Wayfair PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wayfair Bundle

Wayfair's success hinges on navigating a complex external environment, from shifting consumer behaviors to evolving technological landscapes. Our PESTLE analysis dives deep into these critical factors, revealing how political stability, economic fluctuations, and social trends are shaping Wayfair's strategic direction. Understand the opportunities and threats that lie ahead and gain a competitive edge by downloading the full, actionable report today.

Political factors

Government regulations on e-commerce are a significant political factor for Wayfair. Changes in consumer protection laws, data privacy requirements, and digital trade policies in key markets like the US and Europe directly impact Wayfair's operational compliance and ability to access these markets. For instance, the enforcement of stricter data privacy regulations, such as GDPR in Europe, necessitates robust data handling practices and can affect targeted advertising strategies. In 2024, many governments continue to review and update their e-commerce frameworks, with a focus on fair competition and consumer safety, which Wayfair must navigate.

Fluctuations in international trade policies and tariffs directly impact Wayfair's cost of goods sold and pricing. For instance, tariffs imposed by the U.S. on goods from China, a major manufacturing hub for furniture, can significantly increase Wayfair's procurement costs, potentially squeezing profit margins as seen in past trade disputes.

As of early 2024, ongoing trade negotiations and potential shifts in global trade agreements continue to present both opportunities and risks for Wayfair's extensive supply chain. Companies like Wayfair, which source a substantial portion of their inventory internationally, must remain agile to adapt to evolving trade landscapes and their impact on market access and pricing strategies.

Political stability in key operational and sourcing regions is paramount for Wayfair's supply chain integrity and consumer trust. For instance, disruptions in manufacturing hubs due to political unrest can directly impact product availability and delivery times, as seen with past supply chain vulnerabilities exacerbated by regional instability.

Geopolitical events, including international conflicts or trade disputes, pose significant risks. These can escalate logistics costs, create shipping bottlenecks, and even lead to temporary cessation of trade routes, directly affecting Wayfair's ability to source and deliver goods efficiently. The ongoing global geopolitical landscape, with its shifting alliances and trade policies, necessitates constant monitoring and contingency planning.

Furthermore, political instability can dampen consumer sentiment, particularly for non-essential purchases like home furnishings. A volatile political climate often correlates with reduced consumer spending as individuals prioritize essential goods, thereby impacting Wayfair's revenue streams. For example, economic uncertainty stemming from political events in major markets like North America or Europe can lead to a slowdown in discretionary spending, affecting Wayfair's sales growth targets for 2024 and 2025.

Taxation Policies on Online Sales

Evolving taxation policies, especially concerning sales tax collection for online sales, introduce significant complexity for Wayfair’s financial operations. As of late 2024, the landscape continues to adapt, with states increasingly enforcing collection requirements on remote sellers, impacting Wayfair’s compliance burden.

Navigating these varying tax regulations necessitates sophisticated financial systems and can directly influence Wayfair's pricing strategies and overall profitability. For instance, the ongoing debate around digital services taxes in various jurisdictions could further alter the cost structure for online platforms.

Changes in corporate tax rates or the introduction of new levies like digital service taxes can also have a material impact on Wayfair's financial health and its capacity for future investment and expansion.

- Sales Tax Nexus: Wayfair must comply with sales tax collection in states where it establishes economic nexus, a threshold that varies by state and is often based on sales volume or transaction count.

- Digital Services Taxes: Some countries are exploring or implementing taxes on digital services, which could affect Wayfair's revenue streams and operational costs.

- Corporate Tax Rate Fluctuations: Changes in national corporate tax rates, such as potential adjustments in the US federal tax rate, directly impact Wayfair's net income and cash flow.

Government Stimulus and Economic Support

Government stimulus and economic support measures significantly shape the landscape for home goods retailers like Wayfair. During periods of economic uncertainty, direct financial aid or tax credits can indirectly boost consumer spending on discretionary items, including furniture and home decor, thereby benefiting Wayfair's sales. For instance, the impact of COVID-19 stimulus, such as the American Rescue Plan enacted in March 2021, saw increased disposable income for many households, which translated into higher spending on home improvement and furnishing, areas where Wayfair operates.

Conversely, the tapering or withdrawal of these support programs can lead to a contraction in discretionary spending. As government support diminishes, consumers may prioritize essential goods over non-essential purchases, potentially impacting Wayfair's revenue. This shift is often observed as inflation rises and economic conditions normalize post-stimulus periods.

Furthermore, these policies influence broader economic indicators crucial for the retail sector. Government actions affecting labor markets, such as unemployment benefits or job creation initiatives, can impact consumer confidence and overall purchasing power. A strong labor market, often bolstered by supportive government policies, generally correlates with higher consumer confidence, which is a key driver for sales in sectors like home furnishings.

- Stimulus Impact: Government stimulus packages, like those seen in response to the COVID-19 pandemic, can increase disposable income, leading to higher consumer spending on home goods for Wayfair.

- Withdrawal Effects: The cessation of economic support measures may curb discretionary spending, potentially slowing down sales growth for Wayfair as consumers adjust their budgets.

- Labor Market Influence: Government policies affecting employment and wages directly impact consumer confidence and their ability to make large purchases, such as furniture, which is vital for Wayfair's business.

- Consumer Confidence: Stable or improving consumer confidence, often influenced by government economic strategies, is a critical factor for Wayfair's performance in the home goods market.

Government regulations on e-commerce, data privacy, and consumer protection are critical for Wayfair's operations. For instance, the ongoing enforcement of GDPR in Europe impacts data handling and targeted advertising. In 2024, governments worldwide continue to refine e-commerce laws, focusing on fair competition and consumer safety, areas Wayfair must actively manage.

Trade policies and tariffs directly influence Wayfair's sourcing costs and pricing strategies. For example, past U.S. tariffs on Chinese goods increased procurement expenses, impacting profit margins. As of early 2024, evolving trade agreements and negotiations present both opportunities and risks for Wayfair's global supply chain.

Political stability in sourcing and operational regions is vital for Wayfair's supply chain. Regional instability can disrupt manufacturing and lead to product availability issues. Geopolitical events, such as international conflicts, can escalate logistics costs and create shipping bottlenecks, affecting Wayfair's ability to deliver goods efficiently.

Taxation policies, particularly regarding online sales tax collection, add complexity. By late 2024, states are increasingly enforcing collection requirements on remote sellers, increasing Wayfair's compliance burden. Changes in corporate tax rates or the introduction of digital services taxes also impact Wayfair's financial health and investment capacity.

| Political Factor | Impact on Wayfair | Example/Data Point (2024/2025 Focus) |

| E-commerce Regulations | Operational compliance, market access | Continued focus on data privacy (e.g., GDPR enforcement) and consumer protection laws in major markets. |

| Trade Policies & Tariffs | Cost of goods sold, pricing | Ongoing trade negotiations impacting international sourcing costs, with potential for tariffs on goods from key manufacturing regions. |

| Political Stability | Supply chain integrity, product availability | Risk of disruptions in manufacturing hubs due to regional instability affecting delivery times. |

| Taxation Policies | Financial operations, profitability | Increased enforcement of online sales tax collection by states, and potential for digital services taxes in various jurisdictions. |

What is included in the product

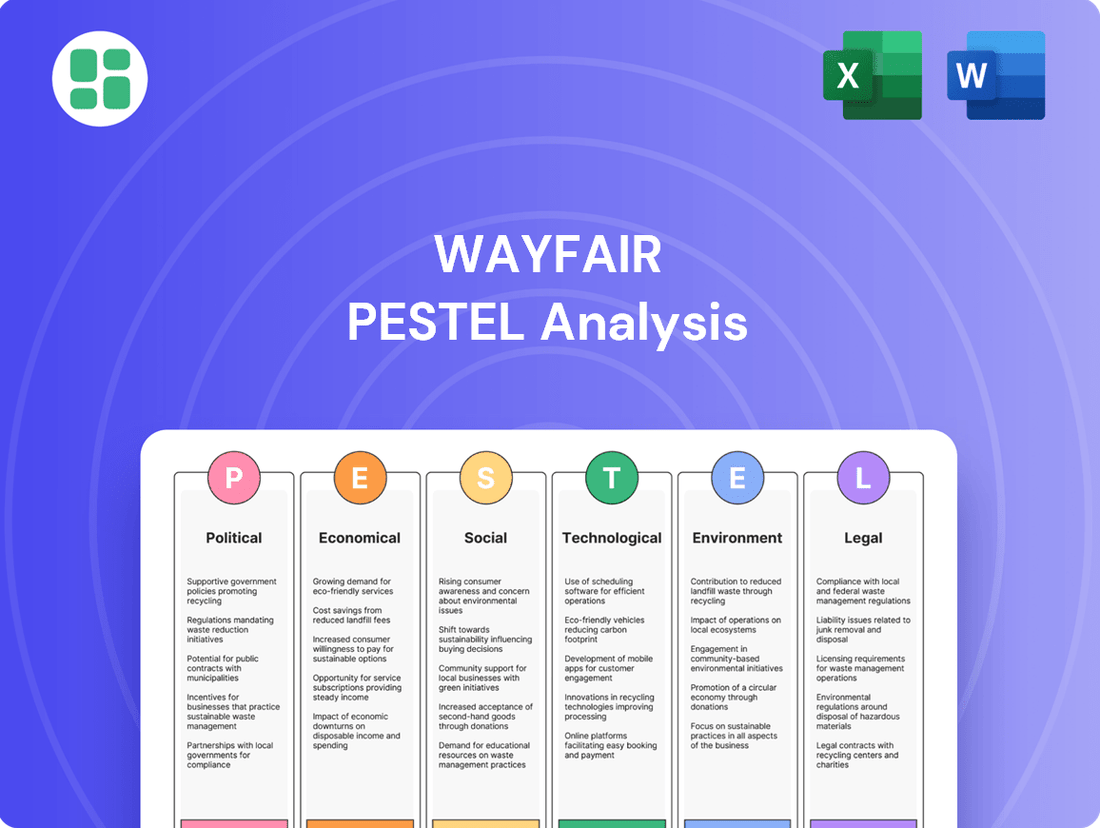

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Wayfair's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by detailing how current trends and market dynamics present both threats and opportunities for Wayfair's growth.

A clear, actionable summary of Wayfair's PESTLE factors, highlighting key opportunities and threats to inform strategic decision-making and mitigate potential risks.

Economic factors

Consumer disposable income is a huge driver for Wayfair, as furniture and home decor are typically discretionary purchases. When people have more money left over after essential expenses, they're more likely to spend on things that improve their living spaces. For example, in late 2023 and early 2024, while inflation showed signs of easing, many households were still contending with higher costs for necessities, which could temper discretionary spending.

Economic downturns or periods of high inflation directly impact this. If inflation eats into purchasing power, meaning people can buy less with the same amount of money, then disposable income effectively shrinks. This can lead to consumers delaying or reducing spending on items like sofas or dining sets, directly affecting Wayfair's sales volume.

Wayfair's performance is therefore very closely tied to the general economic climate and how much purchasing power consumers actually have. For instance, if unemployment rates rise or wage growth stagnates, consumers tend to become more cautious with their spending, impacting Wayfair's revenue streams.

Rising inflation significantly impacts Wayfair's operational costs. For instance, the Producer Price Index for goods, a key indicator of input costs, saw a notable increase in 2024, directly affecting Wayfair's suppliers. This surge in raw material, manufacturing, and transportation expenses for their partners translates into higher procurement costs for Wayfair.

These increased costs can force Wayfair to adjust its pricing. In 2024, consumer price inflation for furniture and bedding remained a concern, highlighting potential challenges in passing these costs onto customers without impacting sales volume. Balancing competitive pricing with the need to maintain profit margins is a critical economic hurdle for Wayfair.

Interest rates directly impact how much it costs consumers to borrow money, affecting big purchases like homes. When rates are low, people are more likely to buy houses, which often leads to increased demand for furniture and home decor as they settle into new spaces. For instance, the Federal Reserve's steady interest rate hikes throughout 2023 and into early 2024 aimed to curb inflation, making mortgages more expensive and potentially slowing down home sales.

A robust housing market, often fueled by accessible mortgage rates, translates to more opportunities for Wayfair. As more homes are bought and sold, there's a natural uptick in people needing to furnish them. Data from the National Association of Realtors indicated existing home sales in 2024 were projected to remain somewhat subdued compared to pre-pandemic levels, reflecting ongoing affordability challenges influenced by interest rates.

Conversely, when interest rates climb, the housing market tends to cool down. This can mean fewer people are buying homes, and consequently, less demand for new furnishings. Wayfair's sales could feel the pinch as consumers become more cautious with discretionary spending due to higher borrowing costs and a less vibrant real estate environment.

Supply Chain Costs and Logistics

Fluctuations in global supply chain costs, encompassing shipping rates, fuel prices, and labor expenses, directly impact Wayfair's operational efficiency and profitability. For instance, the cost of ocean freight, a significant component for Wayfair's product sourcing, saw considerable volatility throughout 2023 and into early 2024. While rates have moderated from their pandemic peaks, they remain sensitive to geopolitical events and demand shifts.

As a drop-shipper managing extensive logistics, efficient and cost-effective transportation is critical for Wayfair. The company relies heavily on third-party logistics providers, making it susceptible to their pricing structures and operational capabilities. Wayfair's ability to maintain competitive pricing and delivery times hinges on managing these transportation costs effectively.

Disruptions or cost increases in the supply chain can lead to higher delivery costs or longer lead times, directly affecting customer satisfaction and Wayfair's financial performance. For example, in late 2023, disruptions in key shipping lanes, such as those impacting the Red Sea, led to rerouting and increased transit times for some goods, potentially adding to Wayfair's operational expenses and impacting delivery estimates.

- Global Shipping Rate Volatility: While container shipping rates have generally decreased from their 2021 highs, they experienced upward pressure in early 2024 due to rerouting around the Red Sea, with some routes seeing increases of over 100% for certain cargo types.

- Fuel Price Impact: Diesel fuel prices, a key determinant of trucking costs, remained a significant factor. In the US, average on-highway diesel prices fluctuated, impacting last-mile delivery expenses for Wayfair.

- Labor Costs: The cost of warehouse labor and transportation personnel continues to be a factor, influenced by broader labor market trends and wage pressures across the logistics sector.

E-commerce Market Growth and Competition

The e-commerce market, especially within the home goods sector, continues its robust expansion, presenting Wayfair with significant growth avenues. For instance, global e-commerce sales are projected to reach $8.1 trillion by 2024, a substantial increase from previous years, indicating a fertile ground for players like Wayfair.

However, this burgeoning market also intensifies competition. Established brick-and-mortar retailers are bolstering their online presence, while new digital-native brands are emerging, all vying for consumer attention and market share. This heightened competition can lead to price wars and necessitate increased marketing spend.

To navigate this dynamic landscape, Wayfair must prioritize continuous innovation and differentiation. This includes enhancing the customer experience, expanding product offerings, and optimizing logistics.

- Global e-commerce sales are expected to hit $8.1 trillion in 2024.

- The home goods segment within e-commerce is a key growth driver.

- Increased competition comes from both traditional retailers expanding online and new digital entrants.

- Wayfair's strategy must focus on differentiation to maintain a competitive edge.

Consumer spending habits are directly influenced by economic conditions. In 2024, while inflation showed signs of moderating, persistent cost pressures on necessities meant many households still had less discretionary income for purchases like furniture. This trend, coupled with rising interest rates making borrowing more expensive, particularly for mortgages, can dampen demand for home goods.

Wayfair's profitability is sensitive to input costs, including raw materials and transportation. For instance, global shipping rates, though down from pandemic peaks, saw volatility in early 2024 due to geopolitical events, impacting logistics expenses. These rising operational costs can pressure Wayfair to adjust pricing, a delicate balance given consumer price sensitivity.

The broader economic environment, including employment levels and wage growth, dictates consumer confidence and spending power. A strong housing market, often supported by lower interest rates, typically fuels demand for home furnishings. However, in 2024, higher mortgage rates contributed to a more subdued housing market, potentially limiting Wayfair's sales growth opportunities.

| Economic Factor | Impact on Wayfair | 2024 Data/Trend |

| Disposable Income | Directly affects spending on discretionary items like furniture. | Moderating inflation but persistent cost pressures limited discretionary spending for many households. |

| Inflation | Increases operational costs (materials, shipping) and can reduce consumer purchasing power. | Producer Price Index for goods saw increases, impacting supplier costs; consumer price inflation for furniture remained a concern. |

| Interest Rates | Influences housing market activity and consumer borrowing costs for large purchases. | Federal Reserve rate hikes continued into early 2024, making mortgages more expensive and potentially slowing home sales. |

| Supply Chain Costs | Affects logistics expenses, delivery times, and overall operational efficiency. | Ocean freight rates experienced volatility; rerouting around the Red Sea in early 2024 led to increased transit times and costs on some routes. |

What You See Is What You Get

Wayfair PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Wayfair PESTLE analysis offers a comprehensive look at the external factors influencing the company's operations and strategic decisions. It covers Political, Economic, Social, Technological, Legal, and Environmental aspects crucial for understanding Wayfair's market position and future challenges.

Sociological factors

Evolving consumer lifestyles, particularly the rise of remote work, have significantly amplified the demand for home furnishings. As more people spend extended periods at home, there's a heightened focus on creating comfortable, personalized, and functional living spaces. This trend directly benefits Wayfair, as consumers are increasingly willing to invest in their homes to enhance their daily lives.

The desire for unique home aesthetics and practical layouts fuels product diversification for Wayfair. For instance, in 2024, the home decor market continued to see robust growth, with online sales channels like Wayfair capturing a substantial share. Consumers are actively seeking out items that reflect their individual styles, driving innovation and expansion in product categories.

Demographic shifts, like changing household formation rates and an aging population, directly impact what consumers buy for their homes. For instance, as more single-person households emerge, the demand for compact, adaptable furniture is likely to rise. Wayfair needs to keep a close eye on these trends to ensure its product selection aligns with evolving consumer needs.

Urbanization is another key factor. As more people move into cities, there's a growing preference for space-saving and multi-functional items, such as sofa beds or nesting tables. Conversely, suburban growth might see a demand for larger, more traditional furniture pieces. Wayfair's ability to segment its offerings based on these geographical preferences will be crucial for success.

In 2024, the U.S. Census Bureau reported that the median age of the U.S. population continues to rise, reaching 38.9 years. This demographic trend suggests a sustained demand for home furnishings that cater to established households and potentially different lifestyle needs compared to younger demographics. Wayfair can leverage this by offering a wider range of products appealing to middle-aged and older consumers.

Consumers are increasingly comfortable with online shopping, even for big-ticket items like furniture. This shift is fueled by a growing reliance on digital platforms, making it a key sociological factor for Wayfair. In 2024, a significant portion of retail sales, estimated to be over 15% globally, occurred online, a trend expected to continue its upward trajectory.

Higher digital literacy across various age groups broadens Wayfair's potential customer base and simplifies the online buying journey. As more people become adept at navigating websites and apps, the barriers to purchasing online diminish. This growing digital fluency is essential for businesses like Wayfair to thrive.

Wayfair's continued success depends on its ability to adapt its user experience to meet these evolving digital consumer expectations. Providing intuitive interfaces and seamless checkout processes is paramount. For instance, Wayfair's investment in augmented reality features in 2024 aims to bridge the gap between online browsing and the in-home experience, directly addressing consumer needs for confidence in large purchases.

Consumer Preferences for Personalization and Variety

Modern consumers are increasingly looking for shopping experiences that feel unique to them, wanting a broad selection of products to fit their personal tastes and financial plans. This trend is evident in the growing demand for customization and a wide array of choices across various sectors, including home goods.

Wayfair directly addresses this by offering an expansive product catalog that spans numerous brands and styles, providing customers with an unparalleled variety. For instance, in Q1 2024, Wayfair reported a net revenue of $2.7 billion, showcasing the scale at which they cater to a large consumer base seeking diverse options for their homes.

The company's ability to leverage data for personalized recommendations and offer customizable product features can significantly boost customer satisfaction and foster long-term loyalty. This approach is crucial in a competitive market where consumers value tailored experiences.

- Demand for Customization: Consumers are actively seeking products that can be personalized, from color choices to specific dimensions, to better reflect their individual needs and aesthetics.

- Variety as a Key Driver: A wide selection of products across different price points and styles is a primary factor influencing purchasing decisions for a significant portion of the online shopper demographic.

- Impact on Loyalty: Personalized recommendations and the ability to find unique items contribute to higher customer satisfaction, leading to repeat business and stronger brand advocacy.

Sustainability and Ethical Consumption Trends

Consumer demand for sustainability is a significant sociological driver. In 2024, a significant portion of consumers, particularly millennials and Gen Z, actively seek out brands demonstrating environmental responsibility and ethical sourcing. For instance, studies indicate that over 60% of consumers are willing to pay more for sustainable products, a trend that directly impacts the home goods market where Wayfair operates.

This growing awareness translates into pressure on Wayfair to ensure its vast supplier network upholds ethical labor standards and offers a robust selection of eco-friendly home furnishings and decor. Wayfair's commitment to transparency in its supply chain, detailing product origins and manufacturing processes, can significantly bolster its brand image and attract a segment of the market prioritizing conscious consumption.

- Consumer Demand: Over 60% of consumers express willingness to pay a premium for sustainable goods, influencing purchasing in the home goods sector.

- Ethical Sourcing Pressure: Wayfair faces increasing scrutiny regarding the ethical labor practices of its suppliers and the availability of eco-conscious product lines.

- Brand Reputation: Transparency in supply chains and a demonstrable commitment to sustainability are key differentiators, enhancing brand loyalty among ethically minded consumers.

- Market Shift: The home goods industry is witnessing a tangible shift towards products with lower environmental impact and verifiable ethical production.

The increasing comfort with online shopping, even for large items like furniture, is a major sociological shift benefiting Wayfair. In 2024, online retail continued its expansion, capturing a significant portion of total sales, making digital platforms crucial for consumer engagement.

Growing digital literacy across demographics makes it easier for consumers to navigate Wayfair's platform, reducing purchase friction. Wayfair's 2024 investment in augmented reality features further enhances this by allowing customers to visualize products in their homes, boosting confidence in online furniture buying.

Consumers now expect personalized experiences and a vast selection to match their unique tastes and budgets. Wayfair's extensive product catalog, which generated $2.7 billion in net revenue in Q1 2024, directly caters to this demand for variety and individual style expression.

Technological factors

Wayfair's commitment to continuous innovation in e-commerce platform technologies, such as website speed and mobile responsiveness, is paramount for customer engagement. In 2024, Wayfair reported that over 70% of its traffic originated from mobile devices, underscoring the need for a seamless mobile experience.

Enhanced user interfaces, personalized shopping powered by AI, and streamlined checkout processes directly impact conversion rates and customer loyalty. Wayfair's investment in AI-driven personalization, which began showing significant results in 2023, aims to improve the average order value and reduce cart abandonment.

By investing in cutting-edge platform technology, Wayfair ensures it maintains a competitive edge in the dynamic online retail landscape. The company’s ongoing platform upgrades are designed to meet evolving consumer expectations for convenience and efficiency in the home goods sector.

Artificial intelligence and machine learning are revolutionizing how Wayfair interacts with its customers. By analyzing extensive customer data, Wayfair can offer incredibly personalized product suggestions and tailor marketing campaigns. This data-driven approach also helps predict inventory needs, ensuring popular items are in stock. For instance, Wayfair's AI-powered recommendation engine has been a key driver in increasing conversion rates and average order value.

Furthermore, AI-powered chatbots and virtual assistants are streamlining customer service. These tools can handle a significant volume of inquiries, providing instant support and freeing up human agents for more complex issues. This not only enhances customer satisfaction by offering quicker resolutions but also optimizes operational efficiency, contributing to cost savings. Wayfair's investment in these technologies underscores their commitment to a superior, seamless online shopping journey.

Augmented reality (AR) and virtual reality (VR) are revolutionizing how customers interact with furniture online. These technologies let people see how items will look in their own homes before buying, cutting down on guesswork and potentially lowering return rates. For instance, Wayfair has been a pioneer, integrating AR into its app to let users virtually place furniture in their spaces. This immersive experience is particularly valuable for large, high-consideration purchases.

The market for AR/VR is growing rapidly, with projections indicating significant expansion. By 2024, the global AR market was valued at over $30 billion, and it's expected to reach hundreds of billions by the end of the decade. This growth signifies increasing consumer and business adoption, making AR/VR a crucial technological factor for e-commerce platforms like Wayfair. Continued investment and development in these areas will further enhance the online furniture shopping journey.

Logistics and Supply Chain Optimization Technologies

Wayfair heavily relies on advanced logistics technologies to power its drop-shipping model. Route optimization software, warehouse automation, and real-time tracking systems are crucial for managing its vast network of suppliers and carriers. These tools help shrink delivery times and cut down on operational expenses. For instance, Wayfair has invested in sophisticated warehouse management systems that can process thousands of orders daily, ensuring timely fulfillment.

Innovations in last-mile delivery and inventory management are continuously improving Wayfair's efficiency and customer experience. By leveraging data analytics, Wayfair can predict demand more accurately and manage inventory levels across its network, minimizing stockouts and overstock situations. This focus on technological advancement in logistics directly impacts Wayfair's ability to offer competitive pricing and reliable delivery, key factors in the online home goods market.

- Route Optimization: Reduces fuel costs and delivery times by finding the most efficient paths for shipments.

- Warehouse Automation: Employs robotics and AI for faster picking, packing, and sorting, increasing throughput.

- Real-time Tracking: Provides visibility into shipment status for both Wayfair and its customers, enhancing transparency.

- Last-Mile Delivery Solutions: Focuses on efficient and cost-effective final delivery to the customer's doorstep.

Cybersecurity and Data Privacy Technologies

Cybersecurity and data privacy are critical for Wayfair, an online retailer managing significant customer and financial data. The company must invest in advanced technologies like end-to-end encryption and sophisticated fraud detection systems to protect user information and build trust. For instance, in 2024, global spending on cybersecurity solutions was projected to reach over $270 billion, highlighting the industry's focus on these areas.

Wayfair's commitment to data privacy is also paramount, requiring ongoing adaptation of its security infrastructure to meet stringent regulations. Failure to comply with evolving data privacy laws, such as GDPR or CCPA, can result in substantial fines and reputational damage. By 2025, data privacy compliance is expected to become even more complex, demanding continuous technological upgrades.

- Data Protection Investment: Wayfair must allocate resources to cutting-edge encryption and fraud prevention tools.

- Regulatory Compliance: Continuous updates to security infrastructure are necessary to adhere to global data privacy laws.

- Customer Trust: Robust cybersecurity directly impacts customer confidence and loyalty in the online marketplace.

- Industry Trends: The growing cybersecurity market, exceeding $270 billion in 2024, underscores the importance of these technologies.

Technological advancements are central to Wayfair's operational efficiency and customer experience. The company's mobile-first strategy, with over 70% of traffic from mobile in 2024, necessitates continuous platform optimization for speed and responsiveness.

AI and machine learning are key drivers for personalization, improving average order value and reducing cart abandonment, as evidenced by Wayfair's AI investments since 2023. These technologies also enhance customer service through AI-powered chatbots, streamlining inquiries and boosting satisfaction.

Augmented reality (AR) integration, allowing customers to visualize furniture in their homes, is a significant differentiator. With the AR market valued at over $30 billion in 2024, Wayfair's pioneering use of this technology positions it for future growth in immersive e-commerce.

Advanced logistics technologies, including route optimization and warehouse automation, are critical for Wayfair's drop-shipping model, ensuring timely deliveries and cost efficiency. Cybersecurity remains paramount, with global spending projected to exceed $270 billion in 2024, requiring Wayfair to invest heavily in data protection and regulatory compliance.

| Technology Area | Key Impact | 2024 Data/Trend |

| Mobile Optimization | Customer engagement, conversion rates | Over 70% of traffic from mobile devices |

| AI/Machine Learning | Personalization, customer service, inventory management | Key driver for conversion and AOV improvements |

| Augmented Reality (AR) | Customer visualization, reduced returns | AR market valued over $30 billion |

| Logistics Technology | Operational efficiency, delivery speed | Crucial for drop-shipping model success |

| Cybersecurity | Data protection, customer trust, regulatory compliance | Global spending projected over $270 billion |

Legal factors

Wayfair navigates a landscape shaped by stringent data privacy laws like the GDPR and CCPA. These regulations dictate how customer information is handled, demanding transparent data collection practices and clear consent mechanisms. Failure to comply can lead to substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

Wayfair operates under a complex web of consumer protection laws, such as the Federal Trade Commission Act, which mandates truthful advertising and prohibits unfair or deceptive practices. These regulations govern everything from product descriptions and pricing to return policies, ensuring a level playing field and safeguarding customers. For instance, in 2023, the FTC continued its focus on online marketplaces, issuing guidance on clear pricing and return information, directly impacting e-commerce platforms like Wayfair.

Adherence to product safety standards is paramount, particularly for furniture and home goods that may involve materials or construction that could pose risks. Wayfair must comply with standards set by organizations like the Consumer Product Safety Commission (CPSC). Failure to meet these standards can lead to costly recalls, significant fines, and severe damage to brand reputation. In 2024, the CPSC actively pursued enforcement actions against companies for violations related to product flammability and lead paint in children's furniture, highlighting the ongoing scrutiny in this sector.

As an online marketplace, Wayfair faces significant legal challenges concerning intellectual property rights and copyright infringement. The platform must actively police listings to prevent the sale of counterfeit or infringing products, a critical task given the vast number of items offered. For instance, in 2024, the e-commerce sector continued to grapple with the rise of counterfeit goods, with reports indicating that intellectual property theft costs the global economy billions annually.

Wayfair's ability to implement effective systems for identifying and removing listings that violate design patents and copyrights is paramount. Failure to manage these risks can result in costly legal battles, substantial fines, and a tarnished brand image. In 2023, several major online retailers faced lawsuits and significant settlements related to the sale of counterfeit merchandise, highlighting the financial and reputational consequences.

E-commerce Specific Legislation and Digital Services Acts

Wayfair operates within a complex legal landscape shaped by e-commerce specific legislation. The Digital Services Act (DSA) in the European Union, for instance, mandates significant responsibilities for online platforms like Wayfair concerning content moderation, user safety, and transparency. This means Wayfair must actively manage user-generated content and ensure its platform adheres to new accountability standards. Failure to comply can result in substantial fines, impacting financial performance.

These evolving digital regulations necessitate ongoing adjustments to Wayfair's operational framework and technological infrastructure. Adapting to requirements such as enhanced transparency in advertising or stricter rules on illegal content requires continuous investment in compliance measures. For a global e-commerce player, understanding and navigating these diverse legal requirements across different jurisdictions is paramount to maintaining market access and avoiding penalties.

Key compliance areas for Wayfair under such legislation include:

- Content Moderation: Implementing robust systems to identify and remove illegal or harmful content promptly.

- Transparency Obligations: Providing clear information to users about content moderation policies and the functioning of its recommendation systems.

- Accountability Mechanisms: Establishing clear channels for users to report problematic content and ensuring timely responses.

- Data Protection: Adhering to strict data privacy laws, which often intersect with digital services regulations.

Labor Laws and Employment Regulations

Wayfair, like any major employer, navigates a complex web of labor laws and employment regulations across its global operations. These rules govern everything from fair wages and safe working conditions to preventing discrimination and providing employee benefits. For instance, in the United States, Wayfair must adhere to the Fair Labor Standards Act (FLSA) regarding minimum wage and overtime, and Title VII of the Civil Rights Act of 1964 concerning employment discrimination. In 2024, many states saw minimum wage increases, impacting Wayfair's direct labor costs.

These legal frameworks directly shape Wayfair's human resource strategies, influencing how it recruits talent, manages employee relations, and structures compensation and benefits packages. Staying compliant is paramount to avoid legal challenges and maintain a positive employer brand.

Anticipating and adapting to changes in labor legislation is crucial for Wayfair's operational stability and financial planning. For example, potential shifts in unionization laws or new mandates for paid leave could significantly affect operating expenses and workforce management strategies.

- Wage and Hour Laws: Wayfair must comply with federal, state, and local minimum wage laws, as well as overtime regulations. For example, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted significantly higher rates.

- Anti-Discrimination Laws: Regulations like the Equal Employment Opportunity Act prohibit discrimination based on race, color, religion, sex, and national origin, impacting hiring and promotion practices.

- Employee Benefits and Leave: Laws such as the Family and Medical Leave Act (FMLA) in the US mandate unpaid leave for certain family and medical reasons, influencing Wayfair's benefits administration.

- Workplace Safety: Adherence to Occupational Safety and Health Administration (OSHA) standards ensures safe working environments for Wayfair employees, particularly in its warehousing and logistics operations.

Wayfair's legal obligations extend to ensuring the safety and compliance of the products it sells, particularly concerning potential hazards. The company must adhere to regulations set by bodies like the Consumer Product Safety Commission (CPSC), which oversees product safety standards. In 2024, the CPSC continued its enforcement actions, fining companies for violations related to hazardous substances in consumer goods, underscoring the critical need for Wayfair to rigorously vet its product offerings and suppliers to avoid substantial penalties and reputational damage.

Environmental factors

Consumers, investors, and regulators are increasingly demanding that companies like Wayfair prioritize sustainability. This environmental shift is pushing businesses towards adopting greener practices and exploring circular economy models. For instance, Wayfair's commitment to sustainability could involve expanding its offerings of furniture made from recycled materials or partnering with services that facilitate furniture repair and resale, tapping into a growing market segment.

The push for a circular economy, which emphasizes reducing waste and maximizing resource reuse, presents both challenges and opportunities for Wayfair. Initiatives like robust product take-back programs or the promotion of durable, repairable goods can resonate with environmentally conscious consumers. In 2024, consumer spending on sustainable products saw a notable increase, with many shoppers willing to pay a premium for eco-friendly options, a trend Wayfair can leverage.

Wayfair's vast operations, from furniture manufacturing to delivering large items, inherently create a significant carbon footprint. This is particularly true given the nature of its business, which often involves shipping bulky goods across considerable distances. The company's extensive supply chain, encompassing production, warehousing, and the final leg of delivery, all contribute to its overall greenhouse gas emissions.

There's a growing expectation for businesses like Wayfair to actively track and reduce their environmental impact, specifically their carbon emissions. This pressure comes from consumers, investors, and regulatory bodies alike, pushing for greater corporate accountability regarding climate change. For example, in 2023, many e-commerce companies faced increased scrutiny over their logistics' environmental impact, with calls for more transparent reporting on emissions.

To address this, Wayfair is under pressure to enhance its logistics efficiency, potentially through route optimization and exploring lower-emission transportation methods. Furthermore, adopting more sustainable packaging solutions and collaborating with suppliers who prioritize emission reduction are key strategies Wayfair can employ. These efforts are crucial for mitigating its environmental impact and meeting evolving sustainability standards in the retail sector.

Wayfair's substantial shipping volume inherently creates a large amount of packaging waste, raising environmental considerations. For instance, in 2023, the e-commerce sector as a whole saw continued growth, contributing to increased packaging material consumption.

There's a noticeable upward trend in consumer and regulatory pressure for more sustainable packaging. This includes a preference for materials that are easily recyclable, biodegradable, or use less overall material, such as reduced plastic or cardboard alternatives.

To address this, Wayfair is increasingly focused on collaborating with its extensive supplier network to implement strategies for waste reduction. This involves ensuring packaging is designed for recyclability and promoting responsible disposal practices, a critical aspect of meeting evolving environmental standards and consumer expectations for 2024 and beyond.

Resource Scarcity and Sustainable Sourcing

The availability and cost of key raw materials for furniture, like timber and metals, are increasingly impacted by environmental issues such as deforestation and the ethical sourcing of minerals. Wayfair, like many in the industry, is feeling the pressure to ensure its supply chain operates sustainably and ethically.

This means actively seeking out suppliers who adhere to responsible forestry practices and mineral extraction standards. For instance, Wayfair's commitment to offering a wider selection of eco-friendly products, such as those made from recycled materials or certified sustainable wood, directly addresses these concerns. This strategy not only mitigates supply chain risks but also taps into a growing market segment of environmentally conscious consumers. In 2023, for example, the global market for sustainable furniture was valued at approximately $50 billion and is projected to grow significantly in the coming years, indicating a strong consumer preference for eco-friendly options.

- Global sustainable furniture market valued at ~$50 billion in 2023, with strong growth projected.

- Increasing consumer demand for furniture made from recycled or certified sustainable materials.

- Wayfair faces scrutiny over deforestation and responsible mining practices within its supply chain.

- Promoting sustainable sourcing can mitigate risks and enhance brand reputation among eco-conscious buyers.

Climate Change Impacts on Supply Chain Resilience

The physical impacts of climate change, such as increasingly frequent and severe extreme weather events, pose a significant threat to Wayfair's global supply chain. These disruptions can directly affect manufacturing operations, transportation routes, and the timely delivery of home goods to customers, impacting sales and customer satisfaction.

Building more resilient and adaptable logistics networks is crucial for Wayfair to mitigate these climate-related risks. This includes diversifying sourcing locations and transportation methods to reduce reliance on vulnerable areas or infrastructure.

Climate-related risks can translate into tangible financial impacts, including increased operational costs due to weather-related delays and potential inventory shortages. For instance, a severe hurricane impacting a key manufacturing region could lead to higher shipping expenses and lost sales opportunities. Proactive risk management strategies, such as investing in weather-resilient warehousing and exploring alternative shipping partners, are essential for Wayfair to maintain operational continuity and financial stability in the face of these environmental challenges.

- Supply Chain Disruptions: Wayfair's reliance on global sourcing means that extreme weather events, like the floods in Southeast Asia in late 2024 that impacted electronics manufacturing, can directly affect product availability and lead times.

- Increased Operational Costs: The need for expedited shipping or rerouting due to climate-induced transportation disruptions can add significant costs. For example, disruptions to major shipping lanes in 2024 saw freight rates surge by as much as 50% on certain routes.

- Inventory Management Challenges: Potential for extended delays or product unavailability due to climate events necessitates robust inventory forecasting and buffer stock strategies, which can tie up capital.

Wayfair faces growing pressure to adopt sustainable practices, driven by consumer and investor demand for eco-friendly options. This includes exploring circular economy models, such as furniture repair and resale, and increasing offerings of products made from recycled materials. In 2024, consumer spending on sustainable goods continued to rise, with many willing to pay a premium for environmentally conscious choices.

The company's extensive logistics network, involving the shipping of bulky items, contributes significantly to its carbon footprint. Wayfair is therefore incentivized to improve logistics efficiency through route optimization and the adoption of lower-emission transportation methods, alongside more sustainable packaging solutions.

Environmental factors also impact Wayfair's raw material sourcing, with concerns around deforestation and ethical mineral extraction affecting timber and metal availability. The global market for sustainable furniture reached approximately $50 billion in 2023, highlighting the consumer preference Wayfair can tap into by prioritizing eco-friendly materials and responsible supplier practices.

Climate change poses risks to Wayfair's global supply chain through extreme weather events, potentially disrupting manufacturing and delivery. This can lead to increased operational costs, such as higher freight rates seen in 2024, and necessitate robust inventory management strategies to mitigate potential shortages and ensure continuity.

| Environmental Factor | Impact on Wayfair | Data/Trend (2023-2025) |

| Sustainability Demand | Increased consumer and investor preference for eco-friendly products and practices. | Global sustainable furniture market valued at ~$50 billion in 2023, with continued growth projected. |

| Carbon Footprint | Operational emissions from logistics and shipping. | E-commerce sector faced scrutiny over logistics emissions in 2023; focus on route optimization and greener transport. |

| Packaging Waste | Consumption of packaging materials due to high shipping volumes. | Continued growth in e-commerce in 2023 contributed to increased packaging material use; demand for recyclable/biodegradable options rising. |

| Raw Material Sourcing | Impact of deforestation and ethical mining on timber and metal availability. | Wayfair pressured to ensure sustainable and ethical sourcing; growth in eco-friendly product lines. |

| Climate Change Events | Supply chain disruptions from extreme weather, leading to increased costs and inventory challenges. | Floods in Southeast Asia in late 2024 impacted electronics manufacturing. Freight rates surged by up to 50% on certain routes in 2024 due to shipping lane disruptions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Wayfair integrates data from reputable sources including government economic reports, industry-specific market research firms, and global technology trend analyses. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Wayfair's operations and strategy.