Yancoal Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yancoal Bundle

Yancoal's marketing mix is a complex interplay of its core products, strategic pricing, extensive distribution, and targeted promotions. Understand how these elements combine to solidify their position in the competitive resources market.

Dive deeper into Yancoal's product portfolio, pricing strategies, and the intricate network of their distribution channels, alongside their promotional campaigns. Unlock the full picture of their market approach.

Gain access to a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Yancoal. This in-depth report is perfect for professionals and students seeking strategic insights and actionable data.

Product

Yancoal's thermal coal is a cornerstone for power generation, particularly across Asia's burgeoning economies. This essential commodity fuels a significant portion of the region's electricity needs, offering a reliable energy source for numerous power plants. In 2024, global demand for thermal coal remained robust, with Asia, especially China and India, continuing to be the primary consumers, accounting for over 70% of worldwide consumption.

The company focuses on delivering thermal coal that meets stringent quality and energy content specifications, crucial for optimizing combustion efficiency in power stations. This tailored approach ensures that Yancoal’s product aligns with diverse customer requirements, contributing to predictable and cost-effective power production. For instance, power plants often require coal with a specific calorific value, typically ranging from 5,000 to 7,000 kcal/kg, to maintain consistent energy output.

Yancoal's metallurgical coal is a cornerstone product, directly fueling steel manufacturing. This includes crucial supplies of semi-soft coking coal and pulverised coal injection (PCI) coal, essential components for blast furnace operations. The demand for these high-quality coals is intrinsically linked to the global steel industry's health.

In 2024, the steel industry, a primary consumer of metallurgical coal, continued to see significant activity, particularly in Asia. For instance, China's crude steel output in the first quarter of 2024 reached approximately 253 million tonnes, a slight increase year-on-year, underscoring the sustained need for Yancoal's products. This robust demand supports industrial expansion and infrastructure projects across the region.

Yancoal's extensive asset base allows them to provide a wide array of coal types and specifications, catering to diverse industrial needs. This broad product offering is a significant advantage in the competitive coal market.

The company's ability to blend different coal products is a key differentiator. This allows Yancoal to precisely meet specific customer requirements, whether for power generation or steelmaking, thereby enhancing customer satisfaction and securing premium pricing.

For instance, in 2024, Yancoal reported that its flexible product offering and blending capabilities contributed to optimizing its sales mix, leading to improved realized prices for its coal products across various markets.

Long-term Supply Reliability

Yancoal’s strategic advantage in long-term supply reliability stems from its geographically diversified asset base. Operating multiple open-cut and underground mines across New South Wales, Queensland, and Western Australia provides a robust foundation for consistent coal delivery. This broad operational footprint minimizes the impact of localized disruptions, ensuring a steady flow of product to global customers.

The company actively invests in operational efficiencies and critical infrastructure to bolster its supply chain resilience. For example, Yancoal’s commitment to enhancing water storage capacity directly addresses potential production interruptions, a crucial factor for maintaining output, especially in water-scarce regions. This proactive approach solidifies Yancoal's reputation as a dependable supplier in international markets.

- Diversified Operations: Mines across NSW, QLD, and WA.

- Infrastructure Investment: Enhancing water storage for operational continuity.

- Mitigating Disruptions: Proactive measures to ensure stable supply.

- Global Reliability: Strengthening Yancoal's position as a consistent international supplier.

Coal Exploration and Project Development

Yancoal's commitment extends beyond existing operations to actively pursuing coal exploration and developing new projects. This strategy is crucial for replenishing reserves and potentially broadening their product portfolio, ensuring long-term supply security and reinforcing their status as a major coal producer.

In 2023, Yancoal reported exploration expenditure of $102 million, a significant investment aimed at identifying and advancing future coal resources. This focus on new project development is designed to sustain and grow their operational base.

- Reserve Replenishment: Exploration activities are vital for replacing depleted reserves and maintaining a healthy resource pipeline.

- Future Growth: Developing new projects opens avenues for expanding production capacity and market reach.

- Strategic Investment: The $102 million exploration spend in 2023 highlights Yancoal's forward-looking investment in future supply.

- Market Position: Proactive project development helps secure Yancoal's competitive position in the global coal market.

Yancoal's product offering encompasses both thermal and metallurgical coal, catering to distinct industrial needs. Thermal coal is vital for power generation, particularly in Asia, where demand remained strong in 2024, with China and India consuming over 70% of global output. Metallurgical coal is essential for steel manufacturing, with China's first-quarter 2024 crude steel output reaching approximately 253 million tonnes, indicating continued demand for Yancoal's products.

The company differentiates itself through its broad product range and blending capabilities, allowing it to precisely meet customer specifications for calorific value and quality. This flexibility was reflected in 2024's sales mix optimization, leading to improved realized prices. Yancoal's strategic investments, such as $102 million in exploration expenditure in 2023, underscore its commitment to future supply and market position.

| Product Type | Primary Use | Key Markets (2024) | Yancoal's Value Proposition | 2024 Demand Indicator |

|---|---|---|---|---|

| Thermal Coal | Power Generation | Asia (China, India) | Quality specifications, blending for efficiency | Asia consumes >70% of global demand |

| Metallurgical Coal | Steel Manufacturing | Asia (China) | High-quality semi-soft coking, PCI coal | China's Q1 2024 crude steel output: ~253 million tonnes |

What is included in the product

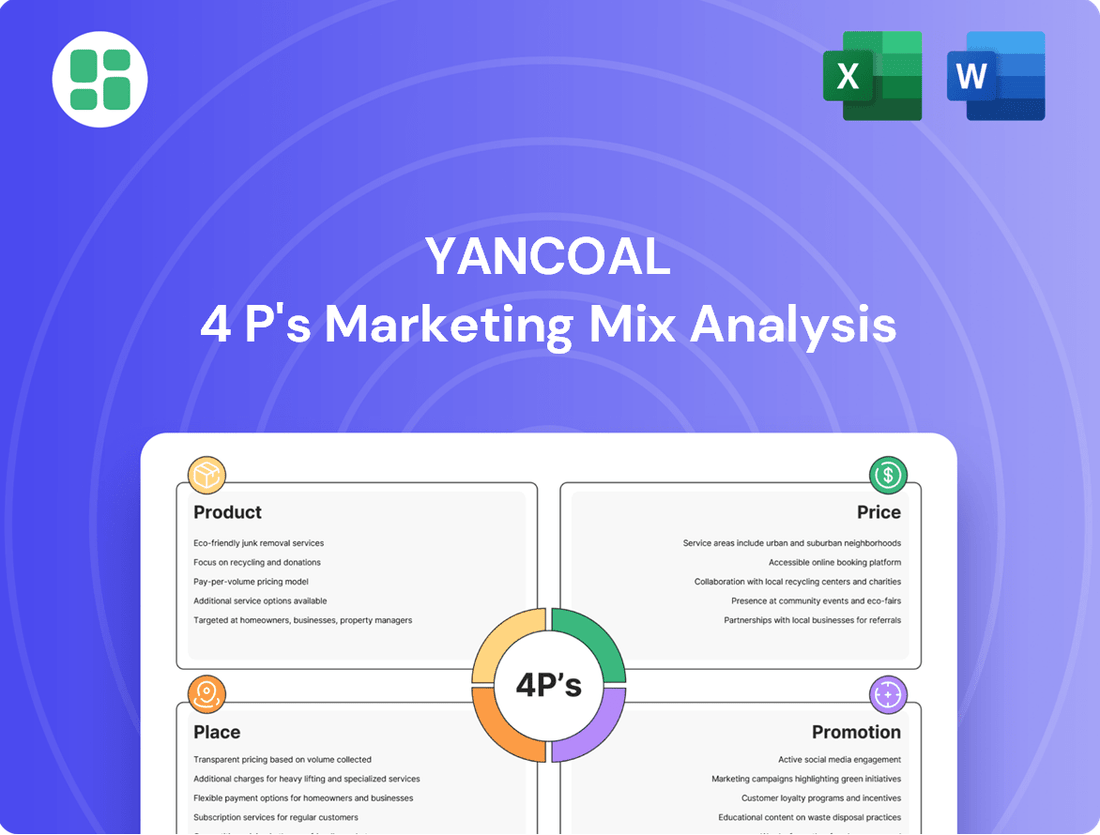

This analysis provides a comprehensive examination of Yancoal's marketing strategies, dissecting its Product, Price, Place, and Promotion elements to reveal its market positioning and competitive advantages.

Simplifies complex Yancoal marketing strategies into actionable 4P insights, easing the burden of identifying and addressing market challenges.

Provides a clear, visual roadmap of Yancoal's 4Ps, alleviating the pain of understanding how each element contributes to overcoming competitive pressures.

Place

Yancoal's extensive Australian mine operations are a cornerstone of its supply chain, encompassing numerous open-cut and underground coal mines. These facilities are strategically situated in New South Wales, Queensland, and Western Australia, key coal-producing regions. In 2023, Yancoal reported saleable coal production of 23.6 million tonnes, highlighting the scale of its operations.

Yancoal's marketing strategy heavily emphasizes the global seaborne export market, with the vast majority of its coal destined for international customers. This focus makes the company a significant player in supplying crucial raw materials to energy and steel sectors across the globe. In 2023, Yancoal's total export volume reached approximately 30.5 million tonnes, highlighting its extensive reach and reliance on efficient shipping and logistics to serve these distant markets.

Yancoal has cultivated a robust presence across crucial Asian markets, including Japan, South Korea, China, Taiwan, India, and Pakistan, alongside significant engagement in South America. These nations represent the primary demand centers for both thermal and metallurgical coal, positioning Asia as the bedrock of Yancoal's global distribution strategy.

The company's strategic focus on Asia is underscored by its substantial export volumes. In 2023, Yancoal's total saleable coal production reached 71.1 million tonnes, with a significant portion directed towards these key Asian economies, solidifying its position as a major supplier in the region.

To effectively manage market volatility, Yancoal actively works to diversify its customer portfolio within these core Asian markets. This approach helps to spread risk and ensure consistent demand for its coal products, even amidst fluctuating global economic conditions.

Access to Major Export Ports

Yancoal's strategic advantage is significantly boosted by its access to key Australian export ports, including Newcastle, Gladstone, and Dalrymple Bay. These facilities are crucial for moving substantial coal volumes from its mines to global markets, ensuring efficient and timely deliveries to its international customer base.

These ports represent vital logistical hubs, functioning as critical bottlenecks that Yancoal leverages for its extensive export operations. For instance, the Port of Newcastle, one of the world's largest coal export terminals, handled approximately 156 million tonnes of coal in the 2023 calendar year, underscoring the scale of operations facilitated by such infrastructure.

- Port of Newcastle: A cornerstone of Yancoal's export strategy, handling significant volumes.

- Port of Gladstone: Essential for accessing markets in Asia and beyond.

- Dalrymple Bay Coal Terminal: Another key facility supporting Yancoal's logistical network.

Optimized Logistics and Supply Chain Management

Yancoal places significant emphasis on refining its logistics and supply chain operations to guarantee the smooth and timely delivery of coal from its mining sites to customers. This strategic focus involves meticulous management of critical resources like rail capacity and port access, alongside proactive measures to counter potential disruptions stemming from adverse weather or infrastructure challenges.

The company's commitment to operational robustness, demonstrated by its adeptness in navigating these intricate logistical networks, underpins its reputation as a dependable supplier in the global coal market. For instance, Yancoal's 2023 operational review highlighted continued efforts to enhance rail transport efficiency, a key component in their supply chain strategy.

- Rail and Port Capacity: Yancoal actively manages and secures necessary rail and port allocations to facilitate efficient coal movement, crucial for meeting delivery schedules.

- Disruption Mitigation: Proactive strategies are in place to minimize the impact of potential disruptions, such as severe weather events or infrastructure failures, ensuring supply chain continuity.

- Operational Resilience: The company's ability to maintain consistent operations despite logistical complexities contributes directly to its reliability and market standing.

- Efficiency Gains: Continuous improvement initiatives in logistics aim to reduce transit times and costs, enhancing Yancoal's competitive edge.

Yancoal's "Place" strategy hinges on its strategically located Australian mines and its access to key export infrastructure. The company's operations are concentrated in New South Wales and Queensland, major coal-producing regions, enabling efficient extraction and transport. In 2023, Yancoal's saleable coal production reached 71.1 million tonnes, showcasing the substantial output capacity from these sites.

The company's logistical network is anchored by its access to major export terminals like the Port of Newcastle, which handled approximately 156 million tonnes of coal in 2023. This port, along with Gladstone and Dalrymple Bay, are critical for Yancoal's global seaborne export strategy, facilitating the movement of its 2023 export volume of roughly 30.5 million tonnes to international customers.

Yancoal's market reach extends significantly into Asia, with Japan, South Korea, China, Taiwan, India, and Pakistan forming its primary demand centers. This geographic focus is supported by robust supply chain management, including securing rail and port capacity to ensure timely deliveries and mitigate potential disruptions, thereby reinforcing its position as a reliable supplier.

| Location Aspect | Key Infrastructure | 2023 Data Point |

|---|---|---|

| Mine Operations | New South Wales, Queensland | 71.1 million tonnes (Saleable Production) |

| Export Hubs | Port of Newcastle | Approx. 156 million tonnes (Coal Handled) |

| Logistical Network | Rail and Port Capacity Management | 30.5 million tonnes (Total Export Volume) |

What You Preview Is What You Download

Yancoal 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Yancoal 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain valuable insights into Yancoal's market positioning and operational tactics.

Promotion

Yancoal prioritizes investor relations and financial reporting as key promotional elements. This involves consistent updates on the ASX and HKEX, alongside detailed annual reports and financial result presentations. For instance, Yancoal's 2023 annual report, released in early 2024, highlighted a statutory profit after tax of US$317 million, demonstrating their commitment to transparency and performance communication.

Yancoal actively promotes its dedication to sustainability via comprehensive annual reports. These documents detail environmental protection efforts, community engagement, and strong governance, meeting growing demands for Environmental, Social, and Governance (ESG) accountability from stakeholders.

In 2023, Yancoal reported a 13% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2020 baseline, highlighting its commitment to environmental stewardship.

This focus on transparent ESG reporting aims to foster trust and showcase responsible mining practices to investors, regulators, and local communities alike.

Yancoal, as a major player in the B2B commodity sector, would strategically leverage industry engagement and conferences to foster relationships and demonstrate its value proposition. These events serve as crucial touchpoints for direct interaction with customers, allowing for discussions on product specifications, logistical capabilities, and market trends.

While specific 2024-2025 conference participation isn't detailed, Yancoal's typical approach would involve attending key mining and energy forums. For instance, in 2023, major global mining conferences saw significant attendance from industry leaders, reflecting the ongoing importance of in-person networking for securing long-term supply agreements.

These engagements are vital for Yancoal to communicate its commitment to reliable supply and competitive pricing, directly addressing customer needs. Such active participation reinforces its brand as a trusted partner, essential for maintaining and expanding its market share in a competitive landscape.

Corporate Website and Digital Presence

Yancoal's corporate website acts as a critical digital storefront, offering a comprehensive overview of its operations, financial performance, and strategic direction. This platform is essential for disseminating information to a wide audience, including investors, media, and potential employees.

In 2024, Yancoal's digital presence is crucial for maintaining transparency and engaging with stakeholders. The website provides direct access to key documents such as annual reports, sustainability disclosures, and market updates, ensuring stakeholders have timely information. For instance, the company's commitment to investor relations is evident through readily available financial statements and ASX announcements.

- Central Information Hub: The website consolidates company overviews, operational details, and career opportunities.

- Investor and Media Relations: Provides access to official reports, announcements, and financial data.

- Transparency and Communication: Serves as a fundamental tool for broad stakeholder engagement.

- Digital Accessibility: Ensures a wide audience can easily access Yancoal's corporate information.

Strategic Positioning as a Low-Cost Producer

Yancoal's promotional strategy heavily emphasizes its standing as a substantial, low-cost coal producer. This core message is a consistent theme in their investor communications, underscoring operational efficiency and the capacity for sustained profitability, even when coal prices are subdued.

This positioning directly resonates with investors and financial professionals who prioritize cost leadership and operational resilience. For instance, in the first half of 2024, Yancoal reported a strong cost performance, with managed operating cash costs per tonne of coal sold remaining competitive, a key metric for demonstrating their low-cost advantage.

- Low-Cost Producer: Yancoal consistently highlights its efficient operations to attract investors seeking stable returns.

- Investor Focus: The company's messaging targets financially astute individuals and institutions valuing cost control.

- Market Resilience: This strategy aims to signal Yancoal's ability to navigate market volatility and maintain profitability.

Yancoal's promotional efforts center on its robust financial performance and commitment to transparency, particularly through detailed reporting. The company's 2023 financial results, released in early 2024, reported a statutory profit after tax of US$317 million, underscoring its operational efficiency and market position.

Furthermore, Yancoal actively promotes its dedication to Environmental, Social, and Governance (ESG) principles, highlighting a 13% reduction in Scope 1 and 2 greenhouse gas emissions intensity by the end of 2023 compared to its 2020 baseline. This focus on sustainability aims to build trust with investors and stakeholders.

The company leverages industry engagement and its corporate website as key promotional tools, showcasing its value proposition as a reliable, low-cost coal producer. These platforms facilitate direct interaction and provide access to crucial financial and operational data, reinforcing Yancoal's market standing.

| Key Promotional Aspect | 2023 Data/Highlight | Stakeholder Focus |

|---|---|---|

| Financial Reporting & Transparency | US$317 million statutory profit after tax (FY2023) | Investors, Financial Professionals |

| Sustainability & ESG Commitment | 13% reduction in GHG emissions intensity (Scope 1 & 2 vs. 2020) | Investors, Regulators, Communities |

| Market Positioning | Substantial, low-cost coal producer | Investors, Customers |

Price

Yancoal's pricing strategy is intrinsically linked to major international coal benchmarks. For thermal coal, the GlobalCOAL NEWC 6,000kCal NAR index (GCNewc) and the All-Published Index 5 (API5) 5,500kCal index serve as key reference points. Metallurgical coal prices are similarly guided by indices like Platts Low Vol PCI FOB Australia and Platts Semi-Soft FOB Australia Indices. For instance, in Q1 2024, the Newcastle benchmark for thermal coal averaged around $130 per tonne, a figure Yancoal's realized prices would closely track, adjusted for specific coal quality and contract terms.

Yancoal's coal prices are highly sensitive to global supply and demand. For instance, in early 2024, increased coal production from China, a major global supplier, put downward pressure on prices. Conversely, robust demand from Asian economies, such as India and Vietnam, looking to fuel their growing industrial sectors, provided a floor for prices during the same period.

Yancoal focuses on enhancing its coal quality and employing strategic blending techniques to secure more favorable pricing. This involves carefully adjusting coal characteristics and mixing different grades to align with specific market demands and customer needs, thereby maximizing revenue per ton.

For instance, Yancoal's 2023 results showed an average realized price for its thermal coal that was competitive, reflecting the success of its quality and blending initiatives in a dynamic global market. Their ability to adapt product specifications allows them to capture premium pricing opportunities and minimize the impact of price volatility.

Cost Control and Operational Efficiency

Yancoal's pricing strategy is deeply rooted in rigorous cost control and operational efficiency. This focus is critical for maintaining profitability, even when global coal prices experience volatility. For instance, Yancoal consistently aims to keep its cash operating costs among the lowest in the industry, a key factor in its resilience during market downturns.

This cost advantage translates directly into a competitive edge. By operating leanly, Yancoal is better positioned to absorb price fluctuations and remain profitable. This efficiency underpins their ability to offer competitive pricing while ensuring sustained financial health across different market cycles.

- Low Cash Operating Costs: Yancoal's commitment to minimizing operating expenses, such as their reported cash operating cost per tonne of coal produced, directly supports their pricing competitiveness.

- Operational Efficiency Gains: Continuous investment in technology and process improvements at their mining sites contributes to higher output and lower per-unit costs.

- Market Resilience: The ability to maintain profitability at lower coal price points demonstrates the strength of their cost structure and its impact on pricing flexibility.

Long-Term Contracts and Spot Sales

Yancoal utilizes a dual approach to sales, balancing the predictability of long-term contracts with the agility of spot sales. Long-term contracts, often tied to quarterly benchmark pricing, offer a degree of revenue stability. This strategy was evident in their 2024 performance, where a significant portion of their coal sales were secured through these agreements, providing a predictable revenue stream amidst fluctuating global energy prices.

Complementing these contracts, Yancoal also engages in spot sales, allowing them to react to immediate market conditions and capitalize on favorable price movements. This flexibility is crucial; for instance, during periods of strong demand in late 2024, their ability to leverage spot sales allowed them to capture higher prices on incremental volumes. This mixed strategy ensures they benefit from both stable income and opportunistic gains.

The precise allocation between contract and spot sales is a dynamic decision, influenced by Yancoal's market forecasts and overarching strategic goals. For example, if Yancoal anticipates a price downturn, they might prioritize locking in more volume through long-term contracts. Conversely, a bullish outlook would encourage a higher proportion of sales to be conducted on the spot market to capture potential price appreciation.

- Long-Term Contracts: Provide revenue stability, often priced against quarterly benchmarks.

- Spot Sales: Offer flexibility to capitalize on immediate market price fluctuations.

- Sales Mix: Dynamically adjusted based on market outlook and Yancoal's strategic objectives.

- 2024 Impact: The blend of contract and spot sales helped Yancoal navigate market volatility, securing a baseline revenue while allowing for opportunistic profit generation.

Yancoal's pricing strategy is anchored to international coal benchmarks like GCNewc for thermal coal and Platts indices for metallurgical coal. For example, in early 2024, the Newcastle benchmark hovered around $130 per tonne, a rate Yancoal's realized prices would closely mirror, adjusted for specific quality and contract terms.

The company actively manages its product quality through blending to achieve premium pricing. This approach allows Yancoal to align its offerings with specific market demands, as seen in their competitive 2023 thermal coal average realized prices, reflecting successful quality and blending initiatives.

Yancoal's pricing is also underpinned by a strong focus on cost control, aiming for industry-leading low cash operating costs. This efficiency provides a crucial competitive edge, enabling them to remain profitable and flexible even amidst global coal price volatility.

| Coal Type | Benchmark Index (Early 2024) | Yancoal's Pricing Strategy Aspect |

|---|---|---|

| Thermal Coal | GCNewc (approx. $130/tonne) | Benchmark-linked, quality enhancement |

| Metallurgical Coal | Platts Low Vol PCI FOB Australia | Benchmark-linked, quality enhancement |

| Overall | N/A | Low cash operating costs, sales mix (contracts vs. spot) |

4P's Marketing Mix Analysis Data Sources

Our Yancoal 4P's Marketing Mix Analysis is built upon comprehensive data from official company reports, investor briefings, and industry publications. We analyze their product portfolio, pricing strategies, distribution networks, and promotional activities to provide an accurate market overview.