Forces Analysis Data Sources

Our ADENTRA Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from ADENTRA's annual reports, investor presentations, and publicly available financial statements. We also leverage industry-specific market research reports and competitor analysis from reputable sources to provide a comprehensive view of the competitive landscape.