Adcock Ingram Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

Adcock Ingram's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any strategic decision.

The complete Porter's Five Forces Analysis delves deep into each of these pressures, offering a comprehensive view of Adcock Ingram's market position and potential vulnerabilities. Unlock actionable insights to navigate this complex environment.

Ready to move beyond the basics? Get a full strategic breakdown of Adcock Ingram’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Adcock Ingram's reliance on a concentrated group of API suppliers, primarily in China and India, grants these suppliers significant leverage. In 2024, global API production remained heavily skewed towards these regions, with limited alternative sourcing options readily available for pharmaceutical companies like Adcock Ingram.

This dependency means that fluctuations in raw material costs or supply chain disruptions from these key API manufacturers can directly translate to increased production expenses for Adcock Ingram. The critical nature of APIs in drug formulation amplifies the bargaining power of these limited suppliers, impacting Adcock Ingram's cost structure and operational continuity.

High switching costs significantly bolster the bargaining power of suppliers to Adcock Ingram. For critical pharmaceutical ingredients, the process of changing suppliers isn't as simple as finding a new vendor; it involves navigating complex and costly regulatory hurdles. These include rigorous re-approval processes and extensive validation studies to ensure product quality and safety remain consistent. In 2024, the pharmaceutical industry continued to face stringent regulatory oversight, making any supplier change a lengthy and expensive undertaking.

These substantial barriers to switching mean Adcock Ingram faces considerable expenses and potential delays if it attempts to qualify new sources for its essential raw materials. The imperative to maintain unwavering product quality and adhere to strict regulatory compliance, such as Good Manufacturing Practices (GMP), severely restricts Adcock Ingram's flexibility in choosing alternative suppliers. This dependency on established, validated suppliers inherently strengthens their negotiating position.

Suppliers of pharmaceutical raw materials face rigorous international and local Good Manufacturing Practices (GMP) and other regulatory mandates. This necessity to comply narrows the field of potential suppliers to those with established quality systems, significantly boosting the leverage of these specialized and certified vendors. For instance, in 2024, the global pharmaceutical excipients market, a key raw material sector, was valued at approximately $10.5 billion, with growth driven by stringent quality demands.

Proprietary Technology and Patents

Proprietary technology and patents held by suppliers can significantly amplify their bargaining power. When Adcock Ingram relies on specialized raw materials or components protected by patents, these suppliers gain considerable leverage. This is especially true for innovative pharmaceutical ingredients or unique manufacturing processes that are critical to Adcock Ingram's product efficacy and market differentiation.

For instance, if a key active pharmaceutical ingredient (API) is exclusively produced using a patented synthesis method, the patent holder can command premium pricing. This situation restricts Adcock Ingram's ability to source the input elsewhere, forcing them to accept the supplier's terms. The cost of these patented inputs directly impacts Adcock Ingram's cost of goods sold and overall profitability.

- Patented Inputs: Suppliers of unique, patented pharmaceutical ingredients or excipients can dictate terms due to their exclusive production capabilities.

- Limited Alternatives: The absence of generic or alternative sources for these proprietary materials leaves Adcock Ingram with little room for negotiation on price or supply conditions.

- Impact on Margins: Higher costs for patented inputs directly squeeze Adcock Ingram's gross profit margins on affected products.

- Innovation Dependence: Adcock Ingram's reliance on supplier innovation for advanced drug formulations further strengthens the supplier's position.

Efforts for Local Sourcing

Adcock Ingram is actively exploring local sourcing for Active Pharmaceutical Ingredients (APIs) in South Africa, aiming to lessen its dependence on imports. However, this strategic move is in its nascent stages and requires substantial capital investment to establish robust local manufacturing capabilities. Until these local production capacities are fully developed, the company will continue to face considerable bargaining power from its international API suppliers.

The success of these local sourcing efforts holds the potential to gradually diminish the influence of global suppliers over time. For instance, in 2024, the pharmaceutical industry globally saw continued supply chain disruptions, highlighting the vulnerability of companies reliant on single-source international suppliers. South Africa's initiative to boost local API production, supported by government incentives, aims to build resilience, though the timeline for significant impact remains a key consideration for Adcock Ingram's supplier negotiation strategy.

- Local API Manufacturing: A strategic imperative for South Africa to reduce import reliance, still facing significant investment hurdles in 2024.

- Supplier Bargaining Power: Adcock Ingram remains exposed to international suppliers until local API production capacity matures.

- Mitigation Potential: Long-term success in local sourcing could eventually reduce supplier leverage.

- Industry Context: Global supply chain vulnerabilities in 2024 underscore the importance of diversifying API sources.

Adcock Ingram's suppliers hold significant bargaining power due to the critical nature of pharmaceutical ingredients and the high costs associated with switching. The limited number of qualified API manufacturers, primarily located in China and India, restricts Adcock Ingram's options. This concentration, evident in 2024, means suppliers can often dictate terms, impacting Adcock Ingram's production costs and supply chain stability.

The stringent regulatory environment, including Good Manufacturing Practices (GMP), further concentrates supplier power. Only a select few suppliers meet these rigorous standards, making it difficult and expensive for Adcock Ingram to find and validate new sources. This dependency, coupled with proprietary technology held by some suppliers, allows them to command premium prices, directly affecting Adcock Ingram's profitability.

While Adcock Ingram is exploring local API sourcing in South Africa to reduce reliance, this initiative is still in its early stages and requires substantial investment. Until local production capacity matures, the company remains vulnerable to the bargaining power of its international suppliers, a situation highlighted by global supply chain disruptions observed in 2024.

| Factor | Impact on Adcock Ingram | 2024 Context |

| Supplier Concentration | Limited sourcing options increase supplier leverage. | Dominance of China and India in API production. |

| Switching Costs | High regulatory and validation expenses deter supplier changes. | Continued stringent pharmaceutical regulations globally. |

| Proprietary Technology | Patented ingredients allow suppliers to set premium prices. | Key for innovative drug formulations. |

| Local Sourcing Efforts | Potential to reduce reliance but requires significant investment. | South Africa's nascent API production initiatives. |

What is included in the product

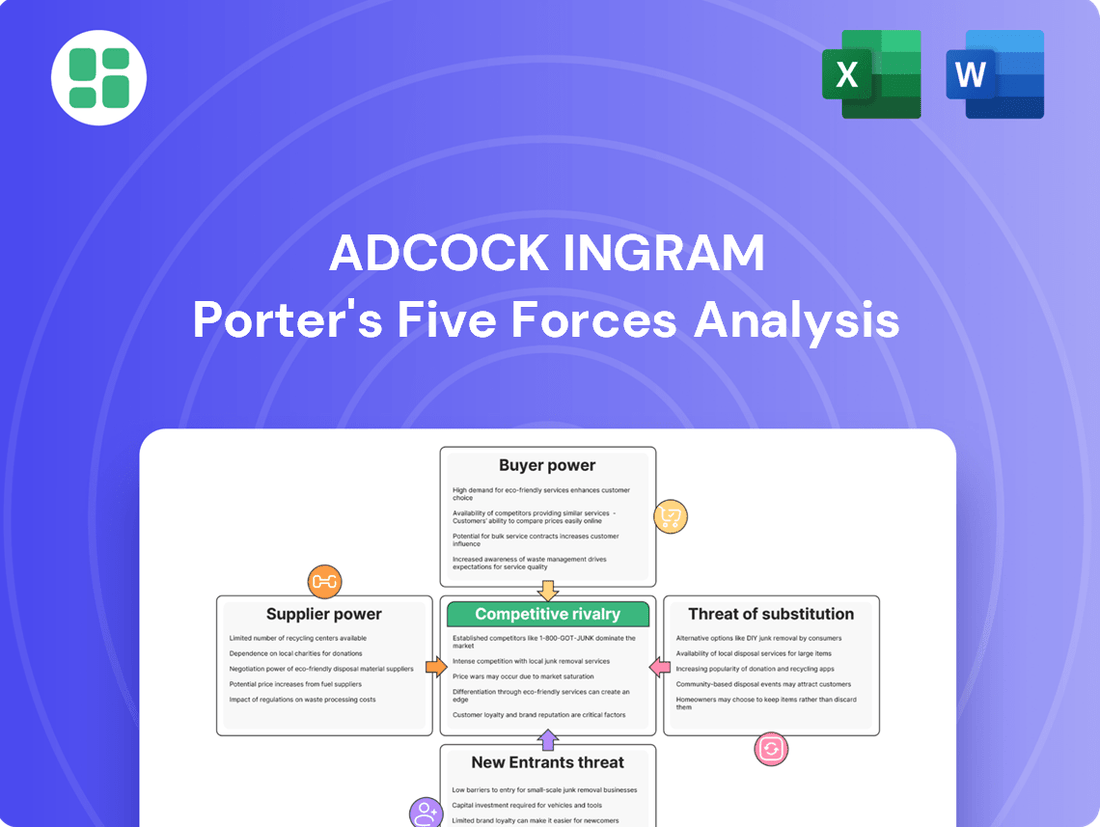

Adcock Ingram's Porter's Five Forces analysis dissects the competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the pharmaceutical sector.

Easily identify and address competitive threats with a visual representation of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Adcock Ingram's diverse customer base, spanning public sector healthcare, private hospitals, pharmacies, and individual consumers, presents a complex demand landscape. The public sector, in particular, is poised to become a more consolidated purchasing force with the anticipated implementation of the National Health Insurance (NHI) scheme.

This centralization of demand within the public sector, a key market for Adcock Ingram, significantly amplifies the bargaining power of these institutional buyers. Their ability to negotiate as a large bloc allows them to exert considerable influence over pricing and contractual terms, potentially impacting Adcock Ingram's revenue and profit margins.

Customers, especially in the public sector and among those watching their spending, are very sensitive to price. This is fueling a greater need for generic medicines that are more affordable. Adcock Ingram's commitment to providing healthcare that is both accessible and budget-friendly places it squarely in a market where price heavily influences buying choices.

In 2024, the demand for generics continued to surge as healthcare costs remained a significant concern for many South Africans. This trend is further amplified by medical aid increases, which push private patients to seek out more cost-effective treatment options. For instance, the South African generic market has seen consistent growth, with some reports indicating it accounts for over 70% of prescription volumes, highlighting the critical role price plays in customer decisions.

South African regulations, particularly those mandating pharmacists to offer generic alternatives, significantly boost the bargaining power of customers. This policy directly increases competition for Adcock Ingram's branded products by providing readily available, often more affordable, substitutes.

Consumers can easily opt for generics if they perceive a better value proposition, directly impacting Adcock Ingram's pricing power and market share for its branded pharmaceuticals. For instance, in 2023, the generic substitution rate in South Africa continued to rise, with certain therapeutic classes seeing substitution rates exceeding 60%, highlighting the tangible impact on branded product sales.

Wholesaler and Pharmacy Influence

Pharmaceutical wholesalers and major pharmacy chains wield substantial bargaining power as key intermediaries in Adcock Ingram's distribution network. Their decisions on inventory levels and purchasing directly impact Adcock Ingram's sales volumes and profitability. For instance, a reduction in inventory held by these entities can lead to decreased order sizes and potentially lower gross margins for the company.

The purchasing power of these large customers is significant, allowing them to negotiate favorable terms and pricing. This can put pressure on Adcock Ingram's revenue streams and market access. Their ability to switch suppliers or consolidate their purchasing further amplifies their influence.

- Wholesaler Power: Large pharmaceutical wholesalers manage extensive distribution networks, controlling product flow to pharmacies and healthcare providers.

- Pharmacy Chain Influence: Major pharmacy chains, with their significant market share, can dictate terms and product placement, impacting Adcock Ingram's sales.

- Inventory Management Impact: Reduced inventory holdings by these intermediaries can directly constrain Adcock Ingram's sales volumes and affect gross margins.

- Purchasing Decisions: The collective purchasing power of these entities significantly influences Adcock Ingram's market penetration and overall revenue generation.

Access to Information and Digital Health

The increasing accessibility of health information online and the proliferation of digital health tools are significantly boosting the bargaining power of customers. Patients can now readily research and compare various medication options, leading to more informed decisions and a greater ability to negotiate pricing or seek alternatives. For instance, in 2024, the global digital health market was valued at over $200 billion, demonstrating the widespread adoption of these technologies that empower consumers.

Patient portals and mobile health applications are central to this shift, fostering a more patient-centric approach to healthcare. These platforms enable individuals to actively manage their health, understand treatment pathways, and even track the efficacy of different medications. This enhanced engagement translates into a stronger negotiating position, whether for individual consumers directly or for healthcare providers acting as their advocates.

- Informed Decision-Making: Digital platforms provide easy access to comparative drug information and patient reviews.

- Patient Empowerment: Mobile apps and portals allow patients to actively participate in their treatment choices.

- Market Transparency: Increased information access drives greater transparency in drug pricing and availability.

- Provider Advocacy: Healthcare providers leverage digital tools to negotiate better terms for their patients.

The bargaining power of customers for Adcock Ingram is considerable, driven by price sensitivity and regulatory support for generics. The anticipated National Health Insurance (NHI) scheme in South Africa is set to consolidate public sector purchasing, amplifying their negotiation leverage. In 2024, the demand for affordable generics remained high, with medical aid increases pushing more patients towards cost-effective options, a trend supported by regulations mandating generic offers by pharmacists.

Wholesalers and large pharmacy chains also exert significant influence due to their substantial purchasing volumes and control over distribution. Their ability to negotiate favorable terms can impact Adcock Ingram's sales and margins. Furthermore, increased online health information access empowers consumers, allowing them to compare options and negotiate pricing more effectively, a trend amplified by the global digital health market's growth exceeding $200 billion in 2024.

Same Document Delivered

Adcock Ingram Porter's Five Forces Analysis

This preview showcases the complete Adcock Ingram Porter's Five Forces Analysis, reflecting the identical, professionally formatted document you will receive instantly upon purchase. You'll gain immediate access to a comprehensive breakdown of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products, all ready for your strategic planning needs.

Rivalry Among Competitors

The South African pharmaceutical arena is a battleground, with Adcock Ingram facing formidable competition from both local giants and global powerhouses. Leading domestic rivals like Aspen Pharmacare and Cipla South Africa, along with international players such as Sanofi, are all actively competing for significant market share. This intense rivalry spans across prescription drugs, over-the-counter medicines, hospital supplies, and consumer health products.

This dynamic landscape means Adcock Ingram must continually innovate and manage costs effectively to maintain its position. For instance, in 2024, the South African pharmaceutical market continued to see robust growth, driven by an increasing demand for healthcare services and new product introductions, further intensifying the competitive pressures on all participants.

The pharmaceutical landscape is increasingly characterized by a surge in generic drug competition, a trend amplified by government initiatives prioritizing affordable healthcare solutions. This dynamic places significant pressure on established players like Adcock Ingram, as price becomes a crucial factor in market penetration and customer acquisition.

In 2024, the global generics market continued its robust growth trajectory, with projections indicating a compound annual growth rate of approximately 7.5% through 2028. This expansion is fueled by patent expirations of blockbuster drugs and a heightened focus on cost containment within healthcare systems worldwide.

Adcock Ingram, with its broad product range, faces intensified rivalry within this generic segment. The company must strategically manage its pricing and operational efficiencies to remain competitive against a growing number of generic manufacturers, many of whom operate with lower overheads and can offer products at more aggressive price points.

The South African pharmaceutical sector operates under significant regulatory oversight, particularly concerning drug pricing. For instance, the Department of Health's reference pricing system, implemented to control healthcare costs, directly impacts how companies like Adcock Ingram can price their products. This creates a challenging environment where pricing flexibility is severely curtailed, forcing a greater reliance on non-price-based competition such as product innovation and marketing efforts.

The price controls on essential medicines within South Africa's pharmaceutical market inherently limit avenues for substantial revenue growth. Consequently, companies are often compelled to seek expansion opportunities in less regulated product categories, such as over-the-counter (OTC) drugs or specialized medical devices. This strategic shift intensifies competition within these less regulated spaces as firms vie for market share against a backdrop of already constrained pricing in core areas.

In 2024, the South African pharmaceutical market continued to grapple with these pricing pressures. While specific figures for Adcock Ingram's price-controlled segments are proprietary, the broader industry trend indicates that companies focusing on generic and essential medicines faced tighter margins. This regulatory landscape fuels intense rivalry, driving companies to differentiate through service, distribution efficiency, and brand reputation rather than aggressive pricing strategies.

Product Differentiation and Innovation

Competitive rivalry in the pharmaceutical sector, including for Adcock Ingram, is significantly shaped by product differentiation. Companies strive to stand out through innovation, robust brand building, and demonstrating superior therapeutic efficacy. This focus on unique product attributes allows firms to capture market share and foster customer loyalty, especially in consumer-facing segments.

Investment in research and development (R&D) is a critical driver of this differentiation. For instance, in 2023, the South African pharmaceutical market saw significant R&D expenditure, with companies aiming to develop novel treatments and improve existing ones. This innovation pipeline directly impacts a company's ability to command premium pricing and build a competitive moat.

- Brand Strength: Adcock Ingram's established brands, particularly in over-the-counter (OTC) and consumer health, benefit from high consumer recognition and trust, providing a buffer against price-based competition.

- Therapeutic Efficacy: Demonstrating superior clinical outcomes and patient benefits for prescription drugs is a key differentiator, often supported by extensive clinical trial data.

- R&D Investment: Companies like Adcock Ingram allocate substantial resources to R&D to develop new formulations, delivery systems, and novel drug candidates, aiming to secure a competitive edge.

- Marketing and Promotion: Effective marketing campaigns that highlight product benefits and build brand equity are essential for differentiating in a crowded marketplace.

Strategic Acquisitions and Partnerships

The competitive landscape is constantly shifting as companies pursue strategic acquisitions and partnerships to broaden their offerings and customer base. Adcock Ingram has been actively involved in this, recently acquiring stakes in other entities, demonstrating a clear strategy for growth and industry consolidation.

These strategic maneuvers directly influence market leadership and the overall competitive intensity within the pharmaceutical sector. For instance, in late 2023, Adcock Ingram announced the acquisition of a significant stake in a complementary pharmaceutical business, aiming to strengthen its position in specific therapeutic areas.

- Strategic Acquisitions: Companies like Adcock Ingram actively acquire smaller players or complementary businesses to gain market share and new product lines.

- Partnerships: Collaborations with other firms, including joint ventures or licensing agreements, allow companies to share risks and access new technologies or markets.

- Impact on Rivalry: These actions can intensify competition by creating larger, more formidable competitors or by opening up new market segments.

- Market Consolidation: The trend towards acquisitions and partnerships often leads to a more consolidated market, where fewer, larger companies hold significant sway.

Competitive rivalry is a defining characteristic of the South African pharmaceutical market, impacting Adcock Ingram significantly. The presence of strong local players like Aspen Pharmacare and international giants such as Sanofi means Adcock Ingram faces intense competition across its product portfolio. This rivalry is further exacerbated by regulatory pricing controls, particularly on essential medicines, which limits pricing flexibility and pushes companies to compete on non-price factors like innovation and brand building.

The growing prominence of generic drugs, driven by healthcare affordability initiatives, intensifies this rivalry. In 2024, the global generics market continued its expansion, with projections suggesting a compound annual growth rate of around 7.5% through 2028. This trend forces Adcock Ingram to focus on operational efficiencies and strategic pricing to remain competitive against lower-cost generic manufacturers.

Adcock Ingram's competitive strategy involves leveraging its established brands, investing in R&D for product differentiation, and pursuing strategic acquisitions. For example, in late 2023, the company bolstered its market position through a significant stake acquisition in a complementary pharmaceutical business. These actions aim to enhance market share and build a stronger competitive moat in an increasingly dynamic sector.

The competitive intensity is also fueled by strategic maneuvers like mergers, acquisitions, and partnerships. These activities can reshape market leadership and create larger, more formidable competitors. In 2024, ongoing consolidation within the South African pharmaceutical sector underscored the drive for scale and market dominance among key players.

SSubstitutes Threaten

The most significant threat of substitution for Adcock Ingram stems from generic medications. South African regulations require pharmacists to offer cheaper generic alternatives to branded prescription drugs. This has caused a substantial shift, with generics capturing a larger market share, directly impacting the sales of Adcock Ingram's patented products.

In 2023, the South African pharmaceutical market saw generics continue to gain traction. While specific market share data for Adcock Ingram's branded versus generic sales isn't publicly detailed, industry reports indicate a consistent year-on-year increase in generic penetration across key therapeutic areas. This trend underscores the ongoing pressure on branded drug revenues.

Consumers increasingly turn to over-the-counter (OTC) drugs and self-medication for common health issues, bypassing prescription routes. This shift is fueled by the convenience and lower cost of readily available remedies. For instance, the global OTC market was valued at approximately $150 billion in 2023 and is projected to grow steadily.

The expanding reach of e-commerce platforms further simplifies access to these self-care options, making them an even more attractive alternative. While Adcock Ingram benefits from its own strong position in the OTC and consumer health sectors, these readily available substitutes pose a challenge to its prescription-based business segments.

In South Africa, traditional and complementary medicines pose a nuanced substitution threat to conventional pharmaceutical products. Many consumers turn to these alternatives for certain health concerns due to cultural accessibility and perceived efficacy, diverting potential demand away from mainstream offerings.

While not subject to the same stringent regulatory oversight as pharmaceuticals, the widespread use of these alternatives is significant. For instance, a 2024 report indicated that an estimated 70% of South Africans rely on traditional medicine to some extent, highlighting a substantial portion of the market where substitutes are actively sought.

Lifestyle Interventions and Preventative Healthcare

The increasing focus on preventative healthcare and lifestyle interventions presents a significant threat of substitutes for traditional pharmaceutical treatments. As individuals and healthcare systems prioritize wellness programs, early detection, and proactive health management, the demand for certain reactive medications could diminish. For instance, a growing trend in wearable technology and digital health platforms empowers consumers to monitor their health and make lifestyle adjustments, potentially reducing the need for prescription drugs to manage conditions like hypertension or type 2 diabetes.

This shift towards proactive health management is supported by substantial growth in the digital health market. By 2024, the global digital health market was valued at over $300 billion, with projections indicating continued expansion. This growth signifies a tangible move towards solutions that aim to prevent illness rather than solely treat it, thereby acting as a direct substitute for some of Adcock Ingram's core product offerings.

- Growing Emphasis on Preventative Care: Public health initiatives and individual choices are increasingly geared towards preventing diseases through diet, exercise, and early screening, reducing reliance on pharmaceutical interventions.

- Digital Health Solutions: Platforms offering remote patient monitoring, personalized wellness plans, and health tracking provide accessible alternatives for managing chronic conditions, substituting for traditional medication adherence.

- Lifestyle Interventions: Programs focused on behavioral changes, such as smoking cessation or weight management, directly address disease causes and can lessen the long-term need for drugs.

- Reduced Demand for Reactive Treatments: As preventative measures become more effective and widespread, the market for certain reactive pharmaceutical treatments may experience a decline in demand.

Technological Advancements in Diagnostics and Treatment

Technological advancements in diagnostics and treatment pose a significant threat of substitution for pharmaceutical companies like Adcock Ingram. Innovations such as AI-powered diagnostic tools can enable earlier disease detection, potentially reducing the reliance on long-term drug therapies. For example, advancements in genetic sequencing and personalized medicine are offering alternative approaches to managing chronic conditions.

These emerging technologies, while still developing, represent a growing challenge to traditional drug-based treatment models. The increasing sophistication of non-pharmacological interventions, including advanced medical devices and digital health solutions, could further erode the market share of pharmaceutical products. By 2024, the global digital health market was valued at over $200 billion, indicating a strong and growing demand for these alternative solutions.

- AI in Diagnostics: AI algorithms are improving the accuracy and speed of diagnosing conditions, potentially reducing the need for certain drug treatments.

- Non-Pharmacological Treatments: The rise of medical devices, therapies, and wellness programs offers alternatives to medication for various ailments.

- Personalized Medicine: Tailored treatment plans based on genetics and lifestyle may decrease reliance on broad-spectrum pharmaceuticals.

- Digital Health Growth: The rapidly expanding digital health sector provides platforms for remote monitoring and intervention, substituting for some in-person medical services and prescriptions.

The rise of generic medications remains a primary substitute threat for Adcock Ingram, driven by South African regulations mandating the offering of cheaper alternatives. This has led to a significant market share shift towards generics, directly impacting the sales of Adcock Ingram's branded products.

Furthermore, the growing consumer preference for over-the-counter (OTC) drugs and self-medication for common ailments presents another substitution challenge. The global OTC market, valued at approximately $150 billion in 2023, continues to expand, fueled by convenience and lower costs, particularly with the increasing accessibility through e-commerce platforms.

Traditional and complementary medicines also represent a notable substitute, with an estimated 70% of South Africans relying on them to some extent in 2024, diverting demand from conventional pharmaceuticals.

The increasing focus on preventative healthcare, supported by a global digital health market exceeding $300 billion in 2024, offers alternatives to traditional drug treatments by promoting wellness and lifestyle interventions.

| Substitute Category | Impact on Adcock Ingram | Key Drivers | 2023/2024 Data Point |

|---|---|---|---|

| Generic Medications | Directly erodes market share of branded products | Regulatory mandates, cost-consciousness | Continued year-on-year increase in generic penetration in SA |

| OTC & Self-Medication | Reduces demand for prescription drugs for common ailments | Convenience, lower cost, e-commerce accessibility | Global OTC market ~ $150 billion (2023) |

| Traditional & Complementary Medicine | Diverts potential demand for certain health concerns | Cultural accessibility, perceived efficacy | ~70% of South Africans rely on traditional medicine to some extent (2024) |

| Preventative Care & Digital Health | Decreases reliance on reactive pharmaceutical treatments | Wellness focus, lifestyle interventions, health tracking | Global digital health market > $300 billion (2024) |

Entrants Threaten

The pharmaceutical sector demands immense capital for research and development, sophisticated manufacturing plants, and broad distribution channels. These substantial initial outlays act as a major deterrent for new players, as only a select few can afford to enter the market on equal footing.

For instance, in 2024, the global pharmaceutical R&D spending reached an estimated $240 billion, highlighting the sheer financial commitment required. This barrier effectively shields established companies like Adcock Ingram from immediate, widespread competition.

The South African Health Products Regulatory Authority (SAHPRA) imposes demanding and often protracted approval procedures for drug registration, clinical trials, and Good Manufacturing Practices (GMP) compliance. This complexity, requiring specialized knowledge and considerable time, acts as a significant deterrent to new market entrants.

Adcock Ingram leverages deeply entrenched distribution channels, reaching extensively into both public and private healthcare systems. For new competitors, replicating this intricate network, which includes pharmacies, hospitals, and government tenders, presents a formidable barrier.

The significant capital and time investment required to establish comparable reach makes market entry particularly challenging.

Furthermore, Adcock Ingram benefits from considerable brand loyalty, a crucial factor in a market where trust and familiarity often dictate purchasing decisions. This loyalty means new entrants must not only offer competitive products but also overcome established consumer preferences.

Intellectual Property and Patent Protection

Existing patents held by established pharmaceutical players like Adcock Ingram significantly raise the barrier to entry. These patents protect novel drug formulations and manufacturing processes, making it incredibly challenging and costly for new companies to develop and launch competing products without facing infringement claims. For instance, in 2024, the pharmaceutical industry globally continued to see substantial investment in R&D, with patent protection remaining a cornerstone of recouping these investments.

While South Africa's intellectual property framework has been a subject of discussion, it still offers a level of protection that acts as a deterrent to direct replication of patented medicines. This legal landscape means that potential new entrants must either invest heavily in developing entirely new, non-infringing compounds or navigate complex licensing agreements, both of which are significant hurdles.

The threat of new entrants is therefore somewhat mitigated by the robust patent portfolios of incumbents. This is particularly true for innovative, high-margin drugs where patent exclusivity can last for many years, effectively shielding a company's market share.

- Patent Exclusivity: Pharmaceutical patents typically grant market exclusivity for 20 years from the filing date, though effective market life is often shorter due to development and regulatory timelines.

- R&D Investment: Global pharmaceutical R&D spending in 2023 reached over $200 billion, underscoring the significant investment required to create patentable innovations.

- South African IP Landscape: While reforms have been proposed, the existing patent laws in South Africa still provide grounds for legal action against infringement, deterring many potential market entrants.

Economies of Scale and Experience Curve Advantages

Established players like Adcock Ingram leverage significant economies of scale in manufacturing, procurement, and distribution. This allows them to achieve lower unit costs, a crucial advantage in the competitive pharmaceutical sector. For instance, in 2024, major pharmaceutical manufacturers often operate plants with capacities exceeding 100 million units annually, enabling substantial cost reductions per item.

The experience curve also plays a vital role. Adcock Ingram's long-standing presence translates into operational efficiencies, refined marketing strategies, and a deeper understanding of regulatory compliance. New entrants face a steep learning curve and would find it challenging to replicate these accumulated efficiencies and cost advantages from the outset.

These inherent advantages create a formidable barrier for potential new entrants. They would need to invest heavily to achieve comparable scale and would likely operate at a cost disadvantage for a considerable period.

- Economies of Scale: Lower per-unit costs through large-scale production and purchasing power.

- Experience Curve: Improved efficiency and reduced costs from accumulated knowledge and optimized processes.

- Market Entry Barrier: Newcomers struggle to match established cost structures and operational expertise.

The threat of new entrants in the pharmaceutical sector, particularly for a company like Adcock Ingram, is significantly constrained by high capital requirements for R&D and manufacturing, coupled with stringent regulatory approvals. These factors necessitate substantial upfront investment and specialized expertise, making market entry a formidable challenge for newcomers. Furthermore, established players benefit from strong brand loyalty and extensive distribution networks, which are difficult and costly to replicate.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution | Deters entry due to financial risk | Global pharmaceutical R&D spending: ~$240 billion |

| Regulatory Hurdles | Complex approval processes (SAHPRA) for drugs and manufacturing | Increases time-to-market and compliance costs | Protracted drug registration timelines |

| Distribution Networks | Entrenched access to public and private healthcare systems | Difficult and expensive for new players to match reach | Extensive pharmacy, hospital, and tender access |

| Brand Loyalty & Patents | Established trust and patent protection on innovative drugs | Requires significant marketing and legal effort to overcome | 20-year patent exclusivity (effective market life shorter) |

| Economies of Scale | Lower unit costs due to large-scale operations | New entrants face cost disadvantages | Annual plant capacities often >100 million units |

Porter's Five Forces Analysis Data Sources

Our Adcock Ingram Porter's Five Forces analysis is built upon a foundation of robust data, including Adcock Ingram's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific research from reputable market intelligence firms and publicly available competitor financial data to provide a comprehensive view of the competitive landscape.