Yancoal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yancoal Bundle

Navigate the complex external forces shaping Yancoal's future with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the mining giant. Gain a strategic advantage by leveraging these critical insights to inform your own market strategies.

Ready to make informed decisions about Yancoal? Our comprehensive PESTLE analysis delivers the essential intelligence you need to anticipate market shifts and identify growth avenues. Don't miss out on actionable insights that can redefine your investment or business approach—download the full version now.

Political factors

The Australian government's commitment to a net-zero future by 2050, with a target of 43% emissions reduction by 2030 under the 'Powering Australia' plan, significantly shapes the energy landscape. This focus, reinforced by the 'Future Made in Australia' initiative, includes substantial incentives for renewable energy projects and the establishment of a federal Environmental Protection Agency (EPA).

These policy shifts present a complex regulatory environment for coal producers such as Yancoal. The increasing emphasis on decarbonization could translate into more stringent emissions standards, higher compliance expenses, and a potential dampening of long-term demand for coal, influencing operational strategies and investment decisions.

Yancoal's export-oriented business model means its performance is closely tied to international relations and trade policies, especially concerning its key Asian markets like China and India. The lifting of China's informal import restrictions on Australian coal in early 2023 was a significant positive, allowing Yancoal to boost exports, with Australian thermal coal exports to China reaching approximately 27.9 million tonnes in 2023.

Despite this recovery, Yancoal remains exposed to the risk of future trade disputes or changes in energy security strategies by its major customers. However, a counterbalancing factor is the ongoing global focus on energy security, which could drive demand for reliable coal suppliers like Yancoal from both Asian and European nations seeking stable energy sources.

The Australian mining sector navigates a shifting regulatory environment, with environmental approvals and ESG considerations frequently subject to policy updates. For instance, Western Australia's Environmental Protection Act Amendment Bill 2024 seeks to expedite approvals through parallel decision-making, potentially shortening project timelines.

Conversely, proposed federal reforms to the Environment Protection Australia (EPA) and EPBC Act might introduce more complex compliance requirements. This dual dynamic of streamlining and adding layers of regulation creates an element of uncertainty for Yancoal's future projects and expansion plans, impacting investment decisions and operational planning.

Carbon Pricing and Emission Reduction Schemes

The Australian government's Safeguard Mechanism reforms, effective from July 1, 2023, place declining emissions baselines on the country's largest industrial emitters, including mining operations. This directly impacts companies like Yancoal by creating a financial incentive to lower their carbon footprint or incur costs through purchasing carbon credits. For instance, under the mechanism, facilities are required to reduce their emissions intensity, with baselines set to decline by 4.3% per year from 2023-24 to 2029-30.

These changes are forcing mining firms to re-evaluate their operational strategies and consider investments in technologies that can reduce greenhouse gas emissions. The increasing focus on carbon pricing mechanisms means that emissions are no longer a purely operational cost but a quantifiable financial liability. This shift is crucial as Australia aims to meet its enhanced Nationally Determined Contribution (NDC) of a 43% reduction in emissions below 2005 levels by 2030.

Furthermore, the upcoming mandatory climate-related financial disclosures, expected to commence for the 2024-25 financial year, will require companies to transparently report their climate-related risks and opportunities. This regulatory push will likely compel Yancoal and its peers to more rigorously quantify and manage their carbon exposure, potentially influencing capital allocation towards greener technologies and practices.

- Safeguard Mechanism Reforms: Declining emissions baselines for large emitters, impacting operational costs and investment in abatement technologies.

- Carbon Credit Costs: Companies must either reduce emissions or purchase credits, introducing a direct financial cost for carbon output.

- Mandatory Climate Disclosures: Starting in 2025, companies will be required to report climate risks and opportunities, increasing transparency and accountability.

- National Emissions Target: Australia's commitment to a 43% emissions reduction by 2030 drives these policy changes.

Indigenous Land Rights and Social License to Operate

The Australian mining sector, including companies like Yancoal, faces significant challenges navigating Indigenous land rights and securing a social license to operate. Recent policy developments in 2024 and early 2025 are increasingly prioritizing Indigenous community involvement in decisions impacting resource extraction. This necessitates proactive engagement from Yancoal, respecting cultural heritage and aligning operations with evolving societal expectations, which can influence project schedules and operational expenditures.

Yancoal's ability to maintain its social license is directly tied to its commitment to Indigenous engagement. For instance, in 2024, several Australian mining projects experienced delays due to disputes over land use and heritage protection, highlighting the financial implications of inadequate consultation. Yancoal must therefore demonstrate tangible benefits and genuine partnership with Traditional Owners to ensure smooth operations and mitigate potential disruptions.

- 2024 Data Point: The average time for securing Indigenous land use agreements in Australia has reportedly increased by 15% in the past two years, reflecting growing complexity and community expectations.

- 2025 Projection: Analysts predict that companies with strong Indigenous engagement strategies will likely see a 5-10% reduction in project approval times compared to peers with weaker relationships.

- Operational Impact: Failure to secure a social license can lead to protests, legal challenges, and operational shutdowns, potentially costing millions in lost revenue and remediation.

- Strategic Imperative: Yancoal's investment in community development programs and cultural awareness training for staff is crucial for fostering trust and long-term viability.

Australia's commitment to net-zero by 2050, with a 43% emissions reduction target by 2030, shapes Yancoal's operating environment. The Safeguard Mechanism reforms, effective July 2023, impose declining emissions baselines on major emitters, requiring Yancoal to reduce its carbon footprint or incur costs for carbon credits, with baselines set to fall 4.3% annually through FY30.

Mandatory climate-related financial disclosures, beginning in FY25, will compel Yancoal to report climate risks and opportunities, likely influencing capital allocation towards lower-emission technologies. This policy direction is critical as Australia aims to meet its 2030 emissions reduction goal, making carbon a quantifiable financial liability for mining firms.

Yancoal's export focus means its performance is tied to international trade policies, with Australian thermal coal exports to China reaching approximately 27.9 million tonnes in 2023 following the lifting of informal import restrictions. However, ongoing global energy security concerns could also drive demand for reliable coal suppliers like Yancoal from both Asian and European markets.

Navigating Indigenous land rights and social license is increasingly critical, with heightened focus on community involvement in resource extraction decisions in 2024-2025. Delays in securing Indigenous land use agreements have reportedly increased by 15% in the past two years, underscoring the financial implications of inadequate consultation for companies like Yancoal.

| Political Factor | Impact on Yancoal | Data/Trend |

| Emissions Reduction Targets & Safeguard Mechanism | Increased compliance costs, investment in abatement technologies, potential carbon credit expenses. | Australia's 2030 target: 43% reduction. Safeguard Mechanism baselines decline 4.3% annually (FY24-FY30). |

| Climate-Related Financial Disclosures | Enhanced transparency on climate risks, potential shift in capital allocation. | Mandatory disclosures commence FY25. |

| International Trade Relations (China) | Opportunity for increased exports, but risk of future trade disputes or policy changes. | Australian thermal coal exports to China: ~27.9 million tonnes in 2023. |

| Indigenous Land Rights & Social License | Potential project delays, increased operational expenditures, need for strong community engagement. | Reported 15% increase in time for Indigenous land use agreements (past 2 years). |

What is included in the product

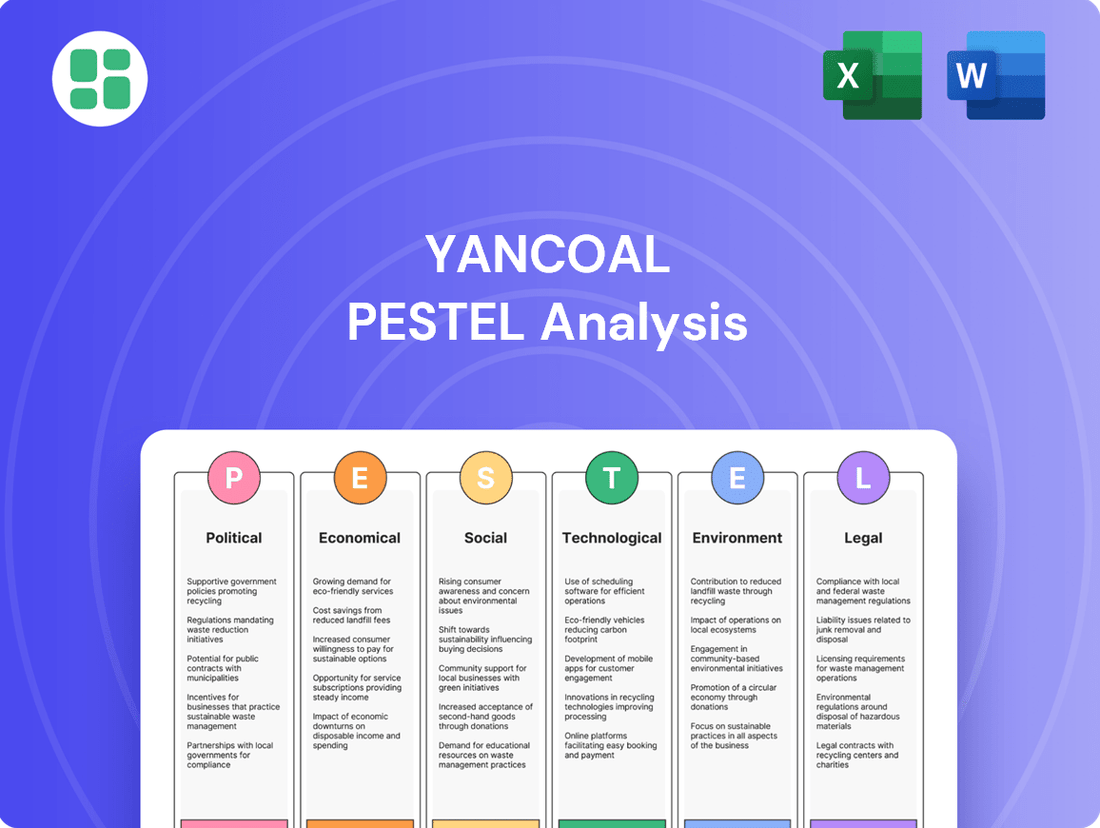

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Yancoal, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A PESTLE analysis for Yancoal provides a clear, summarized version of external factors, acting as a pain point reliever by enabling easy referencing during meetings and strategic planning.

This PESTLE analysis is visually segmented by PESTEL categories, offering quick interpretation and relieving the pain point of sifting through complex data during discussions on external risks and market positioning.

Economic factors

Yancoal's financial health is directly tied to the global appetite for coal and how much it costs. In 2024, global coal demand hit a record high, largely due to increased use in China and India. However, projections indicate this demand will likely stabilize in 2025 and 2026, with a possibility of a slight downturn afterward.

The company felt this impact in 2024, seeing a significant 24% drop in its average ex-mine coal selling price. This price volatility directly affects Yancoal's revenue, prompting the company to actively seek ways to lessen the impact of these market swings.

Australia's metallurgical coal export forecast for fiscal year 2024-25 has been revised upwards to 163 million metric tons, driven by favorable weather conditions and the expected ramp-up of new mining operations. This positive trend is anticipated to continue into 2025-26.

Despite the projected increase in export volumes, revenues are expected to see a downturn. This is primarily due to a decline in global market prices for coking coal, impacting overall revenue generation.

Yancoal reported attributable saleable coal production of 36.9 million tonnes in 2024. The company's forecast for fiscal 2025 remains flat, suggesting a strategic emphasis on maintaining operational stability in the face of prevailing price pressures.

Yancoal, like much of the coal industry, grapples with ongoing cost inflation. This is particularly evident in the rising prices of fuel, essential for mining operations, and increasing labor expenses as demand for skilled workers intensifies. Supply chain disruptions also continue to add to these operational costs, impacting everything from equipment maintenance to the transport of coal.

For Yancoal, effectively managing these escalating input costs is paramount to preserving its profitability and competitive edge. The company's success hinges on its capacity to maintain operational efficiency amidst these pressures. This focus on cost control is vital for Yancoal to navigate the inherent uncertainties within the global energy market and safeguard its cash operating margin.

In 2024, for instance, global energy prices, including coal, have remained volatile. While demand for coal as a transitional fuel continues, the cost of production has seen significant upward movement. For example, reports in early 2024 indicated a 15-20% increase in key operational expenses for many Australian coal producers compared to 2023 levels, directly impacting companies like Yancoal.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Yancoal, an Australian coal producer with substantial international sales. The Australian dollar (AUD) versus the US dollar (USD) exchange rate is a key factor. For instance, during the first half of 2024, the AUD experienced volatility, trading within a range that could affect Yancoal's export pricing and profitability when converted back to AUD.

A stronger AUD, relative to the USD, generally makes Yancoal's coal exports more expensive for international buyers, potentially dampening demand. Conversely, a weaker AUD enhances the company's revenue when export earnings in USD are translated back into its reporting currency. This dynamic is a constant financial management challenge for the company, influencing its cost structure and revenue streams in the global market.

- AUD/USD Performance: In early 2024, the AUD/USD rate saw fluctuations, with periods of strength impacting export competitiveness.

- Revenue Impact: A stronger AUD can reduce the AUD-denominated revenue Yancoal receives for its USD-priced coal sales.

- Cost Exposure: While revenues are exposed, some of Yancoal's operational costs might also be denominated in foreign currencies, creating a more complex hedging requirement.

- Financial Strategy: Managing currency risk through hedging strategies is a crucial element of Yancoal's financial planning to mitigate potential negative impacts.

Investment in Renewable Energy and Diversification

The global push towards renewable energy, bolstered by substantial government backing, presents a significant long-term hurdle for the coal sector. For instance, in 2024, many nations continued to announce ambitious renewable energy targets, with the International Energy Agency (IEA) projecting continued strong growth in solar and wind power capacity additions through 2025.

Yancoal is actively considering long-term strategies to navigate this changing energy environment. This includes exploring potential investments in alternative energy sources and diversifying its existing mining operations. Such a strategic shift is crucial for maintaining competitiveness in an economy increasingly focused on decarbonization and for mitigating the risks tied to a potential decline in coal demand, particularly in developed nations.

- Government Incentives: Many governments are offering tax credits and subsidies for renewable energy projects, accelerating their adoption.

- IEA Projections: The IEA anticipates record renewable capacity additions globally in 2024 and 2025, signaling a sustained shift away from fossil fuels.

- Yancoal's Strategy: The company is evaluating investments in non-coal assets and exploring diversification within its mining portfolio to adapt to market changes.

- Decarbonization Trend: The increasing global emphasis on reducing carbon emissions directly impacts the long-term viability of coal as a primary energy source.

Global economic growth is a primary driver for coal demand, influencing Yancoal's sales volumes and pricing. While 2024 saw record coal demand, projections for 2025 and 2026 suggest a stabilization or slight decline. This trend, coupled with a 24% drop in Yancoal's average ex-mine coal selling price in 2024, highlights the market's sensitivity to economic cycles and the company's need for strategies to mitigate price volatility.

Cost inflation, particularly for fuel and labor, significantly impacts Yancoal's operational expenses. In early 2024, Australian coal producers faced a 15-20% increase in key operational costs compared to 2023. Managing these escalating input costs is crucial for Yancoal to maintain profitability amidst fluctuating global energy prices and supply chain disruptions.

Currency fluctuations, specifically the AUD/USD exchange rate, directly affect Yancoal's revenue. A stronger AUD in early 2024 made Australian coal exports more expensive for international buyers, potentially reducing demand and impacting Yancoal's AUD-denominated earnings from USD-priced sales.

The accelerating global shift towards renewable energy, supported by government incentives and ambitious targets, poses a long-term challenge for coal producers like Yancoal. The IEA anticipates continued strong growth in solar and wind power capacity additions through 2025, prompting Yancoal to explore diversification and investments in alternative energy sources.

| Economic Factor | 2024 Impact/Trend | 2025 Outlook | Yancoal Relevance |

| Global Coal Demand | Record high in 2024 | Stabilization/slight decline | Directly impacts sales volume and pricing |

| Coal Prices | 24% drop in Yancoal's average ex-mine price (2024) | Continued volatility, potential downturn | Affects revenue and profitability |

| Operational Costs | 15-20% increase in key costs for Australian producers (early 2024) | Continued inflationary pressures | Impacts cash operating margin and competitiveness |

| AUD/USD Exchange Rate | Fluctuations impacting export competitiveness | Continued volatility expected | Affects AUD-denominated revenue from USD sales |

| Renewable Energy Growth | Strong capacity additions globally | Continued acceleration | Long-term threat to coal demand, drives diversification strategies |

Preview Before You Purchase

Yancoal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Yancoal PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a clear understanding of the external forces shaping Yancoal's business landscape, enabling informed decision-making and risk mitigation.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into market trends, regulatory changes, and competitive pressures relevant to Yancoal's global mining activities.

Sociological factors

Yancoal's social license to operate hinges on robust community relations, a critical factor given the inherent environmental and social footprint of coal mining. Maintaining trust requires open dialogue and proactive engagement to address concerns about noise, dust, and water management.

In 2023, Yancoal reported investing AUD $21.3 million in community contributions and local procurement, demonstrating a commitment to local economies through employment and development projects. This investment aims to foster goodwill and ensure continued community acceptance, which is crucial for securing necessary permits and maintaining operational continuity.

Yancoal plays a crucial role in regional Australian employment, creating jobs in areas where mining is a primary economic driver. For instance, as of early 2024, the Australian mining sector directly employed over 250,000 people, with Yancoal being a significant contributor to this figure, particularly in New South Wales and Queensland.

However, the mining industry, including Yancoal, is grappling with persistent labor shortages, especially for skilled positions needed to manage increasingly sophisticated mining technologies. This demand for specialized skills is a key challenge for workforce development.

The ongoing integration of automation and digitalization in mining operations necessitates a strategic focus on upskilling and reskilling Yancoal's existing workforce. This shift directly impacts local employment patterns, requiring proactive workforce planning to ensure the company and its employees can adapt to future operational needs.

Health and safety standards are absolutely critical in mining, and Yancoal is no exception. The company must strictly follow all regulations designed to keep its employees safe. This commitment is vital for maintaining a good reputation and ensuring operations run smoothly, especially as new technologies like automation are introduced.

A stark reminder of this necessity came with a fatality at one of Yancoal's mines in 2024, highlighting the ongoing importance of robust safety protocols and continuous improvement in this area.

Public Perception and Anti-Coal Sentiment

Growing global environmental concerns and the strong push for decarbonization are significantly increasing public and investor scrutiny of the coal industry. This rising anti-coal sentiment directly influences policy decisions, limits access to capital, and impacts the social acceptance of coal mining projects.

Yancoal must proactively address these perceptions by demonstrating robust sustainability practices and maintaining transparent reporting on its environmental, social, and governance (ESG) performance. For instance, as of early 2024, many institutional investors are divesting from coal assets due to these concerns, making it harder for companies like Yancoal to secure financing for new developments or expansions.

- Growing Decarbonization Pressure: Global efforts to limit warming to 1.5°C, as outlined in the Paris Agreement, put direct pressure on coal demand.

- Investor Divestment Trends: By the end of 2023, over $1 trillion in assets under management had been pledged to divest from coal by major financial institutions.

- Public Opinion Shift: Surveys in key markets, such as Australia and China, show increasing public support for renewable energy over coal power generation.

- Regulatory Uncertainty: The evolving landscape of climate policies and potential carbon taxes creates significant uncertainty for long-term coal investments.

Corporate Social Responsibility (CSR) Initiatives

Yancoal's dedication to Environmental, Social, and Governance (ESG) principles is a significant sociological factor, directly influencing investor confidence and its social license to operate. The company's commitment extends beyond mere environmental adherence, encompassing vital community engagement and ethical business conduct.

These initiatives are crucial for Yancoal's long-term sustainability and market appeal. For instance, in their 2023 Sustainability Report, Yancoal highlighted investments in community development projects and educational programs, demonstrating a tangible commitment to social well-being.

- Community Investment: Yancoal's focus on local community development programs aims to foster positive relationships and contribute to regional prosperity.

- Educational Support: Investments in education and training initiatives demonstrate a commitment to human capital development within the communities where Yancoal operates.

- Ethical Supply Chains: Ensuring ethical practices throughout its supply chain is paramount for maintaining stakeholder trust and a strong corporate reputation.

- ESG Reporting: The transparency in their annual sustainability reports, detailing these CSR efforts, is key to attracting socially conscious investors and meeting evolving societal expectations.

Sociological factors significantly shape Yancoal's operational environment, influencing its social license to operate and market perception. Public sentiment towards coal mining, driven by environmental concerns and a global push for decarbonization, directly impacts Yancoal's ability to secure investment and maintain community acceptance. The company's commitment to community engagement, demonstrated through substantial investments in local development and employment, is crucial for fostering positive relationships and ensuring long-term operational continuity.

| Sociological Factor | Impact on Yancoal | Supporting Data (2023-2024) |

|---|---|---|

| Community Relations & Social License | Essential for operational continuity and permit acquisition. | AUD $21.3 million invested in community contributions and local procurement. |

| Employment & Labor Market | Key contributor to regional economies, but facing skilled labor shortages. | Australian mining sector employed over 250,000 people; Yancoal a significant employer. Skilled position demand remains high. |

| Health & Safety Standards | Critical for reputation and operational integrity, especially with new technologies. | A fatality at a Yancoal mine in 2024 underscored the ongoing importance of robust safety protocols. |

| Public Opinion & ESG Scrutiny | Growing anti-coal sentiment affects investor confidence and capital access. | Over $1 trillion in assets pledged to divest from coal by end of 2023; increasing public support for renewables. |

Technological factors

Yancoal, operating within the Australian mining sector, is actively embracing automation and robotics. This strategic adoption is driven by the need to boost efficiency and safety across its operations. For instance, the integration of autonomous haul trucks and advanced remote control systems is becoming increasingly common, aiming to streamline complex mining tasks.

These technological advancements are projected to significantly impact the industry's economic landscape. Estimates suggest that by 2030, automation and robotics could contribute substantially to the Australian economy, creating new roles focused on managing and maintaining these sophisticated systems. Yancoal's investment in these areas positions it to capitalize on these future economic benefits.

By leveraging these cutting-edge technologies, Yancoal can achieve greater optimization in its mining processes. This includes enhancing productivity and, crucially, reducing overall operational costs, thereby improving its competitive standing in the global market.

Data analytics and AI are revolutionizing mining. Yancoal can boost efficiency from exploration to processing by adopting these tools. This leads to smarter decisions, better resource use, and less downtime.

Continuous advancements in mining techniques and equipment, such as high-output axial fans for ventilation and other specialized machinery, are crucial for boosting productivity and safety. Yancoal's strategic investment in these cutting-edge technologies can offer a significant competitive edge.

By adopting advanced extraction methods and energy-efficient machinery, Yancoal can increase output, lower energy consumption, and enhance safety across both its open-cut and underground mining operations. For instance, in 2023, Yancoal reported a 7% increase in saleable coal production to 32.4 million tonnes, partly attributed to operational efficiencies driven by technological upgrades.

Electrification of Mining Fleets and Infrastructure

The mining industry is increasingly focused on decarbonization, driving a significant push towards electrifying mine fleets and infrastructure. This transition, while requiring substantial capital outlay, promises to reduce dependence on diesel, cut operational emissions, and enhance air quality within mining environments. Yancoal must proactively evaluate and potentially invest in the necessary electric vehicle charging infrastructure and advanced battery storage systems to remain aligned with overarching sustainability mandates.

This technological shift impacts operational costs and strategic planning. For instance, companies are exploring battery-electric haul trucks, which can offer lower running costs compared to diesel equivalents due to reduced fuel and maintenance expenses. By 2024, several major mining equipment manufacturers are expected to have commercial-grade electric or hybrid large-capacity haul trucks available, signaling a tangible market readiness for this transformation. Yancoal's strategic response will involve assessing the total cost of ownership, including the upfront investment in new equipment and the development of charging and maintenance facilities.

- Electrification Investment: The capital expenditure for electrifying mining fleets and associated infrastructure represents a significant technological and financial undertaking for companies like Yancoal.

- Operational Benefits: Transitioning to electric vehicles can lead to substantial reductions in greenhouse gas emissions and local air pollutants, improving environmental performance and worker health.

- Infrastructure Needs: Developing robust charging stations and reliable power grids at remote mine sites is a critical prerequisite for successful fleet electrification, requiring careful planning and investment.

- Market Trends: By 2025, the availability of commercially viable electric mining equipment is projected to increase, creating both opportunities and competitive pressures for early adopters.

Cybersecurity and Data Security

The increasing digitalization of mining operations, including Yancoal's, makes cybersecurity a paramount technological concern. Protecting operational technology (OT) systems and sensitive data from cyber threats is crucial for maintaining operational continuity and preventing costly disruptions.

Cyberattacks can lead to significant financial losses and reputational damage. For instance, a report by IBM in 2023 indicated that the average cost of a data breach in the industrial sector reached $4.5 million. Yancoal must therefore invest in advanced cybersecurity measures to safeguard its interconnected systems and proprietary information.

- Cybersecurity Investments: Yancoal needs to allocate substantial resources towards robust cybersecurity infrastructure and ongoing threat detection.

- Data Protection: Implementing stringent data security protocols is essential to prevent unauthorized access and protect sensitive operational and financial data.

- Operational Resilience: Ensuring the security of OT systems is vital to prevent cyber-induced shutdowns and maintain uninterrupted production, a key factor for companies like Yancoal operating in a competitive global market.

Technological advancements are reshaping Yancoal's operational landscape, with a significant focus on automation and electrification. By 2024, the mining industry is seeing a greater availability of electric and hybrid haul trucks, driving down operational costs through reduced fuel and maintenance needs. Yancoal's strategic investments in these areas, including infrastructure for electric fleets, are critical for enhancing efficiency and sustainability, positioning the company for future growth and cost savings.

Legal factors

Yancoal navigates a multifaceted legal landscape in Australia, governed by federal and state mining and resources legislation. These regulations dictate crucial aspects of its operations, including the acquisition of exploration licenses and mining leases, the permissible rates of resource extraction, and the imposition of royalties. For instance, the royalty rates can vary significantly between states, impacting the profitability of specific mining sites.

Any shifts in these legislative frameworks can have a direct and substantial effect on Yancoal's ability to operate, its financial commitments, and its future growth strategies. For example, changes to environmental protection laws or native title agreements could necessitate costly operational adjustments or even halt expansion projects, as seen with past regulatory reviews impacting project timelines.

Yancoal operates under a rigorous environmental legal framework, including the federal Environment Protection and Biodiversity Conservation (EPBC) Act and various state-specific environmental regulations. These laws dictate how mining operations must manage their impact on land, water, and air quality.

Upcoming legislative changes, such as the proposed Nature Positive Bill and the potential establishment of a federal Environmental Protection Agency (EPA), signal a trend towards heightened environmental scrutiny. These reforms could translate into more demanding compliance obligations for Yancoal and may introduce new restrictions on mining operations, particularly in ecologically sensitive regions.

Australia's Climate Change Act 2022 sets ambitious goals, aiming for a 43% emissions reduction by 2030 and net-zero by 2050. This legislation, along with reforms to the Safeguard Mechanism, directly impacts major emitters like Yancoal by imposing compliance obligations.

Yancoal must navigate these requirements, which could mean investing in new technologies to cut emissions or acquiring carbon credits, potentially influencing its operational costs and strategic planning significantly in the coming years.

Occupational Health and Safety (OHS) Laws

Yancoal, as a significant coal producer, operates under stringent Occupational Health and Safety (OHS) laws. These regulations are paramount for safeguarding its workforce, a core responsibility for any mining operation. Recent events, including a fatality in early 2024, underscore the non-negotiable importance of rigorous OHS compliance.

Adherence to these legal frameworks involves continuous efforts in areas such as:

- Regular safety audits and inspections

- Comprehensive employee safety training programs

- Thorough incident reporting and investigation procedures

- Investment in safety technology and equipment

Failure to comply can result in severe penalties, reputational damage, and jeopardizing the company's social license to operate. Maintaining a safe working environment is therefore not just a legal requirement but a fundamental aspect of Yancoal's operational integrity and its commitment to its employees.

Corporate Governance and Disclosure Requirements

Yancoal's status as a dual-listed entity on the Australian Securities Exchange (ASX) and the Hong Kong Stock Exchange (HKEx) mandates adherence to rigorous corporate governance and disclosure standards. This means the company must provide timely and transparent updates on its financial results, strategic direction, and environmental, social, and governance (ESG) performance. For instance, Yancoal's 2023 Annual Report, released in March 2024, details its compliance with these obligations.

These disclosure obligations extend to sustainability reporting, with Yancoal aligning its practices with Australian Sustainability Reporting Standards (ASRS) and increasingly incorporating elements of international frameworks such as the International Sustainability Standards Board (ISSB) standards, specifically IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures). This commitment to robust reporting aims to bolster accountability and foster greater investor confidence in the company's operations and future prospects.

- ASX Listing Rule Compliance: Yancoal must adhere to the continuous disclosure obligations of the ASX, ensuring all material information is released to the market promptly.

- HKEx Listing Rule Compliance: Similarly, the company must meet the disclosure requirements stipulated by the HKEx, including the publication of quarterly and annual reports.

- Sustainability Reporting: Yancoal's commitment to ESG is reflected in its sustainability reports, which are increasingly benchmarked against global standards like ISSB.

- Investor Confidence: Transparent and comprehensive disclosures are crucial for maintaining and enhancing the trust of its diverse shareholder base.

Yancoal's operations are heavily influenced by Australian federal and state mining laws, which govern everything from exploration permits to royalty payments, with state-specific rates impacting profitability. Future legislative shifts, particularly concerning environmental protection and native title, could necessitate costly operational changes or even halt project expansions, as demonstrated by past regulatory reviews affecting project timelines.

Environmental factors

The global push to combat climate change represents the most critical environmental challenge for Yancoal. Governments worldwide, including Australia's commitment to a 43% emissions reduction by 2030 and net-zero by 2050, are actively steering economies away from fossil fuels.

This transition directly impacts Yancoal by creating significant long-term uncertainty regarding coal demand. Consequently, the company faces increasing pressure to implement more sustainable operational practices and actively explore viable decarbonization strategies to adapt to evolving market expectations and regulatory landscapes.

Coal mining, including Yancoal's operations, significantly consumes water. In 2023, Australian coal mines collectively used an estimated 160,000 megalitres of water, with a substantial portion attributed to dust suppression and processing. Yancoal's reliance on water resources, especially in regions like New South Wales which experienced below-average rainfall in early 2024, makes it vulnerable to water scarcity and stringent management regulations.

The company's commitment to water stewardship is crucial. Yancoal reported in its 2023 Sustainability Report that it aims to reduce its reliance on fresh water by increasing water recycling rates. For instance, their Moolarben operation achieved a 90% recycled water usage rate for its coal processing in 2023, demonstrating a proactive approach to mitigating scarcity risks and environmental impact.

Mining operations inherently affect local ecosystems, potentially impacting biodiversity. Yancoal, like other resource companies, must undertake rigorous environmental impact assessments and develop comprehensive plans to protect biodiversity and rehabilitate mined land after operations cease.

In 2023, Yancoal reported rehabilitation expenditure of A$46 million, reflecting their commitment to environmental stewardship. Successful rehabilitation is not just a regulatory requirement but also a critical factor in securing ongoing environmental approvals and maintaining social license to operate.

Emissions and Air Quality Management

Coal mining inherently produces atmospheric emissions, such as dust and greenhouse gases, directly impacting air quality. Yancoal's commitment to managing these emissions is crucial for meeting stringent air quality standards and aligning with national and international emission reduction goals. For instance, in 2023, Yancoal reported its Scope 1 and Scope 2 emissions, a key metric for environmental performance.

Effective management strategies are vital. These include the implementation of robust dust suppression techniques across its mining sites and the exploration and adoption of technologies aimed at reducing greenhouse gas emissions from its operational activities. This proactive approach is essential for Yancoal's long-term sustainability and regulatory compliance.

- Emissions Generation: Coal mining operations release dust and greenhouse gases into the atmosphere.

- Regulatory Compliance: Yancoal must adhere to air quality standards and contribute to emission reduction targets.

- Mitigation Strategies: Implementing dust suppression and exploring technologies for Scope 1 and Scope 2 emission reduction are key.

- 2023 Performance: Yancoal's 2023 sustainability reports detail its emission performance and management efforts.

Waste Management and Tailings Storage

Yancoal, like all major coal producers, faces significant environmental challenges related to waste management, particularly the handling of tailings and overburden. These materials are byproducts of the mining process and require careful management to prevent environmental harm. Strict regulatory frameworks govern their disposal and the design of tailings storage facilities, aiming to ensure long-term stability and prevent contamination of soil and water resources.

In 2023, Yancoal reported significant efforts in managing its waste streams. For instance, the company's environmental performance reports detail ongoing rehabilitation activities at its mines, which include progressive backfilling and capping of waste rock emplacements. These actions are crucial for mitigating the environmental footprint associated with waste generation and storage.

Responsible waste management is not just a regulatory requirement but a core component of Yancoal's environmental strategy. The company's commitment to best practices in tailings storage, including ongoing monitoring and maintenance of its facilities, is vital for maintaining its social license to operate and for demonstrating accountability in its environmental stewardship.

- Tailings Management: Yancoal manages large volumes of tailings, requiring robust containment and monitoring systems to prevent leakage and environmental impact.

- Overburden Disposal: The safe and stable disposal of overburden, the material overlying the coal seam, is critical for mine site rehabilitation and long-term landform stability.

- Regulatory Compliance: Adherence to stringent environmental regulations, such as those pertaining to water quality and land disturbance, is paramount for Yancoal's operations.

- Rehabilitation Efforts: The company actively engages in progressive rehabilitation of disturbed land, including waste disposal areas, as part of its commitment to environmental restoration.

The global shift towards decarbonization presents a significant environmental challenge for Yancoal, impacting long-term coal demand and necessitating sustainable operational adjustments. Australia's commitment to emission reductions by 2030 and net-zero by 2050 underscores this transition.

Water scarcity is a key concern, with Australian coal mines using approximately 160,000 megalitres in 2023. Yancoal's Moolarben operation achieved a 90% recycled water usage rate in 2023, showcasing efforts to mitigate water dependency.

Yancoal's environmental stewardship is evident in its 2023 rehabilitation expenditure of A$46 million. Managing atmospheric emissions, including dust and greenhouse gases, is also critical, with the company reporting its Scope 1 and Scope 2 emissions for 2023.

Waste management, particularly tailings and overburden, requires careful handling and adherence to strict regulations. Yancoal's progressive rehabilitation efforts, including backfilling waste rock emplacements, demonstrate a commitment to minimizing its environmental footprint.

| Environmental Factor | Yancoal's Focus/Challenge | 2023 Data/Action |

|---|---|---|

| Climate Change & Emissions | Long-term demand uncertainty due to decarbonization; managing Scope 1 & 2 emissions. | Australia's 2030 emission reduction target; Yancoal reported emissions data. |

| Water Management | Vulnerability to water scarcity; need for efficient water use. | Australian coal mines used ~160,000 ML in 2023; Moolarben achieved 90% recycled water usage. |

| Biodiversity & Land Use | Impact on local ecosystems; need for rehabilitation. | A$46 million rehabilitation expenditure reported. |

| Waste Management | Handling tailings and overburden; regulatory compliance. | Progressive rehabilitation of waste disposal areas. |

PESTLE Analysis Data Sources

Our Yancoal PESTLE analysis is built on comprehensive data from official government publications, leading financial institutions, and reputable industry research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible, up-to-date information.