Yancoal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yancoal Bundle

Yancoal operates in a highly competitive coal market, where the threat of new entrants is moderate due to significant capital requirements. Buyer power can be substantial, especially for large industrial consumers, while supplier power is influenced by the availability of specialized mining equipment and services. The intensity of rivalry among existing players significantly shapes Yancoal's strategic landscape.

The complete report reveals the real forces shaping Yancoal’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Yancoal's reliance on highly specialized heavy mining equipment, such as draglines and large excavators, means the pool of global suppliers is inherently limited. Companies like Caterpillar, Komatsu, and Hitachi dominate this niche market, offering sophisticated machinery crucial for Yancoal's operations.

The uniqueness and significant capital investment required for this equipment translate into substantial switching costs for Yancoal. If a supplier holds a near-monopoly on specific parts or maintenance services for Yancoal's existing fleet, their bargaining power increases considerably, particularly when spare parts are essential for minimizing operational downtime.

The availability of specialized skills like engineers, geologists, and experienced mine operators is vital for Yancoal. A shortage of these professionals, or the presence of strong labor unions, can empower these suppliers to demand higher wages and improved working conditions, directly impacting Yancoal's operational expenses.

The bargaining power of logistics and infrastructure providers, particularly in Australia's coal sector, is a significant factor for companies like Yancoal. In 2024, the reliance on a concentrated network of rail and port operators means these entities can exert considerable influence. For example, limited competition in key coal-exporting regions of Australia grants these providers leverage over transportation costs and scheduling for bulk commodities.

Energy and Consumables Providers

Yancoal's significant reliance on energy, such as electricity and fuel, and essential consumables like explosives, chemicals, and lubricants, places it directly in the path of supplier bargaining power. The concentration of suppliers for these critical inputs can lead to price volatility, directly impacting Yancoal's production costs and overall profitability. For instance, in 2024, global energy markets experienced notable price swings, which would have directly affected Yancoal's operational expenses.

The bargaining power of energy and consumables providers is a key consideration for Yancoal. Specialized or regulated consumables, in particular, can further amplify this power, as Yancoal may have fewer alternative suppliers. This dynamic necessitates careful supplier relationship management and strategic sourcing to mitigate potential cost increases.

- Energy Costs: Fluctuations in global oil and gas prices directly influence Yancoal's fuel expenses, a significant operational cost.

- Consumable Dependence: Reliance on a limited number of suppliers for explosives and specialized chemicals can create leverage for those providers.

- Supply Chain Disruptions: Geopolitical events or natural disasters impacting energy and consumable production can lead to supply shortages and price hikes.

- Contractual Agreements: The terms negotiated in long-term supply contracts play a crucial role in determining Yancoal's exposure to supplier power.

Environmental and Regulatory Compliance Services

As a significant coal producer, Yancoal relies heavily on specialized environmental and regulatory compliance services, including consulting, rehabilitation, and legal advice. The intricate and ever-evolving nature of environmental regulations means these services are critical for Yancoal’s operations and reputation. In 2024, the increasing focus on ESG (Environmental, Social, and Governance) standards globally, particularly in mining, amplifies the importance of expert compliance assistance.

The specialized knowledge and the high stakes involved in regulatory adherence grant these suppliers a moderate level of bargaining power. Failure to comply can result in substantial fines, operational shutdowns, and significant reputational damage, making Yancoal’s need for these services a constant. For instance, in 2023, the global mining sector saw increased scrutiny and enforcement actions related to environmental impact assessments and rehabilitation plans, highlighting the critical role of these service providers.

- Specialized Expertise: Environmental and regulatory compliance requires niche skills and up-to-date knowledge of complex legislation.

- Critical Operations: Yancoal’s ability to operate is directly tied to its compliance status, making these services indispensable.

- Reputational Risk: Non-compliance can lead to severe reputational damage, increasing the perceived value of reliable service providers.

- Market Trends: Growing ESG mandates in 2024 and beyond empower suppliers who can ensure adherence to stringent environmental standards.

The bargaining power of suppliers for Yancoal is shaped by the concentration of specialized equipment manufacturers and the critical nature of their products. Companies like Caterpillar and Komatsu, holding significant market share in heavy mining machinery, can influence pricing and terms due to the high switching costs and the essential role of their equipment in Yancoal's operations. This was evident in 2024 as supply chain constraints for heavy machinery continued to affect delivery times and costs globally.

Furthermore, Yancoal's reliance on specific consumables, such as explosives and chemicals, from a limited supplier base also empowers these providers. Price volatility in global energy markets, as seen in 2024, directly impacts fuel and consumable costs, giving energy and chemical suppliers considerable leverage. The need for specialized environmental and regulatory compliance services, amplified by increasing ESG scrutiny in 2024, further strengthens the position of expert service providers.

| Supplier Category | Key Characteristics | Impact on Yancoal | 2024 Relevance |

|---|---|---|---|

| Heavy Mining Equipment | Limited global suppliers, high capital investment, specialized parts | High switching costs, dependence on maintenance and parts | Continued supply chain pressures affecting availability and cost |

| Energy and Consumables | Concentrated supplier base, price volatility (e.g., fuel, explosives) | Direct impact on operational expenses and profitability | Global energy market fluctuations significantly influenced input costs |

| Environmental & Regulatory Services | Specialized expertise, critical for compliance, reputational risk | Indispensable for operations, leverage due to stringent standards | Increased demand for ESG compliance services |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Yancoal's position in the global coal industry.

Quickly identify and mitigate competitive threats with a visual breakdown of Yancoal's bargaining power of buyers and suppliers.

Customers Bargaining Power

Yancoal's primary customers are large power generators and steel manufacturers, mainly in Asia, who buy thermal and metallurgical coal respectively. These large-volume buyers, due to the commodity nature of coal, possess significant bargaining power. For instance, in 2024, global thermal coal prices experienced volatility, with benchmarks like the Newcastle benchmark fluctuating, allowing major buyers to leverage market conditions for better pricing on substantial orders.

The bargaining power of customers in the global commodity market, particularly for coal, significantly impacts Yancoal. As a price-taker, Yancoal must accept prevailing global prices, which are driven by broad supply and demand forces, not by Yancoal's individual output.

Customers wield considerable influence by referencing global price benchmarks and readily switching to alternative suppliers. This is especially true when the market is oversupplied, as was seen with a global surplus of thermal coal in early 2024, which put downward pressure on prices and amplified buyer leverage.

For standard thermal coal, customers face very low switching costs. This is because the product itself is largely a commodity with minimal differentiation between suppliers. This ease of switching directly empowers buyers, allowing them to readily move to a competitor if Yancoal's pricing, quality, or delivery doesn't meet their needs.

This low switching cost translates into significant bargaining power for Yancoal's customers. They can effectively shop around, comparing offers from various coal producers. For instance, in 2024, global thermal coal prices saw considerable volatility, creating opportunities for buyers to leverage competitive offers and put downward pressure on Yancoal's margins.

Customer's Importance of Coal in Their Cost Structure

The bargaining power of customers is significantly influenced by the importance of coal within their overall cost structure. For industries like power generation and steelmaking, coal is a vital raw material. However, its proportion of total expenses can fluctuate, directly impacting how much leverage customers have in price negotiations.

When coal constitutes a substantial percentage of a customer's operational costs, they possess a stronger incentive to push for lower prices. This is especially true for thermal coal, where the potential for substituting with alternative energy sources or fuels can increase customer leverage.

- Coal as a Percentage of Electricity Generation Costs: In 2023, the cost of coal represented approximately 30-40% of the total operating costs for many coal-fired power plants in the United States, depending on regional fuel prices and plant efficiency.

- Steel Production Cost Breakdown: For steel manufacturers, metallurgical coal can account for 20-30% of their production costs. Fluctuations in coal prices directly impact their profitability and ability to compete.

- Impact of Energy Transition: As countries increasingly shift towards renewable energy sources, the reliance on coal for power generation is declining. This trend can empower electricity consumers and governments to demand lower coal prices or accelerate the transition away from coal.

- Customer Sensitivity to Price Changes: A 10% increase in coal prices could translate to a 3-4% rise in electricity costs for consumers, making them highly sensitive to coal price volatility and more inclined to seek alternative, stable energy solutions.

Potential for Backward Integration by Customers

The potential for very large customers, such as integrated steel mills or utilities, to invest in or acquire coal mining operations themselves represents a significant, albeit often theoretical, lever of bargaining power. This threat of backward integration, even if not actively pursued, can pressure Yancoal to maintain competitive pricing and favorable terms. For instance, in 2024, major steel producers continued to explore supply chain resilience, which could involve direct investment in raw material sources if market conditions become sufficiently unfavorable.

While the capital expenditure and operational expertise required for coal mining present high barriers, the mere possibility of customers undertaking backward integration can influence Yancoal's strategic decisions. This dynamic encourages Yancoal to foster strong relationships and offer compelling value propositions to retain its key customer base. The global energy transition also plays a role, as some utilities might re-evaluate their long-term coal needs, potentially strengthening their negotiating stance with suppliers like Yancoal.

- Threat of Backward Integration: Large customers like steel mills and utilities may consider owning coal mines.

- Barrier to Entry: High capital and expertise are needed for coal mining, making this a difficult step for customers.

- Customer Leverage: The theoretical possibility of backward integration empowers customers to seek better pricing from Yancoal.

- Market Influence: Yancoal's pricing and terms are influenced by the potential for customers to secure their own supply.

Yancoal's customers, primarily large power generators and steel manufacturers, hold substantial bargaining power due to the commodity nature of coal and their significant purchasing volumes. In 2024, global thermal coal prices, like the Newcastle benchmark, showed volatility, enabling these major buyers to negotiate favorable terms. Their ability to easily switch suppliers, especially when the market is oversupplied, as seen with a global thermal coal surplus in early 2024, further amplifies their leverage, putting downward pressure on Yancoal's margins.

| Customer Segment | Coal's Role in Costs | Bargaining Power Factor | 2024 Market Influence |

|---|---|---|---|

| Power Generators | 30-40% of operating costs (US, 2023 est.) | Price sensitivity, potential for alternative energy | Price volatility created buyer leverage |

| Steel Manufacturers | 20-30% of production costs | Impact on profitability and competitiveness | Exploration of supply chain resilience |

Preview the Actual Deliverable

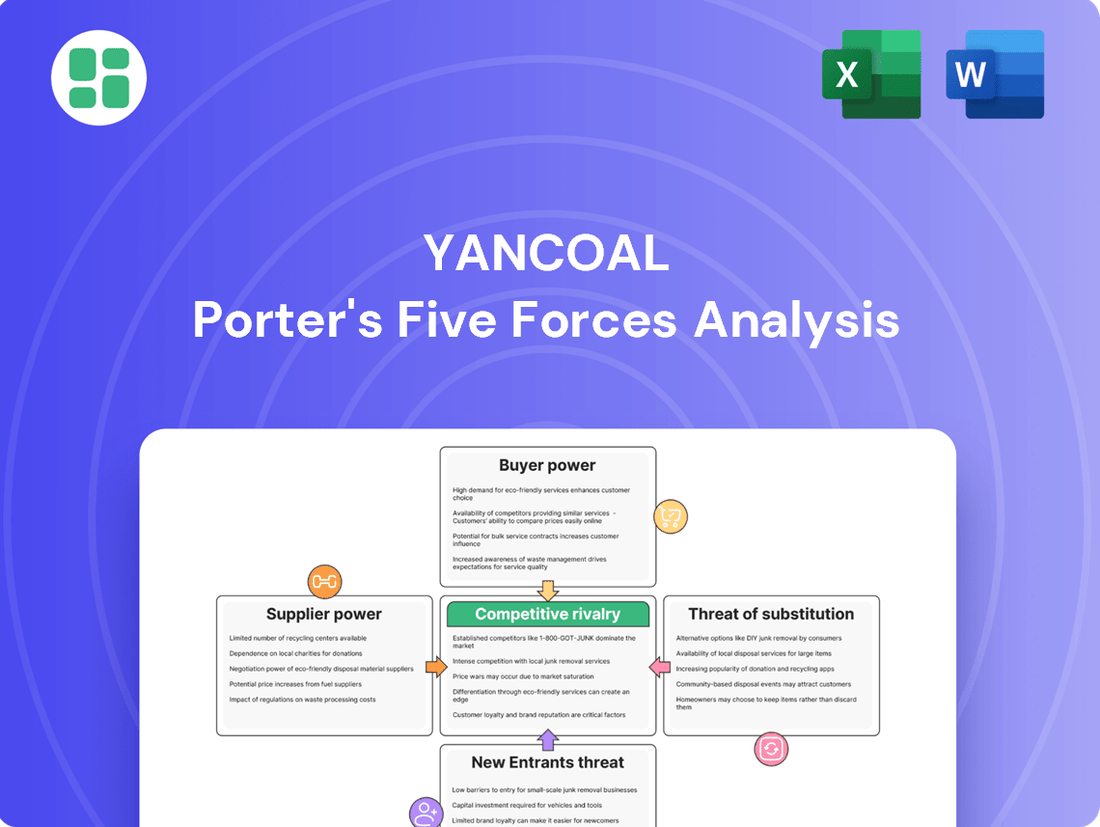

Yancoal Porter's Five Forces Analysis

This preview showcases the complete Yancoal Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The Australian and global coal markets are highly competitive, featuring major players like Glencore, BHP, and Rio Tinto alongside Yancoal. This crowded landscape means companies constantly battle for market share, crucial contracts, and limited port infrastructure access.

Coal, particularly thermal coal, is largely a commodity. This means companies like Yancoal face fierce competition primarily on price. Differentiation is minimal, often boiling down to specific quality metrics like energy content or ash levels, and the efficiency of getting the coal to market.

This commodity nature forces aggressive pricing strategies, especially when the market experiences a downturn. For instance, global thermal coal prices saw significant volatility in 2024, with benchmarks like the Newcastle benchmark fluctuating, directly impacting Yancoal's revenue and profit margins as they had to match or beat competitor pricing to secure sales.

Yancoal operates in an industry characterized by substantial fixed costs, including significant investments in mine development, heavy machinery, and essential infrastructure. These upfront expenses create a powerful incentive for continuous high-volume production to achieve economies of scale and recover capital investment efficiently.

The imperative to maintain high output levels to offset these fixed costs often translates into aggressive pricing strategies and a relentless focus on production volume. This competitive dynamic intensifies rivalry among coal producers, as each seeks to maximize market share and operational efficiency.

For instance, in 2023, Yancoal reported total capital expenditure of AUD 1.2 billion, highlighting the ongoing investment required to sustain and expand operations. Such substantial fixed costs directly fuel the pressure for volume, making price competition a persistent feature of the Australian thermal coal market.

Slow Industry Growth and Mature Market

The global coal market, especially for thermal coal, faces a future of slow or even declining demand. This is largely driven by increasing climate change concerns and the expanding adoption of renewable energy sources. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that while coal demand might see a slight increase in 2024, it is expected to peak and then begin a gradual decline in the years following. This scenario significantly heats up competition among established coal producers like Yancoal as they fight for a smaller or stable piece of the market.

This mature and slowly growing market environment means that companies must work harder to gain or maintain their market share. Any increase in sales often comes at the direct expense of a competitor. This dynamic forces companies to focus intensely on cost efficiency and operational improvements to remain competitive. The pressure to secure contracts and supply agreements becomes paramount in such conditions.

- Stagnant to Declining Demand: Global thermal coal demand is projected to plateau or decrease in the medium to long term.

- Intensified Competition: Slow growth forces existing players to compete more fiercely for market share.

- Focus on Efficiency: Companies must prioritize cost reduction and operational excellence to stay competitive.

- Market Share Battles: Gains for one company often mean losses for another in this environment.

Exit Barriers for Existing Players

The coal mining industry, including players like Yancoal, faces substantial exit barriers. These can include significant asset write-downs if specialized mining equipment must be sold at a loss, substantial environmental rehabilitation obligations that can run into millions of dollars per mine, and long-term contractual commitments to supply coal or maintain certain operational levels. These factors make it economically challenging for companies to simply cease operations, even when market conditions are unfavorable.

These high exit barriers contribute to persistent excess capacity within the coal market. When companies cannot easily exit, they tend to continue operating, albeit at reduced levels, rather than incurring the costs of closure. This keeps more supply available than demand might warrant, which in turn fuels intense price competition and perpetuates rivalry among existing players. For instance, in 2023, global coal prices, while volatile, remained a key indicator of this competitive pressure, with benchmarks like Newcastle thermal coal fluctuating significantly, forcing producers to maintain efficiency to remain profitable.

- High Capital Investment: Coal mines require massive upfront capital for exploration, development, and infrastructure, making divestment difficult without significant capital losses.

- Environmental Liabilities: Post-mining rehabilitation, including land reclamation and water management, represents a substantial, often long-term financial obligation that deters exit.

- Contractual Obligations: Existing supply contracts with power plants or steel mills can lock companies into production for extended periods, creating a disincentive to leave the market prematurely.

- Specialized Assets: Mining equipment and infrastructure are highly specialized and have limited resale value outside the industry, increasing the cost of exiting.

The competitive rivalry in the coal market is intense, driven by the commodity nature of coal and substantial fixed costs. Companies like Yancoal are forced into aggressive pricing strategies to maintain market share and recover investments, especially as demand for thermal coal faces long-term decline. High exit barriers also contribute to persistent capacity, intensifying the fight for sales.

SSubstitutes Threaten

The most significant substitute for thermal coal in power generation is renewable energy, encompassing solar, wind, and hydropower. This shift is heavily influenced by global climate change policies and rapid technological advancements in the renewable sector.

As renewable energy sources become increasingly cost-effective, with solar photovoltaic costs falling by over 80% in the last decade, and with governments worldwide offering incentives for their adoption, the demand for thermal coal faces a sustained structural decline. This directly impacts Yancoal's thermal coal business segment, as utilities increasingly opt for cleaner, cheaper alternatives.

Natural gas is a significant substitute for thermal coal in power generation, primarily due to its cleaner emissions profile. In 2024, the global shift towards decarbonization continues to favor natural gas, with many countries setting targets to reduce coal reliance. This trend directly impacts Yancoal's thermal coal market as power utilities may opt for gas, especially where supply is readily available and competitively priced, driven by stricter environmental mandates.

The threat of substitutes for metallurgical coal is significant, primarily driven by the increasing adoption of recycled steel. Electric arc furnaces (EAFs), which utilize scrap steel, require substantially less, or even no, coking coal compared to traditional blast furnaces. In 2023, EAFs accounted for approximately 70% of US steel production, highlighting a substantial shift away from coal-intensive methods.

Furthermore, advancements in green steelmaking technologies present a longer-term substitute threat. Processes like direct reduced iron (DRI) using hydrogen are gaining traction, aiming to drastically reduce or eliminate the need for coke in steel production. While still in early commercialization phases, these innovations could fundamentally alter metallurgical coal demand in the coming decades.

Nuclear Power and Hydroelectric Power

Nuclear and hydroelectric power represent significant, albeit less direct, substitutes for thermal coal in electricity generation. These sources provide baseload power without emitting greenhouse gases, aligning with global decarbonization efforts. For instance, as of early 2024, nuclear power accounts for approximately 19% of the US electricity generation, and hydroelectricity contributes around 6%.

Government policies and substantial investments in these large-scale, non-fossil fuel alternatives can directly diminish the demand for thermal coal in power grids. Countries are increasingly setting ambitious renewable energy targets. For example, the European Union aims for 42.5% renewable energy by 2030, which includes significant contributions from hydro and potentially new nuclear projects, thereby pressuring coal demand.

- Nuclear Power's Baseload Contribution: Nuclear plants provide consistent, high-capacity electricity, directly competing with coal for baseload power needs.

- Hydroelectric Power's Role: Large-scale dams offer another significant source of non-fossil fuel electricity, particularly in regions with abundant water resources.

- Decarbonization Policies: Government mandates and incentives for low-carbon energy sources accelerate the shift away from coal.

- Investment Trends: Global investment in nuclear and hydroelectric projects, though sometimes facing regulatory hurdles, represents a long-term threat to coal's market share.

Energy Efficiency and Conservation Measures

Improvements in energy efficiency and conservation measures present a significant threat of substitutes for thermal coal, like that used by Yancoal. As industries and households adopt more efficient technologies and practices, the overall demand for electricity decreases.

This reduction in energy consumption indirectly substitutes for all power generation inputs, including thermal coal, by lowering the total energy needed. For instance, in 2024, advancements in building insulation and smart grid technologies continued to drive down energy usage in developed economies.

Key areas impacting coal demand include:

- Residential Energy Efficiency: Widespread adoption of LED lighting and high-efficiency appliances in homes reduces electricity consumption.

- Industrial Process Optimization: Factories implementing energy-saving machinery and operational changes lower their power needs.

- Renewable Energy Integration: While not a direct substitute for coal in existing infrastructure, the growth of renewables contributes to overall reduced reliance on fossil fuels.

- Behavioral Changes: Public awareness campaigns promoting energy conservation can lead to lower demand patterns.

The threat of substitutes for thermal coal is substantial, driven by the increasing competitiveness and adoption of renewable energy sources like solar and wind, alongside natural gas. These alternatives benefit from global decarbonization policies and technological advancements, making them increasingly attractive for power generation.

The metallurgical coal market faces a significant threat from the rise of electric arc furnaces (EAFs) that utilize recycled steel, reducing the need for coking coal. By 2023, EAFs accounted for approximately 70% of US steel production, a clear indicator of this shift.

Nuclear and hydroelectric power also serve as key substitutes for thermal coal in electricity generation, offering carbon-free baseload power. As of early 2024, nuclear power constituted about 19% of US electricity, with hydropower adding another 6%, underscoring their growing role.

| Substitute | Impact on Thermal Coal | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Renewable Energy (Solar, Wind) | High | Cost reduction, government incentives, climate policies | Continued growth, increasing cost-competitiveness |

| Natural Gas | Medium to High | Cleaner emissions, price volatility, supply availability | Strong demand in many regions due to environmental mandates |

| Recycled Steel (EAFs) | High (for metallurgical coal) | Efficiency, reduced environmental impact | Dominant in US steel production (approx. 70% in 2023) |

| Nuclear Power | Medium | Baseload capacity, carbon-free | Significant contributor to electricity grids (approx. 19% in US early 2024) |

| Hydroelectric Power | Medium | Renewable baseload, regional availability | Consistent contributor (approx. 6% in US early 2024) |

Entrants Threaten

The threat of new entrants in the coal industry, specifically for companies like Yancoal, is significantly mitigated by the extraordinarily high capital investment requirements. Establishing a new, large-scale coal mine, whether open-cut or underground, necessitates massive upfront expenditure. This includes costs for extensive exploration, mine development, essential infrastructure like roads and processing facilities, and the purchase of specialized heavy machinery. For instance, developing a new greenfield coal project can easily run into hundreds of millions, if not billions, of dollars, making it a formidable barrier for most potential competitors.

The coal mining sector in Australia faces significant barriers to entry due to complex and lengthy regulatory approval processes. These encompass stringent environmental, social, and governance (ESG) requirements and a multi-stage permitting system that can take years to navigate.

For instance, securing approvals for new mines involves extensive environmental impact assessments, community consultations, and adherence to various state and federal laws. This rigorous process, often involving multiple government departments, significantly increases the cost and time investment for potential new entrants, making it a substantial deterrent.

Access to quality coal reserves is a major hurdle for new entrants. Economically viable and high-grade coal deposits are scarce and often already secured by established companies like Yancoal. For instance, in 2024, the global supply of easily accessible, high-quality thermal coal reserves continued to be concentrated among a few major producers.

Furthermore, the need for significant investment in specialized logistics infrastructure, including rail and port facilities, acts as a substantial barrier. These networks are often already developed and utilized by existing players, making it difficult and costly for newcomers to establish efficient supply chains in 2024.

Economies of Scale Enjoyed by Incumbents

Established players like Yancoal leverage significant economies of scale in areas such as raw material procurement, mining operations, and transportation. This allows them to spread fixed costs over a larger output, reducing their average cost per tonne of coal produced. For instance, Yancoal's extensive infrastructure and long-term supplier contracts in 2024 likely provided substantial cost advantages over potential new entrants who would need to invest heavily to achieve comparable efficiencies.

The cost advantage derived from these economies of scale presents a formidable barrier for new companies entering the coal market. Without the ability to match the volume and operational efficiency of incumbents, new entrants would find it challenging to compete on price, potentially leading to lower profit margins or an inability to gain market share. This cost disparity discourages new companies from investing in the capital-intensive coal industry.

- Economies of Scale: Yancoal benefits from lower per-unit costs due to its large-scale operations.

- Procurement Advantages: Bulk purchasing of equipment and supplies leads to better pricing.

- Logistical Efficiencies: Established transportation networks reduce shipping costs per tonne.

- Barrier to Entry: New entrants face higher initial costs and struggle to compete on price.

Environmental and Social Opposition

The threat of new entrants into the coal mining sector, including for companies like Yancoal, is significantly amplified by growing environmental and social opposition. Heightened awareness of climate change and its impacts fuels robust community resistance to new fossil fuel projects. This opposition translates into substantial social and political hurdles for any new player seeking to establish operations.

These barriers can manifest as prolonged approval processes, escalating development costs due to mitigation requirements, and considerable reputational damage. For instance, in 2023, the International Energy Agency (IEA) reported a continued global trend of declining investment in new coal-fired power generation, reflecting a broader shift away from coal. This makes market entry considerably more challenging and expensive than in previous decades.

- Increased regulatory scrutiny: Governments worldwide are implementing stricter environmental regulations, making it harder and costlier for new mines to gain approval.

- Community activism and legal challenges: Local communities and environmental groups are increasingly using protests and legal avenues to block new mining projects, causing significant delays and cost overruns.

- Investor divestment from fossil fuels: A growing number of institutional investors are divesting from coal companies due to ESG (Environmental, Social, and Governance) concerns, limiting access to capital for new entrants.

The threat of new entrants for Yancoal is low due to immense capital requirements, with new mine development costing hundreds of millions to billions of dollars. Stringent environmental regulations and lengthy approval processes, often taking years, further deter newcomers. Access to prime coal reserves is also a significant barrier, as these are largely controlled by established players like Yancoal, with high-quality deposits becoming increasingly scarce globally in 2024.

Logistical infrastructure, including rail and port access, represents another substantial hurdle, as these networks are typically already established and utilized by incumbent firms. Furthermore, Yancoal benefits from economies of scale, leading to lower per-tonne production costs compared to what a new entrant could achieve without significant initial investment. This cost advantage makes it difficult for new companies to compete on price.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | Developing new coal mines requires billions of dollars for exploration, development, and machinery. | Extremely high barrier, limiting the pool of potential entrants. |

| Regulatory Approvals | Complex, multi-year processes involving environmental and social impact assessments. | Increases cost and time-to-market, posing significant risk. |

| Access to Reserves | Economically viable, high-grade coal deposits are scarce and controlled by incumbents. | Difficult for new players to secure competitive resource bases. |

| Logistics Infrastructure | Need for established rail and port facilities, often already in use by existing companies. | Costly to replicate or gain access to efficient supply chains. |

| Economies of Scale | Large producers like Yancoal achieve lower per-unit costs through high-volume operations. | New entrants struggle to match pricing and cost efficiency. |

Porter's Five Forces Analysis Data Sources

Our Yancoal Porter's Five Forces analysis is built upon comprehensive data from Yancoal's annual reports, investor presentations, and ASX filings. We also incorporate industry-specific reports from reputable sources like S&P Global Market Intelligence and IBISWorld to provide a robust understanding of the competitive landscape.