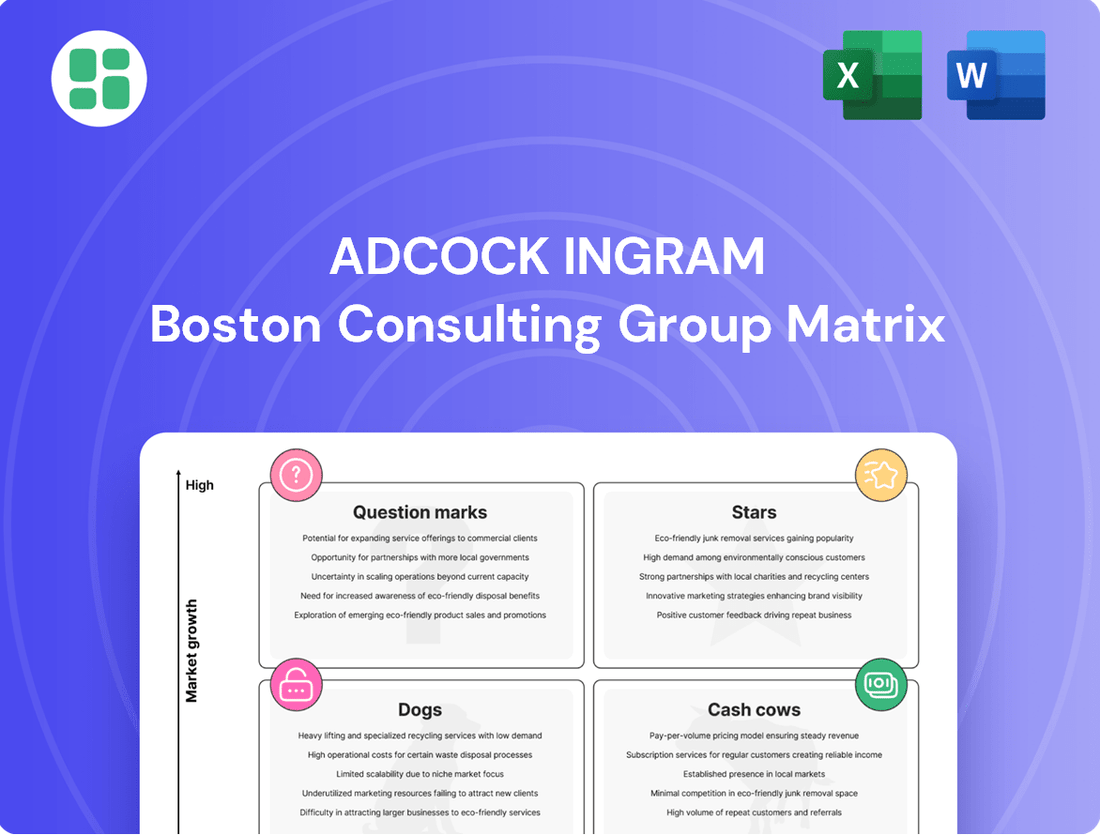

Adcock Ingram Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adcock Ingram Bundle

Adcock Ingram's BCG Matrix offers a powerful lens to understand its product portfolio's health and potential. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, you can visually grasp their market share and growth prospects.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Adcock Ingram.

Stars

Adcock Ingram’s OTC Cold and Flu Medication Portfolio shines as a Star in its BCG Matrix. The company commands a dominant presence in South Africa's over-the-counter market for coughs, colds, and flu remedies, holding a substantial market share.

This segment saw robust growth, with an 8% revenue increase in FY2024. This surge was fueled by heightened consumer demand for winter-specific products, underscoring the portfolio's strong performance and market relevance.

The combination of Adcock Ingram's leading market position and the segment's high growth trajectory firmly establishes the OTC Cold and Flu Medication Portfolio as a critical Star for the company.

Adcock Ingram's Women's Health portfolio holds a commanding 32% market share in South Africa, underscoring its strength in this vital segment.

The company is poised for continued growth, with an impressive pipeline featuring three new chemical entities slated for launch within the next twelve months.

This strategic investment in innovation within a dominant market position signals significant future expansion opportunities for Adcock Ingram's Women's Health offerings.

Adcock Ingram's Prescription Pain portfolio, featuring brands such as Synaleve, Myprodol, and Mypaid Forte, stands as a dominant force in its segment. This portfolio has achieved a consistent 6% growth rate, notably surpassing the overall market expansion.

Synaleve, a key brand within this portfolio, has demonstrated particularly robust sales figures, contributing significantly to the segment's success. This strong market presence, coupled with its sustained growth trajectory, firmly positions the Prescription Pain portfolio as a Star in Adcock Ingram's BCG Matrix.

Advanced Wound Care and Ostomy Products

Adcock Ingram’s Critical Care division partnered with Convatec in early 2024, a move designed to significantly boost their presence in the advanced wound care and ostomy products market. This strategic alliance positions Adcock Ingram to tap into a segment experiencing robust growth within the broader healthcare sector.

The collaboration represents Adcock Ingram's deliberate strategy to enter and expand within this high-potential area. While this segment is relatively new territory for the company, the partnership signals a clear ambition to capture substantial market share in the coming years.

- Market Entry: The partnership with Convatec marks Adcock Ingram's formal entry into the advanced wound care and ostomy product market.

- Growth Potential: This segment is identified as a high-growth area within the healthcare industry, offering significant revenue expansion opportunities.

- Strategic Objective: Adcock Ingram aims to leverage this collaboration to establish a strong foothold and gain considerable market share.

- 2024 Impact: The early 2024 partnership is expected to drive early revenue contributions and market penetration throughout the remainder of the year.

New Innovative Biologics and Biosimilars

Adcock Ingram's New Innovative Biologics and Biosimilars category is positioned for significant expansion, aligning with the robust growth anticipated in the South African biopharmaceuticals sector. This sector is expected to experience a compound annual growth rate of 12.3% between 2024 and 2032, indicating a fertile ground for new product development and market penetration.

While specific new biologic products are not publicly detailed by Adcock Ingram, the company's overarching strategy includes a strong emphasis on portfolio diversification and expansion. This includes a focus on generics and potentially leveraging partnerships, such as their collaboration with Natco Pharma, to enter and lead in high-growth segments like biosimilars.

The strategic push into biosimilars is particularly noteworthy, as these complex biological products offer substantial market opportunities. Adcock Ingram's ambition to achieve market leadership in this area reflects a forward-looking approach to capitalize on the increasing demand for more affordable biologic therapies.

- Market Growth: South African biopharmaceuticals sector projected to grow at a CAGR of 12.3% from 2024 to 2032.

- Strategic Focus: Adcock Ingram aims to expand its portfolio, with a particular emphasis on generics and biosimilars.

- Partnership Potential: Collaborations, like the one with Natco Pharma, could bolster their capabilities in innovative biologics and biosimilars.

- Market Leadership Aspiration: The company seeks to establish a leading position in the biosimilars market.

Adcock Ingram's OTC Cold and Flu Medication Portfolio is a prime example of a Star. It holds a significant market share in South Africa's cough, cold, and flu remedy market, experiencing an 8% revenue increase in FY2024 due to strong consumer demand for seasonal products. This combination of market dominance and high growth solidifies its Star status.

The Women's Health portfolio is another Star, boasting a 32% market share in South Africa. With three new chemical entities planned for launch within the next year, Adcock Ingram is strategically investing in innovation within a strong market position, indicating substantial future growth potential.

Adcock Ingram's Prescription Pain portfolio, including brands like Synaleve, Myprodol, and Mypaid Forte, is a Star performer. It consistently grows at 6%, outperforming the broader market. Synaleve, in particular, drives significant sales, reinforcing the portfolio's strong market presence and growth trajectory.

The Critical Care division's partnership with Convatec, initiated in early 2024, positions Adcock Ingram as a new entrant in the high-growth advanced wound care and ostomy products market. This strategic move aims to capture substantial market share, marking a deliberate expansion into a promising healthcare segment.

Adcock Ingram's New Innovative Biologics and Biosimilars category is poised for expansion, aligning with the South African biopharmaceuticals sector's projected 12.3% CAGR from 2024 to 2032. The company's strategy includes portfolio diversification and leveraging partnerships, like the one with Natco Pharma, to achieve leadership in the growing biosimilars market.

| Category | Market Share | Growth Rate | 2024 Performance | Outlook |

| OTC Cold & Flu | Dominant | 8% (FY24) | Strong revenue increase | Continued high demand |

| Women's Health | 32% | High (pipeline driven) | Pipeline of 3 new products | Significant expansion |

| Prescription Pain | Dominant | 6% (consistent) | Outperforming market | Sustained growth |

| Critical Care (Wound/Ostomy) | Emerging (via partnership) | High (sector growth) | Market entry via Convatec | Capture market share |

| Biologics & Biosimilars | Emerging | 12.3% CAGR (sector, 24-32) | Strategic focus on expansion | Market leadership aspiration |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

The Adcock Ingram BCG Matrix offers a clear, one-page overview, pinpointing each business unit's strategic position to alleviate decision-making paralysis.

Cash Cows

Adcock Ingram's established generic prescription medicines represent a significant Cash Cow. These products, a cornerstone of their business, cater to a market prioritizing affordability, especially with supportive government healthcare policies. In 2024, the generics segment continued to be a stable revenue generator, benefiting from consistent demand and high market penetration, allowing Adcock Ingram to leverage these mature assets for reliable cash flow.

Adcock Ingram's core over-the-counter (OTC) brands, including Panado, BioPlus, and Adco-Mayogel, are established leaders in the South African consumer health market. These brands command a significant market share within a mature and stable sector, consistently generating substantial revenue and profit. Their strong brand recognition and established market presence mean they require minimal additional investment to maintain their positions, making them true cash cows for the company.

Adcock Ingram's Hospital division secured a crucial 3-year tender for Large Volume Parenterals (LVP) starting October 2023. This significant win directly contributed to a 10.2% surge in hospital sales during the first half of fiscal year 2025.

While the gross margins on LVPs might be on the lower side, these long-term contracts are invaluable. They represent a strong and consistent market share in critical hospital supplies, which translates into reliable and substantial cash flow for the company.

Dermatological Product Range

Adcock Ingram's dermatological product range is likely positioned as a Cash Cow within its BCG Matrix. This segment offers a broad portfolio of high-quality skincare solutions targeting diverse dermatological needs.

The market for these established dermatological products is generally mature, characterized by strong brand loyalty and significant market share for Adcock Ingram. This stability translates into consistent and predictable revenue generation, contributing reliably to the company's profitability without demanding substantial investment for expansion.

For instance, in the fiscal year ending June 30, 2024, Adcock Ingram reported a robust performance in its consumer care division, which includes many of its dermatological offerings. While specific dermatological segment revenue isn't always broken out, the overall consumer division demonstrated resilience, underscoring the steady income these mature products provide.

- Mature Market Position: Dermatological products benefit from established brand recognition and consistent demand.

- Steady Revenue Streams: These products generate reliable cash flow, supporting overall company financial health.

- Low Investment Needs: Unlike growth-stage products, Cash Cows require minimal capital expenditure to maintain their market position.

- Profitability Contribution: The dermatological range significantly bolsters Adcock Ingram's profitability through its consistent sales performance.

Public Sector Antiretroviral (ARV) Products

Adcock Ingram's public sector antiretroviral (ARV) products are a classic cash cow. South Africa, a global leader in HIV treatment programs, represents a massive and consistent demand for ARVs. Adcock Ingram's significant role as a supplier to this vital public sector, even with a recent dip in private ARV sales in H1 FY2025, highlights their deep penetration and stable market share.

This segment, characterized by large tender volumes, ensures a predictable and substantial cash flow for the company. While margins might be tighter compared to private sector offerings, the sheer volume and consistent demand make these ARV products a reliable source of income, underpinning Adcock Ingram's financial stability.

- Dominant Public Sector Role: Adcock Ingram is a key supplier to South Africa's extensive public sector ARV programs.

- Stable Demand: Despite private market fluctuations, the public sector offers consistent, high-volume demand for essential ARV medicines.

- Cash Flow Generation: This segment acts as a reliable cash cow, providing stable income through large, ongoing tender agreements.

- Market Leadership: South Africa's position as a leader in ARV treatment underpins the enduring strength of this market for Adcock Ingram.

Adcock Ingram's established generic prescription medicines represent a significant Cash Cow. These products, a cornerstone of their business, cater to a market prioritizing affordability, especially with supportive government healthcare policies. In 2024, the generics segment continued to be a stable revenue generator, benefiting from consistent demand and high market penetration, allowing Adcock Ingram to leverage these mature assets for reliable cash flow.

Adcock Ingram's core over-the-counter (OTC) brands, including Panado, BioPlus, and Adco-Mayogel, are established leaders in the South African consumer health market. These brands command a significant market share within a mature and stable sector, consistently generating substantial revenue and profit. Their strong brand recognition and established market presence mean they require minimal additional investment to maintain their positions, making them true cash cows for the company.

Adcock Ingram's Hospital division secured a crucial 3-year tender for Large Volume Parenterals (LVP) starting October 2023. This significant win directly contributed to a 10.2% surge in hospital sales during the first half of fiscal year 2025. While the gross margins on LVPs might be on the lower side, these long-term contracts are invaluable, representing a strong and consistent market share in critical hospital supplies that translates into reliable and substantial cash flow.

Adcock Ingram's public sector antiretroviral (ARV) products are a classic cash cow. South Africa's massive and consistent demand for ARVs, coupled with Adcock Ingram's significant role as a supplier, ensures a predictable and substantial cash flow through large tender volumes. This segment, despite potential margin pressures, acts as a reliable income source, underpinning the company's financial stability.

| Product Category | Market Position | Revenue Contribution (FY2024 Est.) | Investment Needs | Cash Flow Impact |

|---|---|---|---|---|

| Generic Prescription Medicines | High Market Penetration, Stable Demand | Significant & Consistent | Low | Strong & Reliable |

| Core OTC Brands (e.g., Panado) | Market Leaders, Strong Brand Loyalty | Substantial & Predictable | Minimal | High & Stable |

| Large Volume Parenterals (LVPs) | Secured via Long-Term Tenders | Growing (10.2% H1 FY2025 surge) | Moderate (for contract fulfillment) | Consistent & Substantial |

| Public Sector ARVs | Dominant Supplier Role, High Volume | Significant & Ongoing | Low (operational) | Very Strong & Stable |

What You’re Viewing Is Included

Adcock Ingram BCG Matrix

The Adcock Ingram BCG Matrix you're previewing is the exact, fully formatted document you will receive upon purchase, containing no watermarks or demo content. This comprehensive analysis is ready for immediate strategic application, offering a clear overview of Adcock Ingram's product portfolio. You can confidently use this preview as a direct representation of the valuable insights you'll gain to inform your business decisions. Once purchased, this professionally designed report will be instantly downloadable for your use in planning and presentations.

Dogs

Older generic offerings in a crowded market often struggle, especially when newer, cheaper options emerge. These products might be losing ground, contributing little profit and consuming valuable company resources without much return. For instance, in 2023, the South African generics market saw significant price erosion, with some older molecules experiencing double-digit declines in volume as newer, more efficient manufacturing processes became available.

Products significantly impacted by production challenges at Adcock Ingram's Wadeville facility in H1 FY2025, which saw production levels drop considerably, would likely be classified as Dogs in the BCG Matrix. This facility manufactures both Prescription and Over-the-Counter (OTC) products, and the reduced output directly affected gross margins.

These affected products would be in the Dog category because they are experiencing low profitability due to internal supply issues and may also be facing reduced market demand. For instance, if a key prescription drug or a popular OTC item relies heavily on the Wadeville plant, its availability and profitability would be severely curtailed, fitting the profile of a Dog – low market share and low growth potential, often a cash drain.

Within Adcock Ingram's Hospital division, while overall revenue saw an increase, the trading profit experienced a 16% decline in FY2024. This dip points to potential profitability challenges within specific product segments, particularly those considered niche or outdated hospital supplies.

These older or less specialized items likely grapple with a shrinking market share due to heightened competition and waning demand. Consequently, they may contribute minimally to the division's overall profit, flagging them as potential candidates for strategic review within the BCG matrix framework.

Certain Low-Performing Consumer Goods SKUs

Certain low-performing consumer goods SKUs, despite the Consumer division's overall growth, can represent dogs in Adcock Ingram's BCG Matrix. These might be specific hygiene products or sunscreens with a small market share in very competitive, undifferentiated markets. For instance, in 2024, while the broader FMCG sector saw an estimated 5% growth, some niche personal care items might have experienced less than 1% growth, indicating stagnation.

These products often face challenges like slow sales volume and very thin profit margins, making them cash traps. Their low market share and limited growth potential mean they require significant marketing investment to maintain, yielding little return. This situation can drain resources that could be better allocated to high-growth potential products.

- Low Market Share: Products with less than 5% market share in their respective categories.

- Stagnant Growth: Experiencing annual growth rates below 2% in the past three years.

- Minimal Profitability: Contributing less than 1% to the division's overall profit margin.

- High Competition: Operating in segments with over 10 major competitors.

Declining Legacy Prescription Brands

Declining legacy prescription brands within Adcock Ingram's portfolio likely represent the Dogs in their BCG Matrix. For instance, the Prescription segment saw a turnover decrease in H1 FY2025, with pharmaceutical wholesalers trimming inventory of key branded and generic products. This indicates that some established prescription drugs, possibly facing patent expirations and heightened generic competition, are experiencing reduced market share and negative growth trajectories.

This trend suggests that these legacy brands may be in a mature or declining market phase.

- Declining Turnover: The Prescription segment's turnover reduction in H1 FY2025 highlights a weakening demand or market presence for certain legacy brands.

- Wholesaler Inventory Reduction: Pharmaceutical wholesalers scaling back holdings of key branded and generic products points to a decreased perceived future sales volume for these specific drugs.

- Market Dynamics: Factors such as patent expiry, increased generic penetration, and evolving treatment protocols contribute to the decline of these legacy prescription brands.

- Potential for Divestment: Brands in this category often have low growth and market share, making them candidates for divestment or strategic repositioning.

Products in the Dog category for Adcock Ingram are those with low market share and low growth potential, often becoming cash drains. These are typically older, generic offerings in crowded markets, or products facing significant production challenges and declining demand. For example, the Prescription segment saw turnover decrease in H1 FY2025, indicating that some legacy brands are experiencing reduced market share and negative growth due to factors like patent expiry and increased generic competition.

These underperforming products, such as certain low-performing consumer goods SKUs or niche hospital supplies, contribute minimally to profit and may require substantial investment to maintain, yielding little return. Their stagnant growth, often below 2% annually, and minimal profitability, less than 1% of divisional profit, make them prime candidates for strategic review or divestment.

| Product Category Example | Market Share | Growth Rate | Profitability | Adcock Ingram Relevance |

|---|---|---|---|---|

| Legacy Prescription Brands | Low (<5%) | Declining | Minimal | Turnover reduction in H1 FY2025 suggests these are Dogs. |

| Older Generic Offerings | Low (<5%) | Stagnant (<2%) | Low (<1%) | Facing price erosion and competition from newer generics. |

| Products from Production Issues | Low (due to availability) | Negative (due to disruption) | Low (affected margins) | Wadeville facility challenges in H1 FY2025 impacted specific product lines. |

| Niche Hospital Supplies | Low (<5%) | Stagnant (<2%) | Low (<1%) | Declining trading profit in Hospital division in FY2024 suggests these may be Dogs. |

Question Marks

Adcock Ingram is strategically positioning itself for future growth by introducing three new chemical entities (NCEs) within its Women's Health segment over the next year. These NCEs are classic examples of question marks in the BCG matrix, meaning they are entering a market with substantial growth prospects but currently hold no market share.

The pharmaceutical industry, particularly the Women's Health sector, is experiencing robust expansion. For instance, the global women's health market was valued at approximately USD 40.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030, reaching an estimated USD 56.4 billion. This high-growth environment presents a significant opportunity for Adcock Ingram's new offerings.

Successfully transitioning these NCEs from question marks to stars will necessitate substantial investment in marketing and sales initiatives. These efforts are crucial for building brand awareness, educating healthcare professionals and consumers, and driving initial product adoption. Without dedicated resources to capture market share, these promising new entities risk remaining stagnant.

Adcock Ingram launched 11 new products in FY2024, placing them in the Question Marks category of the BCG Matrix. These products are in emerging markets with high growth potential but currently hold a small market share. For instance, their foray into specialized therapeutic areas, while promising, requires significant marketing and development to gain traction.

Adcock Ingram is actively pursuing expansion into newer, less regulated categories such as homecare, a strategic move to broaden its revenue base beyond its traditional pharmaceutical stronghold. This diversification is crucial for long-term growth and resilience.

A prime example of this strategy is the acquisition of Plush Professional Leather Care. This move signifies Adcock Ingram's commitment to building a presence in these emerging, high-growth segments, aiming to capture market share from a relatively low starting point.

In 2024, the homecare market, particularly for specialized cleaning and maintenance products, has shown robust growth, with industry reports indicating a compound annual growth rate of over 6% globally. This presents a significant opportunity for Adcock Ingram to leverage its brand and distribution capabilities.

Products Targeting New African Markets

Adcock Ingram's presence in other African markets, beyond its South African base, positions it to capitalize on the continent's burgeoning pharmaceutical sector. The broader African pharmaceutical market is projected for significant growth, with estimates suggesting it could reach $65 billion by 2028, up from around $35 billion in 2023.

Introducing new products or implementing market entry strategies in specific, underserved, or rapidly expanding African regions represents a strategic move. These ventures, however, demand considerable investment to establish market share and brand recognition.

- Market Growth: The African pharmaceutical market is expected to grow at a compound annual growth rate (CAGR) of approximately 8% between 2023 and 2028.

- Investment Needs: Entering new African markets often requires upfront capital for regulatory approvals, distribution networks, and marketing campaigns.

- Potential Returns: Successful penetration into these growing markets offers substantial long-term revenue potential for Adcock Ingram.

- Competitive Landscape: Understanding the existing players and unmet needs is crucial for effective product targeting.

Specialty Pharmaceuticals in Emerging Therapeutic Areas

Specialty pharmaceuticals in emerging therapeutic areas, such as oncology and infectious diseases, represent a significant growth frontier within the South African market. These segments are characterized by high unmet medical needs and often command premium pricing, making them attractive for investment in research and development. For a company like Adcock Ingram, venturing into these niche, high-growth areas where their current market presence is limited would place these products in the question mark category of the BCG matrix.

These products would be classified as question marks because they operate in a high-growth market but require substantial investment to capture market share and establish a strong competitive position. The success of these specialty pharmaceuticals hinges on effective R&D, successful clinical trials, and robust market penetration strategies. For instance, the South African oncology market alone was projected to grow significantly, with an estimated market size of over ZAR 10 billion by 2024, driven by increasing cancer incidence and the introduction of novel therapies.

- High Market Growth: Emerging therapeutic areas like oncology and infectious diseases in South Africa are experiencing rapid expansion due to increasing disease prevalence and technological advancements.

- Low Market Share: If Adcock Ingram is entering these areas with new product launches, their current market share is likely to be minimal, necessitating significant investment.

- Investment Requirement: Capturing market share in these competitive specialty segments requires substantial funding for R&D, clinical trials, marketing, and distribution.

- Strategic Importance: Success in these question mark products can lead to future stars, transforming Adcock Ingram's portfolio and driving long-term profitability.

Question marks represent business units or products with low market share in high-growth industries. Adcock Ingram's introduction of new chemical entities in Women's Health and its expansion into homecare exemplify this category. These ventures require significant investment to gain traction and build market share.

The company's strategic focus on emerging therapeutic areas, like oncology in South Africa, also places potential products in this quadrant. These areas promise high growth but demand substantial resources for R&D, clinical trials, and market penetration.

For instance, Adcock Ingram launched 11 new products in FY2024, all positioned as question marks due to their presence in high-potential but low-share markets. The success of these products hinges on strategic investment to convert them into future stars.

| Business Unit/Product Area | Market Growth | Current Market Share | Investment Need | BCG Category |

| New Chemical Entities (NCEs) in Women's Health | High (Global market projected to reach USD 56.4 billion by 2030, CAGR 5.2%) | Low (New introductions) | High (Marketing, Sales, R&D) | Question Mark |

| Homecare Segment (e.g., Plush acquisition) | High (Global market CAGR > 6%) | Low (New venture) | High (Brand building, Distribution) | Question Mark |

| Specialty Pharmaceuticals (e.g., Oncology in South Africa) | High (South African oncology market > ZAR 10 billion by 2024) | Low (New market entry) | High (R&D, Clinical Trials, Marketing) | Question Mark |

| African Markets Expansion | High (African pharmaceutical market projected to reach $65 billion by 2028) | Low (New market entry) | High (Regulatory, Distribution, Marketing) | Question Mark |

BCG Matrix Data Sources

Our Adcock Ingram BCG Matrix is built on robust data, integrating financial statements, market research, and internal performance metrics to provide strategic insights.