Acerinox Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acerinox Bundle

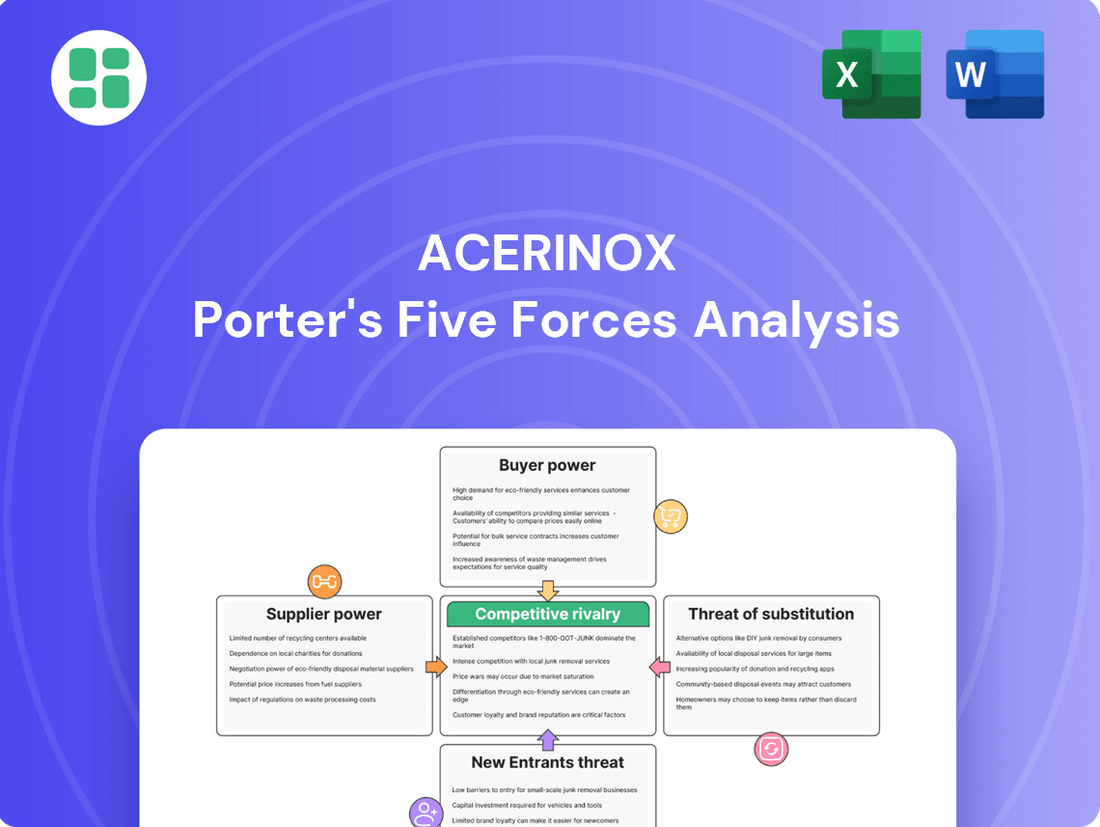

Acerinox faces significant competitive pressures, with moderate buyer and supplier power shaping its stainless steel market. The threat of substitutes and new entrants demands constant strategic adaptation.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Acerinox’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The stainless steel sector, including companies like Acerinox, relies heavily on essential raw materials such as nickel, chromium, and scrap metal. The market for these commodities, especially nickel, has seen considerable price swings, with a notable downward trend in the second quarter of 2025 due to increased supply from countries like Indonesia.

This inherent price volatility in key inputs directly bolsters the bargaining power of suppliers. Such fluctuations can significantly affect Acerinox's production expenses and overall profitability, giving raw material providers leverage in price negotiations.

For Acerinox, the bargaining power of suppliers is significantly influenced by high switching costs associated with specialized inputs. Acquiring specific alloying elements or high-grade scrap, crucial for maintaining the consistent quality demanded in stainless steel production, means that changing suppliers isn't a simple task. These transitions can involve substantial expenses related to qualifying new materials, retooling production lines, and managing potential disruptions to its tightly integrated supply chain.

The inherent need for particular grades and unwavering quality in manufacturing stainless steel inherently restricts Acerinox's ability to readily switch between suppliers. This reliance on specialized inputs, coupled with the imperative for consistent performance, naturally bolsters the leverage of established and dependable suppliers who can guarantee these critical requirements.

Raw materials are a significant cost driver for Acerinox, with nickel, chromium, and molybdenum being critical inputs for stainless steel production. In 2023, the cost of these key raw materials represented a substantial percentage of Acerinox's total production expenses, directly influencing their profitability and pricing strategies.

The consistent availability and quality of these essential inputs are vital for maintaining Acerinox's production output across its diverse product portfolio, which includes flat and long stainless steel products. Any volatility in supply or significant price hikes from major mining or metal suppliers can directly affect Acerinox's ability to meet market demand and maintain its competitive edge.

Limited Threat of Forward Integration by Suppliers

The threat of suppliers of raw materials, such as nickel and chromium, forward integrating into Acerinox's complex stainless steel manufacturing is generally low. This is primarily due to the substantial capital investment, sophisticated technological know-how, and extensive global distribution channels necessary to compete in this sector. These high barriers effectively deter raw material providers from becoming direct competitors in the downstream production of stainless steel.

For instance, establishing a modern stainless steel mill requires investments in the hundreds of millions, if not billions, of dollars. Companies like Acerinox have decades of experience and proprietary processes that are difficult for raw material suppliers to replicate quickly. Furthermore, the established relationships and logistical networks Acerinox maintains with its customers worldwide represent another significant hurdle for potential new entrants from the supplier side.

- High Capital Requirements: Building a stainless steel production facility demands enormous financial outlay, often exceeding $500 million for a new integrated plant.

- Technological Expertise: Advanced metallurgy, process control, and quality assurance are critical and take years to master, creating a steep learning curve for new entrants.

- Established Distribution Channels: Accessing global markets requires established sales networks and logistics, which raw material suppliers typically lack for finished steel products.

- Brand Reputation and Customer Loyalty: Acerinox benefits from a recognized brand and long-standing customer relationships, making it challenging for a newly integrated supplier to gain market share.

Growing Importance of Recycled Content

Acerinox's substantial reliance on recycled stainless steel, often exceeding 90% of its raw material input, significantly reduces its dependence on virgin ore suppliers. This high utilization of scrap metal diversifies its supply chain, lessening the bargaining power of traditional raw material providers. For instance, in 2023, the company continued to emphasize its circular economy approach, with recycled materials forming the backbone of its production.

However, the market for high-quality scrap metal itself presents a different dynamic. Fluctuations in the availability and price of suitable scrap can still exert pressure on Acerinox. The demand for specific grades of recycled stainless steel, driven by both cost and environmental regulations, can lead to price volatility, impacting input costs.

- Diversified Inputs: Acerinox's commitment to over 90% recycled content in 2023 production minimizes reliance on primary raw material suppliers.

- Scrap Market Dynamics: The price and availability of high-quality scrap metal are subject to their own supply and demand forces, creating potential cost pressures.

- Sustainability Alignment: Increased use of recycled materials aligns with growing global sustainability trends, potentially influencing supplier relationships and market positioning.

The bargaining power of suppliers for Acerinox is moderately high due to the critical nature of raw materials like nickel and chromium, and the company's significant reliance on scrap metal. While Acerinox's use of recycled materials mitigates dependence on virgin ore suppliers, the price and availability of quality scrap can still create cost pressures, as seen with nickel price volatility in early 2025.

High switching costs for specialized inputs, coupled with the need for consistent quality, further strengthen supplier leverage. For example, qualifying new suppliers for essential alloying elements involves substantial investment in testing and potential production line adjustments, making Acerinox hesitant to switch.

The threat of backward integration by raw material suppliers into stainless steel manufacturing remains low due to the immense capital requirements, advanced technological expertise, and established distribution networks that Acerinox possesses. Building a new stainless steel plant can cost upwards of $500 million, a barrier few raw material suppliers can overcome.

| Factor | Impact on Acerinox | Justification |

|---|---|---|

| Raw Material Dependence | Moderate to High | Nickel, chromium, and scrap are vital; price swings in nickel in Q2 2025 illustrate supplier leverage. |

| Switching Costs | High | Qualifying new suppliers for specialized inputs involves significant investment and potential disruption. |

| Supplier Backward Integration Threat | Low | Requires massive capital investment (>$500M for a new mill) and advanced technological know-how. |

| Recycled Material Use | Reduces dependence on virgin ore, but scrap market dynamics can still exert pressure. | Acerinox utilized over 90% recycled content in 2023, diversifying its supply base. |

What is included in the product

This analysis unpacks the competitive forces impacting Acerinox, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the stainless steel industry.

Instantly understand strategic pressure with a powerful spider/radar chart, making Acerinox's competitive landscape clear.

Customers Bargaining Power

Acerinox's diverse customer base, spanning industries like construction, automotive, and food processing, significantly dilutes individual customer bargaining power. This broad reach means that even large customers within a specific sector, such as automotive, do not represent an overwhelming portion of Acerinox's overall sales. For instance, the automotive sector, a key demand driver, is just one of many industries that rely on Acerinox's stainless steel and specialty alloys.

Acerinox's strategic focus on product differentiation, particularly through its integration and specialization in high-performance alloys via acquisitions like Haynes International, significantly softens customer bargaining power. This means customers seeking specialized grades or finishes, rather than just basic stainless steel, find it harder to switch suppliers based purely on price. For instance, in 2023, Acerinox reported a 10.4% increase in revenue from its specialized products segment, highlighting the value customers place on these offerings.

For demanding sectors such as automotive and industrial machinery, the costs associated with switching stainless steel suppliers are substantial. These include expenses for re-qualifying materials, redesigning components, and managing potential disruptions to ongoing operations. For instance, a major automotive manufacturer might spend millions on re-testing and re-certifying a new steel grade for a critical chassis component.

The imperative for unwavering quality, dependable performance, and specific industry certifications in these high-stakes applications significantly deters customers from readily changing their suppliers. This inherent hesitancy effectively limits their bargaining power, as the risks and costs of a switch often outweigh the potential benefits of negotiating lower prices.

Price Sensitivity Amidst Market Dynamics

Even with product differentiation, customers, especially those under their own cost pressures or facing stiff competition, often exhibit significant price sensitivity. This is particularly true in sectors where stainless steel is a substantial cost component. For instance, the automotive sector, a key market for Acerinox, has seen increased focus on cost optimization in 2024, leading buyers to scrutinize pricing more closely.

The inherent volatility of raw material prices, a significant factor influencing Acerinox's own pricing strategies, can directly translate into customer behavior. When input costs fluctuate, customers may actively seek out lower-cost alternatives or engage in more aggressive price negotiations. This is especially prevalent when the market offers ample supply, giving buyers more leverage. In 2024, fluctuations in nickel and chromium prices, key inputs for stainless steel, have put this dynamic into sharp relief.

- Price Sensitivity Drivers: Customers in sectors like construction and automotive, where stainless steel represents a notable cost, remain highly sensitive to price changes, particularly when facing their own economic headwinds.

- Impact of Raw Material Volatility: Fluctuations in nickel and chromium prices in 2024 have directly influenced Acerinox's pricing, prompting customers to seek cost-effective alternatives or negotiate more aggressively due to increased market supply.

- Customer Bargaining Levers: The availability of alternative suppliers and the potential for substitution with other materials or grades of stainless steel provide customers with significant bargaining power, especially during periods of high inventory or slower demand.

Limited Threat of Backward Integration by Customers

The threat of backward integration by customers is significantly limited for stainless steel manufacturers like Acerinox. The sheer scale of capital required to establish and operate a stainless steel production facility is immense, often running into hundreds of millions or even billions of dollars. For instance, building a new integrated stainless steel plant involves substantial investments in raw material sourcing, melting, refining, casting, and rolling technologies.

Furthermore, the technological complexity and specialized expertise needed to produce high-quality stainless steel are considerable. This includes mastering intricate metallurgical processes, quality control systems, and environmental compliance. Even large customers in sectors like automotive or appliance manufacturing would find it prohibitively expensive and challenging to replicate this level of technical proficiency and operational scale.

Consequently, the high barriers to entry in stainless steel manufacturing effectively curb customers' ability to produce their own materials. This preserves Acerinox's strong position as a key supplier, as customers generally lack the resources and expertise to vertically integrate into steel production. In 2023, global capital expenditures for new steelmaking facilities often exceeded $1 billion, underscoring this point.

- High Capital Requirements: Establishing stainless steel production demands significant financial investment, often in the hundreds of millions to billions of dollars.

- Technological Sophistication: The manufacturing process involves complex metallurgy and advanced technologies that are difficult for customers to replicate.

- Expertise Barrier: Deep knowledge and specialized skills are essential for efficient and quality stainless steel production, posing a challenge for most customers.

- Limited Vertical Integration: These factors collectively make it highly improbable for even large customers to undertake backward integration into stainless steel manufacturing.

Acerinox faces moderate customer bargaining power. While its diverse customer base across sectors like automotive and construction limits the impact of any single buyer, price sensitivity remains a key factor. For instance, in 2024, the automotive sector's focus on cost optimization intensified buyer scrutiny of stainless steel pricing, especially given fluctuations in raw material costs like nickel and chromium.

The company's product differentiation, particularly with specialized alloys from acquisitions like Haynes International, helps mitigate this power by creating switching costs for customers seeking unique performance characteristics. However, customers can still exert influence by exploring alternative suppliers or substitute materials, especially when market supply is ample.

The threat of backward integration by customers is minimal due to the extremely high capital expenditure and technological complexity involved in stainless steel production, with new facilities often costing over $1 billion.

| Factor | Impact on Acerinox | Supporting Data/Context |

|---|---|---|

| Customer Concentration | Lowers individual customer power | Diverse customer base across construction, automotive, food processing. |

| Product Differentiation | Reduces customer power | Specialized alloys (e.g., via Haynes International) command premium pricing. 2023 specialized products revenue increased 10.4%. |

| Switching Costs | Reduces customer power | Re-qualification, redesign, and operational disruption costs deter frequent supplier changes. |

| Price Sensitivity | Increases customer power | Significant cost component for some sectors; automotive focus on cost optimization in 2024. |

| Raw Material Volatility | Can increase customer power | Fluctuations in nickel/chromium prices in 2024 lead to price sensitivity and negotiation. |

| Threat of Backward Integration | Negligible | High capital ($1B+ for new plants) and technological barriers. |

Preview the Actual Deliverable

Acerinox Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Acerinox, detailing the competitive landscape and strategic positioning within the stainless steel industry. You're viewing the exact, professionally formatted document you'll receive instantly upon purchase, offering a comprehensive examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This analysis is ready for immediate use, providing actionable insights without any placeholders or sample content.

Rivalry Among Competitors

The global stainless steel industry is a crowded arena, featuring major international players like ArcelorMittal, Outokumpu, Nippon Steel, Baosteel, and POSCO, in addition to numerous regional manufacturers. This dense competitive landscape means companies are constantly battling for market share across a wide array of product categories and geographical markets, intensifying rivalry.

Persistent oversupply, especially from major Asian producers in China and Indonesia, creates significant challenges for market rebalancing and intensifies competitive pressure. This imbalance directly impacts pricing and profitability across various global regions, forcing companies to adapt their strategies.

Acerinox's decision to cease operations in Malaysia in 2024 serves as a stark example of this intense global rivalry. The oversupply situation, driven by these Asian competitors, made it difficult to maintain profitability in that specific market, underscoring the pervasive nature of this competitive force.

While the global stainless steel market anticipates a Compound Annual Growth Rate (CAGR) between 4.6% and 8.2% from 2024 through 2030 or 2033, certain regions may experience stagnant demand in 2024 and 2025. This uneven growth landscape, coupled with high capacity utilization among competitors, often triggers more aggressive pricing tactics.

When competitors operate at high capacity, they are more inclined to lower prices to move inventory, intensifying price competition. This environment necessitates that companies like Acerinox continuously refine their operational efficiency and seek cost-saving measures to remain competitive. For instance, in 2023, global stainless steel production reached approximately 57.9 million metric tons, indicating a significant supply base.

Strategic Investments and Product Innovation

Competitive rivalry within the stainless steel sector, including for companies like Acerinox, is intensifying beyond mere price competition. It's increasingly shaped by significant strategic investments in developing higher value-added solutions, embracing technological advancements, and achieving robust product differentiation. This strategic focus is crucial for maintaining and enhancing market standing.

Companies are actively investing in cutting-edge areas such as high-performance alloys, which cater to demanding applications in aerospace, automotive, and energy sectors. Furthermore, a strong emphasis is being placed on sustainability, with initiatives like 'green steel' production gaining traction. For instance, Acerinox has been a proponent of these sustainable practices, aiming to reduce its environmental footprint and meet the growing global demand for eco-friendly materials.

- Investment in High-Performance Alloys: Companies are channeling resources into R&D for alloys with superior strength, corrosion resistance, and temperature tolerance, crucial for industries like aerospace and advanced manufacturing.

- Focus on 'Green Steel' Initiatives: Acerinox, for example, has been investing in reducing CO2 emissions and enhancing energy efficiency in its production processes, aligning with global sustainability targets. In 2023, the company continued its efforts to decarbonize its operations, a trend expected to accelerate.

- Product Differentiation Strategies: Beyond commodity grades, firms are innovating with specialized stainless steel products tailored to specific customer needs, offering enhanced performance and unique properties to command premium pricing.

- Technological Advancements: Adoption of Industry 4.0 technologies, automation, and advanced process controls are key investments aimed at improving production efficiency, product quality, and overall competitiveness.

Impact of Trade Policies and Tariffs

Geopolitical shifts and evolving trade policies, particularly those involving tariffs on key materials like steel and aluminum, directly impact Acerinox's competitive environment. For instance, increased US tariffs, such as those implemented in recent years, can alter global material flows and pricing dynamics.

These policy changes can create advantages for domestic producers by potentially improving their pricing power. However, they also introduce market volatility, as surplus materials might be redirected to other regions, thereby intensifying competition in those markets.

In 2024, the global steel market, a crucial input for Acerinox's stainless steel production, continued to grapple with these trade policy uncertainties. For example, while specific tariff rates vary, the overall trend of protectionist measures in major economies like the United States and the European Union has been a persistent factor influencing import/export volumes and cost structures.

- Tariff Impact: Tariffs on steel and aluminum can boost domestic producers' pricing power, potentially benefiting regional mills.

- Market Uncertainty: Trade policy shifts create volatility, making supply chain management more complex.

- Surplus Diversion: Restricted markets can lead to material surpluses being redirected, intensifying competition elsewhere.

- 2024 Context: Ongoing trade policy discussions in major economies continue to shape the global stainless steel market's competitive landscape.

The stainless steel industry is intensely competitive, with numerous global and regional players vying for market share. This rivalry is fueled by oversupply, particularly from Asian producers, which pressures prices and profitability. Acerinox's withdrawal from Malaysia in 2024 highlights the difficulty of competing in saturated markets. Despite anticipated market growth, stagnant demand in some regions in 2024 and 2025, coupled with high competitor capacity utilization, often leads to aggressive pricing strategies.

Competition extends beyond price, with companies investing heavily in high-performance alloys and sustainability initiatives like green steel production. Acerinox, for example, is committed to reducing its environmental impact. Product differentiation and technological advancements, such as automation and advanced process controls, are also key differentiators. Geopolitical factors, including tariffs on steel and aluminum, further shape the competitive landscape by altering trade flows and creating market uncertainty.

| Key Competitive Factors | Impact on Acerinox | 2024 Data/Context |

|---|---|---|

| Number of Major Global Competitors | Intensifies rivalry for market share | ArcelorMittal, Outokumpu, Nippon Steel, Baosteel, POSCO |

| Global Stainless Steel Production | Indicates supply base and potential oversupply pressure | Approx. 57.9 million metric tons in 2023 |

| Oversupply from Asian Producers | Drives down prices, impacts profitability | Persistent challenge, leading to strategic market exits (e.g., Acerinox in Malaysia) |

| Investment in High-Value Products | Differentiates offerings, commands premium pricing | Focus on aerospace, automotive, energy sector alloys |

| Sustainability Initiatives ('Green Steel') | Meets growing demand, enhances brand image | Acerinox investing in decarbonization efforts |

| Trade Policy (Tariffs) | Creates market volatility, alters cost structures | Ongoing protectionist measures in major economies |

SSubstitutes Threaten

While stainless steel offers excellent durability and corrosion resistance, other materials can step in depending on the specific need. For example, carbon steel is often a more budget-friendly option when extreme rust protection isn't a top priority.

In applications where weight is a key concern, aluminum frequently becomes the material of choice over stainless steel. Similarly, plastics and various composite materials are increasingly being used as substitutes, particularly in industries looking for lighter, more adaptable, or cost-effective solutions.

The threat of substitutes for Acerinox's stainless steel products is significantly influenced by the price-performance trade-off. While alternatives might offer a lower upfront cost, stainless steel's superior durability, corrosion resistance, and hygiene properties often translate to lower life-cycle costs. For instance, in demanding sectors like food processing or chemical industries, the extended service life and reduced maintenance of stainless steel can outweigh the initial price difference.

Ongoing innovations in alternative materials, like advanced plastics and corrosion-resistant aluminum alloys, are making them increasingly competitive with stainless steel. These materials are seeing enhanced properties that broaden their suitability for applications previously dominated by stainless steel. For instance, the global market for advanced plastics is projected to reach over $250 billion by 2024, highlighting their growing appeal.

Customer Willingness to Adopt Substitutes

Customer willingness to switch to substitutes for stainless steel is influenced by more than just material performance. Factors like design flexibility, how easily a material can be shaped and worked with, and even new regulations or environmental trends play a significant role. For instance, the automotive industry's drive for lighter vehicles in 2024 and beyond is pushing manufacturers to consider alternatives like aluminum for certain components, potentially impacting demand for stainless steel.

This shift is driven by a complex interplay of technical and market forces. The ability of a substitute material to meet evolving design specifications or comply with new environmental standards, such as those promoting recyclability or reduced carbon footprints, can accelerate adoption. In 2024, many industries are actively seeking materials that offer a better balance of performance, cost, and sustainability.

- Design Flexibility: Substitutes may offer easier manipulation for intricate designs.

- Fabrication Ease: Simpler manufacturing processes can lower overall costs.

- Regulatory Shifts: New environmental or safety standards can favor alternative materials.

- Environmental Concerns: Growing demand for sustainable materials impacts material choices.

Application-Specific Substitution Risk

The threat of substitutes for Acerinox's stainless steel products is highly dependent on the specific application. While sectors like construction and automotive are significant users, the risk varies. For instance, in some high-end automotive components, the unique properties of stainless steel might be difficult to replicate cost-effectively. However, in less demanding applications, alternative materials could pose a greater challenge.

In 2024, the global construction industry continued to explore advanced composites and high-strength polymers for certain structural and aesthetic elements, potentially impacting demand for stainless steel in specific building applications. Similarly, the automotive sector's drive for lighter vehicles, while often benefiting stainless steel's strength-to-weight ratio, also sees innovation in aluminum alloys and advanced plastics for non-critical parts.

- Application-Specific Risk: The threat of substitutes is not uniform across all stainless steel uses.

- Niche Application Vulnerability: Certain specialized applications within construction, automotive, or consumer goods may face higher substitution risks if alternatives offer comparable performance at a lower price point.

- Material Innovation: Ongoing advancements in materials science, such as new polymers and composite materials, continue to present potential substitutes for stainless steel in various end-markets.

- Cost-Benefit Analysis: The primary driver for substitution remains the ability of alternative materials to meet functional requirements more economically or with added benefits.

The threat of substitutes for stainless steel is significant, driven by a constant evolution in material science and cost considerations. While stainless steel offers distinct advantages, alternatives like advanced plastics, aluminum alloys, and composites are increasingly viable for specific applications. For instance, the automotive sector's push for lighter vehicles in 2024 is leading to greater use of aluminum in non-structural components, directly impacting stainless steel demand.

The price-performance ratio remains a critical factor. Although stainless steel boasts superior durability and corrosion resistance, which can lower life-cycle costs, lower upfront costs of substitutes are attractive. For example, the global advanced plastics market was projected to exceed $250 billion by 2024, indicating a strong market pull for these alternatives.

Customer adoption of substitutes is also influenced by factors beyond pure performance, including design flexibility and ease of fabrication. Regulatory shifts and environmental concerns, such as the demand for recyclable materials, further enhance the appeal of certain substitutes. In 2024, many industries are prioritizing materials that balance performance, cost, and sustainability.

The risk of substitution varies by application. While high-performance sectors may retain stainless steel, less demanding uses are more vulnerable. For example, certain construction and consumer goods applications might find cost-effective substitutes more readily available. The automotive industry's 2024 focus on weight reduction continues to drive innovation in aluminum and polymer alternatives for specific parts.

| Material Substitute | Key Advantages | Potential Applications Affected | 2024 Market Trend/Data Point |

|---|---|---|---|

| Aluminum Alloys | Lighter weight, good corrosion resistance | Automotive body panels, consumer electronics casings | Global aluminum market expected to grow, driven by automotive lightweighting initiatives. |

| Advanced Plastics & Composites | High strength-to-weight ratio, design flexibility, lower cost | Automotive interior parts, construction components, sporting goods | Global advanced plastics market projected to surpass $250 billion by 2024. |

| Carbon Steel | Lower cost | General structural applications, less demanding environments | Continues to be a cost-effective alternative where extreme corrosion resistance is not paramount. |

Entrants Threaten

The integrated stainless steel manufacturing industry, where Acerinox operates, demands colossal upfront capital for essential facilities like melting shops, rolling mills, and finishing lines. For example, establishing a new stainless steel plant can easily run into billions of dollars. This immense financial hurdle significantly deters potential new entrants, making it exceedingly challenging to compete with established players.

Existing global leaders like Acerinox already command substantial economies of scale across their operations, from manufacturing and raw material sourcing to their extensive distribution networks. For instance, Acerinox's 2023 revenue stood at €7.16 billion, demonstrating its significant market presence and operational capacity.

Newcomers would face immense difficulty matching these cost efficiencies. Without the same production volumes and established supply chains, any new entrant would likely operate at a higher cost base, immediately placing them at a severe competitive disadvantage against established players.

Acerinox and its peers have cultivated robust global distribution channels and deep, enduring relationships with a wide array of customers spanning numerous industries. Newcomers would find it exceptionally difficult and time-consuming to build comparable networks and earn the trust and loyalty that established players currently enjoy. For instance, Acerinox reported sales of €7.4 billion in 2023, underscoring the scale of its existing market presence and customer base.

Stringent Regulatory and Environmental Hurdles

The steel industry, including stainless steel producers like Acerinox, faces significant barriers to entry due to increasingly stringent environmental regulations. These rules, covering everything from carbon emissions to waste disposal, demand substantial capital investment in advanced technologies and cleaner production processes. For instance, the European Union’s Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will impose costs on carbon-intensive imports, making it harder for new, less efficient producers to compete.

Compliance with these evolving environmental standards represents a major financial hurdle. New entrants must not only meet current requirements but also anticipate future tightening of regulations, necessitating upfront investment in infrastructure that can adapt. This can easily run into hundreds of millions of dollars, a considerable deterrent for potential competitors looking to enter the market.

- High Capital Expenditure: New steel plants require massive upfront investment, often exceeding $1 billion, to meet modern environmental and operational standards.

- Regulatory Compliance Costs: Adhering to emissions standards, waste management, and safety protocols adds significant ongoing operational expenses.

- Technological Obsolescence Risk: Investing in current technology carries the risk of it becoming outdated as regulations and best practices evolve rapidly.

- Permitting Delays: Obtaining the necessary environmental and operational permits can be a lengthy and complex process, delaying market entry.

Intellectual Property and Technological Expertise

The stainless steel industry, including players like Acerinox, demands significant intellectual property and specialized technological expertise. Manufacturing these advanced materials requires deep metallurgical knowledge and proprietary processes that are not easily replicated. For instance, developing new high-performance alloys or optimizing production efficiency often involves years of research and development, creating a substantial knowledge barrier for potential newcomers.

Incumbents have built up considerable technological advantages and protected intellectual property, making it both difficult and expensive for new entrants to compete. This can include patented manufacturing techniques or unique alloy compositions. In 2024, companies heavily invested in R&D, with leading steel producers allocating billions globally to innovation, further solidifying this barrier. For example, ArcelorMittal's 2024 R&D spending was a significant portion of its revenue, aimed at enhancing product performance and sustainability.

- High Capital Investment: Setting up advanced stainless steel production facilities requires substantial upfront capital, often in the hundreds of millions, if not billions, of dollars.

- Proprietary Knowledge: Expertise in alloy formulation, heat treatment, and finishing processes are critical and often guarded as trade secrets or through patents.

- Continuous Innovation: The need for ongoing product development to meet evolving market demands (e.g., for automotive or construction) necessitates a constant commitment to R&D.

- Skilled Workforce: Access to a highly skilled workforce with specialized metallurgical and engineering backgrounds is essential, and this talent pool is not readily available.

The threat of new entrants in the stainless steel industry is generally low, primarily due to the substantial capital required to establish operations. Building a modern stainless steel plant can easily cost billions of dollars, a significant barrier for any newcomer. Furthermore, established players like Acerinox benefit from massive economies of scale, with 2023 revenues reaching €7.16 billion, making it difficult for new entrants to match their cost efficiencies.

Existing companies also possess strong brand loyalty and established distribution networks, built over years of operation. For instance, Acerinox's 2023 sales of €7.4 billion highlight its extensive market reach. New companies would struggle to replicate these relationships and gain customer trust quickly.

Stringent environmental regulations and the need for specialized technological expertise further deter new entrants. Compliance with evolving standards, like the EU's Carbon Border Adjustment Mechanism (CBAM) set for full implementation in 2026, necessitates significant investment in advanced, cleaner production processes. Additionally, proprietary knowledge in metallurgy and continuous R&D, with leading steel producers globally investing billions in innovation in 2024, creates a substantial knowledge gap that new entrants must overcome.

| Barrier to Entry | Description | Example/Data Point |

| Capital Requirements | Massive upfront investment for plant construction and technology. | Establishing a new stainless steel plant can cost over $1 billion. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Acerinox's 2023 revenue of €7.16 billion indicates significant operational scale. |

| Brand Loyalty & Distribution | Established customer relationships and extensive supply chains. | Acerinox's 2023 sales of €7.4 billion reflect its market penetration. |

| Regulatory Environment | Costs associated with meeting environmental standards. | EU's CBAM (2026) increases costs for carbon-intensive production. |

| Technological Expertise | Need for specialized knowledge and R&D capabilities. | Global steel R&D investments in 2024 reached billions to drive innovation. |

Porter's Five Forces Analysis Data Sources

Our Acerinox Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Acerinox's annual reports and investor presentations, alongside industry-specific market research from firms like CRU Group and Wood Mackenzie. We also incorporate data from financial databases and global trade statistics to provide a robust assessment of the competitive landscape.