Adcock Ingram SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

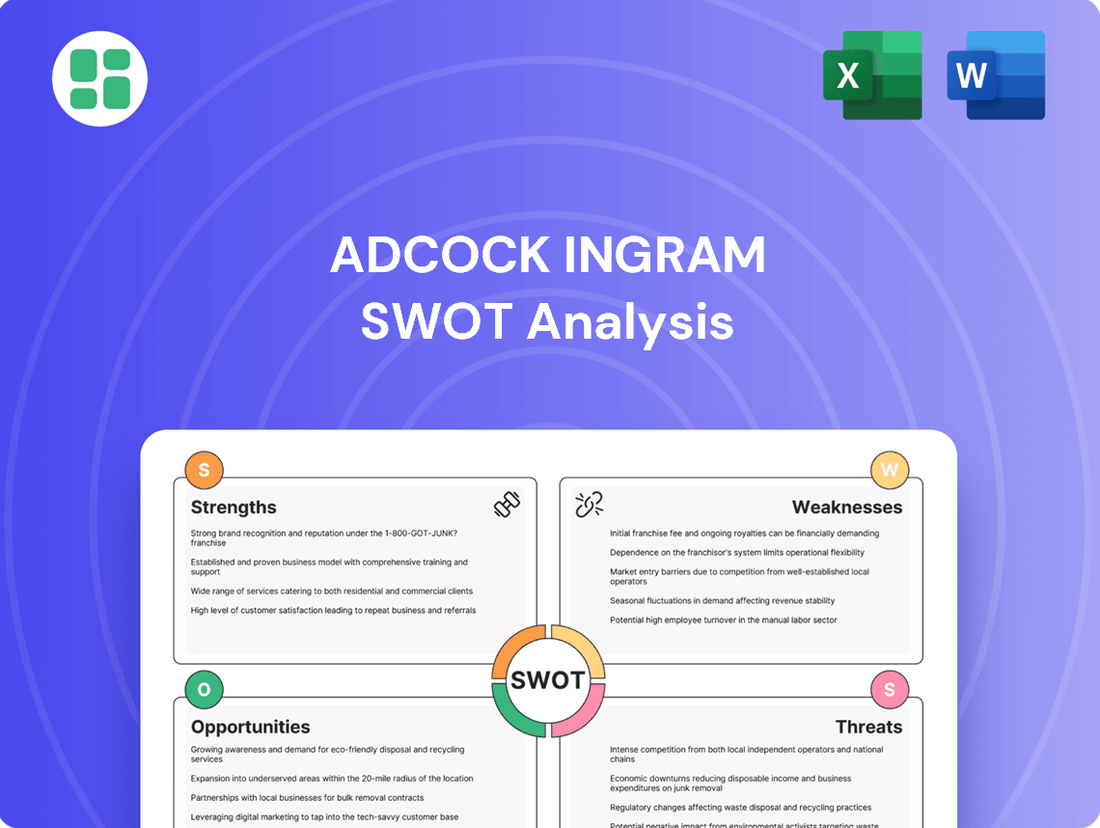

Adcock Ingram's market position is shaped by a dynamic interplay of strong brand recognition and a robust product portfolio, yet it faces challenges from evolving regulatory landscapes and intense competition. Understanding these internal capabilities and external pressures is crucial for strategic planning.

Want the full story behind Adcock Ingram's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Adcock Ingram commands a leading position in the South African private pharmaceutical market, consistently ranking among the top players. This strong market standing, evidenced by its significant market share in key therapeutic areas, provides a formidable competitive edge and a stable platform for continued growth. The company's extensive reach within the domestic market has cultivated a deeply entrenched sales and distribution infrastructure, facilitating efficient product delivery and market penetration.

Adcock Ingram's diverse product portfolio is a significant strength, encompassing prescription drugs, over-the-counter (OTC) medications, hospital products, and consumer goods. This broad offering allows the company to serve a wide array of healthcare needs across both public and private sectors in South Africa and other key markets.

This diversification strategy effectively mitigates risks by reducing dependence on any single product category or market segment. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram reported revenue growth across its various divisions, demonstrating the resilience provided by its comprehensive product mix.

Adcock Ingram's manufacturing strength is anchored by three key facilities situated close to Johannesburg, bolstering its local production prowess. This strategic placement ensures efficient distribution and responsiveness within South Africa.

Expanding its reach, the company holds a significant 49% interest in an Indian joint venture, which operates two additional manufacturing plants. This global footprint, as of the latest available data, enhances its supply chain resilience and market access, particularly for key product lines.

This integrated manufacturing network is fundamental to Adcock Ingram's strategy of delivering affordable healthcare. By controlling a substantial portion of its production, the company can better manage costs and mitigate risks associated with import reliance.

Strategic Partnerships and Acquisitions

Adcock Ingram's strategic partnerships and acquisitions are a significant strength, enabling them to broaden their product portfolio and expand their market presence. The company actively seeks out collaborations and takes over businesses that align with its growth objectives.

A prime example is their 2024 collaboration with Convatec, which focuses on bringing advanced medical products to market. This partnership is designed to leverage Convatec's expertise in areas like ostomy and wound care, complementing Adcock Ingram's existing offerings. Furthermore, the acquisition of the Dermopal brand in 2024 signals a move into the growing dermatological segment, strengthening their position in a high-demand sector.

- Strategic Expansion: Partnerships and acquisitions allow Adcock Ingram to enter new, high-growth market segments.

- Portfolio Enhancement: These moves directly contribute to a more comprehensive and competitive product range.

- Market Reach: Collaborations and acquisitions are key drivers for increasing geographical and customer base penetration.

Commitment to Affordability and Accessibility

Adcock Ingram's commitment to affordability and accessibility is a significant strength, deeply embedded in its business model. The company offers a broad range of generic medicines, directly addressing the market's need for cost-effective healthcare solutions. This strategy resonates strongly with South African government initiatives aimed at making healthcare more accessible to the wider population.

This focus on affordability not only meets a critical market demand but also enhances Adcock Ingram's social value proposition. For instance, in the fiscal year ending March 31, 2024, the company reported that its generics segment continued to be a key driver of volume growth, contributing significantly to its overall market share. This demonstrates a tangible impact of their accessible pricing strategy.

- Focus on Generic Medicines: Adcock Ingram's extensive portfolio of generic pharmaceuticals makes essential treatments more affordable for a larger segment of the population.

- Alignment with National Healthcare Goals: The company's strategy supports South Africa's public health objectives by providing cost-effective medication options.

- Market Demand Fulfillment: Prioritizing affordability directly addresses a substantial and ongoing demand for budget-friendly healthcare products.

- Social Value Proposition: By making healthcare accessible, Adcock Ingram builds goodwill and strengthens its reputation as a socially responsible entity.

Adcock Ingram's robust market position, particularly in the South African private pharmaceutical sector, is a cornerstone of its strength. This leadership is underpinned by a significant market share across various therapeutic areas, providing a stable revenue base. Its extensive distribution network ensures efficient product delivery and deep market penetration, a crucial advantage in the healthcare industry.

The company's diversified product portfolio, spanning prescription drugs, OTC medications, and consumer health products, effectively mitigates risk. This broad offering caters to a wide spectrum of healthcare needs, enhancing resilience against sector-specific downturns. For the fiscal year ending March 31, 2024, Adcock Ingram reported continued volume growth in its generics segment, highlighting the strength of its accessible product strategy.

Adcock Ingram's integrated manufacturing capabilities, including three South African facilities and a stake in Indian operations, bolster its supply chain and cost management. This local production prowess, combined with strategic global partnerships like the one with Convatec in 2024, enhances its ability to deliver affordable and innovative healthcare solutions.

| Strength Area | Description | Supporting Data/Example |

|---|---|---|

| Market Leadership | Dominant position in South African private pharmaceutical market. | Consistently ranks among top players; significant market share in key therapeutic areas. |

| Product Diversification | Broad product portfolio across prescription, OTC, and consumer health. | Mitigates risk; fiscal year ending March 31, 2024, saw strong volume growth in generics. |

| Manufacturing & Supply Chain | Integrated production facilities in South Africa and India. | Strategic partnerships, e.g., Convatec collaboration in 2024, enhance capabilities. |

| Affordability Focus | Emphasis on generic medicines and cost-effective solutions. | Supports public health goals and meets substantial market demand for budget-friendly options. |

What is included in the product

Delivers a strategic overview of Adcock Ingram’s internal capabilities and external market dynamics, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Adcock Ingram's strategic challenges and opportunities.

Weaknesses

Adcock Ingram's financial health is closely tied to the South African economy. When consumers have less disposable income due to high inflation or economic slowdowns, they tend to cut back on non-essential purchases, directly affecting sales of many of Adcock Ingram's products. This sensitivity means that challenging economic periods can significantly hinder the company's ability to grow and maintain stable operations.

Adcock Ingram has faced substantial operational difficulties, particularly at its Wadeville manufacturing site. These issues have directly resulted in lower production volumes, which in turn have squeezed the company's gross profit margins.

These production bottlenecks create inefficiencies in the supply chain and drive up operational expenses. For instance, in the fiscal year ending June 30, 2023, the company reported a decline in its gross profit margin, partly attributed to these manufacturing challenges.

Resolving these production constraints is vital for Adcock Ingram to boost its overall profitability and ensure it can consistently meet market demand for its products.

Adcock Ingram's domestic growth faces a significant hurdle due to South Africa's single-exit pricing (SEP) mechanism. This regulation severely limits pricing flexibility, making it difficult to pass on increased input costs or improve profit margins.

This reliance on price-controlled segments directly constrains revenue expansion opportunities. For instance, in the fiscal year ending March 31, 2024, Adcock Ingram reported that the regulated pricing environment continued to present challenges, impacting the profitability of its South African operations.

Impact of Reduced Inventory Holdings

Adcock Ingram is facing challenges stemming from reduced inventory levels held by pharmaceutical wholesalers. This has resulted in a noticeable slowdown in the company's order intake.

The core issue appears to be that wholesalers are selling more to pharmacies than they are ordering from Adcock Ingram, creating a bottleneck. This imbalance can directly translate into lower production volumes for Adcock Ingram.

The impact of these reduced inventory holdings extends to Adcock Ingram's financial performance, potentially leading to unfavorable effects on its gross margins. For instance, if production scales back significantly, fixed costs spread over fewer units could increase per-unit costs.

- Order Slowdown: Wholesalers' reduced stock levels are directly impacting Adcock Ingram's order flow.

- Channel Disconnect: Pharmacy sales from wholesalers exceed wholesaler orders from Adcock Ingram.

- Production Impact: Lower order volumes necessitate reduced production schedules.

- Margin Pressure: Decreased output and potential inefficiencies can negatively affect gross profit margins.

Exposure to Currency Volatility

Adcock Ingram's profitability can be significantly impacted by currency volatility, particularly concerning its foreign currency-denominated product acquisitions. Adverse movements in forward exchange contract rates have directly affected the company's gross margins. This highlights a key weakness in its operational model, especially considering the pharmaceutical sector's heavy reliance on imported raw materials and finished goods.

The company's financial performance is thus susceptible to fluctuations in global exchange rates. For instance, during the fiscal year ending June 30, 2023, the rand experienced periods of weakness against major currencies, which would have put pressure on companies like Adcock Ingram with substantial import costs. Effectively managing these currency risks is therefore paramount to safeguarding and improving its profit margins.

- Currency Exposure: Adcock Ingram faces risks from its reliance on imported goods, making its gross margins vulnerable to unfavorable exchange rate movements.

- Impact on Margins: Adverse changes in forward exchange contract rates have demonstrably reduced gross profit in the past.

- Industry Dependence: The pharmaceutical industry's need for imported raw materials and finished products amplifies this currency-related vulnerability.

- Risk Management Necessity: Robust currency risk management strategies are crucial for maintaining financial stability and profitability.

Adcock Ingram's profitability is directly impacted by South Africa's single-exit pricing mechanism, which restricts its ability to adjust prices and pass on increased costs. This regulatory environment, as seen in the fiscal year ending March 31, 2024, limits revenue expansion opportunities for its domestic operations.

Operational inefficiencies, particularly at the Wadeville manufacturing site, have led to reduced production volumes and squeezed gross profit margins, as evidenced by the decline in the fiscal year ending June 30, 2023.

Furthermore, reduced inventory levels held by pharmaceutical wholesalers have slowed order intake, potentially impacting production schedules and gross margins due to lower output and increased per-unit costs.

The company's reliance on imported goods exposes its gross margins to currency volatility; for example, during the fiscal year ending June 30, 2023, rand weakness likely pressured margins on imported products.

| Weakness | Impact | Supporting Data/Observation |

|---|---|---|

| Pricing Restrictions (SEP) | Limited revenue growth and profit margin expansion | Fiscal year ending March 31, 2024, reported challenges with regulated pricing. |

| Operational Inefficiencies (Wadeville) | Reduced production volumes and lower gross profit margins | Fiscal year ending June 30, 2023, noted decline in gross profit margins due to manufacturing issues. |

| Wholesaler Inventory Reduction | Slowed order intake and potential production/margin impact | Reduced order flow and potential increase in per-unit costs if production scales back. |

| Currency Volatility | Pressure on gross margins from imported goods | Fiscal year ending June 30, 2023, saw rand weakness impacting import costs. |

Same Document Delivered

Adcock Ingram SWOT Analysis

This is the actual Adcock Ingram SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the comprehensive report. Unlock the full, detailed analysis by completing your purchase.

Opportunities

The South African pharmaceutical market is seeing a substantial rise in demand for generic drugs, largely due to their affordability and government initiatives promoting accessible healthcare. This trend offers a significant growth avenue for Adcock Ingram, especially considering its broad range of generic medications.

In 2023, the South African generics market was valued at approximately R25 billion, with a projected compound annual growth rate of 7% through 2028. Adcock Ingram’s established presence and diverse generic portfolio position it well to leverage this expanding market, potentially increasing its market share and overall revenue.

Adcock Ingram's significant presence in Southern Africa presents a solid foundation for venturing into wider African markets, which are experiencing substantial growth in the pharmaceutical sector. Projections indicate continued expansion, offering Adcock Ingram opportunities to diversify revenue streams and capture new market share.

The broader African pharmaceutical market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 9.5% between 2023 and 2028, reaching an estimated value of over $60 billion by 2028. This robust growth trajectory underscores the potential for Adcock Ingram to replicate its success in new territories.

Furthermore, the strategic stake acquisition by Natco Pharma in Adcock Ingram in late 2023 can serve as a crucial catalyst, potentially unlocking new distribution channels and market access within other African nations, thereby facilitating a more seamless and efficient expansion.

Adcock Ingram is actively seeking strategic acquisitions and partnerships to expand its product range, especially in areas with less stringent price controls. This approach is evident in their recent acquisition of Natco Pharma's South African operations and their continued collaboration with Medline, a global healthcare company.

These inorganic growth strategies are designed to tap into new market segments and bolster their existing product portfolio. For instance, the Natco Pharma deal, valued at approximately R3.5 billion (around $190 million USD based on recent exchange rates), significantly strengthens Adcock Ingram's oncology and specialty medicine offerings.

Rising Healthcare Expenditure and Awareness

South Africa's healthcare sector is experiencing robust growth, driven by increased public and private spending. This expansion is fueled by a rising middle class and a significant uptick in health consciousness among the population, directly translating into a larger market for pharmaceuticals and healthcare products. For instance, total healthcare expenditure in South Africa was estimated to be around R236 billion in 2024, a figure projected to climb further.

Government efforts to bolster the national healthcare infrastructure are also playing a crucial role. These initiatives aim to improve access and quality of care, creating a more favorable environment for companies like Adcock Ingram. This strategic focus on healthcare system enhancement directly supports market expansion and presents clear avenues for growth.

Adcock Ingram is strategically positioned to capitalize on these burgeoning opportunities. The company's established presence and diverse product portfolio align well with the increasing demand for healthcare solutions. This favorable market dynamic, characterized by rising expenditure and enhanced awareness, offers significant potential for Adcock Ingram’s sustained development and increased market share in the coming years.

- Increased Healthcare Spending: South Africa's healthcare expenditure is on an upward trajectory, creating a larger addressable market.

- Growing Health Awareness: A more health-conscious populace drives demand for Adcock Ingram's pharmaceutical and healthcare offerings.

- Government Support: Initiatives to strengthen healthcare systems provide a supportive ecosystem for industry players.

Support for Local Pharmaceutical Manufacturing

The South African government's push for local pharmaceutical manufacturing presents a significant opportunity. Initiatives like the Department of Trade, Industry and Competition's (DTIC) Master Plan for the Pharmaceuticals and Medical Devices Sector aim to bolster domestic production, with a target of increasing local content to 70% by 2030. Adcock Ingram's established manufacturing footprint in South Africa is well-positioned to benefit from these supportive policies.

This strategic alignment with national objectives could translate into several advantages:

- Increased Production Capacity: Leveraging existing facilities to meet growing local demand, potentially reducing reliance on imports which currently account for a substantial portion of the market.

- Supply Chain Resilience: Diminishing vulnerabilities associated with international supply chains, as highlighted by disruptions experienced during the COVID-19 pandemic.

- Government Incentives: Potential access to tax credits, grants, and other financial support mechanisms designed to encourage local investment and job creation within the sector.

- Market Share Growth: Capitalizing on government procurement preferences and a growing consumer preference for locally manufactured goods, thereby expanding market share.

Adcock Ingram is well-positioned to capitalize on the increasing demand for generic drugs in South Africa, a market valued at approximately R25 billion in 2023 and projected to grow at 7% annually. The company's extensive generic portfolio and established presence allow it to benefit from government initiatives promoting affordable healthcare. Furthermore, expansion into other African markets, projected to grow at a CAGR of 9.5% through 2028, presents a significant opportunity for revenue diversification and market share growth, especially with the strategic backing from Natco Pharma.

The company is also actively pursuing strategic acquisitions and partnerships to broaden its product offerings, particularly in areas with less price sensitivity. For instance, the acquisition of Natco Pharma's South African operations for approximately R3.5 billion enhances Adcock Ingram's specialty medicine portfolio. Coupled with increasing healthcare spending in South Africa, estimated at R236 billion in 2024, and a growing health-conscious population, these strategies create a robust environment for sustained development.

The South African government's commitment to boosting local pharmaceutical manufacturing, targeting 70% local content by 2030, offers Adcock Ingram a distinct advantage. Its existing manufacturing capabilities can leverage this policy to increase production, enhance supply chain resilience, potentially access government incentives, and grow market share by catering to local demand and preferences.

| Opportunity Area | Market Data/Fact | Adcock Ingram's Position |

|---|---|---|

| Generic Drug Market Growth | South African generics market valued at ~R25 billion (2023), projected 7% CAGR. | Extensive generic portfolio, established market presence. |

| African Market Expansion | African pharma market projected >$60 billion by 2028, 9.5% CAGR (2023-2028). | Existing Southern Africa footprint, potential for broader reach with Natco Pharma stake. |

| Strategic Acquisitions/Partnerships | Natco Pharma SA acquisition (~R3.5 billion) bolsters specialty offerings. | Actively pursuing inorganic growth to expand product range and market access. |

| Increased Healthcare Spending | South Africa's healthcare expenditure ~R236 billion (2024). | Benefiting from a larger addressable market due to rising public and private spending. |

| Local Pharmaceutical Manufacturing | Government target: 70% local content by 2030. | Established manufacturing footprint well-positioned to benefit from supportive policies and incentives. |

Threats

The South African pharmaceutical sector is a battleground with both domestic companies and global giants vying for market dominance. This intense competition, especially in the crucial generic and biosimilar segments, consistently puts pressure on pricing, potentially eroding profit margins and market share for established players like Adcock Ingram.

In 2024, the South African pharmaceutical market’s growth is projected to be around 6-8%, a figure that underscores the high demand but also the crowded nature of the industry. Adcock Ingram faces the challenge of not only competing on price but also on innovation and product differentiation to secure and expand its position.

The pharmaceutical sector, including Adcock Ingram, faces significant threats from strict regulatory oversight and pricing limitations. In South Africa, the single-exit pricing (SEP) mechanism, for instance, dictates how medicines are priced, impacting potential revenue streams.

While annual price adjustments are permitted, these controls inherently cap the company's ability to fully capitalize on market demand or to expand margins on key products. This regulatory environment can hinder profitability, especially for established or essential medicines where price flexibility is most constrained.

South Africa's persistent high unemployment, hovering around 32.9% in Q1 2024 according to Stats SA, directly squeezes consumer disposable income. This economic pressure significantly dampens demand for healthcare products, impacting Adcock Ingram's sales volumes across various brands.

Sustained economic headwinds, including elevated inflation and interest rates, further erode consumer purchasing power. This creates a challenging market environment where discretionary spending on non-essential healthcare items, even those from established brands, is likely to decline, directly affecting Adcock Ingram's revenue streams.

Vulnerability to Supply Chain Disruptions

Adcock Ingram's reliance on imported pharmaceutical products makes it vulnerable to global supply chain disruptions. South Africa's market, in general, sees a significant portion of its medicines sourced internationally, meaning events like port delays or geopolitical issues can directly impact Adcock Ingram's ability to supply its products. For instance, port congestion issues in 2023 led to noticeable impacts on organic volumes for many in the sector.

These disruptions can translate into tangible financial consequences. Companies face the risk of stockouts, which directly affect sales and customer satisfaction. Furthermore, increased shipping costs and potential price hikes on imported raw materials or finished goods can erode profit margins. The volatility in global logistics and raw material pricing presents a persistent threat to profitability and operational stability for Adcock Ingram.

- Global Sourcing Dependency: A significant percentage of Adcock Ingram's product portfolio relies on international sourcing, exposing it to global logistics challenges.

- Impact of Port Delays: Past port congestion incidents have demonstrably affected the company's organic sales volumes, highlighting the sensitivity of its operations.

- Cost Volatility: Fluctuations in international shipping rates and raw material prices directly influence Adcock Ingram's cost of goods sold and overall profitability.

Potential Delisting from the JSE

A significant threat to Adcock Ingram is the potential delisting from the Johannesburg Stock Exchange (JSE). This could stem from an offer by Natco Pharma to acquire a substantial stake. For instance, if Natco's stake reaches a threshold requiring a mandatory offer to all shareholders, and if this leads to a privatization, delisting becomes a real possibility.

While becoming a private entity might offer strategic advantages, such as reduced regulatory burdens and increased operational flexibility, it presents a significant downside for existing minority shareholders. Delisting would likely diminish the liquidity of their holdings, making it harder to buy or sell Adcock Ingram shares. This could impact the market valuation of their investment.

Furthermore, a delisting would fundamentally alter Adcock Ingram's public reporting and corporate governance framework. The stringent disclosure requirements and shareholder oversight inherent to being a publicly traded company would be replaced by private company norms, potentially affecting transparency and accountability for all stakeholders.

Key considerations regarding potential delisting:

- Reduced Liquidity: Minority shareholders may find it challenging to exit their investment post-delisting.

- Governance Shift: Public reporting obligations and shareholder accountability would change significantly.

- Strategic Flexibility: A private structure could allow for quicker decision-making and less public scrutiny.

- Market Perception: Delisting can sometimes be perceived negatively by the broader investment community.

Intense competition within the South African pharmaceutical market, particularly in generics and biosimilars, exerts constant pricing pressure, potentially squeezing Adcock Ingram's profit margins. Economic downturns, evidenced by South Africa's Q1 2024 unemployment rate of 32.9%, reduce consumer spending power, directly impacting sales volumes for healthcare products.

Adcock Ingram's reliance on imported goods makes it susceptible to global supply chain disruptions, as seen with past port congestion issues affecting organic volumes. Furthermore, regulatory pricing controls, like the single-exit pricing mechanism, limit revenue potential and hinder margin expansion on key products.

SWOT Analysis Data Sources

This Adcock Ingram SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a robust understanding of both internal capabilities and external market dynamics.