Acerinox SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acerinox Bundle

Acerinox, a global leader in stainless steel, possesses significant strengths in its diversified product portfolio and strong market presence. However, understanding its vulnerabilities to raw material price fluctuations and the competitive landscape is crucial for informed decision-making.

Want the full story behind Acerinox’s market position, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Acerinox stands as a global frontrunner in stainless steel, boasting an integrated production model that spans from raw material melting to final finishing. This end-to-end control allows for consistent quality and operational efficiency, a significant advantage in the competitive steel market.

In 2023, Acerinox reported sales of €7.1 billion, demonstrating its substantial market presence. The company’s integrated production is a key driver of its ability to manage costs and maintain product quality across its diverse stainless steel offerings.

The acquisition of Haynes International in 2024 was a pivotal strategic move for Acerinox, significantly bolstering its presence in the high-performance alloys market, particularly within the United States. This integration positions Acerinox to capitalize on Haynes' century-long expertise in research and development, opening doors to specialized sectors such as aerospace and defense.

This strategic expansion is projected to unlock substantial synergies across various operational facets, including cost efficiencies, enhanced sales opportunities, and improved process optimization. By combining their strengths, Acerinox aims to leverage Haynes' established market position and technological prowess to drive growth and innovation in the specialized alloys segment.

Acerinox boasts a diverse product range encompassing stainless steel coils, sheets, plates, and long products. This broad offering serves a variety of critical sectors such as construction, automotive, industrial machinery, food processing, and energy.

This extensive product and sector diversification is a significant strength, as it lessens dependence on any single industry. For instance, in 2023, the company reported that its stainless steel division contributed significantly to its overall performance, demonstrating the resilience of its varied market presence amidst fluctuating global demand.

Commitment to Sustainability and Innovation

Acerinox demonstrates a robust commitment to sustainability, a key strength that resonates with environmentally conscious investors and stakeholders. This dedication is clearly visible in its ambitious decarbonization strategy, aiming to significantly reduce its environmental footprint.

The company's innovative approach to sustainable products is exemplified by EcoACX®, a material boasting over 50% reduced CO2 emissions. This achievement is powered by the significant integration of renewable energy sources and the utilization of more than 90% recycled materials, showcasing a circular economy model in practice.

Further solidifying its leadership in sustainability, Acerinox has implemented nearly 200 specific initiatives. This comprehensive plan has been recognized with the prestigious EcoVadis Platinum medal, placing the company within the top 1% of its industry for its outstanding sustainability performance.

Key highlights of Acerinox's sustainability strengths include:

- EcoACX®: A sustainable product with over 50% reduced CO2 emissions.

- Renewable Energy Integration: Significant use of renewable energy in production processes.

- High Recycled Material Content: Over 90% recycled material used in EcoACX®.

- EcoVadis Platinum Recognition: Top 1% industry ranking for sustainability.

Operational Excellence Initiatives

Acerinox is driving operational excellence through its Beyond Excellence Plan, spanning 2024 to 2026. This comprehensive strategy is designed to boost the company's competitiveness by implementing new continuous improvement projects, advancing digital transformation, and fostering innovation across its operations. The plan is a clear commitment to refining efficiency and reducing costs.

A key objective of this initiative is to achieve a significant EBITDA improvement of EUR 100 million over the plan's duration. This financial target underscores the tangible benefits expected from these operational enhancements, demonstrating a focused effort on maximizing profitability through streamlined processes and smarter technology adoption.

- Beyond Excellence Plan (2024-2026): A strategic roadmap for enhanced competitiveness.

- Key Focus Areas: Continuous improvement projects, digital transformation, and innovation.

- Financial Target: Aiming for a EUR 100 million EBITDA improvement by 2026.

Acerinox's integrated production model, from raw material to finished product, ensures consistent quality and cost control, a significant competitive advantage. The strategic acquisition of Haynes International in 2024 expanded its reach into high-performance alloys, particularly in the US aerospace and defense sectors, leveraging Haynes' century of expertise.

The company's diverse product portfolio, serving sectors like construction, automotive, and energy, reduces reliance on any single market, as evidenced by its stainless steel division's strong performance in 2023. Acerinox's commitment to sustainability is a major strength, highlighted by its EcoACX® product with over 50% reduced CO2 emissions and its EcoVadis Platinum medal, placing it in the top 1% of its industry.

The Beyond Excellence Plan (2024-2026) aims to boost competitiveness through continuous improvement and digital transformation, targeting a EUR 100 million EBITDA improvement by 2026.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Production | End-to-end control from melting to finishing | Ensures consistent quality and operational efficiency |

| Strategic Acquisition | Haynes International (2024) | Bolsters presence in high-performance alloys, especially in the US |

| Product Diversification | Wide range of stainless steel products | Serves multiple critical sectors, reducing market dependency |

| Sustainability Leadership | EcoACX®, renewable energy, high recycled content | EcoVadis Platinum medal (top 1% industry ranking) |

| Operational Excellence Plan | Beyond Excellence Plan (2024-2026) | Targeting EUR 100 million EBITDA improvement by 2026 |

What is included in the product

This SWOT analysis provides a comprehensive view of Acerinox's competitive landscape, detailing its internal strengths and weaknesses alongside external opportunities and threats.

Acerinox's SWOT analysis provides a clear, actionable roadmap to address market volatility and competitive pressures.

Weaknesses

Acerinox’s profitability is significantly exposed to the unpredictable swings in the cost of essential raw materials like nickel and chromium, which are fundamental to stainless steel production. These input costs are projected to see an upward trend in 2025, directly threatening to elevate Acerinox's manufacturing expenses and compress its profit margins.

Acerinox's reliance on stainless steel, a material whose demand is closely tied to global economic health, presents a significant weakness. Sectors like construction and automotive, major consumers of stainless steel, are particularly sensitive to economic downturns.

A slowdown in key markets, for instance, the European Union and the United States, directly impacts Acerinox. This was evident in 2024, where weak demand in these regions led to a noticeable dent in the company's financial results, highlighting its vulnerability to macroeconomic shifts.

Acerinox grapples with fierce competition, particularly from Asian stainless steel manufacturers. Oversupply originating from countries like China and Indonesia has exerted downward pressure on prices, directly impacting profitability. This challenging market dynamic was underscored by Acerinox's decision to halt operations at its Bahru Stainless plant in Malaysia during 2024, a clear indicator of the intense regional competitive landscape.

High Capital Expenditure and Energy Intensity

Acerinox operates in a sector demanding significant upfront investment. The construction and maintenance of stainless steel production facilities, including advanced machinery and infrastructure, represent a substantial capital expenditure. For instance, major expansion projects or upgrades to meet environmental standards can run into hundreds of millions of euros, impacting cash flow and requiring careful financial planning.

The energy-intensive nature of stainless steel manufacturing poses a notable weakness. Processes like melting and refining require vast amounts of electricity and heat, making Acerinox susceptible to volatility in global energy markets. In 2023, for example, persistent high energy prices in Europe directly translated into increased operating costs for many steel producers, including those in Acerinox's operational regions.

These high energy costs necessitate continuous investment in efficiency improvements. To mitigate the impact of rising energy prices and maintain a competitive edge, Acerinox must allocate resources towards adopting more energy-efficient technologies and exploring alternative energy sources. This ongoing need for investment can strain financial resources and divert capital from other growth initiatives.

- Capital Intensive Operations: Stainless steel production requires substantial investment in plant and machinery, with major facility upgrades often costing hundreds of millions of euros.

- Energy Price Sensitivity: The manufacturing process is highly energy-dependent, making the company vulnerable to fluctuations in global electricity and gas prices, which directly impact production costs.

- Need for Efficiency Investments: Ongoing investment in energy-saving technologies is crucial for cost management and competitiveness, potentially diverting capital from other strategic areas.

Impact of Industrial Action and Labor Issues

Industrial disputes represent a significant weakness for Acerinox. The prolonged four-month strike at Acerinox Europa in 2024 serves as a stark example, causing substantial disruptions to operations. This labor action directly led to a considerable drop in crude steel output, impacting the company's ability to meet demand and fulfill contracts.

The financial repercussions of such industrial actions are considerable. For instance, the 2024 strike at Acerinox Europa resulted in an estimated negative impact of EUR -7 million on EBITDA. Beyond immediate financial losses, these disputes can also cause delays in crucial strategic projects, hindering long-term growth and development plans.

- Production Disruption: The 2024 strike at Acerinox Europa led to significant declines in crude steel output.

- Financial Impact: An estimated EUR -7 million hit to EBITDA was recorded for Acerinox Europa due to the 2024 labor dispute.

- Project Delays: Industrial action can postpone important strategic initiatives, affecting future competitiveness.

Acerinox's profitability is heavily influenced by volatile raw material costs, particularly nickel and chromium. Projections for 2025 indicate an upward trend in these input prices, which will likely increase manufacturing expenses and squeeze profit margins.

The company's dependence on stainless steel, a product whose demand is closely tied to economic cycles, makes it vulnerable to global slowdowns. Weak demand in key markets like the EU and US, as seen in 2024, directly impacted Acerinox's financial performance.

Intense competition, especially from Asian producers, puts downward pressure on prices. This was highlighted in 2024 when Acerinox temporarily ceased operations at its Malaysian plant due to the challenging competitive environment.

The energy-intensive nature of steel production exposes Acerinox to fluctuations in energy markets. High energy costs, as experienced in Europe in 2023, directly increase operating expenses.

Same Document Delivered

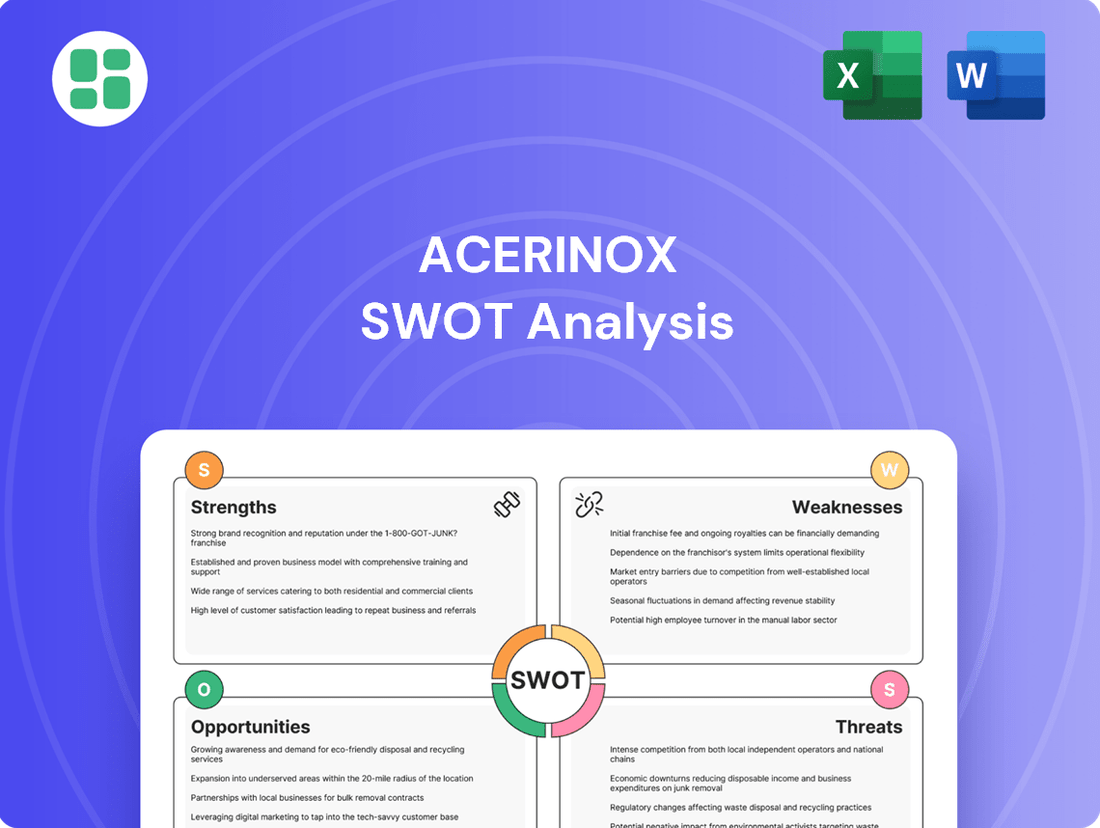

Acerinox SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’ll gain a comprehensive understanding of Acerinox's Strengths, Weaknesses, Opportunities, and Threats, all presented in a clear and actionable format.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing detailed insights into Acerinox's strategic position and competitive landscape.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Acerinox SWOT analysis, ready for your strategic planning needs.

Opportunities

The global stainless steel market is on a strong growth trajectory, fueled by expanding needs in crucial areas. Sectors like construction, automotive (particularly electric vehicles), renewable energy, and healthcare are all showing increased demand. Acerinox, with its broad range of products, is well-positioned to benefit from these expanding markets.

Acerinox's acquisition of Haynes International in 2023 significantly bolsters its position in the high-performance alloys market, a sector projected for robust growth. This move opens doors to specialized industries such as aerospace and defense, where demand for advanced materials is consistently high. Haynes International's established reputation and technological prowess in nickel-based alloys are expected to drive Acerinox's expansion into these lucrative, higher-margin segments.

The global drive towards sustainability is a significant tailwind for Acerinox. As industries increasingly prioritize environmentally friendly materials, the demand for 'green steel' is set to surge. This trend is amplified by regulatory frameworks like the EU's Carbon Border Adjustment Mechanism (CBAM), which incentivizes lower-carbon production methods.

Acerinox is strategically positioned to capitalize on this opportunity with its EcoACX® product line. This initiative, focused on reducing CO2 emissions and incorporating higher percentages of recycled content, directly addresses the growing market preference for sustainable steel. By aligning its product development with these global shifts, Acerinox can capture market share in this expanding segment.

Technological Advancements and Digital Transformation

Acerinox can capitalize on technological advancements by further investing in automation and AI. This can streamline production processes, leading to significant operational efficiencies. For instance, the company could implement AI-driven predictive maintenance, reducing costly downtime. The global industrial automation market is projected to reach USD 367.3 billion by 2028, indicating substantial growth potential.

Embracing advanced manufacturing techniques, such as additive manufacturing for alloys, presents a unique opportunity. This allows for the creation of novel stainless-steel powders and complex geometries, opening new market segments. The additive manufacturing market for metals is expected to grow considerably, reaching an estimated USD 15.7 billion by 2027, showcasing a strong demand for innovative material solutions.

These technological investments can directly impact Acerinox's bottom line through:

- Improved operational efficiency: Reducing waste and energy consumption.

- Enhanced quality control: Minimizing defects and rework.

- Reduced labor costs: Optimizing workforce deployment.

- Development of new product forms: Creating high-value stainless-steel powders for specialized applications.

Infrastructure Development and Urbanization

The global push for infrastructure development, especially in rapidly urbanizing emerging economies, presents a significant opportunity for Acerinox. Projects like China's Belt and Road Initiative and India's Smart Cities Mission are expected to drive substantial demand for stainless steel in construction and infrastructure components. Acerinox, with its established global footprint, is well-positioned to capitalize on this trend, offering specialized stainless steel products for architectural and structural applications.

Specifically, the United Nations projects that by 2050, 68% of the world's population will reside in urban areas, a considerable increase from today. This urbanization surge will necessitate vast investments in buildings, transportation networks, and utilities. Acerinox's ability to supply high-quality stainless steel for these critical infrastructure needs, from bridges and tunnels to high-rise buildings and public transit systems, directly aligns with these growth drivers.

Consider these key aspects:

- Increased Demand: Global infrastructure spending is projected to reach $15 trillion by 2040, with significant portions allocated to emerging markets.

- Urbanization Trends: Asia is expected to account for the majority of urban population growth in the coming decades, boosting demand for construction materials.

- Product Suitability: Acerinox's portfolio includes stainless steel grades ideal for corrosion resistance and durability, crucial for long-lasting infrastructure.

- Market Access: Acerinox's presence in key regions allows it to directly serve these burgeoning infrastructure projects.

Acerinox's strategic acquisition of Haynes International in 2023 positions it strongly in the high-performance alloys sector, a market anticipated for significant expansion, particularly within aerospace and defense. This move allows Acerinox to tap into industries demanding advanced materials, leveraging Haynes' established expertise in nickel-based alloys for higher-margin opportunities.

The growing global emphasis on sustainability presents a substantial opportunity, driven by increasing demand for 'green steel' and favorable regulatory environments like the EU's CBAM. Acerinox's EcoACX® product line, focused on reduced CO2 emissions and recycled content, directly aligns with these market preferences, enabling the company to capture share in this expanding segment.

Investing in automation and AI can unlock significant operational efficiencies for Acerinox, improving production processes and reducing downtime, as the global industrial automation market is projected to reach USD 367.3 billion by 2028. Furthermore, embracing advanced manufacturing techniques like additive manufacturing for alloys offers a pathway to create novel stainless-steel powders and complex geometries, tapping into a metals additive manufacturing market expected to reach USD 15.7 billion by 2027.

Global infrastructure development, especially in emerging economies, is a key growth driver, with projects like China's Belt and Road Initiative and India's Smart Cities Mission expected to boost demand for stainless steel. The United Nations anticipates 68% global urbanization by 2050, necessitating massive investments in construction and transportation, areas where Acerinox's durable, corrosion-resistant stainless steel products are well-suited.

| Opportunity Area | Key Driver | Market Projection/Data |

| High-Performance Alloys | Aerospace & Defense Demand | Haynes acquisition (2023) |

| Sustainable Steel | Environmental Regulations (CBAM) | Growing demand for 'green steel' |

| Automation & AI | Operational Efficiency | Industrial Automation Market: USD 367.3B by 2028 |

| Advanced Manufacturing | Additive Manufacturing | Metals Additive Manufacturing Market: USD 15.7B by 2027 |

| Infrastructure Development | Urbanization & Global Projects | Global Infrastructure Spending: $15T by 2040; 68% Urbanization by 2050 |

Threats

A prolonged global economic slowdown or recession presents a substantial threat to Acerinox. Such conditions directly curb industrial activity and consumer spending, resulting in diminished demand for stainless steel across all its major markets. The company's financial performance is notably susceptible to these macroeconomic shifts; for instance, the market experienced a slowdown in 2024, impacting sales volumes.

Persistent and erratic fluctuations in the prices of critical raw materials like nickel, chromium, and iron ore, alongside energy costs, pose a significant threat to Acerinox's cost structure. For instance, nickel prices on the London Metal Exchange (LME) experienced considerable volatility throughout 2023 and into early 2024, with significant swings impacting production expenses.

Unpredictable surges in these input costs can directly erode profit margins, making it challenging for Acerinox to maintain consistent profitability. These fluctuations also complicate long-term procurement strategies and can force frequent, potentially uncompetitive, pricing adjustments in response to market volatility.

The resurgence of trade protectionism, particularly the imposition or escalation of tariffs between major economic blocs, presents a significant threat. For instance, ongoing trade disputes involving the United States and its partners can directly impact the cost of raw materials and finished goods, disrupting global supply chains.

These trade barriers can inflate input costs for Acerinox and limit its access to key international markets, forcing a reassessment of its global sourcing and sales strategies. Such protectionist measures create uncertainty and can lead to retaliatory actions, further complicating international trade operations.

Intensified Competition from Low-Cost Producers

The stainless steel industry remains intensely competitive, with a significant and persistent threat emanating from low-cost producers, notably those situated in Asia. This competitive pressure is a constant challenge for established players like Acerinox.

The ongoing oversupply of steel, particularly from major exporting nations such as China, continues to exert downward pressure on global steel prices. This dynamic makes it increasingly difficult for Acerinox to protect its profit margins and retain its market share, especially in product categories that are less differentiated or specialized.

- Global Stainless Steel Production (2024 Estimate): Projections indicate global stainless steel production will remain robust, with Asia, particularly China, accounting for a substantial portion, continuing to influence price levels.

- Price Volatility: Stainless steel prices have experienced significant fluctuations, with benchmark prices for key grades like 304 stainless steel showing sensitivity to supply-demand imbalances, often impacted by Asian output.

- Market Share Erosion: In less specialized segments, Acerinox faces the risk of losing market share to competitors who can offer similar products at lower price points, directly impacting revenue streams.

Geopolitical Instability and Supply Chain Disruptions

Ongoing geopolitical tensions, particularly in Eastern Europe and the Middle East, continue to pose a significant threat to global supply chains. These conflicts can directly impact the availability and cost of critical raw materials and energy, essential for steel production. For instance, the volatility in energy markets throughout 2024 has seen fluctuating prices, directly affecting operational expenditures for companies like Acerinox.

Supply chain disruptions translate into higher procurement costs and extended lead times for key inputs, potentially hindering Acerinox's production schedules. This instability creates challenges in maintaining consistent output and meeting customer demand, impacting revenue streams and market share. The risk of material shortages remains a persistent concern, requiring robust contingency planning.

- Increased energy costs in 2024 have added pressure to operational budgets across the industrial sector.

- Disruptions in shipping routes due to regional conflicts can extend delivery times for both raw materials and finished goods.

- Geopolitical instability can lead to sudden price spikes for commodities like nickel and chromium, vital for stainless steel production.

- Acerinox, like other global manufacturers, must navigate these unpredictable supply chain dynamics to ensure operational continuity.

Acerinox faces significant threats from a volatile global economic environment and fluctuating raw material prices, impacting demand and costs. For example, nickel prices on the LME saw substantial swings in 2023-2024, directly affecting production expenses and profit margins. Trade protectionism and intense competition from low-cost Asian producers, particularly China, also threaten market share and pricing power. Geopolitical tensions further disrupt supply chains, increasing energy and raw material costs, as seen with energy market volatility in 2024.

| Threat Factor | Impact on Acerinox | Example Data/Trend (2023-2025) |

|---|---|---|

| Global Economic Slowdown | Reduced demand for stainless steel, impacting sales volumes. | Global industrial production growth forecasts for 2024 showed moderation. |

| Raw Material Price Volatility | Increased production costs, squeezed profit margins. | Nickel prices on LME exhibited significant fluctuations, impacting input costs. |

| Trade Protectionism | Higher input costs, restricted market access. | Ongoing trade disputes affected global supply chains and material costs. |

| Intense Competition & Oversupply | Downward pressure on prices, potential market share erosion. | Asian steel production, particularly from China, continued to influence global price levels. |

| Geopolitical Tensions & Supply Chain Disruptions | Increased energy and raw material costs, extended lead times. | Energy market volatility in 2024 directly affected operational expenditures. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Acerinox's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded and actionable strategic overview.