Wayfair Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wayfair Bundle

Curious about Wayfair's product portfolio performance? Our BCG Matrix analysis offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand the strategic implications and unlock actionable insights for your own business, dive deeper by purchasing the full report.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Wayfair.

Stars

Wayfair's U.S. core e-commerce business is a clear Star in the BCG Matrix. It holds a leading market share among pure-play specialty home product retailers in the United States, a testament to its strong position.

Even with a tough economic climate and a shrinking industry overall, Wayfair has managed to increase its market share, indicating robust relative performance. This core U.S. business is a high-market-share segment within the expanding online home goods market.

Launched in October 2024, the Wayfair Rewards loyalty program is a paid annual subscription designed to enhance customer retention. Members receive benefits such as 5% back in rewards and free shipping, aiming to foster deeper customer relationships and increase lifetime value.

If the program achieves strong adoption, it could significantly boost customer retention and average order values, positioning it as a key growth driver for Wayfair.

Wayfair is making significant strides in advanced technology and AI integration, pouring resources into generative AI to revolutionize the customer journey. This investment translates into features like highly personalized product recommendations, intuitive visual search capabilities, and engaging conversational search options.

The company's commitment to technological advancement, including a major cloud migration, is designed to streamline user navigation and meticulously tailor product assortments to individual shopper preferences. These innovations are vital for boosting customer engagement and securing a stronger market position in the dynamic e-commerce sector.

Strategic Growth of Specialty & Flagship Brands

Wayfair is strategically nurturing its core Wayfair.com platform alongside a curated selection of specialty brands like AllModern, Joss & Main, Birch Lane, and Perigold. This approach targets diverse customer tastes and style preferences, aiming to broaden its market appeal. The company's investment in these brands is designed to capture a larger share of the online home goods market.

Marketing initiatives, such as the 'Welcome to the Wayborhood' campaign, are central to Wayfair's strategy for building robust brand loyalty and enhancing customer lifetime value. By focusing on these key brands, Wayfair seeks to create deeper connections with its customer base. This brand development is crucial for sustainable customer acquisition and retention.

- Brand Diversification: Wayfair's portfolio includes Wayfair.com, AllModern, Joss & Main, Birch Lane, and Perigold, catering to varied style preferences.

- Marketing Investment: Campaigns like 'Welcome to the Wayborhood' are designed to boost brand recognition and customer relationships.

- Growth Drivers: The strategy focuses on enhancing availability, delivery speed, and price competitiveness across its brands to drive profitable growth.

Growing Supplier Advertising Revenue

Growing Supplier Advertising Revenue is a key driver for Wayfair. In 2024, this segment accounted for 1.5% of Wayfair's total revenue, a figure expected to climb to 3-4% in the near future.

This growth is fueled by Wayfair's substantial supplier network and its ability to offer valuable advertising opportunities. Suppliers leverage Wayfair's vast customer traffic and established market position to promote their products.

- Revenue Contribution: 1.5% in 2024, projected 3-4%.

- Growth Drivers: Extensive supplier network and high platform traffic.

- Profitability Impact: Enhances gross margins with minimal additional operational costs.

- Strategic Importance: Scalable revenue stream crucial for overall profitability.

Wayfair's core U.S. e-commerce business is a strong Star in the BCG Matrix, holding a leading market share in the online home goods sector. Despite industry headwinds, Wayfair has consistently increased its market share, demonstrating robust relative performance. The company's strategic investments in technology, like generative AI for personalized customer experiences, and loyalty programs such as Wayfair Rewards, launched in October 2024, are designed to further solidify this position and drive continued growth.

| Category | Market Share | Growth Rate | Wayfair's Position |

| U.S. Online Home Goods | High | Growing | Star |

| Supplier Advertising | N/A (Internal) | High | Potential Star/Cash Cow |

What is included in the product

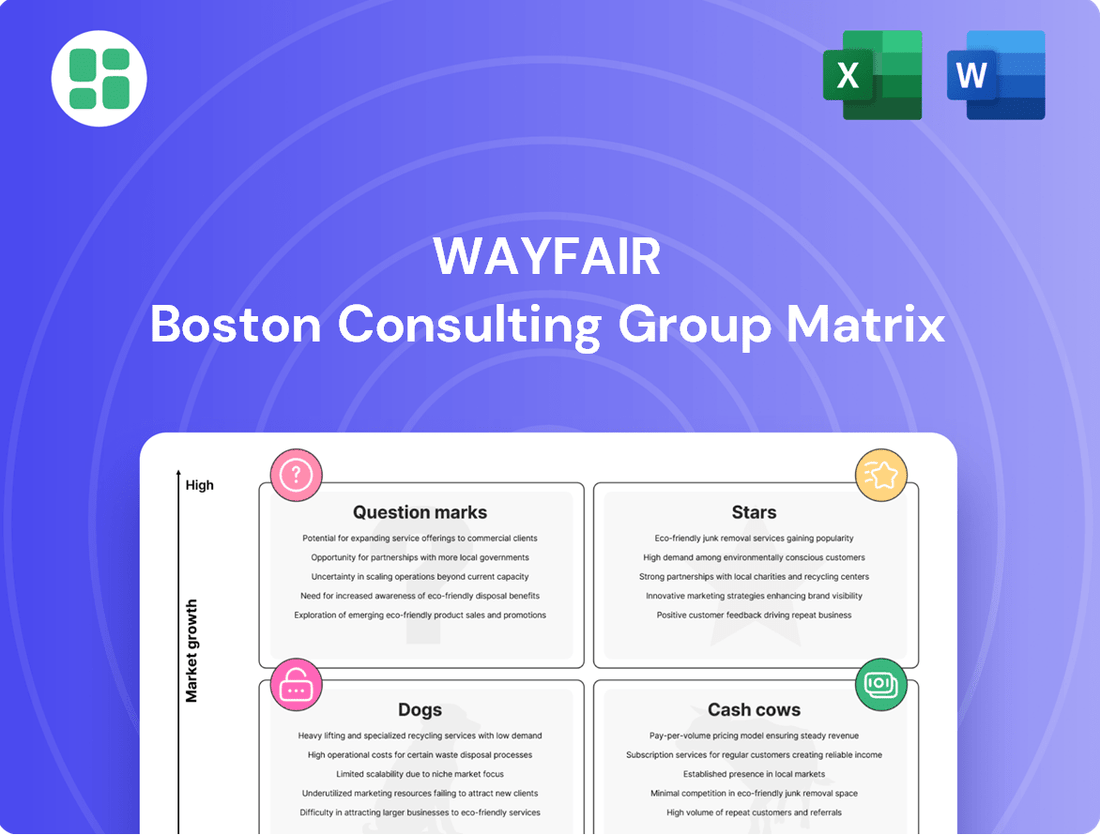

The Wayfair BCG Matrix analyzes its product categories as Stars, Cash Cows, Question Marks, and Dogs to guide investment and resource allocation.

A clear BCG matrix visualizes Wayfair's product lines, easing the pain of resource allocation by highlighting stars for investment and question marks for evaluation.

Cash Cows

Wayfair's established core furniture categories, like sofas and beds, are its bedrock. These are mature markets with steady demand, acting as significant cash generators for the company. In 2024, Wayfair continued to leverage its extensive supplier network and strong brand presence in these essential segments, ensuring consistent revenue streams.

Wayfair's core drop-shipping business model is a prime example of a cash cow. By connecting customers directly with a vast network of suppliers, Wayfair avoids the significant costs and risks associated with holding large amounts of physical inventory. This lean approach allows for high profit margins on sales, as the company primarily earns commissions and revenue from direct sales, generating consistent and substantial cash flow.

In 2023, Wayfair's net revenue was $12.06 billion, demonstrating the scale of its operations. The efficiency of their drop-shipping model, which minimizes inventory risk and carrying costs, is a key contributor to its profitability and ability to generate strong cash flow, enabling reinvestment in other growth areas.

CastleGate Logistics Network, Wayfair's in-house logistics arm, functions as a significant cash cow. It offers warehousing and delivery services to third-party sellers on Wayfair's platform, generating a reliable and profitable revenue stream.

This established infrastructure provides value-added services to suppliers, ensuring consistent income and bolstering Wayfair's overall cash flow. It operates within a mature, low-growth market for operational support services.

Wayfair Professional Program (B2B)

The Wayfair Professional Program is a significant contributor to Wayfair's revenue, acting as a reliable cash cow. This business-to-business segment focuses on serving designers, contractors, and other commercial clients who require bulk orders and materials for larger projects. It taps into Wayfair's extensive product selection and established logistics network, ensuring consistent demand from a customer base less susceptible to discretionary spending fluctuations.

This program provides a stable and recurring revenue stream, bolstering Wayfair's financial performance. By catering to a high-volume, commercial market, Wayfair Professional generates predictable cash flow, which is crucial for supporting other areas of the business. In 2023, Wayfair reported that its B2B segment, which includes Wayfair Professional, saw continued growth, demonstrating its importance as a steady income generator.

- Wayfair Professional Program: Targets businesses, designers, and contractors for bulk and commercial orders.

- Revenue Stability: Offers a predictable and recurring income stream, reducing reliance on individual consumer spending.

- Leverages Existing Infrastructure: Utilizes Wayfair's vast product catalog and supply chain for efficient service.

- Market Position: Caters to a less discretionary customer segment, ensuring consistent cash generation.

Repeat Customer Base

Wayfair's substantial repeat customer base is a cornerstone of its financial stability, acting as a prime example of a cash cow. In the fourth quarter of 2024 and the first quarter of 2025, these loyal customers were responsible for more than 79% of all orders delivered. This high percentage highlights the profitability of retaining existing customers, as the cost to re-engage them is considerably lower than acquiring new ones.

The company's strategic emphasis on cultivating customer loyalty directly supports this cash-generating asset. By focusing on repeat business, Wayfair minimizes its customer acquisition costs and maximizes the lifetime value of its customer relationships.

- High Revenue Stability: Over 79% of Wayfair's orders in Q4 2024 and Q1 2025 came from repeat customers, ensuring a consistent revenue stream.

- Reduced Marketing Spend: Re-engaging existing customers is far more cost-effective than acquiring new ones, boosting profitability.

- Core Business Strategy: Fostering customer loyalty and repeat purchases is central to Wayfair's approach to maintaining its profitable cash cow segment.

Wayfair's core furniture categories, such as sofas and beds, represent mature markets with consistent demand, serving as significant cash generators. In 2024, Wayfair continued to capitalize on its extensive supplier network and strong brand recognition in these essential segments, ensuring a steady flow of revenue.

The company's drop-shipping model, by connecting customers directly with suppliers and avoiding inventory costs, generates high profit margins and substantial cash flow. This efficiency is a key driver of Wayfair's profitability, enabling further investment in growth initiatives.

Wayfair Professional, targeting businesses and designers, contributes significantly as a reliable cash cow. This B2B segment leverages Wayfair's product selection and logistics for bulk orders, offering a stable and recurring revenue stream less impacted by consumer spending fluctuations.

| Cash Cow Segment | Description | Key Financial Contribution | 2024/2025 Data Highlight |

|---|---|---|---|

| Core Furniture Categories | Mature markets with steady demand (e.g., sofas, beds). | Consistent revenue streams from established product lines. | Leveraged strong brand presence and supplier network. |

| Drop-shipping Model | Connects customers directly with suppliers, minimizing inventory costs. | High profit margins and substantial cash flow generation. | Efficient operations contribute significantly to profitability. |

| Wayfair Professional | B2B segment serving designers and contractors for bulk orders. | Stable and recurring revenue, less sensitive to consumer spending. | Demonstrated continued growth in the B2B sector. |

| Repeat Customer Base | Loyal customers driving a significant portion of orders. | Reduced customer acquisition costs and maximized customer lifetime value. | Over 79% of orders in Q4 2024/Q1 2025 from repeat customers. |

What You See Is What You Get

Wayfair BCG Matrix

The Wayfair BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you'll get the comprehensive analysis without any watermarks or placeholder content, ready for immediate strategic application.

Dogs

Wayfair's international operations are currently facing significant headwinds, with a notable revenue decline of 10.9% reported in the first quarter of 2025. This downturn is largely attributed to strategic decisions, such as the company's exit from the German market in January 2025.

These underperforming international segments represent markets where Wayfair holds a low share and struggles to generate growth or profitability. Such operations can become cash traps, diverting resources that could be better utilized elsewhere.

Consequently, these specific international markets are prime candidates for divestiture or a comprehensive restructuring to mitigate further losses and improve overall financial performance.

Highly niche or obsolete product categories on Wayfair, such as specialized historical reproduction furniture or very specific craft supplies, often demonstrate low sales volume. For example, Wayfair's Q1 2024 earnings report indicated a continued focus on optimizing its product assortment to improve inventory turnover, a direct response to categories that underperform.

These underperforming categories can tie up valuable digital shelf space and supplier relationships without yielding significant revenue. In 2023, Wayfair reported a net revenue of $10.4 billion, and the company actively works to prune product lines that do not contribute proportionally to this figure, ensuring resources are allocated to higher-demand items.

Wayfair's marketing efforts, while substantial, can include inefficient spending on channels that don't translate into sales. For instance, if a significant portion of their advertising budget is allocated to platforms or campaigns that consistently show low conversion rates, it represents a drain on resources. This is particularly true if these channels don't align with their core strategy of building a strong brand identity and customer community, such as the 'Welcome to the Wayborhood' initiative.

In 2024, Wayfair's marketing expenditure needs careful scrutiny to identify underperforming areas. If, for example, social media ads on a particular platform are driving high impressions but very few actual purchases, that spend could be deemed inefficient. This type of expenditure doesn't contribute to market share growth or customer acquisition, effectively hindering overall performance.

Underutilized or Legacy Technology Infrastructure

Wayfair's underutilized or legacy technology infrastructure represents a potential drag on resources, even amidst significant modernization efforts. These older systems, if still in place, can incur substantial maintenance costs and require dedicated support teams, diverting capital and talent away from more strategic, growth-oriented initiatives.

Such legacy assets, often failing to integrate seamlessly with newer platforms, can hinder operational efficiency and limit the company's ability to leverage cutting-edge technologies for competitive advantage. For instance, in 2023, companies in the e-commerce sector typically allocated between 15-20% of their IT budget to maintaining legacy systems, a figure Wayfair would aim to minimize.

- High Maintenance Costs: Legacy systems often carry disproportionately high costs for upkeep and patching.

- Limited Scalability: Older infrastructure may struggle to scale efficiently with Wayfair's growing customer base and transaction volumes.

- Security Vulnerabilities: Outdated technology can present increased cybersecurity risks, potentially impacting customer data and business operations.

- Hindered Innovation: Resources tied to legacy systems could otherwise be invested in developing new features or improving customer experience.

Poorly Performing Outlet Stores

Even as Wayfair grows its outlet presence, individual stores that consistently miss sales goals or profitability benchmarks are candidates for the Dogs category. These underperformers, often hampered by suboptimal locations, low customer traffic, or inefficient inventory handling, can become resource drains. For example, a poorly performing outlet in a declining retail area might cost more to operate than it generates in revenue, negatively impacting Wayfair's bottom line.

- Underperforming Outlets: Stores failing to meet sales targets or profitability.

- Potential Causes: Poor location, low foot traffic, inventory management issues.

- Impact: Draining resources and negatively affecting overall revenue and brand equity.

These underperforming areas, like the German market exit in early 2025 which saw a 10.9% revenue drop, represent low-share, low-growth segments. They can consume resources without generating sufficient returns, making them prime candidates for divestment or significant restructuring to improve Wayfair's overall financial health.

Similarly, niche product categories with low sales volume, such as specialized historical furniture, tie up digital shelf space and supplier relationships. Wayfair's Q1 2024 focus on optimizing its product assortment aims to address these underperformers, as seen in their $10.4 billion net revenue for 2023 where resource allocation is key.

Inefficient marketing spend on channels with low conversion rates, and legacy technology infrastructure with high maintenance costs and security risks, also fall into this category. For instance, in 2023, e-commerce companies often spent 15-20% of their IT budget on legacy systems, a cost Wayfair would aim to reduce.

Finally, individual Wayfair outlet stores consistently missing sales goals or profitability benchmarks, perhaps due to poor locations or low foot traffic, can become resource drains. These underperformers negatively impact the company's bottom line and brand equity.

Question Marks

Wayfair's foray into physical retail, marked by its first physical store opening in 2024 and plans for a second in Atlanta by 2026, signifies a strategic move into a high-potential but currently low-share market segment for the company. This expansion requires significant capital, with initial investments likely in the millions for store build-out, inventory, and staffing. The success of these brick-and-mortar ventures hinges on Wayfair's ability to replicate its online customer experience and effectively compete against established retail giants.

Perigold, Wayfair's high-end luxury brand, targets a rapidly expanding segment within the home furnishings industry. While this niche offers substantial growth potential, Perigold's current market share within the overall luxury retail landscape is likely modest when compared to long-standing, established players.

Penetrating this premium market demands considerable investment in a meticulously curated product selection, targeted marketing campaigns, and exceptional customer service, often referred to as white-glove treatment. These investments are crucial for broadening Perigold's customer base and securing a more significant foothold in this profitable market.

The integration of smart technology into home furnishings is a burgeoning market, with global smart home device revenue projected to reach $175 billion in 2024. Wayfair's current market share in this nascent category is likely small, positioning it as a potential Star or Question Mark.

Capturing significant market share in smart home furniture will demand substantial investment in research and development, strategic alliances with technology firms, and robust consumer education initiatives. Without these efforts, Wayfair risks this segment becoming a Dog, unable to compete effectively.

New Service Offerings (e.g., Advanced Design Services)

Wayfair could introduce advanced design services, such as personalized interior design consultations or premium installation support, to tap into a higher-value segment of the home furnishings market. These offerings would likely begin with low market share but possess significant growth potential, requiring substantial investment in specialized talent and targeted marketing campaigns to achieve profitability and scale. For instance, in 2024, the demand for personalized home services continued to rise, with many consumers seeking expert advice to optimize their living spaces.

- Personalized Design Consultations: Offering virtual or in-home consultations with interior designers, leveraging Wayfair's extensive product catalog.

- Advanced Installation Services: Partnering with or developing a network for complex installations, like custom shelving or full room makeovers.

- Investment Needs: Significant upfront costs for hiring and training design professionals, developing robust booking and management systems, and aggressive marketing to build awareness.

- Market Potential: Addressing a growing consumer desire for curated and professionally executed home transformations, potentially commanding higher margins than product sales alone.

New Geographic Market Entries

New geographic market entries for Wayfair would likely be classified as Question Marks within the BCG Matrix. This is because these ventures demand substantial upfront investment in areas like localizing supply chains, marketing efforts, and customer service infrastructure. The potential for success is high, given the growth in online furniture sales in many emerging markets, but the immediate returns are uncertain, making them a classic Question Mark scenario.

Wayfair's approach to new markets would involve careful consideration of the competitive landscape and consumer behavior in each region. For example, entering a market with a less developed e-commerce penetration but a growing middle class presents both opportunity and risk. The company would need to assess factors such as import duties, logistics challenges, and the need for culturally relevant marketing campaigns. By 2024, global e-commerce sales were projected to reach trillions, indicating a significant opportunity for companies like Wayfair willing to navigate new territories.

- Strategic Entry: Entering new, high-growth international regions with nascent online furniture sales represents a Question Mark.

- Investment Required: Significant initial investment is necessary for localized supply chains, marketing, and customer support.

- Uncertain Returns: Immediate returns on these investments are uncertain, a hallmark of Question Mark businesses.

- Market Potential: The global e-commerce market continues to expand, offering substantial long-term growth potential for well-executed international expansions.

New product categories or services that Wayfair is exploring, such as its recent expansion into physical retail or its luxury brand Perigold, can be viewed as Question Marks. These initiatives often require substantial investment to gain traction and establish market share. The success of these ventures is not guaranteed, meaning they have the potential for high growth but also carry significant risk.

Wayfair's move into physical retail, with its first store opening in 2024, represents a classic Question Mark. This requires considerable capital for store setup, inventory, and staffing, and its market share in this segment is currently minimal. Similarly, Perigold, while targeting a growing luxury market, likely holds a small share against established competitors, necessitating significant investment in branding and customer experience.

The smart home furnishings sector, with global revenue projected at $175 billion in 2024, is another area where Wayfair might be considered a Question Mark. Its current market share is likely small, demanding substantial R&D and strategic partnerships to compete effectively. Without focused investment, these emerging categories could fail to gain momentum.

Wayfair's strategic expansion into new geographic markets also fits the Question Mark profile. These ventures demand significant upfront investment in localized operations and marketing. While global e-commerce continues to grow, the immediate returns in these new territories are uncertain, making them high-risk, high-reward opportunities.

| Initiative | Market Share | Growth Potential | Investment Needs | Classification |

|---|---|---|---|---|

| Physical Retail Expansion (2024) | Low | High | High | Question Mark |

| Perigold (Luxury Brand) | Low | High | High | Question Mark |

| Smart Home Furnishings | Low | High | High | Question Mark |

| New Geographic Markets | Low | High | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Wayfair's financial reports, investor presentations, and internal sales data, alongside industry market share analysis and growth projections.