ADENTRA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADENTRA Bundle

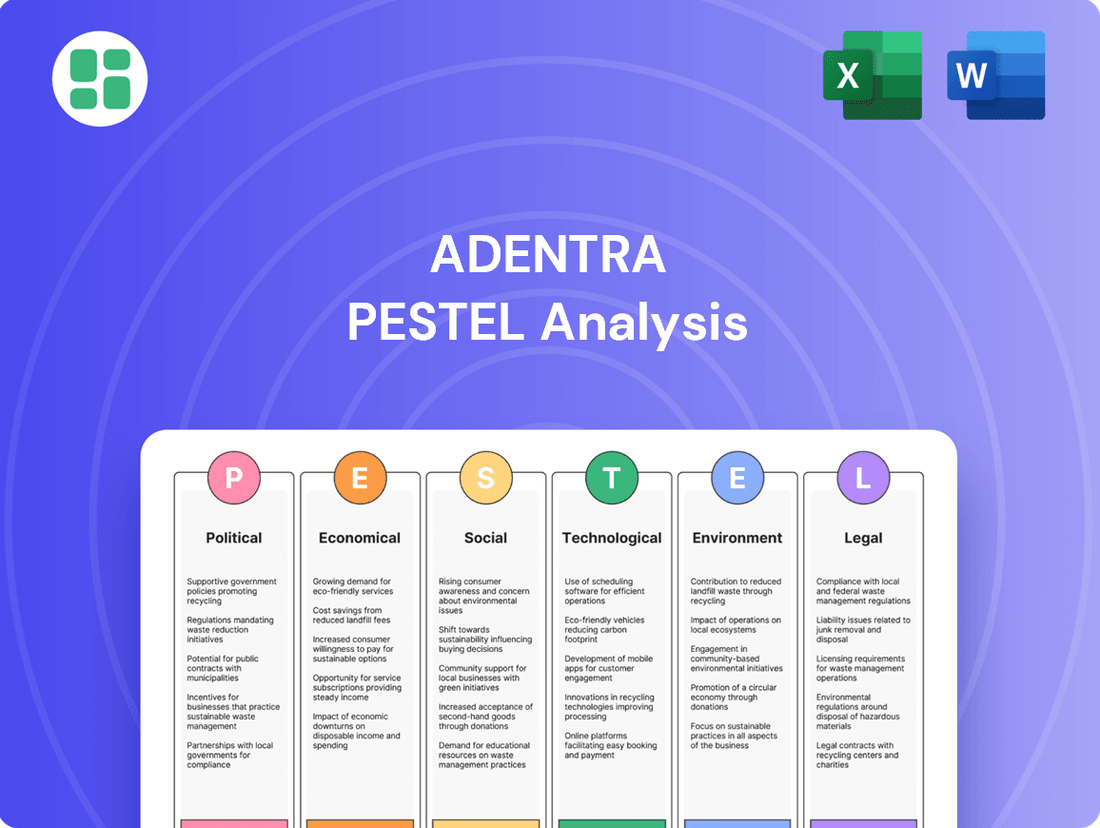

Navigate the complex external forces shaping ADENTRA's trajectory with our meticulously researched PESTEL Analysis. Understand the political, economic, social, technological, environmental, and legal factors that present both opportunities and challenges. Equip yourself with the critical intelligence needed to make informed strategic decisions and gain a competitive advantage. Download the full version now for actionable insights.

Political factors

Government investments in infrastructure projects across North America, such as roads, bridges, and public buildings, directly influence the demand for ADENTRA's architectural products. For instance, in 2024, the Canadian federal government committed to investing billions in infrastructure renewal, a significant portion of which supports building and construction sectors. This increased spending can stimulate large-scale commercial and public construction, leading to higher sales volumes for ADENTRA.

Conversely, reductions in government infrastructure spending could temper growth in these sectors. For example, if a major public transit project ADENTRA supplies materials for is delayed or scaled back due to budget constraints, it directly impacts their revenue projections for that period. The stability and scale of these government commitments are therefore crucial for ADENTRA's strategic planning and sales forecasts.

Changes in trade policies, such as the imposition or removal of tariffs on key building materials like lumber, steel, and aluminum, directly influence ADENTRA's cost of goods sold and the reliability of its supply chains. These policy shifts can create cost volatility and disrupt material availability, impacting project timelines and overall financial performance.

Recent and anticipated tariffs on imports, particularly from countries like Canada, Mexico, and China, can lead to increased material acquisition costs. ADENTRA reported in its first quarter 2025 earnings call that roughly 8% of its product assortment is currently affected by existing tariff measures, with an average tariff rate of 10% applied to these goods.

Updates to national and provincial building codes significantly impact ADENTRA's operations. For instance, the 2024 International Building Code (IBC) and the 2024 Ontario Building Code are likely to introduce new mandates for safety and energy efficiency, directly influencing the specifications and demand for building materials.

These evolving regulations require ADENTRA to continuously adapt its product portfolio to ensure compliance and maintain market relevance. Failure to do so could lead to non-compliance issues and missed opportunities in sectors prioritizing sustainable and safe construction practices, a growing trend in 2024 and beyond.

Political Stability and Elections

Political stability and the outcomes of elections in key North American markets, particularly Canada and the United States, directly influence the construction sector. For instance, the 2024 US presidential election and ongoing Canadian federal and provincial elections can introduce policy shifts impacting housing starts and infrastructure spending, areas crucial for ADENTRA's business.

Government priorities often pivot with electoral results. A focus on affordable housing initiatives or increased infrastructure investment, as seen in various provincial budgets in 2024, can create significant opportunities for construction material suppliers like ADENTRA. Conversely, a tightening of environmental regulations or shifts in economic stimulus packages could present challenges.

- 2024 Canadian Federal Budget: Announced significant investments in housing affordability and infrastructure projects, potentially benefiting ADENTRA's building materials segment.

- US Housing Market Trends (2024-2025): Projections indicate continued demand for residential construction, influenced by interest rate policies and government housing incentives.

- Environmental Policy Debates: Ongoing discussions around building codes and sustainability standards in both Canada and the US could impact material demand and product innovation for ADENTRA.

Housing Affordability Policies

Government initiatives aimed at improving housing affordability, such as tax incentives for new home construction or first-time homebuyer programs, can stimulate residential construction. For instance, in 2024, various regions continued to explore or implement programs like property tax abatements for developers building affordable housing units, directly impacting the demand for construction materials.

These policies can directly boost demand for ADENTRA's products used in new residential builds and renovations. As of early 2025, reports indicate a sustained interest in homeownership, supported by these governmental efforts, which translates to increased orders for lumber, engineered wood products, and other building components that ADENTRA supplies.

- Increased Demand: Policies encouraging homeownership, like the continuation of mortgage interest deductions or potential new first-time buyer credits in 2025, are expected to drive demand for residential construction.

- Stimulated Renovation: Programs focused on energy-efficient upgrades or disaster resilience in existing homes can also boost renovation activity, benefiting ADENTRA's product lines.

- Market Growth: The success of these affordability measures directly correlates with the volume of new housing starts and renovation projects, presenting a positive outlook for companies like ADENTRA.

Government investments in infrastructure and housing affordability initiatives directly shape ADENTRA's market. For example, the 2024 Canadian Federal Budget's focus on infrastructure renewal and housing programs signals increased demand for building materials. Similarly, US housing market trends, influenced by policy in 2024-2025, suggest sustained residential construction activity.

Changes in trade policies and tariffs, particularly those affecting key building materials, create cost volatility for ADENTRA. The company noted in early 2025 that approximately 8% of its products were subject to tariffs averaging 10%, impacting its cost of goods sold and supply chain reliability.

Evolving building codes, such as the 2024 International Building Code and Ontario Building Code, necessitate ADENTRA's continuous product adaptation to meet new safety and energy efficiency mandates. Political stability and election outcomes in North America are also critical, as they can lead to shifts in government priorities and spending on construction projects.

What is included in the product

The ADENTRA PESTLE Analysis provides a comprehensive examination of external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis is meticulously crafted with data-backed insights and forward-looking perspectives to empower strategic decision-making for ADENTRA.

Provides a clear, actionable framework that helps businesses proactively identify and address external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

Elevated interest rates and mortgage rates are a significant economic factor for Adentra. Higher borrowing costs directly impact consumer affordability for housing, potentially slowing demand in the residential construction and renovation sectors. Developers also face increased expenses, which can curb new construction starts.

For example, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2025, a level that has kept mortgage rates elevated. This environment directly affects Adentra's ability to secure financing for projects and influences the purchasing power of its customer base.

Adentra's CEO noted in Q1 2025 that these challenging rate conditions contributed to slower housing sales and a cautious approach to new development projects. This highlights the direct correlation between macroeconomic monetary policy and Adentra's operational performance.

The overall health of the North American economy, as indicated by Gross Domestic Product (GDP) growth, significantly influences the construction industry and, by extension, ADENTRA's performance. A robust economy generally boosts consumer confidence and encourages business investment, leading to a higher demand for both residential and commercial construction projects.

In 2023, Canada's real GDP grew by 1.1%, a notable slowdown from 2022's 3.7% expansion, signaling a more cautious economic environment. Similarly, the U.S. economy demonstrated resilience, with real GDP increasing by 2.5% in 2023, providing a more supportive backdrop for construction demand compared to Canada.

Inflationary pressures continue to impact raw material, energy, and transportation costs, directly affecting ADENTRA's operational expenses and product pricing strategies. While ADENTRA experienced stable product pricing in the first quarter of 2025, a trend that followed deflationary periods in 2023 and 2024, ongoing inflation poses a risk to profit margins if not actively managed.

Housing Starts and Renovation Activity

Housing starts and renovation activity directly reflect the demand for ADENTRA's building materials. While new residential construction experienced a downturn in 2023 and 2024, with housing starts falling below 1.5 million annualized units in late 2023 and early 2024, industry forecasts point to a recovery. This anticipated rebound, particularly in single-family and multi-family construction, is expected to gain momentum throughout 2025, signaling a more favorable market for ADENTRA.

The repair and remodel (R&R) sector also plays a crucial role. Despite economic headwinds that may temper consumer spending on discretionary projects, the aging housing stock continues to drive consistent R&R demand. For instance, the R&R market, valued at over $450 billion in recent years, provides a stable revenue stream, though growth may moderate if interest rates remain elevated.

- Housing Starts Forecast: Projections for 2025 indicate an increase in housing starts, potentially reaching 1.6 to 1.7 million units.

- R&R Market Resilience: The repair and remodel sector is expected to remain robust, supported by the need for ongoing maintenance and upgrades.

- Impact on ADENTRA: An upswing in both new construction and R&R activity will directly translate to higher sales volumes for ADENTRA's product lines.

- Economic Sensitivity: While recovery is anticipated, the pace of growth will be influenced by interest rate movements and overall consumer confidence.

Consumer Spending and Confidence

Consumer spending and confidence are critical drivers for the housing and renovation markets, directly impacting demand for products like decorative surfaces. When homeowners feel financially secure and have ample spending power, they are more inclined to invest in home improvements and new property purchases. This confidence directly translates into increased sales for companies like Adentra.

However, the economic landscape of 2024 and early 2025 presents challenges. Elevated mortgage rates have significantly impacted consumer affordability, a key factor influencing purchasing decisions. This reduced affordability can dampen enthusiasm for major home purchases and renovations, leading to a slowdown in demand for building materials and decorative surfaces.

Several key indicators highlight this trend:

- Consumer Confidence Index (CCI): While fluctuating, the CCI in major economies has shown sensitivity to interest rate hikes and inflation concerns throughout 2024, suggesting a cautious consumer. For instance, the Conference Board's Consumer Confidence Index for the US hovered around 100-110 in early 2024, a notable dip from earlier highs, reflecting economic anxieties.

- Retail Sales Data: Reports on retail sales, particularly for home improvement and building materials, provide a direct measure of consumer spending in this sector. A slowdown in these sales can indicate reduced consumer willingness to spend on discretionary home projects.

- Housing Market Activity: Sales of new and existing homes are a strong proxy for consumer confidence in the housing sector. Lower sales volumes, often linked to affordability issues, directly correlate with reduced demand for renovation materials. In mid-2024, many housing markets experienced slower transaction volumes compared to previous years due to higher borrowing costs.

- Disposable Income Trends: Changes in disposable income, influenced by inflation and wage growth, directly affect consumers' ability to spend on non-essential items like home upgrades. If disposable income is squeezed, spending on decorative surfaces is likely to decrease.

The economic outlook for 2024-2025 presents a mixed but generally improving picture for Adentra. While elevated interest rates continue to influence affordability, there are signs of a rebound in key sectors. Housing starts are projected to increase, and the repair and remodel market remains a stable source of demand. Inflationary pressures are a concern for operational costs, but stable product pricing has been maintained thus far.

| Economic Factor | 2023 Data | Early 2025 Outlook | Impact on Adentra | Key Metric |

| Interest Rates | Fed Funds Rate: 5.25%-5.50% (maintained) | Expected to remain elevated, potentially starting gradual reductions later in 2025. | Increased borrowing costs for projects, reduced consumer affordability. | Mortgage Rates (e.g., 30-year fixed averaging ~7%) |

| GDP Growth | Canada: 1.1% | U.S.: 2.5% | Projected moderate growth for both economies. | Supports overall demand for construction and renovation. | Annual GDP Growth Rate |

| Inflation | Moderate, with some deflationary periods in specific goods. | Slightly elevated but expected to moderate throughout 2025. | Potential increase in raw material and transportation costs. | Consumer Price Index (CPI) |

| Housing Starts | Below 1.5 million annualized units (late 2023/early 2024) | Forecasted to reach 1.6-1.7 million units in 2025. | Directly correlates with demand for building materials. | Annual Housing Starts |

Preview the Actual Deliverable

ADENTRA PESTLE Analysis

The preview shown here is the exact ADENTRA PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ADENTRA, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same ADENTRA PESTLE Analysis document you’ll download after payment, providing a comprehensive strategic overview.

Sociological factors

North America's population is projected to reach over 400 million by 2025, fueling a consistent demand for construction. Smaller average household sizes, with many now consisting of one or two people, also contribute to this need, as more individual living spaces are required.

Urbanization continues to reshape the continent, with a significant portion of the population now residing in cities. This concentration of people in urban centers directly translates to increased demand for both residential and commercial real estate, a key market for ADENTRA's architectural products.

The ongoing shift towards remote and hybrid work models significantly reshapes housing demand. Many individuals now prioritize larger, more affordable living spaces, often found in suburban or rural areas, away from traditional urban cores. This migration directly influences construction and renovation trends, affecting the demand for diverse building materials as people adapt their homes for long-term living and working.

Data from 2024 indicated that approximately 30% of the US workforce was working remotely at least part-time, a substantial increase from pre-pandemic levels. This sustained preference for flexibility means developers and material suppliers must cater to a market seeking home offices, improved connectivity, and more spacious layouts, impacting sales of everything from lumber to smart home technology.

Consumer tastes are constantly shifting, with a growing emphasis on both the visual appeal and practical utility of home products. This means ADENTRA needs to ensure its building materials aren't just sturdy but also align with current design trends, offering both durability and aesthetic appeal to capture market share. For instance, reports from late 2024 indicate a significant uptick in consumer spending on home renovation projects, with a particular focus on sustainable and visually pleasing materials, suggesting a strong demand for products that meet these dual criteria.

Sustainability and Green Building Awareness

Societal shifts are increasingly prioritizing environmental responsibility, directly impacting the building materials sector. Consumers and businesses alike are actively seeking out products that minimize ecological impact, driving a significant demand for sustainable and green building solutions. This trend is particularly evident in the growing market for materials sourced from renewable and recyclable resources.

ADENTRA's strategic alignment with these evolving values is a key strength. The company's commitment to offering products derived from renewable and recyclable materials, underscored by its Forest Stewardship Council (FSC) certification, resonates strongly with this heightened environmental awareness. This positions ADENTRA favorably within a market that increasingly rewards eco-conscious practices.

- Growing Demand: The global green building materials market was valued at approximately USD 230 billion in 2023 and is projected to grow significantly, with an estimated compound annual growth rate (CAGR) of over 10% through 2030.

- Consumer Preference: A 2024 survey indicated that over 70% of new homebuyers consider sustainability features, such as recycled content and energy efficiency, as important factors in their purchasing decisions.

- Regulatory Push: Many governments are implementing stricter building codes and offering incentives for the use of green building materials, further accelerating market adoption.

- ADENTRA's Edge: ADENTRA's FSC certification, for instance, ensures that its wood-based products come from responsibly managed forests, a crucial differentiator for environmentally sensitive clients.

DIY vs. Professional Contractor Trends

The balance between do-it-yourself (DIY) home improvement and professional contracting significantly influences ADENTRA's market strategy. While the post-pandemic DIY boom, fueled by increased time at home, saw a temporary surge, a return to more traditional contractor-led projects is evident. Understanding this dynamic is crucial for optimizing sales channels, particularly for ADENTRA's home center and contractor segments.

Recent data indicates a recalibration in this trend. For instance, a 2024 survey by Home Improvement Research Institute (HIRI) suggested that while DIY spending remained elevated compared to pre-pandemic levels, professional contractor spending saw a stronger rebound in 2023 and is projected to continue this growth through 2025. This shift impacts product demand and the types of services ADENTRA needs to support.

- DIY vs. Pro Spending: While DIY projects remain popular, professional contractor services experienced a stronger recovery in 2023, with projections indicating continued growth into 2025.

- Customer Segmentation: ADENTRA must cater to both DIY enthusiasts and professional contractors, requiring distinct product offerings and support for each segment.

- Market Adaptation: Changes in the DIY/pro ratio necessitate flexible sales strategies and inventory management to align with evolving consumer and professional preferences.

- Economic Influences: Factors like inflation and labor availability can further sway the balance, making it essential for ADENTRA to monitor economic indicators closely.

Societal shifts are increasingly prioritizing environmental responsibility, directly impacting the building materials sector. Consumers and businesses alike are actively seeking out products that minimize ecological impact, driving a significant demand for sustainable and green building solutions. This trend is particularly evident in the growing market for materials sourced from renewable and recyclable resources.

ADENTRA's strategic alignment with these evolving values is a key strength. The company's commitment to offering products derived from renewable and recyclable materials, underscored by its Forest Stewardship Council (FSC) certification, resonates strongly with this heightened environmental awareness. This positions ADENTRA favorably within a market that increasingly rewards eco-conscious practices.

The global green building materials market was valued at approximately USD 230 billion in 2023 and is projected to grow significantly, with an estimated compound annual growth rate (CAGR) of over 10% through 2030. A 2024 survey indicated that over 70% of new homebuyers consider sustainability features, such as recycled content and energy efficiency, as important factors in their purchasing decisions.

| Societal Factor | Impact on ADENTRA | Supporting Data (2023-2025) |

| Environmental Consciousness | Increased demand for sustainable products; enhanced brand reputation for eco-friendly offerings. | Global green building materials market valued at ~USD 230B (2023), projected CAGR >10% through 2030. Over 70% of new homebuyers consider sustainability features (2024). |

| Consumer Preferences | Need for aesthetically pleasing and functional materials; adaptation to renovation trends. | Significant uptick in consumer spending on home renovation projects (late 2024), with focus on sustainable and visually pleasing materials. |

| Workforce Trends (Remote/Hybrid) | Shift in housing demand towards larger, more adaptable spaces; influence on renovation and new build designs. | ~30% of US workforce working remotely at least part-time (2024), driving demand for home office spaces and flexible layouts. |

Technological factors

Innovations in building materials, like advanced composites and energy-efficient options, offer ADENTRA a chance to broaden its product lines. For instance, the global market for advanced composites in construction was valued at approximately $20 billion in 2023 and is projected to grow significantly.

The increasing demand for more durable and sustainable materials, such as recycled plastics and low-carbon concrete, is a major trend. By 2025, the sustainable building materials market is expected to reach over $400 billion globally, driven by environmental regulations and consumer preference.

The building materials distribution sector is undergoing a significant digital transformation, with contractors and builders increasingly relying on online channels to source products. This shift necessitates that ADENTRA enhance its digital presence through comprehensive online catalogs and user-friendly mobile applications. In 2024, e-commerce sales in the construction sector were projected to reach over $1.5 trillion globally, highlighting the critical need for robust digital strategies to capture market share and meet evolving customer demands.

Technological advancements are significantly reshaping supply chain management for companies like ADENTRA. The integration of AI-driven forecasting, for instance, is becoming crucial for predicting demand with greater accuracy, minimizing stockouts and overstocking. In 2024, the global supply chain management market was valued at over $25 billion, with technology adoption being a key driver of growth.

Real-time tracking systems, powered by IoT devices, offer unprecedented visibility into goods movement, allowing ADENTRA to monitor shipments, identify delays proactively, and improve delivery timelines. Warehouse automation, including robotics and automated guided vehicles (AGVs), is also enhancing operational efficiency by speeding up order fulfillment and reducing labor costs. Companies investing in these areas saw an average of 15% reduction in logistics costs in recent studies.

Building Information Modeling (BIM) and Prefabrication

The increasing adoption of Building Information Modeling (BIM) is revolutionizing construction project planning by enabling digital representation and collaboration. This technology streamlines design, construction, and operations, leading to greater efficiency and fewer errors. For instance, BIM adoption in the US is projected to reach 70% by 2025, indicating a significant shift in industry practices.

The parallel trend towards prefabrication in construction means more building components are manufactured off-site in controlled environments. This approach enhances quality control and reduces on-site construction time. Prefabricated construction market growth is substantial, with global revenues expected to exceed $250 billion by 2028, demonstrating its rising importance.

These technological shifts directly impact companies like ADENTRA, which supply architectural components. ADENTRA must adapt its inventory management and logistics to cater to the demand for standardized, pre-manufactured elements. This might involve offering components optimized for BIM workflows and ensuring timely delivery to off-site fabrication facilities.

- BIM adoption in the US is expected to reach 70% by 2025.

- The global pre-fabricated construction market is projected to surpass $250 billion by 2028.

- ADENTRA needs to align its product offerings with BIM standards.

- Logistics must be optimized for off-site manufacturing and just-in-time delivery.

Automation and Robotics in Construction

The construction industry is increasingly embracing automation and robotics, transforming everything from prefabrication to on-site assembly. This shift directly influences the demand for specific building materials and significantly boosts installation efficiency. For ADENTRA, this means their product designs and delivery strategies must anticipate seamless integration with these advanced construction methods to remain competitive.

The adoption of automation is not just a trend; it's a fundamental change. For instance, the global construction robotics market was valued at approximately $3.5 billion in 2023 and is projected to reach over $8 billion by 2030, indicating substantial growth. This technological advancement impacts how materials are handled, processed, and installed, requiring manufacturers like ADENTRA to adapt their offerings.

- Robotic Prefabrication: Automated systems in factories can produce building components with higher precision and speed, potentially altering demand for traditional materials.

- On-Site Automation: Drones for surveying, autonomous vehicles for material transport, and robotic arms for bricklaying are becoming more common, streamlining processes.

- Integration Challenges: ADENTRA's products may need to be designed with interfaces or specifications that allow for easy handling and installation by automated construction equipment.

- Efficiency Gains: By 2025, it's estimated that automation could reduce construction project timelines by up to 20% and labor costs by 15%, a significant driver for adoption.

Technological advancements are driving innovation in construction materials, with a growing emphasis on sustainability and performance. ADENTRA can leverage these trends by incorporating advanced composites and eco-friendly options into its product lines, aligning with a market that valued advanced composites at around $20 billion in 2023 and anticipates the sustainable building materials market to exceed $400 billion by 2025.

The digital transformation of the building materials distribution sector is critical, as online channels become primary sourcing points for contractors. ADENTRA must bolster its digital presence, including user-friendly mobile applications, to capture a share of the construction e-commerce market, which was projected to surpass $1.5 trillion globally in 2024.

Supply chain efficiency is being revolutionized by technologies like AI-driven forecasting and IoT real-time tracking, which can reduce logistics costs by an average of 15%. Furthermore, the increasing adoption of Building Information Modeling (BIM), expected to reach 70% in the US by 2025, and the rise of prefabrication, with a market projected to exceed $250 billion by 2028, necessitate that ADENTRA adapt its product offerings and logistics to support these modern construction methodologies.

Automation and robotics are fundamentally changing construction processes, from prefabrication to on-site assembly, with the global construction robotics market projected to grow from $3.5 billion in 2023 to over $8 billion by 2030. ADENTRA's product design and delivery strategies must accommodate integration with automated equipment to maintain competitiveness and capitalize on efficiency gains that could reduce project timelines by up to 20%.

Legal factors

ADENTRA must navigate a complex web of building codes and safety standards across North America. For instance, the International Building Code (IBC) 2024, adopted by many U.S. jurisdictions, along with evolving provincial codes in Canada, dictates stringent requirements for material performance, fire resistance, and structural integrity. Ensuring ADENTRA's product lines consistently meet these evolving legal mandates is crucial for market access and maintaining product quality.

ADENTRA faces increasing environmental regulations impacting its material sourcing, manufacturing, and waste management. For instance, by the end of 2024, the EU is expected to finalize new directives on extended producer responsibility, potentially increasing compliance costs for companies like ADENTRA that import goods. Failure to adhere to these evolving standards, such as those for sustainable forestry or chemical usage in manufacturing, could lead to significant fines and operational disruptions.

Maintaining compliance, particularly with certifications like Forest Stewardship Council (FSC) for wood products, is paramount for ADENTRA's legal standing and public image. In 2023, the global market for certified wood products saw continued growth, with FSC-certified forest area reaching over 200 million hectares, underscoring the increasing demand for responsibly sourced materials. ADENTRA's commitment to these standards not only ensures legal adherence but also strengthens its brand reputation among environmentally conscious consumers and business partners.

Labor laws significantly impact ADENTRA's operational costs and human resource strategies across its North American facilities. Minimum wage adjustments, worker safety mandates, and evolving employment standards directly influence labor expenses and necessitate ongoing adaptation of HR practices. For instance, in 2024, many US states saw minimum wage increases, with some reaching $16 or higher, directly affecting ADENTRA's payroll in those regions.

Changes in regulations, such as new overtime rules or updated safety protocols, can lead to increased compliance costs and potentially require investments in training or equipment. These shifts directly affect ADENTRA's ability to manage its workforce efficiently and maintain competitive labor costs throughout its distribution network.

Trade and Import/Export Laws

Trade and import/export laws significantly shape ADENTRA's operational capacity, influencing how it sources materials and distributes finished goods across North America. Tariffs, customs duties, and various import/export restrictions directly impact the cost and flow of products. For instance, the U.S. government's ongoing review of trade policies, including potential adjustments to tariffs on goods from various countries, could introduce cost volatility for ADENTRA's supply chain.

The U.S. trade landscape is dynamic, with the possibility of new tariffs or changes to existing ones posing a persistent concern for businesses like ADENTRA. These shifts can directly affect the landed cost of imported components and the competitiveness of exported products. For example, in 2024, ongoing trade negotiations and potential retaliatory tariffs between major economic blocs could indirectly influence ADENTRA's sourcing strategies and overall profitability.

- Tariff Volatility: Fluctuations in U.S. import tariffs can directly increase the cost of raw materials or finished goods for ADENTRA.

- Customs Regulations: Navigating complex customs procedures in both the U.S. and Canada requires diligent compliance to avoid delays and penalties.

- Import/Export Restrictions: Specific product categories may face import or export bans or quotas, impacting ADENTRA's product assortment and market access.

- Trade Agreements: Changes to trade agreements, such as potential renegotiations or the introduction of new accords, can alter market access and competitive dynamics for ADENTRA.

Consumer Protection and Product Liability Laws

Consumer protection laws mandate that ADENTRA ensures its architectural products are safe and free from defects. This means rigorous quality control throughout the manufacturing process, from material sourcing to final inspection. For instance, in 2024, the global construction materials market faced increased scrutiny regarding product safety standards, with regulatory bodies in North America and Europe issuing updated guidelines for building components.

Product liability laws hold ADENTRA accountable for any harm caused by its products. Failing to meet these standards can lead to costly lawsuits, reputational damage, and a loss of customer confidence. In 2023, the architectural products sector saw a notable rise in product liability claims, particularly concerning materials with undisclosed hazardous components, underscoring the critical need for transparency and compliance.

- Consumer Protection Compliance: ADENTRA must align with regulations like the Consumer Product Safety Act (CPSA) in Canada or similar legislation in its operating markets to guarantee product safety.

- Product Liability Risk Mitigation: Implementing robust testing protocols and clear warranty statements helps ADENTRA minimize exposure to product liability claims, which in 2024, saw an average settlement cost of over $500,000 for defective building materials.

- Reputational Impact: Adherence to these laws is paramount for maintaining customer trust and brand integrity, especially as consumer awareness of product safety and manufacturer responsibility continues to grow.

ADENTRA must adhere to a complex framework of intellectual property laws to protect its designs and innovations. This includes patent filings for new manufacturing processes or unique product features, as well as copyright for marketing materials and technical documentation. In 2024, the global intellectual property market continued to grow, with companies increasingly leveraging patents to secure competitive advantages in specialized sectors like architectural materials.

Compliance with data privacy regulations, such as GDPR and CCPA, is essential for ADENTRA's customer interactions and internal data management. Protecting customer information from breaches and ensuring transparent data usage are legal imperatives that build trust. By 2025, the average cost of a data breach is projected to exceed $5 million globally, highlighting the financial risks associated with non-compliance.

ADENTRA's operations are subject to various financial regulations, including those governing accounting practices, tax compliance, and corporate governance. Adherence to standards like GAAP or IFRS, and timely tax filings, are critical for maintaining financial integrity and investor confidence. For instance, in 2024, regulatory bodies worldwide continued to emphasize transparency in financial reporting, with increased scrutiny on sustainability disclosures.

| Legal Area | Key Regulations/Considerations | Impact on ADENTRA | 2024/2025 Data Point |

|---|---|---|---|

| Building Codes & Safety | International Building Code (IBC) 2024, Provincial Codes (Canada) | Ensuring product compliance with structural, fire resistance, and material performance standards. | IBC adoption by numerous U.S. states and Canadian provinces. |

| Environmental Regulations | Extended Producer Responsibility (EU), Sustainable Forestry, Chemical Usage | Compliance with sourcing, manufacturing, and waste management standards to avoid fines and disruptions. | Expected finalization of EU EPR directives by end of 2024. |

| Intellectual Property | Patents, Copyrights, Trademarks | Protecting proprietary designs and innovations to maintain market advantage. | Global IP market growth in 2024, with increased patent filings. |

| Data Privacy | GDPR, CCPA | Secure customer data management and transparent data usage practices. | Projected average cost of data breach to exceed $5 million globally by 2025. |

| Financial Regulations | GAAP/IFRS, Tax Compliance, Corporate Governance | Maintaining financial integrity and investor confidence through accurate reporting. | Increased regulatory emphasis on financial reporting transparency in 2024. |

Environmental factors

Climate change is increasingly driving demand for resilient construction. For instance, in 2024, regions experienced significant weather-related damage, leading to a surge in demand for repair and rebuilding materials. This trend is expected to continue, with projections indicating a rise in the need for specialized roofing and weatherproofing solutions.

ADENTRA can capitalize on this by focusing on durable, weather-resistant products. The increasing frequency of events like severe storms and flooding, which saw billions in damages in 2024 alone, necessitates building materials that can withstand harsher conditions. This presents a clear opportunity for ADENTRA to expand its offerings in this critical market segment.

The construction sector's increasing focus on sustainability directly fuels demand for eco-friendly materials. ADENTRA’s strategy, which includes sourcing from renewable and recyclable resources and holding FSC certification, positions it well to meet this growing market need.

Concerns about resource scarcity, especially for common building materials like lumber and concrete, are increasingly impacting the construction industry. For instance, in 2024, the U.S. experienced significant price fluctuations for lumber, with futures contracts seeing considerable volatility due to supply chain disruptions and increased demand. ADENTRA must proactively manage its material sourcing to mitigate these risks, ensuring consistent access to necessary components.

Exploring alternative and sustainable materials is crucial for ADENTRA's long-term strategy. As global awareness of environmental impact grows, demand for green building solutions is projected to rise. The global sustainable building materials market was valued at over $200 billion in 2023 and is expected to grow substantially in the coming years, presenting an opportunity for ADENTRA to innovate and secure its supply chain.

Waste Management and Recycling Initiatives

The construction industry, a key sector for ADENTRA, is increasingly focused on reducing waste and boosting recycling. This trend directly impacts material choices and how waste is handled. For instance, many regions are implementing stricter regulations on landfilling construction debris, pushing companies towards more sustainable disposal methods.

ADENTRA actively participates in minimizing its environmental impact through internal recycling programs and the adoption of electronic invoicing. These initiatives not only reduce paper consumption but also streamline operations, contributing to a more efficient and eco-conscious business model.

- Growing emphasis on circular economy principles within construction is driving demand for recycled and recyclable building materials.

- ADENTRA's commitment to electronic invoicing, implemented across its operations, significantly reduces paper waste and associated carbon emissions from printing and distribution.

- The company's internal recycling programs aim to divert a substantial portion of operational waste from landfills, aligning with broader environmental goals and potentially reducing disposal costs.

Energy Efficiency Standards in Buildings

Evolving energy efficiency standards for buildings are a significant environmental driver. These regulations encourage the adoption of materials that enhance insulation and lower energy usage in both residential and commercial structures. For instance, the U.S. Department of Energy's 2024 Building Energy Codes Program continues to push for higher performance standards, impacting construction material choices.

ADENTRA can strategically leverage this trend by focusing its distribution on energy-efficient architectural products. This includes advanced insulation materials, high-performance windows, and sustainable building components that meet or exceed new code requirements. Such a focus aligns with market demand and regulatory pressures.

- Growing Demand for Green Building Materials: The global green building materials market was valued at approximately $297.1 billion in 2023 and is projected to grow significantly.

- Impact of Building Codes: Stricter energy codes, such as those implemented in various U.S. states in 2023-2024, mandate improved thermal performance, boosting demand for insulation and efficient windows.

- ADENTRA's Opportunity: By stocking and promoting products that offer superior R-values or U-factors, ADENTRA can capture market share from builders and developers seeking compliance and long-term operational savings for their clients.

The increasing frequency and severity of extreme weather events, such as those observed in 2024 with record-breaking heatwaves and intense storms, are driving demand for resilient construction materials. This trend directly impacts ADENTRA by creating a need for products that can withstand harsher environmental conditions, offering opportunities in repair and new builds designed for durability.

ADENTRA's focus on sustainable sourcing and its FSC certification position it favorably to meet the growing demand for eco-friendly building materials. The global market for these materials, valued at over $200 billion in 2023, continues to expand as environmental consciousness rises, presenting a clear avenue for growth and innovation.

Concerns over resource scarcity, exemplified by lumber price volatility in 2024, necessitate proactive material management. ADENTRA's exploration of alternative and sustainable materials is crucial for mitigating supply chain risks and ensuring consistent access to components, aligning with the projected substantial growth in the green building materials sector.

Evolving energy efficiency standards, such as those continuously updated by the U.S. Department of Energy, are a significant environmental driver. ADENTRA can strategically capitalize on this by distributing energy-efficient architectural products, including advanced insulation and high-performance windows, to meet regulatory demands and market preferences for sustainable construction.

| Environmental Factor | Impact on Construction | ADENTRA's Strategic Response |

|---|---|---|

| Climate Change & Extreme Weather | Increased demand for resilient, weather-resistant materials. Billions in damages from weather events in 2024 highlight this need. | Focus on durable products; expand offerings in weatherproofing solutions. |

| Sustainability & Eco-friendly Materials | Growing market for green building solutions, driven by environmental awareness. Global market valued over $200 billion in 2023. | Leverage sourcing from renewable/recyclable resources and FSC certification. |

| Resource Scarcity & Volatility | Price fluctuations and supply chain disruptions for key materials like lumber (e.g., 2024 volatility). | Proactive material sourcing; explore alternative and sustainable materials. |

| Energy Efficiency Standards | Mandates for improved building insulation and lower energy usage, pushing demand for specific materials. | Distribute energy-efficient architectural products like advanced insulation and high-performance windows. |

PESTLE Analysis Data Sources

Our ADENTRA PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable market research reports, and leading economic indicators. We ensure each factor is supported by current and credible information.