Acerinox PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acerinox Bundle

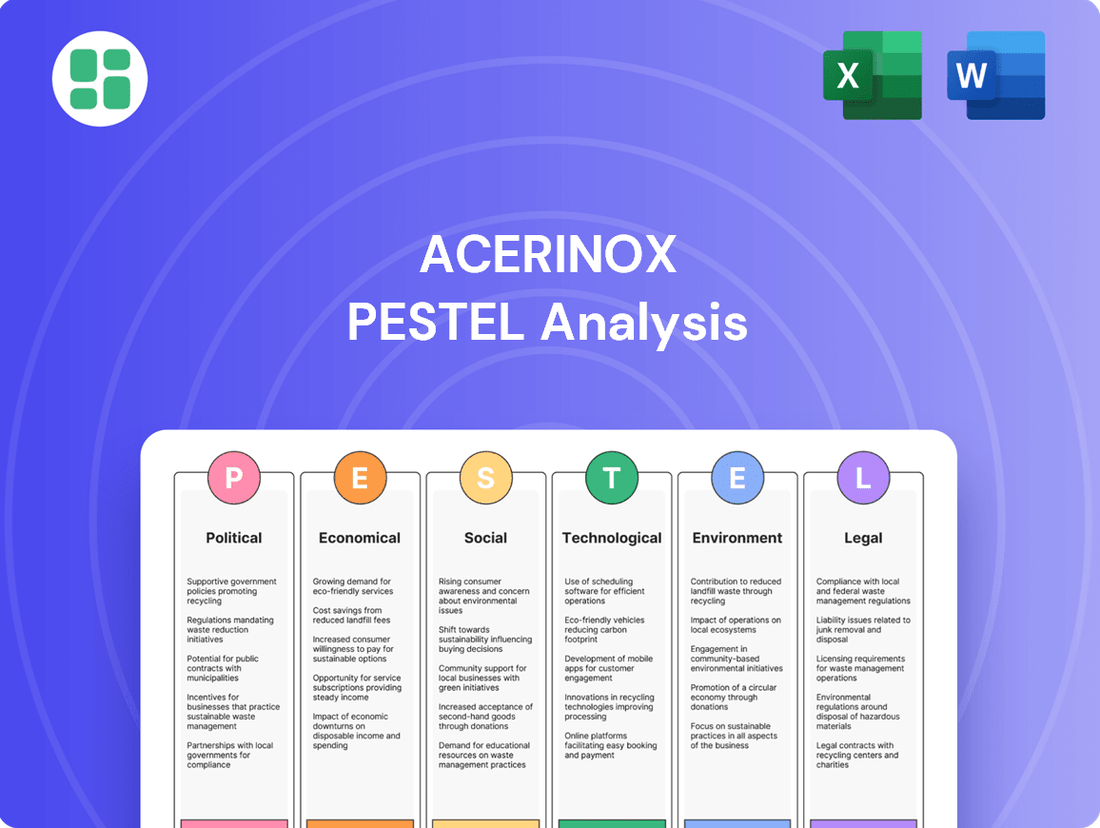

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting Acerinox's operations and future growth. This expertly crafted PESTLE analysis provides actionable intelligence to navigate the complex global landscape. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

Global trade tensions, including the US tariffs on steel and aluminum implemented in 2018, continue to influence international trade dynamics. These tariffs, which have seen some adjustments but remain a factor, directly affect raw material costs and export competitiveness for stainless steel producers like Acerinox.

The ongoing imposition of tariffs and the potential for new trade barriers create uncertainty, potentially increasing import costs and disrupting established supply chains. For Acerinox, this necessitates careful management of sourcing strategies and market access to mitigate the impact on pricing and sales volumes.

The European Union's Carbon Border Adjustment Mechanism (CBAM) introduces significant compliance obligations for Acerinox, particularly affecting its steel imports into the EU. This policy, designed to prevent carbon leakage, will impose financial costs on carbon-intensive goods, requiring Acerinox to meticulously track embedded emissions throughout its supply chain. The transitional reporting phase is currently underway, with full financial implications set to commence in 2026.

Government industrial policies, particularly those focused on decarbonization and energy cost compensation, are pivotal for the competitiveness of the steel sector. Spanish steel producers, including Acerinox, have actively sought government assistance to mitigate soaring energy expenses and to support their ambitious emission reduction targets. For instance, in 2023, the Spanish government introduced measures to help energy-intensive industries, which directly impacts companies like Acerinox, by providing financial aid to offset a portion of their electricity bills.

Geopolitical Instability and Regional Conflicts

Geopolitical instability, including ongoing regional conflicts, presents a significant challenge for companies like Acerinox. These situations can severely disrupt critical raw material supply chains, leading to price volatility and availability issues for essential inputs. Furthermore, such instability often fuels unpredictable fluctuations in energy prices, directly impacting operational costs and manufacturing efficiency. For instance, the ongoing tensions in Eastern Europe have continued to influence global energy markets throughout 2024, creating a less stable operating environment.

Acerinox's financial reporting consistently acknowledges these geopolitical uncertainties as key factors influencing market recovery and overall operational stability. The company must maintain a high degree of strategic flexibility to effectively mitigate the inherent risks associated with these volatile global conditions. This adaptability is crucial for navigating supply chain disruptions and managing the impact of fluctuating commodity and energy prices.

- Supply Chain Vulnerability: Conflicts can interrupt the flow of vital raw materials, impacting production schedules and increasing costs.

- Energy Price Volatility: Geopolitical events directly influence global energy markets, leading to unpredictable and often higher energy expenses for manufacturers.

- Market Uncertainty: Regional conflicts create an unpredictable business environment, making forecasting demand and investment decisions more challenging.

- Operational Risk: Acerinox, like other global manufacturers, faces increased operational risks in regions experiencing heightened geopolitical tensions.

International Relations and Bilateral Agreements

Bilateral trade relations and agreements significantly shape market access and raw material sourcing for companies like Acerinox. For example, the ongoing discussions and potential tariffs between the United States and Indonesia concerning nickel and stainless steel highlight how political relationships directly impact the global stainless steel market. These agreements can create both opportunities and challenges for international trade flows.

The evolving geopolitical landscape in 2024 and 2025 is characterized by a focus on securing supply chains for critical minerals. Acerinox, as a major stainless steel producer, is directly affected by these trends.

- Trade Agreements: Key trade pacts, such as those within the European Union or agreements with major trading partners, influence import/export duties and market entry barriers for Acerinox's products.

- Geopolitical Stability: Political stability in regions where Acerinox sources raw materials or has manufacturing operations is crucial. Instability can disrupt supply chains and increase operational costs.

- Tariff Policies: Changes in tariff policies, like those potentially impacting nickel or finished steel products between major economies, can alter competitive pricing and market demand.

- Critical Mineral Security: National strategies aimed at securing supplies of critical minerals, such as nickel and cobalt, can lead to new trade agreements or restrictions that affect Acerinox's procurement strategies.

Government industrial policies, particularly those focused on decarbonization and energy cost compensation, are pivotal for the competitiveness of the steel sector. Spanish steel producers, including Acerinox, have actively sought government assistance to mitigate soaring energy expenses and to support their ambitious emission reduction targets. For instance, in 2023, the Spanish government introduced measures to help energy-intensive industries, which directly impacts companies like Acerinox, by providing financial aid to offset a portion of their electricity bills.

The European Union's Carbon Border Adjustment Mechanism (CBAM) introduces significant compliance obligations for Acerinox, particularly affecting its steel imports into the EU. This policy, designed to prevent carbon leakage, will impose financial costs on carbon-intensive goods, requiring Acerinox to meticulously track embedded emissions throughout its supply chain. The transitional reporting phase is currently underway, with full financial implications set to commence in 2026.

Geopolitical instability, including ongoing regional conflicts, presents a significant challenge for companies like Acerinox. These situations can severely disrupt critical raw material supply chains, leading to price volatility and availability issues for essential inputs. Furthermore, such instability often fuels unpredictable fluctuations in energy prices, directly impacting operational costs and manufacturing efficiency. For instance, the ongoing tensions in Eastern Europe have continued to influence global energy markets throughout 2024, creating a less stable operating environment.

Bilateral trade relations and agreements significantly shape market access and raw material sourcing for companies like Acerinox. For example, the ongoing discussions and potential tariffs between the United States and Indonesia concerning nickel and stainless steel highlight how political relationships directly impact the global stainless steel market. These agreements can create both opportunities and challenges for international trade flows.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing Acerinox across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A clear, concise Acerinox PESTLE analysis that highlights key external factors, enabling proactive strategy development and mitigating potential disruptions.

Economic factors

Global stainless steel demand is closely tied to worldwide economic expansion, but the market has seen significant ups and downs lately. Factors like too much supply and global political issues have made things volatile. For instance, while the World Steel Association projected a 1.7% global crude steel production increase in 2024, reaching 1,990 million tonnes, stainless steel demand specifically faces these broader economic headwinds.

Looking ahead to 2025, a slight recovery is expected, but it's important to note that consumption volumes will likely still be lower than what we saw before the pandemic. Market analyses suggest a path of steady, yet difficult, growth. This means companies like Acerinox must be prepared to navigate shifting demand patterns across various industries they serve.

The cost of essential inputs like nickel and chromium significantly sways Acerinox's financial performance due to their inherent price volatility. For instance, nickel prices, a critical benchmark for stainless steel, have seen fluctuations, with projections for 2024 and 2025 indicating a range influenced by factors such as supply chain disruptions and the burgeoning demand from the electric vehicle sector. Acerinox's ability to navigate these price swings hinges on robust procurement practices and strategic hedging to control production expenses.

High and volatile energy costs, especially for electricity and natural gas, present a substantial hurdle for energy-intensive steel production in Europe. For instance, in early 2024, European industrial electricity prices remained significantly higher than in other major regions, impacting operational expenses.

These elevated costs directly impact profit margins and can diminish the competitive standing of European steelmakers against international rivals. This is a critical factor for Acerinox as energy constitutes a major portion of production costs in stainless steel manufacturing.

Acerinox's strategy must therefore focus on continued investment in energy efficiency measures and the exploration of alternative, more stable energy sources. This proactive approach is essential to buffer against price fluctuations and maintain cost competitiveness in the global market.

Exchange Rate Fluctuations

Exchange rate fluctuations, particularly between the Euro and the US Dollar, directly influence Acerinox's financial health. These shifts affect how revenues earned in foreign currencies are translated back into Euros, impacting reported earnings and the cost of imported materials. For instance, a weakening US Dollar against the Euro can reduce the Euro-denominated value of sales made in the United States, thereby negatively affecting overall profitability.

The valuation of Acerinox's net financial debt is also sensitive to currency movements. A significant depreciation of the US Dollar, for example, can increase the Euro equivalent of dollar-denominated debt, potentially leading to higher interest expenses and a less favorable balance sheet.

- Euro vs. US Dollar Performance (2024-2025): Observing the EUR/USD exchange rate trends provides insight into potential impacts on Acerinox's translated earnings. For example, if the Euro strengthens significantly against the Dollar in late 2024 and early 2025, Acerinox's US-based revenues would translate to fewer Euros.

- Impact on Operational Costs: Fluctuations can alter the cost of raw materials or components sourced from countries with different currencies, directly affecting Acerinox's cost of goods sold.

- Debt Servicing Costs: Changes in exchange rates can alter the effective cost of servicing debt denominated in foreign currencies, impacting Acerinox's net financial charges.

Economic Health of End-User Industries

The economic health of Acerinox's primary end-user sectors is a critical determinant of its sales performance. Sectors like construction, automotive, industrial machinery, and food processing are major consumers of stainless steel. When these industries thrive, demand for Acerinox's products naturally increases.

Conversely, a downturn in these key markets can significantly impact Acerinox's order book and revenue. For instance, a contraction in manufacturing activity, as indicated by Purchasing Managers' Index (PMI) data, directly correlates with reduced demand for stainless steel. In late 2023 and early 2024, manufacturing PMIs in major economies like the US and the Eurozone hovered around or below the 50-point mark, signaling a period of subdued industrial output and, consequently, weaker demand for materials like stainless steel.

- Construction Sector Performance: Global construction activity, a key driver for stainless steel, showed mixed signals in early 2024. While some regions experienced modest growth, others faced headwinds from higher interest rates and inflation, impacting new project starts.

- Automotive Industry Trends: The automotive sector, a significant consumer of stainless steel, particularly for exhaust systems and components, saw a gradual recovery in production volumes in 2024, driven by easing supply chain issues, though demand remained sensitive to economic conditions.

- Industrial Machinery Demand: Orders for industrial machinery, which rely heavily on stainless steel for durability and corrosion resistance, were influenced by broader industrial investment sentiment. Global industrial production figures for late 2023 and early 2024 indicated a plateauing or slight contraction in some key manufacturing hubs.

- Food Processing Equipment: The food processing industry's demand for stainless steel, used in machinery and processing equipment, remained relatively stable, supported by consistent consumer demand for food products, though capital expenditure could be influenced by broader economic uncertainties.

Global economic growth directly impacts stainless steel demand, with projections for 2024 indicating a modest increase in crude steel production but persistent volatility in stainless steel consumption. Companies like Acerinox must adapt to these fluctuating demand patterns across their key customer industries.

Input costs, particularly for nickel and chromium, significantly influence Acerinox's profitability due to their inherent price volatility. For example, nickel prices in 2024 and 2025 are expected to remain sensitive to electric vehicle sector demand and supply chain dynamics, requiring robust procurement strategies.

High and volatile energy costs, especially electricity and natural gas in Europe, continue to challenge steel producers like Acerinox. European industrial electricity prices in early 2024 remained substantially higher than in other regions, impacting operational expenses and competitiveness.

Exchange rate fluctuations, particularly EUR/USD, directly affect Acerinox's reported earnings and the cost of imported materials. A weaker US Dollar against the Euro, for instance, can reduce the Euro-denominated value of sales made in the United States.

| Economic Factor | 2024 Projection/Status | 2025 Outlook | Impact on Acerinox | Key Data Point |

|---|---|---|---|---|

| Global Economic Growth | Projected modest growth, but with ongoing volatility. | Expected slight recovery, but consumption below pre-pandemic levels. | Influences overall demand for stainless steel products. | World Steel Association projected 1.7% global crude steel production increase in 2024. |

| Input Costs (Nickel, Chromium) | Volatile, influenced by EV demand and supply chains. | Continued sensitivity to market dynamics. | Directly impacts production costs and profit margins. | Nickel prices remain a critical benchmark for stainless steel. |

| Energy Costs | High and volatile in Europe, impacting competitiveness. | Continued pressure expected, necessitating efficiency measures. | Increases operational expenses and affects cost competitiveness. | European industrial electricity prices significantly higher than other regions in early 2024. |

| Exchange Rates (EUR/USD) | Fluctuating, impacting translated earnings and material costs. | Continued potential for volatility. | Affects revenue translation and cost of imported raw materials. | A weakening USD against EUR reduces Euro-denominated sales value. |

Same Document Delivered

Acerinox PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Acerinox delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external forces shaping the stainless steel industry.

Sociological factors

Consumer and industrial demand for environmentally friendly products is on the rise, with a particular focus on items boasting reduced carbon footprints and increased recycled content. This shift is a significant sociological factor influencing market trends across various sectors.

Acerinox's strategic response to this trend is evident in its EcoACX® product line. This sustainable stainless steel offering is manufactured with significantly lower CO2 emissions and incorporates a high percentage of recycled materials, directly aligning with the evolving preferences of a more environmentally conscious market.

The introduction of EcoACX® not only meets this growing demand but also serves to bolster Acerinox's brand image, positioning the company as a leader in sustainable material production. For instance, by 2024, the demand for sustainable materials in construction alone was projected to grow by 15% annually, a testament to this powerful sociological driver.

Stable labor relations are paramount for consistent production in the steel sector. Acerinox's experience, particularly the 2023 strike at its Europa facility, highlights the significant disruption potential. This industrial action led to a substantial drop in production, impacting the company's financial performance.

The strike at Acerinox Europa, which lasted for several months in 2023, resulted in an estimated production loss of around 300,000 tons of stainless steel. This directly affected the company's ability to meet customer demand and fulfill existing orders, demonstrating the tangible economic consequences of labor unrest.

Maintaining a skilled and engaged workforce is crucial for operational efficiency and innovation. Acerinox's ongoing efforts to foster positive industrial relations and invest in employee training are key to mitigating risks associated with labor disputes and ensuring long-term workforce stability.

Stakeholders, from investors to customers and employees, are increasingly scrutinizing corporate behavior, demanding robust Corporate Social Responsibility (CSR) initiatives that go beyond mere legal obligations. Acerinox’s commitment to sustainability, as evidenced by its comprehensive plan targeting ethical governance, eco-efficiency, and positive community engagement, directly addresses these heightened expectations.

This focus on responsible operations is not just about compliance; it's a strategic imperative. For instance, Acerinox's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, a tangible metric that resonates with environmentally conscious investors and customers alike, bolstering its image as a leader in responsible global manufacturing.

Health and Safety Standards

Acerinox places significant emphasis on health and safety, a critical aspect in its heavy industrial operations. The company's dedication to maintaining rigorous health and safety standards is not just about compliance but also about fostering a productive and secure workplace. This focus directly impacts employee well-being and the smooth running of its manufacturing processes.

A key indicator of this commitment is Acerinox's effort to lower its Lost Time Injury Frequency Rate (LTIFR). For instance, in 2023, Acerinox reported an LTIFR of 1.11, a notable improvement from previous periods, demonstrating a proactive approach to risk management and accident prevention. This continuous improvement in safety metrics is vital for operational continuity and enhances employee morale, directly contributing to overall productivity.

- Employee Well-being: Prioritizing health and safety safeguards the workforce in demanding industrial settings.

- Operational Continuity: Reduced accidents mean fewer disruptions to production schedules and supply chains.

- LTIFR Reduction: Acerinox's 2023 LTIFR of 1.11 highlights a strong focus on improving workplace safety.

- Productivity and Morale: A safe environment boosts employee confidence and efficiency.

Demographic Shifts and Talent Attraction

Demographic shifts, such as an aging workforce in established markets like Europe, present a challenge for Acerinox in securing skilled labor for its specialized steel manufacturing. For instance, in 2024, the average age of manufacturing workers in the EU continued to rise, impacting the pool of experienced technicians. This necessitates a strong focus on talent attraction and retention strategies to ensure a consistent supply of qualified personnel.

Acerinox must actively invest in robust training and development programs to upskill existing employees and attract new talent. This commitment to human capital is crucial for maintaining operational expertise and adapting to evolving technological demands within the stainless steel industry. By 2025, companies prioritizing workforce development are expected to see a significant competitive advantage.

- Aging Workforce: Key operating regions face an increasing average age of manufacturing employees, potentially limiting the availability of skilled labor.

- Talent Attraction: Acerinox needs to implement proactive strategies to attract new talent, particularly those with specialized technical skills.

- Retention and Training: Focusing on retaining experienced workers and investing in comprehensive training programs is vital for maintaining operational continuity and expertise.

- Skills Gap Mitigation: Addressing potential skills gaps through targeted recruitment and development initiatives will be critical for future operational success.

Societal expectations around corporate responsibility are evolving rapidly, with a strong emphasis on sustainability and ethical practices. Acerinox's proactive stance on environmental, social, and governance (ESG) issues, including significant investments in reducing its carbon footprint and promoting circular economy principles, directly addresses these growing demands.

The company's commitment to a skilled workforce is underscored by its focus on employee well-being and safety, evidenced by its 2023 Lost Time Injury Frequency Rate (LTIFR) of 1.11, a figure reflecting ongoing efforts to enhance workplace security. Furthermore, demographic shifts, particularly an aging workforce in key European markets, necessitate robust talent attraction and retention strategies, with companies prioritizing workforce development expected to gain a competitive edge by 2025.

| Sociological Factor | Impact on Acerinox | Supporting Data/Trend |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable products, influencing product development and brand perception. | Projected 15% annual growth in demand for sustainable materials in construction by 2024. |

| Labor Relations | Risk of production disruptions and financial impact from industrial action. | 2023 strike at Acerinox Europa resulted in an estimated 300,000-ton production loss. |

| Corporate Social Responsibility (CSR) | Heightened stakeholder scrutiny of ethical governance and community engagement. | 15% reduction in Scope 1 and 2 GHG emissions reported in Acerinox's 2023 sustainability report (vs. 2022). |

| Health and Safety | Crucial for operational efficiency, employee morale, and risk management. | Acerinox's 2023 LTIFR of 1.11 indicates a commitment to workplace safety improvements. |

| Demographic Shifts | Challenges in securing skilled labor due to an aging workforce in established markets. | Rising average age of manufacturing workers in the EU in 2024 impacting the pool of experienced technicians. |

Technological factors

Acerinox is aggressively embracing automation and digital transformation, aiming to boost operational efficiency and refine its production workflows. The company's investment in advanced analytics and the deployment of Automated Guided Vehicles (AGVs) are key components of this strategy, underscoring its commitment to technological advancement for superior operational performance.

Acerinox's commitment to advanced materials and alloy development is a key technological driver. Continuous research and development in new alloys and high-performance materials are crucial for meeting the evolving demands of specialized sectors like aerospace and energy. This focus ensures Acerinox remains competitive in offering solutions for demanding applications.

The strategic acquisition of Haynes International in 2023 for $795 million significantly bolsters Acerinox's capabilities in high-performance alloys. This move not only expands its product portfolio but also facilitates direct access to new, higher-value markets where specialized material properties are paramount.

The steel industry is actively shifting towards decarbonization, with 'green steel' production technologies at the forefront of this transformation. Acerinox is making strategic investments in areas like process electrification and enhanced energy efficiency. These efforts are crucial for reducing its carbon footprint and aligning with evolving environmental regulations.

Acerinox's commitment to sustainability includes a focus on increasing the use of recycled content in its steel production. This not only lowers emissions but also contributes to a more circular economy. By 2024, the company aims to further integrate these green technologies into its operations, a move supported by global trends showing increased demand for low-carbon steel products.

Recycling and Circular Economy Innovations

Acerinox's commitment to innovation in recycling is crucial, especially considering its substantial use of recycled content in stainless steel. The company is actively pursuing advancements in recycling technologies to further enhance its circular economy model. This focus on maximizing waste reuse and integrating more scrap into melting processes directly supports resource efficiency and lessens dependence on primary raw materials.

Technological advancements are enabling Acerinox to process a wider variety of scrap materials and improve the quality of recycled stainless steel. For instance, by 2023, Acerinox reported that approximately 80% of its stainless steel production utilized recycled raw materials. This high percentage underscores the importance of ongoing innovation in sorting, pre-treatment, and melting technologies to maintain and increase this circularity.

- Increased Scrap Utilization: Innovations in shredding and magnetic separation technologies allow Acerinox to recover a greater proportion of ferrous and non-ferrous metals from mixed waste streams, feeding more recycled content into production.

- Advanced Sorting Technologies: The adoption of optical sorters and eddy current separators enables finer segregation of different stainless steel grades, improving the purity of recycled inputs and reducing the need for virgin alloys.

- Energy Efficiency in Melting: New furnace designs and process controls are being developed to reduce the energy required for melting scrap, further lowering the environmental footprint of stainless steel production.

Data Analytics and Process Optimization

Acerinox leverages advanced data analytics to fine-tune its operations, enhancing efficiency across the board. This includes optimizing logistics, managing electric arc furnace energy usage, and improving continuous casting yields. Such a data-driven strategy enables dynamic adjustments and informs long-term strategic planning, directly impacting cost reduction and overall productivity.

The company's commitment to data analytics is evident in its pursuit of operational excellence. For instance, in 2023, Acerinox reported a significant improvement in energy efficiency, partly attributable to data-driven process optimization initiatives. This focus allows for real-time monitoring and predictive maintenance, minimizing downtime and maximizing output.

- Logistics Optimization: Data analytics identifies the most efficient transport routes, reducing fuel consumption and delivery times.

- Energy Management: Real-time monitoring of electric arc furnace consumption allows for precise energy input, lowering costs.

- Production Yields: Analyzing continuous casting data helps optimize metal flow and reduce waste, increasing overall output.

- Predictive Maintenance: Utilizing sensor data predicts equipment failures, enabling proactive repairs and preventing costly disruptions.

Acerinox is actively investing in digital transformation and automation to enhance production efficiency. The company is deploying Automated Guided Vehicles (AGVs) and advanced analytics to streamline workflows, as seen in its 2023 initiatives aimed at improving operational performance through technological integration.

The company's focus on high-performance alloys, bolstered by the 2023 acquisition of Haynes International for $795 million, positions it to meet specialized market demands. This strategic move expands Acerinox's product range and market access for advanced materials critical in sectors like aerospace.

Acerinox is prioritizing 'green steel' technologies, including process electrification and energy efficiency improvements, to reduce its carbon footprint. By 2024, the company aims to increase the use of recycled content, a move supported by growing market demand for low-carbon steel products.

Data analytics plays a crucial role in optimizing Acerinox's operations, from logistics to energy management in electric arc furnaces. In 2023, these data-driven initiatives contributed to significant energy efficiency gains, underscoring the impact of technology on cost reduction and productivity.

Legal factors

Acerinox must navigate a complex web of environmental laws, such as the EU's Industrial Emissions Directive, which necessitates substantial capital outlays for advanced pollution abatement systems. For instance, in 2023, the company reported €231 million in capital expenditure, with a portion dedicated to environmental upgrades across its facilities.

The company is also legally bound by carbon pricing initiatives, including the EU Emissions Trading System (ETS) and the upcoming Carbon Border Adjustment Mechanism (CBAM). These regulations directly translate into financial liabilities for Acerinox's carbon footprint, influencing operational costs and strategic planning for emission reduction.

Acerinox is significantly impacted by international trade laws, particularly anti-dumping duties and safeguard measures that countries implement on stainless steel imports. These regulations directly affect its ability to access certain markets and can lead to increased costs for its products.

For instance, in 2023, the European Union continued its investigation into alleged dumping of stainless steel fasteners from China, which could result in new duties impacting Acerinox's competitive landscape. Such measures force companies like Acerinox to adapt their pricing and supply chain strategies to mitigate the financial impact of punitive tariffs, potentially rerouting production or sourcing to comply with varying international trade policies.

Acerinox must navigate a complex web of labor laws, impacting everything from daily working conditions to the intricacies of collective bargaining. In 2024, for instance, significant labor disputes in Spain, a key operational hub for Acerinox, highlighted the critical need for strict compliance with national legislation governing employee rights and union negotiations. These industrial relations directly influence operational stability and production output.

Competition Law and Anti-Trust Regulations

Acerinox, as a major player in the global stainless steel and specialty alloys market, faces rigorous oversight from competition authorities. Its acquisition of Haynes International in 2023, valued at approximately $795 million, triggered reviews in multiple regions to ensure it wouldn't create monopolies or harm fair competition. Failure to comply with these anti-trust regulations could lead to significant fines and divestiture orders, impacting market share and profitability.

These regulations are designed to prevent market manipulation and protect consumer interests. For instance, if Acerinox were to engage in practices that unfairly disadvantage competitors, such as predatory pricing or exclusive dealing arrangements, it could face substantial penalties. The company must continually monitor its market conduct to align with evolving competition law frameworks across its operational territories, which include the European Union, the United States, and other key markets.

- Regulatory Scrutiny: Acerinox's strategic moves, like the Haynes acquisition, are examined by competition regulators worldwide.

- Compliance Costs: Maintaining compliance requires significant legal and administrative resources to navigate diverse jurisdictional requirements.

- Market Impact: Anti-trust violations can result in hefty fines, operational restrictions, and damage to brand reputation, affecting future growth.

Product Standards and Certifications

Acerinox's stainless steel and specialty alloys must meet stringent national and international product standards and certifications. These regulations are crucial for ensuring safety and quality across various sectors like construction and automotive. For instance, compliance with standards such as ISO 9001 for quality management and specific material certifications for food contact or medical applications are non-negotiable for market access and customer confidence.

Failure to meet these legal requirements can lead to significant penalties, product recalls, and damage to brand reputation. Acerinox's commitment to these standards, therefore, directly impacts its ability to operate and compete globally. In 2023, the company continued to invest in maintaining and obtaining relevant certifications across its product lines.

- Compliance with ISO 9001:2015 ensures consistent quality management systems across Acerinox's operations.

- Adherence to REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations is vital for market access within the European Union.

- Meeting specific industry certifications, such as those for food-grade stainless steel or automotive component standards, is essential for product acceptance in key markets.

- Ongoing investment in testing and certification processes underpins Acerinox's commitment to product safety and reliability.

Acerinox operates under a strict legal framework governing international trade, including anti-dumping duties and safeguard measures. For example, in 2023, the EU's ongoing probe into Chinese stainless steel fasteners highlighted the potential for new duties impacting Acerinox's competitive positioning.

The company must also comply with labor laws, as evidenced by significant labor disputes in Spain during 2024, underscoring the importance of adhering to employee rights and collective bargaining regulations.

Furthermore, Acerinox's acquisition of Haynes International in 2023 for approximately $795 million necessitated reviews by competition authorities globally to prevent market monopolies.

Acerinox's adherence to product standards, such as ISO 9001 and REACH regulations, is critical for market access and maintaining customer trust, with ongoing investments in certification processes throughout 2023.

Environmental factors

Acerinox has committed to significantly reducing its environmental impact, setting a goal to cut Scope 1 and 2 greenhouse gas emissions by more than 45% by 2030. This target aligns with international efforts to limit global warming, reflecting a growing imperative for heavy industry to decarbonize.

Achieving these ambitious targets will demand considerable capital expenditure. Acerinox plans to invest in enhancing energy efficiency across its operations, electrifying key industrial processes, and actively pursuing the integration of renewable energy sources like solar and wind power.

Acerinox's environmental strategy is deeply rooted in the principles of a circular economy, aiming for over 90% recycled material content in its production. This focus significantly reduces the demand for virgin raw materials, a key factor in resource efficiency.

This commitment to recycling not only minimizes waste generation but also bolsters the sustainability credentials of Acerinox's stainless steel products. By utilizing a high proportion of recycled content, the company directly contributes to a more resource-efficient industrial model, aligning with global environmental goals.

Water usage in heavy industrial processes like steelmaking faces growing environmental scrutiny, prompting companies to set ambitious targets for reducing water withdrawal. This pressure stems from concerns over water scarcity and the impact of industrial discharge on local ecosystems.

Acerinox has demonstrated significant progress in this area, notably surpassing its initial 2030 water intensity reduction target ahead of schedule. This achievement highlights the company's proactive approach to responsible water management and conservation across its global operations.

Waste Generation and Recycling Initiatives

Acerinox places significant emphasis on effective waste management and maximizing the recycling of industrial by-products, recognizing these as key environmental responsibilities. The company's integrated production process allows for the active reuse of generated waste, which not only supports a more sustainable operational model but also significantly reduces the amount of material sent to landfills.

In 2023, Acerinox reported a substantial reduction in waste generation, with specific initiatives targeting circular economy principles. For instance, the company's Spanish facilities processed approximately 50,000 tonnes of by-products internally, diverting them from landfill and reintegrating them into the production cycle. This aligns with broader industry trends where companies are increasingly focused on resource efficiency.

- Waste Reduction Targets: Acerinox aims to further decrease its waste footprint by 5% by 2025 compared to 2022 levels.

- Recycling Rates: In 2023, the company achieved an overall recycling rate of 85% for its production waste across its global operations.

- Circular Economy Investments: The company allocated €15 million in 2024 towards new technologies to enhance by-product valorization and recycling capabilities.

- Landfill Diversion: Acerinox successfully diverted over 90% of its non-hazardous industrial waste from landfills in the past year through internal reuse and external recycling partnerships.

Energy Transition and Renewable Energy Adoption

The global shift towards cleaner energy sources presents a substantial environmental factor influencing the steel industry. Acerinox is actively engaged in this transition, integrating renewable energy solutions and investigating cleaner fuel alternatives as core components of its decarbonization strategy. This proactive approach aims to significantly reduce the company's operational environmental footprint and ensure alignment with escalating global sustainability mandates and market expectations.

Acerinox's commitment to renewable energy adoption is demonstrated through various initiatives. For instance, the company has invested in solar power generation at several of its facilities. In 2023, Acerinox reported that approximately 15% of its total electricity consumption was sourced from renewable energy, a figure it aims to increase substantially by 2030. This strategic move not only addresses environmental concerns but also offers potential long-term cost savings and enhances energy security.

- Renewable Energy Integration: Acerinox is increasing its reliance on solar and wind power for its operations.

- Decarbonization Goals: The company aims to reduce its Scope 1 and Scope 2 emissions by 30% by 2030 compared to 2020 levels.

- Cleaner Fuels Exploration: Research into hydrogen and other low-carbon fuels is underway to further reduce emissions from steel production processes.

- Market Alignment: These efforts align Acerinox with the growing demand for sustainably produced steel from environmentally conscious customers and investors.

Acerinox is actively addressing environmental regulations and market demands for sustainability. The company has set a target to reduce its Scope 1 and 2 greenhouse gas emissions by over 45% by 2030, aligning with global decarbonization efforts.

Significant investments are being made in energy efficiency, process electrification, and renewable energy sources like solar and wind to achieve these emission reduction goals. Acerinox aims for over 90% recycled material content in its production, embodying circular economy principles.

The company has demonstrated success in water management, exceeding its 2030 water intensity reduction target ahead of schedule. Furthermore, Acerinox prioritizes waste management, with initiatives like internal by-product processing, diverting substantial material from landfills.

| Environmental Metric | Target/Status (2023/2024) | Notes |

|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | >45% by 2030 (vs. 2020 baseline) | Focus on energy efficiency, electrification, renewables |

| Recycled Material Content | >90% | Key to circular economy strategy |

| Water Intensity Reduction | Achieved ahead of 2030 target | Demonstrates strong water management |

| Waste Generation Reduction | 5% by 2025 (vs. 2022) | Ongoing focus on waste minimization |

| Overall Recycling Rate (Production Waste) | 85% (2023) | Highlights efficient by-product utilization |

| Circular Economy Investments | €15 million (2024) | For enhanced by-product valorization |

PESTLE Analysis Data Sources

Our Acerinox PESTLE Analysis is built on a robust foundation of data from official government publications, international economic organizations, and leading industry research firms. We integrate insights from regulatory updates, market performance reports, and technological advancements to provide a comprehensive view.