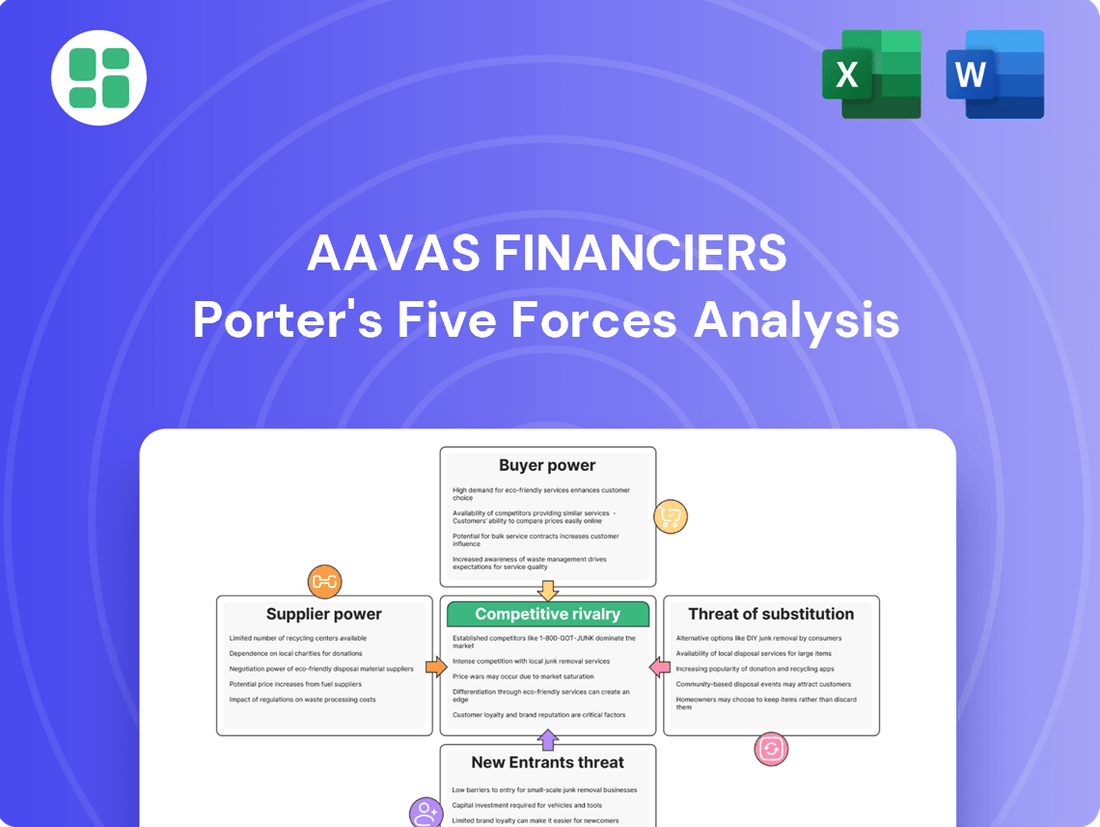

Aavas Financiers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

Aavas Financiers operates within a landscape shaped by intense competition and evolving customer demands. Understanding the power of buyers and the threat of new entrants is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Aavas Financiers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aavas Financiers benefits from a diversified funding profile, drawing capital from various avenues. These include term loans from banks and financial institutions, refinance facilities from the National Housing Bank (NHB), non-convertible debentures (NCDs), and co-lending arrangements. This broad base of suppliers significantly reduces the company's dependence on any single source, thereby mitigating supplier power.

Aavas Financiers benefits from its strong ability to secure funding at competitive rates. This is evidenced by its consistent access to capital from a broad spectrum of lenders, including major public and private sector banks, as well as international financial institutions like the Asian Development Bank and International Finance Corporation.

This diversified funding base significantly reduces the bargaining power of any single supplier. By having multiple avenues for raising capital, Aavas Financiers is not overly reliant on any one lender, allowing them to negotiate more favorable terms and maintain access to funds even if one source becomes less accommodating.

Aavas Financiers' strategic decision to avoid short-term commercial papers significantly bolsters its bargaining power against potential suppliers. By not depending on these volatile instruments, the company insulates itself from the pressures of rapidly changing interest rates that can impact the cost of short-term funding.

This approach ensures Aavas Financiers maintains a stable and predictable cost of capital, reducing its vulnerability to suppliers who might otherwise leverage the company's need for immediate liquidity. In 2023, Aavas Financiers reported a healthy liquidity coverage ratio, demonstrating its robust financial standing independent of short-term debt markets.

Impact of Regulatory Harmonization

The Reserve Bank of India's (RBI) regulatory harmonization, effective January 1, 2025, aims to align prudential norms for Housing Finance Companies (HFCs) and Non-Banking Financial Companies (NBFCs). This includes updated guidelines on public deposit acceptance and liquid asset maintenance.

While these adjustments might raise compliance burdens for certain HFCs, leading rating agencies anticipate a limited negative effect on well-established entities like Aavas Financiers. This is primarily because Aavas is already largely adhering to these forthcoming standards.

- RBI Harmonization: New rules from Jan 1, 2025, for HFCs and NBFCs.

- Key Areas: Public deposit acceptance and liquid asset rules are being standardized.

- Impact on Aavas: Major rating agencies foresee minimal adverse impact due to Aavas's existing compliance.

- Supplier Power: Harmonized regulations could indirectly influence supplier terms by standardizing financial sector operations.

Stable Borrowing Costs

Despite a slight uptick in Aavas Financiers' average borrowing cost from 7.5% in March 2024 to 7.7% in March 2025, these costs are still considered manageable for its lending activities.

Aavas's ability to maintain relatively stable funding costs, supported by a varied funding strategy and robust credit ratings, effectively curbs the influence of individual lenders in setting unfavorable terms.

- Stable Borrowing Costs: Aavas Financiers' average borrowing cost saw a minor increase from 7.5% in March 2024 to 7.7% in March 2025.

- Diversified Funding Mix: The company utilizes a range of funding sources, reducing reliance on any single lender.

- Strong Credit Ratings: High credit ratings facilitate access to capital at competitive rates, enhancing stability.

- Limited Supplier Power: These factors collectively diminish the bargaining power of its lenders.

Aavas Financiers' bargaining power with suppliers, primarily its lenders, remains low due to its diversified funding strategy and strong financial standing. The company actively sources capital from multiple banks, financial institutions, and through instruments like Non-Convertible Debentures (NCDs).

This broad access to funds, coupled with its avoidance of volatile short-term debt, allows Aavas to negotiate favorable terms. For instance, as of March 2025, Aavas Financiers' average borrowing cost was 7.7%, a manageable figure reflecting its ability to secure capital without being overly dependent on any single supplier.

The upcoming regulatory harmonization by the RBI from January 1, 2025, is expected to have a minimal impact on Aavas, as the company already largely complies with the new prudential norms for HFCs and NBFCs, further solidifying its position against supplier pressure.

| Funding Source | March 2024 | March 2025 |

|---|---|---|

| Average Borrowing Cost | 7.5% | 7.7% |

| Key Lenders | Public Sector Banks, Private Banks, NHB, ADB, IFC | Public Sector Banks, Private Banks, NHB, ADB, IFC |

| Debt Instruments | Term Loans, NCDs | Term Loans, NCDs |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Aavas Financiers' position in the affordable housing finance sector.

Effortlessly identify and mitigate competitive threats by visualizing Aavas Financiers' Porter's Five Forces, providing a clear roadmap to navigate industry pressures.

Customers Bargaining Power

Aavas Financiers focuses on low and middle-income customers in semi-urban and rural regions. Many of these individuals have limited or no access to credit from traditional banks because they lack formal income documentation. This situation inherently curtails their bargaining power.

This customer segment often finds itself with fewer alternative lenders, especially for housing finance. Consequently, their ability to negotiate terms or prices with specialized financial institutions like Aavas is significantly reduced, strengthening Aavas's position.

Aavas Financiers primarily serves self-employed individuals with modest credit histories. This demographic, while often overlooked by larger financial institutions, generally possesses lower bargaining power when it comes to loan terms. For instance, in 2024, the average loan size for self-employed individuals in India, a key segment for Aavas, remained significantly lower than for salaried employees, indicating a less robust financial standing and thus, reduced negotiation leverage.

The availability of government subsidies significantly influences the bargaining power of customers for housing finance companies like Aavas Financiers. Initiatives such as the Pradhan Mantri Awas Yojana (PMAY) and its Credit Linked Subsidy Scheme (CLSS) provide substantial interest subsidies, effectively lowering the cost of homeownership for eligible low and middle-income segments. For instance, CLSS can reduce the effective interest rate by up to 6.5% for certain income groups, directly enhancing affordability and customer choice.

This increased affordability empowers customers, as they can more readily access housing finance. With subsidies making loans more palatable, customers gain leverage to compare offerings from various lenders, seeking the best terms and services. This heightened competition among financiers to cater to subsidy-eligible borrowers naturally strengthens the customer's position in negotiations.

Low Loan-to-Value Ratios

Aavas Financiers' conservative approach, evidenced by its low average loan-to-value (LTV) ratios of approximately 55%, significantly impacts customer bargaining power. This strategy, focusing on smaller loan amounts, means customers often have less equity in their properties. Consequently, these customers may find it harder to secure higher LTV loans from other institutions, reducing their ability to negotiate favorable terms.

- Low LTVs Limit Customer Options: Aavas' average LTV of around 55% means borrowers typically contribute over 40% of the property value themselves.

- Reduced Bargaining Leverage: Customers with substantial down payments are less dependent on a single lender, giving them more power to negotiate.

- Focus on Smaller Ticket Sizes: This strategy inherently caters to a segment where customers may have less access to larger, more flexible financing options elsewhere.

- Mitigated Risk, Increased Customer Dependence: While Aavas reduces its risk, this can inadvertently increase customer reliance on Aavas if other lenders are unwilling to offer comparable terms on smaller loan amounts.

Increasing Digitalization and Awareness

The increasing digitalization of financial services is a significant factor in the bargaining power of customers for companies like Aavas Financiers. As more financial products and loan options become accessible online, particularly through fintech platforms, customers in semi-urban and rural areas are gaining greater awareness. This enhanced access to information allows them to more easily compare offerings from various lenders.

This heightened awareness, coupled with streamlined digital application processes, empowers customers by giving them a clearer understanding of market rates and terms. For instance, by mid-2024, the penetration of digital financial services continued to expand, with a notable increase in mobile banking adoption even in Tier 2 and Tier 3 cities. This trend directly translates to customers being better equipped to negotiate for more favorable loan conditions.

- Digital Adoption: By the end of 2023, India's internet user base surpassed 700 million, with a significant portion residing in rural and semi-urban areas, indicating a growing digital savviness.

- Fintech Influence: Fintech platforms are increasingly offering comparison tools for home loans, making it simpler for borrowers to identify the most competitive rates and terms available in the market.

- Informed Borrowers: Customers can now readily access information on interest rates, processing fees, and eligibility criteria, reducing information asymmetry and strengthening their negotiating position.

- Competitive Landscape: The proliferation of digital lenders and NBFCs intensifies competition, forcing established players to offer attractive terms to retain and attract customers.

While Aavas Financiers serves a customer base with generally lower bargaining power due to limited credit access and smaller loan requirements, certain factors are beginning to shift this dynamic. Government subsidies enhance affordability and choice, while increasing digitalization empowers customers with more information and access to alternative lenders.

The average loan size for self-employed individuals, a key demographic for Aavas, remained relatively modest in 2024, underscoring their limited leverage. However, the growing digital financial landscape, with an internet user base exceeding 700 million by the end of 2023, is enabling these customers to compare offerings more effectively.

The Pradhan Mantri Awas Yojana's Credit Linked Subsidy Scheme, for instance, can reduce effective interest rates by up to 6.5%, making housing finance more accessible and increasing customer options. This, combined with fintech platforms offering loan comparison tools, is gradually strengthening the customer's negotiating position.

| Factor | Impact on Customer Bargaining Power | Supporting Data (as of 2024/late 2023) |

|---|---|---|

| Limited Credit Access & Documentation | Weakens bargaining power | Aavas focuses on customers lacking formal income proof, a segment with fewer financing alternatives. |

| Government Subsidies (e.g., PMAY-CLSS) | Strengthens bargaining power | Subsidies can lower effective interest rates by up to 6.5%, enhancing affordability and choice. |

| Digitalization & Fintech | Strengthens bargaining power | Over 700 million internet users (end-2023); fintech platforms facilitate loan comparisons. |

| Conservative Lending (Low LTVs) | Weakens bargaining power | Aavas' average LTV around 55% reduces customer dependence on other lenders for larger loan amounts. |

Full Version Awaits

Aavas Financiers Porter's Five Forces Analysis

This preview showcases the exact Aavas Financiers Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive understanding of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the housing finance sector. This detailed analysis is fully formatted and ready for immediate use, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The Indian housing finance market, a significant sector valued at approximately USD 0.48 trillion in 2025 and anticipated to climb to USD 0.86 trillion by 2030, presents a dynamic landscape. While this substantial growth signals ample opportunity, it simultaneously fuels intense rivalry among a multitude of existing participants.

This fragmentation means Aavas Financiers faces competition not just from large, established banks but also from a growing number of smaller, specialized housing finance companies and non-banking financial companies. Each player is vying for a slice of this expanding market, leading to aggressive pricing and innovative product offerings.

Banks remain the dominant force in India's home mortgage market, holding a significant 62.67% share in 2024. This dominance stems from their inherent advantages, including access to cheaper funds and vast, established branch networks that reach a wider customer base.

However, Housing Finance Companies (HFCs) like Aavas Financiers are not standing still. Their loan portfolios saw a robust 13.2% growth in FY24, indicating a strong competitive push. This rapid expansion highlights the intensifying rivalry, as HFCs strive to capture market share from the established banking sector.

Aavas Financiers actively sidesteps intense rivalry from major banks and larger Non-Banking Financial Companies (NBFCs) by concentrating its efforts on the operationally demanding niche of serving low and middle-income individuals in smaller towns (tiers 3, 4, and 5). This strategic focus often includes borrowers who may lack traditional income documentation, a segment less attractive to larger institutions.

This specialized operational model, combined with a robust and widespread branch network, forms a significant competitive advantage for Aavas. For instance, as of March 2024, Aavas had a presence across 12 states with 363 branches, enabling deep penetration into these underserved markets and building strong customer relationships.

Improving Asset Quality Across HFCs

The competitive rivalry within the housing finance sector is intensifying, partly driven by an improving asset quality landscape. For instance, Gross Non-Performing Assets (GNPAs) for Housing Finance Companies (HFCs) saw a significant drop to 2.2% by March 2024, a notable decrease from the 4.3% recorded in March 2022.

This overall enhancement in asset quality signals a more stable and healthier competitive environment. It indicates that companies are more effectively managing their credit risks, which in turn can lead to more aggressive competition as firms feel more confident in their lending practices.

- Declining GNPA: HFC GNPA fell to 2.2% in March 2024 from 4.3% in March 2022.

- Improved Risk Management: Lower NPAs suggest better credit risk management across the sector.

- Increased Competition: A healthier asset quality can embolden HFCs to compete more aggressively.

Strategic Expansion and Technology Adoption

Aavas Financiers is actively strengthening its competitive position through a dual strategy of physical expansion and technological advancement. By increasing its branch network, Aavas aims to reach a wider customer base and provide localized services, a critical factor in the housing finance sector.

The company's commitment to technology is evident in its adoption of Generative AI bots for enhanced customer interaction and the development of customer-facing applications. These digital tools are designed to streamline operations, improve efficiency, and offer a superior customer experience, directly addressing the evolving expectations of borrowers.

This proactive approach is essential in a dynamic market where competition is fierce. Both established housing finance companies and newer fintech players are constantly innovating to capture market share. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a 13% year-on-year growth in Assets Under Management (AUM), reaching ₹20,877 crore, demonstrating the effectiveness of its strategic initiatives.

- Branch Network Expansion: Aavas Financiers continued to grow its physical presence, aiming for greater accessibility.

- Technology Investments: Significant capital allocated to GenAI and customer apps to boost efficiency and service.

- Competitive Landscape: Strategic moves are crucial to counter competition from both traditional and digital financial entities.

- FY24 Performance: AUM grew to ₹20,877 crore, reflecting successful strategic execution.

Competitive rivalry in the Indian housing finance sector is robust, with banks holding a significant market share. However, Aavas Financiers differentiates itself by focusing on underserved low and middle-income segments in smaller towns, a niche less attractive to larger competitors.

This strategic focus, supported by an expanding branch network and technological investments, allows Aavas to effectively compete. The sector's improving asset quality, with HFC Gross NPAs dropping to 2.2% by March 2024, further intensifies competition as firms gain confidence.

| Metric | March 2022 | March 2024 |

| HFC Gross NPAs | 4.3% | 2.2% |

| Aavas Financiers AUM Growth (YoY FY24) | 13% | |

| Aavas Financiers AUM (FY24) | ₹20,877 crore |

SSubstitutes Threaten

Government housing schemes, such as the Pradhan Mantri Awas Yojana (PMAY) and its Credit Linked Subsidy Scheme (CLSS), present a significant threat of substitutes for Aavas Financiers. These initiatives provide substantial interest subsidies and financial assistance, making homeownership more accessible and affordable for lower-income groups. For instance, PMAY aimed to deliver housing for all by 2022, with significant uptake in the years leading up to and including 2024, directly impacting the demand for traditional housing finance.

Traditional bank loans act as an indirect substitute for Aavas Financiers, particularly for customers who may eventually qualify for formal banking services or access priority sector lending. Banks hold a dominant 62.67% share of the housing loan market, demonstrating their significant reach and influence.

Informal lending channels, such as local moneylenders and community savings groups, pose a significant threat to Aavas Financiers, especially in semi-urban and rural markets. These alternatives offer a quick and accessible source of funds for individuals who may not qualify for formal loans, often bypassing stringent documentation requirements.

While informal lending can be considerably more expensive, with interest rates potentially exceeding those of formal institutions, its speed and flexibility make it a viable substitute for immediate cash needs. For instance, in many parts of India, informal lenders are deeply embedded in the community fabric, providing essential financial support when formal channels are inaccessible.

Personal Savings and Family Support

For many low and middle-income individuals, personal savings and family support can act as substitutes for formal housing finance. This can slow down the process of homeownership, but it does reduce the immediate need for external funding. In 2024, the average household savings rate in India hovered around 30%, indicating a significant pool of personal funds available for various needs, including housing.

While these informal methods offer an alternative, they often come with limitations. The pace of accumulation might not match the urgency of securing housing, and the amount available might be insufficient for larger purchases or construction projects. This reliance on personal or familial resources can extend the timeline for achieving homeownership for a substantial segment of the population.

- Personal Savings: Individuals may delay home purchases or construction to build up sufficient personal funds, bypassing the need for loans.

- Family Support: Financial assistance from relatives can supplement or replace external financing, especially for initial down payments or smaller housing needs.

- Extended Timelines: While these substitutes reduce reliance on formal lenders, they often lead to longer periods before individuals can afford to buy or build a home.

- Limited Scale: The capacity of personal savings and family support to fund significant housing investments is generally constrained compared to institutional financing.

Rental Housing Market

The availability of affordable rental housing, especially in rapidly urbanizing regions, presents a potential substitute for homeownership. This is particularly relevant for individuals who encounter substantial hurdles in securing a home loan, making renting a more accessible option.

However, in India, a deeply ingrained cultural inclination towards owning a home significantly moderates the long-term threat posed by rental substitutes. This preference for ownership remains a powerful counterforce.

For instance, in 2024, while rental yields in major Indian metros might hover around 3-4%, the aspirational value placed on property ownership continues to drive demand for home loans, even for first-time buyers. This cultural factor is crucial in understanding the competitive landscape for housing finance companies like Aavas Financiers.

Key considerations regarding rental housing as a substitute include:

- Accessibility for lower-income groups: Rental options often provide a lower entry barrier compared to the down payment and loan eligibility requirements for homeownership.

- Urban migration dynamics: As more people move to cities for work, the demand for rental units increases, potentially impacting the immediate need for home purchases.

- Cultural predisposition: The strong societal emphasis on owning a home as a marker of stability and achievement in India remains a dominant factor.

- Financial flexibility: Renting offers greater flexibility for individuals whose employment or financial situation might be less stable, avoiding long-term mortgage commitments.

Government housing schemes, like PMAY, directly substitute Aavas Financiers by offering subsidized housing finance, making homeownership more attainable for target demographics. These programs saw substantial activity through 2024, impacting the demand for traditional housing loans.

Traditional banks, holding a significant 62.67% of the housing loan market, also act as substitutes, especially for customers who can meet their eligibility criteria. Informal lending channels, though often more expensive, provide quick access to funds, particularly in rural and semi-urban areas where Aavas Financiers operates.

Personal savings and family support can delay or negate the need for external financing, with Indian household savings rates around 30% in 2024. While rental housing is an alternative, the strong cultural preference for homeownership in India, despite potentially lower rental yields (3-4% in metros in 2024), remains a key factor.

| Substitute Type | Impact on Aavas Financiers | Key Data/Observation (2024) |

|---|---|---|

| Government Schemes (PMAY) | Directly reduces demand for Aavas's services through subsidies. | High uptake in years leading to and including 2024. |

| Traditional Banks | Captures a large share of the housing loan market. | Hold 62.67% market share in housing loans. |

| Informal Lending | Offers quick, albeit costly, alternatives, especially in target markets. | Deeply embedded in community fabric for immediate needs. |

| Personal Savings/Family Support | Can delay or eliminate the need for formal loans. | Indian household savings rate around 30%. |

| Rental Housing | Provides an alternative to ownership, though cultural preference for ownership is strong. | Metro rental yields around 3-4%; strong aspirational value for ownership. |

Entrants Threaten

The Indian housing finance sector operates under a stringent regulatory environment, primarily governed by the Reserve Bank of India (RBI) and the National Housing Bank (NHB). This oversight creates substantial hurdles for potential new entrants. For instance, the harmonized prudential norms for Housing Finance Companies (HFCs) and Non-Banking Financial Companies (NBFCs), effective from January 2025, mandate higher capital adequacy ratios and more rigorous compliance procedures, making it costly and complex to establish a new player in the market.

The housing finance sector, particularly for companies like Aavas Financiers that cater to a wide range of customers, demands significant upfront investment. New players entering this market need substantial capital not only to establish operations but also to maintain adequate capitalization, which is crucial for weathering economic downturns. For instance, in 2023, the Indian housing finance sector saw continued growth, with companies needing to demonstrate strong financial health to attract both customers and investors.

Aavas Financiers boasts a significant competitive advantage through its established distribution and branch network. As of March 31, 2024, the company operated 397 branches, strategically located across 13 states, with a strong emphasis on semi-urban and rural geographies. This extensive physical footprint is vital for serving its core customer base, making it difficult and costly for new players to replicate.

The sheer scale and deep penetration of Aavas Financiers' branch network represent a substantial barrier to entry. Building a comparable retail presence, essential for customer acquisition and service delivery in its target markets, demands significant capital investment and a considerable amount of time. This inherent difficulty discourages potential new entrants from challenging Aavas's market position.

Specialized Underwriting and Risk Management

Aavas Financiers' strength in specialized underwriting for individuals with informal incomes and limited credit histories presents a significant barrier to new entrants. This niche requires tailored risk assessment models and deep local market understanding, which are not easily replicated. For instance, as of March 31, 2024, Aavas Financiers reported a Gross Non-Performing Asset (GNPA) ratio of 1.06%, demonstrating effective risk management within its specialized segment.

Building the necessary infrastructure and expertise to serve this borrower segment is a time-consuming and capital-intensive process. Newcomers would need to invest heavily in developing unique underwriting methodologies and establishing trust within these communities. The company's focus on affordable housing finance, a segment often underserved by traditional banks, further solidifies its position.

- Specialized Expertise: Aavas excels in assessing creditworthiness for borrowers with informal incomes and limited credit histories, a segment requiring unique underwriting and risk management.

- High Entry Barriers: Developing these specialized capabilities and local market trust takes years of operational experience, making it difficult for new players to enter.

- Operational Track Record: Aavas's proven ability to manage risk in this niche, evidenced by its low GNPA ratio of 1.06% as of March 2024, reinforces its competitive advantage.

- Niche Market Focus: The company's dedication to affordable housing finance, a segment often overlooked by larger financial institutions, creates a defensible market position.

Brand Recognition and Trust in Niche Markets

Building brand recognition and trust among low and middle-income customers in semi-urban and rural areas is a significant undertaking that requires sustained effort over time. New entrants face a considerable hurdle in replicating the deep-rooted trust that established players like Aavas Financiers have cultivated.

Aavas Financiers boasts an established track record and a trusted brand within its specific niche, particularly in serving customers in semi-urban and rural geographies. This existing reputation makes it difficult for new competitors to swiftly achieve market acceptance and secure customer loyalty, as demonstrated by Aavas's consistent growth.

- Established Trust: Aavas Financiers has spent years building relationships and a reputation for reliability, a crucial factor for its target demographic.

- Niche Focus: Their specialization in affordable housing finance in underserved areas creates a strong brand identity that is hard for generalist lenders to match quickly.

- Customer Loyalty: Positive past experiences and word-of-mouth referrals contribute to a loyal customer base, acting as a barrier to entry.

The threat of new entrants for Aavas Financiers is moderate, primarily due to high capital requirements and the need for specialized expertise. However, the company's established brand trust and extensive branch network in semi-urban and rural areas create significant barriers.

New players would need substantial capital to meet regulatory norms, such as the harmonized prudential norms effective from January 2025, which mandate higher capital adequacy ratios. Replicating Aavas Financiers' network of 397 branches as of March 31, 2024, also demands considerable investment and time.

Furthermore, Aavas's proven ability to underwrite loans for individuals with informal incomes, evidenced by a Gross Non-Performing Asset (GNPA) ratio of 1.06% as of March 2024, showcases a unique capability that is difficult for newcomers to quickly develop.

| Factor | Impact on New Entrants | Aavas Financiers' Advantage |

|---|---|---|

| Capital Requirements | High | Established financial strength |

| Regulatory Environment | Stringent (RBI/NHB) | Experience in compliance |

| Distribution Network | Costly to replicate (397 branches as of Mar 2024) | Extensive reach in target geographies |

| Specialized Underwriting | Difficult to develop (low GNPA of 1.06% as of Mar 2024) | Proven risk management for niche segments |

| Brand Trust & Loyalty | Time-consuming to build | Deep-rooted in semi-urban/rural markets |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aavas Financiers leverages data from their annual reports, investor presentations, and disclosures to understand internal strengths and weaknesses. We also incorporate industry reports, market research, and economic indicators to assess external competitive pressures.