WT Microelectronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WT Microelectronics Bundle

Navigate the complex external forces shaping WT Microelectronics's trajectory with our comprehensive PESTLE analysis. Understand critical political, economic, social, technological, legal, and environmental factors that could impact your investments or strategic decisions. Download the full analysis now to gain actionable intelligence and stay ahead of the curve.

Political factors

Global geopolitical tensions, especially between the US and China, directly affect the semiconductor supply chain. Trade restrictions, export controls, and tariffs imposed by these nations can disrupt the flow of essential components. For distributors like WT Microelectronics, this necessitates a strategic approach to diversify their sourcing and customer base to mitigate risks.

Policies like the US CHIPS Act, enacted in 2022 with significant funding allocated for domestic semiconductor manufacturing, aim to reduce reliance on overseas production. This initiative could fundamentally alter the global distribution network for semiconductors, potentially creating new opportunities and challenges for established players.

Governments globally are actively pouring significant funds into the semiconductor industry. For instance, the US CHIPS and Science Act alone allocates over $52 billion to boost domestic chip manufacturing and research, with further investments expected from other nations. These substantial subsidies and incentives are designed to bolster national supply chains and enhance technological competitiveness.

WT Microelectronics, operating as a global distributor, must carefully monitor and adapt to these diverse regional government policies. The dynamic landscape of these incentives can influence where manufacturing occurs and how supply chains are structured, directly impacting WT Microelectronics' operational strategies and market positioning.

Political stability in key semiconductor manufacturing hubs, especially Taiwan, remains a paramount concern for WT Microelectronics. Taiwan's dominance in advanced chip production means any geopolitical tensions, such as those observed in the Taiwan Strait, could significantly disrupt global supply chains.

The potential for conflict directly impacts WT Microelectronics' sourcing capabilities and product distribution networks. For instance, in 2024, the ongoing geopolitical climate continues to be a significant risk factor for companies reliant on Taiwanese foundries, with potential disruptions affecting lead times and costs for critical components.

Export Controls and Sanctions

Export controls and sanctions, particularly those targeting advanced semiconductor technologies and manufacturing equipment, pose a significant challenge for companies like WT Microelectronics. These regulations, which have intensified in recent years, can disrupt supply chains and limit market access. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has implemented various measures affecting the export of advanced chips and related technologies to certain countries.

WT Microelectronics must maintain rigorous compliance programs to navigate this complex regulatory landscape. Failure to adhere to these controls can result in substantial fines and reputational damage, impacting business continuity. The company needs to stay abreast of evolving sanctions lists and export restrictions, ensuring all transactions and partnerships align with international trade laws.

Key considerations for WT Microelectronics regarding export controls and sanctions include:

- Monitoring regulatory changes: Continuously tracking updates from bodies like BIS and equivalent international agencies.

- Supply chain due diligence: Verifying the origin and destination of all components and products to ensure compliance.

- Market access limitations: Assessing how sanctions might restrict access to key markets or suppliers.

- Technological restrictions: Understanding limitations on the export of specific advanced manufacturing equipment or chip designs.

Regionalization of Supply Chains

The global semiconductor supply chain is increasingly shifting from broad globalization towards regionalization. This is largely due to rising geopolitical tensions and a heightened focus on national security, prompting countries to secure their own chip manufacturing capabilities. For instance, the US CHIPS and Science Act, signed in 2022, allocated $52.7 billion for semiconductor manufacturing and research, aiming to bolster domestic production.

This trend necessitates companies like WT Microelectronics, a global distributor, to adapt by diversifying their manufacturing footprints and cultivating more robust regional supply networks. This strategic pivot presents both hurdles, such as increased logistical complexity and potentially higher operational costs, and significant opportunities for growth by serving these emerging regional markets.

- Geopolitical Drivers: Nations are prioritizing domestic semiconductor production to mitigate risks associated with global supply chain disruptions, as seen in the US CHIPS Act and similar initiatives in Europe and Asia.

- Resilience Focus: Companies are actively seeking to build more resilient supply chains by diversifying manufacturing locations away from single points of failure, a strategy gaining traction throughout 2024 and projected to continue.

- Market Opportunities: Regionalization creates new market opportunities for distributors capable of supporting localized manufacturing and R&D efforts, potentially leading to increased market share in specific geographic areas.

Global political dynamics significantly impact WT Microelectronics, particularly the US-China trade relationship and its implications for semiconductor supply chains. Government incentives, such as the US CHIPS Act, are reshaping manufacturing landscapes, with over $52 billion allocated to bolster domestic production. Political stability in key regions like Taiwan is crucial, as disruptions in 2024 highlighted the vulnerability of sourcing from this dominant chip-producing area.

Export controls and sanctions, exemplified by US Bureau of Industry and Security (BIS) regulations, create compliance challenges for distributors. These measures can restrict market access and disrupt the flow of advanced technologies. WT Microelectronics must navigate these evolving regulations diligently to avoid penalties and maintain business operations.

The trend towards regionalization in semiconductor manufacturing, driven by geopolitical concerns and national security, necessitates strategic adaptation. WT Microelectronics faces the challenge of diversifying its supply networks to accommodate these shifts, which also present opportunities in emerging regional markets.

| Factor | Impact on WT Microelectronics | 2024/2025 Data/Trend |

|---|---|---|

| Geopolitical Tensions (US-China) | Disruptions to supply chain, need for diversification | Continued trade restrictions and export controls impacting component availability. |

| Government Incentives (e.g., CHIPS Act) | Reshaping manufacturing locations, new market opportunities | Over $52 billion allocated in the US; similar initiatives globally encouraging regional production. |

| Political Stability (Taiwan) | Risk to sourcing and distribution networks | Ongoing geopolitical climate in the Taiwan Strait remains a significant risk factor for 2024/2025. |

| Export Controls & Sanctions | Compliance burden, market access limitations | Intensified regulations from bodies like BIS affecting advanced chip exports. |

What is included in the product

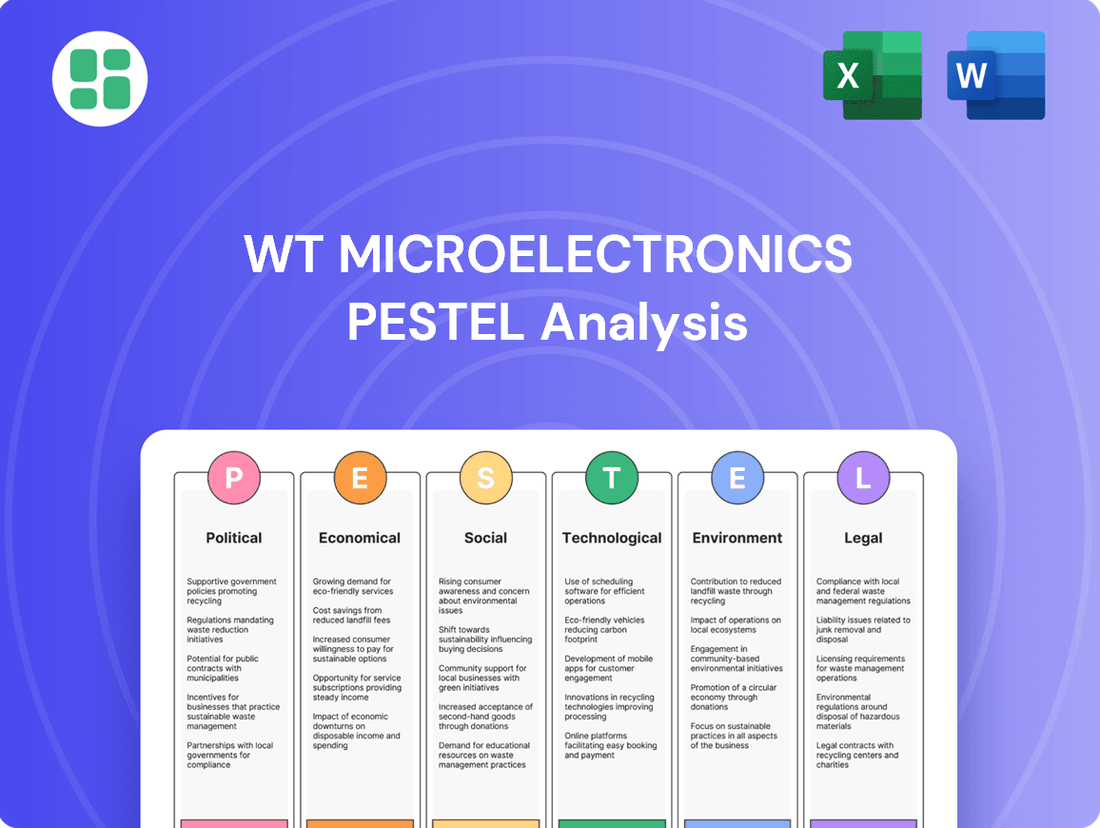

This PESTLE analysis examines the external macro-environmental factors impacting WT Microelectronics, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions, to identify strategic opportunities and threats.

A concise PESTLE analysis for WT Microelectronics offers a clear, summarized version of complex external factors, simplifying strategic discussions and reducing the pain of information overload.

Economic factors

Global economic growth is a primary driver for WT Microelectronics. When economies are expanding, businesses and consumers tend to spend more on electronic devices, which directly translates to higher sales volumes for semiconductor companies like WT Microelectronics. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a steady rate that supports demand across various tech sectors.

The semiconductor industry, in particular, is poised for robust growth in 2024 and 2025, fueled by strong demand in key areas. The burgeoning fields of artificial intelligence (AI), the expansion of data centers, the increasing adoption of electric vehicles in the automotive sector, and the persistent demand for consumer electronics are all significant tailwinds. Analysts anticipate the global semiconductor market to see substantial increases, with some projections indicating growth exceeding 10% year-over-year for 2024, driven by these high-growth segments.

Inflationary pressures and rising interest rates directly impact WT Microelectronics by increasing borrowing costs for capital investments in advanced manufacturing and research. For instance, the US Federal Reserve's aggressive rate hikes through 2023 and into early 2024 have made financing new semiconductor fabrication plants significantly more expensive.

These macroeconomic shifts also ripple through WT Microelectronics' customer base, as higher interest rates can dampen consumer demand for electronics like smartphones and computers. A slowdown in consumer spending directly translates to reduced orders for the semiconductor components WT Microelectronics supplies.

The global inflation rate, hovering around 5-6% in many developed economies during 2023-2024, further erodes purchasing power, making consumers more price-sensitive and potentially delaying upgrades to electronic devices, thus impacting WT Microelectronics' revenue streams.

Currency exchange rate fluctuations represent a significant economic factor for WT Microelectronics, a global distributor operating in multiple markets. Given its international business model, the company is directly exposed to the impact of varying exchange rates on its financial performance.

These shifts can materially affect WT Microelectronics' reported revenue and cost of goods sold when transactions denominated in foreign currencies are converted back to its reporting currency. For instance, a strengthening US dollar against other major currencies could reduce the dollar value of sales made in those foreign markets, impacting overall profitability.

In 2024, for example, many emerging market currencies experienced volatility against the US dollar, a trend that continued into early 2025. This environment necessitates careful management of currency exposure to mitigate potential negative impacts on WT Microelectronics' bottom line.

Supply Chain Dynamics and Inventory Levels

WT Microelectronics operates within a semiconductor industry prone to cyclical shortages and oversupply, directly impacting its supply chain. While 2024 marked a recovery, the company must prioritize robust inventory management for 2025, particularly for high-demand AI components and established manufacturing processes.

Navigating potential bottlenecks remains a key challenge. For instance, the global semiconductor shortage experienced in 2020-2022 significantly disrupted production for many tech firms. As of early 2025, while overall supply has improved, specific segments like advanced packaging materials and certain mature node components still face capacity constraints, affecting lead times and costs.

- AI Chip Demand: Continued strong demand for AI accelerators is straining the supply of advanced nodes and specialized packaging.

- Mature Node Constraints: Despite overall improvements, certain mature nodes essential for automotive and industrial applications still experience tight supply.

- Inventory Optimization: WT Microelectronics needs to balance holding sufficient inventory to meet demand against the risks of obsolescence and carrying costs in a dynamic market.

- Geopolitical Factors: Trade tensions and regional manufacturing initiatives can create localized supply chain disruptions, requiring agile sourcing strategies.

Performance of Key Customer Industries

WT Microelectronics' success is intrinsically linked to the vitality of its core customer sectors. The automotive industry, particularly the burgeoning electric vehicle (EV) market, along with consumer electronics like smartphones and PCs, and the robust industrial and data center segments, all directly influence the company's performance.

Positive momentum is building for 2025, driven by escalating demand in artificial intelligence (AI) applications. Furthermore, a projected recovery in sales for PCs and smartphones offers a favorable outlook, suggesting increased order volumes for WT Microelectronics.

- Automotive Sector Growth: The global automotive market is expected to see significant growth, with EVs projected to capture a larger share. For instance, EV sales are anticipated to reach approximately 16.7 million units globally in 2024, a substantial increase from previous years, positively impacting semiconductor demand in this segment.

- Consumer Electronics Recovery: After a period of slower sales, the consumer electronics market, especially smartphones and PCs, is showing signs of resurgence. Global smartphone shipments are forecast to grow by 3.8% in 2024, reaching 1.17 billion units, indicating a healthier demand environment.

- Data Center and AI Expansion: The insatiable demand for data processing, fueled by AI advancements, continues to drive growth in the data center market. Investments in AI infrastructure are expected to surge, creating sustained demand for high-performance computing components.

- Industrial Automation: The ongoing trend of industrial automation and smart manufacturing further bolsters demand for specialized semiconductors, a key area for WT Microelectronics.

Global economic expansion is a key driver for WT Microelectronics. As economies grow, demand for electronic devices increases, directly benefiting semiconductor suppliers. The IMF projected global growth at 3.2% for 2024, a rate that supports broad tech sector demand.

The semiconductor industry itself is set for significant growth in 2024 and 2025, propelled by AI, data centers, electric vehicles, and consumer electronics. Projections suggest the global semiconductor market could grow by over 10% year-over-year in 2024, driven by these expanding areas.

Inflation and rising interest rates directly impact WT Microelectronics by increasing the cost of capital for essential investments in manufacturing and R&D. For example, the US Federal Reserve's interest rate hikes through early 2024 have substantially increased financing costs for new semiconductor facilities.

These economic shifts also affect WT Microelectronics' customers, as higher interest rates can reduce consumer spending on electronics like smartphones and PCs, leading to fewer orders for the company's components.

Global inflation, which remained around 5-6% in many developed nations during 2023-2024, diminishes purchasing power, making consumers more price-conscious and potentially delaying upgrades to electronic devices, thereby impacting WT Microelectronics' revenue.

Currency exchange rate volatility is a significant economic factor for WT Microelectronics due to its global operations. Fluctuations can materially alter reported revenue and costs when foreign currency transactions are converted to its reporting currency.

For instance, a stronger US dollar against other currencies can decrease the dollar value of international sales, impacting overall profitability. Many emerging market currencies experienced volatility against the US dollar in 2024, a trend expected to continue into early 2025, necessitating careful currency risk management.

WT Microelectronics operates in a cyclical semiconductor industry, facing potential shortages and oversupply that impact its supply chain. While 2024 saw a market recovery, the company must focus on robust inventory management for 2025, especially for high-demand AI components and established manufacturing processes.

Navigating supply chain bottlenecks remains a challenge. Although overall supply improved by early 2025, specific areas like advanced packaging materials and certain mature node components still face capacity constraints, affecting lead times and costs.

WT Microelectronics' performance is closely tied to its key customer sectors, including the automotive industry (especially EVs), consumer electronics (smartphones, PCs), and the industrial and data center segments. Positive trends are emerging for 2025, with strong demand in AI applications and a projected recovery in PC and smartphone sales, indicating potential for increased order volumes.

The automotive sector is experiencing significant growth, with EVs projected to capture a larger market share. Global EV sales were expected to reach around 16.7 million units in 2024, a substantial increase that positively impacts semiconductor demand in this area.

The consumer electronics market is showing signs of recovery after a slower period. Global smartphone shipments were forecast to grow by 3.8% in 2024, reaching 1.17 billion units, suggesting a healthier demand environment.

The relentless demand for data processing, driven by AI advancements, continues to fuel growth in the data center market. Investments in AI infrastructure are projected to surge, creating sustained demand for high-performance computing components.

The ongoing trend of industrial automation and smart manufacturing further boosts demand for specialized semiconductors, a crucial market for WT Microelectronics.

| Economic Factor | 2024 Projection/Trend | 2025 Outlook | Impact on WT Microelectronics | Key Data Point |

| Global Economic Growth | Projected 3.2% (IMF) | Steady growth expected | Supports demand for electronics and semiconductors | IMF Global Growth Forecast 2024: 3.2% |

| Semiconductor Market Growth | Expected >10% YoY | Continued strong growth | Increased sales volumes for components | Global Semiconductor Market Growth 2024: >10% |

| Interest Rates | Elevated, potential stabilization | May remain elevated | Increases borrowing costs, can dampen consumer spending | US Federal Reserve Rate Hikes (2023-early 2024) |

| Inflation | 5-6% in developed economies (2023-2024) | Gradual moderation expected | Erodes purchasing power, increases price sensitivity | Developed Economies Inflation 2023-2024: 5-6% |

| Currency Exchange Rates | Volatility in emerging markets | Continued volatility possible | Affects reported revenue and costs | Emerging Market Currency Volatility vs. USD (2024) |

| Supply Chain Dynamics | Recovery, but specific constraints remain | Ongoing need for inventory management | Risk of shortages, impacts lead times and costs | Mature Node Constraints (Early 2025) |

| Key Customer Sector Demand | Strong in AI, EV; recovery in Consumer Electronics | Continued strength in AI, Data Centers; robust Consumer Electronics | Drives order volumes for semiconductors | Global EV Sales 2024: ~16.7 million units; Global Smartphone Shipments 2024: 1.17 billion units |

What You See Is What You Get

WT Microelectronics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of WT Microelectronics provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It's designed to offer actionable insights for business planning and risk assessment.

Sociological factors

Consumer preferences are rapidly shifting towards technologies like AI-integrated devices and the Internet of Things (IoT). This trend directly fuels demand for semiconductors, the building blocks of these innovations. For instance, the global AI chip market was valued at approximately $22.6 billion in 2023 and is projected to reach $102.6 billion by 2028, demonstrating substantial growth.

WT Microelectronics is well-positioned to capitalize on this evolution. The increasing integration of AI across various consumer electronics, from smartphones to smart home appliances, necessitates more sophisticated and specialized semiconductor components. This creates a significant opportunity for WT Microelectronics to supply the advanced chips required for these AI-powered devices.

The semiconductor industry is grappling with a significant labor shortage, with estimates suggesting a need for over 70,000 new skilled workers globally by 2030. This deficit, particularly in specialized engineering and technician roles, could constrain manufacturing output and escalate operational expenses across the WT Microelectronics supply chain.

The semiconductor industry, including companies like WT Microelectronics, faces a significant challenge with an aging workforce in key manufacturing regions. A substantial percentage of experienced semiconductor employees are nearing retirement age, intensifying existing labor shortages. For instance, in 2024, projections indicated a growing gap between the demand for skilled semiconductor professionals and the available talent pool.

To counter this, WT Microelectronics and its industry partners are focusing on robust workforce development strategies. This includes substantial investments in upskilling and reskilling programs designed to retain valuable experienced employees and attract a new, diverse generation of talent. These initiatives are crucial for maintaining operational continuity and fostering innovation in a rapidly evolving technological landscape.

Demand for Ethical and Sustainable Sourcing

Consumers, investors, and regulators are increasingly demanding that electronics supply chains prioritize ethical and sustainable sourcing. This trend is pushing companies to scrutinize their entire value chain, from raw material extraction to component manufacturing.

WT Microelectronics, as a key distributor in the electronics sector, is positioned to influence and facilitate the adoption of these responsible practices. By partnering with suppliers who demonstrate a commitment to environmental stewardship and fair labor, WT Microelectronics can help meet this growing demand. For instance, a significant portion of global consumers, around 60% according to a 2024 survey by Accenture, consider sustainability when making purchasing decisions, directly impacting the demand for ethically sourced components.

- Growing Consumer Awareness: A majority of consumers now factor sustainability into their buying habits, creating market pressure for ethical sourcing.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are becoming critical for investment decisions, driving demand for transparent and responsible supply chains.

- Regulatory Push: Governments worldwide are implementing stricter regulations concerning supply chain transparency and environmental impact, influencing component sourcing.

- WT Microelectronics' Role: The company can leverage its distribution network to promote and supply components from manufacturers adhering to high ethical and sustainability standards.

Shifts in Global Manufacturing Footprints

Societal and political pressures are increasingly prompting a reassessment of where goods are manufactured globally. This means companies are rethinking their supply chains, often looking to bring production closer to home or diversify manufacturing locations to reduce risks. For WT Microelectronics, this could mean their suppliers are adjusting where they build factories, impacting how products are moved and managed.

These shifts are driven by a desire for greater supply chain resilience, especially after disruptions experienced in recent years. For instance, many nations are actively encouraging domestic semiconductor manufacturing through incentives, aiming to secure critical technology supply. This trend directly affects the global distribution of microelectronics production.

- Reshoring Initiatives: Governments worldwide are implementing policies and offering subsidies to encourage the return of manufacturing, particularly in strategic sectors like semiconductors.

- Supply Chain Diversification: Companies are actively reducing reliance on single geographic regions, spreading production across multiple countries to mitigate geopolitical and logistical risks.

- Focus on Sustainability: Growing consumer and regulatory demand for environmentally responsible production is also influencing manufacturing location decisions, favoring regions with stricter environmental standards and renewable energy access.

Societal expectations are increasingly emphasizing ethical labor practices and diverse representation within the workforce. This trend impacts WT Microelectronics by influencing recruitment strategies and demanding transparency in supplier labor conditions. For instance, a 2024 Deloitte survey indicated that 70% of employees consider a company's commitment to diversity and inclusion when choosing an employer.

Technological factors

The semiconductor industry is on a relentless innovation curve, with advancements like High Bandwidth Memory (HBM) and Chip-on-Wafer-on-Substrate (CoWoS) packaging becoming critical. WT Microelectronics needs to actively track these shifts to maintain its distribution of cutting-edge components.

Emerging materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) are also transforming power electronics and high-frequency applications. For instance, the SiC market alone was projected to reach $6.3 billion in 2023 and is expected to grow significantly, highlighting the need for distributors like WT Microelectronics to offer these advanced solutions.

The rapid advancement and widespread adoption of technologies like artificial intelligence (AI), 5G, the Internet of Things (IoT), and electric vehicles (EVs) are significantly boosting the demand for sophisticated semiconductor solutions. These sectors are creating substantial new markets for WT Microelectronics, as they rely heavily on high-performance and specialized chips to function.

For instance, the global AI chip market was projected to reach over $100 billion by 2025, with AI applications driving demand for advanced processors and memory. Similarly, the rollout of 5G networks is necessitating new chipsets for both infrastructure and devices, with the 5G infrastructure market alone expected to grow substantially in the coming years.

The proliferation of IoT devices, from smart home gadgets to industrial sensors, also requires a vast array of microcontrollers and connectivity chips. Electric vehicles, a rapidly expanding segment of the automotive industry, are increasingly incorporating advanced power management ICs, sensors, and processing units, all of which represent key product areas for semiconductor suppliers like WT Microelectronics.

The increasing digitalization and interconnectedness of semiconductor supply chains, including those managed by WT Microelectronics, expose them to escalating cybersecurity threats. These complex networks, handling massive data flows and intricate logistics, are prime targets for cyberattacks.

WT Microelectronics, by its very nature, deals with sensitive intellectual property and critical operational data. Protecting this information from breaches and preventing disruptions to its logistics operations are paramount, requiring sophisticated cybersecurity defenses.

For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, a stark reminder of the financial and operational risks involved. A successful attack on WT Microelectronics' systems could lead to significant financial losses, reputational damage, and a severe impact on its ability to serve its clients.

Automation and Digitalization in Logistics

The logistics sector is rapidly embracing automation and digitalization. This trend is significantly boosting efficiency and cutting operational expenses for businesses involved in distribution. For instance, the global warehouse automation market was valued at approximately $4.5 billion in 2023 and is projected to reach over $10 billion by 2030, showcasing substantial growth driven by these technological advancements.

WT Microelectronics can capitalize on these advancements to streamline its extensive supply chain operations. By integrating technologies like AI-powered route optimization and robotic process automation (RPA) in its warehouses, the company can achieve faster order fulfillment and reduced handling errors. Data from 2024 indicates that companies implementing advanced automation in their logistics saw an average reduction of 15-20% in labor costs and a 10% increase in throughput.

Key areas where WT Microelectronics can leverage these technologies include:

- Warehouse Automation: Implementing automated storage and retrieval systems (AS/RS) and robotic picking solutions to enhance speed and accuracy.

- Supply Chain Visibility: Utilizing IoT sensors and blockchain technology for real-time tracking of goods, improving transparency and predictability.

- Data Analytics: Employing AI and machine learning to analyze supply chain data for demand forecasting, inventory management, and risk mitigation.

- Digital Freight Platforms: Leveraging digital marketplaces and platforms to optimize freight matching and transportation management, potentially reducing shipping costs by up to 10% as reported by industry studies in late 2024.

Supplier R&D and Evolving Standards

WT Microelectronics' reliance on its semiconductor suppliers' research and development is a critical technological factor. The company's ability to offer advanced products hinges on these suppliers consistently innovating and investing in new technologies. For instance, advancements in AI and 5G require suppliers to develop increasingly sophisticated chipsets, directly impacting WT Microelectronics' product pipeline.

Adherence to evolving industry standards is equally vital. As technology progresses, new standards for performance, efficiency, and compatibility emerge. WT Microelectronics must ensure its suppliers meet these benchmarks to guarantee its own products remain competitive and interoperable within the broader tech ecosystem. For example, the transition to USB4 or new Wi-Fi standards necessitates supplier alignment.

Fostering strong, collaborative relationships with these innovative suppliers is paramount. This ensures WT Microelectronics gains early access to next-generation components and can influence the development of products tailored to market needs. In 2024, major semiconductor players like TSMC and Intel continued significant R&D spending, with TSMC reportedly investing over $10 billion in advanced manufacturing technologies, directly benefiting companies like WT Microelectronics.

- Supplier Innovation: WT Microelectronics' product portfolio is directly influenced by the R&D investments of its key semiconductor partners, ensuring access to cutting-edge components.

- Evolving Standards: The company's competitiveness relies on suppliers' adoption of new technological standards, such as advancements in AI processing or next-generation connectivity.

- Strategic Partnerships: Maintaining strong ties with leading semiconductor manufacturers, like TSMC, which invested over $10 billion in R&D in 2024, is crucial for securing advanced technology.

- Market Responsiveness: Collaborative supplier relationships enable WT Microelectronics to align its offerings with rapidly changing market demands driven by technological shifts.

The semiconductor industry's rapid evolution, particularly in areas like High Bandwidth Memory (HBM) and advanced packaging such as Chip-on-Wafer-on-Substrate (CoWoS), directly impacts WT Microelectronics' product offerings. The increasing demand from AI, 5G, IoT, and electric vehicles necessitates distribution of sophisticated chipsets, with the global AI chip market projected to exceed $100 billion by 2025.

Technological advancements in materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) are critical for power electronics, with the SiC market alone reaching an estimated $6.3 billion in 2023. WT Microelectronics must stay abreast of these material innovations to serve evolving market needs.

Logistics automation is a key technological driver, with the global warehouse automation market valued at approximately $4.5 billion in 2023 and expected to grow significantly. Companies implementing automation saw an average 15-20% reduction in labor costs in 2024.

WT Microelectronics' product pipeline is heavily reliant on supplier R&D, with companies like TSMC investing over $10 billion in advanced manufacturing technologies in 2024. Ensuring supplier adherence to new standards, such as USB4, is crucial for competitiveness.

| Technological Factor | Impact on WT Microelectronics | Relevant Data/Projection |

| Advanced Semiconductor Technologies (HBM, CoWoS) | Drives demand for cutting-edge components in distribution. | Critical for AI, 5G, IoT, EV sectors. |

| Emerging Materials (SiC, GaN) | Expands product portfolio for power electronics. | SiC market: ~$6.3 billion in 2023. |

| Logistics Automation & Digitalization | Enhances operational efficiency and reduces costs. | Warehouse automation market: ~$4.5 billion (2023), ~15-20% labor cost reduction (2024). |

| Supplier R&D and Innovation | Ensures access to next-generation products. | TSMC R&D investment: >$10 billion (2024). |

Legal factors

Intellectual property is the bedrock of the semiconductor industry, with companies like WT Microelectronics heavily reliant on patent protection for their chip designs and manufacturing innovations. In 2024, the global semiconductor market, valued at an estimated $600 billion, sees intense competition where IP is a key differentiator and competitive advantage.

WT Microelectronics must navigate a complex web of international patent laws to ensure its operations and the products it distributes are fully compliant. Failure to do so could lead to costly legal battles and significant disruption, impacting its ability to secure new supply agreements or expand into new markets.

Global data privacy regulations like GDPR and CCPA are increasingly stringent, impacting how companies handle sensitive information. WT Microelectronics must navigate these rules to protect customer and supplier data, facing potential fines for non-compliance. For instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher.

WT Microelectronics, as a major global distributor, navigates a complex web of antitrust and competition laws across its operating regions. These regulations are crucial for maintaining a fair marketplace and preventing monopolistic practices.

Key areas of focus include rules around market dominance, ensuring no single entity unfairly controls supply chains. The company's acquisition of Future Electronics in 2023, valued at approximately $1.3 billion, underwent scrutiny to ensure it did not stifle competition.

Adherence to fair trade practices is also paramount, covering aspects like pricing, distribution agreements, and preventing anti-competitive collusion. WT Microelectronics must continuously monitor and comply with these evolving legal frameworks to operate responsibly and maintain its competitive edge.

International Trade Laws and Customs

WT Microelectronics operates globally, meaning it must strictly adhere to numerous international trade laws, customs regulations, and import/export controls. This complex web of rules impacts how the company moves its products across borders. For instance, the World Trade Organization (WTO) agreements, which many countries follow, set standards for trade practices. In 2023, global trade volume saw fluctuations, with the WTO projecting a 0.9% growth in merchandise trade volume for 2024, down from 1.3% in 2023, highlighting the dynamic nature of these regulations.

Successfully managing tariff structures and trade agreements is vital for WT Microelectronics to ensure efficient distribution worldwide. Different countries impose varying duties on electronic components, which can significantly affect the final cost of goods. For example, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, has specific rules of origin that can influence supply chain strategies for companies like WT Microelectronics operating within North America. Understanding these agreements helps optimize logistics and maintain competitive pricing.

Key considerations for WT Microelectronics include:

- Compliance with WTO Trade Facilitation Agreement: Streamlining customs procedures to reduce delays and costs for imported and exported goods.

- Navigating Regional Trade Agreements: Leveraging agreements like the EU's single market or ASEAN's Free Trade Area to reduce tariffs and non-tariff barriers.

- Adherence to Export Controls: Managing regulations on the export of sensitive technologies, particularly in the semiconductor industry, to comply with national security interests.

- Understanding Import Tariffs: Analyzing the impact of tariffs imposed by major markets, such as those seen in US-China trade relations, on component sourcing and product pricing.

Product Liability and Safety Standards

WT Microelectronics operates in an environment where electronic components face rigorous product liability and safety standards across international markets. Adherence to these regulations, such as those from the EU's General Product Safety Regulation or the US Consumer Product Safety Commission, is paramount for safeguarding consumers and mitigating potential legal repercussions. For instance, in 2024, the global market for electronic components continued to see increased scrutiny on material safety and end-of-life disposal, with new directives impacting supply chain compliance.

Failure to meet these evolving safety benchmarks can result in significant financial penalties and reputational damage. WT Microelectronics must diligently ensure that all distributed components comply with standards like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which govern the use of specific materials in electronics. In 2025, expect continued emphasis on cybersecurity within hardware, adding another layer of compliance for component distributors.

- Global Safety Regulations: WT Microelectronics must navigate a complex web of international product liability and safety standards.

- Consumer Protection: Ensuring component safety is crucial for protecting end-users and preventing harm.

- Legal and Financial Risks: Non-compliance can lead to costly lawsuits, fines, and damage to brand reputation.

- Evolving Compliance Landscape: Expect ongoing updates to regulations, particularly concerning material safety and cybersecurity in electronic components.

WT Microelectronics must navigate a complex landscape of intellectual property laws, safeguarding its innovations and the products it distributes. In 2024, the semiconductor industry's intense competition underscores the critical role of patents, with the global market valued at approximately $600 billion.

The company also faces stringent data privacy regulations, such as GDPR, with potential fines up to 4% of global annual revenue for non-compliance, impacting how customer and supplier data is handled.

Antitrust and competition laws are vital for WT Microelectronics to maintain fair market practices, especially after its $1.3 billion acquisition of Future Electronics in 2023, which underwent scrutiny to prevent stifling competition.

International trade laws and customs regulations significantly influence WT Microelectronics' global operations. The WTO projected only 0.9% growth in merchandise trade volume for 2024, highlighting the dynamic nature of these rules.

Environmental factors

WT Microelectronics operates within the electronics sector, which faces stringent environmental regulations like RoHS and REACH. These directives govern the use of hazardous substances in electronic products, impacting component sourcing and manufacturing processes.

Compliance with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is crucial for WT Microelectronics. This requires meticulous attention to the materials used in the semiconductors and electronic components they distribute, ensuring they meet the specified limits for substances like lead, mercury, and cadmium.

The company's ability to maintain supply chain transparency and conduct thorough material verification is paramount. For instance, as of early 2024, the European Chemicals Agency (ECHA) continues to update its list of Substances of Very High Concern (SVHC) under REACH, requiring ongoing vigilance from distributors like WT Microelectronics to ensure their product portfolios remain compliant.

Semiconductor manufacturing, including WT Microelectronics' operations and its extensive logistics network, is notoriously energy-intensive. This high energy demand directly translates into a significant carbon footprint, a growing concern for the industry. For instance, the global semiconductor industry's energy consumption is projected to rise substantially, potentially reaching 10-20% of global electricity consumption by 2030 if current trends continue, highlighting the scale of the challenge.

WT Microelectronics must actively address the environmental impact of its own facilities and extend this scrutiny to its supply chain. As regulatory bodies and consumers increasingly demand greater corporate environmental responsibility, reducing emissions is becoming a critical factor for maintaining competitiveness and brand reputation. Many leading semiconductor companies, including competitors of WT Microelectronics, have set ambitious net-zero targets, aiming for significant emission reductions by 2030 and beyond.

The electronics sector is a significant contributor to global waste, with e-waste volumes projected to reach 74.7 million metric tons by 2030, a 33% increase from 2023. WT Microelectronics, as a distributor, plays a role in the circular economy by facilitating the responsible collection and recycling of electronic components and packaging. This includes supporting take-back programs and promoting the use of recycled materials in their supply chain.

Customer and Investor Demand for Sustainability

Customers and investors are increasingly prioritizing sustainability, influencing WT Microelectronics' operational strategies. This growing demand for environmentally conscious supply chains is a significant environmental factor. Companies demonstrating robust sustainability initiatives are seeing improved brand perception and investment appeal.

WT Microelectronics can leverage this trend by highlighting its commitment to greener practices. For instance, a recent survey indicated that over 70% of consumers consider sustainability when making purchasing decisions, and a similar sentiment is reflected in institutional investor mandates for ESG (Environmental, Social, and Governance) compliance.

- Growing Consumer Preference: A significant portion of consumers, estimated at over 70% in recent studies, now factor sustainability into their buying choices.

- Investor ESG Focus: Institutional investors are increasingly allocating capital towards companies with strong ESG credentials, impacting access to funding and valuation.

- Supply Chain Scrutiny: The entire product lifecycle, from sourcing to disposal, is under greater environmental scrutiny, pushing companies like WT Microelectronics to adopt circular economy principles.

- Regulatory Tailwinds: Evolving environmental regulations globally are further incentivizing and sometimes mandating sustainable business practices.

Climate Change Impact on Supply Chain Resilience

Climate change presents a significant environmental challenge for WT Microelectronics, particularly concerning the physical integrity of its supply chain. More frequent and severe extreme weather events, such as floods and typhoons, directly threaten manufacturing facilities and critical logistics routes. For instance, the semiconductor industry experienced disruptions in 2024 due to severe flooding in key manufacturing regions, impacting production schedules globally.

WT Microelectronics must proactively integrate these climate-related risks into its strategic supply chain planning. This involves assessing vulnerabilities and developing contingency measures to ensure operational continuity even when facing environmental disruptions. The company's ability to maintain service levels hinges on its preparedness for these escalating climate impacts.

- Increased frequency of extreme weather events: Typhoons, floods, and heatwaves are becoming more common and intense, directly impacting manufacturing sites and transportation networks.

- Supply chain disruption risks: Damage to factories, port closures, and transportation delays can lead to significant production stoppages and revenue loss.

- Need for enhanced resilience planning: WT Microelectronics must invest in diversifying manufacturing locations and strengthening logistics infrastructure to mitigate these environmental threats.

Environmental regulations like RoHS and REACH significantly impact WT Microelectronics by restricting hazardous substances in components, demanding rigorous material verification. The semiconductor industry's substantial energy consumption, projected to increase, contributes to a considerable carbon footprint, pushing companies toward net-zero targets. Growing consumer and investor demand for sustainability is a key factor, with over 70% of consumers considering environmental impact in purchasing decisions.

The increasing frequency of extreme weather events poses a direct threat to WT Microelectronics' supply chain, potentially causing disruptions to manufacturing and logistics. This necessitates enhanced resilience planning, including diversifying production sites and strengthening infrastructure to mitigate climate-related risks.

| Environmental Factor | Impact on WT Microelectronics | Key Data/Trend (2024-2025) |

|---|---|---|

| Regulatory Compliance | Adherence to RoHS and REACH for hazardous substances. | ECHA continues updating SVHC lists, requiring constant product portfolio vigilance. |

| Carbon Footprint | High energy consumption in semiconductor manufacturing and logistics. | Global semiconductor energy use projected to rise, potentially reaching 10-20% of global electricity by 2030. |

| E-Waste | Role in circular economy, responsible collection, and recycling. | E-waste volumes projected to reach 74.7 million metric tons by 2030, a 33% increase from 2023. |

| Climate Change & Extreme Weather | Threats to supply chain integrity and operational continuity. | Disruptions observed in 2024 due to flooding in key manufacturing regions. |

PESTLE Analysis Data Sources

Our PESTLE analysis for WT Microelectronics is informed by a comprehensive review of government publications, industry-specific market research, and economic trend reports. We leverage data from official regulatory bodies and leading technology forecasting firms to ensure a robust understanding of the macro-environment.