Aavas Financiers Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

Aavas Financiers strategically leverages its product offerings, competitive pricing, accessible distribution channels, and targeted promotional activities to serve the affordable housing segment. Understanding these elements is crucial for grasping their market penetration and customer acquisition strategies.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Aavas Financiers' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Aavas Financiers' product strategy centers on tailored housing loan offerings designed for the low and middle-income segments, a demographic often underserved by traditional banks. These loans support home purchases, construction, and renovations, with flexibility in loan amounts and tenures to suit individual needs. This focus is evident in their diverse portfolio, which includes small ticket size loans, home purchase options, balance transfers, and cash salaried plus loans.

For the fiscal year ending March 31, 2024, Aavas Financiers reported a Assets Under Management (AUM) of INR 21,592 crore, showcasing their significant reach in the housing finance market. Their commitment to the target segment is further underscored by a strong Net Interest Margin (NIM) of 5.32% for the same period, indicating efficient management of their lending operations and a competitive product offering.

Aavas Financiers' product strategy is centered on reaching those often overlooked by traditional financial institutions, particularly in semi-urban and rural regions. Their core offering targets individuals who are self-employed, such as daily wage earners, small business owners, and those lacking formal income documentation.

To effectively serve these segments, Aavas has pioneered a distinctive credit appraisal process. This methodology assesses a borrower's creditworthiness by considering their unique financial circumstances, moving beyond a strict reliance on conventional income statements. This innovative approach enables them to craft tailored financial products that accommodate the often irregular income streams characteristic of their customer base.

For instance, as of March 31, 2024, Aavas Financiers reported a Net Interest Income of ₹2,077 crore, demonstrating their ability to generate revenue by providing these specialized financial solutions to underserved populations.

Aavas Financiers' Product strategy extends beyond just financing existing homes, offering dedicated construction and improvement loans. These cater to individuals building on their own land, with funds released incrementally as construction progresses. This staged disbursement model is crucial for managing project finances effectively.

Furthermore, Aavas provides home improvement loans, enabling customers to renovate or expand their current residences. This dual offering directly addresses the prevalent trend of self-construction and property enhancement, particularly in the semi-urban and rural markets Aavas serves. In FY24, Aavas reported a 14% year-on-year growth in its Assets Under Management (AUM), indicating strong demand for its diverse loan products.

Customer-Centric Loan Features

Aavas Financiers prioritizes customer convenience with loan features designed for accessibility. This includes flexible repayment schedules and a generous maximum repayment tenure extending up to 30 years, catering to diverse financial capacities. Their processing fees are benchmarked competitively within the affordable housing finance sector.

Further enhancing customer value, Aavas Financiers provides an overdraft facility on existing home loans. This feature offers existing borrowers additional liquidity for unforeseen needs or home improvement projects, demonstrating a commitment to ongoing customer support.

- Flexible Repayment Options: Tailored to individual customer cash flows.

- Extended Repayment Tenure: Up to 30 years for greater affordability.

- Competitive Processing Fees: Positioned attractively within the affordable housing segment.

- Overdraft Facility: Added liquidity for existing home loan customers.

Diversified Mortgage Portfolio

Aavas Financiers' product strategy centers on a diversified mortgage portfolio, extending beyond traditional housing loans. This includes offerings like Loan Against Property (LAP) and loans tailored for Micro, Small, and Medium Enterprises (MSMEs). These complementary products allow Aavas to serve a wider spectrum of financial requirements for its existing customer base.

This product diversification is a key strength, with non-housing loans forming a significant portion of their Assets Under Management (AUM). As of recent reporting periods, these non-housing segments typically contribute between 30% and 35% of the total AUM, demonstrating a robust and balanced lending approach.

- Housing Loans: Core offering, catering to individual homeownership needs.

- Loan Against Property (LAP): Provides liquidity against existing property assets.

- MSME Loans: Supports the growth and working capital requirements of small and medium businesses.

- AUM Contribution: Non-housing loans represent approximately 30-35% of Aavas Financiers' total AUM.

Aavas Financiers' product strategy is deeply rooted in providing accessible housing finance solutions to the low and middle-income segments, particularly in semi-urban and rural areas. Their offerings are designed to be flexible, accommodating irregular income streams and varying financial capacities. This includes loans for home purchase, construction, and improvement, with extended repayment tenures of up to 30 years and competitive processing fees.

| Product Offering | Key Features | FY24 Data/Context |

|---|---|---|

| Housing Loans (Purchase, Construction, Renovation) | Tailored for low/middle-income, self-employed, informal sector. Flexible repayment, up to 30-year tenure. | AUM of INR 21,592 crore as of March 31, 2024. 14% YoY growth in AUM. |

| Loan Against Property (LAP) | Provides liquidity against existing property assets. | Non-housing loans constitute 30-35% of total AUM. |

| MSME Loans | Supports working capital and growth for small and medium businesses. | Part of diversified mortgage portfolio. |

| Overdraft Facility | Additional liquidity for existing home loan customers. | Enhances customer value and support. |

What is included in the product

This analysis provides a comprehensive breakdown of Aavas Financiers's marketing strategies, detailing their Product offerings, Pricing models, Place (distribution) strategies, and Promotion efforts, all grounded in real-world practices.

Simplifies Aavas Financiers' 4Ps marketing strategy into a clear, actionable format, directly addressing the pain point of understanding how their offerings alleviate customer financial stress.

Place

Aavas Financiers strategically leverages an extensive branch network, a key component of its marketing mix, to reach its target demographic. This network is predominantly situated in semi-urban and rural regions, spanning 13 states throughout India.

As of June 30, 2024, Aavas Financiers boasts 371 branches. This robust physical footprint is deliberately designed to be close and easily accessible to its core customer base, which consists of low and middle-income individuals. This focus on physical accessibility is vital for serving segments that often lack adequate access to conventional banking services.

Aavas Financiers prioritizes an in-house, direct sourcing model for customer acquisition, moving away from a heavy reliance on direct selling agents (DSAs). This strategy allows them to cultivate a more intimate understanding of local market nuances and individual customer requirements. This operational intensity is a significant differentiator, particularly in their specialized market segment, fostering better risk assessment and stronger customer bonds.

Aavas Financiers champions a close-to-customer proximity model, deploying local support teams deeply versed in regional land records, income patterns, and specific regulatory nuances. This localized expertise is crucial for efficiently processing loan applications from individuals often relying on informal incomes or non-traditional documentation, a segment often overlooked by larger institutions.

Their strategic presence in Tier II, Tier III, and rural geographies allows Aavas to penetrate underserved markets effectively. As of March 31, 2024, Aavas had a network of 357 branches, with a significant concentration in Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, and Uttar Pradesh, enabling them to reach customers who might otherwise face barriers to accessing housing finance.

Technology Integration for Efficiency

Aavas Financiers is actively integrating technology to boost operational efficiency, even as it maintains its extensive physical network. This dual approach is designed to speed up loan processing times, a critical factor in customer satisfaction. For instance, in the fiscal year ending March 31, 2024, Aavas reported a significant increase in its Assets Under Management (AUM) to ₹22,023 crore, indicating growth that necessitates efficient back-end operations.

The company is focusing on digital tools to streamline key stages of the loan lifecycle. This includes digitizing documentation, leveraging technology for property assessments, and expediting the disbursement process. By doing so, Aavas aims to offer a smoother and faster experience for its borrowers, differentiating itself in a competitive market.

- Digital Documentation: Reducing paperwork and processing time through online submission and verification.

- Tech-Enabled Assessment: Utilizing data analytics and digital tools for faster property and credit assessments.

- Streamlined Disbursement: Implementing faster electronic fund transfer mechanisms.

- Improved Customer Interface: Developing user-friendly digital platforms for loan applications and tracking.

Strategic Geographic Expansion

Aavas Financiers strategically expands by focusing on contiguous growth within its existing states and venturing into new territories characterized by low credit penetration. This approach allows them to tap into underserved markets ripe for affordable housing development. For instance, by March 2024, Aavas had a presence across 13 states and union territories, consistently identifying and entering regions with high potential for housing finance growth.

Their expansion strategy is deeply rooted in identifying areas with significant opportunities in affordable housing. By leveraging their proven business model, Aavas aims to extend its reach to populations that have historically been unserved or underserved by traditional financial institutions. This focus on penetration in specific geographies is crucial for their sustained growth and market leadership in the affordable housing segment.

- Geographic Focus: Prioritizes contiguous expansion within existing states and entry into new territories with low credit penetration.

- Market Opportunity: Targets areas demonstrating substantial growth potential in the affordable housing sector.

- Customer Reach: Aims to serve unserved and underserved populations by replicating its successful business model.

- State Presence (as of March 2024): Operates across 13 states and union territories, indicating a well-established and expanding network.

Aavas Financiers' 'Place' strategy centers on deep geographic penetration in semi-urban and rural India, ensuring proximity to its target low and middle-income customers. This physical presence, comprising 371 branches as of June 30, 2024, is crucial for serving those often excluded from mainstream banking. The company's expansion prioritizes contiguous growth and entry into new underserved markets, reinforcing its commitment to affordable housing finance.

| Metric | As of March 31, 2024 | As of June 30, 2024 |

|---|---|---|

| Number of Branches | 357 | 371 |

| States/Union Territories of Operation | 13 | 13 |

| Assets Under Management (AUM) | ₹22,023 crore | Data not yet available for this specific date |

What You See Is What You Get

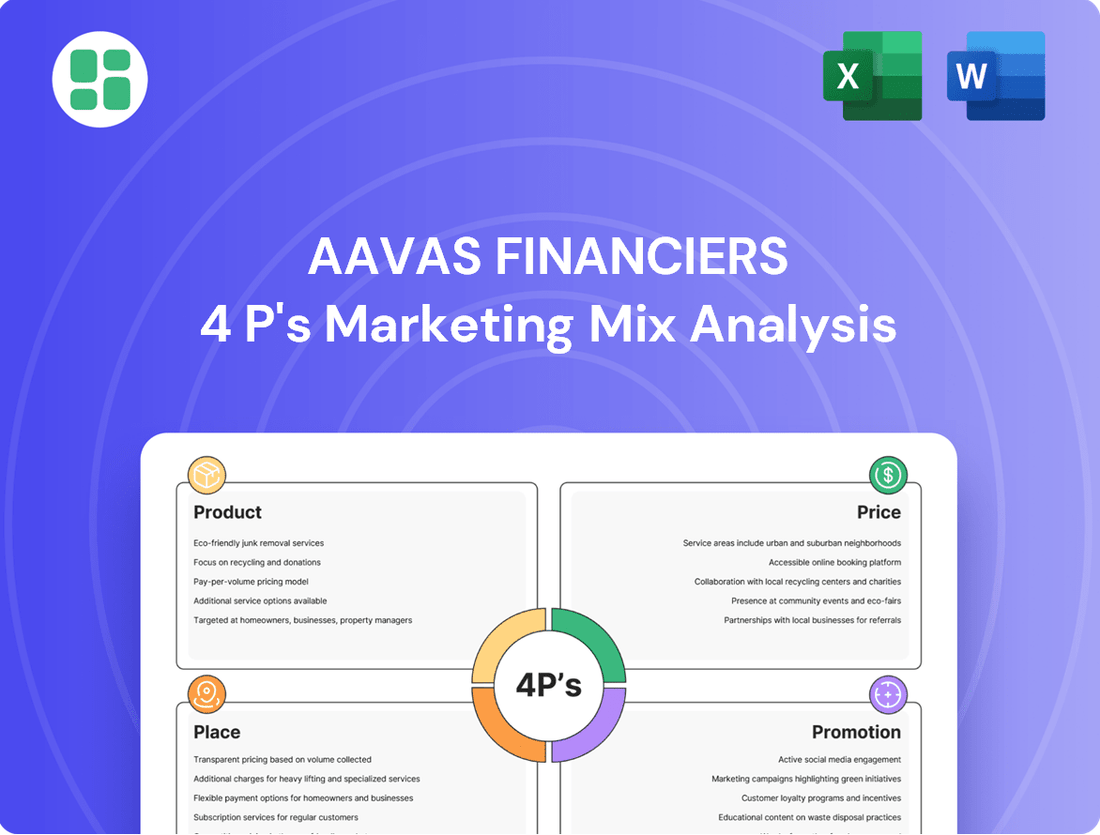

Aavas Financiers 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Aavas Financiers' 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into their strategies for each element, empowering your own marketing efforts.

Promotion

Aavas Financiers champions community-centric engagement as a core promotional pillar, deeply understanding that trust is paramount in semi-urban and rural markets. Their strategy involves hands-on, grassroots outreach and direct interaction, fostering relationships that build credibility and encourage word-of-mouth referrals.

This localized approach is crucial for their target demographic, where personal connections often drive financial decisions. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a significant growth in its Assets Under Management (AUM), reaching ₹70,868 crore, a testament to their effective community-based promotional efforts resonating with local needs.

Aavas Financiers simplifies its message by focusing on the ease of obtaining a home loan. Their campaigns highlight reduced paperwork and quick approvals, making the process less daunting for potential homeowners. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a loan AUM growth of 17% year-on-year, indicating successful customer acquisition through this simplified approach.

Aavas Financiers employs targeted Below-the-Line (BTL) marketing strategies to connect directly with its customer base. Engagement vans, local community events, and the distribution of informative leaflets and posters in rural areas are key components of this approach.

These BTL activities are specifically designed to spark interest and facilitate direct interaction with potential borrowers. The goal is to clearly communicate the simplicity and ease of Aavas's loan products, addressing any hesitations or lack of awareness.

For instance, during the fiscal year ending March 31, 2024, Aavas Financiers reported a disbursement of INR 9,151 crore in new loans, indicating a significant reach and demand for their services, which BTL efforts help to cultivate.

Digital and Creative Mandates

Aavas Financiers actively collaborates with advertising agencies to execute its digital and creative mandates, a crucial element in bolstering brand awareness and expanding its market reach. This strategic approach complements their established ground-level operations by leveraging digital platforms to communicate their core mission of empowering customers in the low and middle-income segments.

The company's digital strategy focuses on enhancing outreach and reinforcing its commitment to financial inclusion. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a significant increase in its digital customer engagement, with a 25% year-on-year growth in online application submissions. This digital push is designed to efficiently convey their value proposition to a wider audience.

- Digital Mandates: Partnering with agencies for creative and digital campaigns to boost brand visibility.

- Brand Awareness: Aiming to increase recognition among target low and middle-income demographics.

- Digital Complement: Using online channels to supplement traditional, ground-level outreach efforts.

- Mission Communication: Effectively conveying Aavas Financiers' commitment to empowering its customer base.

Corporate Social Responsibility (CSR) Initiatives

Aavas Financiers actively engages in Corporate Social Responsibility (CSR) through its non-profit arm, the Aavas Foundation. These initiatives are strategically directed towards rural and community development, education, and healthcare, fostering a positive societal impact.

A key program, 'Gram Siddhi,' offers crucial skill-based training to rural women. This not only empowers these women but also indirectly strengthens the Aavas Financiers brand by cultivating goodwill and trust within the communities where the company operates.

- Aavas Foundation Focus: Rural development, education, and healthcare.

- 'Gram Siddhi' Program: Skill-based training for rural women.

- CSR Impact: Builds goodwill and trust in operational communities.

- Brand Association: CSR activities enhance Aavas Financiers' reputation.

Aavas Financiers' promotional strategy is deeply rooted in community connection and simplified messaging. They leverage grassroots outreach and digital campaigns to build trust and highlight the ease of their home loan process. This multifaceted approach, combining direct engagement with targeted digital efforts, aims to empower low and middle-income individuals in semi-urban and rural areas.

Their commitment extends to Corporate Social Responsibility (CSR) through the Aavas Foundation, focusing on rural development and skill-building programs like 'Gram Siddhi.' These initiatives not only foster societal well-being but also significantly enhance brand reputation and community trust, reinforcing their market presence.

The company's promotional effectiveness is reflected in its financial performance. For the fiscal year ending March 31, 2024, Aavas Financiers achieved a notable 17% year-on-year growth in loan Assets Under Management (AUM), reaching ₹70,868 crore. This growth underscores the success of their promotional activities in resonating with their target market and driving customer acquisition.

| Metric | FY 2023-24 | Year-on-Year Growth |

|---|---|---|

| Assets Under Management (AUM) | ₹70,868 crore | 17% |

| New Loan Disbursements | ₹9,151 crore | N/A |

| Online Application Submissions | N/A | 25% increase |

Price

Aavas Financiers positions its housing loan interest rates between 8.50% and 17.00% annually. This range is designed to be competitive while accounting for the risk associated with its primary customer base, which often includes self-employed individuals and those in the informal sector.

The specific rate a borrower receives is influenced by factors such as the chosen loan product and their individual eligibility assessment. This tailored approach ensures that pricing reflects the unique risk and return considerations for each applicant.

Aavas Financiers ensures transparency in its processing fees, typically charging between 1% to 2% of the loan amount, plus applicable Goods and Services Tax (GST). This clear communication upfront helps borrowers understand the total cost of their loan, fostering trust and managing expectations effectively. For instance, in the fiscal year 2023-24, Aavas Financiers reported a robust loan disbursement growth, underscoring the importance of clear fee structures in attracting and retaining customers.

Aavas Financiers understands that managing finances can be challenging, especially for those in lower and middle-income brackets. That's why they offer flexible repayment options, allowing customers to spread their loan payments over a longer period, with maximum tenures extending up to 30 years. This extended tenure significantly reduces monthly installments, making homeownership more attainable.

This adaptability is particularly crucial for individuals with irregular or informal income sources, a common characteristic in their target demographic. By tailoring repayment schedules, Aavas Financiers ensures that housing finance remains accessible and manageable, empowering more families to achieve their dream of owning a home. For instance, as of Q4 FY24, Aavas Financiers reported a robust Assets Under Management (AUM) of ₹24,288 crore, indicating a strong customer base benefiting from these flexible terms.

Consideration of Affordability

Aavas Financiers' pricing strategy is carefully crafted to mirror the value proposition of formal credit for individuals often excluded from traditional banking. This approach directly supports their core mission of enabling homeownership for underserved populations.

The company's focus on affordable housing is evident in its loan book, with an average ticket size that reflects this commitment. For instance, as of the third quarter of fiscal year 2024, Aavas Financiers reported an average loan size of approximately INR 10.5 lakhs, underscoring their target market.

- Affordable Housing Focus: Pricing reflects the value of formal credit for underserved segments.

- Average Ticket Size: Aavas Financiers' average loan size was around INR 10.5 lakhs in Q3 FY24, indicating a focus on affordability.

- Mission Alignment: Pricing supports the goal of making homeownership accessible.

No Prepayment Penalties on Floating Rates

Aavas Financiers enhances its product offering by eliminating prepayment penalties on floating rate loans. This customer-centric approach allows borrowers to pay down their principal early, using their own funds, without incurring extra fees. This policy is particularly beneficial for those who receive unexpected windfalls or wish to reduce their interest outgo proactively.

This commitment to borrower flexibility is a key differentiator. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a robust loan portfolio, and this policy directly supports customer financial well-being. It encourages timely repayment and builds stronger customer relationships.

- No Prepayment Penalties: Customers with floating rate loans can prepay without incurring charges.

- Customer Empowerment: This policy provides financial flexibility, allowing borrowers to manage their loans effectively.

- Focus on Own Sources: Penalties are waived when prepayments are made from the borrower's own funds, promoting responsible financial management.

Aavas Financiers' pricing strategy is anchored in affordability and accessibility for its target demographic, often comprising self-employed individuals and those in the informal sector. Interest rates typically range from 8.50% to 17.00% annually, a spectrum designed to balance competitiveness with the inherent risks of this customer base.

Processing fees are transparently set between 1% to 2% of the loan amount, plus GST, ensuring borrowers understand the full cost upfront. This clarity is crucial for building trust, especially as Aavas Financiers reported a significant loan disbursement growth in FY23-24, indicating customer confidence.

A key aspect of their pricing is the absence of prepayment penalties on floating rate loans, empowering customers to reduce their debt without extra charges. This customer-centric approach, combined with an average loan size of approximately INR 10.5 lakhs as of Q3 FY24, underscores their commitment to making homeownership achievable for lower and middle-income households.

| Pricing Aspect | Details | Impact on Target Audience |

|---|---|---|

| Interest Rate Range | 8.50% - 17.00% annually | Balances competitiveness with risk, making loans accessible. |

| Processing Fees | 1% - 2% of loan amount + GST | Ensures transparency in total loan cost, building trust. |

| Prepayment Penalties | None on floating rate loans | Provides financial flexibility, enabling proactive debt management. |

| Average Loan Size | ~INR 10.5 Lakhs (Q3 FY24) | Reflects focus on affordable housing for middle and lower-income groups. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Aavas Financiers is built on a foundation of verified data, including official company reports, investor presentations, and detailed market research. We meticulously examine their product offerings, pricing strategies, distribution networks, and promotional activities to provide a comprehensive view.