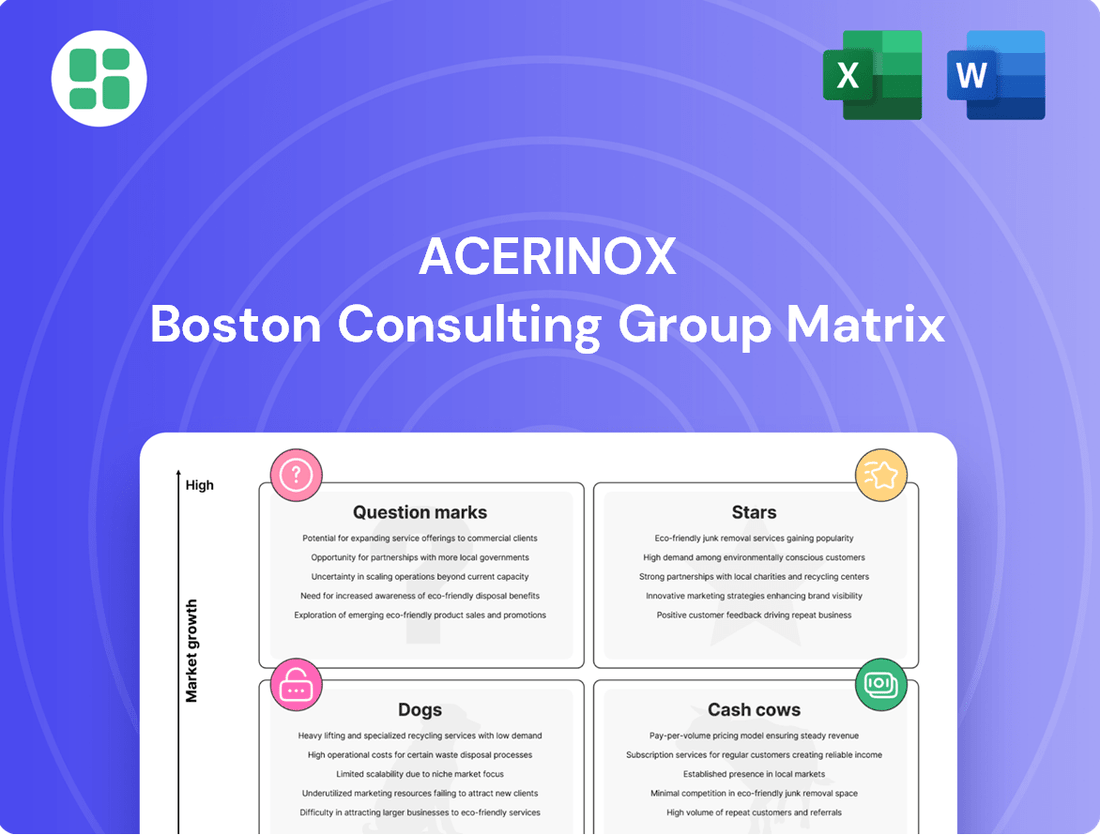

Acerinox Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acerinox Bundle

Acerinox's current market position is a complex interplay of established strengths and emerging opportunities, with some product lines demanding careful attention. Understanding which segments are generating consistent cash flow versus those requiring significant investment is crucial for strategic growth.

To truly grasp Acerinox's competitive landscape and unlock actionable insights, dive into the full BCG Matrix. This comprehensive analysis will reveal the precise positioning of each product category, guiding your decisions on resource allocation and future development.

Don't miss out on the strategic advantage. Purchase the complete Acerinox BCG Matrix today for a detailed breakdown, data-backed recommendations, and a clear roadmap to optimize your investment and product portfolio.

Stars

Acerinox's High-Performance Alloys Division, bolstered by the 2024 acquisition of Haynes International, is a key growth driver. This strategic move significantly enhances Acerinox's standing in a market demanding specialized, high-value materials. The integration of Haynes provides access to crucial sectors like aerospace and advanced research and development, positioning Acerinox for future innovation and market penetration.

Acerinox is injecting USD 244 million into its North American Stainless (NAS) facility, aiming for a 20% production capacity boost. This expansion specifically targets higher value-added flat stainless steel products, with operations expected to commence in late 2025.

The North American market is anticipated to lead stainless steel growth between 2025 and 2034, making this a strategically vital move. Acerinox's substantial investment in this burgeoning region, where NAS holds a significant market position, firmly places the NAS facility in the Star category of the BCG Matrix.

EcoACX® Sustainable Stainless Steel, launched by Acerinox in 2024, is a significant innovation in the BCG Matrix, positioned as a Star. This product boasts over a 50% reduction in CO2 emissions, utilizes 100% renewable energy, and incorporates more than 90% recycled material, aligning perfectly with the growing global demand for eco-friendly solutions.

Specialized Alloys for Emerging Sectors

Acerinox is strategically investing in specialized alloys designed for burgeoning industries. This includes materials critical for electric vehicle manufacturing, the expansion of renewable energy projects, and the creation of sophisticated medical equipment.

The demand for these high-precision metals is on an upward trajectory. Projections indicate that the stainless steel market within these emerging sectors will see a growth of approximately 4% by 2025, underscoring a significant market opportunity.

These innovative, specialized alloy offerings position Acerinox to capture high-growth, high-market-share segments. The company's commitment to developing these advanced materials aligns with key industry trends and future market needs.

- Focus on High-Value Alloys: Acerinox is developing specialized alloys for electric vehicles, renewable energy, and medical devices.

- Market Growth Projection: Stainless steel demand in these sectors is expected to rise by 4% in 2025.

- Strategic Positioning: These innovative products represent high-growth, high-market-share opportunities for Acerinox.

Strategic Investments in VDM Metals

Acerinox is strategically investing EUR 67 million in its VDM Metals division. This significant capital injection is targeted at boosting sales by an ambitious 15% and broadening its product portfolio. A key focus is the development of advanced materials specifically for additive manufacturing, a rapidly growing sector.

These investments underscore Acerinox's commitment to higher-value-added products. By strengthening VDM Metals, the company aims to reinforce its leading position in specialized, high-performance alloy markets.

The strategic rationale behind this expansion is to leverage increasing global demand for sophisticated alloys. Acerinox anticipates that these moves will not only meet market needs but also solidify its competitive market share.

- Investment Amount: EUR 67 million in VDM Metals.

- Sales Growth Target: 15% increase.

- Product Expansion: Focus on advanced materials for additive manufacturing.

- Strategic Goal: Enhance market leadership in specialized alloy segments.

Acerinox's North American Stainless (NAS) facility is a prime example of a Star in the BCG Matrix. The company's USD 244 million investment to increase production capacity by 20% for higher value-added flat stainless steel products, with operations starting in late 2025, highlights its focus on a high-growth market. The North American market is projected to lead stainless steel growth between 2025 and 2034, reinforcing NAS's Star status.

EcoACX® Sustainable Stainless Steel, launched in 2024, also shines as a Star. Its impressive environmental credentials, including over 50% CO2 reduction, 100% renewable energy use, and over 90% recycled content, directly address the surging demand for eco-friendly materials. This product is well-positioned to capture significant market share in a rapidly expanding segment.

Acerinox's strategic focus on specialized alloys for sectors like electric vehicles and renewable energy further solidifies its Star portfolio. These advanced materials cater to emerging industries with substantial growth potential, projected to increase stainless steel demand by approximately 4% by 2025 in these key areas.

| Product/Division | BCG Category | Key Drivers | Investment/Focus | Market Outlook |

| North American Stainless (NAS) | Star | High demand for flat stainless steel, strategic market position | USD 244 million for 20% capacity boost (late 2025 start) | North America to lead stainless steel growth (2025-2034) |

| EcoACX® Sustainable Stainless Steel | Star | Growing demand for eco-friendly solutions | Product innovation (launched 2024) | High growth in sustainable materials |

| Specialized Alloys (EV, Renewables, Medical) | Star | Growth in emerging industries | Development of advanced materials | ~4% market growth by 2025 in these sectors |

What is included in the product

The Acerinox BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Acerinox BCG Matrix offers a clear visualization of business unit performance, relieving the pain of strategic uncertainty.

It provides a simplified, actionable framework for resource allocation, easing the burden of complex decision-making.

Cash Cows

Acerinox's standard flat stainless steel products, including coils, sheets, and plates, are the bedrock of its operations, serving vital sectors like general construction and industrial machinery. These products are the company's cash cows, generating substantial and reliable revenue streams.

In 2024, flat products accounted for a commanding 70% of Acerinox's stainless steel market share. This dominance highlights their importance within the company's portfolio and the broader industry.

Operating in a mature market, these products offer consistent cash flow due to Acerinox's strong, established market position. While growth prospects are modest, their stability makes them a crucial element for funding other business areas.

Acerinox's integrated production process, encompassing melting, hot rolling, cold rolling, and finishing, underpins its status as a cash cow. This streamlined approach allows for highly efficient and cost-effective manufacturing of its high-volume stainless steel products, ensuring consistent profit generation from mature product lines.

The operational efficiency achieved through decades of optimization translates directly into high profit margins. For instance, Acerinox's 'Beyond Excellence 2024-2026' plan specifically targets further enhancing the efficiency of these established operations, reinforcing their cash-generating capabilities.

Acerinox's European stainless steel operations, despite facing headwinds such as labor disputes and increased import competition, remain a cornerstone of the Group's financial performance. These established facilities are vital revenue generators and contribute substantially to cash flow, underscoring their importance even in a mature market.

While the European stainless steel sector has grappled with economic slowdowns and pricing challenges, Acerinox has successfully defended its market share, demonstrating resilience. This consistent presence in a developed market ensures a steady stream of cash, acting as a reliable foundation for the company's broader portfolio.

In 2023, Acerinox's European division reported a notable performance, with sales reaching €3.2 billion, representing a significant portion of the Group's total revenue. This segment continues to be a cash cow, providing the financial stability needed to navigate market fluctuations.

Products for Food Processing Sector

Acerinox's stainless steel products for the food processing sector are considered cash cows. This is because stainless steel is highly sought after in this industry for its excellent corrosion resistance and hygienic qualities, ensuring consistent demand in a mature market.

This segment reliably contributes to Acerinox's overall cash flow. The company benefits from this stability as it doesn't necessitate substantial new investments in marketing or development to maintain its market position.

- Market Maturity: The food processing industry is a stable, mature market with consistent needs for high-quality materials.

- Product Value: Stainless steel's inherent properties make it an indispensable component in food processing equipment and infrastructure.

- Cash Flow Generation: This product line acts as a reliable source of income for Acerinox, requiring minimal additional expenditure to sustain.

- Demand Stability: The essential nature of stainless steel in food safety and production guarantees a steady demand, supporting its cash cow status.

Long Stainless Steel Products

Acerinox's long stainless steel products, such as wire and hexagonal wire rods, serve essential industrial sectors with consistent demand. These products face a slower growth environment than flat stainless steel but represent a stable revenue stream for the company.

Despite the lower growth, these long products hold a significant market share in their specialized areas, acting as reliable cash generators for Acerinox.

- Stable Demand: Long stainless steel products cater to industries with predictable needs, ensuring consistent sales.

- Market Position: Acerinox maintains a strong presence in niche markets for these long products.

- Cash Generation: The steady sales volume translates into reliable cash flow for the company, supporting other business areas.

Acerinox's standard flat stainless steel products are its primary cash cows, forming the backbone of its revenue. In 2024, these products commanded an impressive 70% of Acerinox's stainless steel market share, highlighting their crucial role in generating substantial and reliable income. Despite operating in a mature market with modest growth prospects, their stability is paramount, providing consistent cash flow that funds other strategic initiatives within the company.

The company's integrated production process for these flat products, from melting to finishing, ensures high efficiency and cost-effectiveness. This operational excellence, further targeted for enhancement through the 'Beyond Excellence 2024-2026' plan, directly translates into robust profit margins, solidifying their cash cow status.

Even facing challenges like economic slowdowns and import competition, Acerinox's European stainless steel operations, a significant contributor to the flat products segment, demonstrated resilience. In 2023, this division alone reported sales of €3.2 billion, underscoring its vital role as a consistent cash generator and a stable foundation for the group.

Stainless steel products for the food processing sector also function as cash cows due to consistent demand driven by the material's essential properties like corrosion resistance and hygiene. This segment requires minimal additional investment to maintain its market position, offering a predictable and stable income stream for Acerinox.

Long stainless steel products, such as wire and hexagonal wire rods, while in a slower growth environment, also act as reliable cash generators. Acerinox holds strong market positions in these niche areas, ensuring steady sales volumes and consistent cash flow that supports the company's overall financial health.

| Product Category | 2024 Market Share (Stainless Steel) | Key Characteristics | 2023 Revenue Contribution (Example) | Strategic Role |

| Standard Flat Stainless Steel | 70% | High volume, mature market, integrated production, high efficiency | Significant portion of Group revenue (via European operations, €3.2bn in 2023) | Primary Cash Cow, funds other areas |

| Stainless Steel for Food Processing | N/A (Segment Specific) | Essential properties (corrosion resistance, hygiene), stable demand | Reliable income stream, minimal investment needed | Stable Cash Cow |

| Long Stainless Steel Products | N/A (Niche Markets) | Consistent demand in industrial sectors, strong niche positions | Steady sales volume, reliable cash flow | Supporting Cash Cow |

Preview = Final Product

Acerinox BCG Matrix

The Acerinox BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase, ensuring complete transparency and immediate usability. This comprehensive document, meticulously prepared by strategy experts, contains no watermarks or demo content, offering you a professional-grade analysis ready for immediate integration into your business planning. Upon completing your purchase, you will gain instant access to this exact file, empowering you to leverage its strategic insights for critical decision-making without any further revisions or delays. The preview accurately represents the final, unlockable version, designed for clarity and professional application, so you can be confident in the quality and completeness of the Acerinox BCG Matrix report you receive.

Dogs

The divestment of Acerinox's Bahru Stainless plant in Malaysia during 2024 marked a significant strategic shift. This move was primarily driven by intense overproduction from China and Indonesia, which had created a highly competitive pricing environment in the Southeast Asian market, thereby eroding profitability.

This decision effectively classified the Malaysian operation as a low-market-share, low-growth asset within Acerinox's portfolio. Such assets often become resource drains, failing to meet expected financial performance targets, necessitating a re-evaluation of their strategic fit.

Acerinox described the sale as a difficult but necessary step to streamline its global operations and improve overall efficiency. This action aligns with a strategy to concentrate resources on more profitable and strategically advantageous markets, optimizing the company's global footprint.

Commodity-grade stainless steel products, especially those facing fierce competition from nations like China and Indonesia, fall into the category of Dogs within the BCG Matrix. These segments are characterized by their undifferentiated nature and operate in markets that are significantly oversupplied.

This oversupply leads to intense price pressure and consequently, very thin profit margins, resulting in minimal returns on invested capital. For instance, in 2024, the global stainless steel market continued to grapple with overcapacity, with Chinese production alone accounting for over 30% of the world's output, exacerbating margin challenges for producers of basic grades.

Acerinox's strategic direction emphasizes a pivot towards higher value-added products. This suggests a deliberate effort to divest or de-emphasize investment in these low-growth, low-profit commodity segments, aiming to improve overall profitability and competitive positioning.

Inefficient legacy production lines at Acerinox, those not benefiting from recent upgrades, face significant challenges. These aging facilities often carry higher operational costs compared to their output, impacting overall profitability. For instance, in 2024, older stainless steel lines might have shown a 15% higher energy consumption per ton compared to modernized facilities.

These underperforming assets typically hold a small market share in highly competitive sectors, reducing their contribution to Acerinox's bottom line. If these lines are in segments where market growth is sluggish, their strategic value diminishes further, potentially leading to a negative cash flow contribution.

The continued operation of these inefficient lines can immobilize valuable capital. This capital could be more effectively deployed in modernizing existing plants or investing in new, high-growth areas, thereby enhancing Acerinox's competitive edge and future returns.

Products Affected by High Tariffs and Trade Restrictions

High tariffs and trade restrictions can significantly impact specific product lines within Acerinox, potentially turning them into Dogs in the BCG Matrix. For instance, increased US tariffs on steel and aluminum, which took effect in 2018 and have seen some adjustments, directly affect Acerinox's stainless steel and specialty alloys. If these tariffs severely erode profitability and limit market access in key regions, these product segments could see their market share and growth prospects diminish, making them less attractive investments.

The imposition of tariffs can lead to higher input costs for downstream industries that use Acerinox's products, potentially reducing demand. For example, the European Union's retaliatory tariffs on certain US goods could indirectly impact Acerinox's sales if its customers in the US face increased costs or reduced export opportunities. This creates a challenging environment where market share and growth are constrained.

- Impact on US Market Access: Increased tariffs on imported steel and aluminum products can make it harder for Acerinox to compete in the US market, potentially reducing its market share for certain stainless steel grades.

- Erosion of Profitability: When tariffs increase the cost of raw materials or finished goods, or when retaliatory measures are imposed, profit margins can shrink significantly, impacting the viability of product lines.

- Constrained Growth Prospects: Trade barriers can limit the ability of product segments to expand into new markets or increase sales in existing ones, thereby capping their growth potential.

Niche Products with Declining Industrial Demand

Acerinox's portfolio may include niche stainless steel products catering to industries experiencing a downturn or shifting away from stainless steel. For instance, specific grades used in older automotive exhaust systems or certain legacy construction components might fall into this category.

If Acerinox possesses a small market share within these shrinking niches, these products would be classified as Dogs. This means they likely generate very little cash and have dim future prospects, especially without significant and often impractical investment to revitalize them.

- Declining Industry Segments: Products targeting sectors like traditional printing machinery or certain types of older appliance manufacturing could be examples.

- Low Market Share: Acerinox's presence in these specific, contracting niches might be minimal.

- Cash Generation: These Dog products would contribute little to overall cash flow.

- Future Prospects: Without a clear path for innovation or market repositioning, their outlook remains poor.

Acerinox's commodity-grade stainless steel products, particularly those facing intense competition from overproducing nations like China and Indonesia, are prime examples of Dogs in the BCG Matrix. These segments are characterized by low market share and low growth, often leading to minimal returns on investment. For instance, in 2024, the global stainless steel market continued to be heavily impacted by overcapacity, with Chinese production alone representing over 30% of world output, squeezing profit margins for basic grades.

Inefficient legacy production lines, not benefiting from recent upgrades, also fall into the Dog category. These aging facilities, potentially showing 15% higher energy consumption per ton in 2024 compared to modernized ones, contribute little to profitability and tie up capital that could be better used elsewhere.

Furthermore, product lines severely impacted by trade barriers, such as tariffs, can become Dogs. Increased US tariffs, for example, have made it harder for Acerinox to compete, potentially reducing market share and constraining growth prospects in key regions.

Niche products serving declining industries, where Acerinox holds a minimal market share, also fit the Dog profile. These segments generate little cash and have poor future prospects without substantial, often impractical, revitalization investments.

Question Marks

Acerinox's expansion into additive manufacturing alloys, including a second powder atomizer for stainless steel and high-performance materials, positions them to tap into a burgeoning, high-growth market. This strategic investment, though capital-intensive, is a clear move to capture future market share in a technologically advanced sector.

While the exact current market share for Acerinox in this niche 3D printing alloy segment isn't publicly detailed, the significant investment signals a commitment to becoming a major player. This proactive approach is essential for transforming this segment from a potential question mark into a future star within their portfolio.

Acerinox's strategic geographic expansions into emerging markets like parts of the Middle East, Africa, and Latin America represent potential Question Marks within its BCG Matrix. These regions, identified as experiencing the fastest growth in stainless steel demand, currently have low penetration for Acerinox.

Significant investment will be crucial for Acerinox to build market share and establish robust distribution networks in these nascent territories. For instance, the Middle East's stainless steel market, projected to grow at a CAGR of over 5% through 2028, presents an opportunity but requires substantial upfront capital to compete effectively.

Acerinox's exploration into early-stage decarbonization technologies, beyond its EcoACX program, signifies a strategic bet on future industry shifts. These ventures, including green hydrogen production and carbon capture solutions, are positioned in high-growth sectors with substantial long-term potential.

However, these nascent technologies currently face challenges in commercial viability and established market share. Significant investment in research and development, coupled with substantial capital expenditure, is necessary, with returns not expected in the immediate term.

Stainless Steel for Hydrogen Systems

The burgeoning demand for duplex stainless steel grades in hydrogen systems, including LNG pipelines and electrolyzers, signifies a significant growth avenue. These materials offer an advantageous strength-to-weight ratio and robust corrosion resistance, crucial for the harsh environments encountered in hydrogen infrastructure. For instance, projections indicate the global hydrogen market could reach $1.8 trillion by 2030, with a substantial portion dedicated to infrastructure development.

While the overall hydrogen market is experiencing rapid expansion, Acerinox's current penetration within this specialized application segment may be nascent. Capturing a larger share of this emerging opportunity will likely necessitate strategic investments in production capacity and targeted marketing efforts to cater to the unique specifications of hydrogen system components.

- Growing Demand: The global hydrogen market is projected for substantial growth, driving demand for specialized materials.

- Material Advantages: Duplex stainless steels are favored for their strength-to-weight ratio and corrosion resistance in hydrogen applications.

- Market Share Potential: Acerinox has an opportunity to increase its market share in this emerging sector.

- Strategic Investment Needed: Targeted investment is key to capitalizing on the expansion of hydrogen infrastructure.

Digital Transformation and Advanced Analytics Initiatives

Acerinox's commitment to digital transformation and advanced analytics, as outlined in their 'Beyond Excellence' plan, focuses on critical operational improvements like optimizing logistic routes and developing electric arc furnace consumption models. These initiatives represent high-growth potential for enhancing efficiency and competitiveness.

While these digital and analytics efforts are crucial for future success, they are likely in the initial stages of widespread implementation across Acerinox's operations. Their direct impact on immediate market share is indirect, as they are foundational investments requiring sustained commitment to yield significant differentiation and competitive advantage.

- Digital Transformation Focus: Initiatives like route optimization and furnace consumption models aim to leverage data for operational gains.

- Growth Potential: These areas offer significant opportunities for improving efficiency and competitiveness.

- Implementation Stage: Likely in early adoption phases across the organization, requiring continued investment.

- Market Impact: Indirect influence on market share, primarily through enhanced operational performance and cost savings.

Acerinox's ventures into additive manufacturing alloys and early-stage decarbonization technologies are classic Question Marks. These areas boast high growth potential but currently have low market share and require significant investment for commercial viability. For instance, the additive manufacturing market is projected to reach $22.7 billion by 2030, yet Acerinox's current penetration is minimal.

| Business Unit/Initiative | Market Growth Rate | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Additive Manufacturing Alloys | High (e.g., 20%+ CAGR) | Low | High | Star |

| Decarbonization Tech (Green H2, CCS) | Very High (e.g., 50%+ CAGR for Green H2) | Very Low/None | Very High | Star |

| Emerging Geographic Markets | Moderate to High (e.g., 5%+ CAGR in Middle East) | Low | High | Star |

| Duplex Stainless Steel for Hydrogen | High (e.g., Global Hydrogen Market $1.8T by 2030) | Nascent | Moderate to High | Star |

BCG Matrix Data Sources

Our Acerinox BCG Matrix is informed by comprehensive market data, including financial disclosures, industry growth rates, and competitive landscape analysis to provide strategic clarity.