WT Microelectronics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WT Microelectronics Bundle

WT Microelectronics is a key player in semiconductor distribution, but understanding its full potential requires a deeper dive. Our SWOT analysis reveals critical strengths like its extensive product portfolio and strong supplier relationships, alongside potential threats in market volatility and intense competition.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

WT Microelectronics holds the top spot globally in semiconductor distribution as of 2024, commanding a significant 14% market share, a notable increase from 9.9% in 2023, bolstered by strategic moves like the Future Electronics acquisition. This leadership is amplified by an expansive operational footprint spanning Asia Pacific, the Americas, and EMEA, ensuring broad market access and revenue diversification.

WT Microelectronics excels in providing comprehensive, end-to-end supply chain management services. This includes vital support in logistics, warehousing, and technical assistance for electronic components. These integrated services are key to optimizing client operations, as demonstrated by their role in streamlining production for major OEMs and ODMs.

WT Microelectronics demonstrates exceptional financial strength, highlighted by its Q1 2025 unaudited consolidated revenue of approximately NT$247.4 billion (US$7.5 billion), marking a significant 28% increase year-on-year. This robust top-line growth was complemented by impressive profitability, with operating profit and net profit surging 75% and 70% respectively, surpassing initial expectations.

The company's growth trajectory is expected to continue, with analysts forecasting a strong 23% revenue expansion in 2025, a rate that outpaces the overall industry. This positive outlook is further supported by projections of an 80% leap in statutory earnings per share, underscoring WT Microelectronics' solid financial performance and promising growth prospects.

Strategic Acquisition to Enhance Global Footprint

WT Microelectronics' strategic acquisition of Future Electronics in April 2024 for US$3.8 billion marked a significant enhancement of its global reach. This move was particularly impactful in expanding its presence across the Americas and EMEA regions. The integration of Future Electronics' complementary business model is poised to strengthen WT Microelectronics' end-to-end service offerings.

The acquisition is projected to drive substantial value creation for both customers and suppliers on a global scale. By combining forces, WT Microelectronics is solidifying its position as a leading force in the electronics distribution industry. This strategic integration is a key driver for future growth and market leadership.

- US$3.8 billion acquisition price for Future Electronics in April 2024.

- **Americas and EMEA** are key regions for expanded global footprint.

- **Complementary business models** are being integrated for enhanced service capabilities.

Diversified Product Lines and Application Markets

WT Microelectronics boasts a robust and varied product range, underpinned by strong, enduring relationships with leading global upstream suppliers. This ensures a consistent supply of diverse components essential for their broad customer base.

The company is strategically enhancing its product offerings, introducing innovative lines designed to meet evolving market needs. Concurrently, WT Microelectronics is expanding its footprint in high-growth sectors, demonstrating a proactive approach to market capture.

Key growth areas WT Microelectronics is targeting include:

- Automotive Electronics: With the automotive industry's rapid shift towards electrification and advanced driver-assistance systems, demand for specialized components is surging.

- Industrial Automation: The ongoing digital transformation in manufacturing, driving efficiency and connectivity, fuels the need for sophisticated industrial control and sensor solutions.

- Green Energy and Energy Management: As global efforts to combat climate change intensify, the renewable energy sector and smart grid technologies are experiencing significant expansion, requiring advanced power management and conversion components.

- Medical Devices and High-Speed Transmission: The increasing sophistication of healthcare technology and the demand for faster data transfer in communication networks create substantial opportunities for specialized semiconductor solutions.

- Cloud Data Centers and the Internet of Things (IoT): The exponential growth in data generation and the proliferation of connected devices necessitate high-performance components for data processing, storage, and network infrastructure.

This strategic diversification across multiple high-demand application markets effectively mitigates the risks associated with over-reliance on any single industry segment, fostering greater business resilience.

WT Microelectronics' global leadership in semiconductor distribution, holding a 14% market share in 2024, is a significant strength. This position is further bolstered by its expansive operational presence across Asia Pacific, the Americas, and EMEA, facilitating broad market access. The company's robust financial performance, evidenced by a 28% year-on-year revenue increase to NT$247.4 billion (US$7.5 billion) in Q1 2025, demonstrates strong underlying business health and growth potential.

What is included in the product

Analyzes WT Microelectronics’s competitive position through key internal and external factors.

Offers a clear, actionable SWOT breakdown for WT Microelectronics, simplifying complex market dynamics into manageable insights.

Weaknesses

The semiconductor industry's inherent cyclicality presents a significant weakness for WT Microelectronics. Despite a projected strong 2025, the industry has experienced more frequent downturns over the last 14 years, increasing the risk profile for distributors.

These cycles can trigger inventory oversupply and downward price pressure, directly impacting WT Microelectronics' revenue and profit margins. For example, during the 2022-2023 downturn, many semiconductor companies saw significant inventory build-ups, leading to price cuts and reduced order volumes.

WT Microelectronics' reliance on effective inventory management and its vulnerability to price volatility presents a significant weakness. The electronics distribution sector, particularly segments like memory products, often operates with thin gross margins, frequently below 5%. This makes accurate demand forecasting and precise inventory control absolutely critical.

Any miscalculation in predicting customer needs or managing stock levels can result in substantial inventory write-downs. For instance, distributors faced severe profit erosion in 2023 following sharp declines in memory prices, highlighting the direct impact such volatility can have on cash flow and profitability.

WT Microelectronics faces a significant weakness in its geographic exposure to markets experiencing slower recoveries. In 2024, Europe, a key region for the company, is still navigating an inventory adjustment phase, particularly impacted by subdued demand within the industrial control and automotive sectors. This sluggishness in Europe, coupled with ongoing uncertainties in the Americas, where a substantial part of WT Microelectronics' operations and recent acquisitions are integrated, poses a considerable risk.

The company's reliance on these regions means that a prolonged or deeper slowdown could act as a drag on its overall growth trajectory. Even if other markets demonstrate robust performance, the slower recovery in Europe and the Americas, which represent a significant portion of WT Microelectronics' business, could temper the company's ability to achieve its full growth potential. This geographic concentration in markets with weaker economic momentum is a clear vulnerability.

Operational Costs Associated with Extensive Services

WT Microelectronics' commitment to offering comprehensive supply chain management, encompassing logistics, warehousing, and technical support, naturally leads to significant operational expenses. These extensive services, while valuable to clients, necessitate considerable investment in a global infrastructure, specialized personnel, and advanced technology to maintain. For example, in the first half of 2024, WT Microelectronics reported operating expenses of NT$30.1 billion, reflecting the costs associated with its broad service portfolio.

Maintaining this global footprint and diverse service range puts pressure on profit margins. This is particularly true during economic slowdowns or when facing aggressive competition in the semiconductor distribution market. The company's gross profit margin for the first half of 2024 was 7.6%, indicating the challenge of balancing extensive service delivery with profitability.

- High Infrastructure Investment: Global warehousing and logistics networks require substantial capital outlay.

- Personnel Costs: Employing skilled technical support and logistics staff globally contributes to elevated operating expenses.

- Technology Adoption: Continuous investment in supply chain management software and automation is essential but costly.

- Competitive Pricing: The need to remain competitive can limit the ability to fully pass on these high operational costs to customers.

Integration Risks from Large Acquisitions

The acquisition of Future Electronics, a significant move for WT Microelectronics, introduces considerable integration risks. Merging two distinct business models, IT systems, and corporate cultures across numerous international locations demands substantial management focus and resources. For instance, integrating disparate enterprise resource planning (ERP) systems can be a complex and time-consuming process, potentially leading to operational hiccups.

These integration challenges could directly impact WT Microelectronics' financial performance. Any delays or unforeseen issues in combining operations, such as synchronizing supply chains or harmonizing sales processes, might lead to increased costs or revenue disruptions. For example, a poorly managed IT integration could result in data loss or system downtime, affecting order fulfillment and customer service.

- Integration Complexity: Combining IT infrastructures and operational workflows from two companies of WT Microelectronics' and Future Electronics' scale presents a significant undertaking.

- Cultural Harmonization: Merging distinct organizational cultures across global teams requires careful planning and execution to avoid internal friction.

- Financial Impact: Integration costs and potential operational disruptions can negatively affect profitability in the short to medium term.

WT Microelectronics' reliance on a few key suppliers creates a significant vulnerability. A disruption at a major supplier, whether due to production issues, geopolitical events, or financial distress, could severely impact WT Microelectronics' ability to source critical components. This concentration risk was highlighted in 2023 when supply chain bottlenecks, particularly for advanced microcontrollers, led to extended lead times and increased costs for many distributors.

The thin profit margins inherent in electronics distribution, often below 5% gross margin, amplify the impact of any supply chain interruption. For instance, if a primary supplier faces a production halt, WT Microelectronics might struggle to find alternative sources quickly or at comparable prices, directly squeezing already tight margins and potentially leading to lost sales opportunities.

WT Microelectronics' extensive global operations, while a strength, also present a weakness in terms of managing diverse regulatory environments and tax landscapes. Navigating varying compliance requirements across different countries can be complex and resource-intensive. For example, the company's presence in Asia, Europe, and the Americas necessitates adherence to distinct trade regulations, data privacy laws, and tax codes, each with its own set of compliance costs and potential penalties for non-adherence.

The integration of Future Electronics, a substantial acquisition, introduces considerable complexity in harmonizing these varied operational and regulatory frameworks. Ensuring consistent compliance across all merged entities, especially concerning financial reporting and customs procedures, demands significant oversight. The potential for missteps in managing these diverse regulatory requirements could lead to fines, operational delays, or reputational damage, impacting overall business performance.

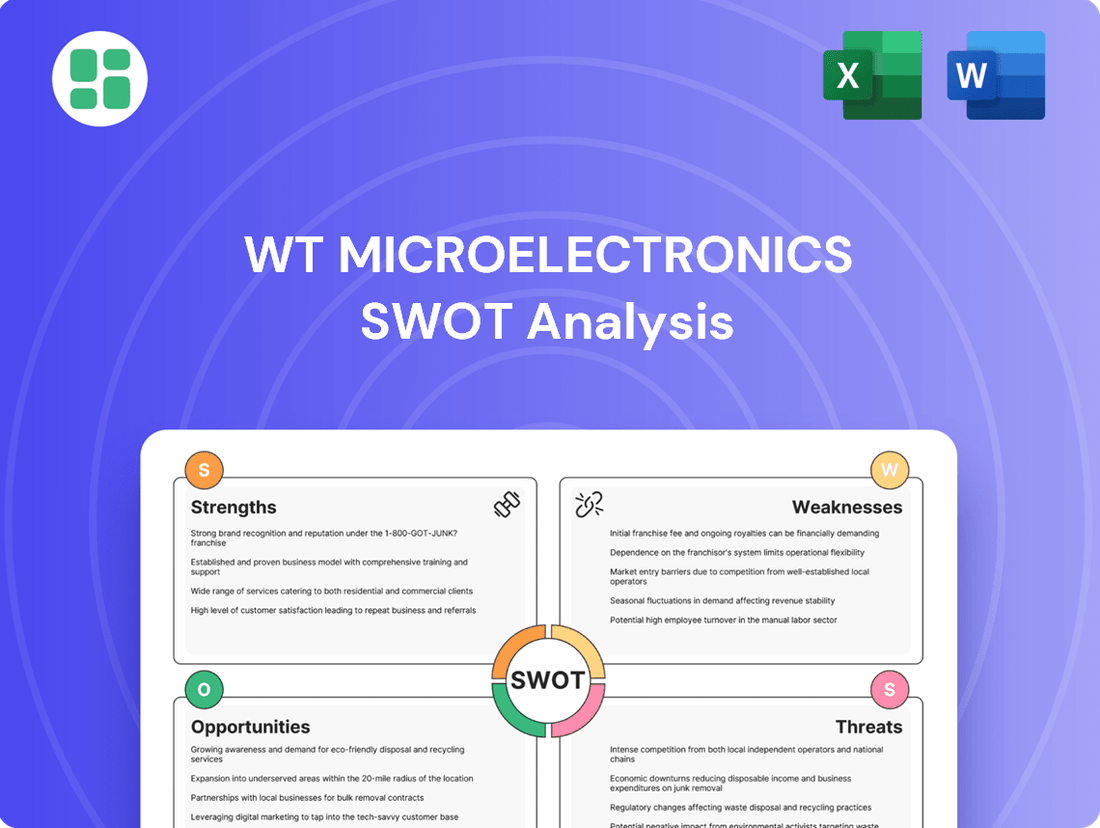

Preview the Actual Deliverable

WT Microelectronics SWOT Analysis

This is the actual WT Microelectronics SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full WT Microelectronics SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete WT Microelectronics SWOT analysis. Once purchased, you’ll receive the full, editable version, ready to be integrated into your business strategy.

Opportunities

The global semiconductor market is booming, fueled by the insatiable appetite for Artificial Intelligence (AI), the Internet of Things (IoT), and other cutting-edge technologies. The AI semiconductor market alone is anticipated to surpass $150 billion by 2025, presenting a massive opportunity for companies that distribute specialized chips and memory.

WT Microelectronics is strategically positioned to leverage this growth by providing essential components for AI servers, data centers, and the ever-increasing number of AI-powered consumer electronics. This surge in demand for advanced computing power directly translates into significant revenue potential for the company.

The ongoing digital transformation in manufacturing and supply chain management presents a significant opportunity for WT Microelectronics. By embracing Industry 4.0 technologies like AI, the company can automate critical design processes, leading to faster product development cycles and increased production efficiency. This automation also extends to optimizing overall performance across its operations.

Investing in advanced IT platforms and exploring 'Logistics-as-a-Service' (LaaS) models can further enhance WT Microelectronics' competitive edge. These initiatives are crucial for streamlining complex supply chain operations and providing clients with greater visibility and control. For instance, the global supply chain management market was valued at approximately $22.3 billion in 2023 and is projected to grow substantially, highlighting the demand for such advanced solutions.

WT Microelectronics is strategically broadening its reach into high-growth sectors like automotive electronics, industrial automation, and green energy. This diversification is key to unlocking new revenue streams and lessening dependence on established markets.

The company is also targeting specialized niches, including advanced packaging materials and high-bandwidth memory (HBM) crucial for the booming AI sector. For instance, the automotive electronics market, a key focus, is projected to grow significantly, with global sales expected to reach over $150 billion by 2025, according to various industry reports.

Increased Focus on Supply Chain Resilience and Diversification

Geopolitical tensions and past disruptions, like the 2020-2022 chip shortage impacting the automotive sector which saw production cuts of millions of vehicles, have underscored the urgent need for stronger, more varied semiconductor supply chains. Original Equipment Manufacturers (OEMs) are actively looking to build more dependable supplier relationships and move away from depending too heavily on just one or two locations.

WT Microelectronics, with its established global presence and a wide array of services, is well-positioned to become a crucial ally in constructing these resilient supply chains. The company can offer the reliability and consistent service that customers are now prioritizing, helping them mitigate risks associated with supply chain vulnerabilities.

- Global Footprint: WT Microelectronics operates across Asia, the Americas, and Europe, offering a geographically diverse supplier base.

- Value-Added Services: Beyond distribution, the company provides solutions like logistics management, technical support, and inventory management, enhancing supply chain efficiency.

- Market Trends: The demand for diversified supply chains is a significant trend, with many tech giants actively investing in new manufacturing facilities outside of traditional hubs. For instance, Intel announced significant investments in new fabs in Arizona and Ohio in 2021 and 2022, signaling this shift.

Potential for Further Industry Consolidation

The electronic component distribution landscape is dynamic, with ongoing consolidation trends. WT Microelectronics, as a leading global distributor, is strategically positioned to capitalize on this by pursuing further acquisitions. These strategic moves can significantly bolster its market presence, broaden its product offerings, and sharpen its competitive edge. For instance, its 2023 acquisition of Future Electronics, a major player, demonstrated this strategy's effectiveness, expanding WT's global reach and product portfolio considerably.

The industry's consolidation provides WT Microelectronics with a clear opportunity to enhance its market standing. By integrating complementary businesses, WT can achieve greater economies of scale and operational efficiencies. This proactive approach to consolidation is crucial for maintaining leadership in a rapidly evolving market, especially as larger players seek to optimize their operations and expand their service capabilities.

- Market Share Growth: Acquisitions allow WT to absorb competitors' customer bases and supplier relationships, directly increasing its market share.

- Product Line Expansion: Acquiring companies with specialized product lines or technologies can quickly diversify WT's offerings and appeal to a wider customer base.

- Geographic Reach: Strategic acquisitions in under-penetrated regions can significantly expand WT's global footprint and service capabilities.

- Synergies and Efficiencies: Merging operations can lead to cost savings through shared resources, optimized logistics, and streamlined administrative functions.

The burgeoning demand for AI, IoT, and advanced computing presents a substantial opportunity for WT Microelectronics, particularly with the AI semiconductor market projected to exceed $150 billion by 2025. The company is well-positioned to supply critical components for AI servers and data centers, capitalizing on this technological wave.

WT Microelectronics can enhance its competitive edge by embracing Industry 4.0 technologies for process automation and exploring Logistics-as-a-Service models, as the global supply chain management market is expected to see significant growth beyond its 2023 valuation of approximately $22.3 billion. Diversifying into automotive, industrial automation, and green energy sectors, alongside specialized niches like advanced packaging and HBM, further unlocks new revenue streams.

The global push for more resilient semiconductor supply chains, highlighted by past shortages affecting industries like automotive, creates an opening for WT Microelectronics. Its established global presence and comprehensive services make it an attractive partner for OEMs seeking reliable suppliers and diversified sourcing strategies.

Industry consolidation offers WT Microelectronics a strategic avenue for growth through acquisitions, as demonstrated by its 2023 acquisition of Future Electronics. This approach enhances market share, expands product lines, broadens geographic reach, and unlocks significant operational synergies.

Threats

Escalating geopolitical tensions, especially between the U.S. and China, continue to cast a shadow over the global semiconductor industry. These tensions manifest as trade protectionism, which can fragment supply chains and create uncertainty for companies like WT Microelectronics.

New export controls targeting advanced AI technologies and restrictions on essential minerals crucial for chip manufacturing represent direct threats. Such measures can disrupt WT Microelectronics' access to vital components, inflate production costs, and potentially limit their reach into key markets.

While WT Microelectronics has noted minimal direct impact from existing U.S. tariffs, the overarching economic and industry-wide instability stemming from these geopolitical dynamics remains a significant concern. The potential for broader disruptions could affect demand and operational stability.

While the semiconductor industry anticipates a positive trajectory for 2025, it remains vulnerable to economic headwinds. A global economic slowdown or a downturn in key sectors such as consumer electronics could significantly dampen demand for electronic components. This would likely result in an oversupply situation and put downward pressure on pricing.

The electronic component distribution landscape is fiercely competitive, with established giants and emerging players constantly battling for market dominance. This intense rivalry often translates into significant pricing pressures, particularly for commoditized components, which can squeeze profit margins for distributors like WT Microelectronics. For instance, in 2023, the global electronic components distribution market experienced a slight contraction due to macroeconomic headwinds, intensifying the need for competitive pricing strategies.

This margin erosion is a persistent threat, especially in product categories like memory, where price fluctuations are common and margins are already thin. To counteract this, distributors must focus on differentiation through value-added services, such as supply chain management, technical support, and customization, to maintain profitability. Companies that fail to innovate and provide unique solutions risk being relegated to a purely transactional role, making them vulnerable to further margin compression.

Technological Obsolescence and Rapid Innovation Cycles

The semiconductor industry moves at lightning speed, with new technologies emerging constantly. This rapid innovation means components can become outdated very quickly. For WT Microelectronics, this presents a significant challenge in managing its product inventory and ensuring it stays ahead of the curve. For instance, the average product lifecycle in semiconductors has been shrinking, with some advanced components seeing obsolescence within 18-24 months.

Failure to embrace and integrate cutting-edge technologies, such as advancements in chiplet architecture or new materials for advanced packaging, could severely impact WT Microelectronics' competitive standing. The company must continuously invest in understanding and distributing next-generation memory solutions and processors to avoid falling behind market demands. In 2024, the demand for AI-specific chips and advanced packaging solutions saw significant growth, highlighting the need for distributors to adapt quickly.

This dynamic environment necessitates a proactive approach to technology adoption and a robust strategy for managing product lifecycles. WT Microelectronics faces the threat of:

- Rapid devaluation of existing inventory due to technological shifts.

- Increased costs associated with staying current with a broad and evolving product catalog.

- Potential loss of market share if unable to offer the latest semiconductor innovations to its customers.

Supply Chain Disruptions and Resource Scarcity

WT Microelectronics, like other semiconductor distributors, faces significant threats from supply chain disruptions. Beyond geopolitical tensions, natural disasters and extreme weather events pose a real risk to manufacturing operations. For instance, a severe drought in Taiwan, a major hub for semiconductor production, could impact water availability, which is crucial for chip manufacturing processes.

Resource scarcity, particularly for essential raw materials like copper, also presents a challenge. Copper is vital for electrical conductivity in semiconductors. The increasing demand for electronics, coupled with potential supply constraints, could drive up costs. In 2024, global copper prices have shown volatility, reflecting these supply-demand dynamics.

- Natural Disasters: Earthquakes or typhoons in key manufacturing regions can halt production.

- Resource Scarcity: Limited availability of water and raw materials like copper can increase operational expenses.

- Increased Lead Times: Disruptions lead to longer waiting periods for components, impacting delivery schedules.

- Higher Costs: Shortages and increased demand for resources translate to higher procurement costs for distributors.

The semiconductor industry is highly susceptible to macroeconomic downturns, which can significantly reduce demand for electronic components. For example, the global economic outlook for 2025 indicates potential slowdowns in key consumer markets, which could lead to oversupply and price erosion for distributors like WT Microelectronics.

Intense competition within the electronic component distribution sector, characterized by established players and new entrants, exerts considerable pricing pressure, particularly on commoditized products. This competitive landscape, as evidenced by a slight contraction in the global market in 2023, necessitates aggressive pricing strategies that can compress profit margins.

The rapid pace of technological advancement in semiconductors poses a threat of inventory devaluation and increased costs for staying current. With product lifecycles shrinking, some advanced components now become obsolete within 18-24 months, demanding continuous investment in new technologies and robust inventory management to maintain market share.

Supply chain vulnerabilities, including geopolitical tensions, natural disasters, and resource scarcity (like water and copper), can disrupt production and increase operational costs. For instance, volatility in copper prices during 2024 highlights the impact of resource demand on procurement expenses.

| Threat Category | Specific Risk | Potential Impact on WT Microelectronics | Illustrative Data Point |

| Macroeconomic Headwinds | Global Economic Slowdown | Reduced demand, oversupply, price erosion | 2023 market contraction in electronic components distribution |

| Competitive Intensity | Pricing Pressure on Commoditized Goods | Margin compression, reduced profitability | Thin margins in memory product categories |

| Technological Obsolescence | Rapid Product Lifecycle Shrinkage | Inventory devaluation, increased operational costs, loss of market share | 18-24 month obsolescence for some advanced components |

| Supply Chain Disruptions | Resource Scarcity (e.g., Copper) | Increased procurement costs, longer lead times | Volatility in global copper prices in 2024 |

SWOT Analysis Data Sources

This WT Microelectronics SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These data sources provide a robust and accurate basis for understanding the company's current standing and future potential.