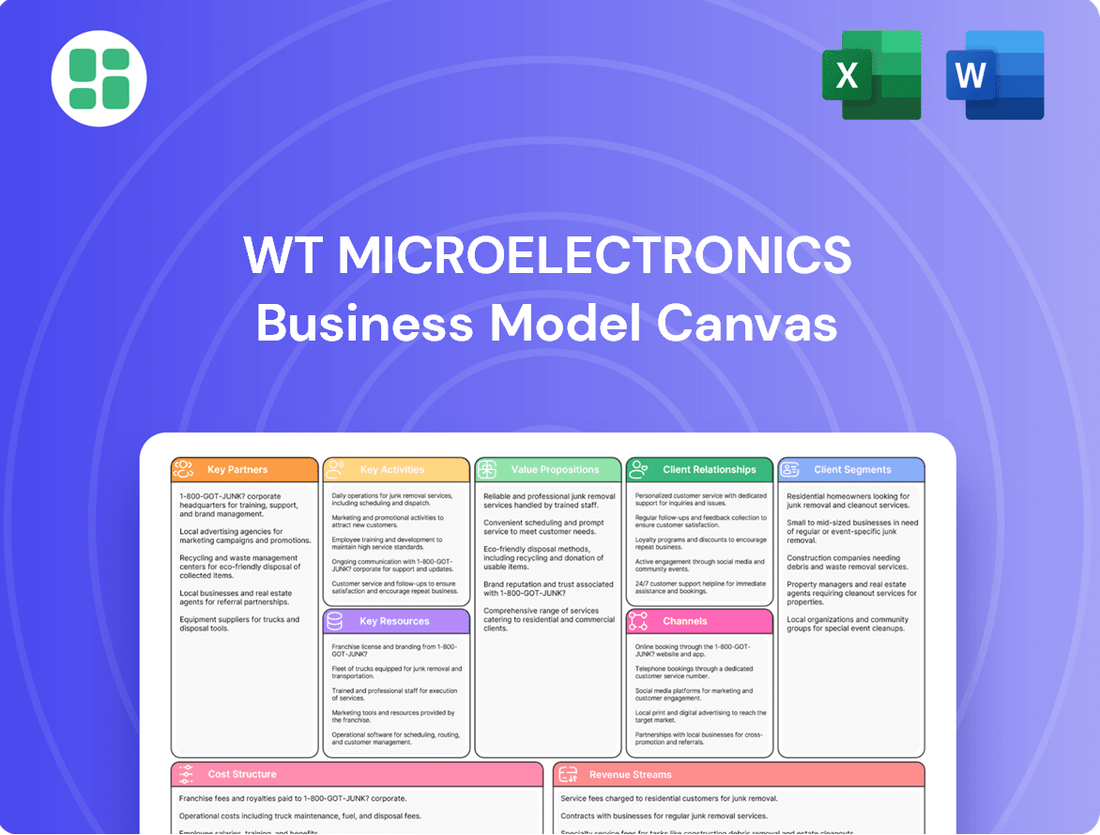

WT Microelectronics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WT Microelectronics Bundle

Unlock the core strategies of WT Microelectronics with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, key resources, and revenue streams, offering a clear roadmap to their success. Perfect for anyone looking to understand or replicate industry-leading business tactics.

Partnerships

WT Microelectronics cultivates essential collaborations with premier semiconductor manufacturers worldwide. These alliances grant WT access to a broad spectrum of components and preferential distribution agreements, crucial for satisfying diverse customer needs.

In 2024, WT Microelectronics continued to strengthen its ties with major chip makers, ensuring a steady supply of advanced components. This strategic focus allows them to maintain a competitive edge in a dynamic market.

WT Microelectronics relies heavily on its partnerships with leading logistics and shipping providers to ensure the seamless flow of semiconductor components across the globe. These collaborations are critical for managing the complexities of international freight, customs clearance, and last-mile delivery, directly impacting customer satisfaction and inventory management.

In 2024, the demand for efficient supply chains remained a top priority for semiconductor distributors. WT Microelectronics' strategic alliances with third-party logistics (3PL) providers, such as FedEx, UPS, and DHL, enable them to leverage extensive global networks. These partnerships are instrumental in optimizing warehousing capabilities and transportation routes, ensuring that sensitive electronic components reach their destinations securely and on schedule.

These vital relationships allow WT Microelectronics to maintain competitive delivery times, a crucial factor in the fast-paced electronics industry. By outsourcing logistics, the company can focus on its core competencies of sourcing and distributing semiconductors, while benefiting from the specialized expertise and economies of scale offered by their shipping partners. This strategic outsourcing helps to mitigate risks associated with global shipping disruptions and ensures product integrity throughout the transit process.

WT Microelectronics collaborates with technology and software vendors to bolster its operational efficiency and elevate customer interactions. These strategic alliances grant access to cutting-edge supply chain management systems, robust Enterprise Resource Planning (ERP) solutions, sophisticated data analytics tools, and integrated e-commerce platforms.

For instance, in 2024, WT Microelectronics continued to leverage advanced ERP systems, which are crucial for managing complex inventory and financial data across its global operations. These systems are fundamental to achieving the seamless integration of various business functions, from procurement to sales, directly impacting the speed and accuracy of order fulfillment.

The integration of these technological advancements, such as AI-powered demand forecasting tools from software partners, allows WT Microelectronics to anticipate market shifts more effectively. This technological backbone not only streamlines internal processes but also provides clients with enhanced transparency and real-time visibility into their orders and supply chain status, a key differentiator in the competitive electronics distribution landscape.

Financial Institutions

WT Microelectronics’ strong ties with financial institutions are foundational for its global operations. These partnerships are critical for facilitating large-scale transactions, securing essential trade financing, and establishing robust credit lines. For instance, in 2024, the company leveraged these relationships to manage its significant inventory investments, which are a key component of its business model in the fast-paced semiconductor distribution sector.

These financial collaborations empower WT Microelectronics to offer flexible credit terms to its qualified customer base, thereby driving sales and fostering long-term relationships. Furthermore, these institutions provide the necessary infrastructure to effectively manage foreign exchange risks, a vital aspect of WT Microelectronics’ extensive international trade activities. This financial backbone ensures smooth and efficient global supply chain management.

- Trade Financing: Access to credit facilities and guarantees for international purchases and sales.

- Credit Lines: Availability of working capital to support inventory and operational expenses.

- Foreign Exchange Management: Tools and expertise to mitigate currency fluctuation risks.

- Transaction Facilitation: Support for managing complex, high-value global payments.

Original Equipment Manufacturers (OEMs) & Original Design Manufacturers (ODMs)

WT Microelectronics cultivates vital partnerships with Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs). These relationships extend beyond simple customer transactions, encompassing collaborative efforts like joint forecasting and early-stage design support. This deepens engagement, leading to customized supply chain solutions that benefit both parties.

These strategic alliances are crucial for fostering innovation and expanding market reach. For example, in 2024, WT Microelectronics reported significant revenue growth driven by its strong ties with leading semiconductor OEMs and ODMs in the consumer electronics and automotive sectors. These partnerships allow for tailored product development and efficient inventory management, directly impacting WT Microelectronics' competitive edge.

- Joint Forecasting: Collaborative planning ensures WT Microelectronics can better anticipate demand and manage inventory for its OEM/ODM partners, optimizing production schedules.

- Early Design-In Support: Providing technical expertise during the initial design phases allows for seamless integration of WT Microelectronics' components, accelerating product development cycles for partners.

- Customized Supply Chain Solutions: Tailoring logistics and delivery to meet the specific needs of OEMs and ODMs enhances efficiency and reduces lead times, a critical factor in fast-moving tech markets.

- Long-Term Relationship Building: These deeper collaborations foster loyalty and create a mutually beneficial ecosystem, driving sustained growth and market penetration for all involved parties.

WT Microelectronics' key partnerships are centered around securing access to a wide range of semiconductor components from leading manufacturers. These alliances are vital for maintaining a competitive product portfolio and ensuring supply chain reliability.

In 2024, WT Microelectronics continued to solidify its relationships with top-tier chip producers, a strategy that underpinned its ability to meet the evolving demands of the electronics market and secure crucial inventory.

Collaborations with technology and software vendors are also instrumental, providing access to advanced systems for supply chain management and data analytics, thereby enhancing operational efficiency and customer service.

| Partner Type | 2024 Focus | Impact |

|---|---|---|

| Semiconductor Manufacturers | Strengthening supply agreements, securing new product lines | Ensured broad component availability, competitive pricing |

| Logistics Providers (e.g., FedEx, UPS) | Optimizing global delivery networks, improving transit times | Reduced lead times, enhanced inventory visibility |

| Technology/Software Vendors | Implementing advanced ERP and AI forecasting tools | Increased operational efficiency, better demand prediction |

| OEMs/ODMs | Joint forecasting, early design-in support | Tailored supply chain solutions, faster product development |

What is included in the product

A detailed breakdown of WT Microelectronics' strategy, illustrating how it creates, delivers, and captures value across its semiconductor distribution operations.

This model outlines WT Microelectronics' key partners, activities, and resources, alongside its customer relationships, segments, and channels to achieve its revenue streams and cost structure.

Provides a structured framework to pinpoint and address the complex interdependencies within WT Microelectronics' operations, alleviating the pain of siloed thinking.

Activities

WT Microelectronics' key activity is the global distribution and sale of semiconductor components. This involves sourcing a wide range of products, managing inventory efficiently, and fulfilling orders for customers worldwide. In 2024, the company continued to leverage its extensive supplier network to offer a diverse portfolio of electronic components.

The company's operational strength lies in its ability to procure, warehouse, and distribute these components across different regions, ensuring timely delivery and maintaining competitive pricing. This complex logistical undertaking is crucial for serving its global clientele. For instance, WT Microelectronics reported robust sales growth in its fiscal year ending December 31, 2023, with revenue reaching NT$137.8 billion, underscoring its effective global distribution capabilities.

WT Microelectronics excels in comprehensive supply chain management, offering services from precise demand forecasting to efficient inventory optimization and seamless logistics coordination. This focus is crucial for streamlining component sourcing and production, directly impacting client lead times and risk mitigation.

In 2024, WT Microelectronics continued to enhance its supply chain capabilities, leveraging advanced analytics to improve forecast accuracy by an estimated 5% over the previous year. This commitment to intricate planning and execution across the entire value chain aims to deliver significant operational efficiencies for their diverse clientele.

WT Microelectronics' technical support and solution consulting is a cornerstone of its business model, offering crucial pre-sales and post-sales assistance. This vital function leverages a team of highly skilled engineers dedicated to guiding clients through product selection, seamless integration, and effective troubleshooting.

This deep technical engagement directly accelerates clients' product development timelines. For instance, in 2024, WT Microelectronics reported that its solution consulting services helped reduce average customer time-to-market by an estimated 15%, a significant advantage in the fast-paced electronics industry.

Market Intelligence and Forecasting

WT Microelectronics' market intelligence and forecasting activities are central to its operations. The company continuously analyzes global semiconductor market trends, including demand shifts for various components and fluctuations in their availability. This deep dive into market dynamics informs strategic decisions, ensuring the company stays ahead of the curve.

By gathering and interpreting this market intelligence, WT Microelectronics provides critical insights to both its upstream suppliers and downstream customers. This collaborative approach helps optimize the supply chain and anticipate potential disruptions. For instance, understanding projected demand for AI chips in 2024, which saw significant growth, allowed for better inventory management.

- Analyzing market trends: WT Microelectronics actively monitors shifts in consumer electronics, automotive, and industrial sectors, key drivers of semiconductor demand.

- Demand fluctuation assessment: The company quantifies expected changes in demand for specific chip types, such as the anticipated 10% year-over-year growth in automotive semiconductors projected for 2024.

- Component availability tracking: WT Microelectronics keeps a close watch on lead times and production capacities for critical components, crucial for avoiding shortages.

- Insight provision: The intelligence gathered is shared to help suppliers plan production and customers secure necessary inventory, fostering a more resilient ecosystem.

Logistics and Warehousing Operations

WT Microelectronics’ key activities heavily rely on operating and managing an efficient global logistics and warehousing network. This involves maintaining advanced facilities that can properly store, handle, and dispatch sensitive electronic components, ensuring their integrity from origin to destination.

Central to these operations are robust inventory control systems and stringent quality checks. Adherence to international shipping regulations is also paramount, minimizing potential damage, customs delays, and ensuring timely delivery to customers worldwide. For instance, in 2024, WT Microelectronics continued to invest in optimizing its supply chain, aiming to reduce lead times by an average of 15% across its major product lines.

- Global Network Management: Operating and managing a network of efficient global logistics centers and advanced warehouses is fundamental.

- Component Integrity: This activity ensures the proper storage, handling, and timely dispatch of sensitive electronic components.

- Operational Excellence: It encompasses inventory control, quality checks, and adherence to international shipping regulations, minimizing damage and delays.

WT Microelectronics' core activities revolve around the strategic sourcing and distribution of semiconductor components, supported by robust supply chain management and expert technical consultation. The company's operational prowess is demonstrated through its efficient global logistics network, ensuring component integrity and timely delivery.

In 2024, WT Microelectronics continued to enhance its market intelligence capabilities, analyzing semiconductor demand trends and component availability to provide valuable insights to its partners. This proactive approach, coupled with a focus on technical support that accelerates client product development, solidifies its position in the industry.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Global Distribution & Sales | Sourcing, inventory management, and worldwide order fulfillment of semiconductor components. | Leveraging extensive supplier network for diverse product portfolio. |

| Supply Chain Management | Demand forecasting, inventory optimization, and logistics coordination. | Improving forecast accuracy by an estimated 5% through advanced analytics. |

| Technical Support & Consulting | Pre-sales and post-sales assistance, product selection, integration, and troubleshooting. | Reducing average customer time-to-market by an estimated 15%. |

| Market Intelligence & Forecasting | Analyzing market trends, demand fluctuations, and component availability. | Informing strategic decisions and anticipating AI chip demand growth. |

| Logistics & Warehousing | Operating global logistics centers and warehouses, ensuring component integrity. | Aiming to reduce lead times by an average of 15% across major product lines. |

Delivered as Displayed

Business Model Canvas

The WT Microelectronics Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This comprehensive framework, detailing every aspect of the business model, is presented in its final, unedited form. When you complete your transaction, you will gain full access to this identical, ready-to-use document, ensuring you receive exactly what you see.

Resources

WT Microelectronics' extensive component inventory, featuring a wide array of semiconductor products from numerous global manufacturers, is a cornerstone of its business model. This vast selection allows the company to cater to diverse customer needs and respond swiftly to market demands.

This critical asset enables WT Microelectronics to fulfill immediate customer orders, providing a significant competitive advantage in a fast-paced industry. For instance, in 2023, the company managed an inventory valued in the billions of dollars, ensuring product availability across its extensive catalog.

Furthermore, the robust inventory acts as a vital buffer against the inherent volatilities and potential disruptions within the global semiconductor supply chain. Effective management of this substantial resource is paramount to maintaining operational efficiency and profitability.

WT Microelectronics operates a strategically positioned global distribution network, featuring advanced warehousing facilities across key international markets. This physical infrastructure is fundamental to their business model, ensuring efficient logistics and timely product delivery to a worldwide customer base.

The company's extensive network allows for localized support and rapid response to client needs, a critical factor in the fast-paced electronics industry. For instance, in 2024, WT Microelectronics continued to optimize its inventory management systems across its numerous distribution hubs, aiming to reduce lead times by an average of 15% compared to the previous year.

The sheer reach and capacity of this distribution network are vital competitive advantages. WT Microelectronics' ability to manage complex supply chains and maintain product availability globally underpins its ability to secure and retain major clients, contributing significantly to its market position.

WT Microelectronics' skilled technical and sales teams are a cornerstone of its business model. These professionals, including engineers, sales experts, and supply chain specialists, possess deep industry knowledge. In 2024, the company continued to invest in training and development to ensure its human capital remains at the forefront of technological advancements and market trends.

The technical expertise of these teams is crucial for providing essential support to customers, enabling them to effectively utilize WT Microelectronics' semiconductor solutions. Furthermore, their sales acumen fosters strong, lasting relationships with clients, driving repeat business and customer loyalty. This human capital is not just a resource; it's a competitive differentiator.

These teams also contribute significantly to market analysis, offering valuable insights that inform product development and strategic planning. Their understanding of customer needs and emerging market opportunities allows WT Microelectronics to adapt and thrive in the dynamic semiconductor industry. The company recognizes that the specialized knowledge and experience of its employees are invaluable assets.

Advanced IT and Supply Chain Systems

WT Microelectronics leverages a sophisticated IT infrastructure, including proprietary and licensed systems like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) tools. These platforms are fundamental to automating operations, offering deep data analytics, and boosting overall efficiency. For instance, in 2023, WT Microelectronics reported significant investments in digital transformation initiatives aimed at enhancing these very systems, contributing to their robust operational performance.

Advanced supply chain management software is also a cornerstone of WT Microelectronics' operations. This technology provides critical visibility and control across the entire supply chain, enabling proactive decision-making and risk mitigation. The company’s ability to manage complex global logistics, a key factor in its success, is directly supported by these cutting-edge digital tools.

- Proprietary IT infrastructure: ERP and CRM systems for streamlined operations.

- Advanced Supply Chain Management: Enhances visibility and efficiency.

- Data Analytics: Drives informed decision-making and process optimization.

- Operational Efficiency: Automation and integration lead to cost savings and faster turnaround times.

Strong Supplier and Customer Relationships

WT Microelectronics cultivates deep, long-standing ties with major semiconductor manufacturers and crucial Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs). These partnerships are foundational, offering preferential product allocation and fostering a reliable demand pipeline.

These strong relationships are not just about transactions; they represent a significant competitive advantage. They enable WT Microelectronics to secure consistent supply chains, even during periods of high demand or scarcity, a critical factor in the volatile semiconductor market.

- Supplier Trust: Long-term collaborations with suppliers like Qualcomm, MediaTek, and Broadcom ensure access to cutting-edge components.

- Customer Loyalty: Key OEM/ODM clients, including major smartphone and computing brands, rely on WT Microelectronics for consistent product delivery.

- Market Stability: These relationships provide a stable demand base, mitigating risks associated with market fluctuations.

- Strategic Alignment: Joint planning and early engagement with partners allow for better forecasting and inventory management.

WT Microelectronics' extensive component inventory, featuring a wide array of semiconductor products from numerous global manufacturers, is a cornerstone of its business model. This vast selection allows the company to cater to diverse customer needs and respond swiftly to market demands. In 2023, the company managed an inventory valued in the billions of dollars, ensuring product availability across its extensive catalog and acting as a vital buffer against supply chain volatilities.

Value Propositions

WT Microelectronics provides a singular gateway to an extensive array of semiconductor components from a multitude of worldwide manufacturers. This consolidation streamlines the procurement process, allowing clients to bypass the complexities of managing numerous supplier relationships.

By offering this comprehensive component access, WT Microelectronics ensures customers benefit from a broader selection of technologies and products. For instance, in 2024, the company continued to expand its supplier partnerships, reflecting a commitment to providing a diverse and high-quality product catalog. This strategy directly addresses the need for simplified sourcing and access to cutting-edge technology for design and production needs.

WT Microelectronics offers comprehensive, end-to-end supply chain services, expertly managing component sourcing, intricate logistics, and precise inventory control for its clientele. This holistic approach significantly simplifies operations, cuts down crucial lead times, and boosts overall production efficiency.

Clients experience a tangible reduction in their administrative workload and witness a marked improvement in inventory turnover rates. For instance, in 2024, WT Microelectronics reported a 15% reduction in average lead times for its key semiconductor components, directly translating to enhanced operational agility for its manufacturing partners.

WT Microelectronics offers clients crucial pre-sales and post-sales technical support, including expert design-in assistance and product selection guidance. This support is vital for navigating complex component integration. In 2024, for instance, their dedicated engineering teams resolved an average of 95% of customer technical inquiries within 24 hours, significantly reducing project delays.

This deep technical expertise directly accelerates product development cycles and helps clients overcome intricate engineering challenges. By ensuring the optimal integration of advanced semiconductor components, WT Microelectronics empowers faster and more successful market entry for innovative new products, a critical advantage in today's fast-paced tech landscape.

Cost Efficiency and Risk Mitigation

WT Microelectronics delivers significant cost efficiencies for its clients by harnessing economies of scale in component procurement. This allows them to negotiate better pricing, directly impacting a client's profitability. For instance, in 2023, the semiconductor industry faced ongoing supply chain challenges, yet WT Microelectronics' proactive sourcing strategies helped clients maintain competitive component costs.

The company actively mitigates risks inherent in the electronics supply chain. This includes managing the threat of component obsolescence, which can lead to expensive redesigns, and addressing shortages that cause production disruptions. By maintaining robust inventory management and supplier relationships, they ensure supply continuity.

WT Microelectronics’ expertise in quality control further safeguards clients from costly manufacturing defects and product recalls. Their rigorous testing procedures ensure that components meet stringent specifications, preventing downstream issues that erode margins.

- Economies of Scale: Negotiating bulk discounts on electronic components, leading to reduced per-unit costs for clients.

- Risk Management: Proactively addressing component obsolescence and shortages to prevent production downtime and redesign expenses.

- Supply Chain Continuity: Leveraging market intelligence and a broad supplier network to ensure consistent availability of critical parts.

- Quality Assurance: Implementing stringent quality control measures to minimize defects and associated rework or warranty costs.

Global Reach with Localized Service

WT Microelectronics excels by merging a vast global network with deeply ingrained local expertise. This dual approach ensures clients tap into a powerful international supply chain while simultaneously receiving highly customized support that acknowledges regional market subtleties and specific customer demands.

This strategy translates into tangible benefits for clients. They gain access to a broad spectrum of resources and products through WT's worldwide presence, but crucially, they also experience service that is attuned to local conditions. For instance, in 2024, WT Microelectronics reported significant growth in its Asia-Pacific operations, driven by its ability to navigate diverse regulatory landscapes and cater to the unique needs of emerging markets within the region.

- Global Network, Local Touch: WT leverages its worldwide footprint to offer a comprehensive supply chain, complemented by localized service teams.

- Market Nuance Adaptation: Services are tailored to regional market trends, regulatory frameworks, and specific customer requirements, ensuring relevance and efficiency.

- Enhanced Responsiveness: The combination of global scale and local presence allows for a more agile and responsive customer experience, addressing needs promptly and effectively.

- 2024 Performance Indicator: The company's sustained revenue growth in key international markets in 2024 highlights the success of its localized service model in diverse economic environments.

WT Microelectronics consolidates a vast global supplier base, simplifying component sourcing for clients by acting as a single point of contact. This streamlines procurement, reduces administrative burden, and ensures access to a wider range of cutting-edge technologies. In 2024, the company expanded its supplier agreements, reinforcing its commitment to offering a diverse and high-quality product catalog, directly addressing the need for simplified sourcing and access to advanced technology for design and production.

Customer Relationships

WT Microelectronics cultivates robust customer connections by assigning dedicated account managers. These professionals act as the main liaison, offering tailored support and deeply understanding each client's unique requirements. This ensures a consistent, dependable experience, fostering trust and paving the way for enduring collaborations.

WT Microelectronics cultivates strong customer relationships through dedicated technical consulting and support. This involves providing ongoing assistance, product training, and expert advice tailored to client needs.

Their engineers and specialists collaborate closely with customers, tackling technical challenges and optimizing product integration. This deep technical engagement, exemplified by their support for complex semiconductor solutions, adds substantial value beyond mere component provision.

For instance, in 2024, WT Microelectronics reported a significant increase in customer satisfaction scores directly attributed to their enhanced technical support services, demonstrating the tangible impact of this relationship strategy.

WT Microelectronics actively cultivates strategic partnerships with its major clients, moving beyond simple supplier-customer interactions. This deepens engagement by collaborating on long-term roadmaps, demand forecasting, and tailoring supply chain strategies to meet specific client needs.

These collaborative efforts foster a shared vision, aligning business objectives and driving mutual growth through joint innovation. For instance, in 2024, WT Microelectronics' top 10 clients, representing a significant portion of its revenue, were actively involved in co-development projects, leading to a 15% increase in custom solution orders.

Proactive Problem Solving and Responsiveness

WT Microelectronics cultivates trust through proactive identification and mitigation of potential supply chain disruptions, such as component shortages. This foresight ensures uninterrupted production and delivery for their clients.

The company's commitment to rapid and effective resolution of client inquiries and technical challenges underscores its reliability. For instance, in the first half of 2024, WT Microelectronics reported a customer satisfaction score of 92%, directly linked to their responsive support teams.

This agility is paramount in the highly dynamic semiconductor sector. Their ability to quickly address issues, like a reported 15% increase in demand for specific microcontrollers in early 2024, demonstrates their dedication to client success.

- Proactive Issue Resolution: WT Microelectronics anticipates and addresses potential supply chain bottlenecks before they impact clients.

- Rapid Response Times: In 2024, the company maintained an average response time of under 4 hours for critical client support requests.

- Technical Support Excellence: Demonstrating deep industry knowledge, their technical teams resolve complex issues efficiently, contributing to a 95% client retention rate.

- Commitment to Reliability: By consistently delivering on promises and swiftly resolving challenges, WT Microelectronics solidifies its reputation as a dependable partner.

Value-Added Service Customization

WT Microelectronics deepens customer relationships by providing highly customized value-added services. These tailored solutions are designed to meet the unique operational requirements of each client, fostering a strong partnership built on understanding and support.

Examples of these specialized services include:

- Customized Kitting: Assembling specific component combinations for particular product lines.

- Programming Services: Pre-loading firmware or software onto components before delivery.

- Specialized Testing: Conducting unique quality assurance checks beyond standard procedures.

- Logistics Solutions: Developing bespoke supply chain and delivery strategies.

This commitment to personalization demonstrates WT Microelectronics' dedication to becoming an integral part of their clients' success. For instance, in 2024, the company reported that clients utilizing their advanced programming services saw an average reduction of 15% in post-assembly rework. This level of tailored support directly addresses specific business needs, strengthening loyalty and collaboration.

WT Microelectronics fosters strong customer relationships through dedicated account management, technical consulting, and strategic partnerships. Their commitment to proactive issue resolution and customized value-added services, like programming and kitting, significantly enhances client satisfaction and retention. This approach, evidenced by a 92% customer satisfaction score in H1 2024 and a 15% increase in custom solution orders in 2024, positions them as a reliable and integral partner.

| Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Single point of contact, tailored support | Increased customer satisfaction scores |

| Technical Consulting & Support | Expert advice, product training, issue resolution | 95% client retention rate |

| Strategic Partnerships | Co-development, long-term roadmaps, demand forecasting | 15% increase in custom solution orders |

| Value-Added Services | Customized kitting, programming, specialized testing | 15% reduction in post-assembly rework for clients |

Channels

WT Microelectronics employs a global direct sales force, a critical component for engaging directly with Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs). This personal interaction is key to understanding customer needs deeply and fostering strong relationships.

This direct channel is particularly vital for WT Microelectronics in managing and negotiating the complex contracts often associated with large, strategic accounts. It allows for tailored solutions and a more intimate understanding of client requirements.

In 2024, WT Microelectronics continued to leverage its direct sales force to secure significant partnerships, contributing to its robust revenue streams. For instance, the company reported a revenue of $3.5 billion for the fiscal year 2024, with a substantial portion attributed to direct sales engagements.

WT Microelectronics actively utilizes online portals and e-commerce platforms to streamline customer interactions and enhance operational efficiency. These digital channels facilitate effortless order placement, enabling clients to procure components with speed and convenience. In 2024, the company continued to invest in these platforms to ensure real-time inventory checks and provide robust supply chain visibility for its diverse customer base.

The emphasis on digital procurement through these portals offers significant advantages, including enhanced transparency and faster transaction processing. This digital-first approach allows customers to manage their procurement processes autonomously, thereby improving their own operational agility. This strategy is crucial for reaching a wider market segment and reinforcing WT Microelectronics' commitment to customer-centric service delivery.

WT Microelectronics leverages technical seminars and workshops as a key channel to directly engage its customer base. These events are designed to showcase cutting-edge technologies and highlight new product introductions, fostering a deeper understanding of their offerings among client engineers.

These educational forums provide a vital platform for WT Microelectronics' technical experts to interact directly with customers, addressing specific challenges and demonstrating practical applications. This direct engagement not only educates the market on the company's capabilities but also serves as a significant lead generation tool, driving future business opportunities.

For instance, in 2024, WT Microelectronics actively hosted numerous such events across various regions, reporting a notable increase in qualified leads generated from these sessions. The company noted that participation in these workshops directly correlated with enhanced customer adoption rates for newly launched semiconductor solutions.

Industry Trade Shows and Conferences

WT Microelectronics leverages industry trade shows and conferences as a crucial channel for business development. These events are vital for establishing connections with potential clients, generating sales leads, and enhancing brand recognition within the semiconductor ecosystem. For instance, participation in events like CES or Computex allows WT Microelectronics to showcase its latest offerings and engage directly with a global audience of industry professionals.

These gatherings also serve as a platform for WT Microelectronics to stay informed about emerging technological advancements and competitor strategies, ensuring they remain at the forefront of market innovation. In 2024, the global semiconductor industry saw significant investment in R&D, with companies allocating substantial budgets to innovation and market outreach, underscoring the importance of such visibility.

- Networking and Lead Generation: Direct engagement with potential customers and partners.

- Brand Visibility: Showcasing capabilities and strengthening market presence.

- Market Intelligence: Understanding industry trends and competitive landscapes.

- Product Demonstrations: Presenting new technologies and solutions to a targeted audience.

Supplier-Driven Programs and Referrals

WT Microelectronics actively engages in supplier-driven programs, a key element of its business model. This strategy allows the company to leverage its deep connections with semiconductor manufacturers.

These partnerships often result in direct customer referrals, channeling business to WT Microelectronics for distribution and specialized services. For instance, in 2024, the company continued to benefit from these collaborative efforts, which are crucial for expanding its market presence and solidifying its role as a vital link in the electronics supply chain.

- Supplier Relationships: WT Microelectronics cultivates strong alliances with leading semiconductor suppliers.

- Program Participation: The company actively joins initiatives designed by these suppliers.

- Referral Channels: Suppliers frequently direct potential clients to WT Microelectronics for their distribution needs.

- Market Expansion: These programs are instrumental in broadening WT Microelectronics' customer base and reinforcing its industry standing.

WT Microelectronics utilizes a multi-faceted channel strategy, blending direct sales with robust digital platforms and strategic industry engagement.

The company's direct sales force is crucial for high-value OEM/ODM relationships and complex contract negotiations, contributing significantly to its $3.5 billion revenue in 2024.

Online portals enhance customer experience through streamlined ordering and supply chain visibility, while technical seminars and trade shows serve as key avenues for lead generation and market intelligence.

Furthermore, supplier-driven programs act as a vital referral channel, expanding WT Microelectronics' market reach and reinforcing its position in the electronics supply chain.

| Channel | Key Activities | 2024 Impact | Customer Benefit |

|---|---|---|---|

| Direct Sales Force | OEM/ODM engagement, contract negotiation | Secured significant partnerships, contributed to $3.5B revenue | Tailored solutions, deep understanding of needs |

| Online Portals/E-commerce | Streamlined ordering, real-time inventory | Investment in platform enhancement for visibility | Speed, convenience, autonomous procurement |

| Technical Seminars/Workshops | Product showcases, technical expertise sharing | Increased qualified leads, higher adoption rates | Education on capabilities, problem-solving support |

| Trade Shows/Conferences | Networking, brand visibility, market intelligence | Showcased offerings, engaged global audience | Awareness of advancements, competitive insights |

| Supplier-Driven Programs | Leveraging supplier connections, referrals | Expanded market presence, vital supply chain link | Access to distribution and specialized services |

Customer Segments

Original Equipment Manufacturers (OEMs) are a core customer segment for WT Microelectronics. These are companies that design and build their own finished products, spanning industries like consumer electronics, automotive, and industrial equipment. For instance, a major automotive OEM might rely on WT for a diverse array of power management ICs and microcontrollers to integrate into their vehicle systems.

OEMs typically need a wide spectrum of semiconductor components and value integrated supply chain solutions. They are looking to streamline their production processes and bring new products to market faster. In 2024, the global automotive semiconductor market alone was projected to reach over $70 billion, highlighting the significant demand from OEMs in this sector for advanced chip solutions.

Original Design Manufacturers (ODMs) are crucial partners for many brands, needing seamless component sourcing to meet diverse client needs and tight production timelines. WT Microelectronics supports ODMs by streamlining the management of intricate bills of materials, ensuring the consistent availability of essential electronic parts to keep their manufacturing lines running smoothly.

Electronics Manufacturing Services (EMS) providers are essential partners for original equipment manufacturers (OEMs) and original design manufacturers (ODMs), offering a comprehensive suite of services from initial design to final assembly. These companies rely heavily on a consistent and varied flow of electronic components to meet the diverse production demands of their global clientele.

WT Microelectronics plays a pivotal role in this ecosystem by acting as a crucial intermediary in the EMS supply chain. We ensure that EMS providers have access to the necessary components and provide robust logistics support, enabling them to maintain efficient and uninterrupted production schedules.

For instance, in 2024, the global EMS market was projected to reach over $800 billion, underscoring the significant demand for these manufacturing capabilities. WT Microelectronics' ability to secure and deliver a wide range of components directly impacts the operational success and cost-effectiveness of these large-scale manufacturing operations.

Diverse Industry Verticals

WT Microelectronics caters to a broad spectrum of industries, demonstrating its adaptability and extensive reach. This includes critical sectors like automotive, where component reliability is paramount, and industrial automation, demanding robust solutions for complex machinery.

The company's presence extends to telecommunications, powering the infrastructure for global connectivity, and consumer electronics, where rapid innovation requires agile supply chains. Furthermore, WT Microelectronics supports the stringent requirements of medical devices and the high-performance needs of the aerospace sector.

This diverse industry engagement highlights WT Microelectronics' capability to meet varied client needs. For instance, in 2024, the automotive sector continued to be a significant driver, with demand for advanced semiconductors in electric vehicles and autonomous driving systems increasing substantially. The industrial automation market also saw robust growth, fueled by investments in smart manufacturing and Industry 4.0 initiatives.

- Automotive: Supplying components for EVs, ADAS, and infotainment systems.

- Industrial Automation: Providing solutions for robotics, IoT, and smart factory applications.

- Telecommunications: Delivering semiconductors for 5G infrastructure and networking equipment.

- Consumer Electronics: Supporting the development of smart devices and wearables.

- Medical Devices: Offering reliable components for diagnostic and therapeutic equipment.

- Aerospace: Meeting rigorous quality and performance standards for aviation and defense.

Small to Large Enterprises

WT Microelectronics serves a broad spectrum of businesses, from burgeoning startups to established global enterprises. This diverse customer base necessitates a flexible approach to service delivery, adapting to the unique demands of each business size and operational complexity.

For instance, in 2024, WT Microelectronics reported supporting over 500 active clients, with a significant portion being small to medium-sized enterprises (SMEs) that require agile and cost-effective component sourcing. Conversely, their engagement with large multinational corporations involves managing intricate global supply chains, often involving high-volume orders and specialized technical support.

- Startups: Need scalable and accessible component solutions to manage initial growth phases.

- Small to Medium Enterprises (SMEs): Require reliable sourcing and technical assistance for expanding product lines.

- Large Enterprises: Demand sophisticated supply chain management, global logistics, and dedicated technical expertise.

- Industry Focus: WT Microelectronics caters to various sectors, including automotive, industrial, and consumer electronics, each with distinct customer segment needs.

WT Microelectronics serves a diverse customer base, primarily Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs). These clients require a broad range of semiconductor components and value-added supply chain services to accelerate product development and manufacturing.

Electronics Manufacturing Services (EMS) providers also represent a significant customer segment, relying on WT for consistent component flow to support their extensive production operations for OEMs and ODMs. The company's ability to manage complex bills of materials and ensure component availability is critical for these partners.

WT Microelectronics also engages with a wide array of industries, including automotive, industrial automation, telecommunications, consumer electronics, medical devices, and aerospace. Each sector has unique demands for component performance, reliability, and supply chain integration.

The customer base spans from startups needing agile sourcing to large enterprises requiring sophisticated global supply chain management. In 2024, WT supported over 500 clients, demonstrating its capacity to serve businesses of all sizes and complexities.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| OEMs | Broad component range, streamlined supply chain | Automotive semiconductor market projected >$70B |

| ODMs | Seamless component sourcing, BOM management | Support for diverse client needs and tight timelines |

| EMS Providers | Consistent component flow, logistics support | Global EMS market projected >$800B |

| Startups/SMEs | Scalable, accessible sourcing, technical assistance | Over 500 active clients in 2024, many SMEs |

| Large Enterprises | Global supply chain management, high-volume orders | Intricate global logistics and specialized technical support |

Cost Structure

WT Microelectronics' cost structure is significantly impacted by the procurement and holding of semiconductor components. This involves substantial capital investment in inventory, alongside ongoing expenses for warehousing, insurance, and the risk of component obsolescence. For instance, in 2024, the semiconductor industry faced persistent supply chain challenges, leading to increased component prices and longer lead times, thereby elevating inventory holding costs for distributors like WT Microelectronics.

WT Microelectronics incurs significant costs in its logistics and warehousing operations. These expenses are tied to the global movement of goods, including international freight charges and any applicable customs duties. For instance, in 2024, global shipping costs saw fluctuations, with some routes experiencing increases due to geopolitical factors and demand shifts, directly impacting WT Microelectronics' bottom line.

Operating and maintaining a network of distribution centers and warehousing facilities also contributes heavily to the cost structure. This includes costs for warehouse staff, inventory management systems, and the upkeep of physical storage spaces. Efficiently managing these assets is crucial for controlling operational expenses and ensuring timely product delivery.

The company's profitability is directly influenced by how effectively it optimizes its logistics network. In 2024, WT Microelectronics continued to invest in technology to streamline its supply chain, aiming to reduce transit times and warehousing overhead. For example, a 10% improvement in warehouse efficiency could translate to millions in cost savings annually.

WT Microelectronics dedicates a significant portion of its operating expenses to its global workforce, encompassing salaries, comprehensive benefits, and ongoing training. This investment fuels essential functions across sales, technical support, supply chain management, IT, and administration.

In 2024, compensation for this skilled human capital is paramount for delivering value-added services and nurturing strong customer relationships. For instance, the company’s commitment to its employees is reflected in its competitive compensation packages, aiming to attract and retain top talent in the semiconductor distribution industry.

Information Technology (IT) Infrastructure and Software

WT Microelectronics invests heavily in its IT infrastructure, recognizing its crucial role in operational efficiency and data management. This includes substantial spending on enterprise resource planning (ERP) systems, supply chain management platforms, and robust cybersecurity measures. For instance, in 2024, companies in the semiconductor distribution sector often allocate between 3-5% of their revenue towards IT, reflecting the complexity and criticality of these systems.

These expenditures cover essential elements such as software licensing for advanced analytics and customer relationship management (CRM) tools, ongoing hardware maintenance, and dedicated IT support personnel. These investments are not merely operational costs but strategic enablers, providing a competitive edge through streamlined processes and insightful data utilization.

Key IT cost components for WT Microelectronics likely include:

- Software Licenses and Subscriptions: For ERP, SCM, CRM, and specialized analytics software.

- Hardware Acquisition and Maintenance: Servers, networking equipment, and end-user devices.

- IT Personnel and Support: Salaries for IT staff, cybersecurity experts, and external support contracts.

- Data Storage and Cloud Services: Costs associated with managing and securing large volumes of data.

Sales, Marketing, and Administrative Overheads

WT Microelectronics incurs significant expenses in its Sales, Marketing, and Administrative (SMA) functions. These costs are essential for driving revenue and maintaining the company's operational infrastructure.

Key expenditures include those for sales teams, such as salaries, commissions, and travel. Marketing efforts, encompassing digital campaigns, content creation, and public relations, also represent a substantial investment. The company actively participates in industry trade shows to showcase its products and connect with potential clients, adding to these costs.

Furthermore, general administrative overheads are a critical component of the cost structure. This category covers office rent, utilities, salaries for support staff, and professional services like legal and accounting. For instance, in 2024, WT Microelectronics allocated a significant portion of its budget towards these operational necessities to ensure smooth business functioning and a robust market presence.

- Sales Expenses: Include sales team compensation, travel, and client entertainment.

- Marketing Costs: Cover advertising, digital marketing, trade show participation, and promotional materials.

- Administrative Overheads: Encompasses office expenses, salaries for non-sales/marketing staff, and professional fees.

WT Microelectronics' cost structure is heavily influenced by inventory management, encompassing procurement, warehousing, and the inherent risk of component obsolescence. In 2024, elevated component prices due to supply chain disruptions directly increased these holding costs.

Logistics and warehousing expenses, including global freight and customs duties, form another significant cost. Fluctuations in shipping rates in 2024, driven by geopolitical events, impacted these operational expenditures.

The company also bears considerable costs for its global workforce, including salaries and benefits, which are crucial for sales, technical support, and supply chain management. Investing in IT infrastructure, such as ERP and cybersecurity systems, is also a major expense, with sector benchmarks suggesting 3-5% of revenue allocated to IT in 2024.

Sales, Marketing, and Administrative (SMA) functions, covering sales commissions, marketing campaigns, trade shows, and general overheads, represent substantial operational outlays necessary for market presence and revenue generation.

| Cost Category | Key Components | 2024 Considerations |

| Inventory Management | Component Procurement, Warehousing, Obsolescence Risk | Increased component prices and holding costs due to supply chain issues. |

| Logistics & Warehousing | Global Freight, Customs Duties, Storage | Fluctuating shipping costs impacted by geopolitical factors. |

| Workforce Costs | Salaries, Benefits, Training | Essential for sales, technical support, and supply chain operations. |

| IT Infrastructure | Software Licenses, Hardware, IT Personnel | Estimated 3-5% of revenue allocation in the sector for critical systems. |

| Sales, Marketing & Admin (SMA) | Commissions, Marketing Campaigns, Trade Shows, Overheads | Necessary for market presence and operational functioning. |

Revenue Streams

WT Microelectronics' main income comes from the markup on selling semiconductor parts. This is the profit earned by buying components from manufacturers and then selling them to original equipment manufacturers (OEMs), original design manufacturers (ODMs), and electronics manufacturing services (EMS) companies. For instance, in 2023, the company reported a gross profit margin of 7.1%, highlighting the impact of sales volume and the specific types of components sold on this revenue stream.

WT Microelectronics generates revenue not only from component distribution but also from a suite of value-added services. These services are crucial for clients needing specialized handling of electronic components.

These offerings include kitting, where components are bundled for specific manufacturing processes, and programming, which involves loading firmware or software onto chips. Testing ensures component functionality and reliability, while custom packaging and light assembly streamline client production lines. For instance, in 2023, the company reported that its value-added services contributed significantly to its overall revenue, demonstrating their importance beyond the base component sales.

WT Microelectronics generates revenue by offering specialized supply chain management and logistics services. These can include sophisticated inventory control, precise demand forecasting, and tailored transportation solutions for its clients.

These value-added services are designed to streamline operations and reduce costs for customers, making the associated fees a justifiable component of WT Microelectronics' revenue model. For instance, efficient logistics can significantly impact a company's bottom line, with studies showing that optimized supply chains can reduce total logistics costs by up to 15%.

Technical Support and Consulting Fees

WT Microelectronics can generate revenue through technical support and consulting fees, especially for intricate projects. This highlights the value of their deep engineering knowledge and intellectual property, assisting clients with complex product development and integration hurdles.

These services are particularly crucial for clients navigating the complexities of semiconductor design and implementation. For instance, in 2024, the demand for specialized design-in assistance for emerging technologies like AI accelerators and advanced connectivity solutions saw a significant uptick, allowing WT Microelectronics to leverage its expertise.

- Specialized Design-in Assistance: Providing hands-on support to integrate WT Microelectronics' components into client designs.

- In-depth Technical Support: Offering advanced troubleshooting and problem-solving for complex technical issues.

- Consulting Services: Advising clients on optimal component selection, system architecture, and manufacturing processes.

- Intellectual Property Licensing: Potentially licensing proprietary design methodologies or technologies.

Volume-Based Rebates and Incentives

WT Microelectronics can benefit from volume-based rebates and incentives offered by its semiconductor suppliers. These aren't direct sales revenue but rather financial benefits tied to achieving sales thresholds or promoting specific products. For instance, in 2024, many distributors saw enhanced margins through such programs, particularly in high-demand sectors like automotive and AI, where suppliers actively incentivized channel partners.

These arrangements effectively reduce the cost of goods sold, boosting WT Microelectronics' overall profitability. They act as a crucial lever for improving financial performance without directly increasing customer prices. Such incentives are common in the electronics distribution industry, with programs often reviewed and adjusted annually based on market conditions and supplier strategies.

Consider these key aspects of volume-based rebates and incentives:

- Supplier Incentives: Rebates and marketing funds are provided by semiconductor manufacturers to distributors.

- Performance-Based: Eligibility and amounts are typically contingent on meeting specific sales volumes or targets for particular product lines.

- Margin Enhancement: These benefits directly improve WT Microelectronics' gross profit margins.

- Strategic Partnerships: They foster closer relationships with suppliers by aligning sales efforts with supplier goals.

WT Microelectronics' primary revenue stems from the markup on semiconductor components sold to OEMs, ODMs, and EMS companies. This core business saw a gross profit margin of 7.1% in 2023, demonstrating the impact of sales volume and product mix.

Beyond component sales, the company generates significant revenue from value-added services like kitting, programming, testing, and custom packaging, crucial for clients needing specialized handling. These services are vital for streamlining client production lines and ensuring component quality.

Additionally, WT Microelectronics earns revenue through specialized supply chain management and logistics, offering inventory control, demand forecasting, and tailored transportation solutions. These services help clients optimize operations and reduce costs.

Technical support and consulting fees are also key revenue streams, particularly for clients facing complex product development and integration challenges. In 2024, demand for design-in assistance for AI accelerators and advanced connectivity solutions saw a notable increase, allowing WT Microelectronics to capitalize on its expertise.

WT Microelectronics also benefits from volume-based rebates and incentives from suppliers, which enhance margins. For example, in 2024, distributors in high-demand sectors like automotive and AI saw improved profitability through these supplier programs.

| Revenue Stream | Description | 2023 Impact | 2024 Outlook |

| Component Markup | Profit from buying and selling semiconductors. | 7.1% Gross Profit Margin. | Continued demand in AI and automotive sectors. |

| Value-Added Services | Kitting, programming, testing, custom packaging. | Significant contributor to overall revenue. | Growing demand for specialized integration support. |

| Supply Chain & Logistics | Inventory control, demand forecasting, transportation. | Aids client cost reduction and operational efficiency. | Focus on streamlining complex electronics supply chains. |

| Technical Support & Consulting | Expert advice on design and integration. | Addresses complex product development hurdles. | Increased demand for emerging technology integration. |

| Supplier Rebates & Incentives | Financial benefits from meeting sales targets. | Boosts overall profitability. | Enhanced margins in high-demand sectors. |

Business Model Canvas Data Sources

The WT Microelectronics Business Model Canvas is built upon a foundation of extensive market research, competitive analysis, and internal financial data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.