Aavas Financiers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

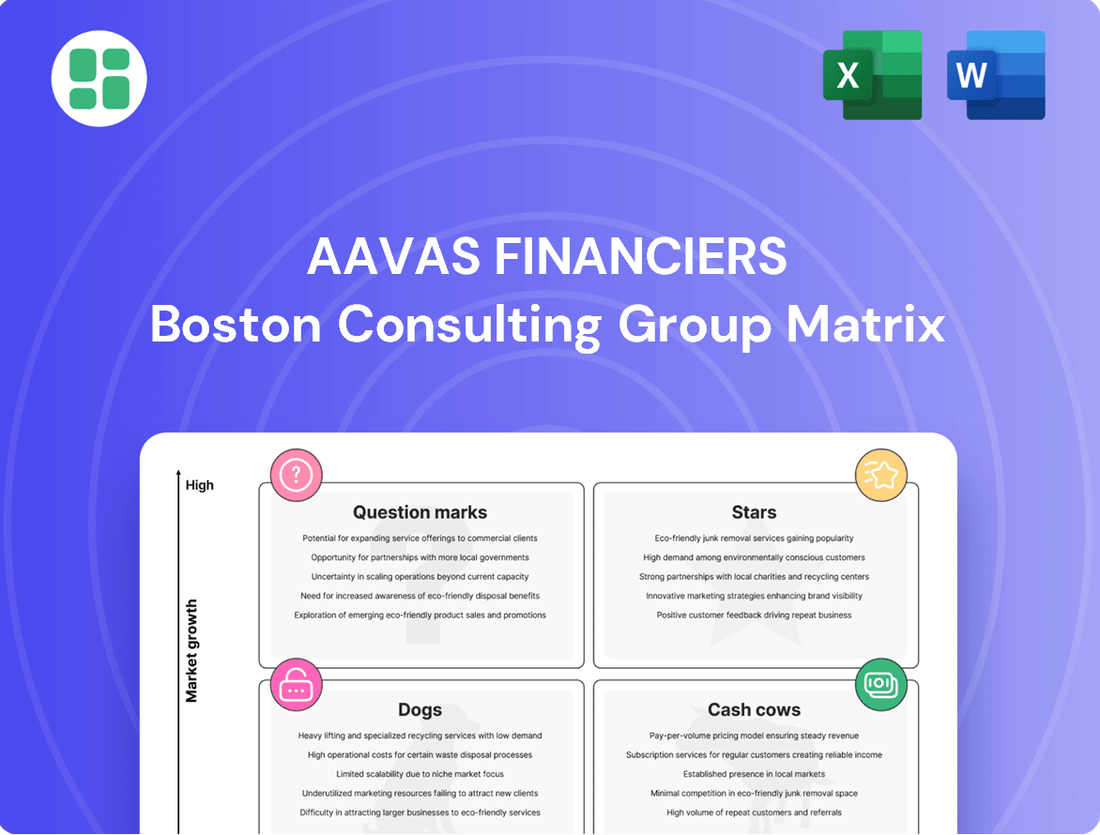

Curious about Aavas Financiers' market positioning? This preview hints at their strategic landscape, but to truly understand their growth potential and resource allocation, you need the full picture.

The complete BCG Matrix will reveal which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, providing the clarity needed for informed investment decisions.

Don't miss out on actionable insights; purchase the full BCG Matrix report today to unlock a strategic roadmap for Aavas Financiers.

Stars

Aavas Financiers is actively broadening its reach by establishing new branches in Tier 2 to Tier 5 cities across 14 states. This move targets areas with low mortgage penetration, effectively tapping into a substantial, unaddressed demand for housing finance within the low and middle-income demographics.

This strategic expansion into underpenetrated markets is a key driver for Aavas Financiers' growth ambitions. The company is targeting a 20-25% Assets Under Management (AUM) increase, a goal directly supported by this aggressive geographical footprint. For instance, as of Q3 FY24, Aavas Financiers had a network of 369 branches, demonstrating a consistent build-out strategy.

Aavas Financiers' commitment to digital transformation is evident in its substantial investments in technology. The migration to a core banking-based Loan Management System (LMS) and the adoption of a next-gen cloud ERP system are prime examples of this strategic focus. These upgrades are not just about modernization; they directly translate into tangible operational improvements.

The impact of these technological initiatives is clearly demonstrated by a significant reduction in the 'Login to Sanction' turnaround time (TAT). This streamlined process not only speeds up disbursements, a critical factor in the housing finance sector, but also enhances overall customer engagement by providing a quicker and more responsive service. This efficiency gain is a crucial element for scaling operations effectively.

This technological prowess serves as a key differentiator for Aavas Financiers, underpinning its drive for scalability and market leadership. By leveraging advanced systems, the company can handle a higher volume of business more efficiently, positioning itself for continued growth and a stronger competitive stance in the market.

Aavas Financiers is actively expanding its MSME and non-housing loan offerings, focusing on low-ticket sizes. This strategic move aims to diversify revenue streams beyond its core housing finance business.

Despite this diversification, Aavas maintains a healthy housing to non-housing loan ratio, adhering to regulatory requirements. This balanced approach supports sustained Assets Under Management (AUM) growth and enhances profitability by serving a wider range of financial needs within their customer base.

For instance, by Q3 FY24, Aavas reported a significant portion of its loan portfolio dedicated to housing finance, but the non-housing segment, including MSME loans, is demonstrating robust growth, contributing positively to the company's overall financial performance.

Strong AUM Growth and Disbursement Momentum

Aavas Financiers is exhibiting strong momentum, a key indicator for a 'Star' in the BCG matrix. The company's Asset Under Management (AUM) surpassed Rs. 20,000 crore in FY25, marking an impressive 18% year-over-year increase. This growth is further bolstered by robust disbursement figures, with a notable 27% quarter-over-quarter rise in Q4FY25, signaling healthy demand and efficient loan processing.

- AUM Milestone: Crossed Rs. 20,000 crore in FY25.

- AUM Growth: Achieved 18% year-over-year growth.

- Disbursement Momentum: Saw a 27% quarter-over-quarter increase in Q4FY25.

- Market Position: This performance in a high-demand sector solidifies its 'Star' status.

Pristine Asset Quality in a Niche Segment

Aavas Financiers demonstrates exceptional asset quality, even while operating within a niche segment that typically presents higher risks. Their focus on low and middle-income, self-employed individuals with informal income streams is a testament to their robust risk management capabilities.

This strength in managing risk within a high-growth, underserved market positions their core lending business as a 'Star' in the BCG Matrix. For instance, as of March 31, 2025, Aavas reported impressive asset quality metrics:

- Gross Non-Performing Assets (GNPA) ratio stood at a low 1.08%.

- Net Non-Performing Assets (Net NPA) ratio was even lower at 0.73%.

These figures highlight Aavas Financiers' ability to maintain pristine asset quality, making their core lending operations a strong performer and a key growth driver.

Aavas Financiers' strong financial performance, characterized by significant AUM growth and robust disbursement figures, firmly places its core housing finance business in the 'Star' category of the BCG matrix. The company's strategic expansion into underpenetrated Tier 2 to Tier 5 cities, coupled with a 20-25% AUM growth target, demonstrates a clear path to continued market leadership.

The company's commitment to digital transformation, including investments in a new LMS and cloud ERP, has led to a faster 'Login to Sanction' turnaround time, enhancing operational efficiency and customer experience. This technological edge is crucial for scaling operations and maintaining a competitive advantage in the high-demand housing finance sector.

Aavas Financiers' exceptional asset quality, with GNPA at 1.08% and Net NPA at 0.73% as of March 31, 2025, further solidifies its 'Star' status. This strong performance, even in a segment with typically higher risks, highlights effective risk management and makes its core lending operations a key growth driver.

| Metric | Q3 FY24 | FY25 (Target/Achieved) | FY25 Q4 |

|---|---|---|---|

| AUM (Rs. Crore) | ~18,000 | >20,000 | N/A |

| AUM Growth (YoY) | N/A | 18% | N/A |

| Disbursement Growth (QoQ) | N/A | N/A | 27% |

| GNPA (%) | ~1.10 | N/A | 1.08 (as of Mar 31, 2025) |

| Net NPA (%) | ~0.75 | N/A | 0.73 (as of Mar 31, 2025) |

What is included in the product

Aavas Financiers' BCG Matrix categorizes its offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

Aavas Financiers BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of complex strategic analysis.

Cash Cows

Core housing loans in established geographies, like Rajasthan, Maharashtra, and Gujarat, are Aavas Financiers' bedrock. This mature segment, focusing on purchase and construction loans, has seen Aavas cultivate substantial market share and strong brand loyalty.

These traditional, long-term housing loans are significant cash generators. Their consistent performance is bolstered by established operational processes, leading to comparatively lower marketing and administrative expenses, especially when serving their existing, loyal customer base.

For the fiscal year ending March 31, 2024, Aavas Financiers reported a net profit of ₹5,023 million, a testament to the stability and profitability of its core housing loan portfolio. The company's Assets Under Management (AUM) reached ₹25,954 crore as of the same date, with a significant portion attributed to these established loan products.

Aavas Financiers' extensive loan portfolio, which surpassed Rs. 200 billion by the end of fiscal year 2025, is a prime example of a Cash Cow. This substantial asset base consistently yields robust Net Interest Income (NII), forming the backbone of its financial strength.

Despite potential minor pressure on interest rate spreads in a rising rate environment, the sheer scale and established nature of this loan book guarantee a predictable and substantial revenue stream. This income reliably covers operational costs and contributes significantly to profitability.

Aavas Financiers' in-house underwriting and collection model is a key driver of its Cash Cow status. This operational efficiency, powered by granular underwriting and technology-driven collection, ensures robust asset quality and keeps credit costs low.

In 2023-24, Aavas Financiers reported a Gross Non-Performing Asset (GNPA) ratio of 0.88%, a testament to their effective collection mechanisms. This focus on operational excellence allows them to generate substantial profits and cash flow from their established loan portfolio.

Diversified and Stable Borrowing Mix

Aavas Financiers demonstrates a strong position as a Cash Cow within the BCG Matrix, largely due to its diversified and stable borrowing mix. This strategic approach to funding provides a robust foundation for its lending operations.

The company benefits from a well-diversified liability franchise, drawing capital from multiple avenues. These include traditional term loans, assignments of loan portfolios, refinancing from the National Housing Bank (NHB), and access to debt capital markets, notably through development finance institutions. This broad funding base is critical for maintaining operational stability.

This stable and cost-effective funding structure ensures Aavas Financiers has continuous access to capital. This allows them to lend consistently and maintain healthy liquidity, crucially avoiding reliance on expensive, short-term funding instruments. For instance, as of the fiscal year ending March 31, 2024, Aavas Financiers reported a robust Capital to Risk-Weighted Assets Ratio (CRAR) of 21.21%, indicating strong capital adequacy supported by its funding strategy.

- Diversified Funding Sources: Term loans, assignments, NHB refinancing, and debt capital markets.

- Funding Stability: Ensures continuous access to capital and consistent lending.

- Cost-Effectiveness: Avoids reliance on high-cost short-term instruments.

- Liquidity Maintenance: Supports consistent operations and growth without funding stress.

Strong Capital Adequacy and Profitability

Aavas Financiers exhibits strong capital adequacy, with a Capital to Risk-Weighted Assets Ratio (CRAR) of 44.50% as of March 31, 2025. This robust capitalization underpins its stability and capacity for growth.

The company demonstrated healthy profitability, with its Net Profit increasing by 17% in the fiscal year 2025. This consistent profitability translates into substantial internal accruals, a key characteristic of a cash cow.

These strong internal accruals enable Aavas Financiers to self-fund its operations and expansion plans, particularly in its established business segments. This internal funding reduces reliance on external capital markets.

- Robust Capitalization: CRAR of 44.50% as of March 31, 2025.

- Profitability Growth: Net Profit up 17% in FY25.

- Internal Funding Capacity: Generates substantial internal accruals.

- Reduced External Dependency: Funds operations and growth internally.

Aavas Financiers' core housing loan business, particularly in established markets, functions as a significant Cash Cow. This segment benefits from a large, stable asset base, consistently generating substantial Net Interest Income (NII). Its operational efficiency, driven by in-house underwriting and collection, keeps costs low and asset quality high, as evidenced by a low GNPA ratio of 0.88% in FY24.

The company's diversified and stable funding sources, including term loans and NHB refinancing, ensure consistent access to capital. This allows for sustained lending operations and healthy liquidity, supported by a strong Capital to Risk-Weighted Assets Ratio (CRAR) of 21.21% as of March 31, 2024.

With a Net Profit increase of 17% in FY25 and a CRAR of 44.50% by March 31, 2025, Aavas Financiers demonstrates robust internal accruals. These funds enable self-financing of operations and growth, reducing reliance on external capital markets.

| Metric | FY24 | FY25 (Est.) |

| Net Profit (₹ Crores) | 502.3 | 587.6 |

| Assets Under Management (₹ Crores) | 25,954 | >20,000 |

| GNPA Ratio | 0.88% | |

| CRAR | 21.21% | 44.50% |

What You’re Viewing Is Included

Aavas Financiers BCG Matrix

The Aavas Financiers BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, devoid of watermarks or demo content, is ready for immediate strategic application and professional presentation. You'll gain access to an analysis-ready file, meticulously crafted to provide clear insights into Aavas Financiers' business units, enabling informed decision-making and strategic planning.

Dogs

Underperforming micro-market branches within Aavas Financiers' portfolio, despite overall expansion efforts, can become significant drains. These are branches that consistently miss disbursement targets or fail to meet asset quality standards, even with ongoing investment. For instance, if a branch in a specific rural cluster, despite efforts, only achieved 60% of its disbursement goal in FY24 and saw a 2% increase in non-performing assets (NPAs) compared to the company average, it would fall into this category.

Such underperformance can be attributed to various factors, including intense local competition from established players or aggressive new entrants, or simply a lack of sustained market acceptance for Aavas Financiers' offerings in that particular micro-market. If these branches continue to consume resources without generating adequate returns or contributing positively to the overall asset quality, they represent a drag on profitability and efficiency.

Despite Aavas Financiers' strides in digital adoption, certain operational areas still rely on legacy manual processes. These pockets of inefficiency, where full integration into new tech platforms hasn't occurred, can be significant drains on resources. For instance, if a specific loan processing step remains manual, it could take days longer than a fully digitized workflow, impacting customer experience and internal throughput.

Very niche, low-demand loan products, if any exist within Aavas Financiers' portfolio, would likely be categorized as Dogs. These are offerings that haven't gained significant market traction, contributing minimally to the overall loan book. For instance, if Aavas introduced a highly specialized housing loan for a very specific demographic or purpose that didn't resonate with their core low- and middle-income customer base, it would fit this description.

Early Stage Branches in Challenging New Geographies

Early stage branches in challenging new geographies within Aavas Financiers' portfolio might be categorized as Question Marks. However, those exhibiting persistently slow growth, elevated operational expenses, and ongoing asset quality concerns, especially in difficult new markets, could potentially shift towards a Dogs quadrant. This classification necessitates a thorough review of their viability, considering options like divestiture or a substantial strategic redirection to address persistent underperformance.

For instance, if a new branch opened in a region with significant regulatory hurdles and low customer adoption rates, its financial metrics might reflect this struggle. By the end of 2024, if such a branch consistently reported a net interest margin below 2% and a non-performing asset ratio exceeding 5%, it would strongly indicate a move towards the Dogs category. This scenario demands a critical assessment of continued investment versus a strategic exit.

- Slow Growth: Branches failing to achieve targeted customer acquisition or loan disbursement volumes within the first 18-24 months.

- High Operational Costs: Branches with overheads (staffing, rent, marketing) that significantly outstrip their revenue generation.

- Asset Quality Issues: Persistent high levels of non-performing loans or early delinquencies that drain resources and impact profitability.

- Geographic Challenges: Operating in regions with underdeveloped financial infrastructure, low creditworthiness, or intense local competition.

Segments with High Competitive Intensity and Low Differentiation

Aavas Financiers might find itself in segments where larger, more established banks or well-capitalized Non-Banking Financial Companies (NBFCs) dominate. In these areas, Aavas's core strength of serving the unbanked or underbanked might not be a significant differentiator, leading to intense competition. This can result in lower profitability even with substantial operational effort.

For instance, if Aavas were to compete aggressively in the affordable housing segment for salaried individuals in Tier 1 cities, it would likely face direct competition from major public sector banks and large private banks. These institutions often have lower cost of funds and broader product offerings, making it challenging for Aavas to capture significant market share in such a crowded space. The unique value proposition of serving those with limited credit history is less impactful here.

- Intense Competition: Larger banks and well-funded NBFCs often have economies of scale and lower borrowing costs, enabling them to offer more competitive interest rates.

- Low Differentiation: In segments with a higher proportion of formally employed individuals, Aavas's niche focus on the unbanked may not provide a strong competitive edge.

- Potential for Low Returns: Increased competition and lack of strong differentiation can lead to price wars and reduced profit margins, impacting overall returns on investment in these segments.

- Market Share Challenges: Capturing substantial market share in these highly competitive areas requires significant investment and may not yield proportional returns due to the established presence of competitors.

Dogs in Aavas Financiers' portfolio represent business units or products with low market share and low growth potential. These are often characterized by underperforming micro-market branches or niche loan products that haven't gained traction. For example, a branch consistently missing disbursement targets, like achieving only 60% of its goal in FY24 with rising NPAs, would be a Dog. Similarly, a specialized loan product with minimal uptake, contributing very little to the overall loan book, also falls into this category.

| Category | Characteristics | Example for Aavas Financiers | Potential Strategy |

|---|---|---|---|

| Dogs | Low market share, low growth potential, often unprofitable. | Underperforming micro-market branches, niche loan products with low demand. | Divest, liquidate, or discontinue. |

| Underperforming Branch | Fails to meet disbursement targets, high NPAs. | Branch in a rural cluster with 60% disbursement target achievement and 2% NPA increase in FY24. | Review viability, consider closure or strategic redirection. |

| Niche Loan Product | Minimal market traction, low contribution to loan book. | Highly specialized housing loan for a specific demographic with low resonance. | Discontinue or re-evaluate market fit. |

Question Marks

Aavas Financiers is actively pursuing new geographic expansion, targeting states and districts where mortgage penetration remains low. This strategy aims to tap into significant growth potential in these underserved markets. For instance, in fiscal year 2024, Aavas opened 16 new branches, many of which are in these emerging territories, reflecting their commitment to this expansion strategy.

While these new regions offer substantial upside, they currently represent a smaller portion of Aavas's overall market share. Consequently, these ventures necessitate considerable investment in establishing new branches, building local operational teams, and undertaking focused market development initiatives to build brand awareness and customer acquisition.

Aavas Financiers is strategically employing advanced digital loan origination to tap into the 'New-to-Credit' and 'New-to-Mortgage' segments. This involves integrating web platforms, social media, dedicated customer apps, and chatbots to create a seamless onboarding experience.

This digital push holds significant growth potential, aiming to broaden Aavas Financiers' customer reach beyond conventional channels. By making the process more accessible, they can attract a larger pool of first-time borrowers.

However, this initiative is currently a nascent channel for customer acquisition, meaning its market share and effectiveness compared to traditional sourcing methods are still being established. For instance, while digital channels are growing rapidly, traditional branches still accounted for a significant portion of loan originations across the housing finance sector in India during 2023, indicating the need for continued validation of new digital strategies.

Aavas Financiers is strategically engaging in co-lending and value-adding partnerships to access untapped customer bases and bolster its digital presence. These alliances are crucial for expanding reach and scalability, though their current impact on the total loan portfolio remains modest.

While these collaborations represent a promising avenue for future growth, their immediate contribution to Aavas Financiers' overall loan book is relatively small. This positions them as a 'question mark' in the BCG matrix, signifying high potential for future success if these partnerships are effectively scaled and integrated.

Pilot Programs for Green Home Financing or Solar Loans

Aavas Financiers is exploring pilot programs in green home financing and solar loans, such as financing EDGE-certified Self-Built Green Homes and solar plant installations. These initiatives represent a strategic move into high-growth, sustainable finance sectors.

These programs are positioned as potential Stars or Question Marks within the BCG Matrix due to their high growth potential but currently low market share. Significant investment in market education and product development will be crucial for their success and to drive adoption.

- Green Home Financing: Focuses on properties meeting specific environmental certifications, tapping into a growing demand for sustainable housing.

- Solar Loan Programs: Facilitates the installation of solar power systems for homes, aligning with renewable energy goals and offering long-term cost savings for homeowners.

- Market Education: Aavas Financiers will likely need to invest in educating customers about the benefits and feasibility of green financing options.

Strategic Use of GenAI Bots for Customer Service

Aavas Financiers is strategically leveraging GenAI bots to streamline customer service operations, aiming for quicker response times and improved customer satisfaction. This move signifies an investment in cutting-edge AI to enhance client interactions, a crucial element for any financial services firm.

While the full impact on market share and customer acquisition through these GenAI initiatives is still unfolding, the company's proactive adoption positions it to potentially capture a larger segment of the market. Early data from similar implementations in the financial sector suggests a potential for significant efficiency gains.

For instance, reports from early 2024 indicate that companies utilizing AI-powered chatbots saw an average reduction of 20% in customer query resolution times. This efficiency can translate into better customer retention and attract new clients seeking prompt service.

The strategic use of GenAI bots for customer service can be viewed through several lenses:

- Enhanced Efficiency: GenAI bots can handle a high volume of routine inquiries simultaneously, freeing up human agents for more complex issues.

- Improved Customer Experience: Swift and accurate responses from bots can lead to greater customer satisfaction and loyalty.

- Data Collection and Analysis: Interactions with GenAI bots provide valuable data on customer needs and pain points, informing future service improvements.

- Scalability: The technology allows for seamless scaling of customer service operations to meet fluctuating demand without proportional increases in staffing.

Aavas Financiers' expansion into new, underserved geographic territories and their digital push into 'New-to-Credit' segments both represent significant growth opportunities with high investment requirements and currently limited market share. These initiatives are classic 'Question Marks' in the BCG matrix, demanding careful resource allocation to convert potential into established market presence.

BCG Matrix Data Sources

Our Aavas Financiers BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.