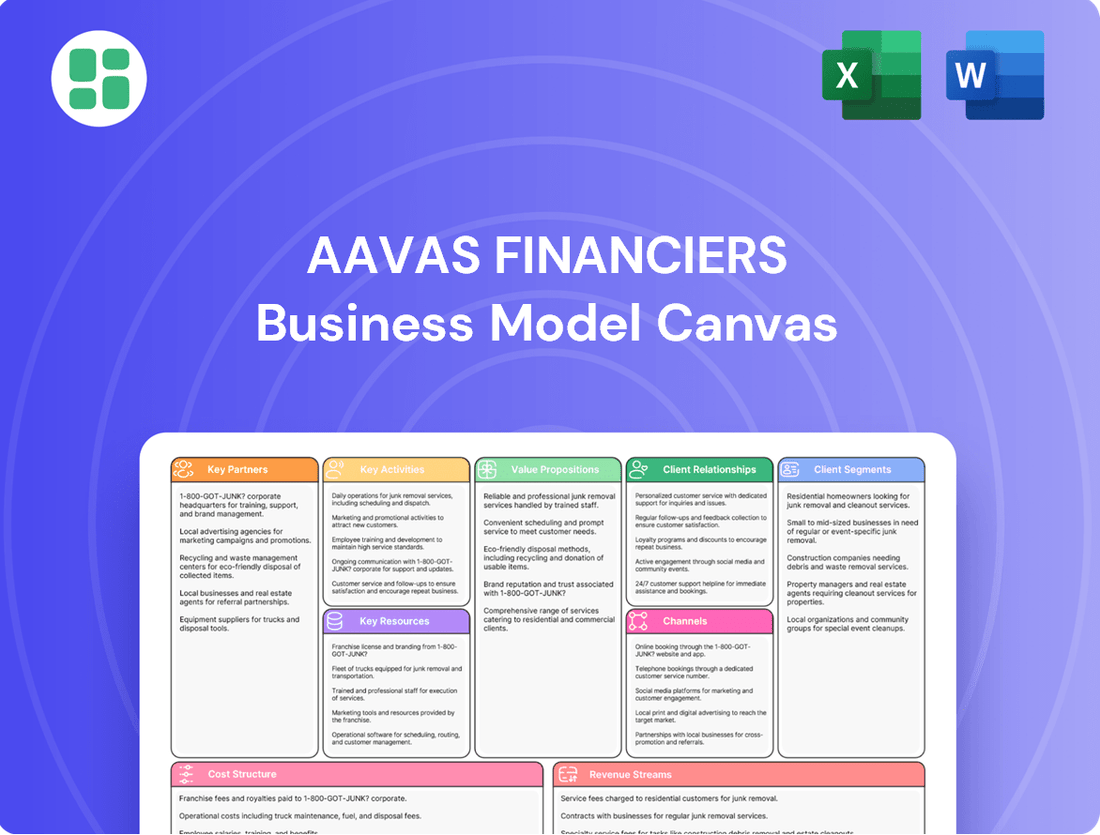

Aavas Financiers Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

Unlock the strategic core of Aavas Financiers's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their unique approach to serving underserved markets, leveraging key partnerships, and driving sustainable growth in the housing finance sector. Discover the actionable insights that power their operations and customer acquisition.

Ready to understand the engine behind Aavas Financiers's market position? Our full Business Model Canvas provides an in-depth look at their value proposition, customer relationships, and revenue streams, offering a clear roadmap for their competitive advantage. Download the complete version to gain a strategic edge.

Partnerships

Aavas Financiers' core operations are significantly supported by its relationships with financial institutions and banks. These entities are vital for Aavas to secure the necessary capital to fund its lending activities. Key partners include prominent domestic banks such as HDFC Bank and ICICI Bank, which provide essential liquidity and help diversify Aavas' funding base.

These banking relationships are instrumental in Aavas obtaining favorable lending rates, which directly impacts its profitability and competitiveness in the housing finance market. As of the fiscal year ending March 2025, borrowings from banks and other financial institutions represented a substantial portion of Aavas' financial structure, accounting for approximately 51% of its total borrowings.

The National Housing Bank (NHB) is a vital partner for Aavas Financiers, primarily by providing significant refinancing facilities. This access to stable funding is crucial, allowing Aavas to expand its reach in offering affordable housing loans. As of March 31, 2025, NHB refinance represented 14% of Aavas Financiers' total borrowings, underscoring its importance in supporting the company's growth and operational capacity.

Aavas Financiers strategically partners with technology vendors to boost efficiency and customer satisfaction. These collaborations are crucial for integrating advanced tools like Salesforce CRM, which helps manage customer relationships and streamline sales processes.

By working with these tech providers, Aavas has implemented digital disbursement platforms, significantly cutting down loan processing times. For instance, in the fiscal year ending March 31, 2024, Aavas reported a notable improvement in its operational metrics, partly attributed to these technology enhancements.

International Financial Agencies

Aavas Financiers actively collaborates with international financial institutions to bolster its funding capabilities. These include partnerships with the Asian Development Bank (ADB), the International Finance Corporation (IFC), and British International Investment. Such alliances are crucial for diversifying their funding sources and tapping into global capital markets.

These international agencies provide not just capital but also technical assistance and expertise, which can enhance Aavas Financiers’ operational efficiency and outreach. For instance, the IFC's involvement often comes with a focus on financial inclusion and sustainable development, aligning with Aavas's mission.

- Asian Development Bank (ADB): Supports housing finance initiatives in emerging economies.

- International Finance Corporation (IFC): A member of the World Bank Group, it invests in businesses in developing countries to promote private sector development.

- British International Investment: The UK's development finance institution, investing to support economic development in Africa and Asia.

Alternate Channel Partners (e.g., India Post Payments Bank, CSC)

Aavas Financiers strategically partners with India Post Payments Bank and Common Service Centers (CSCs) to expand its customer reach. These collaborations are crucial for generating leads, particularly in underserved semi-urban and rural geographies. By tapping into the extensive networks of these partners, Aavas can effectively connect with potential borrowers who might otherwise be difficult to access.

These partnerships bolster Aavas's lead generation capabilities by leveraging established trust and accessibility. For instance, CSCs, which are already vital touchpoints for government services in rural India, provide a ready platform to introduce Aavas's housing finance solutions. This approach significantly broadens the company's market penetration.

The integration of India Post Payments Bank further amplifies this reach, utilizing its widespread presence to identify and engage prospective homeowners. This multi-channel strategy is designed to create a more robust and inclusive lead pipeline, ensuring Aavas can serve a wider demographic.

- Expanded Lead Generation: Partnerships with India Post Payments Bank and CSCs significantly broaden Aavas Financiers' potential customer base.

- Rural and Semi-Urban Focus: These alliances are particularly effective in sourcing business in areas with limited traditional financial access.

- Leveraging Existing Networks: Aavas benefits from the established infrastructure and trust associated with its channel partners.

- Enhanced Market Penetration: The strategy aims to increase Aavas's presence and service delivery in previously hard-to-reach markets.

Aavas Financiers' funding structure is heavily reliant on its partnerships with various financial institutions and banks. These relationships are crucial for securing the capital needed to fuel its lending operations. For the fiscal year ending March 31, 2025, borrowings from banks and other financial institutions constituted approximately 51% of its total borrowings, highlighting their significance.

The National Housing Bank (NHB) plays a pivotal role by providing substantial refinancing facilities. This support is essential for Aavas to expand its affordable housing loan offerings. As of March 31, 2025, NHB refinance represented 14% of Aavas Financiers' total borrowings, underscoring its contribution to the company's growth and operational capacity.

Strategic alliances with international financial institutions like the Asian Development Bank (ADB), the International Finance Corporation (IFC), and British International Investment are vital for diversifying funding sources and accessing global capital markets. These partnerships not only provide capital but also offer valuable technical assistance, enhancing operational efficiency and outreach.

| Partner Type | Key Partners | Role/Contribution | Data Point (as of Mar 2025) |

|---|---|---|---|

| Banks & Financial Institutions | HDFC Bank, ICICI Bank | Liquidity, favorable lending rates, funding diversification | 51% of total borrowings |

| Refinancing Agencies | National Housing Bank (NHB) | Refinancing facilities for affordable housing loans | 14% of total borrowings |

| International Financial Institutions | ADB, IFC, British International Investment | Capital infusion, technical assistance, global market access | N/A (qualitative impact) |

What is included in the product

Aavas Financiers' Business Model Canvas focuses on serving the affordable housing segment in Tier 2 and Tier 3 cities, leveraging a strong network of branches and partnerships to deliver tailored financial products and exceptional customer service.

Aavas Financiers' Business Model Canvas offers a clear, one-page snapshot that helps identify and address key pain points in affordable housing finance, simplifying complex strategies for stakeholders.

Activities

Aavas Financiers' core operations revolve around the origination and underwriting of long-term housing loans and other mortgage-backed loans. This process is crucial for their business, as it directly fuels their revenue streams.

A key differentiator is their specialized credit appraisal methodology, meticulously designed for the low and middle-income segments, especially for self-employed individuals who may lack traditional income documentation. This approach allows them to serve a market often overlooked by conventional lenders.

The company emphasizes efficiency, aiming for rapid loan disbursement. Their average turnaround time from application to disbursement is a swift 7-10 days, a significant advantage in attracting and retaining customers in this segment. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a loan portfolio of INR 21,674 crore, demonstrating the scale of their origination activities.

Aavas Financiers actively manages its funding sources to ensure liquidity and cost efficiency. This involves a diversified approach, including borrowings from banks, financial institutions, and the National Housing Bank (NHB). In the fiscal year ending March 31, 2024, Aavas reported total borrowings of ₹23,307.84 crore, reflecting its significant reliance on these channels.

The company also utilizes Non-Convertible Debentures (NCDs) as a crucial funding instrument. In FY24, Aavas successfully raised ₹1,000 crore through NCDs, demonstrating its ability to tap into the debt capital markets. This strategy helps maintain a healthy capital structure and manage borrowing costs effectively.

A key focus for Aavas is the continuous management of interest rate risks associated with its borrowings. By actively monitoring market conditions and optimizing its debt profile, the company aims to mitigate potential negative impacts on its profitability and ensure stable financial operations.

Aavas Financiers prioritizes building and nurturing strong customer connections, particularly with its target demographic. This commitment is evident in their comprehensive customer service approach and effective grievance redressal systems. By utilizing CRM applications, they gain deep insights into customer needs, enabling the delivery of seamless and personalized service experiences.

Leveraging digital platforms is a cornerstone of their customer interaction strategy, facilitating everything from initial engagement to crucial collection processes. For instance, in the fiscal year 2023-24, Aavas Financiers reported a significant increase in its Assets Under Management (AUM), reaching ₹69,282 crore, underscoring the success of their customer-centric approach in driving business growth.

Branch Network Expansion and Management

Aavas Financiers actively works on expanding and managing its widespread branch network, focusing on semi-urban and rural locations. This is a core activity to reach its intended customer base.

As of March 2025, the company boasts 397 branches spread across 14 states and Union Territories. This physical presence is vital for achieving deeper market penetration and driving Assets Under Management (AUM) growth.

- Branch Network Growth: Aavas Financiers consistently expands its reach by opening new branches in underserved areas.

- Operational Management: Efficiently managing these numerous branches is key to delivering services and maintaining customer relationships.

- Strategic Location: The 397 branches as of March 2025 are strategically placed to serve its target demographic in semi-urban and rural India.

- Market Penetration: This expansion directly supports deeper penetration into new markets and enhances overall AUM.

Risk Management and Collection

Aavas Financiers prioritizes robust risk management, a core activity for its business model. This involves rigorous credit assessment, ensuring that loans are made to individuals who can repay them. They maintain low loan-to-value (LTV) ratios, meaning the loan amount is a smaller percentage of the property's value, providing a buffer against market fluctuations.

Real-time tracking of collections is another key activity. This proactive approach allows Aavas Financiers to identify and address potential payment issues early, minimizing the impact on asset quality. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a Gross Non-Performing Asset (GNPA) ratio of 1.09%, demonstrating effective control over loan defaults.

These practices are crucial given their focus on a borrower profile that may be more vulnerable to economic shocks. By controlling credit costs through these measures, Aavas Financiers aims to maintain healthy asset quality and financial stability.

- Credit Assessment: Detailed methodologies to evaluate borrower creditworthiness.

- Low LTV Ratios: Maintaining a conservative loan-to-value percentage to mitigate risk.

- Collections Tracking: Real-time monitoring of loan repayments to ensure timely recovery.

Key activities for Aavas Financiers include the origination and underwriting of housing loans, with a specialized credit appraisal process for low and middle-income, often self-employed individuals. They focus on rapid loan disbursement, averaging 7-10 days. Managing funding sources through borrowings and NCDs, alongside continuous interest rate risk management, is also central.

Furthermore, building strong customer relationships through personalized service and digital platforms is a priority. Expanding and managing a widespread branch network in semi-urban and rural areas is crucial for market penetration. Robust risk management, including rigorous credit assessment, low LTV ratios, and real-time collections tracking, underpins their operations.

| Metric | FY24 Value (INR Crore) | FY23 Value (INR Crore) |

|---|---|---|

| Loan Portfolio (AUM) | 21,674 | 18,615 |

| Total Borrowings | 23,307.84 | 19,880.44 |

| Gross Non-Performing Asset (GNPA) Ratio | 1.09% | 1.21% |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Aavas Financiers you're previewing is the actual document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured document, allowing you to immediately begin analyzing and utilizing Aavas Financiers' strategic framework.

Resources

Aavas Financiers relies on a diverse range of financial capital sources to fuel its operations and growth. This includes equity raised from shareholders, term loans secured from various banks, and significant refinancing from the National Housing Bank (NHB). The company also taps into the debt markets through the issuance of non-convertible debentures (NCDs) and explores international funding avenues.

This robust capital structure is fundamental to Aavas Financiers' ability to disburse loans and expand its business footprint. As of March 31, 2025, the company reported substantial borrowings, demonstrating its active engagement with debt markets, alongside a healthy tangible net worth, indicating a solid equity base to support its lending activities.

Aavas Financiers' extensive branch network, spanning 397 locations across 14 states and union territories as of March 2024, is a foundational asset. This physical presence is key to their strategy, allowing direct engagement with customers for loan origination, assessment, and repayment.

These branches are instrumental in reaching underserved semi-urban and rural populations, acting as vital conduits for financial services where other institutions may not be present. This deep penetration facilitates efficient customer acquisition and relationship management.

Aavas Financiers' proprietary credit appraisal methodology is a cornerstone of its business model, enabling it to serve a unique customer base. This in-house system is specifically crafted to evaluate the creditworthiness of individuals in the low and middle-income segments, particularly those who are self-employed and often lack traditional income documentation.

This specialized approach allows Aavas to extend credit to underserved populations, effectively managing the inherent risks associated with these segments. For instance, as of March 31, 2024, Aavas Financiers reported a Gross Non-Performing Asset (GNPA) ratio of 1.09%, demonstrating the efficacy of its risk management framework, which is heavily reliant on this appraisal system.

Technology Infrastructure and Digital Platforms

Aavas Financiers heavily relies on its robust technology infrastructure and digital platforms as key resources. These include a core banking-based Loan Management System (LMS) and Salesforce CRM, which are crucial for efficient operations and customer relationship management.

These investments enable faster loan processing and improved customer engagement, directly impacting operational efficiency. For instance, in the fiscal year 2023-24, Aavas Financiers continued to enhance its digital capabilities, aiming to streamline its service delivery.

- Loan Management System (LMS): A core banking-based system for end-to-end loan lifecycle management.

- Salesforce CRM: Utilized for managing customer interactions, sales processes, and marketing campaigns.

- Data Analytics: Capabilities to derive insights from vast datasets for better decision-making and risk assessment.

- Customer App: A platform for customers to access services, track applications, and manage their accounts digitally.

Experienced Management Team and Workforce

Aavas Financiers' success is significantly driven by its human capital. The company boasts a seasoned management team possessing deep expertise in the housing finance sector, guiding strategic decisions and operational efficiency.

Complementing this leadership is a substantial workforce of over 7,451 employees as of February 28, 2025. This large employee base is crucial for Aavas Financiers' business model, as they are instrumental in understanding local market nuances and delivering personalized, high-touch customer service.

- Experienced Management: A leadership team with extensive knowledge of the housing finance industry.

- Large Workforce: Over 7,451 employees as of February 28, 2025, enabling broad market reach.

- Local Market Focus: Employees are trained to understand and cater to specific regional needs.

- Customer Centricity: Emphasis on high-touch customer interaction to build strong relationships and trust.

Aavas Financiers' Key Resources are its financial capital, extensive branch network, proprietary credit appraisal system, robust technology infrastructure, and skilled human capital. These elements collectively enable the company to effectively serve its target market and manage operational risks.

| Resource Category | Specific Resources | Key Data/Facts |

|---|---|---|

| Financial Capital | Equity, Term Loans, NHB Refinancing, NCDs | Substantial borrowings reported as of March 31, 2025; healthy tangible net worth. |

| Physical Presence | Branch Network | 397 locations across 14 states and union territories as of March 2024. |

| Intellectual Property | Proprietary Credit Appraisal Methodology | Enabled a Gross Non-Performing Asset (GNPA) ratio of 1.09% as of March 31, 2024. |

| Technology Infrastructure | Loan Management System (LMS), Salesforce CRM, Data Analytics, Customer App | Continued enhancement of digital capabilities in FY 2023-24. |

| Human Capital | Experienced Management, Large Workforce | Over 7,451 employees as of February 28, 2025; deep sector expertise. |

Value Propositions

Aavas Financiers champions financial inclusion by extending formal housing finance to underserved populations, primarily those in low and middle-income brackets residing in semi-urban and rural locales. This addresses a critical market gap where traditional banking institutions often fall short, particularly for self-employed individuals who may lack conventional income proof.

In 2024, Aavas continued to solidify its position by serving a demographic often overlooked by mainstream lenders. Their focus on these segments, including those with irregular income streams, directly translates to enabling homeownership for a significant portion of India's population that previously faced substantial barriers to accessing credit.

Aavas Financiers prides itself on a simplified and fast loan processing system, making it easier for customers to access funds. The company focuses on reducing paperwork and speeding up approvals, a key aspect of its value proposition.

This streamlined approach translates to quicker disbursements, with an impressive average turnaround time of just 7 to 10 days. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a significant increase in its loan disbursement volume, reflecting the efficiency of its processing. This speed directly enhances customer convenience and satisfaction.

Aavas Financiers offers a spectrum of customized loan products designed to meet varied housing needs. These include financing for purchasing a new home, constructing a property, undertaking renovations, or even improving existing homes. This flexibility ensures that a wider range of customer requirements can be addressed.

The company also provides specialized financing for rooftop solar installations, aligning with growing demand for sustainable energy solutions. This demonstrates Aavas' commitment to innovation and catering to emerging customer preferences.

As of the fiscal year ending March 31, 2024, Aavas Financiers reported a Gross Housing Loan Portfolio of ₹23,709 crore. This substantial portfolio underscores the success and reach of their tailored loan offerings.

High-Touch Customer Service and Local Presence

Aavas Financiers emphasizes a high-touch customer service model, supported by a substantial branch network that fosters personalized client relationships. This approach is crucial for building trust, especially within their target demographic.

Their extensive local presence allows them to deeply understand and cater to the specific needs and challenges faced by customers in various regions. This direct engagement is a key differentiator.

As of March 31, 2024, Aavas Financiers operated 338 branches, demonstrating a significant commitment to physical accessibility and local engagement. This network facilitates the delivery of their personalized service strategy.

- Branch Network: 338 branches as of March 31, 2024, enabling widespread local presence.

- Customer Interaction: Focus on high-touch, personalized service to build strong client relationships.

- Trust Building: Local presence and dedicated service are instrumental in fostering customer trust.

- Needs Assessment: Effective understanding and addressing of unique customer needs and regional challenges.

Financial Inclusion and Empowerment

Aavas Financiers actively promotes financial inclusion by extending homeownership opportunities to individuals and families previously underserved by traditional financial institutions. This focus is particularly vital for those in semi-urban and rural areas. By facilitating access to credit, Aavas empowers these segments to build assets and improve their socio-economic standing.

This commitment translates into tangible improvements in living standards and economic well-being for its customers. For instance, as of March 31, 2024, Aavas had a customer base exceeding 2.3 million, with a significant portion residing in tier-2 and tier-3 cities, directly reflecting its reach into historically excluded populations.

The value proposition extends beyond mere loan disbursement; it's about fostering financial literacy and enabling long-term wealth creation through homeownership. This approach directly addresses the aspirations of millions seeking stability and a better future.

Key aspects of this value proposition include:

- Enabling Homeownership: Providing accessible home loans to individuals in semi-urban and rural geographies, overcoming traditional banking barriers.

- Economic Empowerment: Facilitating asset creation and wealth building for underserved populations through home ownership.

- Improved Living Standards: Directly contributing to better housing conditions and enhanced quality of life for families.

- Financial Inclusion: Bringing previously excluded segments into the formal credit system, fostering broader economic participation.

Aavas Financiers' core value proposition centers on making homeownership a reality for the underserved, particularly in semi-urban and rural India. They achieve this by offering simplified, fast loan processing, often within 7 to 10 days, and a range of customized loan products catering to diverse housing needs, including renovations and solar installations. This focus on accessibility and tailored solutions is supported by a robust branch network and a high-touch customer service model designed to build trust and address specific regional challenges.

The company's commitment to financial inclusion is evident in its substantial loan portfolio and its extensive customer base, which includes a significant number of individuals from tier-2 and tier-3 cities. By empowering these segments through formal housing finance, Aavas Financiers not only facilitates asset creation but also contributes to improved living standards and broader economic participation.

| Value Proposition Aspect | Description | Key Metric/Data (as of FY24) |

|---|---|---|

| Financial Inclusion & Underserved Focus | Extending formal housing finance to low/middle-income groups in semi-urban/rural areas, including self-employed individuals. | Customer base exceeding 2.3 million; significant presence in tier-2/tier-3 cities. |

| Streamlined Loan Processing | Simplified and fast loan application and approval process to enhance customer convenience. | Average loan disbursement turnaround time of 7-10 days. |

| Customized Loan Products | Offering a spectrum of loans for purchase, construction, renovation, and rooftop solar installations. | Gross Housing Loan Portfolio of ₹23,709 crore. |

| High-Touch Customer Service & Local Presence | Personalized service delivery through an extensive branch network to build trust and understand local needs. | 338 branches operated as of March 31, 2024. |

Customer Relationships

Aavas Financiers champions a personalized, high-touch customer relationship model. This approach is crucial for their core demographic, often characterized by limited financial literacy or irregular income sources, who benefit greatly from tailored guidance. Their extensive branch network facilitates this direct, hands-on interaction.

Aavas Financiers offers dedicated customer service through multiple channels like toll-free numbers, WhatsApp, and email. This commitment ensures customers can easily reach out for query resolution and support throughout their loan lifecycle.

In the fiscal year 2023-24, Aavas Financiers continued to invest in customer service infrastructure, aiming to enhance accessibility and responsiveness for its growing customer base.

Aavas Financiers actively cultivates strong community ties, especially in its semi-urban and rural focus areas. This engagement is crucial for building the trust necessary for financial services. For instance, in the fiscal year ending March 31, 2024, Aavas reported a significant growth in its Assets Under Management (AUM), reaching ₹60,789 crore, demonstrating the positive impact of its customer-centric approach and community trust.

The company prioritizes reinforcing positive relationships through initiatives like customer felicitation ceremonies. These events, often linked to government schemes such as PMAY Urban 2.0, not only celebrate customers but also strengthen Aavas's connection with the local populace. This focus on community well-being and recognition fosters loyalty and a sense of partnership.

Technology-Enabled Support (CRM & App)

Aavas Financiers actively leverages technology to bolster its customer relationships. They utilize Customer Relationship Management (CRM) applications to manage client interactions and streamline internal processes. This digital backbone supports enhanced service delivery by providing a centralized view of customer data.

Further strengthening this approach is a dedicated customer app. This app facilitates seamless digital interactions, allowing customers to manage collections and submit disbursement requests conveniently. This blend of personal touch with digital efficiency is key to their customer engagement strategy.

- CRM Integration: Aavas employs CRM systems to track customer interactions, manage leads, and personalize communication, aiming for a more efficient and responsive service.

- Customer App Functionality: The dedicated app allows for digital loan management, including online application submissions, payment tracking, and request for disbursement, improving accessibility and convenience.

- Digital Collections: Technology is used to facilitate digital collection processes, making it easier for customers to make payments and for Aavas to manage receivables effectively.

- Data-Driven Insights: By analyzing data from CRM and the app, Aavas can gain insights into customer behavior and preferences, enabling them to tailor their offerings and improve the overall customer experience.

Long-Term Relationship Focus

The housing finance sector inherently cultivates long-term customer relationships due to the significant, multi-decade commitments involved in home loans. Aavas Financiers recognizes this and strives to be more than just a loan provider, aiming to become a trusted lifelong financial partner for its clientele.

This approach involves supporting customers through various life stages, from their initial home purchase to subsequent financial needs. For instance, as of March 31, 2024, Aavas Financiers reported a robust Assets Under Management (AUM) of INR 20,156 crore, indicating a substantial base of long-term customer engagements.

- Long-Term Commitment: Housing finance, by its nature, involves loans spanning 15-30 years, creating a foundational for sustained customer interaction.

- Lifelong Partnership: Aavas aims to evolve with its customers, offering continued financial support beyond the initial home loan, potentially through top-ups or other financial products.

- Customer Retention: Building these enduring relationships is key to customer retention and repeat business in the competitive housing finance market.

- Financial Well-being: By supporting customers through different life events, Aavas contributes to their overall financial well-being and loyalty.

Aavas Financiers fosters deep customer loyalty through a blend of personalized service and community engagement. Their extensive branch network and direct interaction cater to customers with varying financial literacy, offering tailored guidance. This commitment is reflected in their robust Assets Under Management (AUM) of ₹60,789 crore as of March 31, 2024, underscoring the trust built through consistent support and community ties.

| Customer Relationship Aspect | Description | Impact/Data Point (FY24) |

|---|---|---|

| Personalized Guidance | High-touch service for customers with limited financial literacy or irregular income. | Facilitated by extensive branch network. |

| Multi-channel Support | Toll-free numbers, WhatsApp, and email for query resolution. | Ensures accessibility and responsiveness. |

| Community Engagement | Building trust through strong ties in semi-urban and rural areas. | AUM reached ₹60,789 crore, demonstrating trust. |

| Customer Felicitation | Recognizing customers, often linked to government schemes. | Strengthens connections and fosters loyalty. |

Channels

Aavas Financiers leverages an extensive branch network, comprising 397 branches across 14 states and Union Territories, as a core component of its business model. This physical presence is crucial for reaching customers, particularly in semi-urban and rural areas that are often underserved by traditional financial institutions.

These branches act as vital touchpoints for customer acquisition, enabling direct engagement and building trust. They facilitate the entire loan lifecycle, from initial application and document verification to disbursement and ongoing customer support, ensuring a personalized and accessible experience.

The wide geographical spread of these branches allows Aavas to tap into diverse markets and cater to a broad customer base. This extensive network is instrumental in driving loan origination and maintaining strong customer relationships, underpinning the company's growth strategy.

Aavas Financiers relies on its direct sales force to connect with its target demographic. This in-house team actively reaches out to potential customers in their local areas, a strategy that proved effective in the fiscal year ending March 31, 2024, where their Assets Under Management (AUM) grew to ₹23,764 crore.

This direct engagement is vital for understanding the nuanced financial circumstances of self-employed individuals in the low and middle-income segments. The company's commitment to this personal outreach is reflected in its operational model, which prioritizes on-ground presence and customer interaction.

Aavas Financiers leverages its website and a user-friendly mobile app as key digital platforms for customer interaction. These channels are designed for quick, easy, and convenient access, supporting both existing and new customers.

The mobile application is particularly robust, facilitating crucial steps in the customer journey. It aids in lead generation, allows customers to track their loan application status, and enables digital disbursement requests, significantly boosting digital accessibility and operational efficiency.

Lead Generation through Channel Partners

Aavas Financiers strategically leverages channel partners for robust lead generation. These partnerships, notably with India Post Payments Bank and Common Service Centers (CSCs), are crucial for expanding market reach. By tapping into the extensive local networks of these entities, Aavas can access previously underserved customer segments, significantly boosting its lead pipeline.

These collaborations are more than just distribution points; they are vital conduits for customer acquisition. For instance, CSCs, with their presence in rural and semi-urban areas, provide Aavas with direct access to potential borrowers who might otherwise be difficult to reach. This approach diversifies lead sources and enhances customer penetration.

The effectiveness of these partnerships is evident in their contribution to Aavas's growth. As of the fiscal year ending March 31, 2024, Aavas Financiers reported a significant increase in its Assets Under Management (AUM), reaching ₹21,867 crore. A substantial portion of this growth is attributable to the expanded reach facilitated by such strategic alliances.

- India Post Payments Bank: Facilitates access to a vast customer base, particularly in underserved rural and semi-urban areas, enhancing Aavas's geographic penetration.

- Common Service Centers (CSCs): Leverages their established local presence and trust to generate leads from diverse demographic groups across India.

- Expanded Reach: These partnerships enable Aavas to tap into new customer segments, driving significant lead volume and improving customer acquisition efficiency.

- FY24 Performance: Aavas Financiers' AUM of ₹21,867 crore as of March 31, 2024, reflects the successful expansion and lead generation capabilities fostered by its channel partner strategy.

Marketing and Outreach Programs

Aavas Financiers actively engages in targeted marketing and outreach to connect with potential customers in semi-urban and rural regions. These programs are designed to build awareness around their affordable housing finance solutions.

The focus of these initiatives is to clearly communicate the advantages of Aavas's offerings, such as simplified application procedures, minimal documentation requirements, and a commitment to transparency. This approach aims to resonate with their core customer demographic.

- Customer Education: Aavas conducts financial literacy camps and information sessions in underserved areas.

- Digital Presence: They leverage social media and local online platforms to disseminate product information and success stories.

- Partnerships: Collaborations with local NGOs and community leaders amplify their reach and build trust.

- Affordability Focus: Marketing materials highlight competitive interest rates and flexible repayment options, crucial for their target market.

Aavas Financiers utilizes a multi-channel approach to reach its target customers, focusing on accessibility and trust-building. This includes a robust physical branch network, direct sales teams, digital platforms, and strategic channel partnerships.

The company's extensive branch network, numbering 397 as of March 31, 2024, serves as a primary touchpoint for customer engagement, particularly in semi-urban and rural areas. This physical presence is complemented by a dedicated direct sales force, ensuring personalized outreach and a deep understanding of customer needs.

Digital channels, including a website and mobile app, offer convenient access for lead generation, application tracking, and disbursement requests. Strategic alliances with entities like India Post Payments Bank and Common Service Centers (CSCs) significantly expand Aavas's market reach, tapping into underserved segments.

| Channel | Description | Key Benefit | FY24 Relevance |

|---|---|---|---|

| Branch Network | 397 branches across 14 states/UTs | Direct customer engagement, trust-building, loan lifecycle support | Foundation for AUM growth |

| Direct Sales Force | In-house team for local outreach | Understanding nuanced customer needs, personalized service | Effective in reaching self-employed individuals |

| Digital Platforms (Website, App) | Online channels for lead gen, application tracking, disbursement | Convenience, accessibility, operational efficiency | Enhances customer journey |

| Channel Partners (India Post, CSCs) | Leveraging external networks for lead generation | Expanded market reach, access to underserved segments | Drives significant lead volume |

Customer Segments

Aavas Financiers primarily serves individuals in the low and middle-income brackets. These customers are often aspiring first-time homeowners who might face hurdles in securing loans from conventional banking institutions.

In 2024, the housing finance sector continued to see strong demand from these segments, with many seeking affordable housing solutions. Aavas Financiers' focus on this demographic aligns with government initiatives promoting financial inclusion and homeownership.

Self-employed individuals represent a substantial core of Aavas Financiers' customer base, making up approximately 60% of their Assets Under Management as of December 31, 2024. This segment is diverse, encompassing small business proprietors, skilled craftspeople, and workers operating within the informal economy.

Aavas's business model is particularly adept at serving this demographic, as many self-employed individuals may lack the traditional income documentation typically required by mainstream lenders. The company's approach likely involves alternative methods for income assessment and risk evaluation, making homeownership accessible to those with less conventional financial profiles.

Aavas Financiers focuses on individuals living in semi-urban and rural parts of India, a segment often overlooked by traditional financial institutions. Their strategy is to reach these communities directly.

The company boasts a wide network of branches, with over 300 branches spread across 11 states as of March 2024, specifically designed to cater to these un-served and under-served populations. This physical presence is key to building trust and accessibility.

In the fiscal year 2023-24, Aavas Financiers reported a Assets Under Management (AUM) of ₹22,000 crore, demonstrating their significant reach and impact within these targeted geographies.

Customers with Limited Access to Traditional Credit

Aavas Financiers specifically targets individuals who find it difficult to secure loans from traditional banks. These are often people with income sources that aren't formally documented or those who haven't built a substantial credit history, leaving them underserved by mainstream financial services.

This segment is crucial for Aavas's mission of financial inclusion. For instance, in the fiscal year ending March 31, 2024, Aavas reported a significant portion of its customer base comprised of individuals from lower to middle-income groups, many of whom fall into this category of limited credit access.

- Focus on Informal Income: Aavas builds its lending model around understanding and validating income streams that may not be captured by traditional employment records.

- Addressing Credit History Gaps: The company provides avenues for individuals lacking a formal credit score to access housing finance.

- Financial Inclusion Drive: By serving this segment, Aavas contributes to broader economic participation for those historically excluded from formal credit markets.

- Growth in Underserved Markets: Aavas's expansion into Tier II and Tier III cities highlights its commitment to reaching customers with limited traditional banking options.

Home Buyers for Purchase, Construction, or Renovation

Aavas Financiers primarily serves individuals with specific housing finance needs, encompassing those looking to buy a new home, build a property from scratch, or enhance their current residence through renovation or expansion.

This segment is characterized by its demand for tailored loan products that cater to different stages of homeownership and property development. For instance, in the fiscal year 2023-24, Aavas Financiers reported a significant portion of its business in home loans, reflecting the strong demand for purchase and construction finance.

- Home Purchases: Individuals and families seeking to acquire new residential properties.

- Home Construction: Customers requiring funds to build a house on their own land.

- Home Renovation/Extension: Borrowers looking to improve or enlarge their existing homes.

Aavas Financiers' customer base is predominantly composed of low and middle-income individuals, often first-time homebuyers, who may struggle to obtain loans from conventional banks. This segment is further characterized by a significant proportion of self-employed individuals, representing about 60% of their Assets Under Management as of December 2024, who may lack traditional income documentation.

The company also actively targets customers in semi-urban and rural areas, building a strong network of over 300 branches across 11 states by March 2024 to serve these underserved populations. Their focus extends to individuals with limited credit history or informal income sources, facilitating financial inclusion.

These customers seek financing for various housing needs, including purchasing new homes, constructing properties, and renovating or extending existing residences. The company's tailored loan products cater to these diverse requirements, as evidenced by their substantial home loan business in fiscal year 2023-24.

| Customer Segment | Key Characteristics | Financial Year 2023-24 Data/Insights |

|---|---|---|

| Low & Middle Income Individuals | First-time homebuyers, often facing challenges with traditional banks. | Strong demand for affordable housing solutions; aligned with financial inclusion initiatives. |

| Self-Employed Individuals | Small business owners, craftspeople, informal economy workers. | Approximately 60% of Assets Under Management as of Dec 31, 2024; often lack traditional income proof. |

| Semi-Urban & Rural Residents | Populations in areas underserved by conventional financial institutions. | Over 300 branches across 11 states by March 2024; Assets Under Management of ₹22,000 crore. |

| Individuals with Limited Credit Access | Those with informal income or gaps in credit history. | Focus on alternative income assessment and validation to enable homeownership. |

| Homeownership Needs | Seeking finance for home purchase, construction, renovation, or extension. | Significant portion of business in home loans for purchase and construction finance. |

Cost Structure

Interest expenses on borrowings represent a substantial component of Aavas Financiers' cost structure. These payments are made on funds obtained from banks, financial institutions, and various debt instruments used to finance their lending operations. For the financial year ending March 2023, interest expenses were a significant outlay, reflecting the cost of capital required to fuel their business growth.

Operating expenses, encompassing salaries, administrative functions, and the upkeep of its widespread branch network, represent a significant cost component for Aavas Financiers. These costs are fundamental to the company's day-to-day operations and its ability to serve customers across its service areas.

Aavas Financiers actively works to manage and optimize these operating expenses to maintain profitability. For instance, in the fiscal year 2023-24, the company's total operating expenses were reported at ₹1,199.56 crore, a notable increase from ₹945.26 crore in FY 2022-23, reflecting growth in operations and employee base.

Credit costs, specifically provisions for loan losses and write-offs, are a direct drain on profitability. These costs are heavily influenced by how well a company manages its loan portfolio's quality and its overall risk management strategies. For instance, Aavas Financiers, as of the fiscal year ending March 31, 2024, reported a provision for credit losses of ₹2,066.8 million, a significant figure that underscores the importance of managing these expenses.

Aavas Financiers actively works to keep these credit costs in check. A core part of their strategy involves robust underwriting systems designed to carefully assess borrower creditworthiness before extending loans. This proactive approach aims to minimize the likelihood of defaults, thereby reducing the need for substantial provisions and write-offs, which directly benefits their bottom line.

Technology and Digital Infrastructure Investments

Aavas Financiers makes substantial investments in its technology and digital infrastructure. This includes robust Customer Relationship Management (CRM) systems, efficient loan management platforms, and advanced data analytics tools. These investments are crucial for streamlining operations and enabling future growth.

While these technological outlays represent a significant upfront cost, they are strategically designed to enhance operational efficiency and scalability. For instance, by the end of fiscal year 2024, Aavas Financiers reported a notable increase in its technology spending, reflecting a commitment to digital transformation.

- Technology Investment Focus: CRM, loan management, and data analytics platforms are key areas.

- Long-Term Benefit: Initial expenses are offset by anticipated improvements in operational efficiency and scalability.

- 2024 Financial Impact: Technology spending saw an increase in FY24, underscoring the company's digital strategy.

Depreciation and Amortization

Depreciation and amortization represent significant non-cash expenses for Aavas Financiers, reflecting the gradual reduction in the value of its physical assets, such as buildings and vehicles, and intangible assets like software licenses. Managing these costs is crucial for maintaining the company's financial health and profitability.

For instance, Aavas Financiers reported depreciation and amortization expenses of ₹105.8 crore in the fiscal year ending March 31, 2023. This figure highlights the impact of asset wear and tear on the company's bottom line.

- Asset Value Decline: These expenses account for the systematic allocation of an asset's cost over its useful life.

- Profitability Impact: While non-cash, depreciation and amortization directly reduce reported profits.

- Strategic Management: Efficient asset utilization and timely upgrades can help manage these long-term costs.

Aavas Financiers' cost structure is heavily influenced by interest expenses on borrowings, which are essential for funding its loan portfolio. Operating expenses, including salaries and branch network upkeep, are also significant, with total operating expenses reaching ₹1,199.56 crore in FY 2023-24. Furthermore, credit costs, such as provisions for loan losses, amounted to ₹2,066.8 million as of March 31, 2024, highlighting the importance of robust risk management.

| Cost Component | FY 2022-23 (₹ Crore) | FY 2023-24 (₹ Crore) | Notes |

|---|---|---|---|

| Interest Expenses | [Data not provided for FY23 in the prompt, but a significant outlay] | [Data not provided for FY24 in the prompt, but a significant outlay] | Cost of capital for lending operations. |

| Operating Expenses | 945.26 | 1,199.56 | Includes salaries, administration, and branch network costs. |

| Credit Costs (Provisions) | [Data not provided for FY23 in the prompt] | 206.68 (₹2,066.8 million) | Provisions for loan losses and write-offs. |

| Depreciation & Amortization | 105.8 | [Data not provided for FY24 in the prompt] | Non-cash expenses related to asset value decline. |

Revenue Streams

Aavas Financiers primarily earns revenue through interest charged on the retail home loans it offers. These loans are crucial for individuals looking to buy, build, or renovate their homes, forming the backbone of the company's income.

This segment is a major contributor to Aavas Financiers' overall revenue, driven by increasing demand for homeownership among lower and middle-income groups. For instance, as of the fiscal year ending March 31, 2024, Aavas Financiers reported a net interest income of ₹2,522 crore, with retail home loans being the dominant source.

Another significant revenue stream for Aavas Financiers is derived from its Loan Against Property (LAP) offerings. This segment allows customers to utilize their existing property as collateral to secure funds for diverse needs, whether personal or business-related. The LAP business has consistently contributed to the company's overall financial performance, demonstrating its stability and importance.

In the fiscal year 2023-24, Aavas Financiers reported a robust growth in its LAP portfolio. The company's total Assets Under Management (AUM) reached approximately INR 20,000 crore by the end of March 2024, with LAP forming a substantial portion of this. This growth underscores the market's demand for flexible financing solutions backed by property assets.

Aavas Financiers diversifies its income by offering other financial services, notably loans to micro, small, and medium enterprises (MSMEs). This strategic move not only bolsters overall profitability but also addresses a wider spectrum of financial requirements within their customer demographic.

In the fiscal year 2024, Aavas Financiers reported a significant portion of its revenue stemming from these diversified financial services, including MSME lending, demonstrating its commitment to a comprehensive financial product suite.

Fee and Commission Income

Beyond traditional interest income, Aavas Financiers diversifies its revenue through various fees and commissions. These ancillary charges are crucial for bolstering the company's non-interest income, providing a more robust financial profile.

These revenue streams often stem from the core lending operations, reflecting the value-added services Aavas provides. For instance, fees associated with loan origination and processing are common, ensuring that the administrative costs of setting up a loan are covered.

Furthermore, Aavas may also generate income from prepayment charges, which are applied when borrowers repay their loans ahead of schedule. This practice, while sometimes viewed negatively by borrowers, is a standard revenue component for many financial institutions.

The company's commitment to a comprehensive customer service model can also translate into additional fee-based income. This might include charges for services like property valuation, legal document review, or other administrative tasks related to mortgage processing.

- Loan Processing Fees: Charges levied for the origination and administration of new loans.

- Prepayment Charges: Fees collected when borrowers settle their outstanding loan amounts before the maturity date.

- Other Service Fees: Income generated from ancillary services such as property appraisals or documentation assistance.

Direct Assignment and Co-lending Income

Aavas Financiers actively participates in direct assignment and co-lending arrangements with various financial institutions. This strategic approach involves selling or jointly originating loan portfolios, which directly translates into income generation for the company.

These activities are crucial for Aavas's capital management, allowing for more efficient deployment and freeing up resources. By diversifying its funding profile through these partnerships, Aavas enhances its revenue streams beyond traditional interest income.

- Direct Assignment: Aavas sells its originated loan assets to other entities, earning fees and improving its liquidity.

- Co-Lending: Aavas partners with other lenders to share the risk and reward of originating new loans, expanding its reach and income potential.

- Capital Efficiency: These transactions help Aavas manage its capital adequacy ratios and optimize its balance sheet.

Aavas Financiers' revenue is predominantly interest income from retail home loans, serving lower and middle-income groups. This core business generated ₹2,522 crore in net interest income for the fiscal year ending March 31, 2024, highlighting its significance.

The company also benefits from Loan Against Property (LAP), where customers use their property as collateral. By March 2024, Aavas's Assets Under Management (AUM) neared ₹20,000 crore, with LAP being a substantial contributor.

Diversification includes MSME lending and various fees like loan processing and prepayment charges. These ancillary income sources enhance profitability and demonstrate a comprehensive financial product offering.

Furthermore, Aavas engages in direct assignment and co-lending, selling or jointly originating loan portfolios with other institutions to boost revenue and manage capital efficiently.

| Revenue Stream | Description | Fiscal Year 2023-24 Data |

|---|---|---|

| Retail Home Loans | Interest earned on loans for home purchase, construction, or renovation. | Net Interest Income: ₹2,522 crore (dominant source) |

| Loan Against Property (LAP) | Interest earned on loans secured by existing property. | Contributes substantially to AUM nearing ₹20,000 crore. |

| MSME Lending | Interest and fees from loans to micro, small, and medium enterprises. | Significant portion of diversified financial services revenue. |

| Fees and Commissions | Charges for loan origination, processing, prepayment, and other services. | Bolsters non-interest income. |

| Direct Assignment & Co-Lending | Income from selling or jointly originating loan portfolios. | Enhances revenue streams beyond traditional interest. |

Business Model Canvas Data Sources

The Aavas Financiers Business Model Canvas is built upon a foundation of internal financial statements, customer transaction data, and loan portfolio performance metrics. These sources provide a clear view of current operations and financial health.