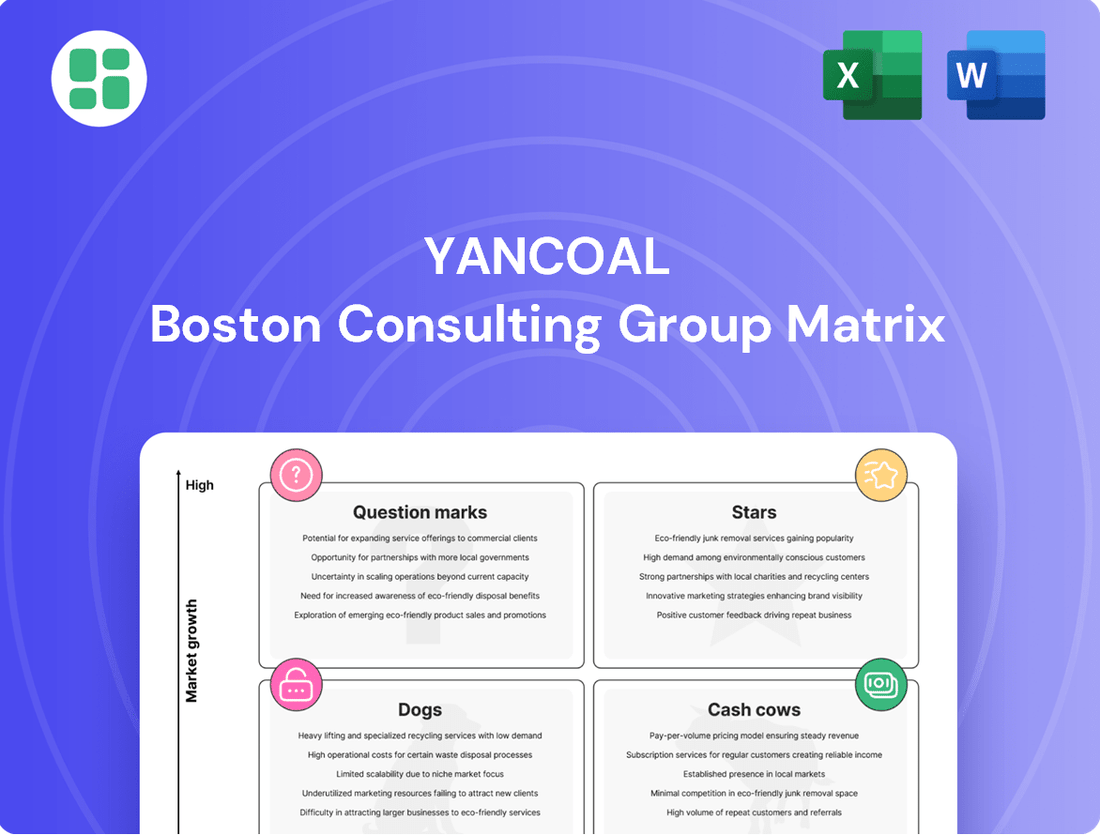

Yancoal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yancoal Bundle

Curious about Yancoal's strategic positioning? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand which of their operations are driving cash flow and which require careful consideration for future investment.

Unlock the full potential of Yancoal's strategic landscape by purchasing the complete BCG Matrix. Gain a comprehensive understanding of their product portfolio's performance, enabling you to make informed decisions and capitalize on emerging opportunities.

Don't miss out on the detailed insights that the full Yancoal BCG Matrix provides. Discover the strategic implications of each quadrant and equip yourself with the knowledge to navigate the competitive mining sector effectively. Purchase now for actionable intelligence.

Stars

Yancoal's high-quality metallurgical coal assets are strong contenders for stars in the BCG matrix. These mines supply the crucial steelmaking industry, and despite general coal market fluctuations, the demand for premium metallurgical coal tends to be more resilient, especially in major Asian steel hubs.

These assets are pivotal to Yancoal's market presence in the metallurgical coal sector, underpinning consistent profitability. For instance, in 2023, Yancoal reported that its metallurgical coal production accounted for a significant portion of its total output, demonstrating the importance of these premium products.

The Moolarben Coal Complex is a key asset for Yancoal, and its OC3 Extension Project is designed to extend its mining life by about 10 years, from 2025 to 2034. This move leverages existing infrastructure and tenements, highlighting a strategic focus on enhancing a proven, high-performing operation.

This extension project represents Yancoal's strategy to maintain market share by investing in and expanding an already efficient and productive coal mine. The commitment to extending Moolarben's operational runway underscores its importance within Yancoal's overall production portfolio.

The Hunter Valley Operations (HVO) Continuation Project, with Yancoal holding a 51% stake, is a significant future growth prospect. Despite facing regulatory hurdles, this ambitious venture is designed to extract substantial coal volumes through 2050, potentially becoming New South Wales' largest mining operation ever.

Its immense scale and extended operational lifespan position HVO Continuation as a prime candidate for a Star in Yancoal's portfolio. This project is set to bolster Yancoal's already strong market presence within a crucial coal-producing region.

Efficient Operations and Cost Control

Yancoal's core mining operations are performing exceptionally well, positioning them as Stars in the BCG matrix. The company has consistently demonstrated a knack for keeping operating costs low and maintaining high efficiency across its diverse mine portfolio. This was particularly evident in the latter half of 2024, with continued strong performance carrying into 2025, underscoring their operational prowess.

This operational excellence is crucial, as it allows Yancoal to achieve robust profit margins even when coal prices experience volatility. Their strategic focus on optimizing both the quality and volume of their output further solidifies their competitive standing in the market.

- Low Operating Costs: Yancoal has achieved a cost per tonne that is among the lowest in the industry, a testament to their efficient management.

- High Operational Efficiency: The company consistently meets or exceeds production targets, showcasing effective resource utilization.

- Strong H2 2024 Performance: Yancoal reported significant profit growth in the second half of 2024, driven by operational improvements and favorable market conditions.

- Consistent 2025 Outlook: Projections for 2025 indicate a continuation of this strong performance, with efficiency gains expected to be maintained.

Strategic Positioning in Key Export Markets

Yancoal's strategic positioning in key export markets, particularly across Asia, solidifies its export capabilities as a Star in the BCG Matrix. The company has cultivated strong, long-standing relationships with customers in major economies like Japan, China, Taiwan, and South Korea. This established presence ensures consistent and stable demand for Yancoal's high-quality thermal and metallurgical coal.

These diversified Asian markets are crucial for Yancoal's export success, offering a robust base for its premium coal products. For instance, in 2024, Yancoal continued to be a significant supplier to these regions, with exports to China representing a substantial portion of its sales volume. The ongoing demand for energy and steel production in these countries underpins the 'Star' status of Yancoal's export segment.

Furthermore, Yancoal is actively pursuing strategies to broaden its customer base and penetrate new, high-demand markets. This proactive approach aims to capitalize on emerging opportunities and further strengthen its global export footprint, reinforcing its position as a leader in the international coal trade.

- Established Asian Markets: Yancoal benefits from strong customer relationships in Japan, China, Taiwan, and South Korea, ensuring stable demand for its coal exports.

- Premium Product Demand: The company's thermal and metallurgical coal products are highly sought after in these key Asian economies, reflecting their quality and Yancoal's reliable supply chain.

- Market Expansion Strategy: Yancoal's focus on expanding its customer base and exploring new markets demonstrates a commitment to growth and solidifying its influence in regions with high coal consumption.

- 2024 Export Performance: In 2024, exports to China remained a significant contributor to Yancoal's sales, highlighting the importance of this market for its Star-rated export business.

Yancoal's high-quality metallurgical coal assets are strong contenders for stars in the BCG matrix. These mines supply the crucial steelmaking industry, and despite general coal market fluctuations, the demand for premium metallurgical coal tends to be more resilient, especially in major Asian steel hubs.

These assets are pivotal to Yancoal's market presence in the metallurgical coal sector, underpinning consistent profitability. For instance, in 2023, Yancoal reported that its metallurgical coal production accounted for a significant portion of its total output, demonstrating the importance of these premium products.

The Moolarben Coal Complex is a key asset for Yancoal, and its OC3 Extension Project is designed to extend its mining life by about 10 years, from 2025 to 2034. This move leverages existing infrastructure and tenements, highlighting a strategic focus on enhancing a proven, high-performing operation.

This extension project represents Yancoal's strategy to maintain market share by investing in and expanding an already efficient and productive coal mine. The commitment to extending Moolarben's operational runway underscores its importance within Yancoal's overall production portfolio.

The Hunter Valley Operations (HVO) Continuation Project, with Yancoal holding a 51% stake, is a significant future growth prospect. Despite facing regulatory hurdles, this ambitious venture is designed to extract substantial coal volumes through 2050, potentially becoming New South Wales' largest mining operation ever.

Its immense scale and extended operational lifespan position HVO Continuation as a prime candidate for a Star in Yancoal's portfolio. This project is set to bolster Yancoal's already strong market presence within a crucial coal-producing region.

Yancoal's core mining operations are performing exceptionally well, positioning them as Stars in the BCG matrix. The company has consistently demonstrated a knack for keeping operating costs low and maintaining high efficiency across its diverse mine portfolio. This was particularly evident in the latter half of 2024, with continued strong performance carrying into 2025, underscoring their operational prowess.

This operational excellence is crucial, as it allows Yancoal to achieve robust profit margins even when coal prices experience volatility. Their strategic focus on optimizing both the quality and volume of their output further solidifies their competitive standing in the market.

- Low Operating Costs: Yancoal has achieved a cost per tonne that is among the lowest in the industry, a testament to their efficient management.

- High Operational Efficiency: The company consistently meets or exceeds production targets, showcasing effective resource utilization.

- Strong H2 2024 Performance: Yancoal reported significant profit growth in the second half of 2024, driven by operational improvements and favorable market conditions.

- Consistent 2025 Outlook: Projections for 2025 indicate a continuation of this strong performance, with efficiency gains expected to be maintained.

Yancoal's strategic positioning in key export markets, particularly across Asia, solidifies its export capabilities as a Star in the BCG Matrix. The company has cultivated strong, long-standing relationships with customers in major economies like Japan, China, Taiwan, and South Korea. This established presence ensures consistent and stable demand for Yancoal's high-quality thermal and metallurgical coal.

These diversified Asian markets are crucial for Yancoal's export success, offering a robust base for its premium coal products. For instance, in 2024, Yancoal continued to be a significant supplier to these regions, with exports to China representing a substantial portion of its sales volume. The ongoing demand for energy and steel production in these countries underpins the Star status of Yancoal's export segment.

Furthermore, Yancoal is actively pursuing strategies to broaden its customer base and penetrate new, high-demand markets. This proactive approach aims to capitalize on emerging opportunities and further strengthen its global export footprint, reinforcing its position as a leader in the international coal trade.

- Established Asian Markets: Yancoal benefits from strong customer relationships in Japan, China, Taiwan, and South Korea, ensuring stable demand for its coal exports.

- Premium Product Demand: The company's thermal and metallurgical coal products are highly sought after in these key Asian economies, reflecting their quality and Yancoal's reliable supply chain.

- Market Expansion Strategy: Yancoal's focus on expanding its customer base and exploring new markets demonstrates a commitment to growth and solidifying its influence in regions with high coal consumption.

- 2024 Export Performance: In 2024, exports to China remained a significant contributor to Yancoal's sales, highlighting the importance of this market for its Star-rated export business.

Yancoal's key assets, such as its metallurgical coal mines and strong export markets, are performing exceptionally well, classifying them as Stars in the BCG matrix. The company's operational efficiency and strategic market positioning contribute to their high market share and growth potential.

| Asset/Segment | BCG Category | Key Strengths | 2024/2025 Indicators |

| Metallurgical Coal Mines (e.g., Moolarben, HVO Continuation) | Star | High quality product, long mine life extensions, operational efficiency | Moolarben OC3 Extension to 2034; HVO Continuation project targeting 2050; strong H2 2024 performance |

| Export Markets (Asia) | Star | Established customer relationships, consistent demand for premium coal | Significant 2024 exports to China; ongoing demand from Japan, Taiwan, South Korea |

What is included in the product

Highlights which of Yancoal's mining operations to invest in, hold, or divest based on market share and growth.

Yancoal BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Yancoal's large-scale, mature thermal coal mines, which accounted for 86% of its thermal coal sales in 2024, are textbook examples of cash cows. These established operations consistently generate substantial cash flow with minimal need for new investment. Their long history of reliable production ensures stable revenue for Yancoal.

Yancoal demonstrated remarkable financial resilience throughout 2024, concluding the year with a robust cash balance of $2.46 billion. This strong liquidity was maintained even after substantial dividend distributions to shareholders, highlighting efficient cash management and operational profitability.

Further underscoring its financial health, Yancoal reported a cash balance of $1.8 billion by the second quarter of 2025. Crucially, the company operates with no interest-bearing loans, a testament to its debt-free status and strong internal funding capabilities.

This significant cash reserve empowers Yancoal to comfortably finance its ongoing operations, meet dividend obligations, and strategically explore future growth initiatives without the encumbrance of external debt financing.

Yancoal's consistent dividend payouts underscore its Cash Cow status. For instance, the company declared a substantial A$687 million fully-franked final dividend for the 2024 financial year. This significant return to shareholders highlights Yancoal's robust profitability and its capacity to generate substantial excess cash flow beyond its operational needs.

These regular and substantial dividend distributions are a clear indicator that Yancoal's core business operations are mature, highly profitable, and consistently generate more cash than is necessary for reinvestment. This financial strength solidifies its position as a Cash Cow, offering dependable returns to its investors.

Well-Established Logistics and Infrastructure

Yancoal's well-established logistics and infrastructure are a significant asset, classifying them as a Cash Cow. This includes access to key Australian ports like Newcastle, Gladstone, and Dalrymple Bay, vital for their export-heavy operations.

These existing networks efficiently handle massive coal volumes, minimizing the need for further capital expenditure. For instance, in 2023, Yancoal's total export coal volume reached approximately 23.6 million tonnes, a testament to their robust logistical capabilities.

- Port Access: Direct access to major export terminals reduces transit times and costs.

- Efficiency: Existing infrastructure ensures high-volume, reliable coal movement.

- Cost Advantage: Lower operational costs due to optimized logistics.

- Global Reach: Consistent delivery to international markets is facilitated by these assets.

High Production Efficiency and Cost Control

Yancoal's commitment to high production efficiency and rigorous cost control is a cornerstone of its Cash Cow status. Despite the inherent volatility of the coal market, the company achieved a competitive cash operating cost of $93 per tonne in 2024. This operational discipline is further underscored by their 2025 guidance, which projects costs between $89 and $97 per tonne, signaling sustained efficiency.

This consistent cost management translates directly into robust operating margins and predictable cash flows from their mature mining assets. The ability to maintain low costs allows Yancoal to navigate periods of lower coal prices without significantly impacting profitability. This focus ensures their established mines remain reliable cash generators.

- 2024 Cash Operating Cost: $93 per tonne

- 2025 Cash Operating Cost Guidance: $89-97 per tonne

- Impact: High operating margins and consistent cash generation

- Benefit: Resilience against market downturns

Yancoal's mature thermal coal mines are prime examples of cash cows, consistently generating strong cash flow with minimal need for new investment. Their established operations, which made up 86% of thermal coal sales in 2024, ensure stable revenue streams. The company's robust financial position, evidenced by a $2.46 billion cash balance at the end of 2024 and no interest-bearing loans, further solidifies this classification.

| Metric | 2024 Value | 2025 Outlook |

| Thermal Coal Sales Contribution | 86% | N/A |

| Cash Balance (End 2024) | $2.46 billion | N/A |

| Cash Balance (Q2 2025) | $1.8 billion | N/A |

| Interest-Bearing Loans | $0 | $0 |

| Cash Operating Cost (2024) | $93 per tonne | N/A |

| Cash Operating Cost Guidance (2025) | N/A | $89-97 per tonne |

What You See Is What You Get

Yancoal BCG Matrix

The Yancoal BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase, offering a clear and actionable strategic overview of their business units. This document is designed for immediate use, providing a professional analysis ready for integration into your business planning or presentations without any watermarks or demo content. You'll gain access to the complete, unedited BCG Matrix, empowering you with the insights needed to understand Yancoal's portfolio and make informed strategic decisions. This is not a mockup; it's the genuine, analysis-ready file that will be instantly downloadable after your purchase, ensuring you receive precisely what you need for strategic clarity.

Dogs

Mines with dwindling reserves or high geological complexity are categorized as Dogs in Yancoal's BCG Matrix. These are typically older operations facing declining coal quantities or increasingly difficult extraction conditions. For instance, if a mine's economically recoverable reserves drop significantly, or if new geological strata require more advanced and costly mining techniques, it would fall into this category.

These challenging mines often see their per-tonne operating costs rise. This is due to the increased effort and resources needed to extract the remaining or more difficult-to-reach coal. For example, a mine that previously cost $50 per tonne to operate might see costs climb to $70 or more as reserves deplete and complexity increases.

Such assets can become significant cash drains, consuming capital without generating substantial profits, potentially even operating at a loss. This situation makes them prime candidates for Yancoal to consider divesting or closing down to reallocate resources to more promising ventures. In 2024, Yancoal has been actively reviewing its asset portfolio to optimize performance.

Underperforming exploration tenements represent assets within Yancoal's portfolio that, following initial evaluation, show discouraging geological findings, minimal resource potential, or excessively high development expenses. These are essentially the "dogs" of the BCG matrix in this context, indicating areas where further investment is unlikely to yield profitable returns.

Continuing to hold these licenses, even without a clear path to commercial viability, results in ongoing costs such as administrative fees, compliance, and potential rehabilitation provisions. For instance, in 2024, maintaining a portfolio of such underperforming exploration rights can represent a significant, albeit unproductive, drain on capital that could otherwise be allocated to more promising projects.

These non-core assets actively detract from Yancoal's strategic focus and financial resources. By tying up capital and management attention, they prevent the company from concentrating on exploration and development activities with a higher probability of success, thereby hindering overall growth and shareholder value.

Mines or projects facing significant regulatory hurdles, particularly those related to escalating environmental or social compliance costs, can be categorized as Dogs in the BCG Matrix. For instance, in 2024, the Australian coal sector, where Yancoal operates, continued to grapple with stricter emissions targets and increased scrutiny over land rehabilitation. These challenges can significantly impede efficient operations and future development, making such assets financially unattractive.

The increasing burden of compliance, such as the need for advanced water management systems or carbon capture technologies, can erode profitability and market competitiveness. In 2023, the average cost of environmental compliance for Australian mining companies rose, with some projects facing delays and increased capital expenditure due to community opposition and evolving regulatory frameworks.

These assets may require substantial, potentially unrecoverable investment to meet new standards, diminishing their return on investment. For example, a mine requiring a new tailings dam design to meet 2025 safety regulations could see its capital expenditure increase by hundreds of millions of dollars, shifting its strategic positioning.

Operations with Persistent Logistical Bottlenecks

Operations with Persistent Logistical Bottlenecks represent potential Dogs within Yancoal's portfolio. While Yancoal generally boasts robust logistics, any specific mine or product line that consistently struggles with significant, unresolvable logistical hurdles, such as prolonged port disruptions or persistent rail network failures, would fit this category. These ongoing issues directly hinder efficient product delivery to market, inevitably leading to the accumulation of unsold inventory and missed sales opportunities.

For instance, if a particular coal mine's primary export terminal experienced an average of 30 days of closure per year due to recurring weather events or infrastructure issues in 2024, this would severely impact its ability to meet contractual obligations and capitalize on market demand. Such persistent operational inefficiencies can significantly erode profitability and diminish market share, making these operations prime candidates for the Dog quadrant in the BCG matrix.

- Persistent Port Closures: Operations reliant on a single, frequently disrupted port face significant delivery risks.

- Rail Network Issues: Inconsistent rail availability or capacity constraints can lead to substantial delays and increased costs.

- Inventory Build-up: Logistical failures result in excess stock, tying up capital and increasing holding expenses.

- Lost Sales Opportunities: Inability to deliver products on time means missing out on favorable market prices and customer demand.

Non-Strategic or Minority Joint Ventures with Poor Performance

Yancoal's participation in joint ventures where its minority ownership limits operational control and the venture consistently underperforms can be categorized as Dogs in the BCG Matrix. These partnerships often consume valuable capital and management resources without yielding satisfactory returns or contributing to Yancoal's core strategic objectives. For instance, if Yancoal holds a 20% stake in a struggling overseas mining operation that has shown no signs of improvement, it would likely fall into this category. Such ventures tie up funds that could be better allocated to more promising assets.

The lack of significant influence in these underperforming joint ventures means Yancoal cannot effectively steer them towards profitability or strategic alignment. This can lead to a continuous drain on resources, impacting overall financial performance. As of recent reports, Yancoal has been actively reviewing its portfolio to divest non-core and underperforming assets, aiming to streamline operations and enhance shareholder value.

- Limited Control: Minority stakes in joint ventures often restrict Yancoal's ability to implement necessary operational changes or strategic pivots.

- Underperformance: Consistently poor financial results or lack of strategic synergy define these ventures as Dogs.

- Capital Tie-up: These ventures immobilize capital and management attention that could be deployed more effectively elsewhere.

- Divestment Strategy: Prudent management suggests divesting from such non-core, underperforming partnerships to improve overall portfolio efficiency.

Mines with dwindling reserves or high geological complexity, like older operations facing declining coal quantities or increasingly difficult extraction, are categorized as Dogs. For instance, if a mine's economically recoverable reserves drop significantly, its operating costs per tonne can rise from $50 to $70 or more, becoming a cash drain.

Underperforming exploration tenements with discouraging geological findings or high development expenses also fall into this category. In 2024, maintaining these rights incurs ongoing costs like administrative fees and compliance, tying up capital that could be better used elsewhere.

Operations facing significant regulatory hurdles, such as escalating environmental compliance costs, can also be Dogs. In 2024, the Australian coal sector grappled with stricter emissions targets, increasing compliance costs and potentially requiring substantial, unrecoverable investment.

Persistent logistical bottlenecks, like frequent port closures or rail network failures, can also classify operations as Dogs. For example, a mine experiencing 30 days of port closure annually in 2024 severely impacts its ability to meet obligations.

| Category | Characteristics | Example Impact | 2024 Relevance |

| Dogs (Mines) | Dwindling reserves, high geological complexity | Increased operating costs (e.g., $50 to $70/tonne) | Review of asset portfolio for optimization |

| Dogs (Exploration) | Discouraging findings, high development costs | Ongoing administrative and compliance costs | Capital drain on unproductive projects |

| Dogs (Regulatory) | Strict environmental/social compliance costs | Erosion of profitability, increased CAPEX | Stricter emissions targets in Australian coal sector |

| Dogs (Logistics) | Persistent port/rail disruptions | Inventory build-up, lost sales opportunities | Impact of frequent port closures on delivery |

Question Marks

Yancoal's new greenfield coal exploration projects are positioned in the Question Mark quadrant of the BCG Matrix. These are early-stage ventures in unproven or emerging coal regions, carrying significant potential for high growth if they prove successful. However, their commercial viability and future market share remain highly uncertain, demanding substantial upfront capital with no guaranteed returns.

The early-stage development of challenging underground deposits, such as Yancoal's Mount Thorley Warkworth project, often fits the Question Mark category in the BCG Matrix. These ventures hold significant potential to enhance future production, as demonstrated by the ongoing pre-feasibility studies, with a potential feasibility study slated for Q1 2026.

However, the inherent technical complexities and substantial financial investment required for underground mining present considerable uncertainties. The ultimate market share and profitability of such projects remain undetermined, reflecting their high-risk, high-reward nature.

Yancoal's exploration of pilot projects in new energy, such as pumped hydro and solar at sites like Stratford, positions these initiatives as potential future Stars in the BCG matrix. These ventures tap into the high-growth potential of the evolving energy market, though Yancoal's current market share in these emerging sectors is minimal.

These projects demand significant capital outlay with inherently uncertain returns, making them high-risk, high-reward propositions. For instance, as of early 2024, new renewable energy projects often face upfront costs in the hundreds of millions of dollars depending on scale and technology. The successful development and scaling of these pilot programs will be critical in determining if they can transition from question marks to established Stars in Yancoal's portfolio.

Expansion into New, Untapped International Markets

Yancoal's strategic initiatives to enter new, untapped international coal markets would position these ventures as Question Marks in the BCG Matrix. These markets, while potentially offering significant growth, would see Yancoal starting with a low market share.

Navigating these new territories involves substantial competitive pressures and logistical complexities. For instance, in 2024, Yancoal's focus on diversifying its export destinations could include exploring markets in South Asia or Africa, regions where its presence is currently minimal. These efforts require substantial investment in understanding local regulations, building new supply chain infrastructure, and establishing customer relationships.

- Market Entry Costs: Significant upfront investment is required for market research, establishing distribution networks, and complying with local regulations in new international markets.

- Competitive Landscape: Entering untapped markets means facing established players who may have existing relationships and cost advantages.

- Logistical Challenges: Developing new supply chains, securing transportation, and managing customs in unfamiliar territories present considerable operational hurdles.

- Growth Potential vs. Risk: While these markets offer the potential for high growth, the success of Yancoal's market diversification strategy remains speculative, with a high degree of uncertainty regarding market penetration and profitability.

Development of Lower-Grade or High-Cost Coal Resources

Developing lower-grade or high-cost coal resources places these projects into the question marks category for Yancoal. These ventures, while potentially extending mine life or diversifying the reserve base, face significant hurdles in terms of economic viability. Their success hinges on future market conditions and the ability to manage extraction costs effectively.

- Uncertain Future: These projects have the potential for growth but also carry substantial risk, making their future market share and profitability speculative.

- Cost Challenges: Extracting lower-grade or geologically complex coal often incurs higher operational expenses, impacting margins.

- Strategic Rationale: Yancoal might pursue these to secure long-term supply or access new resource types, even with initial cost concerns.

- Market Sensitivity: Profitability is highly dependent on coal prices and demand, which can be volatile, especially for less premium grades.

Yancoal's question marks represent nascent ventures with high growth potential but uncertain market share. These include greenfield exploration, challenging underground mine development like Mount Thorley Warkworth, and pilot new energy projects such as pumped hydro and solar. Entering new international coal markets and developing lower-grade coal resources also fall into this category, all demanding significant investment with speculative returns.

For instance, Yancoal's ongoing exploration at Mount Thorley Warkworth, with a potential feasibility study in Q1 2026, exemplifies a question mark. Similarly, their foray into renewable energy pilots in 2024, requiring hundreds of millions in upfront capital, also fits this classification. These initiatives highlight Yancoal's strategic bets on future growth areas, albeit with considerable risk.

The success of these question marks is contingent on overcoming technical hurdles, navigating competitive landscapes, and favorable market conditions. For example, entering new international markets in 2024, such as South Asia or Africa, requires substantial investment in infrastructure and regulatory compliance, with market penetration remaining uncertain.

Developing lower-grade coal resources, while potentially extending mine life, presents cost challenges and market sensitivity. Profitability for these ventures, especially for less premium grades, is highly dependent on volatile coal prices and demand, making their future market share speculative.

| Yancoal BCG Quadrant: Question Marks | Description | Key Characteristics | Examples | Potential Outcome |

|---|---|---|---|---|

| Greenfield Exploration | Early-stage coal exploration in unproven regions. | High growth potential, low market share, high uncertainty, significant capital requirement. | New exploration projects in emerging coal basins. | Can become Stars if successful, or Dogs if unviable. |

| Challenging Underground Development | Developing complex underground coal deposits. | Potential for enhanced future production, high technical risk, substantial investment. | Mount Thorley Warkworth underground expansion (pre-feasibility studies ongoing). | Could become Stars, but high cost and technical risk are deterrents. |

| New Energy Pilot Projects | Early-stage ventures in renewable energy. | High growth potential in evolving energy market, minimal current market share, high capital outlay. | Pumped hydro and solar pilots at Stratford (as of early 2024). | Transition to Stars if scaled successfully, otherwise remain question marks. |

| New International Market Entry | Expanding into untapped global coal markets. | Potential for significant growth, low initial market share, competitive pressures, logistical complexities. | Diversifying export destinations to South Asia or Africa (focus in 2024). | Can capture market share and become Stars, or face significant barriers. |

| Lower-Grade/High-Cost Resources | Developing coal resources with higher extraction costs. | Potential to extend mine life, high operational expenses, market sensitivity to coal prices. | Projects involving geologically complex or lower-quality coal seams. | Viability highly dependent on future market conditions and cost management. |

BCG Matrix Data Sources

Our Yancoal BCG Matrix is built on comprehensive data, integrating company financial reports, industry growth forecasts, and market share analysis to provide strategic clarity.