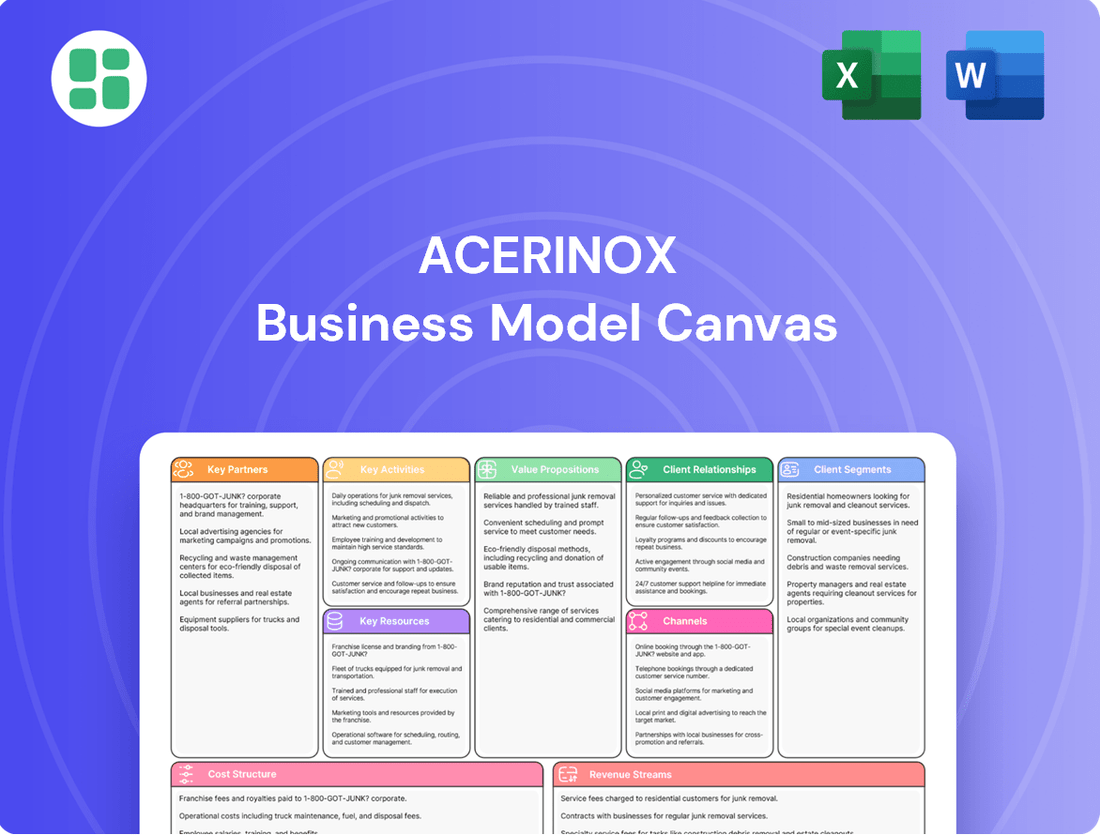

Acerinox Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acerinox Bundle

Unlock the full strategic blueprint behind Acerinox's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Acerinox's key partnerships with raw material suppliers are foundational to its stainless steel manufacturing. The company depends on a steady flow of nickel, chromium, and scrap metal, which are vital for producing high-quality stainless steel. For instance, in 2023, Acerinox's procurement strategy emphasized securing these critical inputs, with a significant portion of its raw material costs tied to global commodity prices.

Maintaining an efficient and resilient supply chain is paramount for Acerinox's operational continuity and its ability to navigate market volatility. The company actively seeks suppliers who align with its commitment to ethical practices and sustainability, fostering long-term, trustworthy relationships to ensure a dependable source of necessary materials.

Acerinox’s strategic alliances with premier technology and equipment providers are fundamental to its ongoing production enhancements and market standing. These partnerships enable access to cutting-edge manufacturing machinery, crucial for staying ahead in a dynamic industry.

A prime example is Acerinox's investment in VDM Metals, which includes collaborations for advanced equipment like powder atomizers, essential for additive manufacturing capabilities. This focus on technological integration ensures efficient and high-quality output.

Acerinox actively pursues strategic acquisitions to broaden its market presence and enhance its product offerings. A prime example is the 2024 acquisition of Haynes International, a move that significantly expanded Acerinox's footprint into crucial sectors such as aerospace.

This acquisition not only granted Acerinox access to new, high-growth markets but also bolstered its capabilities within the high-performance alloys segment. Haynes International's expertise complements Acerinox's existing portfolio, creating a more robust offering for demanding industries.

Research and Development Collaborators

Acerinox actively partners with leading research institutions and industry experts to fuel innovation. These collaborations are crucial for developing advanced alloys, refining product designs, and implementing more sustainable manufacturing processes. For instance, their commitment to R&D aims to create higher value-added products, with a specific focus on emerging markets like 3D printing applications.

These strategic alliances ensure Acerinox stays at the forefront of material science and production technology. By leveraging external expertise, the company can accelerate the development of specialized stainless steel solutions tailored to evolving customer needs across diverse sectors.

- Collaboration with Universities: Fosters cutting-edge research into new material properties and applications.

- Industry Expert Consultations: Provide insights into market trends and technological advancements for product development.

- Joint R&D Projects: Focus on creating high-performance alloys and sustainable manufacturing techniques.

- Focus on Emerging Technologies: Development of materials suitable for additive manufacturing (3D printing).

Logistics and Distribution Partners

Acerinox relies on a robust network of logistics and distribution partners to ensure its stainless steel and specialty alloys reach customers worldwide efficiently. These collaborations are critical for managing the complex supply chain, from raw material sourcing to final product delivery across various industries like construction, automotive, and appliances.

In 2024, Acerinox's commitment to optimizing its supply chain was evident in its continued investment in logistics infrastructure and strategic partnerships. The company aims to reduce lead times and transportation costs, which are vital for maintaining competitiveness in the global market. For instance, efficient handling of products like coils, sheets, and plates requires specialized transport and warehousing solutions.

- Global Reach: Partnerships with international shipping lines and freight forwarders enable Acerinox to serve a diverse customer base across continents, ensuring products arrive on schedule.

- Cost Efficiency: Negotiating favorable rates with logistics providers and optimizing transportation routes helps Acerinox manage operational costs, contributing to its profitability.

- Product Integrity: Specialized handling and storage by partners maintain the quality and integrity of Acerinox's stainless steel products, preventing damage during transit.

- Timely Delivery: The reliability of these partners is paramount for meeting customer demands, especially in sectors with just-in-time manufacturing processes.

Acerinox's strategic acquisitions, such as the 2024 purchase of Haynes International, are pivotal partnerships that significantly expand its market reach and product capabilities, particularly in high-performance alloys for sectors like aerospace. This move bolsters its competitive edge by integrating Haynes' specialized expertise into Acerinox's existing portfolio, creating a more comprehensive offering for demanding industrial applications.

What is included in the product

Acerinox's business model focuses on the global stainless steel and special alloys market, leveraging integrated production and a diversified product portfolio to serve a broad range of industrial customers.

It emphasizes operational efficiency, innovation, and strategic acquisitions to maintain a competitive edge and drive sustainable growth across its value chain.

Acerinox's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its operations, enabling rapid identification of inefficiencies and opportunities for streamlining in the complex stainless steel market.

Activities

Acerinox's core activity is the integrated manufacturing of stainless steel, transforming raw materials through melting, hot rolling, cold rolling, and finishing processes. This vertical integration allows for control over the entire production chain.

The company's production footprint spans key regions, with significant facilities located in Spain, the United States, and South Africa. This geographical diversification supports global market access and operational resilience.

In 2023, Acerinox produced approximately 2.5 million tons of stainless steel, a testament to its robust integrated manufacturing capabilities. This volume underscores the scale of its operations and its position in the global market.

Acerinox's key activity of high-performance alloy production is central to its strategy, especially after acquiring VDM Metals and Haynes International. This specialization allows them to create advanced materials essential for industries with stringent requirements, such as aerospace and energy.

These specialized alloys are produced using complex metallurgical processes, ensuring they meet the high standards for strength, corrosion resistance, and temperature tolerance demanded by critical applications. For instance, the aerospace sector relies on these materials for engine components and structural parts, where failure is not an option.

In 2024, Acerinox's focus on these high-value segments is expected to contribute significantly to its revenue. The demand for these specialized alloys is driven by growth in sectors like defense and renewable energy, where advanced materials are increasingly crucial for performance and longevity.

Acerinox’s commitment to Research, Development, and Innovation (R&D&i) is central to its business model. This involves ongoing investment to elevate product quality, pioneer novel materials, and refine manufacturing workflows. For instance, the company actively pursues initiatives aimed at boosting energy efficiency and curbing emissions.

A significant aspect of Acerinox's R&D&i efforts is the creation of sustainable products, such as their EcoACX® line. These developments are crucial for maintaining a competitive edge and aligning with growing environmental demands in the market.

Global Sales and Distribution

Managing a global sales force and an extensive distribution network is a core activity for Acerinox, enabling them to serve a wide array of customers across diverse geographical markets. This ensures their stainless steel and high-performance alloys reach key sectors effectively.

These products are vital for industries such as construction, automotive manufacturing, and industrial machinery production, where quality and reliability are paramount. Acerinox's strategic approach to sales and distribution directly impacts its market penetration and customer relationships.

- Global Reach: Acerinox operates in over 70 countries, demonstrating a significant commitment to international market presence.

- Sectoral Focus: Key customer segments include automotive (19% of sales in 2023), construction (16%), and industrial applications.

- Distribution Channels: The company utilizes a mix of direct sales, service centers, and distributors to ensure efficient product delivery.

- Sales Performance: In 2023, Acerinox reported total sales of €7,121 million, reflecting the scale of its global distribution efforts.

Operational Excellence and Sustainability Initiatives

Acerinox's commitment to operational excellence is exemplified by its 'Beyond Excellence' program, a strategic driver for enhanced competitiveness and efficiency. This initiative underpins their efforts to boost productivity across all facets of their business.

Sustainability is a core pillar, with a significant focus on decarbonization pathways and the integration of circular economy principles. Acerinox aims to minimize its environmental footprint through these dedicated efforts.

- Operational Excellence: Acerinox's 'Beyond Excellence' program targets continuous improvement in productivity and efficiency.

- Sustainability Focus: A strong emphasis on decarbonization and circular economy principles guides their environmental strategy.

- Environmental Impact Reduction: Initiatives are in place to actively reduce the company's overall environmental impact.

Acerinox's key activities encompass the integrated manufacturing of stainless steel and the production of high-performance alloys, supported by robust Research, Development, and Innovation (R&D&i). These core functions are amplified by a global sales and distribution network, all underpinned by a commitment to operational excellence and sustainability.

The company's integrated manufacturing process transforms raw materials into various steel products, while its specialized alloy production caters to high-demand sectors. In 2023, Acerinox's sales reached €7,121 million, with its global operations spanning over 70 countries.

R&D&i efforts focus on product enhancement and sustainable materials, such as the EcoACX® line, crucial for maintaining market competitiveness. The company's 'Beyond Excellence' program drives productivity, and sustainability initiatives prioritize decarbonization and circular economy principles.

| Key Activity | Description | 2023 Data/Focus |

| Integrated Manufacturing | Steel production from raw materials to finished products. | Approximately 2.5 million tons of stainless steel produced. |

| High-Performance Alloys | Production of advanced materials for demanding industries. | Acquisition of VDM Metals and Haynes International; focus on aerospace and energy sectors. |

| R&D&i | Innovation in product quality, new materials, and process efficiency. | Development of sustainable products like EcoACX®; energy efficiency initiatives. |

| Sales & Distribution | Global market reach and customer service. | Operations in over 70 countries; €7,121 million in total sales. |

| Operational Excellence & Sustainability | Efficiency improvements and environmental responsibility. | 'Beyond Excellence' program; decarbonization and circular economy focus. |

What You See Is What You Get

Business Model Canvas

The Acerinox Business Model Canvas you're previewing is the authentic document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this exact, professionally structured Business Model Canvas, ready for your strategic planning needs.

Resources

Acerinox's global production facilities are its backbone, representing substantial physical assets. These include major plants strategically located in Spain, the United States (North American Stainless), South Africa (Columbus Stainless), and Germany (VDM Metals).

These extensive facilities contribute to a significant combined melting shop capacity, reaching an impressive 3.5 million tons annually. This robust infrastructure is crucial for meeting global demand for stainless steel and specialty alloys.

Acerinox leverages cutting-edge technology throughout its production, from initial melting to final finishing. This includes specialized equipment ensuring high-quality stainless steel and special alloys. The company's integrated approach optimizes efficiency and product consistency.

Recent capital expenditures highlight Acerinox's dedication to technological leadership. Investments in new rolling and Skin-Pass mills enhance their finishing capabilities. Furthermore, a second powder atomizer for additive manufacturing signifies expansion into advanced materials and production methods.

Acerinox relies heavily on its highly skilled workforce, encompassing engineers, metallurgists, and production specialists. This technical expertise is fundamental to navigating intricate manufacturing processes and upholding stringent product quality standards. In 2023, Acerinox reported a global workforce of approximately 7,500 employees, highlighting the scale of human capital investment.

The deep knowledge possessed by these employees is a vital intellectual resource, directly contributing to Acerinox's capacity for innovation and the development of advanced stainless steel products. This expertise enables the company to adapt to evolving market demands and maintain a competitive edge in specialized material science.

Intellectual Property and Brand Reputation

Acerinox's intellectual property portfolio is a cornerstone of its competitive advantage, encompassing proprietary product designs, advanced manufacturing processes, and unique specialized alloy compositions that differentiate its offerings in the global market.

The company's long-standing reputation as a trusted global leader in stainless steel manufacturing represents a significant intangible asset, built over decades of consistent quality and innovation.

This strong brand reputation, coupled with its intellectual property, allows Acerinox to command premium pricing and foster customer loyalty, directly impacting its revenue streams and market share.

In 2024, Acerinox continued to invest in R&D to enhance its IP, aiming to solidify its position in high-value segments of the stainless steel industry.

- Proprietary Product Designs: Unique steel formulations and product specifications.

- Advanced Manufacturing Processes: Patented techniques for enhanced efficiency and quality.

- Specialized Alloy Compositions: Exclusive material blends for specific high-performance applications.

- Global Brand Reputation: Decades of trust and recognition as a stainless steel leader.

Access to Raw Materials and Energy

Acerinox's business model hinges on securing consistent and cost-effective access to key raw materials, primarily stainless steel scrap, nickel, and chrome. These are the building blocks for its diverse product portfolio. Reliable energy sources are equally critical, directly impacting production costs and output.

The company's commitment to sustainability is a significant factor in its raw material strategy. Acerinox boasts an impressive circular economy approach, with over 90% of its stainless steel production utilizing recycled content. This significantly reduces its dependence on primary, often more volatile, virgin materials.

- Raw Material Sourcing: Acerinox prioritizes secure and efficient access to essential inputs like stainless steel scrap, nickel, and chrome.

- Energy Dependency: Reliable and cost-effective energy sources are fundamental to maintaining competitive production costs.

- Circular Economy Impact: Over 90% recycled content in stainless steel production minimizes reliance on virgin materials and enhances supply chain resilience.

- Cost Management: Efficient raw material and energy procurement directly contribute to the company's overall cost competitiveness in the global market.

Acerinox's key resources are its extensive global production facilities, including major plants in Spain, the US, South Africa, and Germany, with a combined melting shop capacity of 3.5 million tons annually. These are complemented by cutting-edge technology and a highly skilled workforce of approximately 7,500 employees as of 2023. The company's intellectual property, including proprietary product designs and advanced manufacturing processes, along with a strong global brand reputation, further solidifies its market position.

The company's raw material strategy is centered on securing nickel, chrome, and stainless steel scrap, with a strong emphasis on sustainability, achieving over 90% recycled content in its stainless steel production. Reliable energy sources are also crucial for cost-effective operations.

Acerinox's commitment to innovation is evident in its 2024 R&D investments, aimed at enhancing its intellectual property and expanding into high-value market segments.

The company's strategic sourcing of raw materials and efficient energy management directly contribute to its cost competitiveness.

Value Propositions

Acerinox boasts a wide variety of stainless steel products, such as coils, sheets, plates, and long products. This extensive selection ensures they can meet the diverse demands across numerous industrial sectors globally.

In 2024, Acerinox continued to solidify its market position by emphasizing the superior quality of its offerings. This commitment to excellence is a cornerstone of their value proposition, resonating with customers who depend on reliable, high-performance materials for critical applications.

Acerinox's High-Performance Alloys Division delivers specialized materials engineered for extreme environments, crucial for sectors like aerospace and advanced industrial machinery. These alloys offer customers unparalleled corrosion resistance and exceptional mechanical strength, enabling performance in the most demanding applications.

In 2023, Acerinox's Specialty Stainless Steel segment, which includes these high-performance alloys, generated €3,053 million in revenue, highlighting the significant market demand for these advanced materials. This segment's performance underscores the value proposition of providing solutions that meet stringent industry requirements.

Acerinox champions sustainability by offering products like EcoACX®, a stainless steel solution that slashes CO2 emissions by over half. This is achieved through a commitment to 100% renewable energy and the utilization of more than 90% recycled materials in its production.

This focus on eco-friendly practices directly addresses the growing demand from environmentally aware customers and assists them in meeting their own corporate sustainability targets. It positions Acerinox as a responsible partner in a world increasingly prioritizing green initiatives.

Integrated Production and Quality Control

Acerinox’s vertically integrated production, spanning from raw material sourcing to the final product, is a cornerstone of its business model. This end-to-end control allows for rigorous quality assurance at each step, ensuring that customers receive consistently high-performing and dependable stainless steel products. For example, in 2023, Acerinox maintained its focus on operational efficiency, contributing to a robust performance despite market fluctuations.

This integrated approach directly translates into enhanced product reliability and customer satisfaction. By overseeing the entire value chain, Acerinox minimizes variability and potential defects, offering a superior product experience. The company's commitment to quality is reflected in its operational metrics; for instance, its production facilities consistently aim for high uptime and yield rates.

Key aspects of this value proposition include:

- Vertical Integration: Control over the entire production cycle from mining to finished goods.

- Stringent Quality Control: Implementation of rigorous checks at every manufacturing stage.

- Product Consistency: Assurance of uniform quality and performance across all product lines.

- Customer Reliability: Delivery of dependable stainless steel solutions tailored to client needs.

Global Reach and Reliable Supply

Acerinox's global reach and reliable supply are cornerstones of its business model. With production facilities and a distribution network strategically located across multiple continents, the company ensures worldwide availability of its stainless steel products. This extensive footprint is crucial for maintaining a consistent and dependable supply chain, a key value proposition for its diverse customer base.

This global presence translates into significant operational advantages. For instance, in 2023, Acerinox operated production plants in Spain, South Africa, the United States, and Malaysia, supported by a commercial network reaching over 80 countries. This geographical diversification mitigates risks associated with regional disruptions and enhances the company's ability to serve international markets efficiently.

- Global Footprint: Production facilities in Europe, Africa, North America, and Asia.

- Extensive Distribution: Commercial network serving over 80 countries.

- Supply Chain Reliability: Consistent product access and delivery for customers worldwide.

- Market Responsiveness: Ability to adapt to diverse regional demands and economic conditions.

Acerinox's value proposition centers on delivering a comprehensive range of high-quality stainless steel products, including specialized alloys for demanding applications. The company's commitment to sustainability, exemplified by products like EcoACX®, appeals to environmentally conscious customers and supports their green targets.

Vertical integration ensures consistent quality and reliability throughout the production process, from raw materials to finished goods. This end-to-end control, combined with a global operational footprint and extensive distribution network, guarantees dependable supply to over 80 countries, making Acerinox a trusted partner for diverse industrial needs.

| Value Proposition Aspect | Description | 2023/2024 Data/Impact |

|---|---|---|

| Product Diversity & Quality | Wide variety of stainless steel products, including high-performance alloys. | Specialty Stainless Steel revenue: €3,053 million in 2023, demonstrating strong demand. |

| Sustainability | Eco-friendly solutions like EcoACX® reducing CO2 emissions. | EcoACX® uses over 90% recycled materials and 100% renewable energy. |

| Vertical Integration | End-to-end control from raw materials to final product. | Ensures consistent quality and reliability, contributing to robust operational performance. |

| Global Reach & Reliability | Production facilities across continents and a commercial network in over 80 countries. | Mitigates supply chain risks and ensures consistent product access worldwide. |

Customer Relationships

Acerinox cultivates robust customer connections via specialized sales personnel and technical assistance, offering expert guidance and help. This commitment ensures clients get customized solutions and ongoing support from initial contact through the entire product journey.

Acerinox cultivates long-term B2B partnerships with its industrial clients, frequently securing multi-year contracts. This strategy guarantees consistent demand and allows for a profound understanding of evolving customer requirements, fostering mutual growth and stability.

In 2023, Acerinox's stainless steel division, a key area for B2B relationships, generated €4.4 billion in revenue, highlighting the significant contribution of these enduring partnerships to its financial performance.

Acerinox actively partners with clients to engineer bespoke stainless steel and alloy products, precisely tailored to their unique operational needs. This collaborative development process ensures that the final materials are ideally suited for demanding industrial applications, fostering strong, value-driven customer relationships.

After-Sales Service and Technical Assistance

Acerinox's commitment to customer satisfaction extends beyond the initial sale through robust after-sales service and technical assistance. This proactive approach fosters enduring customer loyalty and ensures optimal product performance. In 2024, the company continued to invest in training its technical teams across its global operations to provide expert support.

The company offers comprehensive support for product application, troubleshooting, and performance optimization. This includes access to technical documentation, online resources, and direct assistance from specialized engineers. For instance, Acerinox's stainless steel products often require specific handling and processing advice, which their technical teams readily provide.

- Customer Support Channels: Acerinox provides multiple avenues for customers to access technical assistance, including dedicated phone lines, email support, and an online portal with FAQs and troubleshooting guides.

- Product Application Guidance: Technical experts offer tailored advice on the best stainless steel grades and product forms for specific customer applications, ensuring optimal material selection and performance.

- Troubleshooting and Issue Resolution: The company prioritizes swift and effective resolution of any product-related issues, minimizing downtime and ensuring customer operational continuity.

- Technical Training and Knowledge Sharing: Acerinox periodically conducts training sessions for customers on the proper use, maintenance, and advanced applications of their stainless steel products.

Digital Engagement and Optimization

Acerinox leverages digital engagement to streamline operations and enhance customer relationships. The company employs advanced analytics to optimize interactions, ensuring efficient service delivery across all touchpoints.

Digital platforms are central to managing everything from order processing to supplier compliance. This focus on digital optimization aims to create a superior overall customer experience, fostering loyalty and satisfaction.

- Digital Platforms: Acerinox utilizes integrated digital systems for order management and supplier compliance, improving efficiency.

- Advanced Analytics: The company employs data analytics to understand customer behavior and optimize service delivery.

- Customer Experience: Digital tools are deployed to enhance the overall customer journey, from initial contact to post-sale support.

- Operational Efficiency: By digitizing key processes, Acerinox aims to reduce lead times and improve responsiveness to customer needs.

Acerinox prioritizes building strong, collaborative relationships with its industrial clients, often through long-term contracts and co-development of specialized stainless steel products. This approach ensures tailored solutions and a deep understanding of client needs, fostering mutual growth and stability. In 2023, the company's stainless steel division, a core area for these B2B relationships, achieved €4.4 billion in revenue, underscoring the financial significance of these partnerships.

| Customer Relationship Aspect | Description | 2023/2024 Data/Focus |

|---|---|---|

| B2B Partnerships | Long-term contracts and collaborative development | €4.4 billion revenue from stainless steel division (2023) |

| Technical Support | Expert guidance and after-sales service | Continued investment in technical team training (2024) |

| Digital Engagement | Streamlined operations and enhanced customer experience | Use of advanced analytics for optimized interactions |

Channels

Acerinox leverages a dedicated direct sales force to cultivate relationships with substantial industrial clients and pivotal accounts across its international operations. This direct engagement is crucial for nuanced negotiations and fostering strong, lasting partnerships.

In 2023, Acerinox's commercial operations, heavily reliant on its direct sales network, contributed significantly to its overall performance, with stainless steel sales volumes reaching 1.2 million tonnes.

Acerinox boasts a robust global distribution network, featuring strategically located warehouses and reliable logistics partners. This infrastructure is crucial for ensuring timely and efficient delivery of stainless steel products to customers across diverse international markets.

In 2024, Acerinox continued to optimize its supply chain, with its distribution network playing a key role in serving over 80 countries. This extensive reach allows the company to cater to a broad customer base, from large industrial clients to smaller specialized manufacturers.

Acerinox operates a global network of regional sales offices and subsidiaries, including North American Stainless (NAS). This localized presence is crucial for understanding and responding to specific market demands across different geographies.

In 2024, Acerinox's strategic network of regional offices and subsidiaries facilitated direct engagement with customers, contributing to its robust sales performance. This structure allows for tailored approaches to diverse customer needs and market dynamics.

Industry Trade Shows and Events

Acerinox actively participates in key industry trade shows and events, acting as a vital channel to present its latest stainless steel and alloy innovations. These gatherings are instrumental in forging new business connections and reinforcing ties with existing clientele, directly contributing to enhanced brand recognition within the global market.

In 2023, Acerinox showcased its offerings at prominent events like the EuroBLECH exhibition, a significant platform for metalworking technologies. Such participation allows for direct engagement with potential customers and industry peers, fostering opportunities for collaboration and market penetration.

These events are not just about product display; they are strategic touchpoints for understanding market trends and competitive landscapes. For instance, by attending events like the Stainless Steel World Conference, Acerinox gains insights into emerging demands and technological advancements, informing its product development and market strategy.

The company's presence at these exhibitions directly supports its customer relationships and brand visibility. For example, the 2024 outlook includes participation in several regional and international metal and engineering fairs, aiming to solidify its position as a leading supplier in the stainless steel sector.

- Product Showcase: Presenting new stainless steel grades and alloy solutions.

- Networking: Establishing new contacts and strengthening existing customer relationships.

- Brand Visibility: Enhancing recognition within the stainless steel and alloys industries.

- Market Intelligence: Gathering insights on industry trends and competitive activities.

Digital Platforms and Online Presence

Acerinox leverages digital platforms to expand its market reach and enhance customer engagement. These channels are crucial for marketing efforts, providing product information, and handling customer inquiries efficiently. In 2024, the company continued to invest in its online presence, recognizing its importance in a globalized market.

The company's online strategy focuses on accessibility and information dissemination. This includes detailed product catalogs, technical specifications, and news updates, making it easier for a diverse range of stakeholders to access relevant data. The digital presence supports Acerinox's commitment to transparency and customer service.

- Digital Marketing: Acerinox utilizes online advertising and social media to reach a wider audience and promote its stainless steel and specialty alloys.

- Customer Support: Online portals and contact forms facilitate direct communication for inquiries, technical assistance, and order tracking.

- Information Hub: The corporate website serves as a central repository for company news, financial reports, and sustainability initiatives, crucial for investors and partners.

- E-commerce Potential: While core business is B2B, digital platforms may explore e-commerce options for specific product lines or services in the future, enhancing sales channels.

Acerinox utilizes a multi-faceted channel strategy, combining a direct sales force for key accounts with a robust global distribution network for broader market reach. This approach ensures both personalized service for large industrial clients and efficient product delivery across over 80 countries in 2024.

Industry events and digital platforms serve as crucial supplementary channels for Acerinox. These avenues facilitate product showcasing, networking, market intelligence gathering, and enhanced customer engagement, supporting brand visibility and market penetration.

| Channel | Description | 2023/2024 Relevance |

| Direct Sales Force | Cultivates relationships with substantial industrial clients and pivotal accounts. | Crucial for nuanced negotiations and fostering strong partnerships; supported 1.2 million tonnes of stainless steel sales in 2023. |

| Global Distribution Network | Strategically located warehouses and logistics partners for efficient delivery. | Ensures timely delivery to customers in diverse international markets, serving over 80 countries in 2024. |

| Regional Sales Offices/Subsidiaries | Localized presence to understand and respond to specific market demands. | Facilitated direct customer engagement and tailored approaches to diverse needs in 2024. |

| Industry Trade Shows & Events | Platform for showcasing innovations, networking, and market intelligence. | Instrumental in forging new connections and reinforcing existing ties; participation planned for numerous events in 2024. |

| Digital Platforms | Online presence for marketing, product information, and customer engagement. | Continued investment in 2024 to expand market reach and enhance customer interaction. |

Customer Segments

The construction industry represents a crucial customer segment for Acerinox, relying on stainless steel for its strength and visual appeal in structural parts, exterior finishes, and roofing. Global construction output was projected to grow by 3.1% in 2024, according to Statista, highlighting the sector's importance.

Demand within construction is closely tied to large-scale infrastructure initiatives and ongoing urban renewal projects, which directly translate into increased need for durable materials like stainless steel. For instance, major infrastructure spending packages announced by various governments in late 2023 and early 2024 are expected to drive significant material consumption.

The automotive sector is a significant customer for Acerinox, relying on its stainless steel for critical components like exhaust systems, catalytic converters, and decorative trim. The material's excellent corrosion resistance and favorable strength-to-weight ratio are paramount for vehicle longevity and efficiency. In 2023, global automotive production reached approximately 85 million vehicles, underscoring the substantial demand within this segment.

Industrial machinery and equipment manufacturers, particularly those in chemical processing, food processing, and pharmaceuticals, are key customers. They need stainless steel for its crucial properties like hygiene, exceptional durability, and resistance to corrosive or demanding operational conditions. This segment's demand for specialized stainless steel grades and finishes, often tailored to specific application requirements, represents a significant revenue stream.

Energy Sector

Acerinox serves the demanding Energy Sector, encompassing traditional power generation, oil and gas exploration, and the burgeoning renewable energy market. In these environments, components frequently face extreme conditions, including high temperatures, immense pressure, and corrosive substances, making specialized alloys and stainless steel indispensable.

The strategic acquisition of Haynes International in 2023, for approximately $795 million, directly bolstered Acerinox's capabilities within this sector, alongside aerospace. This move expanded its portfolio of high-performance materials, crucial for applications like turbines, pipelines, and offshore drilling equipment.

- Energy Sector Applications: Power generation (turbines), oil and gas (pipelines, offshore equipment), renewable energy (wind turbine components, solar energy infrastructure).

- Material Requirements: Resistance to high temperatures, high pressure, and corrosive environments.

- Haynes International Acquisition Impact: Enhanced Acerinox's offering of specialized alloys, strengthening its position in critical energy infrastructure projects.

- Market Relevance: The global energy transition necessitates advanced materials for both traditional and renewable energy sources, creating sustained demand.

Household Appliances and Consumer Goods

Acerinox's stainless steel finds extensive application in household appliances and consumer goods, prized for its attractive appearance, robust nature, and simple maintenance. This sector often requires very particular surface treatments and shapes to meet design and functional specifications.

In 2024, the global market for stainless steel in appliances was robust, with demand driven by consumer preferences for modern and durable products. For instance, the European market for white goods, a significant consumer of stainless steel, saw steady growth throughout the year, with manufacturers investing in new appliance lines that frequently feature stainless steel components.

- Aesthetic Appeal: Stainless steel's sleek finish enhances the visual appeal of modern kitchens and living spaces.

- Durability and Longevity: Appliances made with stainless steel are known to last longer, resisting corrosion and wear.

- Hygiene and Ease of Cleaning: The non-porous surface of stainless steel makes it easy to sanitize, a key factor for kitchen appliances.

- Versatility in Design: It can be formed into various shapes and finished with different textures to meet diverse product designs.

Acerinox caters to a diverse range of customer segments, each with specific material needs. Key sectors include construction, automotive, industrial machinery, energy, and consumer goods like household appliances. These industries rely on stainless steel for its durability, corrosion resistance, and aesthetic qualities.

The automotive sector, for example, utilizes stainless steel for exhaust systems and catalytic converters, with global automotive production around 85 million vehicles in 2023. The energy sector, particularly with the growth in renewables, demands specialized alloys for components facing extreme conditions. The acquisition of Haynes International in 2023 significantly strengthened Acerinox's position in these high-performance markets.

| Customer Segment | Key Applications | 2023/2024 Relevance |

|---|---|---|

| Construction | Structural parts, exterior finishes | Global construction output projected to grow 3.1% in 2024. |

| Automotive | Exhaust systems, catalytic converters | Global automotive production ~85 million vehicles in 2023. |

| Industrial Machinery | Chemical & food processing equipment | Demand for specialized grades tailored to specific applications. |

| Energy | Turbines, pipelines, offshore equipment | Haynes acquisition in 2023 bolstered high-performance alloys. |

| Household Appliances | Kitchen appliances, decorative trim | Steady demand driven by consumer preference for modern, durable products. |

Cost Structure

Raw material costs represent the most substantial portion of Acerinox's expenses, driven primarily by the acquisition of nickel, chromium, and various grades of scrap metal. These essential inputs are fundamental to stainless steel production.

Global commodity price volatility directly influences Acerinox's profitability. For instance, in 2023, nickel prices experienced significant swings, impacting the cost base for stainless steel manufacturers.

Stainless steel production is a significant energy consumer, making energy costs a major component of Acerinox's operating expenses. In 2023, energy represented a substantial portion of their cost of sales, directly impacting profitability.

Acerinox actively pursues energy efficiency measures and decarbonization strategies to mitigate these costs. For instance, their investments in renewable energy sources and process optimization aim to reduce their reliance on fossil fuels and lower their overall energy expenditure, a critical factor for competitive pricing in 2024.

Labor and personnel costs represent a substantial portion of Acerinox's expenses. These include wages, salaries, and benefits for its diverse global workforce, reflecting the company's operational scale. For instance, in 2023, Acerinox reported personnel expenses of €1,155.5 million, highlighting the significant investment in its human capital.

The company's labor agreements and workforce management strategies, such as temporary layoffs experienced in Spain, can directly influence these costs. These measures are often implemented to adapt to market conditions and optimize operational efficiency, as seen during periods of economic fluctuation.

Capital Expenditures and Depreciation

Acerinox's cost structure is significantly influenced by capital expenditures, particularly ongoing investments in property, plant, and equipment. These investments are crucial for modernizing facilities, expanding production capacity, and adopting new technologies to maintain a competitive edge. For instance, in 2023, Acerinox reported capital expenditures of €241 million, a notable increase from €186 million in 2022, reflecting a commitment to asset renewal and strategic growth initiatives.

Depreciation of these substantial assets forms a recurring non-cash expense within the cost structure. This accounting practice reflects the gradual reduction in the value of tangible assets over their useful lives. While not an outflow of cash in the current period, depreciation impacts profitability and is a key factor in financial reporting and valuation.

- Capital Expenditures: Acerinox invested €241 million in CapEx in 2023, up from €186 million in 2022, focusing on modernization and expansion.

- Depreciation: This non-cash expense, tied to the company's extensive plant and equipment, impacts reported profits.

- Asset Value: The company's tangible assets, subject to depreciation, represent a significant portion of its overall balance sheet.

Logistics and Distribution Costs

Acerinox’s cost structure is significantly influenced by logistics and distribution expenses. These encompass the global movement of raw materials to its manufacturing facilities and the delivery of finished stainless steel and high-performance alloys to a diverse customer base. Freight, warehousing, and efficient inventory management are key components of these operational outlays.

The company actively seeks to optimize its logistic routes and supply chain networks to mitigate these costs. This focus is crucial for maintaining competitive pricing and ensuring timely delivery in the international market.

- Global Freight and Transportation: Costs incurred for shipping raw materials like ferroalloys and scrap metal to production sites, as well as transporting finished steel products to distribution centers and end-users worldwide.

- Warehousing and Inventory Management: Expenses related to storing raw materials and finished goods, including facility upkeep, security, and the cost of capital tied up in inventory.

- Distribution Network Optimization: Investments in efficient distribution channels and partnerships to reduce transit times and handling costs for products reaching various international markets.

- Fuel and Energy Costs: A significant variable impacting transportation expenses, directly influenced by global energy market fluctuations.

Acerinox's cost structure is heavily weighted towards raw materials, with nickel and chromium being paramount. Energy consumption is another significant expense, directly impacted by global price volatility. In 2023, personnel costs were substantial at €1,155.5 million, reflecting the company's global workforce.

Capital expenditures are a key investment area, with €241 million spent in 2023 to modernize facilities and expand capacity. Logistics and distribution costs are also considerable, covering the global movement of materials and finished products.

| Cost Category | 2023 (€ million) | Significance |

|---|---|---|

| Raw Materials | N/A (Major Component) | Nickel, chromium, scrap metal are essential inputs. |

| Energy | N/A (Major Component) | Significant consumer; impacted by global prices. |

| Personnel | 1,155.5 | Reflects global workforce and labor agreements. |

| Capital Expenditures | 241 | Investments in modernization and expansion. |

| Logistics & Distribution | N/A (Significant) | Global movement of materials and products. |

Revenue Streams

Acerinox's core revenue generation lies in the sale of stainless steel flat products, encompassing hot and cold rolled coils, sheets, plates, and strips. These versatile materials are fundamental to numerous industries, driving demand across various sectors.

In 2024, Acerinox continued to see robust demand for its flat products, contributing significantly to its overall financial performance. The company reported that sales of these products remained a cornerstone of its business, reflecting their widespread use in construction, automotive, and appliance manufacturing.

Acerinox generates significant revenue from selling stainless steel long products. These include items like wire rods, bars, and profiles, which are essential components across many industries. For instance, in 2023, Acerinox's total sales reached €7,180 million, with long products playing a crucial role in this overall performance.

The demand for these long products is robust, driven by sectors such as construction, where they are used for reinforcement and structural elements, and industrial manufacturing, for machinery and equipment. This broad application base ensures a consistent revenue stream for Acerinox from this product category.

Acerinox's strategic acquisitions of VDM Metals and Haynes International have dramatically expanded its revenue base, introducing high-performance alloys as a significant income source. These specialized materials, crucial for demanding sectors like aerospace, fetch premium prices due to their superior properties.

In 2023, the Stainless Steel division, which includes these high-performance alloys, reported a notable EBITDA of €733 million. This segment's performance underscores the value and profitability generated by these advanced materials in specialized markets.

Value-Added Services and Custom Solutions

Acerinox generates revenue through value-added services, offering specialized finishing and custom product development tailored to specific client needs. This approach deepens customer relationships and allows for premium pricing beyond standard material costs.

These services can include:

- Precision cutting and shaping to exact specifications.

- Surface treatments and coatings for enhanced durability or aesthetics.

- Development of bespoke stainless steel products for niche applications.

For instance, in 2023, Acerinox's focus on higher-value products and services contributed to its resilient performance, even amidst challenging market conditions, demonstrating the financial impact of these customized offerings.

Sales of Sustainable Products (e.g., EcoACX®)

Acerinox generates revenue through the sale of specialized sustainable products, such as its EcoACX® range. This caters to a growing market segment prioritizing environmental impact, offering materials with demonstrably lower carbon footprints and a significant proportion of recycled content.

This strategic focus on sustainability directly taps into increasing global demand for eco-friendly solutions. For instance, in 2023, the demand for sustainable materials in construction alone saw a significant uptick, with many projects actively seeking suppliers who can meet stringent environmental certifications.

- EcoACX® Sales: Revenue derived from customers specifically seeking products with reduced environmental impact.

- Market Alignment: Captures revenue from the growing global trend towards sustainability in material sourcing.

- Premium Pricing Potential: Opportunity for higher margins due to the specialized nature and environmental benefits of these products.

Acerinox's revenue streams are diversified, primarily driven by the sale of stainless steel in both flat and long product forms. These core offerings serve a broad industrial base, ensuring consistent demand. The company also generates substantial income from high-performance alloys, a segment significantly bolstered by strategic acquisitions.

Value-added services, including precision cutting and specialized finishing, further enhance revenue by catering to specific client needs and commanding premium pricing. Additionally, Acerinox is capitalizing on the growing market for sustainable materials with its EcoACX® range, tapping into environmental consciousness for additional income.

| Revenue Stream | Key Products/Services | 2023 Contribution (Illustrative) |

|---|---|---|

| Stainless Steel Flat Products | Hot/Cold Rolled Coils, Sheets, Plates | Significant portion of total sales |

| Stainless Steel Long Products | Wire Rods, Bars, Profiles | Crucial to €7,180 million total sales |

| High-Performance Alloys | Specialized alloys for demanding sectors | Notable EBITDA from Stainless Steel division (€733 million) |

| Value-Added Services | Precision cutting, surface treatments, custom development | Contributed to resilient performance |

| Sustainable Products | EcoACX® range | Growing demand in sectors like construction |

Business Model Canvas Data Sources

The Acerinox Business Model Canvas is informed by a comprehensive review of financial reports, investor presentations, and annual disclosures. This data provides a solid foundation for understanding the company's revenue streams, cost structures, and key financial relationships.