Adcock Ingram PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

Unlock the critical external forces shaping Adcock Ingram's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, evolving social attitudes, technological advancements, environmental regulations, and legal frameworks are impacting their operations and future growth. Gain a strategic advantage by leveraging these expert insights to refine your own market approach. Download the full version now for actionable intelligence.

Political factors

The South African government's National Health Insurance (NHI) Act, officially enacted in May 2024, represents a monumental shift towards universal healthcare coverage. This legislation seeks to integrate public and private healthcare services, a move that could significantly reshape Adcock Ingram's operational landscape.

The NHI's implementation is poised to influence Adcock Ingram's drug procurement strategies, pricing structures, and distribution networks. A potential reallocation of patient demand from the private sector to the public sector, driven by NHI benefits, could alter market dynamics and impact the company's revenue streams from medical schemes.

The pharmaceutical sector operates under stringent regulations, and shifts in these frameworks, particularly concerning drug registration, quality assurance, and patent rights, significantly impact Adcock Ingram. For instance, SAHPRA's evolving guidelines for new drug approvals and post-market surveillance directly influence product launch timelines and ongoing market presence. Adcock Ingram's commitment to adhering to these evolving standards, including those for Good Manufacturing Practices (GMP), is paramount for maintaining its license to operate and ensuring product safety and efficacy in the South African market.

Political stability in South Africa, a key market for Adcock Ingram, remains a significant consideration. While the country has a democratic framework, occasional political uncertainty can influence investor confidence and economic policy. For instance, the 2024 general elections in South Africa led to coalition government discussions, highlighting the dynamic nature of its political landscape.

Government effectiveness and the efficacy of anti-corruption efforts directly impact the ease of doing business. In 2023, South Africa's Corruption Perception Index score was 42, indicating persistent challenges. This can affect regulatory environments and operational costs for companies like Adcock Ingram, especially when expanding into other African nations with varying governance structures.

Unstable political situations in any of Adcock Ingram's operating regions can create ripple effects. Disruptions to supply chains, fluctuations in consumer spending due to economic policy shifts, and an unpredictable business climate are direct consequences. This unpredictability necessitates robust risk management strategies to safeguard growth and expansion plans.

Government Spending on Healthcare

Government spending on healthcare significantly impacts the public sector's pharmaceutical procurement. South Africa's commitment to bolstering its health sector is evident in the 2025 budget, which allocates an additional R28.9 billion to healthcare. This increased investment is poised to drive greater demand for pharmaceuticals, potentially benefiting companies like Adcock Ingram by expanding their market share within the public healthcare system.

This increased government expenditure creates a more favorable environment for Adcock Ingram's public sector sales. The expanded budget directly translates to enhanced purchasing power for public hospitals and clinics. Consequently, Adcock Ingram can anticipate a rise in tender opportunities and order volumes for its pharmaceutical products.

- Increased Health Budget: South Africa's 2025 budget earmarks R28.9 billion for healthcare, signaling substantial growth in public sector spending.

- Public Sector Demand: Higher government allocations directly boost the purchasing power for pharmaceuticals within public healthcare facilities.

- Market Opportunity for Adcock Ingram: This trend presents a significant opportunity for Adcock Ingram to increase its sales and market penetration in the public sector.

Trade Policies and Regional Integration

Trade policies, including tariffs and trade agreements, significantly influence Adcock Ingram's operational costs and market access across Africa. The African Continental Free Trade Area (AfCFTA) aims to boost intra-African trade, potentially reducing import costs for raw materials and simplifying the export of finished goods. For instance, by 2024, the AfCFTA is projected to increase intra-African exports by 81% compared to 2021 levels, offering Adcock Ingram enhanced supply chain efficiency and broader market reach.

These regional integration efforts can either streamline Adcock Ingram's continental operations or introduce complexities depending on specific policy implementations.

- AfCFTA's Impact: Expected to increase intra-African exports by 81% by 2024, potentially lowering Adcock Ingram's raw material import costs.

- Supply Chain Efficiency: Favorable trade policies can enhance Adcock Ingram's ability to move products efficiently across African borders.

- Market Reach: Reduced trade barriers can expand Adcock Ingram's access to new customer bases within the continent.

- Tariff Volatility: Fluctuations in tariffs can directly impact the cost of goods, affecting Adcock Ingram's pricing strategies and profitability.

The South African government's continued investment in healthcare, with a R28.9 billion allocation in the 2025 budget, directly translates to increased demand for pharmaceuticals in the public sector, benefiting Adcock Ingram.

The National Health Insurance (NHI) Act, enacted in May 2024, signifies a major policy shift towards universal healthcare, potentially altering Adcock Ingram's patient demand and revenue from medical schemes.

Political stability, as evidenced by the coalition government discussions following the 2024 elections, remains a key factor influencing investor confidence and economic policy in Adcock Ingram's primary market.

Evolving regulatory frameworks, such as SAHPRA's drug approval guidelines, and adherence to Good Manufacturing Practices are critical for Adcock Ingram's operational continuity and market access.

What is included in the product

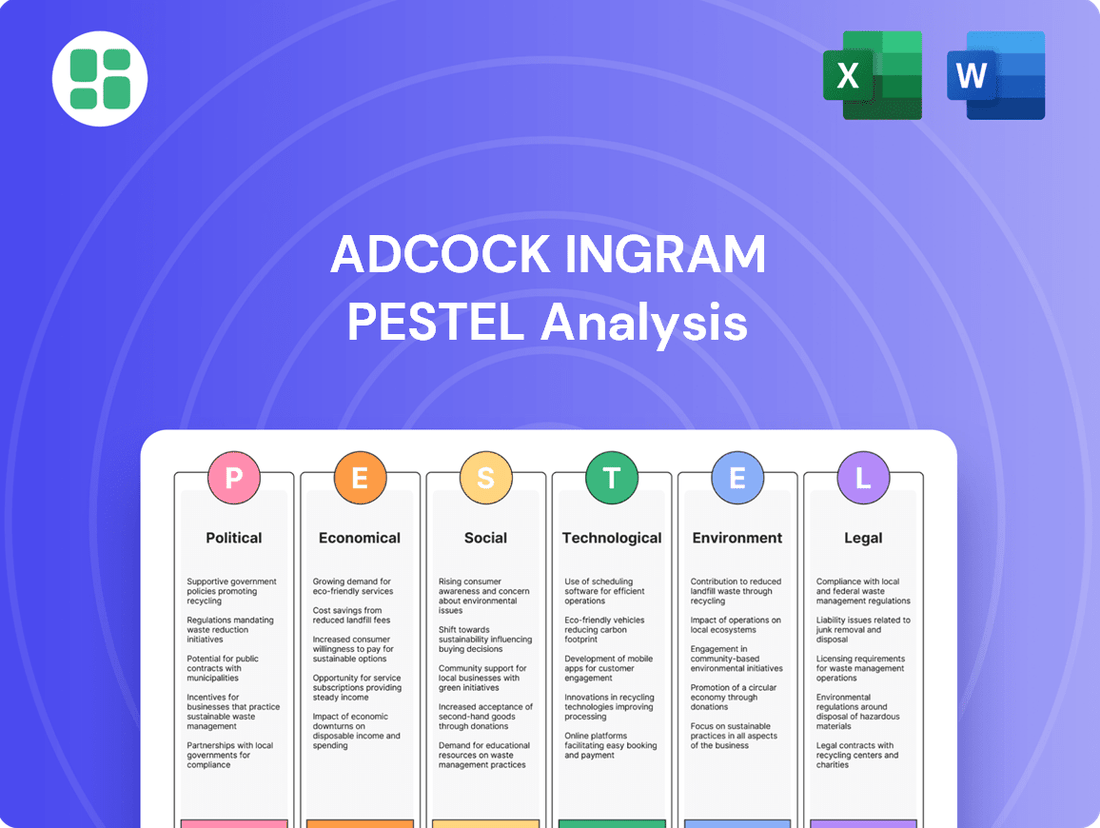

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Adcock Ingram, offering insights into market dynamics and strategic positioning.

The Adcock Ingram PESTLE analysis provides a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain point of navigating complex and unpredictable market environments.

Economic factors

South Africa's economic growth is a key driver for Adcock Ingram. For instance, in the first quarter of 2024, the South African economy expanded by a modest 0.4% quarter-on-quarter, following a contraction in the previous period. This growth directly impacts consumer disposable income, influencing their ability to spend on healthcare products and services.

Higher economic growth generally translates to increased consumer confidence and spending power, which benefits Adcock Ingram. In 2023, the company reported a revenue increase of 8% to R10.5 billion, partly supported by a recovering consumer market. This trend is expected to continue as economic conditions improve, boosting demand for both prescription and over-the-counter medications.

Adcock Ingram's performance in other African markets also hinges on their respective economic growth rates. For example, Nigeria, a significant market for the company, experienced a GDP growth of approximately 3.46% in the first quarter of 2024. Such expansion in key markets directly correlates with higher healthcare expenditure and, consequently, greater sales opportunities for Adcock Ingram's product portfolio.

South Africa's inflation rate has been a significant concern, with the consumer price index (CPI) reaching 5.1% year-on-year in April 2024, slightly up from 5.0% in March. This rise in inflation directly translates to increased operational costs for Adcock Ingram, particularly for imported raw materials and finished pharmaceutical products. The company must absorb these higher input costs or pass them on to consumers, impacting sales volumes.

Currency fluctuations, specifically the South African Rand's performance against major currencies like the US Dollar, pose a substantial risk. For instance, a weaker Rand increases the cost of imported active pharmaceutical ingredients (APIs) and machinery, directly squeezing Adcock Ingram's profit margins. Effective hedging strategies are crucial to mitigate the impact of this volatility on their bottom line.

Healthcare expenditure is a significant driver for Adcock Ingram. In South Africa, total health expenditure is anticipated to rise from an estimated R277 billion in the 2024/25 fiscal year to R329 billion by 2027/28, indicating robust growth. This upward trend in both public and private healthcare spending, including medical aid contributions and government health budgets, directly impacts the size and potential of the pharmaceutical market.

The increasing overall healthcare spending in South Africa, projected to see a compound annual growth rate (CAGR) of approximately 5.8% between 2024 and 2028, signals expanding opportunities for pharmaceutical companies like Adcock Ingram. This growth reflects a greater investment in health services, which translates to higher demand for medicines and healthcare products.

Drug Pricing Regulations

Drug pricing regulations significantly influence Adcock Ingram's financial performance. South Africa's Single Exit Price (SEP) mechanism, for instance, restricts the company's freedom to set prices for pharmaceuticals, directly impacting revenue streams and profit margins, particularly on regulated prescription medications.

This regulatory environment necessitates strategic adjustments, such as diversifying the product portfolio into areas with less stringent price controls. For example, Adcock Ingram might focus on over-the-counter (OTC) products or specialized medical devices where pricing flexibility is greater.

- Impact on Revenue: Price controls, like the SEP, can cap potential revenue growth for key pharmaceutical products.

- Profit Margin Pressure: Regulated pricing directly squeezes profit margins, especially when input costs rise.

- Strategic Diversification: Companies often shift focus to less regulated segments like consumer healthcare or generics to mitigate pricing risks.

- Market Access Challenges: Navigating complex pricing regulations can also create barriers to market entry for new products.

Access to Funding and Investment Climate

Adcock Ingram's capacity for research, development, and strategic acquisitions hinges on the availability of capital, both from local and global sources. A robust investment climate, particularly encouraging foreign direct investment, directly fuels the company's growth ambitions.

South Africa's investment landscape in early 2024 saw a cautious optimism, with efforts to attract foreign capital. For instance, the South African Reserve Bank maintained its repo rate at 8.25% in March 2024, signaling a stable, albeit high, cost of borrowing that can influence investment decisions.

- Capital Availability: Access to both domestic and international funding is crucial for Adcock Ingram's R&D and expansion projects.

- Investment Climate: A positive environment for foreign direct investment is essential for supporting the company's strategic growth.

- Interest Rates: The South African Reserve Bank's repo rate, at 8.25% as of March 2024, impacts the cost of capital for investments.

South Africa's economic performance directly influences Adcock Ingram's revenue. The country's GDP growth, while modest at 0.4% in Q1 2024, impacts consumer spending on healthcare. In 2023, Adcock Ingram saw an 8% revenue increase to R10.5 billion, buoyed by a recovering consumer market.

Inflation remains a key economic factor, with South Africa's CPI at 5.1% in April 2024, increasing Adcock Ingram's operational costs for imported materials. Currency fluctuations, particularly the Rand's weakness, also raise the cost of raw materials, affecting profit margins.

Healthcare expenditure growth is a positive economic indicator for Adcock Ingram. Total health spending in South Africa is projected to grow from an estimated R277 billion in 2024/25 to R329 billion by 2027/28, signaling expanding market opportunities.

Drug pricing regulations, like South Africa's Single Exit Price (SEP) mechanism, directly impact Adcock Ingram's revenue and profit margins, necessitating strategic diversification into less regulated product segments.

| Economic Indicator | Value/Trend | Impact on Adcock Ingram |

|---|---|---|

| South Africa GDP Growth (Q1 2024) | 0.4% quarter-on-quarter | Influences consumer disposable income and healthcare spending. |

| South Africa Inflation (CPI, April 2024) | 5.1% year-on-year | Increases operational costs for imported goods and materials. |

| South African Rand vs USD | Weakening trend | Raises cost of imported active pharmaceutical ingredients (APIs). |

| Total Health Expenditure (SA Projection) | R277bn (2024/25) to R329bn (2027/28) | Indicates growing market size and demand for pharmaceuticals. |

| South Africa Repo Rate (March 2024) | 8.25% | Affects the cost of capital for investments and expansion. |

Same Document Delivered

Adcock Ingram PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Adcock Ingram's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Adcock Ingram.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of the Adcock Ingram PESTLE analysis.

Sociological factors

South Africa's population is projected to reach over 65 million by 2025, with a growing segment of older adults. This demographic shift, coupled with the persistent high burden of diseases like HIV/AIDS, tuberculosis, diabetes, and hypertension, significantly shapes the demand for Adcock Ingram's product lines, particularly chronic disease management medications and treatments for infectious diseases.

The increasing prevalence of non-communicable diseases (NCDs) is a critical factor; for instance, diabetes prevalence in South Africa was estimated at around 12% in 2024, requiring a steady supply of antidiabetic drugs. Adcock Ingram's strategic focus on these therapeutic areas is therefore directly influenced by these evolving health needs, impacting sales volumes and product development priorities.

Growing public health consciousness is a significant driver for Adcock Ingram. Consumers are increasingly seeking out over-the-counter (OTC) medications and products that support their well-being and preventive care strategies. This trend directly fuels demand for Adcock Ingram's extensive portfolio in these categories.

Lifestyle shifts also play a crucial role. As more people adopt healthier habits, the market for nutritional supplements and wellness products expands. Conversely, rising rates of lifestyle-related diseases, such as diabetes and cardiovascular conditions, create a sustained demand for Adcock Ingram's pharmaceutical offerings designed to manage these chronic illnesses.

Societal inequalities significantly impact how easily people can access and afford healthcare, a critical issue in nations like South Africa where a large portion of the population lacks medical insurance. Adcock Ingram's commitment to offering accessible and affordable healthcare products directly responds to this pressing social demand, particularly as governments worldwide, including South Africa, work towards implementing universal health coverage.

In South Africa, for instance, out-of-pocket healthcare expenditure can be a substantial burden for many households. Data from 2023 indicated that a significant percentage of healthcare spending was borne by individuals, highlighting the need for cost-effective solutions. Adcock Ingram's strategy to broaden access to essential medicines aligns with the national goal of reducing financial barriers to healthcare, aiming to serve a wider demographic.

Education and Health Literacy

The educational attainment and health literacy of a population directly impact how well people understand and follow medical advice, affecting medication adherence and the demand for specific health information. For Adcock Ingram, this means their outreach and product information must resonate with diverse literacy levels to ensure effective use and better public health.

In South Africa, where Adcock Ingram operates, approximately 86.8% of the population aged 20 and over had completed at least some secondary education as of 2022, indicating a solid foundation for health education. However, variations in literacy persist, influencing how health information is received and acted upon.

Consider these points:

- Health Literacy Impact: Lower health literacy is linked to poorer health outcomes, including higher rates of chronic disease and increased healthcare costs, creating a direct market challenge and opportunity for pharmaceutical companies.

- Targeted Communication: Adcock Ingram's marketing and patient support programs must be designed with varying health literacy levels in mind, utilizing clear, simple language and diverse communication channels to maximize engagement and understanding.

- Educational Initiatives: Investing in public health education and disease awareness campaigns can build trust and improve adherence, directly benefiting Adcock Ingram's product portfolio by fostering a more informed consumer base.

- Data-Driven Approach: Analyzing demographic data on education and health literacy in key markets allows Adcock Ingram to tailor its strategies for maximum impact and effectiveness in promoting its products and improving patient well-being.

Cultural Beliefs and Traditional Medicine

Cultural beliefs significantly shape healthcare choices across many African markets, influencing the adoption of conventional pharmaceuticals. The persistent reliance on traditional medicine, sometimes as a primary treatment or a complementary therapy, directly impacts the demand for Adcock Ingram's products. For instance, a 2023 report indicated that in some sub-Saharan African countries, over 70% of the population utilizes traditional healers and remedies, highlighting the need for culturally sensitive marketing strategies.

Adcock Ingram must navigate these cultural nuances to effectively position its offerings. Understanding how traditional practices are integrated into daily life allows for more targeted product development and promotional campaigns. This includes respecting and potentially collaborating with traditional healthcare providers where appropriate, ensuring that Western pharmaceuticals are seen as a viable and complementary option rather than a replacement that dismisses cultural heritage.

- Cultural Integration: Over 60% of consumers in certain African nations express a preference for treatments that align with their cultural beliefs, impacting pharmaceutical market penetration.

- Traditional Medicine Market: The traditional medicine market in Africa is projected to reach USD 15 billion by 2027, underscoring its economic significance and influence on healthcare decisions.

- Marketing Adaptation: Adcock Ingram's success hinges on adapting marketing messages to resonate with local cultural values, potentially featuring testimonials or educational content that bridges traditional and modern healthcare.

- Product Acceptance: Research suggests that pharmaceutical products perceived as culturally appropriate see a 25% higher adoption rate compared to those that do not acknowledge local customs.

Societal attitudes towards health and wellness are evolving, with a greater emphasis on preventive care and self-management of health. This shift directly benefits Adcock Ingram by increasing demand for its over-the-counter products and chronic disease management medications.

The increasing burden of non-communicable diseases, such as diabetes which affected an estimated 12% of South Africans in 2024, creates a sustained need for Adcock Ingram's pharmaceutical offerings. Furthermore, cultural beliefs significantly influence healthcare choices, with a substantial portion of the population in some African nations utilizing traditional medicine, necessitating culturally sensitive marketing strategies for Adcock Ingram.

Health literacy levels also play a crucial role; while 86.8% of South Africans aged 20+ had some secondary education by 2022, variations in literacy impact how health information is received. Adcock Ingram must tailor its communication to ensure effective product understanding and adherence across diverse literacy levels.

Societal inequalities, particularly the out-of-pocket healthcare expenditure which remained a significant burden in 2023, highlight the need for accessible and affordable healthcare solutions. Adcock Ingram's strategy to broaden access aligns with national goals of reducing financial barriers to essential medicines.

Technological factors

Pharmaceutical manufacturing is seeing rapid technological evolution. Innovations like continuous manufacturing, which streamlines production by eliminating batch processing, offer significant efficiency gains. For Adcock Ingram, adopting these methods could lead to lower operational costs and faster product delivery.

Automation is another key technological factor. Robotic systems and advanced process control are increasingly being implemented to enhance precision and consistency in drug production. This not only improves product quality and safety but also helps in meeting stringent regulatory requirements, a critical aspect for companies like Adcock Ingram operating in a highly regulated industry.

Furthermore, advancements in quality control technologies, such as real-time analytics and AI-driven inspection systems, are transforming how pharmaceutical products are monitored. These technologies allow for immediate detection and correction of deviations, ensuring higher product integrity and reducing the risk of costly recalls. Adcock Ingram's ability to integrate these sophisticated quality control measures will be vital for its competitive edge and reputation.

Adcock Ingram's research and development capabilities are crucial, directly influencing its capacity to launch new medications and broaden its treatment portfolios. The speed of discovering novel drugs, creating generic versions, and successfully navigating clinical trials are key determinants of market competitiveness.

The company's commitment to R&D, whether through internal investment or collaborations for technology acquisition, forms the bedrock of its sustained expansion. For instance, in the fiscal year 2023, Adcock Ingram reported investing R362 million in research and development, a significant portion of which is directed towards expanding its product pipeline in critical therapeutic areas.

The healthcare sector is rapidly embracing digital solutions, with telemedicine and e-prescribing becoming increasingly common. Adcock Ingram can capitalize on this trend by integrating these technologies into its operations, potentially streamlining pharmaceutical distribution and enhancing patient access to healthcare services, particularly in underserved regions.

Data Analytics and Artificial Intelligence (AI)

Adcock Ingram is poised to leverage advancements in data analytics and artificial intelligence to revolutionize its operations. The pharmaceutical industry, in general, is seeing a significant push towards AI in drug discovery, with some estimates suggesting AI can reduce drug development timelines by several years and cut costs by billions. For Adcock Ingram, this translates to faster identification of promising drug candidates and more efficient clinical trial design, potentially accelerating the launch of new treatments.

The application of big data analytics and AI extends to optimizing Adcock Ingram's supply chain. By analyzing vast datasets, the company can predict demand more accurately, manage inventory levels effectively, and identify potential disruptions before they impact operations. This data-driven approach to logistics is crucial in ensuring timely delivery of medicines, especially in a dynamic market. For instance, AI-powered predictive maintenance can minimize downtime in manufacturing facilities, contributing to overall operational efficiency.

Furthermore, these technologies offer Adcock Ingram the potential to personalize medicine and gain deeper market insights. Analyzing patient data, where permissible and ethically handled, can lead to more targeted therapies and improved patient outcomes. Understanding market trends and competitor activities through advanced analytics will also empower more informed strategic decision-making, allowing Adcock Ingram to adapt quickly to evolving healthcare landscapes.

- AI in drug discovery can reduce development time by up to 30%.

- Data analytics can improve supply chain efficiency by 15-20%.

- Personalized medicine, driven by AI, is a growing market segment expected to reach over $100 billion by 2025.

- Predictive analytics in clinical trials can identify patient cohorts with higher success probabilities.

Biotechnology and Biosimilars Development

The burgeoning biotechnology sector presents a significant avenue for Adcock Ingram to enhance its product offerings. The increasing development of biosimilars, which are essentially highly similar versions of existing biological medicines, allows for the introduction of more cost-effective treatments. This is particularly relevant for complex biological drugs where originator products can be prohibitively expensive.

Adcock Ingram's strategic alignment with providing accessible healthcare solutions, especially within the African continent, directly benefits from the biosimilar trend. By incorporating these more affordable alternatives, the company can broaden patient access to critical therapies, thereby addressing unmet medical needs and strengthening its market position. For instance, the global biosimilars market was valued at approximately $20 billion in 2023 and is projected to grow substantially, indicating a robust demand for these products.

Key opportunities arising from this technological factor include:

- Portfolio Expansion: Introducing biosimilar versions of high-value biologics to complement existing Adcock Ingram products.

- Enhanced Affordability: Offering patients more accessible treatment options, thereby increasing market penetration.

- Market Growth: Capitalizing on the projected expansion of the global biosimilars market, which is expected to reach over $100 billion by 2030.

- Partnership Potential: Collaborating with biotechnology firms or biosimilar developers to secure licensing or manufacturing agreements.

The integration of artificial intelligence and advanced data analytics is revolutionizing Adcock Ingram's operational efficiency and strategic decision-making. AI is accelerating drug discovery, with estimates suggesting it can shorten development timelines by up to 30%, and improving supply chain management, potentially boosting efficiency by 15-20% through better demand forecasting and inventory control.

Personalized medicine, a significant trend driven by AI, is creating new market opportunities. This segment, projected to exceed $100 billion by 2025, allows Adcock Ingram to develop more targeted therapies, enhancing patient outcomes. Furthermore, predictive analytics can optimize clinical trials by identifying patient groups with higher success probabilities, streamlining the research process.

Adcock Ingram's investment in R&D, R362 million in fiscal year 2023, underpins its ability to leverage these technological advancements. By embracing innovations like continuous manufacturing and AI-driven quality control, the company can reduce costs, improve product quality, and maintain a competitive edge in the highly regulated pharmaceutical landscape.

| Technology Area | Impact on Adcock Ingram | Key Statistic/Projection |

|---|---|---|

| AI in Drug Discovery | Accelerated R&D, reduced development costs | Can reduce development time by up to 30% |

| Data Analytics in Supply Chain | Improved efficiency, better demand forecasting | Can improve supply chain efficiency by 15-20% |

| Personalized Medicine | New market opportunities, enhanced patient outcomes | Market projected to exceed $100 billion by 2025 |

| Continuous Manufacturing | Increased production efficiency, lower operational costs | Streamlines production, eliminates batch processing |

Legal factors

Adcock Ingram operates within a highly regulated pharmaceutical landscape, where stringent national and international laws dictate every stage of a drug's lifecycle, from initial research and development through manufacturing, packaging, and advertising. Compliance with these evolving regulations is paramount for market access and sustained business operations.

Navigating the complex drug approval pathways, particularly those managed by bodies like the South African Health Products Regulatory Authority (SAHPRA), is crucial for Adcock Ingram. For instance, in 2023, SAHPRA reported processing thousands of applications, highlighting the significant time and resource investment required for new drug approvals, which directly impacts Adcock Ingram's ability to bring innovative treatments to market efficiently.

Intellectual Property (IP) laws, especially patent protections, are critical for Adcock Ingram in the pharmaceutical sector. These laws govern the exclusivity of new drug formulations, directly influencing the company's ability to develop and market both patented and generic medications.

Navigating the complex web of patent expirations and challenges is paramount for Adcock Ingram's strategy in the generic drug market. For instance, the expiration of patents on blockbuster drugs opens lucrative opportunities for generic manufacturers, but requires careful legal maneuvering to avoid infringement claims.

In 2024, the global pharmaceutical IP landscape continues to be shaped by ongoing patent litigation and evolving regulatory frameworks for biosimilars. Adcock Ingram's success hinges on its ability to leverage IP rights for innovation while strategically entering markets as patents expire.

South Africa's Single Exit Price (SEP) system, which regulates the maximum price pharmaceutical companies can charge for medicines, directly impacts Adcock Ingram's revenue streams. Any adjustments to this pricing framework, particularly in anticipation of or during the implementation of the National Health Insurance (NHI) scheme, could significantly alter the company's profitability. For instance, a shift towards more stringent price controls under NHI could compress margins on existing products.

Reimbursement policies set by both private medical schemes and government healthcare programs are crucial determinants of Adcock Ingram's market access and product sales volume. Favorable reimbursement rates encourage wider adoption of their pharmaceuticals, while restrictive policies can limit market penetration. The evolving landscape of healthcare funding in South Africa, especially with the NHI's proposed structure, will be a key factor in how effectively Adcock Ingram's portfolio is utilized.

Consumer Protection and Product Liability Laws

Adcock Ingram operates under stringent consumer protection laws that mandate product safety, efficacy, and truthful labeling. Non-compliance can lead to significant legal liabilities and damage to its brand reputation, especially crucial in the healthcare sector where consumer trust is paramount. For instance, in 2023, the South African Department of Health continued to enforce regulations like the Medicines and Related Substances Act, ensuring pharmaceuticals meet rigorous quality standards.

Product liability laws hold manufacturers responsible for harm caused by defective products. Adcock Ingram must meticulously manage its supply chain and quality control processes to mitigate risks. The company's commitment to these regulations is vital for maintaining consumer confidence and avoiding costly recalls or lawsuits. In 2024, ongoing scrutiny of pharmaceutical product quality across Africa highlights the importance of robust compliance frameworks.

- Product Safety and Efficacy: Adcock Ingram must ensure all its pharmaceutical and healthcare products meet strict safety and efficacy standards as defined by regulatory bodies.

- Accurate Labeling and Marketing: Compliance with laws requiring clear, accurate information on product labels and in marketing materials is essential to prevent misleading consumers.

- Consumer Redress Mechanisms: The company needs to have processes in place to handle consumer complaints and provide appropriate redress, aligning with consumer protection legislation.

- Regulatory Enforcement: Adherence to regulations set by authorities like the South African Health Products Regulatory Authority (SAHPRA) is critical to avoid penalties and maintain market access.

Labor Laws and Employment Regulations

South Africa's labor laws, such as the Basic Conditions of Employment Act (BCEA) and the Labour Relations Act (LRA), significantly influence Adcock Ingram's operational costs and human resource strategies. These laws mandate minimum wages, regulate working hours, and outline procedures for dismissals and retrenchments, directly impacting employee compensation and workforce management. For instance, the national minimum wage in South Africa was R25.42 per hour as of March 2024, a figure Adcock Ingram must adhere to across its operations.

Compliance with these stringent labor regulations is paramount for Adcock Ingram to maintain a stable workforce and mitigate the risk of costly legal disputes and reputational damage. The company must navigate regulations concerning fair labor practices, including preventing unfair discrimination and ensuring safe working conditions, which can add to overheads but are crucial for employee morale and productivity. In 2023, the Department of Employment and Labour reported a significant number of labor disputes, highlighting the importance of proactive compliance.

Adcock Ingram's engagement with trade unions, facilitated by the LRA, also plays a critical role. Collective bargaining agreements can influence wage levels, benefits, and working conditions, requiring careful negotiation and management. The Pharmaceutical and Allied Workers Union (PAWUSA) is a key stakeholder, and its agreements with Adcock Ingram directly affect labor costs and industrial relations. Recent reports indicate ongoing wage negotiations in the broader pharmaceutical sector impacting companies like Adcock Ingram.

- Adherence to the Basic Conditions of Employment Act (BCEA) for minimum wage and working hour regulations.

- Compliance with the Labour Relations Act (LRA) governing trade union recognition and collective bargaining.

- Ensuring fair labor practices to avoid unfair dismissal claims and discrimination lawsuits.

- Managing operational costs influenced by legally mandated employee benefits and safety standards.

Adcock Ingram operates within a framework of evolving legal and regulatory requirements that significantly shape its business. The South African Health Products Regulatory Authority (SAHPRA) plays a pivotal role, overseeing drug approvals and market access. In 2023, SAHPRA processed thousands of applications, underscoring the rigorous nature of these processes.

Intellectual property laws, particularly patent protection, are vital for Adcock Ingram's innovation pipeline and its strategy in the generic market. The global IP landscape in 2024 continues to be dynamic, with ongoing litigation and evolving biosimilar regulations impacting market entry and product exclusivity.

South Africa's pricing regulations, such as the Single Exit Price (SEP) system, directly influence Adcock Ingram's revenue. Potential adjustments, especially in light of the National Health Insurance (NHI) scheme, could compress profit margins.

Consumer protection laws mandate product safety, efficacy, and truthful labeling, with SA's Medicines and Related Substances Act being a key example enforced in 2023. Product liability laws also necessitate robust quality control to mitigate risks, a factor of ongoing scrutiny in 2024 across Africa.

Environmental factors

Adcock Ingram faces increasing scrutiny regarding the environmental impact of its entire supply chain, from the initial sourcing of raw materials to the final distribution of its products. This includes the energy used in manufacturing and transportation, as well as the waste generated at each stage.

Sustainable resource management is paramount for Adcock Ingram’s long-term success. For instance, improving water efficiency in manufacturing processes and reducing energy consumption are key areas. In 2023, the pharmaceutical industry globally saw a push for greener manufacturing, with companies investing in renewable energy sources to power their facilities.

Responsible waste disposal, including the management of pharmaceutical packaging and manufacturing byproducts, is also critical. Adcock Ingram's commitment to reducing its environmental footprint directly influences its operational costs and brand reputation, especially as consumers and regulators demand greater environmental accountability.

Pharmaceutical manufacturing, including operations by companies like Adcock Ingram, inherently produces diverse waste streams, encompassing chemical byproducts and hazardous materials. Ensuring responsible disposal and implementing robust pollution control measures are paramount to mitigating environmental harm.

Adcock Ingram, like all pharmaceutical firms, faces stringent environmental regulations governing waste management and emissions. For instance, in South Africa, the National Environmental Management Act (NEMA) and its associated waste management regulations set strict standards for the treatment, storage, and disposal of hazardous waste, with non-compliance potentially leading to significant fines and operational disruptions.

Climate change presents a growing challenge for Adcock Ingram, potentially altering disease prevalence and thus impacting demand for specific pharmaceuticals. For instance, increased temperatures and altered rainfall patterns can lead to shifts in vector-borne diseases, requiring adjustments in product portfolios.

Extreme weather events, a consequence of climate change, pose a significant risk to Adcock Ingram's supply chain. Disruptions from floods, storms, or droughts can hinder the sourcing of raw materials and the distribution of finished goods, potentially affecting product availability for patients.

In 2023, global temperatures continued to rise, with the World Meteorological Organization reporting it as the warmest year on record. This underscores the urgency for Adcock Ingram to proactively assess and build resilience against climate-related operational and health impacts to ensure continued business operations and product accessibility.

Regulatory Pressure for Eco-friendly Practices

Increasing environmental regulations and growing public demand for corporate social responsibility are compelling businesses to adopt more eco-friendly operations. This includes a shift towards sustainable packaging and the implementation of green chemistry principles in manufacturing processes.

Adcock Ingram's dedication to environmental stewardship is a key factor in enhancing its brand image and effectively meeting the expectations of its stakeholders. This commitment can translate into tangible benefits, such as improved investor relations and stronger consumer loyalty.

- Environmental Regulations: South Africa's National Environmental Management Act (NEMA) and related legislation continue to drive stricter compliance for industries, including pharmaceuticals.

- Sustainable Practices: Adcock Ingram has reported on initiatives like waste reduction and water conservation, aligning with global sustainability trends. For instance, in their 2023 Integrated Report, they highlighted efforts to reduce their carbon footprint.

- Stakeholder Expectations: Investors and consumers are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, making eco-friendly practices a competitive advantage.

Biodiversity and Natural Resource Dependency

The pharmaceutical sector, including companies like Adcock Ingram, can rely on natural resources for active pharmaceutical ingredients (APIs) and excipients. For instance, certain plant-derived compounds are crucial for drug development. The increasing global focus on biodiversity conservation means that sustainable sourcing of these materials is becoming paramount.

Adcock Ingram's operations could be indirectly affected by biodiversity loss. For example, if a key botanical source for an ingredient faces extinction due to habitat destruction, it could disrupt supply chains. This underscores the need for responsible sourcing strategies and investment in sustainable agricultural practices to ensure long-term availability of raw materials. In 2024, reports indicated that over 30% of plant and animal species are at risk of extinction, a statistic that highlights the growing environmental pressures on industries dependent on natural resources.

The company's commitment to sustainability is therefore not just an ethical consideration but a strategic imperative. Implementing robust environmental management systems and engaging in ethical supply chain partnerships are key to mitigating risks associated with natural resource depletion and biodiversity decline. For example, Adcock Ingram's sustainability reports often detail efforts to reduce their environmental footprint, including waste management and water conservation, which indirectly support broader biodiversity goals.

- Natural Resource Dependency: Pharmaceutical ingredients can be derived from plants, fungi, and other natural sources, creating a direct link to biodiversity.

- Supply Chain Risks: Biodiversity loss and depletion of natural resources can lead to ingredient scarcity and price volatility for companies like Adcock Ingram.

- Sustainable Sourcing: Adcock Ingram's long-term viability may depend on its ability to implement and maintain responsible sourcing practices for its raw materials.

- Environmental Impact: Operations need to be managed to minimize negative impacts on ecosystems, supporting the preservation of biodiversity for future ingredient availability.

Adcock Ingram must navigate increasingly stringent environmental regulations, such as South Africa's National Environmental Management Act (NEMA), impacting waste management and emissions. The company's sustainability initiatives, including waste reduction and water conservation, are crucial for aligning with global trends and stakeholder expectations, as evidenced by their 2023 Integrated Report highlighting carbon footprint reduction efforts.

Climate change presents risks through altered disease patterns affecting product demand and extreme weather events disrupting supply chains, underscoring the need for resilience, especially given 2023 being the warmest year on record globally.

Adcock Ingram's reliance on natural resources for pharmaceutical ingredients necessitates sustainable sourcing to mitigate risks from biodiversity loss, with over 30% of species facing extinction risk by 2024, impacting ingredient availability and price.

The company's environmental stewardship enhances brand image and stakeholder relations, making eco-friendly practices a competitive advantage in a market where ESG performance is increasingly scrutinized.

PESTLE Analysis Data Sources

Our Adcock Ingram PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. These sources provide comprehensive insights into political stability, economic indicators, and regulatory frameworks impacting the pharmaceutical sector.