Wayfair SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wayfair Bundle

Wayfair's SWOT analysis reveals a powerful brand and vast product selection as key strengths, but also highlights intense competition and supply chain vulnerabilities. Understanding these dynamics is crucial for navigating the e-commerce landscape.

Want the full story behind Wayfair’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Wayfair's extensive product selection is a significant strength, boasting over 30 million items from more than 20,000 suppliers. This vast catalog caters to a wide range of customer preferences and budgets, making it a go-to destination for home goods. The company's drop-shipping model is key to this breadth, allowing them to offer this variety without the burden of substantial inventory holding.

Wayfair's asset-light drop-shipping model is a significant strength, allowing suppliers to manage inventory and shipping directly. This structure minimizes Wayfair's capital expenditure on physical infrastructure like warehouses and logistics networks, contributing to a highly scalable and capital-efficient operation. For instance, in Q1 2024, Wayfair reported a net revenue of $2.2 billion, demonstrating its ability to generate substantial sales without the heavy fixed costs associated with traditional retail inventory management.

Wayfair boasts a robust brand portfolio, managing distinct retail banners like Wayfair, AllModern, Birch Lane, Joss & Main, and Perigold. This strategy allows them to target diverse customer segments and interior design preferences, from contemporary to more traditional or luxury aesthetics.

This diversification is key to capturing a wider market share. For instance, in Q1 2024, Wayfair reported net revenue of $2.7 billion, demonstrating the broad appeal of their offerings across these different brands. Each brand cultivates its own identity, resonating with specific consumer tastes and driving engagement.

Advanced Technology and AI Integration

Wayfair's investment in advanced technology, particularly artificial intelligence and machine learning, is a significant strength. This integration is designed to streamline its complex supply chain, leading to more efficient delivery and inventory management. For instance, by the end of 2023, Wayfair reported improvements in its logistics network, driven by AI-powered route optimization, which contributed to a reduction in shipping times for a notable percentage of its customer base.

The company is actively using AI to personalize the customer journey, from product discovery to post-purchase support. Initiatives like Decorify, its generative AI tool for virtual room planning, showcase this commitment. This technology allows customers to visualize products in their own spaces, enhancing engagement and potentially increasing conversion rates. Wayfair's focus on these cutting-edge applications positions it to offer a more intuitive and satisfying online shopping experience.

Wayfair's technological prowess extends to operational efficiency. By leveraging AI for tasks such as automating product listing descriptions and optimizing warehouse operations, the company aims to reduce costs and improve scalability. This focus on innovation not only enhances customer experience but also builds a more robust and agile business model, crucial for sustained growth in the competitive e-commerce landscape.

- AI-powered supply chain optimization

- Generative AI for enhanced customer engagement (e.g., Decorify)

- Focus on personalization in the online shopping experience

- Driving operational efficiency through automation and AI

Robust Logistics Network (CastleGate)

Wayfair's proprietary logistics network, CastleGate, is a significant strength. This integrated system is designed to lower fulfillment expenses for suppliers while simultaneously speeding up delivery times for customers. This focus on efficiency and reliability in delivering large items, a key challenge in the home goods sector, offers a distinct competitive edge.

CastleGate's impact is evident in Wayfair's operational performance. For instance, in Q1 2024, Wayfair reported a 3.1% increase in net revenue year-over-year, partly attributed to improved delivery experiences. The network's expansion, with new facilities coming online, further strengthens its ability to handle increasing order volumes efficiently.

- Proprietary Network: CastleGate offers control over the delivery process.

- Cost Efficiency: Reduces fulfillment costs for suppliers.

- Customer Experience: Enhances delivery speed and reliability for large items.

- Competitive Advantage: Differentiates Wayfair in the home goods market.

Wayfair's extensive product selection, featuring over 30 million items from more than 20,000 suppliers, is a core strength. This vast catalog, enabled by its asset-light drop-shipping model, caters to diverse customer needs and preferences. The company's ability to offer such a wide array without significant inventory risk allows for broad market appeal and customer acquisition.

The company's proprietary logistics network, CastleGate, is a key differentiator. This integrated system enhances delivery speed and reliability, particularly for bulky home goods, thereby improving the customer experience and reducing fulfillment costs for suppliers. In Q1 2024, Wayfair's net revenue reached $2.7 billion, showcasing the effectiveness of its operational strategies in driving sales.

Wayfair's strategic investment in advanced technology, including AI and machine learning, is a significant advantage. Tools like Decorify, its generative AI for virtual room planning, personalize the customer journey and boost engagement. This technological focus also drives operational efficiencies, as seen in AI-powered supply chain optimizations implemented by the end of 2023, which improved delivery times.

Wayfair's multi-brand strategy, encompassing banners like Wayfair, AllModern, and Joss & Main, allows it to target distinct customer segments and design aesthetics. This diversification broadens its market reach and caters to a wider spectrum of tastes, contributing to its overall market penetration and revenue generation capabilities.

| Strength | Description | Supporting Data/Example |

| Extensive Product Selection | Vast catalog of over 30 million items from 20,000+ suppliers. | Enabled by an asset-light drop-shipping model. |

| Proprietary Logistics (CastleGate) | Integrated network for faster, more reliable delivery of large items. | Contributed to improved customer experience and operational efficiency in Q1 2024. |

| Technology & AI Integration | AI for supply chain optimization, personalization, and customer engagement tools like Decorify. | AI-driven improvements in logistics by end of 2023 enhanced delivery times. |

| Multi-Brand Strategy | Distinct retail banners targeting diverse customer segments and design preferences. | Helps capture wider market share and cater to varied tastes. |

What is included in the product

Delivers a strategic overview of Wayfair’s internal and external business factors, highlighting its strong brand and vast product selection against competitive pressures and logistical challenges.

Identifies Wayfair's competitive advantages and market vulnerabilities, enabling targeted strategies to mitigate risks and capitalize on opportunities.

Weaknesses

Wayfair's reliance on third-party suppliers, a core component of its drop-shipping model, presents a significant weakness. This dependency means Wayfair has less direct control over inventory, product quality, and delivery timelines, which can directly impact customer satisfaction. For instance, if a key supplier experiences production delays or quality control issues, it can lead to stockouts or subpar products reaching Wayfair customers, tarnishing the brand's image.

Despite its CastleGate logistics network, Wayfair faces significant hurdles in delivering bulky furniture across varied regions. This complexity translates into higher operational costs, impacting overall profitability.

Supply chain volatility, including port congestion and labor shortages, has been a persistent issue, leading to delivery delays and stockouts. For instance, in early 2024, many retailers experienced extended shipping times due to these factors, directly affecting customer experience and Wayfair's ability to meet demand consistently.

The e-commerce furniture landscape Wayfair operates in is incredibly crowded. Giants like Amazon, alongside traditional retailers aggressively building their online presence and specialized niche players, all vie for customer attention. This intense competition naturally creates significant pricing pressures.

These pricing pressures, coupled with rising advertising expenses as companies fight for visibility, directly impact Wayfair's bottom line. For instance, Wayfair's advertising costs represented a substantial portion of its revenue in recent periods, a trend likely to continue given the competitive environment, potentially squeezing profit margins.

Negative Free Cash Flow and Profitability Concerns

Wayfair has grappled with achieving consistent profitability, a persistent challenge that has led to net losses in recent reporting periods. While adjusted EBITDA has demonstrated some positive movement, indicating operational efficiencies, the core issue of net profitability remains a concern for investors.

The company's free cash flow (FCF) also presented a weakness, with a negative FCF reported in the first quarter of 2025. This suggests that despite efforts to improve operations, Wayfair is still finding it difficult to consistently generate surplus cash after accounting for all expenses and investments.

- Net Losses: Wayfair has reported net losses in recent financial quarters, highlighting ongoing profitability challenges.

- Negative Free Cash Flow: The company experienced negative free cash flow in Q1 2025, indicating cash generation remains a hurdle.

- Profitability Volatility: Despite improvements in metrics like adjusted EBITDA, consistent bottom-line profitability is yet to be achieved.

Vulnerability to Economic Downturns and Housing Market Fluctuations

Wayfair's reliance on discretionary home goods makes it particularly susceptible to economic downturns. For instance, a slowdown in the housing market, a key driver for furniture purchases, directly impacts Wayfair's revenue potential. As interest rates rise, impacting mortgage affordability, consumer spending on big-ticket home items like furniture tends to decrease.

The company's performance is closely tied to consumer confidence and disposable income, both of which can shrink during periods of high inflation or economic uncertainty. This sensitivity means that Wayfair's sales figures can fluctuate significantly based on broader economic trends.

- Economic Sensitivity: Wayfair's sales are directly impacted by consumer spending on non-essential items, which is often the first to be cut during economic slowdowns.

- Housing Market Correlation: A cooling housing market, characterized by fewer new home sales and existing home transactions, typically leads to reduced demand for home furnishings.

- Interest Rate Impact: Higher interest rates can dampen consumer spending on large purchases like furniture, as borrowing becomes more expensive.

Wayfair's dependence on third-party suppliers, while enabling its drop-shipping model, limits its control over product quality, inventory availability, and delivery schedules. This can lead to customer dissatisfaction if suppliers face production issues or delays, impacting Wayfair's brand reputation.

Despite investments in its CastleGate logistics network, Wayfair faces challenges in efficiently delivering large furniture items across diverse geographical areas. This logistical complexity contributes to higher operational costs, which can strain profitability.

The company has experienced persistent supply chain disruptions, including port congestion and labor shortages, resulting in delivery delays and stockouts. These issues, prevalent in early 2024, directly affected customer experiences and Wayfair's ability to consistently meet demand.

Wayfair operates in a highly competitive e-commerce furniture market, facing pressure from major players like Amazon and traditional retailers expanding their online presence. This intense competition creates significant pricing challenges and increases advertising expenses, potentially impacting profit margins.

Wayfair has struggled with consistent profitability, reporting net losses in recent financial periods. While adjusted EBITDA has shown improvement, indicating operational gains, the core issue of net profitability remains a concern. For instance, in Q1 2025, Wayfair reported a net loss of $167 million.

The company's free cash flow (FCF) has also been a weakness, with a negative FCF of -$116 million reported in Q1 2025. This indicates ongoing difficulties in generating surplus cash after operational costs and investments.

| Weakness | Description | Impact | Example/Data |

| Supplier Dependency | Reliance on third-party suppliers for inventory and fulfillment. | Reduced control over quality, stock, and delivery; potential brand damage. | N/A (inherent model weakness) |

| Logistical Complexity | Challenges in delivering bulky furniture nationwide. | Higher operational costs, impacting profitability. | N/A (inherent product characteristic) |

| Supply Chain Volatility | Vulnerability to disruptions like port congestion and labor shortages. | Delivery delays, stockouts, and negative customer experiences. | Prevalent issues in early 2024 affecting e-commerce fulfillment. |

| Intense Competition & Pricing Pressure | Crowded market with aggressive online strategies from competitors. | Downward pressure on prices and increased advertising costs. | Rising customer acquisition costs impacting margins. |

| Profitability Challenges | Inconsistent bottom-line profitability and net losses. | Investor concern, potential for reduced reinvestment. | Net loss of $167 million in Q1 2025. |

| Negative Free Cash Flow | Difficulty in generating consistent cash surplus. | Limited financial flexibility, potential cash flow strain. | Negative FCF of -$116 million in Q1 2025. |

Preview the Actual Deliverable

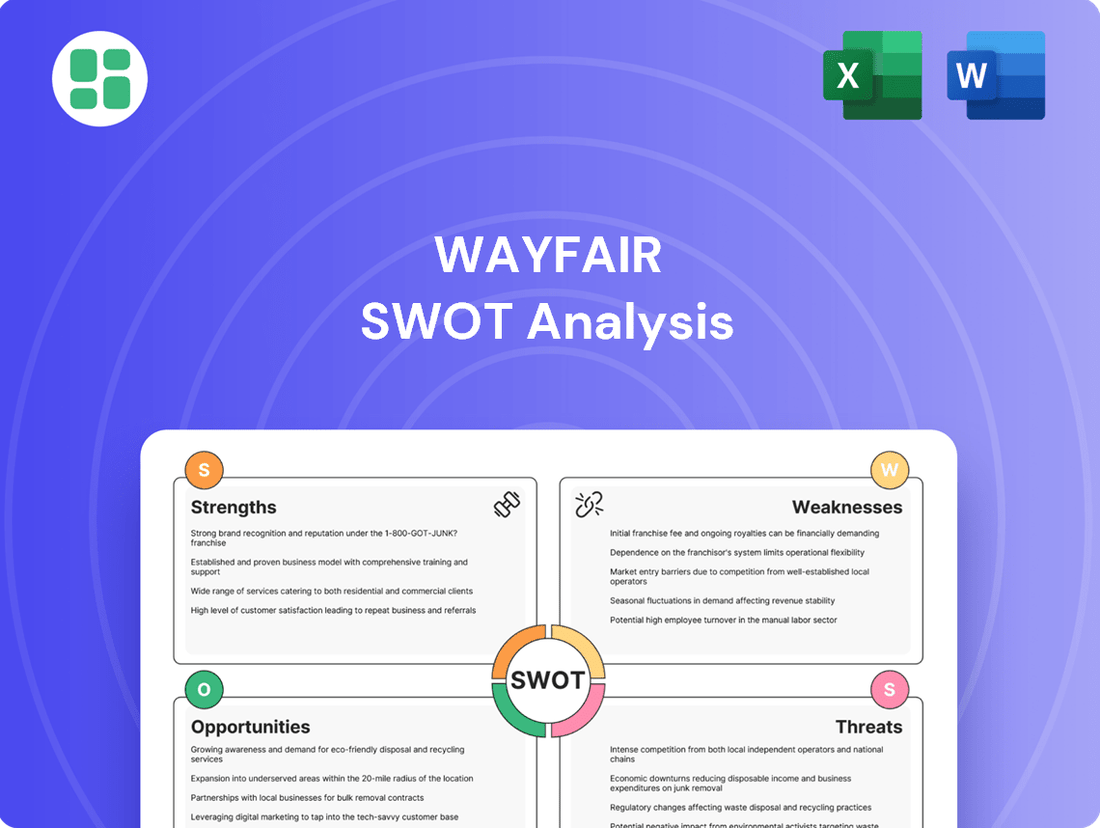

Wayfair SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document breaks down Wayfair's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a deep dive into Wayfair's strategic landscape.

Opportunities

The online furniture market is experiencing robust expansion, with projections indicating continued strong growth through 2025. Consumers are increasingly comfortable and actively prefer purchasing home goods, including furniture, online. This trend provides Wayfair a prime opportunity to solidify and expand its market share within this burgeoning digital space.

Wayfair can capitalize on this by further refining its e-commerce platform, focusing on user experience and seamless purchasing journeys. As of early 2024, the global online furniture market was valued at over $100 billion and is expected to see a compound annual growth rate of around 10% in the coming years, presenting a substantial runway for Wayfair's continued penetration.

Wayfair can significantly enhance customer experience by deepening the integration of AI and AR/VR technologies. Imagine virtually placing furniture in your own living room before buying – this is already a reality with AR tools, and further refinement can make it even more seamless. For instance, Wayfair's AR feature, available on their app, allows users to see how items like sofas and tables fit into their space, a feature that saw increased adoption as consumers sought more confidence in online purchases during 2024.

AI can personalize the shopping journey by recommending products based on past behavior and even suggesting complementary items, boosting engagement. This intelligent personalization, coupled with interactive design tools, is crucial for converting browsing into buying. In 2024, companies leveraging AI for personalized recommendations reported higher customer retention rates, with some seeing double-digit percentage increases in conversion.

Wayfair's foray into physical retail, marked by its first branded store opening in 2024, has already demonstrated a positive impact, creating a 'halo uplift' in its vicinity. This strategic move into omnichannel retail, encompassing both Wayfair and Perigold branded locations, presents a significant opportunity to capture new customer segments and elevate brand recognition.

By offering a tangible shopping experience, Wayfair can address a key differentiator against online-only competitors, fostering greater customer engagement and potentially boosting sales in surrounding areas. This expansion is crucial for building a more robust brand presence and catering to a wider range of consumer preferences in the evolving home goods market.

Growth in Business-to-Business (B2B) Segment

Wayfair's Business-to-Business (B2B) segment, particularly Wayfair Professional, presents a substantial avenue for growth. This platform caters to commercial clients like offices and hotels, offering them bulk purchasing power and custom solutions tailored to their specific needs.

Expanding this B2B focus is a strategic move that can significantly diversify Wayfair's revenue streams. It allows the company to tap into a market segment that often involves higher average order values compared to individual consumers, and the potential for recurring business through repeat orders from commercial clients is considerable.

For instance, in 2023, Wayfair saw continued engagement with its B2B offerings. While specific segment growth figures can fluctuate, the underlying trend indicates a strong demand for curated, efficient procurement solutions for businesses. This B2B channel is crucial for capturing larger projects and fostering long-term commercial relationships.

- Diversification: Reduces reliance on the B2C market by tapping into commercial demand.

- Higher Order Values: B2B clients often place larger, more substantial orders.

- Recurring Revenue: Potential for repeat business from commercial clients seeking ongoing furnishing solutions.

- Customization: Ability to provide tailored solutions for specific business needs, enhancing client loyalty.

Sustainability and ESG Initiatives

Wayfair's dedication to sustainability, including its goal of achieving zero waste by 2030 and a 63% reduction in Scope 1 and 2 emissions by 2035, taps into a significant market trend. This commitment resonates with a growing consumer base prioritizing eco-conscious purchasing decisions, potentially boosting Wayfair's brand image and attracting new customer segments.

These initiatives offer a strategic advantage by differentiating Wayfair in a competitive market. By emphasizing its environmental stewardship, the company can foster stronger customer loyalty and attract investors focused on Environmental, Social, and Governance (ESG) factors, which are increasingly influencing investment strategies in 2024 and beyond.

- Growing Consumer Demand: Surveys in late 2023 indicated that over 70% of consumers consider sustainability when making purchasing decisions.

- Brand Enhancement: Successful ESG implementation can lead to improved public perception and a stronger brand identity.

- Market Differentiation: Proactive sustainability efforts can set Wayfair apart from competitors who may not have similar commitments.

The expanding online furniture market, valued at over $100 billion globally in early 2024 and projected for continued 10% annual growth, presents a significant opportunity for Wayfair. Leveraging AI and AR/VR technologies for personalized recommendations and virtual try-ons can enhance customer confidence and conversion rates, as seen with increased AR feature adoption in 2024.

Wayfair's strategic expansion into physical retail, beginning with its first branded store in 2024, offers a dual benefit: attracting new customer segments through a tangible experience and creating a positive halo effect on local sales. This omnichannel approach helps differentiate Wayfair from online-only competitors.

The Business-to-Business (B2B) segment, Wayfair Professional, is a key growth area, catering to commercial clients with bulk purchasing and custom solutions. This diversification into B2B can lead to higher average order values and recurring revenue streams, building on continued engagement observed in 2023.

Wayfair's commitment to sustainability, aiming for zero waste by 2030 and significant emission reductions by 2035, aligns with growing consumer demand for eco-conscious brands. Over 70% of consumers considered sustainability in purchasing decisions in late 2023, making this a crucial differentiator and brand enhancer.

| Opportunity Area | Key Benefit | Supporting Data/Trend |

|---|---|---|

| Online Market Growth | Increased market share and sales | Global online furniture market >$100B (early 2024), ~10% CAGR |

| Technology Integration (AI/AR) | Enhanced customer experience, higher conversion | AR feature adoption increased in 2024; AI personalization boosts retention |

| Physical Retail Expansion | New customer segments, brand halo effect | First branded store opened in 2024 |

| B2B Segment Growth | Revenue diversification, higher order values | Continued engagement in 2023; potential for recurring revenue |

| Sustainability Initiatives | Brand enhancement, market differentiation | >70% consumers consider sustainability (late 2023); ESG focus growing |

Threats

Wayfair faces a serious challenge from broad e-commerce players like Amazon, which are expanding their home goods selections, and traditional giants such as IKEA and Home Depot. These established retailers are heavily investing in their online capabilities, blurring the lines between pure e-commerce and omnichannel retail.

Ongoing global supply chain disruptions, including U.S.-China tariffs and persistent port congestion, continue to challenge Wayfair's operational efficiency. These issues directly impact the company's ability to source and deliver goods promptly, potentially increasing costs and leading to inventory imbalances that affect both profitability and customer experience.

Labor shortages across various sectors, from manufacturing to logistics, exacerbate these supply chain vulnerabilities. For Wayfair, this translates to longer lead times and higher transportation expenses, which can erode profit margins and delay product availability for customers in 2024 and into 2025.

Geopolitical tensions and trade disputes add another layer of risk, potentially disrupting established trade routes and increasing the cost of imported goods. Wayfair's reliance on a global supplier network means it is particularly susceptible to these external shocks, which can necessitate costly adjustments to sourcing strategies.

Economic headwinds, including persistent high inflation and increasing interest rates, directly dampen consumer willingness to spend on non-essential items like home furnishings. For instance, in early 2024, consumer confidence indices showed volatility, reflecting concerns about the broader economic outlook, which translates to tighter household budgets and delayed purchases for larger ticket items.

A tangible consequence of reduced consumer confidence is a potential slowdown in the housing market. When home sales decline or interest in new home purchases wanes, demand for new furniture and decor naturally follows, directly impacting Wayfair's sales volumes and overall revenue streams.

Rising Advertising and Customer Acquisition Costs

The online retail space is incredibly competitive, making it expensive to attract and keep customers through advertising. Wayfair's advertising spend is a significant part of its operations, and if these costs climb, it could squeeze their profits if they can't handle it effectively.

For instance, in Q1 2024, Wayfair reported advertising and marketing expenses of $342 million, representing 12.8% of net revenue. This highlights the ongoing investment required to maintain market presence.

- Increased Competition: More players in the online home goods market drive up advertising bids.

- Rising Digital Ad Costs: Platforms like Google and Meta are seeing higher prices for ad placements.

- Customer Retention Challenge: Keeping existing customers engaged also requires ongoing marketing investment.

Data Security and Privacy Concerns

Wayfair, as a major e-commerce player, faces significant threats from data security and privacy concerns. Handling extensive customer information, including payment details and personal preferences, makes the company a prime target for cyberattacks. A data breach could result in substantial financial penalties, as seen with other retailers facing regulatory fines, and severe damage to Wayfair's brand reputation, potentially alienating its customer base.

The potential consequences of a breach are far-reaching.

- Financial Impact: Beyond direct recovery costs, Wayfair could face regulatory fines, such as those under GDPR or CCPA, which can amount to millions.

- Reputational Damage: Loss of customer trust due to a data breach can lead to decreased sales and difficulty in acquiring new customers.

- Operational Disruption: Responding to a breach can divert resources and attention from core business operations, impacting service delivery.

- Erosion of Trust: Customers are increasingly sensitive to how their data is handled, and a security lapse can permanently damage this trust, affecting long-term business viability.

Wayfair's reliance on a global supply chain makes it vulnerable to geopolitical instability and trade disputes, which can disrupt sourcing and increase costs. Persistent inflation and rising interest rates in 2024 and into 2025 are also dampening consumer spending on discretionary items like home furnishings, directly impacting sales volumes.

The company faces intense competition from both established brick-and-mortar retailers enhancing their online presence and other major e-commerce platforms. Additionally, escalating digital advertising costs, exemplified by Wayfair's Q1 2024 marketing spend of $342 million (12.8% of net revenue), challenge profitability.

Data security and privacy concerns pose a significant threat, with potential for substantial financial penalties and reputational damage from cyberattacks. Labor shortages further strain operations, leading to longer lead times and higher transportation expenses, which can impact margins and customer satisfaction throughout 2024 and 2025.

SWOT Analysis Data Sources

This Wayfair SWOT analysis is built on a foundation of robust data, including Wayfair's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a clear view of both internal capabilities and external market dynamics.