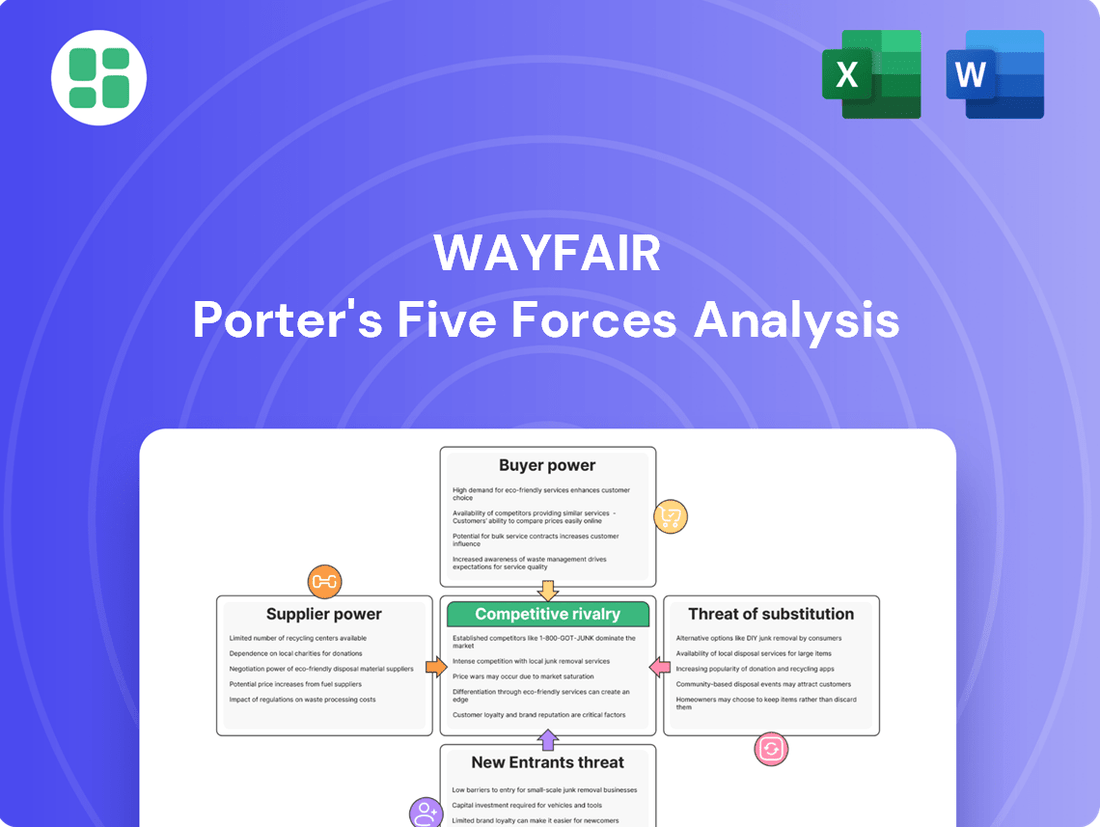

Wayfair Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wayfair Bundle

Wayfair faces significant pressure from intense rivalry within the online home goods market, while the threat of new entrants is moderate due to high initial investment. Buyer power is also considerable, given the ease of price comparison and brand switching.

The complete report reveals the real forces shaping Wayfair’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Wayfair's reliance on a vast drop-shipping network, featuring over 20,000 suppliers globally, significantly mitigates the bargaining power of individual suppliers. While suppliers manage inventory, which can be a source of leverage, Wayfair's scale and supplier diversity mean no single supplier can dictate terms. In 2023, Wayfair's net revenue was $12.2 billion, underscoring its substantial purchasing volume and ability to source from numerous alternatives.

Wayfair's strategy to strengthen supplier relationships and offer services like its CastleGate logistics network directly counters supplier power. By providing efficient delivery solutions, Wayfair makes it easier and more cost-effective for suppliers to reach customers, thereby reducing their leverage.

Wayfair's substantial sales volume grants it considerable leverage over suppliers, as many depend on the e-commerce giant for widespread market reach. This platform dependence limits suppliers' ability to dictate terms or raise prices significantly.

The growth in Wayfair's supplier advertising business, as highlighted by its CEO, underscores suppliers' reliance on the platform for crucial visibility. This reliance further strengthens Wayfair's bargaining position, as suppliers are willing to invest in advertising to access Wayfair's customer base.

Supplier Power 4

Supplier power for Wayfair is influenced by the increasing diversification of sourcing away from China. Countries like Brazil, India, and Turkey are becoming more prominent in global supply chains due to trade uncertainties and tariffs. This shift could dilute the concentration of supply, potentially diminishing the leverage individual suppliers hold over time.

The trend of suppliers diversifying their manufacturing bases away from single-country reliance, particularly China, is a significant factor. For instance, by mid-2024, many furniture manufacturers were actively exploring or expanding production in alternative locations. This strategic move by suppliers aims to mitigate risks associated with geopolitical tensions and trade policies, which could indirectly impact Wayfair's negotiation power with its suppliers.

- Diversification of Sourcing: Suppliers are actively moving production from China to nations like Brazil, India, and Turkey.

- Impact of Trade Policies: Tariffs and trade uncertainties are key drivers behind this geographical shift in manufacturing.

- Potential for Reduced Supplier Concentration: As more suppliers establish operations in diverse locations, the market becomes less concentrated, potentially weakening individual supplier leverage.

- Wayfair's Negotiation Position: This diversification could lead to more competitive supplier pricing and terms for Wayfair in the long run.

Supplier Power 5

Despite economic headwinds like inflation and potential tariffs, Wayfair is actively working to manage supplier power. By investing in supply chain optimization, particularly through AI-driven insights, Wayfair aims to enhance efficiency and provide more adaptable terms for its suppliers.

These efforts are crucial as Wayfair navigates a landscape where suppliers, especially those with unique or high-demand products, can exert significant influence. For instance, in 2023, Wayfair reported a net revenue of $11.9 billion, highlighting the scale of its operations and the importance of strong supplier relationships.

- AI-powered supply chain: Wayfair's use of artificial intelligence helps to streamline logistics and predict demand, potentially reducing reliance on any single supplier.

- Diversification efforts: The company continuously seeks to diversify its supplier base to avoid over-dependence on a few key partners.

- Negotiating leverage: Wayfair's substantial order volumes give it considerable negotiating power, which it leverages to secure favorable terms.

Wayfair's vast supplier network, exceeding 20,000 globally, significantly dilutes the bargaining power of individual suppliers. This scale, coupled with Wayfair's substantial purchasing volume, evidenced by $11.9 billion in net revenue in 2023, allows it to negotiate favorable terms and easily find alternatives.

Wayfair actively strengthens its position by offering services like the CastleGate logistics network, making it more attractive for suppliers to work with them. Furthermore, suppliers' increasing reliance on Wayfair for customer reach and visibility, demonstrated by their investment in the platform's advertising business, further limits their ability to dictate terms.

The ongoing diversification of sourcing away from China, with countries like Brazil and India gaining prominence by mid-2024, also contributes to reducing supplier concentration. This geographical shift, driven by trade policy uncertainties, can lead to more competitive pricing for Wayfair.

| Factor | Impact on Supplier Bargaining Power | Wayfair's Strategy/Mitigation |

|---|---|---|

| Supplier Network Size | Low (due to diversity) | Leverages scale for negotiation, easy to find alternatives. |

| Purchasing Volume | Low (due to Wayfair's leverage) | Significant negotiating power, as seen in $11.9B net revenue (2023). |

| Supplier Dependence on Platform | Low (due to Wayfair's reach) | Suppliers invest in Wayfair's advertising, indicating reliance. |

| Sourcing Diversification | Potentially Low (as concentration decreases) | Shift away from China to Brazil, India by mid-2024 reduces individual supplier leverage. |

What is included in the product

This analysis dissects Wayfair's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the online home goods market.

Quickly identify and mitigate competitive threats by visualizing Wayfair's supplier power and buyer bargaining strength with an intuitive threat matrix.

Customers Bargaining Power

Customers wield considerable influence in Wayfair's market. The online furniture and home goods sector is intensely competitive, with countless options from various e-commerce sites and brick-and-mortar stores. This abundance of choice means customers can easily switch to a competitor if they find better prices or service, forcing Wayfair to remain competitive.

The bargaining power of customers is significantly amplified by the ease of online price comparison and access to detailed product information. Wayfair's customers can effortlessly check prices and read reviews across various platforms, empowering them to find the best deals and quality. In 2024, the online retail landscape continued to favor informed consumers, with price transparency being a key driver in purchasing decisions.

Despite Wayfair's extensive selection and competitive pricing, customers are becoming more value-focused. This trend means they are often more sensitive to price and actively look for deals and sales. For instance, in early 2024, many consumers reported prioritizing discounts when making online home goods purchases, directly impacting how they view Wayfair's offerings.

Buyer Power 4

The bargaining power of customers in the home furnishings sector is significant, largely due to subdued consumer demand and a contracting market. This environment gives buyers more leverage as retailers vie for a smaller pool of discretionary spending. For instance, in the first quarter of 2024, retail sales growth in the home furnishings category experienced a slowdown compared to previous periods, indicating increased price sensitivity among consumers.

This situation forces companies like Wayfair to compete more aggressively on price and value. Customers can easily switch between retailers, comparing prices and product offerings online, which further amplifies their power. The ease of access to information and the abundance of choices available in the digital marketplace empower consumers to demand better deals and higher quality for their money.

- Increased Consumer Leverage: A contracting market and subdued demand in the home furnishings sector in early 2024 grant customers greater bargaining power.

- Price Sensitivity: Retailers face pressure to offer competitive pricing and promotions to attract and retain customers amidst a challenging economic climate.

- Ease of Comparison: The digital landscape allows consumers to readily compare prices and products across multiple retailers, intensifying competition.

- Switching Costs: Low switching costs for consumers in the online retail environment further empower them to seek the best value.

Buyer Power 5

The bargaining power of customers for Wayfair is significant, amplified by a declining active customer base. As of December 31, 2024, Wayfair saw a 4.5% year-over-year decrease in active customers, a trend that continued with a 5.4% decline by March 31, 2025. This indicates customers are less loyal and more inclined to shop around, giving them greater leverage to demand better prices or terms.

This shift in customer behavior means Wayfair faces pressure to compete aggressively on price and value to retain its customer base. The ease with which customers can switch to competitors offering similar products or better deals directly translates into increased bargaining power.

- Declining Active Customers: A 4.5% year-over-year drop by December 31, 2024, and a 5.4% drop by March 31, 2025, highlights customer churn.

- Reduced Customer Loyalty: The decrease suggests customers are not as committed, making them more price-sensitive and willing to explore alternatives.

- Increased Price Sensitivity: Customers can easily compare prices across numerous online furniture retailers, forcing Wayfair to maintain competitive pricing.

- Availability of Substitutes: The vast number of online and brick-and-mortar furniture retailers provides ample substitutes, empowering customers with choice.

The bargaining power of customers remains a potent force for Wayfair. With a 4.5% year-over-year decrease in active customers by December 31, 2024, and a further 5.4% decline by March 31, 2025, Wayfair's customer base is showing reduced loyalty. This trend empowers customers, making them more inclined to seek out better deals and terms from competitors.

This heightened customer leverage compels Wayfair to engage in aggressive price and value competition. The ease of online price comparison, coupled with the broad availability of substitute products from numerous retailers, means customers can readily switch for more favorable offerings.

| Metric | Value (as of March 31, 2025) | Implication for Customer Bargaining Power |

|---|---|---|

| Active Customers (YoY Change) | -5.4% | Indicates reduced customer loyalty and increased willingness to shop around. |

| Price Sensitivity | High | Customers actively seek discounts and promotions due to a contracting market. |

| Ease of Comparison | Very High | Online platforms allow effortless price and product comparisons, intensifying competition. |

| Availability of Substitutes | Abundant | Numerous online and physical retailers offer alternatives, strengthening customer choice. |

Preview the Actual Deliverable

Wayfair Porter's Five Forces Analysis

This preview showcases the complete Wayfair Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the online home goods market. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises. You're not just seeing a sample; you're viewing the actual deliverable, providing immediate insight into Wayfair's strategic landscape.

Rivalry Among Competitors

Competitive rivalry in the online furniture and home goods sector is fierce. Wayfair contends with e-commerce behemoths like Amazon and Walmart, who leverage vast customer bases and logistics networks. Specialized online players such as Overstock and Houzz also present significant competition, often focusing on specific niches or design aesthetics.

Traditional brick-and-mortar furniture retailers and large stores like IKEA and Home Depot are significantly boosting their online capabilities. This shift intensifies the competition for Wayfair, creating a more challenging omnichannel landscape where customers expect seamless experiences across both physical and digital channels.

For instance, IKEA's digital sales saw substantial growth, contributing significantly to its overall revenue, while Home Depot has invested heavily in its e-commerce platform and same-day delivery options. This forces Wayfair to continuously innovate and enhance its online offerings to maintain its competitive edge against these established players who are effectively bridging the gap between online and offline shopping.

Competitive rivalry within the online home goods sector, where Wayfair operates, is intense. Companies constantly vie for market share by focusing on competitive pricing, a wide array of product choices, superior customer service, and the seamless efficiency of their logistics and supply chains. These elements are crucial for building and maintaining customer loyalty and attracting new buyers.

In 2024, the e-commerce landscape continues to be shaped by aggressive pricing strategies. For instance, Wayfair’s net revenue for the first quarter of 2024 was $2.7 billion, a slight decrease from the previous year, indicating the pressure to remain competitive on price. This environment forces businesses to innovate and differentiate to stand out.

Competitive Rivalry 4

Competitive rivalry within the online furniture and home goods sector is intense. Wayfair's market share, hovering around 10-12% in 2023, underscores a fragmented landscape where numerous players vie for customer attention and loyalty. This fragmentation means that established brands and emerging online retailers alike are constantly innovating and competing on price, product selection, and customer experience.

The battle for market share is particularly fierce due to the relatively low switching costs for consumers. Customers can easily compare prices and offerings across different platforms, forcing companies like Wayfair to invest heavily in marketing, logistics, and customer service to retain their customer base. This dynamic fuels aggressive pricing strategies and continuous efforts to differentiate product assortments.

- Fragmented Market: Wayfair's approximate 10-12% market share in 2023 highlights a highly competitive environment with no single dominant player.

- Low Switching Costs: Consumers can readily switch between online retailers, intensifying the need for Wayfair to maintain competitive pricing and superior service.

- Aggressive Competition: Rivalry is characterized by price wars, extensive product variety, and significant marketing expenditures as companies battle for customer acquisition and retention.

Competitive Rivalry 5

The home goods industry is experiencing intensified competitive rivalry due to significant macroeconomic challenges. High interest rates, for instance, impact consumer spending on discretionary items like furniture, forcing companies to compete more aggressively for market share. In 2024, the Federal Reserve maintained a hawkish stance on interest rates, which continued to affect borrowing costs for consumers and businesses alike, dampening demand in interest-sensitive sectors such as housing and home furnishings.

These economic pressures, coupled with ongoing issues in the housing market, such as fluctuating home sales and construction starts, further exacerbate the fight for sales. Companies are increasingly resorting to price promotions and aggressive marketing campaigns to attract and retain customers in a contracting or stagnant market. For example, Wayfair, a major player, has focused on optimizing its promotional strategies and improving delivery efficiency to stand out amidst this tough competitive landscape.

Tariffs on imported goods also add another layer of complexity, increasing operational costs for many retailers in the sector. This can lead to either higher prices for consumers, further reducing demand, or squeezed profit margins for businesses. Consequently, the environment demands constant innovation and operational efficiency to navigate these headwinds and maintain a competitive edge.

- Macroeconomic Headwinds: High interest rates and housing market issues in 2024 pressured consumer spending on home goods.

- Intensified Competition: Companies are actively competing for sales through promotions and marketing to offset reduced demand.

- Cost Pressures: Tariffs on imported goods contribute to increased operating costs, impacting pricing and profitability.

- Strategic Responses: Retailers like Wayfair are focusing on promotional optimization and delivery improvements to gain an advantage.

The competitive rivalry in the online furniture and home goods market is exceptionally high, with Wayfair facing pressure from both e-commerce giants and specialized online retailers. Traditional brick-and-mortar stores are also enhancing their online presence, creating a challenging omnichannel environment. This intense competition necessitates continuous innovation in pricing, product selection, and customer experience to maintain market share.

| Competitor Type | Key Strengths | Impact on Wayfair |

|---|---|---|

| E-commerce Giants (e.g., Amazon, Walmart) | Vast customer base, established logistics, broad product categories | Price competition, customer acquisition challenges |

| Specialized Online Retailers (e.g., Overstock, Houzz) | Niche focus, specific design aesthetics, curated selections | Targeted competition for specific customer segments |

| Omnichannel Retailers (e.g., IKEA, Home Depot) | Physical store presence, brand recognition, integrated online/offline experience | Customer retention through seamless shopping, potential for showrooming |

SSubstitutes Threaten

The threat of substitutes for Wayfair is significant, primarily stemming from traditional brick-and-mortar furniture retailers. These physical stores offer customers the ability to see, touch, and test furniture before purchasing, providing a sensory experience that online platforms cannot fully replicate. Furthermore, physical stores often provide immediate availability, allowing customers to take their purchases home the same day, a stark contrast to the delivery times associated with online orders.

In 2024, the furniture retail market continues to see a blend of online and offline sales. While online furniture sales have grown, physical stores still command a substantial portion of the market. For instance, reports from late 2023 and early 2024 indicate that while e-commerce penetration in furniture is rising, a significant percentage of consumers still prefer to buy furniture in person, especially for larger or more expensive items.

The threat of substitutes for Wayfair is significant, primarily driven by the accessibility and affordability of used furniture options. Consumers can easily turn to second-hand markets, consignment stores, or online marketplaces for pre-owned goods. These alternatives often present substantially lower price points, making them attractive to budget-conscious shoppers.

Furthermore, the used furniture market offers unique, vintage, or discontinued items that may not be available through traditional retailers like Wayfair. For instance, the resale market for home goods has seen robust growth, with platforms like Chairish reporting substantial increases in transaction volume, indicating a strong consumer appetite for pre-owned, curated pieces. This trend directly challenges Wayfair's new product offerings by providing a viable, often more economical, alternative.

The threat of substitutes for Wayfair is moderate, primarily stemming from DIY furniture projects and custom-built solutions. Consumers looking for highly personalized designs or aiming to reduce costs might opt for these alternatives. For instance, the growing popularity of platforms like Etsy, which heavily features handmade and custom furniture, presents a direct substitute for Wayfair's mass-produced offerings.

4

Rental furniture services present a significant threat of substitution for Wayfair. These services cater to individuals and businesses with temporary housing or transient needs, offering an alternative to outright purchase. This is particularly relevant for students, short-term residents, or companies needing to furnish temporary office spaces.

The growth in the rental furniture market, especially with companies like Feather and Fernish expanding their reach, directly competes with Wayfair's core business model. For instance, in 2024, the global furniture rental market was projected to reach over $100 billion, indicating a substantial alternative for consumers who prefer flexibility over ownership.

- Rental furniture services offer a flexible alternative to purchasing furniture, appealing to those with short-term housing needs.

- Companies like Feather and Fernish are expanding, providing direct competition to traditional furniture retailers like Wayfair.

- The furniture rental market is a growing segment, with projections indicating significant market size in 2024, underscoring the threat of substitutes.

5

The threat of substitutes for Wayfair is significant, as consumers have many alternative ways to spend their discretionary income. Beyond just competing furniture retailers, consider that experiences like travel or the purchase of new electronics can easily divert funds that might have gone to home furnishings. For instance, in 2024, global travel spending is projected to reach trillions, directly impacting the pool of money available for home goods.

These substitutes aren't limited to direct product replacements. They represent a broader competition for consumer attention and budget.

- Alternative Leisure Activities: Travel, dining out, and entertainment compete directly with home decor spending.

- Technology Purchases: New gadgets and electronics often take priority over furniture upgrades for consumers.

- DIY and Home Repair: Some consumers opt for do-it-yourself projects or home improvements that don't involve purchasing new furniture, diverting spend.

- Rental Services: The growth of furniture rental services also offers an alternative to outright purchase, particularly for those with temporary housing needs.

The threat of substitutes for Wayfair is considerable, encompassing both direct furniture alternatives and broader consumer spending diversions. Traditional brick-and-mortar stores offer a tactile experience, while the burgeoning used furniture market provides cost-effective and unique options. Furthermore, the increasing popularity of furniture rental services caters to transient needs, presenting a flexible alternative to ownership.

Beyond direct furniture competition, Wayfair faces substitutes in how consumers allocate their discretionary income. Experiences like travel, technology purchases, and even home improvement projects can divert funds away from furniture spending. For instance, global travel spending in 2024 was projected to exceed $1.5 trillion, illustrating a significant competing demand for consumer budgets.

| Substitute Category | Key Characteristics | Impact on Wayfair | 2024 Market Relevance |

|---|---|---|---|

| Brick-and-Mortar Retailers | Sensory experience, immediate availability | Draws customers seeking physical validation | Still holds significant market share in furniture sales |

| Used Furniture Market | Affordability, unique/vintage items | Appeals to budget-conscious and design-focused consumers | Growing transaction volume on platforms like Chairish |

| Rental Furniture Services | Flexibility, short-term solutions | Targets students, transient populations, temporary spaces | Global market projected to exceed $100 billion |

| Alternative Consumer Spending | Travel, electronics, experiences | Reduces overall discretionary income available for furniture | Global travel spending projected over $1.5 trillion |

Entrants Threaten

The threat of new entrants in the online furniture retail sector, particularly for companies like Wayfair, is generally considered moderate. While the initial barrier to entry for establishing an online storefront is relatively low, the complexities of the furniture industry present more substantial challenges for newcomers.

The significant capital investment required to build and manage an efficient supply chain and logistics network capable of handling large, bulky, and often fragile items like furniture is a key deterrent. Companies need extensive warehousing, transportation fleets, and sophisticated inventory management systems. For instance, Wayfair's substantial investment in its own logistics network, including its network of fulfillment centers and its proprietary "first mile" pickup capabilities, highlights the scale of this undertaking. In 2023, Wayfair continued to invest in its logistics infrastructure, aiming to improve delivery times and reduce costs, a testament to the ongoing importance of this operational aspect.

New entrants face significant hurdles in the online home goods market, largely due to the substantial capital required for effective marketing and brand development. Building customer trust is paramount in a sector already dominated by giants like Wayfair and Amazon, who have invested heavily in establishing their reputations and customer loyalty over many years.

The cost of customer acquisition remains a major barrier; for instance, Wayfair's advertising and marketing expenses in 2023 were $1.2 billion, highlighting the scale of investment needed to gain visibility. This financial commitment makes it challenging for newcomers to compete on a level playing field.

The threat of new entrants in the online home goods market, where Wayfair operates, is moderately high. Established players like Wayfair benefit significantly from economies of scale in purchasing, marketing, and logistics. This allows them to negotiate better prices with suppliers and spread advertising costs over a larger customer base, creating a cost advantage that new entrants would struggle to match initially.

For instance, Wayfair's extensive supplier network and efficient warehousing infrastructure, which handled billions in revenue in 2023, present substantial barriers. A new competitor would need considerable capital to replicate these operational efficiencies and achieve comparable pricing power. The brand recognition and customer loyalty Wayfair has cultivated over years also pose a challenge for newcomers seeking to capture market share.

4

The threat of new entrants for Wayfair is relatively low, primarily due to the significant barriers established by its existing infrastructure and operational scale. Wayfair's extensive network of over 25,000 suppliers provides a vast product selection, a feat that would require substantial time and resources for a new competitor to build.

Furthermore, Wayfair's proprietary logistics network, CastleGate, represents a critical competitive moat. This system, which includes fulfillment centers and a dedicated transportation network, allows for efficient delivery and cost savings that are difficult for newcomers to match. In 2023, Wayfair continued to invest in its logistics capabilities, aiming to further enhance delivery speed and customer experience, making it even harder for new players to compete on this front.

- Supplier Network: Over 25,000 suppliers offering a wide product range.

- Logistics Infrastructure: CastleGate provides a significant advantage in delivery speed and cost.

- Brand Recognition: Wayfair has built substantial brand awareness in the online home goods market.

- Capital Investment: The high upfront investment required for logistics and inventory deters many potential entrants.

5

The threat of new entrants in the online home goods market, particularly for a company like Wayfair, is moderate but increasing. While the initial capital investment for an e-commerce platform might seem lower than traditional brick-and-mortar retail, significant barriers exist.

Technological advancements are a key factor. Companies are increasingly investing in AI-powered interactive design experiences and augmented reality (AR) to enhance customer engagement and visualization. For instance, in 2024, many furniture retailers are rolling out AR features that allow customers to see how furniture looks in their own homes, a capability that requires substantial R&D and technical expertise. This raises the bar for new players looking to compete on innovation and user experience.

- High Investment in Technology: Developing advanced AR and AI features for product visualization and customization requires significant upfront capital and ongoing technological development.

- Brand Loyalty and Customer Acquisition Costs: Building brand recognition and acquiring customers in a crowded market like online home goods is expensive, often requiring substantial marketing budgets. Wayfair, for example, spent over $1.3 billion on advertising and marketing in 2023.

- Logistics and Supply Chain Complexity: Establishing efficient and cost-effective logistics and supply chain networks for bulky home goods is a major hurdle. This includes warehousing, last-mile delivery, and managing returns, which are critical for customer satisfaction.

- Economies of Scale: Established players like Wayfair benefit from economies of scale in purchasing, logistics, and operations, giving them a cost advantage that new entrants struggle to match initially.

The threat of new entrants for Wayfair is moderate, largely due to the substantial capital required for logistics and marketing. While the online space is accessible, building a robust supply chain for bulky furniture is a significant barrier. Wayfair's investment in its CastleGate logistics network and its extensive supplier base of over 25,000 partners create considerable economies of scale.

Customer acquisition costs remain high, with Wayfair spending over $1.3 billion on advertising and marketing in 2023, making it difficult for new players to gain traction. Furthermore, the increasing importance of advanced technology like AR for product visualization in 2024 necessitates significant R&D investment, further deterring new entrants.

| Barrier | Description | Impact on New Entrants |

| Capital Investment (Logistics) | Building efficient warehousing and delivery for furniture is costly. | High barrier |

| Marketing & Brand Building | High customer acquisition costs and need for brand trust. | High barrier |

| Supplier Network | Establishing relationships with thousands of suppliers. | Time-consuming and resource-intensive |

| Technology Investment | Developing AR/AI for customer experience. | Increasing barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Wayfair leverages a comprehensive blend of data, including Wayfair's own investor relations materials, SEC filings, and industry-specific market research reports. We also incorporate data from financial news outlets and competitor announcements to paint a complete picture of the competitive landscape.