Aavas Financiers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Aavas Financiers's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a decisive edge and make informed decisions.

Political factors

Government housing initiatives, particularly the Pradhan Mantri Awas Yojana (PMAY), significantly bolster demand for affordable housing loans, a core segment for Aavas Financiers. These schemes, offering interest subsidies and financial assistance, directly stimulate the market, especially in semi-urban and rural regions where Aavas has a strong presence.

The government's ongoing commitment to the 'Housing for All' agenda, evidenced by recent announcements to construct additional houses under PMAY Gramin over the next five years, signals a sustained positive policy environment. This consistent political backing creates a fertile ground for companies like Aavas Financiers, which are strategically positioned to serve the low and middle-income housing needs of the population.

The stability of regulatory frameworks, particularly from the National Housing Bank (NHB), is crucial for housing finance companies like Aavas Financiers. Consistent guidelines and reports on housing trends, such as those published by the NHB, foster a predictable operating environment, essential for long-term planning and investment.

Aavas Financiers' adherence to Reserve Bank of India (RBI) directives, including maintaining specific proportions for housing and non-housing loans, highlights how regulatory compliance directly shapes its business model and operational strategies. This stability allows the company to navigate the financial landscape with greater confidence.

Government policies focused on financial inclusion are a significant tailwind for Aavas Financiers. These initiatives aim to bring formal credit to populations previously excluded from traditional banking systems, directly mirroring Aavas' core business strategy. For instance, the Pradhan Mantri Jan Dhan Yojana (PMJDY) has brought millions into the formal banking fold, creating a larger pool of potential customers for housing finance companies like Aavas. As of early 2024, India's financial inclusion efforts continue to expand, with a growing emphasis on digital access and credit availability in Tier 2 and Tier 3 cities.

Political Stability and Regional Focus

Aavas Financiers' operations are deeply intertwined with the political stability of the rural and semi-urban areas it serves across 14 Indian states. Maintaining a consistent political landscape in these regions is crucial for ensuring predictable business growth and mitigating potential operational disruptions. For instance, as of early 2024, Aavas continues to leverage its strategic alliance with the Rajasthan government's e-mitra network, which streamlines service delivery and enhances customer outreach in its core operating areas.

This localized political engagement means that regional government policies and administrative efficiency directly impact Aavas's ability to penetrate markets and operate smoothly. Changes in local governance or policy implementation can create both opportunities and challenges for the company's expansion and service provision strategies.

- Political Stability: Aavas's business model relies on stable political environments in its operating regions to ensure consistent demand and minimize operational risks.

- Regional Focus: The company's presence in 14 states means it must navigate diverse local political landscapes, each with unique dynamics.

- Government Partnerships: Collaborations like the one with Rajasthan's e-mitra network highlight the importance of positive government relations for service delivery and customer acquisition.

Budgetary Allocations for Housing Sector

Budgetary allocations for the housing sector are a key political factor impacting companies like Aavas Financiers. For instance, the Indian Union Budget 2024-25 continued to emphasize affordable housing, a segment Aavas Financiers actively serves. The government's commitment to schemes like PMAY 2.0 and the establishment of an Urban Infrastructure Development Fund (UIDF) with an initial corpus of ₹10,300 crore demonstrate sustained capital expenditure directed towards housing and related infrastructure.

These allocations directly translate into market stimulation. Increased government spending on housing projects and infrastructure development, such as roads and utilities, can boost demand for housing units. This, in turn, creates a more favorable environment for housing finance companies by increasing the pool of potential borrowers and supporting property values.

The budget's focus on these areas provides a clear signal of continued government support for the housing ecosystem. This sustained investment is crucial for companies like Aavas Financiers, as it underpins market growth and provides a stable operating landscape.

Key budgetary impacts include:

- Increased Demand: Government spending on housing schemes like PMAY 2.0 directly boosts demand for affordable homes.

- Infrastructure Development: Allocations for urban infrastructure, such as the UIDF, indirectly support the housing market by improving connectivity and amenities.

- Policy Continuity: The continuation of pro-housing policies signals a stable regulatory environment for housing finance.

- Stimulated Lending: Government initiatives often encourage financial institutions to lend more to the housing sector.

Government housing initiatives remain a cornerstone for Aavas Financiers, with the Pradhan Mantri Awas Yojana (PMAY) continuing to drive demand for affordable housing loans. The government's commitment to the 'Housing for All' agenda, including recent pushes for additional PMAY Gramin housing, ensures a favorable policy environment, particularly benefiting Aavas's focus on semi-urban and rural markets.

Regulatory stability, especially from the National Housing Bank (NHB) and the Reserve Bank of India (RBI), provides a predictable operational framework for Aavas. Adherence to directives on loan proportions and consistent reporting on housing trends foster confidence for long-term planning.

Financial inclusion policies, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY), are expanding the potential customer base for Aavas by bringing more individuals into the formal financial system, especially in Tier 2 and Tier 3 cities.

Budgetary allocations in the 2024-25 Indian Union Budget, including continued emphasis on affordable housing and the establishment of the Urban Infrastructure Development Fund (UIDF) with ₹10,300 crore, signal sustained government investment that directly stimulates the housing finance market.

| Policy/Initiative | Impact on Aavas Financiers | Key Data/Context (as of early 2024/2025) |

|---|---|---|

| Pradhan Mantri Awas Yojana (PMAY) | Drives demand for affordable housing loans. | Continued government focus on PMAY Gramin expansion. |

| Financial Inclusion Policies (e.g., PMJDY) | Expands potential customer base in underserved areas. | Growing formal banking access in Tier 2/3 cities. |

| Budgetary Allocations (2024-25) | Stimulates market through housing and infrastructure spending. | ₹10,300 crore corpus for Urban Infrastructure Development Fund (UIDF). |

| Regulatory Framework (NHB/RBI) | Ensures predictable operating environment and compliance. | Stable guidelines for housing finance companies. |

What is included in the product

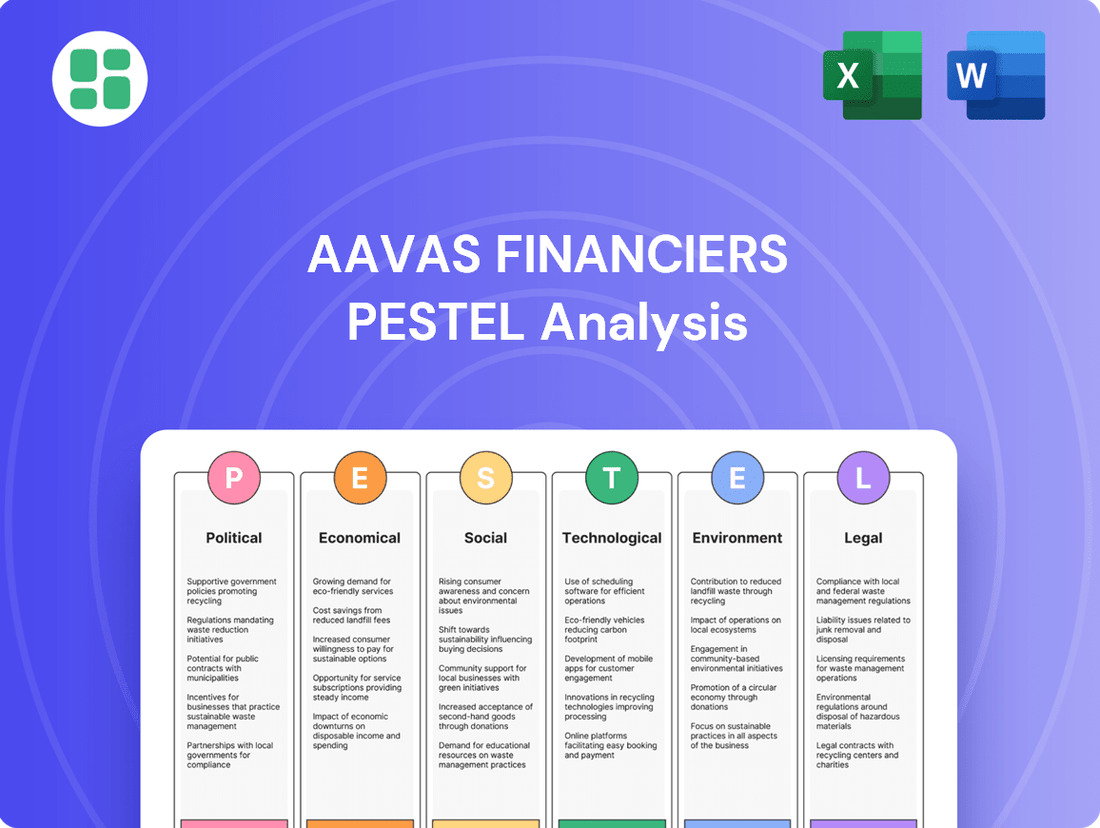

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Aavas Financiers, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's strategic landscape, identifying potential threats and opportunities for informed decision-making.

Aavas Financiers' PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of information overload during strategic planning.

This analysis acts as a pain point reliever by offering visually segmented PESTEL categories, enabling quick interpretation of market dynamics and reducing the time spent deciphering complex external influences.

Economic factors

Interest rate fluctuations, especially changes in the Reserve Bank of India's (RBI) repo rate, significantly influence Aavas Financiers' operational costs and profitability. A lower repo rate generally makes borrowing cheaper for housing finance companies (HFCs) like Aavas, potentially boosting borrower affordability. However, if lending rates don't fall as quickly, this can squeeze their net interest margins (NIMs).

In response to rising funding costs, Aavas Financiers has demonstrated a proactive approach by adjusting its lending rates. For instance, during periods of increased repo rates, such as the hikes seen in 2022-2023 which took the repo rate from 4% to 6.5%, Aavas has strategically repriced its loan portfolio to mitigate margin compression. This adaptation is crucial for maintaining financial stability amidst a dynamic interest rate environment.

Inflationary pressures are a significant concern for Aavas Financiers, as rising costs can directly impact the disposable income of their core customer base, primarily in the low and middle-income segments. For instance, if inflation outpaces wage growth, these households may struggle to meet their loan obligations, potentially affecting Aavas's asset quality.

Conversely, an increase in disposable income, especially in the semi-urban and rural areas where Aavas primarily operates, fuels demand for housing loans. As of early 2024, reports indicated a steady, albeit moderate, rise in real disposable income for many Indian households, which bodes well for Aavas's growth prospects.

India's GDP growth is a significant driver for the housing sector. For instance, the Indian economy is projected to grow by 6.5% in FY2024-25, according to the Reserve Bank of India. This expansion fuels job creation and increases disposable income, directly benefiting housing demand.

Stable employment rates are crucial for Aavas Financiers, as their target demographic often relies on both formal and informal sector employment. A healthy job market ensures borrowers can meet their loan obligations, reducing the risk of defaults and encouraging new loan applications. This economic stability is key to Aavas's operational success.

Competition in Housing Finance Market

The Indian housing finance sector is a dynamic arena, characterized by robust competition between banks and Housing Finance Companies (HFCs). Banks, leveraging their lower cost of funds and extensive branch networks, actively compete for market share. HFCs, like Aavas Financiers, are carving out niches by focusing on underserved customer segments, often those with informal income streams. This competitive landscape directly impacts Aavas's ability to set lending rates, design innovative products, and expand its market reach.

In 2023-24, the housing loan segment saw significant growth, with banks holding a dominant share. However, HFCs are steadily increasing their presence. For instance, as of March 2024, the total housing loan portfolio of scheduled commercial banks stood at approximately ₹25.6 lakh crore, while HFCs contributed around ₹3.7 lakh crore. This highlights the intense battle for customers, forcing HFCs to differentiate through specialized offerings and customer service.

- Intensified Competition: Banks and HFCs are aggressively pursuing market share in the burgeoning Indian housing finance market.

- HFC Niche Focus: Companies like Aavas Financiers concentrate on expanding access to housing finance for previously underserved borrower segments.

- Bank Advantages: Banks benefit from a lower cost of funds and a wider geographical presence, posing a competitive challenge.

- Impact on Aavas: Competition influences Aavas Financiers' pricing strategies, product development, and overall market penetration efforts.

Affordability and Property Price Trends

Housing affordability remains a key economic driver, directly impacted by property price movements and the ease of securing home loans. As of late 2024 and early 2025, while property prices in major Indian cities continue to climb, potentially pressuring debt-to-income ratios for some buyers, overall buyer sentiment remains robust. This sustained confidence, even with a return to more normalized sales volumes after a period of high demand, signals a healthy market for housing finance providers.

Aavas Financiers specifically targets the affordable housing segment, recognizing the need to make homeownership accessible. This strategic focus positions the company to capitalize on the demand from a significant portion of the population whose purchasing power is directly linked to these affordability dynamics. For instance, the Reserve Bank of India's repo rate, a benchmark for lending costs, has seen stability in recent periods, contributing to predictable loan availability.

- Property Price Growth: While specific figures vary by city, average property price appreciation in Tier-1 Indian cities was observed in the range of 5-8% year-on-year through much of 2024.

- Loan Availability: Lending institutions continue to offer competitive home loan interest rates, with many floating rates hovering around 8.5-9.5% as of late 2024.

- Affordability Index: Housing affordability indices, which track the ratio of housing prices to household income, show a mixed picture, with some metropolitan areas becoming less affordable due to price increases outpacing income growth.

- Aavas's Market Position: Aavas Financiers's average loan ticket size, typically in the INR 10-15 lakh range, directly addresses the affordability needs of its core customer base.

Economic stability in India, marked by a projected GDP growth of around 6.5% for FY2024-25, underpins demand for housing finance. This growth translates into job creation and increased disposable incomes, directly benefiting companies like Aavas Financiers. Furthermore, a stable employment landscape ensures borrowers can service their loans, mitigating default risks and supporting new loan origination.

Housing affordability remains a critical economic factor, with property prices in major Indian cities seeing an average year-on-year increase of 5-8% through 2024. While this can impact debt-to-income ratios, overall buyer sentiment remains strong, with home loan interest rates for floating options generally between 8.5-9.5% as of late 2024. Aavas Financiers' focus on affordable housing, with average loan ticket sizes around INR 10-15 lakh, positions it well to serve this market.

| Economic Factor | Data Point (2024-2025) | Impact on Aavas Financiers |

|---|---|---|

| GDP Growth Projection | ~6.5% (FY2024-25) | Drives housing demand and income growth for borrowers. |

| Property Price Appreciation (Tier-1 Cities) | 5-8% YoY (2024) | Can affect affordability but buyer sentiment remains robust. |

| Home Loan Interest Rates (Floating) | 8.5-9.5% (Late 2024) | Influences borrowing costs for customers and Aavas's funding costs. |

| Aavas's Average Loan Ticket Size | INR 10-15 Lakh | Targets the affordable housing segment, aligning with market needs. |

Same Document Delivered

Aavas Financiers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Aavas Financiers delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate insights into the strategic landscape Aavas Financiers operates within, all presented in a clear and actionable format.

Sociological factors

There's a noticeable rise in the desire for home ownership, particularly among individuals in semi-urban and rural areas of India who fall into the low and middle-income brackets. This aspiration is fueled by a combination of improving living standards and increased opportunities for social advancement.

Aavas Financiers is strategically positioned to serve this growing demographic, actively helping them achieve their dream of owning a home. By doing so, the company plays a significant role as a social enabler, contributing to community development.

This fundamental societal trend is a key driver for Aavas Financiers' sustained growth prospects. For instance, in the fiscal year 2023-24, Aavas Financiers reported a 14% year-on-year growth in Assets Under Management (AUM), reaching ₹56,480 crore, demonstrating their success in tapping into this market.

India's rapid urbanization continues to fuel internal migration, with a notable increase in women participating in this movement. This demographic shift is significantly boosting housing demand in smaller cities, specifically Tier 2, Tier 3, and Tier 4 locations, areas where Aavas Financiers has strategically focused its expansion.

Aavas Financiers' growth strategy directly addresses this trend by expanding its branch network in a contiguous manner across its core markets. This approach allows the company to effectively tap into the evolving housing needs of these growing urban centers.

As of March 2024, Aavas Financiers operates across 14 states and boasts a network of 397 branches, demonstrating its established presence and ability to serve these increasingly important, developing urban and semi-urban markets.

Financial literacy is on the rise, with a notable increase in digital adoption even in rural India. This trend is a game-changer for formal credit access, making digital loan processes more viable. Aavas Financiers' strategy to tap into local networks and use technology directly addresses this societal evolution, aiming to broaden financial inclusion.

The growing comfort with digital platforms is crucial for companies like Aavas to scale their operations effectively. As of early 2024, over 70% of India's internet users are in rural and semi-urban areas, a significant increase from previous years, indicating a strong potential for digital financial services adoption.

Empowerment of Women through Home Ownership

Aavas Financiers champions women's empowerment by actively enabling home ownership, a crucial step towards financial independence and asset building. This commitment is reflected in a substantial portion of their loan portfolio being allocated to properties owned by women, directly addressing a significant social disparity in asset accumulation. This strategic focus aligns with global efforts like UN Sustainable Development Goal 5, which aims to achieve gender equality and empower all women and girls.

The company's dedication is further underscored by its social bond program, which specifically earmarks funds for financing initiatives benefiting women. In fiscal year 2024, Aavas Financiers reported that approximately 60% of its customer base comprised women, demonstrating a tangible impact on gender equity in housing finance. This proactive approach not only fosters individual empowerment but also contributes to broader societal progress by increasing women's stake in property ownership.

Key aspects of Aavas Financiers' social impact include:

- Facilitating Home Ownership for Women: A significant percentage of Aavas Financiers' loan book is dedicated to women borrowers, promoting financial independence.

- Alignment with SDG 5: The company's efforts directly contribute to achieving gender equality and empowering women, as outlined in the UN's Sustainable Development Goals.

- Targeted Social Bond Financing: Aavas Financiers utilizes its social bond program to channel funds specifically towards women's housing finance needs.

- Customer Base Demographics: In FY24, women constituted around 60% of Aavas Financiers' customer base, highlighting the widespread reach of their empowerment initiatives.

Community Engagement and Trust Building

Building trust within semi-urban and rural communities is crucial for Aavas Financiers, especially since its customer base often has limited access to conventional banking services. Aavas's strategy of offering tailored lending solutions and deeply understanding the specific requirements of self-employed and informal sector individuals cultivates robust community ties. This focus on personalized service directly contributes to customer loyalty and retention, as evidenced by their consistent growth in these underserved markets.

Aavas Financiers' commitment to community engagement is a cornerstone of its operational success. For instance, in fiscal year 2023-24, the company reported a net profit of INR 522 crore, reflecting the effectiveness of its localized approach. Their customer-centric model, which prioritizes building relationships over transactional interactions, has been instrumental in penetrating markets where financial inclusion is a significant challenge. This deepens their market penetration and solidifies their reputation as a reliable financial partner.

- Customer-Centric Approach: Aavas prioritizes understanding and catering to the unique financial needs of self-employed and informal sector workers, fostering strong community relationships.

- Market Penetration: The company's focus on personalized lending solutions has enabled significant penetration in semi-urban and rural areas, where traditional banking access is limited.

- Trust as a Differentiator: Building and maintaining trust within these communities is a key competitive advantage for Aavas, driving customer retention and loyalty.

- Financial Performance: Aavas Financiers reported a Assets Under Management (AUM) growth of 20% year-on-year to INR 19,000 crore as of March 31, 2024, underscoring the success of its community-focused strategy.

The increasing aspiration for homeownership, especially in India's semi-urban and rural areas among lower and middle-income groups, is a significant sociological driver for Aavas Financiers. This trend is supported by improving living standards and a desire for social mobility.

Aavas Financiers actively facilitates this dream, acting as a social enabler and contributing to community development. This societal shift is a core reason for their consistent growth, as seen in their 14% year-on-year AUM growth to ₹56,480 crore in FY23-24.

The company's focus on women's empowerment through home ownership directly addresses societal disparities. With approximately 60% of their customer base being women in FY24, Aavas is making a tangible impact on gender equity and financial independence.

Aavas Financiers' success is built on fostering trust within communities by offering tailored solutions and understanding the needs of the self-employed and informal sector. This customer-centric approach has driven significant market penetration in underserved areas.

| Sociological Factor | Impact on Aavas Financiers | Supporting Data (FY23-24/Early 2024) |

|---|---|---|

| Rising Homeownership Aspiration (Semi-urban/Rural) | Drives demand for Aavas's core products. | 14% YoY AUM growth to ₹56,480 crore. |

| Increased Female Participation in Urban Migration | Boosts housing demand in Tier 2/3/4 cities. | 397 branches across 14 states, focusing on these areas. |

| Growing Financial Literacy & Digital Adoption | Enables digital loan processes and broader financial inclusion. | Over 70% of India's internet users are in rural/semi-urban areas. |

| Women's Empowerment & Financial Independence | Strengthens Aavas's social impact and customer base. | ~60% of customer base are women; social bond financing for women. |

| Community Trust & Relationship Building | Key differentiator and driver of customer loyalty. | INR 522 crore net profit; 20% YoY AUM growth to ₹19,000 crore as of March 31, 2024. |

Technological factors

Aavas Financiers is increasingly leveraging digital lending platforms and automation to streamline its operations. These technologies are instrumental in speeding up loan origination, management, and collection processes, significantly cutting down the average turnaround time for loan approvals. For instance, by automating key stages of the loan lifecycle, Aavas aims to boost operational efficiency and enhance its productivity metrics, a critical factor in the competitive housing finance landscape.

The company's continued investment in digital infrastructure is a strategic imperative for scaling its business and elevating the customer experience. By adopting advanced platforms, Aavas can process a higher volume of applications more effectively and provide a smoother, faster service to its customers. This focus on digital transformation is vital for maintaining a competitive edge and meeting the evolving expectations of borrowers in the current market environment.

Aavas Financiers is increasingly leveraging data analytics, including AI and machine learning, to enhance its credit assessment processes. This is particularly crucial for their target demographic, which often includes individuals with limited formal credit documentation. By analyzing alternative data sources, Aavas can more accurately gauge creditworthiness, thereby mitigating risks and maintaining strong asset quality. This technological adoption underpins their commitment to granular underwriting practices.

The growing use of smartphones and mobile internet in rural and semi-urban areas is a key technological driver for financial services. This trend directly supports the adoption of mobile banking and specialized customer applications, making financial interactions more accessible to a wider population.

Aavas Financiers has seen significant success with its customer app, which reportedly doubled collections in the financial year 2025. This achievement highlights the effective integration of mobile technology, enhancing both customer convenience and operational efficiency for the company.

This digital interface significantly improves accessibility for borrowers, allowing them to manage their accounts and transactions more easily. The ability to conduct banking activities through a mobile app breaks down geographical barriers and streamlines the customer experience.

Cybersecurity and Data Privacy

As Aavas Financiers expands its digital footprint, cybersecurity and data privacy are paramount. The company's reliance on online platforms for loan applications and customer interactions means safeguarding sensitive financial and personal data is non-negotiable. This is especially true given the financially vulnerable demographic Aavas serves, for whom trust is a cornerstone of their engagement.

Failure to protect customer information could lead to significant reputational damage and regulatory penalties. For instance, India's Digital Personal Data Protection Act, 2023, imposes strict obligations on data fiduciaries, with potential fines for non-compliance. Aavas must invest in advanced cybersecurity measures, including encryption, regular vulnerability assessments, and employee training, to mitigate these risks. The company's business continuity also hinges on maintaining the integrity of its IT systems against cyber threats.

- Data Breach Impact: A significant data breach could cost companies millions in recovery and legal fees, alongside irreparable damage to customer trust.

- Regulatory Landscape: Compliance with regulations like the Digital Personal Data Protection Act, 2023, is crucial, with potential penalties for violations.

- Customer Trust: For Aavas, maintaining the privacy of its financially vulnerable customer base is vital for long-term business success and customer retention.

- System Integrity: Robust cybersecurity ensures the uninterrupted operation of Aavas's digital services, preventing disruptions to loan processing and customer support.

Technology for Operational Efficiency and Cost Optimization

Aavas Financiers is strategically upgrading its technology to boost operational efficiency and optimize costs, aiming for better governance and profitability. Investments in digital infrastructure are designed to lower the operational expenses to asset ratio, directly impacting net margins.

This technology focus is a key driver for improving the company's overall financial performance. For instance, in FY23, Aavas reported a significant improvement in its cost-to-income ratio, partly attributed to ongoing digital initiatives.

- Digital Transformation: Continued investment in cloud-based platforms and AI-powered analytics to streamline loan processing and customer service.

- Cost Reduction: Initiatives to reduce manual interventions and paper-based processes, leading to lower administrative overheads.

- Data Analytics: Leveraging advanced analytics to improve risk assessment and customer segmentation, thereby optimizing lending practices.

- Scalability: Implementing technology solutions that can scale efficiently with business growth, ensuring cost-effectiveness.

Technological advancements are reshaping Aavas Financiers' operations, particularly through digital lending platforms and automation, which expedite loan processing and management. The company's strategic investment in digital infrastructure, including AI and machine learning for credit assessment, is crucial for serving its target demographic with limited formal credit history, as seen in its customer app doubling collections in FY25.

Aavas is also prioritizing robust cybersecurity measures, essential for protecting sensitive customer data in line with regulations like India's Digital Personal Data Protection Act, 2023, to maintain customer trust and avoid penalties. This focus on technology is also aimed at optimizing costs and improving governance, with digital initiatives contributing to a better cost-to-income ratio, as observed in FY23.

| Key Technology Initiatives | Impact | Data/Example |

| Digital Lending Platforms & Automation | Faster loan origination, management, and collection; improved operational efficiency. | Aims to significantly cut average loan approval turnaround time. |

| AI & Machine Learning for Credit Assessment | Enhanced creditworthiness evaluation for individuals with limited credit history; risk mitigation. | Leverages alternative data sources for granular underwriting. |

| Mobile App Development | Increased customer accessibility, convenience, and collections efficiency. | Reportedly doubled collections in FY25. |

| Cybersecurity & Data Privacy | Safeguarding sensitive data, ensuring regulatory compliance (e.g., DPDP Act 2023), maintaining customer trust. | Essential for mitigating reputational damage and regulatory penalties. |

| Digital Infrastructure Upgrade | Cost optimization, improved governance, and enhanced profitability. | Contributed to improved cost-to-income ratio in FY23. |

Legal factors

Aavas Financiers, operating as a housing finance company, is subject to the stringent regulations of the National Housing Bank (NHB). These rules dictate critical operational parameters, including capital adequacy ratios and asset quality standards. For instance, NHB mandates specific provisioning norms for non-performing assets, which directly impact Aavas Financiers' profitability and risk management strategies.

Compliance with NHB's directives, such as maintaining a minimum proportion of housing loans to total loans, is crucial for Aavas Financiers' continued operation and market standing. In fiscal year 2023-24, Aavas Financiers reported a Gross Non-Performing Asset (GNPA) ratio of 1.03%, demonstrating its adherence to asset quality benchmarks set by the NHB.

While the National Housing Bank (NHB) is Aavas Financiers' primary regulator, the Reserve Bank of India (RBI) also sets crucial parameters. These include guidelines on interest rate setting, liquidity management, and how non-performing assets (NPAs) are recognized. For instance, RBI's policy repo rate adjustments directly impact Aavas's borrowing costs and, consequently, its lending rates. As of early 2024, the repo rate has remained stable, providing a predictable cost of funds environment.

Aavas Financiers must strictly adhere to consumer protection laws, especially considering its customer base, which often includes individuals with lower financial literacy. The company's commitment to fair lending practices, clear disclosure of loan terms, and efficient complaint resolution is not just good business but a legal necessity to build and maintain customer confidence. For instance, regulations like the Reserve Bank of India's Fair Practices Code (FPC) mandate transparency in all dealings, directly impacting how Aavas structures its loan products and communicates with borrowers.

Land and Property Laws

The intricacies of land and property laws across India, particularly in rural and semi-urban regions where Aavas Financiers primarily operates, significantly influence the security and due diligence for housing loans. Navigating these diverse legal frameworks is crucial for Aavas to ensure collateral validity and mitigate risks in property transactions.

For instance, the Registration Act, 1908, mandates the registration of property documents, a process that can vary in efficiency and transparency across states. In 2023, states like Uttar Pradesh saw efforts to digitize land records, aiming to streamline property transactions and reduce disputes, which directly benefits Aavas's loan origination process.

- Land Title Clarity: Ambiguities in land titles, common in many Indian states, necessitate rigorous due diligence by Aavas to confirm ownership and prevent future legal challenges.

- Property Registration Processes: Variations in state-level property registration procedures and associated fees can impact the cost and timeline of securing loan collateral.

- Enforcement of Property Rights: The effectiveness of legal mechanisms for enforcing property rights and resolving land disputes affects the overall risk profile of Aavas's loan portfolio.

- Regulatory Compliance: Adherence to evolving property laws, such as those related to RERA (Real Estate Regulatory Authority) for under-construction properties, is vital for Aavas's compliance and customer trust.

Data Privacy and Protection Regulations

Aavas Financiers must navigate India's evolving data privacy landscape, particularly the Digital Personal Data Protection Act, 2023. This legislation mandates stringent requirements for collecting, processing, and storing customer data, emphasizing consent and security. Failure to comply can result in significant fines, with penalties potentially reaching up to INR 250 crore for breaches. Ensuring robust data protection measures is therefore crucial for Aavas's legal standing and customer trust.

The increasing digitalization of financial services means Aavas must prioritize safeguarding sensitive customer information. This includes implementing secure data handling practices and obtaining explicit consent for data usage, aligning with regulatory expectations. A breach of these regulations could not only lead to financial penalties but also severely damage Aavas's reputation among its customer base.

- Digital Personal Data Protection Act, 2023: Sets new standards for data handling in India.

- Consent Management: Legal imperative to obtain clear consent for data usage.

- Security Mandates: Requirement for secure data storage and processing practices.

- Penalty Provisions: Potential fines up to INR 250 crore for non-compliance.

Aavas Financiers operates under the watchful eye of the National Housing Bank (NHB), which sets crucial rules for capital adequacy and asset quality. For instance, NHB's provisioning norms for bad loans directly influence Aavas's profitability and risk management. The company's adherence to these standards is vital for its continued operation and market position, as seen in its Gross Non-Performing Asset (GNPA) ratio of 1.03% reported for FY2023-24.

Beyond the NHB, the Reserve Bank of India (RBI) also plays a significant role, influencing everything from interest rates to how non-performing assets are recognized. Changes in the RBI's policy repo rate, which remained stable in early 2024, directly affect Aavas's borrowing costs and, consequently, its lending rates.

Consumer protection laws are paramount, especially given Aavas Financiers' customer base, which often includes individuals with limited financial literacy. Adhering to fair lending practices and transparent disclosure, as mandated by regulations like the RBI's Fair Practices Code, is essential for building customer trust.

The company must also navigate complex land and property laws across India, which vary significantly by state. These laws impact the security and due diligence for housing loans, with initiatives like the digitization of land records in Uttar Pradesh in 2023 aiming to streamline processes and reduce disputes.

| Regulatory Body | Key Regulations/Impact | Aavas Financiers' Performance/Action (FY23-24 or early 2024) |

|---|---|---|

| National Housing Bank (NHB) | Capital Adequacy, Asset Quality, Loan-to-Total Loan Ratio | GNPA Ratio: 1.03% |

| Reserve Bank of India (RBI) | Interest Rate Setting, Liquidity Management, NPA Recognition, Fair Practices Code | Stable Policy Repo Rate Environment |

| Government of India | Digital Personal Data Protection Act, 2023; Property Laws (e.g., Registration Act, 1908) | Focus on data privacy compliance; navigating state-specific property registration processes |

Environmental factors

Aavas Financiers is actively championing affordable green housing in India, working with partners like the International Finance Corporation (IFC) and running its own Green Housing Program. This focus promotes sustainable construction, energy savings, and water conservation in homes, directly supporting broader environmental objectives. By distributing Green Home Certificates, Aavas incentivizes its customers to adopt more eco-friendly lifestyles.

The increasing frequency and intensity of climate-related events like floods and extreme weather pose a growing threat to property values. This vulnerability directly impacts the collateral securing housing loans, potentially diminishing their worth and affecting borrowers' ability to repay. For instance, regions prone to heavy monsoon rains or coastal storms face heightened risks.

While specific data for Aavas Financiers regarding climate risk impact on their portfolio isn't publicly detailed, this is a significant emerging environmental factor for the entire housing finance sector. Companies like Aavas may need to adapt their risk assessment models and lending policies to account for these geographical vulnerabilities. The Reserve Bank of India has also been emphasizing climate risk management for financial institutions.

Aavas Financiers is actively enhancing its ESG reporting, aligning with global sustainability trends. This focus is crucial for attracting impact investors and bolstering its corporate image, especially as sustainability becomes a key differentiator in the financial sector.

The company's commitment to UN Sustainable Development Goals, particularly SDG 11 for Sustainable Cities and Communities, underscores its dedication to broader environmental and social stewardship. This strategic alignment signals a proactive approach to responsible business practices.

Sustainable Building Material Adoption

Aavas Financiers' focus on financing green homes indirectly drives the adoption of sustainable building materials. By encouraging borrowers to build eco-friendly, Aavas fosters a market demand for materials like fly ash bricks and recycled steel. This initiative aligns with India's growing emphasis on reducing the carbon footprint of its construction sector, which accounted for approximately 22% of the country's total greenhouse gas emissions in 2023.

The company's commitment to developing a value chain for green self-built homes further solidifies this trend. This involves not just financing but also potentially guiding customers towards sustainable material suppliers and construction practices. Such a move is crucial as the green building materials market in India is projected to reach USD 30.5 billion by 2025, indicating a significant shift in construction preferences.

- Growth in Green Building Materials: The Indian green building materials market is expected to expand significantly, reaching an estimated USD 30.5 billion by 2025.

- Environmental Impact Reduction: Aavas's promotion of green homes aids in lowering the environmental impact of housing construction, contributing to broader conservation goals.

- Value Chain Development: The company's efforts to build a robust value chain for green self-built homes supports the increased use of eco-friendly materials.

- Alignment with National Goals: This strategy supports India's national objectives for sustainable development and reduced carbon emissions in the building sector.

Resource Efficiency in Operations

Aavas Financiers can enhance its environmental footprint by focusing on resource efficiency within its own operations. This includes initiatives like reducing energy consumption in its network of branches, which numbered over 300 as of March 2024, and minimizing paper usage through accelerated digitalization of customer processes.

These internal efficiencies, while not directly tied to lending products, bolster Aavas's commitment to sustainability. For instance, a 10% reduction in paper usage across all branches could translate to significant savings in raw materials and waste disposal.

Key areas for operational resource efficiency include:

- Energy Consumption: Implementing energy-saving measures in branch offices, such as LED lighting and smart thermostats, can reduce the company's carbon emissions.

- Digitalization: Further digitizing customer onboarding and document management can drastically cut down on paper and printing needs.

- Waste Management: Optimizing waste segregation and recycling programs within Aavas facilities contributes to a circular economy approach.

Aavas Financiers is actively promoting green housing, partnering with organizations like the IFC and offering Green Home Certificates to incentivize eco-friendly construction and energy savings. This focus aligns with India's goal to reduce the construction sector's carbon footprint, which was around 22% of total greenhouse gas emissions in 2023. The market for green building materials in India is projected to reach USD 30.5 billion by 2025, underscoring a significant shift in construction preferences that Aavas is capitalizing on.

Climate change poses a risk to property values, impacting loan collateral and borrower repayment capabilities, particularly in flood-prone or coastal areas. While Aavas's specific portfolio impact isn't detailed, the Reserve Bank of India is increasingly emphasizing climate risk management for financial institutions, suggesting a need for adapted risk assessment models.

Aavas is also focusing on operational efficiency, aiming to reduce energy consumption in its over 300 branches (as of March 2024) and minimize paper usage through digitalization. These internal efforts, alongside its external green housing initiatives, bolster its commitment to sustainability and ESG reporting, crucial for attracting impact investors.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aavas Financiers is built upon a robust foundation of data from official government publications, reputable financial news outlets, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.