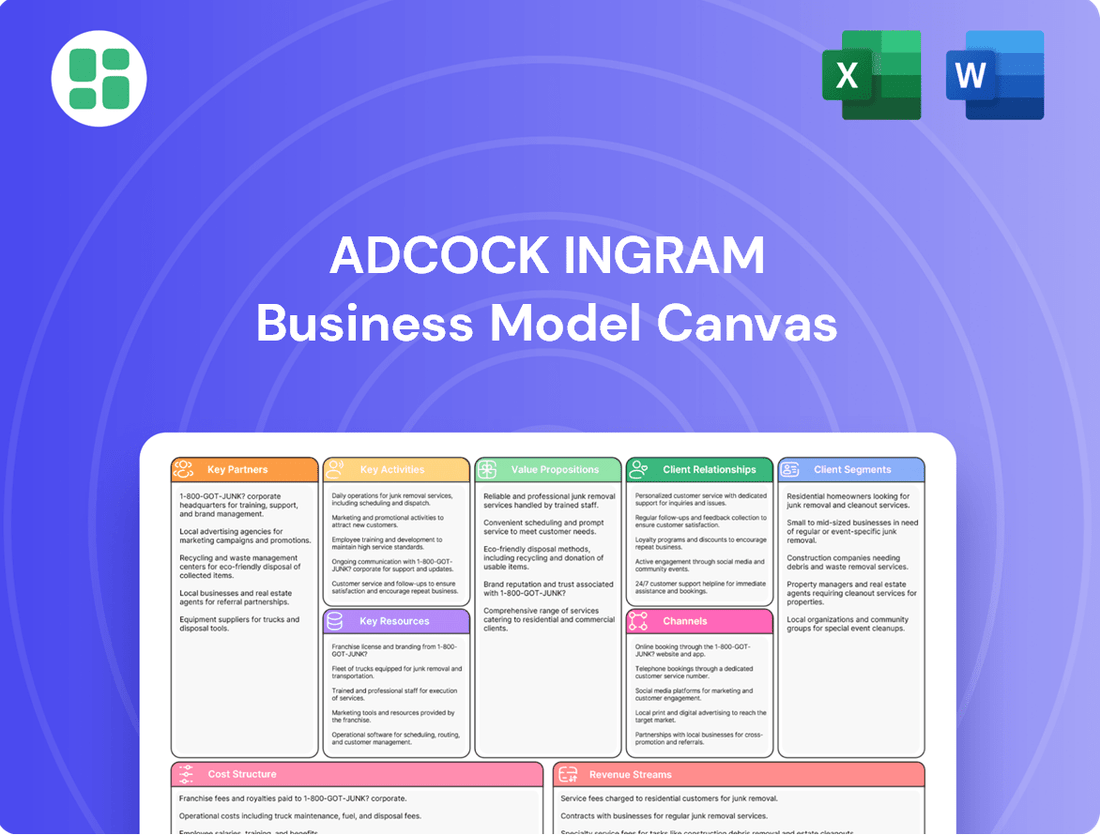

Adcock Ingram Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

Discover the strategic framework behind Adcock Ingram's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for aspiring leaders. Unlock the full blueprint to understand how they consistently deliver value and maintain market dominance.

Partnerships

Adcock Ingram's strategic partnerships with multinational pharmaceutical giants are foundational to its business model, enabling the company to license and distribute a wide array of innovative medicines. These collaborations are vital for bringing cutting-edge treatments, especially in niche therapeutic areas, to the South African and broader African markets.

A prime example of this strategy in action is Adcock Ingram's ongoing relationship with global leaders like Bristol Myers Squibb and Pfizer, which allows them to offer advanced oncology and cardiovascular treatments. For instance, in their 2023 fiscal year, Adcock Ingram reported that its Prescription business, heavily reliant on these licensing agreements, saw a revenue increase of 10%, underscoring the commercial success of these international alliances.

Adcock Ingram's success hinges on its key partnerships with suppliers and service providers. The company depends on a strong network of suppliers for critical raw materials, active pharmaceutical ingredients (APIs), and packaging components. These relationships are crucial for maintaining the high quality and consistency of their pharmaceutical products, a cornerstone of their business.

Furthermore, Adcock Ingram relies heavily on service providers, particularly in logistics and distribution. These partners are vital for ensuring efficient supply chain management and the timely delivery of products across South Africa and other operating regions. For instance, in the 2023 financial year, Adcock Ingram reported a significant portion of its cost of sales related to procurement, highlighting the importance of these supplier relationships for cost efficiency.

Adcock Ingram's key partnerships with public sector entities, including government health departments and public hospitals, are crucial for its business model. These collaborations enable the company to secure significant supply agreements, such as participating in large-volume parenteral tenders, which are vital for revenue generation and market penetration within the public healthcare system.

These partnerships are not just about sales; they underscore Adcock Ingram's commitment to making healthcare accessible and affordable. By supplying essential medicines and healthcare products to public institutions, the company directly contributes to the well-being of a broad segment of the population, aligning with its core mission.

Pharmaceutical Wholesale and Retail Channels

Adcock Ingram's key partnerships with major pharmaceutical wholesalers and retail pharmacy chains are fundamental to its distribution strategy. These include prominent players such as Clicks and Dis-Chem, ensuring their prescription and over-the-counter (OTC) medications reach a broad consumer base across South Africa. This extensive network is crucial for market penetration. In 2024, Adcock Ingram reported that its extensive distribution network, bolstered by these partnerships, contributed significantly to its market presence. The company also actively collaborates with independent pharmacies, further widening its reach and ensuring accessibility to its product portfolio in diverse geographic locations.

These strategic alliances are critical for Adcock Ingram's operational efficiency and market access. The company leverages these relationships to:

- Ensure widespread product availability: Partnerships with major wholesalers and retail chains guarantee that Adcock Ingram's medicines are readily accessible to patients and healthcare providers.

- Facilitate efficient supply chain management: Collaborations with wholesalers streamline the logistics of moving products from manufacturing to point-of-sale, reducing lead times and costs.

- Expand market reach: Engaging with both large retail chains and independent pharmacies allows Adcock Ingram to capture a significant share of both the private and public healthcare sectors.

- Drive sales and market penetration: The strong presence of partner pharmacies ensures that Adcock Ingram's brands are visible and available to a large customer base, directly impacting sales performance.

Strategic Investors and Co-Owners

The Bidvest Group Limited stands as Adcock Ingram's controlling shareholder, offering substantial strategic direction and crucial financial support. This partnership is foundational to Adcock Ingram's operational stability and growth initiatives, leveraging Bidvest's extensive resources and market expertise.

A significant recent development involves Natco Pharma's proposed acquisition of a substantial stake in Adcock Ingram. This move is strategically designed to broaden Adcock Ingram's reach into new geographical markets and enhance its product offerings, especially within the generics sector. The transaction also carries the potential for Adcock Ingram to be delisted from the Johannesburg Stock Exchange (JSE), transitioning to a privately held company.

- Bidvest Group Limited: Controlling shareholder providing strategic and financial backing.

- Natco Pharma Acquisition: Proposed acquisition of a substantial stake to expand geographical footprint and generics portfolio.

- Potential Delisting: Transaction may lead to Adcock Ingram operating as a privately held entity, delisted from the JSE.

Adcock Ingram's key partnerships with major pharmaceutical wholesalers and retail pharmacy chains, such as Clicks and Dis-Chem, are critical for ensuring widespread product availability and efficient distribution across South Africa. These alliances, bolstered by a robust network of independent pharmacies, significantly enhance market penetration and sales performance. For instance, in 2024, Adcock Ingram highlighted the integral role of its distribution partners in maintaining its strong market presence and accessibility.

| Partnership Type | Key Partners | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| Wholesalers & Retail Chains | Clicks, Dis-Chem | Widespread product availability, market penetration | Contributed significantly to market presence and sales. |

| Independent Pharmacies | Various | Expanded reach, diverse geographic access | Ensured accessibility to product portfolio in diverse locations. |

| Public Sector | Government Health Departments, Public Hospitals | Securing supply agreements, revenue generation | Vital for market penetration within the public healthcare system. |

What is included in the product

A detailed breakdown of Adcock Ingram's operations, outlining its key customer segments, value propositions, and revenue streams.

This model provides a strategic overview of Adcock Ingram's market approach and operational framework.

The Adcock Ingram Business Model Canvas offers a structured approach to identify and address critical business challenges by mapping out key value propositions and customer segments.

By visually representing the entire business, the Adcock Ingram Business Model Canvas helps pinpoint inefficiencies and areas for improvement, thereby alleviating operational pain points.

Activities

Adcock Ingram's primary focus is the manufacturing of a wide array of healthcare products. This encompasses everything from prescription medicines to everyday over-the-counter remedies, essential hospital supplies, and consumer health items. Their operations are centered around sophisticated production sites, such as their facilities located in Clayville and Wadeville.

Maintaining stringent quality control throughout the manufacturing process is paramount. Adcock Ingram's commitment to high production standards ensures that their diverse product range consistently meets regulatory requirements and consumer expectations. Efficient output is also a key driver, enabling them to effectively cater to the dynamic demands of the healthcare market.

Adcock Ingram’s commitment to Research, Development, and Product Innovation is a cornerstone of its strategy. The company actively invests in R&D to not only launch novel products but also to enhance its current offerings. A clear demonstration of this focus is the introduction of eleven new products during the financial year concluding in June 2024.

This dedication to innovation is crucial for Adcock Ingram to stay ahead in a dynamic healthcare landscape and to effectively meet the ever-changing needs of patients and healthcare providers. By consistently developing new solutions, the company solidifies its competitive position in the market.

Furthermore, Adcock Ingram leverages strategic collaborations to accelerate its innovation pipeline and broaden its product range. A notable example is its partnership with Convatec, which facilitates the introduction of advanced medical products, thereby diversifying the company's portfolio and bringing cutting-edge solutions to market.

Adcock Ingram leverages extensive marketing campaigns across its consumer, OTC, prescription, and hospital divisions. A strong sales force is crucial for promoting this diverse product portfolio.

The company's distribution network is designed for efficiency, ensuring products reach pharmacies, hospitals, and retail outlets. This network is a key enabler of their market reach.

Adcock Ingram actively works to expand its distribution channels, with a particular focus on penetrating informal markets, which represented a significant growth opportunity in 2024.

Supply Chain and Inventory Management

Adcock Ingram's key activities heavily rely on the efficient management of its supply chain. This involves everything from securing raw materials to ensuring products are available in warehouses and through wholesale networks.

Operational hurdles, such as aligning production with demand and dealing with wholesalers reducing their stock levels, directly affect the company's bottom line. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram reported a 10.3% increase in revenue to R17.7 billion, partly driven by improved supply chain performance and product availability, though managing inventory remains a constant focus.

Optimizing these intricate processes is paramount for controlling costs and guaranteeing that products reach consumers when and where they are needed.

- Sourcing and Procurement: Securing high-quality raw materials and finished goods efficiently.

- Logistics and Distribution: Managing the movement of goods from suppliers to Adcock Ingram's facilities and then to wholesale partners.

- Inventory Control: Balancing stock levels to meet demand without incurring excessive holding costs or stockouts.

- Demand Planning: Accurately forecasting market needs to align production and inventory.

Regulatory Compliance and Quality Assurance

Adcock Ingram's commitment to regulatory compliance is paramount, given its operations within the heavily regulated pharmaceutical sector. This involves meticulously adhering to all applicable laws and standards across the various markets it serves. For instance, in South Africa, the company actively engages with the South African Health Products Regulatory Authority (SAHPRA) to ensure all products meet stringent safety and efficacy requirements.

Maintaining high-quality standards is intrinsically linked to regulatory adherence. Adcock Ingram focuses on robust quality assurance processes throughout its value chain, from research and development to manufacturing and distribution. This dedication is reflected in its pursuit and maintenance of various certifications, underscoring its commitment to excellence and patient safety.

A key aspect of their compliance strategy includes achieving and sustaining certifications like Level 1 Broad-Based Black Economic Empowerment (B-BBEE) status in South Africa. This not only signifies adherence to local socio-economic legislation but also facilitates market access and strengthens stakeholder relationships. In 2024, Adcock Ingram continued to prioritize these regulatory and quality frameworks to ensure continued market trust and operational integrity.

- Adherence to SAHPRA regulations

- Maintaining Level 1 B-BBEE contributor status

- Ensuring product safety and efficacy through quality assurance

- Facilitating market access through compliance

Adcock Ingram's key activities revolve around manufacturing a diverse range of healthcare products, from prescription drugs to consumer health items, supported by robust R&D and product innovation, as evidenced by the launch of eleven new products in FY24. They also focus on expanding distribution, particularly into informal markets, and ensuring stringent regulatory compliance and quality assurance, maintaining their Level 1 B-BBEE status.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot of the comprehensive Adcock Ingram Business Model Canvas, ready for your use. You will gain full access to this professionally structured and detailed document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Adcock Ingram's manufacturing and production facilities, including major sites in Clayville and Wadeville, are the backbone of its operations. These plants are equipped for large-scale pharmaceutical formulation, enabling the company to meet significant market demand.

In 2024, Adcock Ingram continued to invest in its manufacturing infrastructure. For instance, the company reported capital expenditure of approximately R300 million towards upgrading and expanding its production capabilities, focusing on enhancing efficiency and ensuring compliance with stringent quality standards.

These physical assets are crucial for Adcock Ingram's ability to produce a wide array of products, from over-the-counter medicines to specialized hospital products. The ongoing maintenance and strategic upgrades of these facilities are paramount to overcoming operational hurdles and boosting production capacity to meet evolving healthcare needs.

Adcock Ingram’s diverse product portfolio, encompassing prescription, over-the-counter, hospital, and consumer healthcare items, is a cornerstone of its business. This extensive range includes popular brands such as Panado and Epi-max, demonstrating significant market penetration and consumer trust.

Complementing this product breadth is a robust intellectual property portfolio. This includes proprietary product formulations, valuable trademarks, and essential licenses for international brands like Skinoren, which are critical for maintaining competitive advantage and market access.

In 2024, Adcock Ingram reported that its consumer division, which heavily relies on these well-known brands, continued to be a significant contributor to revenue, showcasing the enduring strength and appeal of its diverse product offerings across various health and wellness segments.

Adcock Ingram's human capital is a cornerstone, encompassing skilled professionals in R&D, manufacturing, quality assurance, sales, marketing, and regulatory affairs. This diverse expertise is crucial for driving innovation, ensuring operational excellence, and effectively navigating market dynamics.

The company's commitment to investing in talent and continuous employee development directly fuels its strategic objectives. For instance, in fiscal year 2023, Adcock Ingram reported a significant investment in its workforce, underscoring the importance of human capital in achieving its growth and market leadership aspirations.

Extensive Distribution Network and Channels

Adcock Ingram's extensive distribution network is a cornerstone of its business model, ensuring its pharmaceutical and healthcare products reach a broad customer base. This network includes vital links to pharmaceutical wholesalers, thousands of retail pharmacies, and numerous hospitals across South Africa and other African markets. In 2024, the company continued to leverage this infrastructure to maintain product availability and meet the healthcare needs of a diverse population.

This widespread reach is a significant competitive advantage, enabling Adcock Ingram to effectively serve various market segments. The company's ability to efficiently deliver products across geographies is paramount for its operations. For instance, their presence in over 13,000 retail outlets in South Africa underscores the depth of this network.

- Widespread Reach: Access to over 13,000 retail pharmacy outlets in South Africa.

- Diverse Channels: Partnerships with pharmaceutical wholesalers, hospitals, and direct-to-consumer avenues.

- Timely Delivery: Ensuring efficient and prompt product availability across key African markets.

- Market Penetration: Facilitating access to a broad spectrum of healthcare consumers.

Financial Capital and Brand Reputation

Adcock Ingram's financial capital is a cornerstone of its business model. In the fiscal year ending June 30, 2023, the company reported revenue of R23.6 billion, demonstrating strong operational performance. Its robust cash generation capabilities, evidenced by a healthy operating cash flow, ensure the company can fund its day-to-day activities, pursue strategic investments, and reward shareholders. Access to R1.8 billion in committed working capital facilities further bolsters its financial flexibility, allowing it to navigate market dynamics and seize opportunities.

Beyond financial strength, Adcock Ingram leverages its significant brand reputation as a key resource. The company's long-standing presence in the healthcare sector has cultivated deep customer loyalty. This trust is built on a consistent track record of delivering quality and affordable healthcare solutions. This intangible asset is invaluable, driving customer preference and supporting market share against competitors.

- Financial Strength: Adcock Ingram's R23.6 billion in revenue for FY23 highlights its substantial financial performance.

- Cash Generation: Robust operating cash flow supports ongoing operations and strategic initiatives.

- Capital Access: R1.8 billion in committed working capital facilities provides essential financial flexibility.

- Brand Equity: Long-standing brand loyalty and reputation for quality and affordability are critical intangible assets.

Adcock Ingram's intellectual property, including proprietary formulations and trademarks for brands like Panado and Epi-max, is a critical resource. This IP is further strengthened by licenses for international brands such as Skinoren, ensuring continued market access and competitive edge.

In 2024, the company emphasized the ongoing value of its intellectual property in maintaining market leadership. This portfolio is essential for driving innovation and differentiating its diverse product range, which spans prescription, over-the-counter, and consumer healthcare items.

The company's commitment to research and development, coupled with strategic brand management, continuously enhances this intellectual capital. This focus ensures Adcock Ingram remains a trusted provider of healthcare solutions.

Value Propositions

Adcock Ingram's core mission is to make healthcare products accessible and affordable for everyone, from low-income families to those with higher incomes, across South Africa and other African nations. This focus directly addresses significant public health challenges by making vital medicines available to more people.

In 2024, Adcock Ingram continued to emphasize this by ensuring their product portfolio, which includes a wide range of prescription and over-the-counter medicines, remained competitively priced. For instance, their efforts in managing supply chains and optimizing manufacturing processes contributed to keeping essential drug costs down, a critical factor for many consumers.

Adcock Ingram boasts a remarkably diverse product range, encompassing prescription pharmaceuticals, accessible over-the-counter remedies, essential hospital supplies, and everyday consumer health products. This extensive offering spans numerous therapeutic categories, ensuring the company addresses a wide spectrum of healthcare needs.

This broad portfolio enables Adcock Ingram to effectively cater to distinct segments within the healthcare industry, from chronic disease management to acute care and general wellness. For instance, in the fiscal year ending March 31, 2024, the company reported significant revenue contributions from its various divisions, highlighting the strength of its diversified approach.

By providing a comprehensive suite of health and wellness solutions, Adcock Ingram positions itself as a convenient, one-stop shop for consumers and healthcare providers alike. This strategy not only broadens market reach but also fosters customer loyalty by meeting a wide array of health requirements under one trusted brand.

Adcock Ingram's commitment to quality is a cornerstone of its business, evident in its robust portfolio of trusted brands like Panado and Bioplus. This focus on reliability fosters strong consumer confidence and cultivates enduring brand loyalty.

The company's unwavering adherence to stringent quality control measures and regulatory standards is paramount. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram reported a revenue of R17.4 billion, underscoring the scale of operations where consistent quality is critical.

Innovation and Advanced Medical Solutions

Adcock Ingram actively drives innovation through robust research and development initiatives, aiming to introduce cutting-edge medical solutions. Their strategic alliances, such as the one with Convatec, significantly bolster their portfolio in niche segments like advanced wound care, reflecting a commitment to staying at the forefront of medical advancements.

This focus on bringing novel products to market is crucial for maintaining competitiveness. In 2024, the pharmaceutical industry saw significant investment in R&D, with global spending projected to exceed $200 billion, underscoring the importance of such strategies for companies like Adcock Ingram.

- Continuous R&D Investment: Adcock Ingram dedicates resources to developing new pharmaceutical and healthcare products.

- Strategic Partnerships: Collaborations, like the one with Convatec, expand their capabilities in specialized medical areas.

- Market Relevance: Innovation ensures Adcock Ingram remains competitive and responsive to evolving healthcare needs.

- Advanced Offerings: The company aims to provide advanced medical solutions, enhancing patient care and treatment outcomes.

Contribution to Public Health and Economic Development

Adcock Ingram plays a crucial role in South Africa's public health by ensuring access to essential medicines. In 2024, the company continued its focus on manufacturing and distributing a wide range of pharmaceuticals, directly impacting health outcomes across the nation.

Economically, Adcock Ingram's operations are significant. Their local manufacturing facilities in 2024 supported job creation, contributing to the livelihoods of many South Africans. The company's commitment to Broad-Based Black Economic Empowerment (B-BBEE) further underscores its dedication to inclusive economic development.

- Local Manufacturing: Adcock Ingram's manufacturing sites are vital for domestic medicine supply, reducing reliance on imports and bolstering the local economy.

- Job Creation: In 2024, the company directly and indirectly employed thousands, providing stable employment and skills development opportunities.

- B-BBEE Compliance: Adherence to B-BBEE standards in 2024 demonstrates a commitment to equitable participation and economic transformation within South Africa.

- Healthcare Access: By making essential medicines available, Adcock Ingram directly contributes to improved public health, a cornerstone of societal well-being and economic productivity.

Adcock Ingram offers a broad spectrum of healthcare products, from prescription drugs to over-the-counter remedies and consumer health items. This extensive portfolio ensures they cater to diverse health needs across various market segments.

The company's commitment to quality, exemplified by trusted brands like Panado, builds significant consumer confidence and loyalty. Their adherence to stringent quality control and regulatory standards is critical, especially given their substantial operational scale, as evidenced by their R17.4 billion revenue in the fiscal year ending June 30, 2023.

Adcock Ingram actively pursues innovation through research and development and strategic partnerships, such as their collaboration with Convatec. This focus on new solutions keeps them competitive and responsive to evolving healthcare demands, aligning with a global R&D investment trend projected to exceed $200 billion in 2024.

By ensuring the accessibility and affordability of essential medicines, Adcock Ingram plays a vital role in public health. Their local manufacturing operations in 2024 also contribute significantly to job creation and economic development through their commitment to B-BBEE standards.

| Value Proposition | Description | Key Aspect | Supporting Data/Example |

| Accessible & Affordable Healthcare | Making a wide range of medicines and health products available to all income levels. | Broad Product Portfolio | Focus on competitively priced essential drugs in 2024. |

| Comprehensive Product Offering | Providing a diverse selection of prescription, OTC, hospital, and consumer health products. | One-Stop Health Solution | Catering to chronic disease management, acute care, and general wellness. |

| Trusted Quality & Reliability | Ensuring high standards in all products, fostering strong consumer trust. | Brand Equity | Strong consumer confidence in brands like Panado and Bioplus. |

| Innovation & Advanced Solutions | Developing new medical products through R&D and strategic alliances. | Market Leadership | Partnership with Convatec for advanced wound care solutions. |

| Contribution to Public Health & Economy | Improving health outcomes by providing essential medicines and creating local employment. | Social Responsibility | Local manufacturing and B-BBEE compliance supporting economic transformation in 2024. |

Customer Relationships

Adcock Ingram directly engages healthcare professionals via its dedicated sales and medical representative teams. This personal interaction facilitates education on new products and allows for crucial feedback collection from doctors, pharmacists, and hospital staff, fostering strong partnerships within the healthcare ecosystem.

In 2024, Adcock Ingram continued to leverage these relationships, with its sales force actively promoting its diverse pharmaceutical portfolio. This direct engagement is vital for understanding market needs and ensuring healthcare providers are well-informed about Adcock Ingram's therapeutic solutions.

The RxHCPHub platform complements these efforts by offering a digital channel for educational content and resources, further strengthening the company's bond with healthcare professionals and supporting their ongoing professional development.

Adcock Ingram prioritizes strong customer relationships through comprehensive care and support services. A dedicated helpline and email support are available to address inquiries, offer product details, and manage adverse event reporting, ensuring easy access for consumers and healthcare professionals.

Building trust is paramount, and prompt attention to concerns is a cornerstone of their approach. For instance, in their 2024 fiscal year, Adcock Ingram reported a significant focus on customer engagement initiatives, aiming to enhance the overall experience for their diverse user base.

Adcock Ingram prioritizes mass-market brand building for its over-the-counter and consumer goods. They invest in advertising and promotional activities to cultivate brand loyalty and encourage direct consumer purchases, a strategy that has historically driven significant sales volume.

Engaging consumers across multiple media platforms is key to their approach. This direct interaction helps Adcock Ingram forge a strong connection with the end-users of their diverse product portfolio, fostering trust and repeat business.

For instance, in 2024, the company continued its robust marketing campaigns for flagship brands like Clicks and Dis-Chem, which are staples in many South African households, reflecting a sustained commitment to consumer engagement.

Investor Relations and Transparency

Adcock Ingram prioritizes open communication with its shareholders and the broader investor community. This commitment to transparency is demonstrated through their regular integrated reports and financial results announcements, ensuring stakeholders have a clear view of the company's operational performance and strategic direction.

The company actively engages with investors via presentations, fostering an environment where information flows freely. This consistent dialogue is crucial for building trust and confidence, which in turn helps attract and retain investment.

- Regular Reporting: Adcock Ingram publishes integrated reports and financial results, providing detailed insights into company performance.

- Investor Presentations: The company conducts investor presentations to discuss strategy, financial health, and governance with stakeholders.

- Building Confidence: Transparent communication is key to fostering investor confidence and attracting capital.

- 2024 Performance Focus: For instance, their 2024 financial updates would detail key growth drivers and market positioning, reinforcing transparency.

Strategic Partnerships and Key Account Management

Adcock Ingram cultivates strategic partnerships with major pharmaceutical wholesalers, national hospital networks, and government tender authorities. These vital relationships are managed through dedicated key account management to foster long-term, mutually beneficial collaborations and ensure smooth supply chain operations.

These strategic alliances are fundamental to Adcock Ingram's ability to achieve significant sales volumes and expand its market reach. For instance, strong relationships with government tender bodies are crucial for securing large contracts, as evidenced by the pharmaceutical sector's reliance on such agreements for substantial revenue streams.

- Key Partner Management: Dedicated teams oversee relationships with major pharmaceutical wholesalers and national hospital groups.

- Government Tenders: Strategic engagement with government tender bodies is critical for large-volume sales and market penetration.

- Mutual Benefit: Focus on long-term, mutually beneficial collaborations to ensure sustained supply and market access.

- Supply Chain Efficiency: Efficient supply agreements are a direct result of these well-managed strategic partnerships.

Adcock Ingram's customer relationships span healthcare professionals, consumers, investors, and strategic partners. Direct engagement through sales teams and digital platforms like RxHCPHub strengthens ties with medical professionals, while mass-market advertising builds brand loyalty among consumers. Transparent communication with investors via regular reports and presentations fosters confidence, and dedicated key account management ensures robust partnerships with wholesalers and government bodies.

Channels

Adcock Ingram relies heavily on pharmaceutical wholesalers as a primary distribution channel, reaching pharmacies and healthcare facilities throughout South Africa. These partners are key to ensuring broad market access for both prescription and over-the-counter medications.

In 2024, the company continued to leverage this extensive network, which is vital for efficient supply chain management and meeting diverse customer needs across the nation.

Adcock Ingram leverages a broad retail pharmacy network, encompassing major chains like Clicks and Dis-Chem, alongside numerous independent pharmacies across South Africa. This extensive reach ensures their diverse product portfolio, from over-the-counter remedies to prescription medications, is readily accessible to a wide consumer base.

The direct engagement within these pharmacy settings is crucial for driving sales through in-store promotions and strategic product placement. For instance, in 2024, Adcock Ingram's commitment to visibility within these channels contributed to their continued market presence, with pharmacies remaining a primary point of purchase for many healthcare products.

Adcock Ingram directly supplies public and private hospitals and clinics, a crucial channel especially for its hospital products division. This includes essential items like large volume parenterals and critical care products, vital for the acute care segment.

Serving government tenders through these direct relationships is a key aspect of their strategy. In 2024, Adcock Ingram continued to strengthen these partnerships, recognizing the significant volume and strategic importance of the hospital sector in their revenue mix.

Fast-Moving Consumer Goods (FMCG) Retailers

Adcock Ingram leverages Fast-Moving Consumer Goods (FMCG) retail channels for its consumer goods, including brands like Plush Professional Leather Care and personal care items. This strategy places their products in supermarkets and general stores, significantly expanding their reach to a wider consumer demographic beyond exclusive pharmacy distribution.

This approach is crucial for revenue diversification, tapping into the high-volume, frequent purchase nature of the FMCG market. In 2024, the South African FMCG market continued its growth trajectory, with grocery retail sales showing robust performance, underscoring the potential for Adcock Ingram’s products in these accessible outlets.

- Expanded Reach: Access to supermarkets and general stores broadens the consumer base for personal care and leather care products.

- Revenue Diversification: Entry into the high-volume FMCG sector offers a secondary revenue stream independent of traditional pharmacy sales.

- Market Penetration: Increased visibility in everyday shopping environments enhances brand awareness and accessibility.

- Sales Volume Potential: The FMCG model encourages frequent purchases, potentially driving higher sales volumes for these product lines.

Direct Sales Force and Online Platforms

Adcock Ingram utilizes a direct sales force to build relationships and secure orders with healthcare professionals and institutions, a crucial strategy for their prescription and specialized product lines. This personal engagement ensures detailed product information is delivered and needs are met effectively.

Their online platforms, including the official website, serve as a vital communication hub. These channels are instrumental for investor relations, disseminating financial reports, and providing valuable information to healthcare professionals, fostering transparency and digital engagement.

- Direct Sales Force: Engages healthcare professionals and institutions for prescription and specialized products.

- Online Platforms: Website used for investor relations, reporting, and information dissemination to healthcare professionals.

- Digital Engagement: Online presence enhances transparency and provides a channel for communication.

Adcock Ingram's channel strategy is multi-faceted, encompassing pharmaceutical wholesalers, an extensive retail pharmacy network, direct hospital and clinic supply, and broader FMCG retail channels.

These channels are supported by a direct sales force and robust online platforms, ensuring wide market penetration and effective communication with stakeholders.

In 2024, the company continued to optimize these channels to drive sales and maintain market presence.

| Channel | Primary Use | 2024 Focus/Data Point |

|---|---|---|

| Wholesalers | Broad market access for Rx and OTC | Vital for efficient supply chain management |

| Retail Pharmacies | Consumer access to diverse products | Key point of purchase, supported by in-store promotions |

| Hospitals & Clinics | Direct supply of hospital products, government tenders | Strategic importance for acute care segment |

| FMCG Retail | Consumer goods, personal care | Diversification into high-volume grocery retail |

| Direct Sales Force | Healthcare professional engagement | Securing orders for prescription and specialized lines |

| Online Platforms | Investor relations, information dissemination | Enhancing transparency and digital engagement |

Customer Segments

The General Public and Consumers segment encompasses a vast group of individuals seeking readily available solutions for everyday health concerns and personal care. This includes purchasing over-the-counter (OTC) medications for common ailments like headaches or minor infections, as well as a wide array of consumer goods for hygiene and household needs. Adcock Ingram's strategy here focuses on making these products accessible and affordable, ensuring they meet the daily wellness requirements of millions. In 2024, the South African OTC market alone was valued at billions of Rands, with consumer healthcare products forming a significant portion, highlighting the sheer scale of this customer base.

Healthcare professionals, including doctors and specialists, are key decision-makers who prescribe Adcock Ingram's pharmaceutical products. Their recommendations significantly influence patient treatment choices and the adoption of new therapies within the market.

Building strong relationships with these medical practitioners is vital. Adcock Ingram leverages its medical representative force and educational initiatives, such as scientific conferences and webinars, to engage with them. For instance, in 2024, the company continued its focus on medical education, aiming to enhance understanding of its innovative product portfolio.

The trust these professionals place in the quality and efficacy of Adcock Ingram's offerings is paramount to driving sales and market penetration. Their endorsement is often the most powerful marketing tool, directly impacting prescription volumes and brand loyalty.

Pharmacies, encompassing both independent outlets and those within large retail chains, represent a crucial customer segment for Adcock Ingram. These businesses serve as the primary point of sale for a significant portion of Adcock Ingram's product portfolio, directly reaching the end consumer.

Furthermore, pharmacies play a vital role in inventory management and providing essential advice to consumers regarding medication and health products. In 2024, the South African pharmaceutical market, a key region for Adcock Ingram, saw continued growth, with pharmacies being central to its distribution network.

Cultivating robust relationships with pharmacists is paramount. Their recommendations and commitment to stocking Adcock Ingram's products directly influence sales volume and market penetration. This strategic focus ensures that Adcock Ingram's offerings are readily available and actively promoted at the point of care.

Public and Private Hospitals/Clinics

Public and private hospitals and clinics are a cornerstone customer segment for Adcock Ingram, particularly for its hospital products division. This includes vital areas like critical care supplies and large volume parenteral solutions, which are fundamental to daily operations in these facilities. Adcock Ingram engages with this segment through various channels, including competitive tenders and direct supply contracts, ensuring consistent availability of essential medical products.

The company's ability to meet the diverse and often stringent requirements of both public and private healthcare institutions is paramount. For instance, in 2024, Adcock Ingram continued to be a key supplier to numerous public hospitals across South Africa, contributing to the accessibility of essential medicines and medical devices. Private hospitals, with their often higher volume demands and specific product preferences, also represent a significant revenue stream, with Adcock Ingram tailoring its offerings to meet these specialized needs.

- Key Hospital Product Focus: Critical care supplies and large volume parenterals are central to Adcock Ingram's offerings to this segment.

- Procurement Channels: Tenders and direct supply agreements are the primary methods for serving public and private healthcare facilities.

- Market Reach: Adcock Ingram serves a broad base of both public sector facilities and private healthcare providers.

- Operational Importance: Meeting the specific needs of these institutions is critical for patient care and Adcock Ingram's market position.

Government and Non-Governmental Organizations (NGOs)

Adcock Ingram actively engages with government and non-governmental organizations, particularly focusing on public health initiatives and participating in tender processes. This is a significant channel, especially within South Africa's public healthcare sector and other African markets where these entities drive large-scale medicine distribution.

These partnerships are vital for Adcock Ingram to achieve its public health objectives and ensure broad access to essential medicines. For instance, in 2023, Adcock Ingram secured several key government tenders, contributing to the supply of critical pharmaceuticals across public hospitals and clinics.

- Public Health Initiatives: Supplying essential medicines for government-backed health programs.

- Tender Processes: Participating in competitive bidding for public sector contracts.

- South African Focus: Significant engagement with the National Department of Health and provincial health departments.

- African Expansion: Targeting similar partnerships in other African nations to broaden reach.

Adcock Ingram's customer segments are diverse, ranging from the general public seeking over-the-counter remedies to healthcare professionals who prescribe their pharmaceuticals. The company also targets pharmacies as key distribution partners and hospitals for its specialized medical supplies. Furthermore, government and non-governmental organizations are crucial for public health initiatives and large-scale distribution contracts, particularly in South Africa and other African markets.

| Customer Segment | Key Products/Services | Engagement Strategy | 2024 Market Relevance |

|---|---|---|---|

| General Public/Consumers | OTC medications, personal care items | Accessibility, affordability, widespread retail presence | Significant share of South African consumer healthcare market |

| Healthcare Professionals | Prescription pharmaceuticals | Medical education, representative force, product efficacy | Influential in treatment choices and market adoption |

| Pharmacies | Full product portfolio | Strong relationships, stocking, point-of-sale promotion | Central to distribution and consumer access in a growing market |

| Hospitals & Clinics | Critical care supplies, parenteral solutions | Tenders, direct contracts, meeting stringent requirements | Key supplier to public and private facilities |

| Government & NGOs | Essential medicines for public health programs | Tender participation, public health partnerships | Vital for broad access and large-scale distribution |

Cost Structure

Adcock Ingram's manufacturing and production costs are a substantial part of its financial outlay. These costs encompass everything from the procurement of raw materials and active pharmaceutical ingredients (APIs) to the packaging of finished goods and the wages for production line staff. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram reported cost of sales of R15.1 billion, a significant portion of which is directly tied to manufacturing.

The operational efficiency of its manufacturing plants, such as the Wadeville facility, plays a critical role in managing these expenses. Any disruptions or inefficiencies at these sites can directly increase per-unit production costs. Maintaining high levels of operational efficiency is therefore paramount for Adcock Ingram to protect its gross profit margins in a competitive pharmaceutical market.

Adcock Ingram's distribution and logistics expenses are a significant cost driver, encompassing warehousing, transportation, and inventory management across its diverse product lines and extensive geographical reach within South Africa and beyond. These costs are crucial for ensuring product availability and timely delivery to pharmacies, hospitals, and other healthcare providers.

In the fiscal year 2023, Adcock Ingram reported a substantial investment in its supply chain capabilities to enhance efficiency and manage these distribution costs effectively. The company's focus on optimizing its logistics network aims to mitigate rising fuel prices and operational expenses, which are key components of this cost category.

Adcock Ingram's commitment to innovation is reflected in its significant investment in Research and Development. In the fiscal year 2023, the company allocated R680 million towards R&D, focusing on new product development and expanding its existing portfolio. This investment is crucial for maintaining a competitive edge in the dynamic pharmaceutical landscape.

The pharmaceutical sector's stringent regulatory environment also presents a substantial cost. Adcock Ingram dedicates considerable resources to regulatory compliance, quality assurance, and securing necessary product licenses and approvals. These expenditures are vital for ensuring product safety, efficacy, and market access, with compliance costs in 2023 estimated to be around R350 million.

Sales, Marketing, and Administrative Expenses

Sales, Marketing, and Administrative Expenses are a significant component of Adcock Ingram's cost structure. These encompass the costs associated with building and maintaining the company's brand, promoting its diverse product portfolio, and ensuring efficient day-to-day operations. For instance, in the fiscal year ending June 30, 2023, Adcock Ingram reported selling, general, and administrative expenses of R3.5 billion, highlighting the substantial investment in these areas.

Effective management of these operating expenses is paramount for Adcock Ingram's profitability. The company actively pursues strategies to optimize its sales force remuneration, including salaries and commissions, and to enhance the return on investment from its marketing campaigns. Furthermore, streamlining administrative processes and overheads contributes to maintaining a competitive cost base.

- Sales Force Costs: Salaries and commissions paid to the sales teams responsible for reaching customers and driving revenue.

- Marketing and Brand Building: Investments in advertising, promotions, and public relations to enhance brand visibility and product appeal.

- Administrative Overheads: Costs related to general management, finance, human resources, and other support functions necessary for business operations.

- Cost Control Focus: Adcock Ingram's commitment to managing these expenses efficiently is a key factor in its overall financial performance and profitability.

Acquisition and Integration Costs

Adcock Ingram's cost structure is significantly influenced by acquisition and integration expenses. These costs arise from strategic moves like acquiring brands such as Dermopal, which involves due diligence, legal fees, and the operational costs of merging new entities.

In 2024, the company continued to explore strategic partnerships and potential investments, such as its previous stake acquisition in Natco Pharma, which would have incurred similar upfront acquisition and subsequent integration costs. These expenditures are crucial for expanding market reach and product portfolios but represent a substantial component of their overall spending.

- Due Diligence: Expenses incurred to thoroughly investigate potential acquisition targets.

- Legal and Advisory Fees: Costs associated with legal counsel, investment bankers, and consultants during the acquisition process.

- Integration Expenses: Costs related to merging systems, operations, personnel, and brand identities of acquired entities.

- Potential Future Acquisitions: Ongoing costs for evaluating and pursuing strategic investment opportunities in the pharmaceutical sector.

Adcock Ingram's cost structure is heavily weighted towards manufacturing and distribution. The company reported a cost of sales of R15.1 billion for the fiscal year ending June 30, 2023, reflecting significant outlays in raw materials, production, and packaging. Logistics and supply chain optimization are also key cost drivers, with substantial investments made in 2023 to manage these expenses effectively, especially in light of rising fuel prices.

Research and development, along with regulatory compliance, represent substantial ongoing investments crucial for market competitiveness and product safety. In 2023, R&D expenditure was R680 million, and compliance costs were estimated around R350 million. Sales, marketing, and administrative expenses form another significant category, with R3.5 billion reported in FY2023, underscoring the investment in brand building and operational support.

Acquisition and integration costs are also a notable part of Adcock Ingram's spending, as seen with past brand acquisitions and ongoing evaluations of strategic partnerships. These upfront and integration expenses are vital for portfolio expansion and market reach.

| Cost Category | FY2023 (R billions) | Key Components |

| Cost of Sales | 15.1 | Raw materials, APIs, packaging, production labor |

| Selling, General & Administrative | 3.5 | Sales force, marketing, brand building, administration |

| Research & Development | 0.68 | New product development, portfolio expansion |

| Regulatory Compliance | ~0.35 | Quality assurance, product licensing, market access |

| Distribution & Logistics | N/A (Integrated into Cost of Sales/OpEx) | Warehousing, transportation, inventory management |

Revenue Streams

Adcock Ingram generates substantial revenue through the sale of prescription medicines. These are the core products, dispensed by pharmacists based on a physician's order, forming a critical pillar of the company's financial performance.

This segment is a major driver of Adcock Ingram's turnover. For the financial year ending June 30, 2023, Adcock Ingram reported a revenue of R23.7 billion, with prescription medicines playing a dominant role in achieving this figure.

The company's overall revenue is directly influenced by the sales volumes of these prescription drugs and the average prices they can achieve in the market. Fluctuations in these two factors significantly impact the company's top-line growth.

Adcock Ingram generates income by selling over-the-counter (OTC) medications, which consumers can buy without a prescription at pharmacies and various retail locations. This segment thrives on established brand loyalty and effective consumer advertising campaigns. Key products such as Panado and Bioplus are significant contributors to revenue within this category.

Revenue is generated by supplying specialized hospital products, such as large volume parenterals (LVPs) and critical care items, to public and private healthcare facilities. These sales are typically secured through long-term tender agreements and direct supply contracts.

The significant LVP tender secured in October 2023 directly bolstered this revenue stream, highlighting the importance of such contracts for Adcock Ingram's financial performance.

Sales of Consumer Goods and Personal Care Products

Adcock Ingram's strategic move into consumer goods and personal care, including brands like Epi-max, taps into the vast Fast-Moving Consumer Goods (FMCG) retail market. This diversification broadens their revenue base beyond pharmaceuticals by addressing everyday consumer needs.

In the financial year ending June 30, 2023, Adcock Ingram reported significant growth in its Consumer Division, which includes these product lines. This division saw a revenue increase, demonstrating the success of their strategy to capture a wider market share.

- Diversified Revenue: Sales of personal care items and consumer goods through FMCG channels provide a stable, recurring income stream separate from their pharmaceutical business.

- Market Reach: Targeting broader consumer needs allows Adcock Ingram to leverage existing retail infrastructure and reach a larger customer demographic.

- Brand Portfolio: Brands like Epi-max, known for dermatological care, are positioned to capitalize on growing consumer interest in specialized personal care products.

- Sales Performance: The Consumer Division's contribution to overall revenue underscores the viability and growth potential of this segment for Adcock Ingram.

International Sales and Licensing Agreements

Adcock Ingram diversifies its income through international sales, extending its presence beyond South Africa into other African markets. This geographical expansion is a key component of its growth strategy.

Revenue is also bolstered by licensing agreements, where Adcock Ingram secures rights to distribute established international brands within its core operating regions. A notable example is the agreement for Skinoren products, showcasing how the company leverages partnerships to broaden its product portfolio and revenue streams.

- International Sales: Adcock Ingram actively participates in sales across various African markets, contributing to its overall revenue.

- Licensing Agreements: The company generates income by licensing international brands for distribution, enhancing its market offerings.

- Brand Distribution: Agreements like the one for Skinoren products highlight Adcock Ingram's role in bringing global brands to local consumers.

Adcock Ingram's revenue streams are diverse, encompassing prescription medicines, over-the-counter (OTC) products, and specialized hospital supplies. The company also generates income from consumer goods and personal care items, alongside international sales and licensing agreements for established brands.

| Revenue Stream | Key Products/Activities | Financial Year End June 30, 2023 Data |

|---|---|---|

| Prescription Medicines | Core pharmaceutical products dispensed with a prescription. | Major contributor to R23.7 billion total revenue. |

| Over-the-Counter (OTC) Medications | Products available without a prescription, e.g., Panado, Bioplus. | Significant turnover driver through brand loyalty and marketing. |

| Hospital Products | Specialized items like LVPs and critical care supplies. | Bolstered by tender agreements, such as the LVP tender in Oct 2023. |

| Consumer Goods & Personal Care | FMCG products, including brands like Epi-max. | Consumer Division saw revenue increase, demonstrating growth potential. |

| International Sales & Licensing | Sales in other African markets and distribution rights for brands like Skinoren. | Geographical expansion and brand partnerships broaden income. |

Business Model Canvas Data Sources

The Adcock Ingram Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial statements, and internal operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.