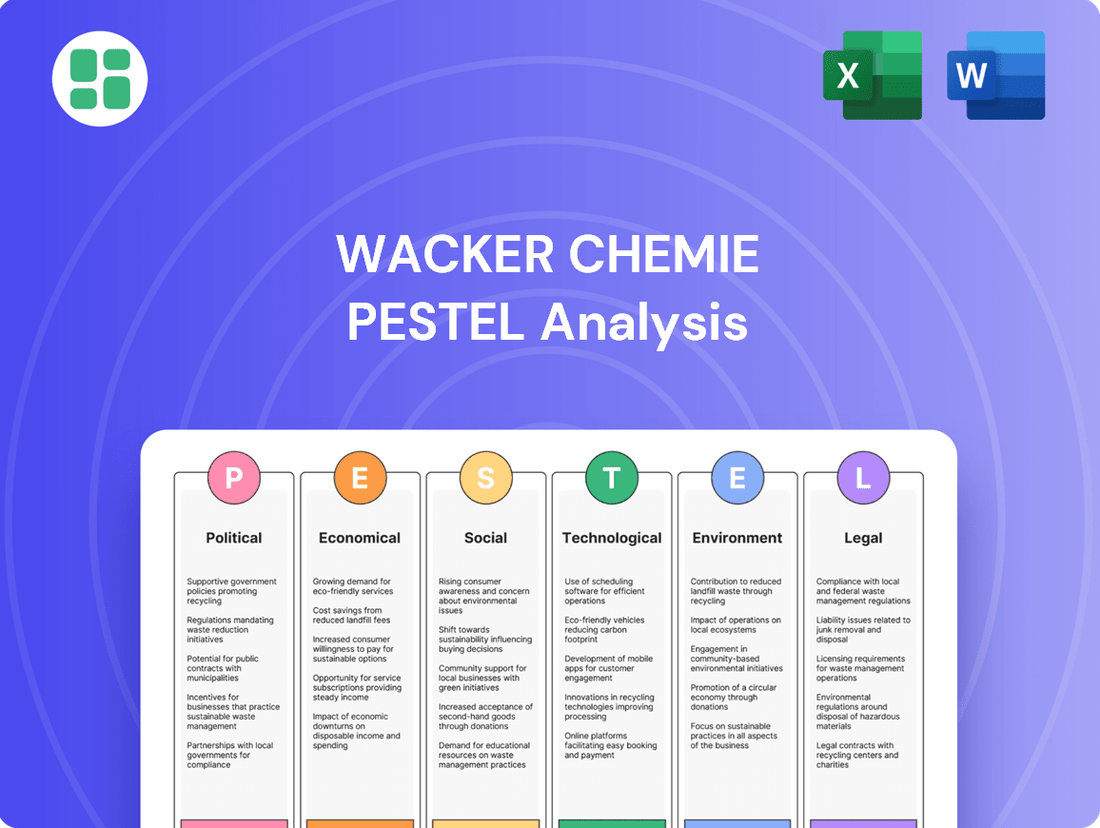

Wacker Chemie PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wacker Chemie Bundle

Navigate the complex external forces shaping Wacker Chemie's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a critical strategic advantage.

Political factors

Wacker Chemie's extensive global operations are directly shaped by international trade policies, with tariffs and ongoing trade disputes, especially concerning polysilicon vital for the solar sector, posing significant challenges. These policy shifts can alter cost structures and market competitiveness for Wacker's products.

Geopolitical uncertainties, such as regional conflicts or shifts in international relations, can create considerable disruptions to Wacker's intricate supply chains and volatile demand patterns. This instability directly impacts the company's ability to access key markets and maintain consistent operational stability.

For example, recent adjustments in United States trade policy have introduced a notable degree of uncertainty within the global polysilicon market, a critical raw material for Wacker. This policy environment necessitates careful strategic planning and risk mitigation for Wacker's solar-grade silicon business.

Government energy policies, particularly those concerning subsidies for renewable energy sources and regulations on industrial energy pricing, significantly impact Wacker Chemie's operational costs. As an energy-intensive chemical producer, fluctuations in energy prices directly affect profitability and competitiveness.

The European Union's commitment to sustainable energy, evidenced by targets for renewable energy adoption and carbon emission reductions, presents both opportunities and challenges. For instance, in 2023, Germany, a key market for Wacker Chemie, continued to implement measures to stabilize industrial electricity prices, aiming to mitigate the impact of global energy market volatility on its manufacturing sector.

The chemical industry, including companies like Wacker Chemie, is heavily influenced by evolving regulations. For instance, the EU Chemicals Strategy for Sustainability, a key policy initiative, is driving stricter requirements for chemical production and use. This strategy, alongside ongoing revisions to regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), pushes for safer and more sustainable chemical alternatives.

Wacker Chemie must actively adapt its product lines and manufacturing methods to meet these increasingly stringent standards. The company's commitment to innovation in areas like bio-based materials and circular economy principles will be crucial for navigating this regulatory landscape. For example, by 2023, Wacker Chemie reported a significant portion of its sales were already from products with sustainability benefits, demonstrating proactive adaptation.

Government Support for Innovation and Industry

Government initiatives, such as the German government's High-Tech Strategy 2025, aim to boost innovation and digitalization across industries, potentially benefiting Wacker Chemie through increased R&D funding and collaborative projects in areas like advanced materials and sustainable technologies. This focus on future-oriented sectors aligns with Wacker's strategic direction, creating fertile ground for new product development and market penetration.

Political support for industrial modernization, including streamlined regulatory processes and incentives for investment in cutting-edge manufacturing, can enhance Wacker Chemie's operational efficiency and competitive edge. For instance, Germany's emphasis on a circular economy and resource efficiency, supported by policy frameworks, encourages companies like Wacker to invest in sustainable production methods and materials, potentially leading to cost savings and improved environmental performance.

- Government R&D Funding: Germany's Federal Ministry of Education and Research (BMBF) allocated approximately €19.1 billion for research and development in 2024, with a significant portion directed towards key technologies relevant to Wacker Chemie, such as materials science and biotechnology.

- Industrial Policy Support: The German government's "Alliance for Industry" initiative aims to reduce bureaucratic hurdles and promote investment, potentially lowering operational costs and accelerating Wacker's expansion plans.

- Sustainability Mandates: Policies promoting the circular economy and carbon neutrality create demand for Wacker's bio-based and recyclable materials, fostering growth in these segments.

Political Stability in Key Markets

Political stability in Wacker Chemie's key operational regions, including Europe, the USA, and China, directly impacts its business continuity and the security of its investments. For instance, in 2024, Germany, a major hub for Wacker Chemie, continued to navigate complex geopolitical landscapes, influencing energy policy and industrial competitiveness.

Changes in government priorities or unforeseen political shifts can introduce significant risks. These might include alterations in environmental regulations, trade policies affecting raw material sourcing or product exports, or even disruptions stemming from social unrest. Such instability can directly affect Wacker Chemie's production schedules and market access.

The company's exposure to different political environments necessitates a proactive approach to risk management. For example, in 2024, China's evolving regulatory framework for chemical production and its trade relations with other major economies presented ongoing considerations for Wacker Chemie's substantial operations and market presence there.

- Europe: Continued focus on the Green Deal and its implications for chemical manufacturing, potentially impacting energy costs and regulatory compliance for Wacker Chemie's European facilities.

- USA: The 2024 US election cycle and subsequent policy shifts could influence industrial incentives, trade agreements, and environmental standards affecting Wacker Chemie's North American business.

- China: Navigating China's economic policies and its role in global supply chains remains a key factor for Wacker Chemie, with ongoing adjustments to industrial and environmental regulations in 2024.

Political factors significantly influence Wacker Chemie's global operations, particularly through trade policies and geopolitical stability. For instance, in 2024, ongoing trade disputes and tariffs, especially concerning polysilicon, directly impact Wacker's cost structures and market competitiveness in the solar sector.

Government energy policies and sustainability mandates are also crucial. In 2023, Germany's efforts to stabilize industrial electricity prices highlight the impact of energy policy on Wacker's operational costs as an energy-intensive producer.

Regulatory environments, such as the EU Chemicals Strategy for Sustainability, drive demand for Wacker's sustainable materials, with the company reporting a significant portion of its 2023 sales from such products.

Government R&D funding, like Germany's €19.1 billion allocation for research in 2024, supports innovation in materials science, a key area for Wacker Chemie.

| Region | Key Political Factor (2024) | Impact on Wacker Chemie |

|---|---|---|

| Europe | Green Deal implementation | Affects energy costs and regulatory compliance for chemical manufacturing. |

| USA | Election cycle policy shifts | Influences industrial incentives, trade agreements, and environmental standards. |

| China | Economic and environmental regulations | Impacts Wacker Chemie's substantial operations and market presence. |

What is included in the product

This PESTLE analysis of Wacker Chemie examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides a comprehensive overview of the external forces shaping the company's landscape, offering insights for strategic decision-making.

A clear, concise PESTLE analysis of Wacker Chemie that highlights key external factors, providing a readily usable resource for strategic discussions and decision-making.

Economic factors

Wacker Chemie's fortunes are intrinsically linked to the pulse of the global economy. As a provider of specialty chemicals crucial for sectors like construction, automotive, and electronics, the company's sales and profitability directly reflect the health of these end markets. For instance, in 2024, while global economic growth was projected to be around 2.7%, a slowdown in key industrial hubs could temper demand for Wacker's advanced materials.

A sluggish global economy, characterized by reduced consumer spending and lower industrial output, translates into weaker demand for Wacker Chemie's products. This is particularly evident in regions like China, a significant market for many chemical producers. If China's industrial sector experiences a contraction, as it did in certain periods of 2023, it can have a material impact on Wacker's revenue streams.

Fluctuations in raw material and energy prices directly impact Wacker Chemie's production expenses and overall profitability. For instance, the price of silicon, a key input for Wacker Chemie, experienced volatility throughout 2024, with some reports indicating a slight decrease in early 2025 compared to the previous year's highs.

While European energy prices are anticipated to trend lower than the peaks seen in 2024, they are expected to remain elevated compared to other global regions due to ongoing regulatory frameworks. This persistent cost pressure is a significant hurdle for energy-intensive chemical manufacturers like Wacker Chemie, impacting their competitiveness.

Unfavorable shifts in exchange rates, especially concerning the Euro against the US Dollar, pose a risk to Wacker Chemie's financial performance. For instance, a stronger dollar relative to the euro can reduce the euro-denominated value of Wacker Chemie's U.S. sales when translated back into its reporting currency.

As a global player, Wacker Chemie's financial results are inherently sensitive to currency volatility. Fluctuations can impact reported sales figures, profitability, and the price competitiveness of its chemical products across various international markets, affecting its overall market position.

In 2023, Wacker Chemie reported that currency effects had a negative impact on its sales, contributing to a slight decrease in revenue compared to the previous year, underscoring the ongoing influence of exchange rate movements on its business.

Market Dynamics in Polysilicon and Specialty Chemicals

The polysilicon market is currently experiencing significant oversupply, leading to a notable decline in prices, particularly for solar-grade polysilicon. This presents a considerable challenge for Wacker Chemie's Polysilicon division, impacting its revenue and profitability in this segment.

However, the specialty chemicals sector, encompassing silicones and polymers, shows a more optimistic outlook. Demand for these products is projected to continue growing, driven by the increasing need for high-performance and sustainable solutions across various industries.

For instance, Wacker Chemie reported that its silicones business saw a 7% increase in sales in the first quarter of 2024 compared to the previous year, reaching €750 million, highlighting the resilience and growth potential within this segment.

- Polysilicon Market: Oversupply and price erosion, especially for solar-grade material, create headwinds for Wacker Chemie's polysilicon business.

- Specialty Chemicals Growth: Strong demand for silicones and polymers, driven by sustainability and performance trends, offers significant growth opportunities.

- Q1 2024 Performance: Wacker Chemie's silicones division reported a 7% year-over-year sales increase, reaching €750 million, underscoring market strength.

- Sustainability Focus: The demand for eco-friendly and high-performance chemical solutions is a key driver for Wacker's specialty chemicals segment.

Investment and Capital Expenditures

Wacker Chemie is actively investing in strategic projects, notably expanding its production capabilities for silicone specialties and high-purity polysilicon for the semiconductor industry. These capital expenditures are foundational for the company's long-term growth trajectory and operational improvements.

While the company anticipates capital expenditures to be somewhat reduced compared to prior periods, the focus remains on high-impact initiatives. For instance, in 2023, Wacker Chemie reported capital expenditures of approximately €1.1 billion, with a significant portion allocated to capacity expansions in Asia and Europe for its polysilicon and silicone divisions.

Looking ahead to 2024 and 2025, the company's investment strategy will continue to prioritize projects that enhance its competitive edge and meet growing market demand. These investments are vital for maintaining Wacker Chemie's position in key global markets and ensuring future profitability.

- Strategic Investments: Continued focus on expanding global production networks for silicone specialties and semiconductor-grade polysilicon.

- Capital Expenditure Outlook: Expected to be lower than previous years but strategically deployed for growth and efficiency.

- 2023 Capital Expenditures: Approximately €1.1 billion, with significant allocations to polysilicon and silicone capacity.

- Future Growth Drivers: Investments are crucial for meeting market demand and enhancing competitive positioning.

The global economic climate significantly influences Wacker Chemie's performance, with demand for its products closely tied to industrial output and consumer spending. A projected global growth of around 2.7% for 2024 suggests a moderate demand environment, but regional slowdowns, particularly in key markets like China, could temper sales for Wacker's advanced materials.

Wacker Chemie's profitability is directly impacted by the cost of raw materials and energy. While European energy prices are expected to ease from 2024 highs, they are likely to remain elevated compared to other regions. For instance, the price of silicon, a critical input, saw fluctuations in 2024, with some indications of a slight decrease in early 2025 from prior year peaks.

Currency exchange rates, especially the Euro against the US Dollar, present a notable risk. A stronger dollar can decrease the euro-denominated value of Wacker's US sales, impacting reported revenues and profitability. In 2023, currency effects negatively affected Wacker Chemie's sales, highlighting the ongoing sensitivity to these fluctuations.

| Economic Factor | Impact on Wacker Chemie | 2024/2025 Data/Outlook |

|---|---|---|

| Global Economic Growth | Influences demand for specialty chemicals | Projected ~2.7% global growth in 2024; regional slowdowns pose risk |

| Raw Material & Energy Prices | Affects production costs and profitability | Silicon price volatility; European energy prices expected to remain elevated |

| Currency Exchange Rates | Impacts reported sales and profitability | Stronger USD vs. EUR reduces euro-denominated US sales value; negative impact noted in 2023 |

Preview Before You Purchase

Wacker Chemie PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Wacker Chemie PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. You'll find a comprehensive breakdown of each element, offering valuable insights for informed decision-making.

Sociological factors

Societal expectations are increasingly pushing for greener products, and Wacker Chemie is responding. Consumers are actively seeking out goods that minimize environmental impact, a trend that directly shapes how chemical companies innovate. This shift means companies like Wacker must prioritize developing solutions that address environmental concerns.

Wacker Chemie's strategic investments in sustainable technologies, such as biodegradable silicones and energy-efficient materials, directly cater to this rising consumer demand. For instance, their work on advanced materials for solar energy and electric vehicles highlights their commitment to aligning their portfolio with eco-conscious market preferences, which are projected to continue their upward trajectory through 2025 and beyond.

The availability of a skilled workforce is crucial for Wacker Chemie, especially in specialized chemical manufacturing. Demographic shifts, such as an aging population in some key markets, could affect the supply of experienced chemists and engineers. In 2023, Wacker Chemie employed approximately 16,000 people globally, underscoring the importance of robust talent acquisition and retention strategies to address these demographic trends.

Societal expectations and increasingly stringent regulations around health and safety are paramount for Wacker Chemie's operations. In 2024, the chemical industry globally faced heightened scrutiny, with a focus on reducing workplace incidents and environmental impact. Wacker Chemie's commitment to global safety initiatives, including its participation in the Responsible Care program, directly addresses these evolving societal demands.

Corporate Social Responsibility and Reputation

Wacker Chemie's dedication to corporate social responsibility, evident in its ethical political communication and support for disaster relief via the WACKER Relief Fund, significantly bolsters its public image and stakeholder confidence. Transparency in its sustainability initiatives is paramount for maintaining and enhancing this reputation, especially as consumers and investors increasingly scrutinize corporate environmental and social impact.

For instance, Wacker Chemie reported a sustainability score from EcoVadis in 2023 that placed it in the top 10% of companies assessed, reflecting a strong commitment to CSR. This focus on responsible business practices is crucial for building long-term trust with a diverse range of stakeholders, from employees to the communities in which it operates.

- Reputation Enhancement: Wacker's CSR activities directly contribute to a positive public perception and build trust among stakeholders.

- Sustainability Transparency: Open communication about sustainability efforts is a key driver of Wacker's reputation in 2024 and beyond.

- Disaster Relief: Initiatives like the WACKER Relief Fund demonstrate corporate citizenship and strengthen community ties.

- Third-Party Validation: Achieving high ratings from sustainability assessment platforms like EcoVadis validates Wacker's CSR commitments to the market.

Urbanization and Infrastructure Development

Global urbanization continues to fuel demand for construction materials, directly benefiting Wacker Chemie's polymers division, which supplies essential chemicals for this sector. As more people move to cities, the need for new buildings, roads, and public works increases, creating a consistent market. For instance, projections indicate that by 2050, 68% of the world's population will live in urban areas, a significant rise from 56% in 2021, according to the United Nations.

However, this growth isn't without its challenges. A slowdown in construction, particularly in key markets like China, can create headwinds for Wacker Chemie. In 2023, China's property sector experienced significant contraction, impacting demand for building materials and consequently, the specialty chemicals that go into them. This highlights the sensitivity of Wacker's polymers segment to macroeconomic conditions in major construction hubs.

- Urbanization Trend: Global urban population expected to reach 68% by 2050.

- Market Driver: Increased construction activity directly boosts demand for Wacker's polymers.

- Regional Impact: Weakness in China's construction sector in 2023 negatively affected demand.

Societal shifts towards sustainability and ethical consumption are significantly influencing Wacker Chemie's product development and market strategy. Consumers are increasingly demanding eco-friendly chemical solutions, pushing companies like Wacker to invest heavily in biodegradable materials and energy-efficient innovations. This trend is expected to intensify through 2025, making alignment with environmental values a key competitive advantage.

Wacker Chemie's commitment to corporate social responsibility, demonstrated through initiatives like the WACKER Relief Fund and high EcoVadis sustainability ratings (top 10% in 2023), builds crucial trust with stakeholders. Transparency in these efforts is vital, as consumers and investors alike scrutinize environmental and social impacts, reinforcing the importance of ethical business practices for long-term reputation and market standing.

The demand for Wacker Chemie's polymers is closely tied to global urbanization, with 68% of the world's population projected to live in urban areas by 2050. However, economic downturns in key construction markets, such as the contraction in China's property sector in 2023, can negatively impact demand for these essential building materials.

| Sociological Factor | Impact on Wacker Chemie | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Environmental Consciousness | Drives demand for sustainable products; necessitates investment in green technologies. | Growing consumer preference for biodegradable silicones and energy-efficient materials; Wacker's focus on solar and EV materials. |

| Corporate Social Responsibility (CSR) | Enhances reputation and stakeholder trust; transparency is key. | Wacker's top 10% EcoVadis rating in 2023; participation in Responsible Care program. |

| Urbanization | Boosts demand for construction materials, benefiting the polymers division. | Projected 68% global urban population by 2050; however, China's property sector slowdown in 2023 impacted material demand. |

| Workforce Demographics | Affects availability of skilled labor (chemists, engineers). | Wacker employed ~16,000 globally in 2023; aging populations in some markets pose talent acquisition challenges. |

Technological factors

Wacker Chemie's specialty chemical business thrives on innovation, particularly in silicones, polymers, polysilicon, and biosolutions. These advancements are crucial for meeting evolving industry demands and boosting product performance. For instance, in 2023, Wacker reported significant R&D investments, a testament to their commitment to developing novel applications and high-value specialty chemicals that drive sales and market leadership.

Wacker Chemie is heavily invested in advanced manufacturing and digitalization to boost efficiency. For instance, their significant investments in state-of-the-art etching facilities for semiconductor-grade polysilicon underscore this commitment. This focus is vital for enhancing productivity and cutting operational costs in a competitive global market.

Wacker Chemie's commitment to innovation is evident in its robust Research and Development (R&D) capabilities, crucial for pioneering new technologies and enhancing existing product lines to meet evolving market needs. This focus is particularly vital for addressing the growing demand for sustainable solutions like bio-based materials and chemicals designed with safety at their core.

The integration of Artificial Intelligence (AI) within chemical R&D presents a significant avenue for Wacker Chemie to accelerate the discovery of novel materials and streamline decision-making processes. In 2023, Wacker Chemie reported a substantial investment in R&D, underscoring its strategic priority to maintain a competitive edge through technological advancement.

Renewable Energy Technologies

The ongoing advancements in renewable energy technologies, especially solar photovoltaics (PV), significantly influence the demand for Wacker Chemie's polysilicon. As the world pushes for cleaner energy solutions, the PV sector's future, and by extension the polysilicon market, appears robust even with present-day market fluctuations. For instance, the International Energy Agency reported in 2024 that solar PV capacity additions reached a record 440 GW in 2023, a 50% increase from 2022, underscoring the strong growth trajectory. This trend directly benefits Wacker Chemie as a key supplier.

Wacker Chemie's polysilicon is a critical component for solar panels. The increasing global commitment to decarbonization, with many nations setting ambitious renewable energy targets for 2030 and beyond, fuels this demand. For example, the European Union aims for 42.5% renewable energy by 2030, which will require substantial solar installations. This technological shift creates a sustained need for high-purity polysilicon, a core product for Wacker.

- Global solar PV capacity is projected to reach over 2,000 GW by 2030, according to various industry forecasts.

- Wacker Chemie is a leading producer of hyperpure polysilicon, essential for the semiconductor and solar industries.

- The cost of solar PV technology has fallen dramatically, making it increasingly competitive with fossil fuels, driving adoption.

- Investments in solar energy manufacturing, including polysilicon production, are expected to see significant growth through 2025 and beyond.

Biotechnology and Life Sciences Advancements

Technological progress in biotechnology and life sciences presents a significant avenue for growth for Wacker Chemie's Biosolutions division. This is especially true in burgeoning sectors like biopharmaceuticals and bio-ingredients, where innovation can drive demand for specialized chemical products and solutions. Wacker Chemie's strategic investments in upgrading its facilities for these specific areas highlight a clear commitment to capitalizing on these advancements.

These investments are not just about capacity; they are about enhancing capabilities to meet the evolving needs of the life sciences industry. For instance, advancements in fermentation technology and downstream processing are crucial for producing complex biopharmaceuticals. Wacker Chemie's focus on these areas positions them to benefit from the increasing global demand for biologics and other bio-based products.

- Biopharma Growth: The global biopharmaceutical market is projected to reach over $700 billion by 2029, a compound annual growth rate of approximately 9.5%, according to recent market analyses.

- Bio-Ingredient Demand: The market for bio-based ingredients, particularly in food and cosmetics, is also expanding rapidly, driven by consumer preference for natural and sustainable products.

- Wacker's Investment Focus: Wacker Chemie has been actively investing in expanding its biopharmaceutical production capacities and enhancing its portfolio of bio-based ingredients, demonstrating a clear strategic alignment with these technological trends.

Technological advancements are reshaping Wacker Chemie's operational landscape, particularly in digitalization and advanced manufacturing. Their substantial investments in state-of-the-art facilities, such as those for semiconductor-grade polysilicon, are designed to boost efficiency and reduce costs. This strategic focus on enhancing productivity through technology is paramount in the highly competitive global chemical market.

Innovation remains a cornerstone for Wacker Chemie, with significant R&D spending in 2023 fueling the development of new technologies and improved product lines. This commitment is vital for meeting market demands, especially for sustainable solutions like bio-based materials and safer chemicals. The integration of AI in R&D further accelerates material discovery and decision-making.

The booming renewable energy sector, particularly solar photovoltaics, directly impacts Wacker Chemie's polysilicon business. With global solar capacity additions reaching a record 440 GW in 2023, a 50% increase from 2022, the demand for high-purity polysilicon is robust. This upward trend is expected to continue, driven by decarbonization efforts and favorable cost economics of solar technology.

Biotechnology and life sciences offer significant growth opportunities for Wacker Chemie's Biosolutions division. The biopharmaceutical market, projected to exceed $700 billion by 2029, and the expanding market for bio-based ingredients are key areas of focus. Wacker's investments in biopharmaceutical production and bio-ingredient portfolios align directly with these technological growth trends.

Legal factors

Wacker Chemie navigates a complex web of chemical regulations, including REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and CLP (Classification, Labelling and Packaging). These laws require detailed substance registration and clear hazard communication, impacting Wacker's product development and market entry strategies across the EU. For instance, REACH compliance often involves significant data generation and testing costs, which can influence the economic viability of certain chemical formulations.

The upcoming Ecodesign Framework Regulation, set to be fully implemented in the coming years, will introduce new sustainability requirements for products, including chemical substances. This means Wacker must increasingly focus on the lifecycle impact of its offerings, from raw material sourcing to end-of-life management, to ensure continued market access and customer acceptance. Failure to adapt could lead to market exclusion or substantial penalties.

Wacker Chemie's operations are heavily influenced by stringent environmental laws, particularly those concerning CO2 emissions trading systems prevalent in Europe. These regulations directly affect operational costs and strategic planning, pushing the company to invest in cleaner technologies and processes.

The company has publicly committed to achieving net-zero emissions by 2045, a target directly driven by these evolving legal frameworks and the global push for decarbonization. This commitment underscores the significant impact of environmental legislation on Wacker Chemie's long-term business strategy and its pursuit of sustainability.

Wacker Chemie's operations are significantly shaped by stringent product liability and safety standards within the specialty chemicals sector. Adhering to these regulations is not just a legal obligation but a critical component of risk management and brand reputation. For instance, in 2023, the chemical industry globally saw increased scrutiny on product safety, with regulatory bodies like the European Chemicals Agency (ECHA) continuing to enforce REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) compliance, which impacts how Wacker introduces and markets its products.

The company must ensure its diverse product portfolio, from silicones to polysilicon, consistently meets or exceeds international safety benchmarks. This involves rigorous testing, clear labeling of potential hazards, and providing comprehensive safety data sheets (SDS) to customers. Failure to comply can lead to substantial fines, product recalls, and severe damage to customer trust, as demonstrated by past incidents in the chemical industry where inadequate safety communication resulted in significant legal liabilities.

Competition Law and Anti-Trust Regulations

Wacker Chemie, as a significant global player, navigates a complex web of national and international competition laws and anti-trust regulations. These rules are designed to foster fair market practices and prevent monopolistic behavior. For instance, the European Union's Directorate-General for Competition actively scrutinizes mergers and acquisitions, as well as alleged cartels, to maintain a level playing field. Failure to comply can result in substantial fines and reputational damage, impacting Wacker's ability to operate freely.

Compliance in this domain is not just about avoiding penalties; it's fundamental to Wacker's long-term sustainability and market access. The company must ensure its pricing strategies, distribution agreements, and potential collaborations do not stifle competition. Recent enforcement actions, such as the European Commission's investigations into potential anti-competitive practices in various chemical sectors, underscore the heightened regulatory scrutiny that companies like Wacker face. In 2023, the total fines imposed by competition authorities globally for anti-trust violations exceeded €2 billion, highlighting the significant financial risks involved.

- Adherence to EU and national competition laws is paramount for Wacker Chemie's global operations, preventing legal challenges and ensuring fair market practices.

- The company must actively monitor and comply with anti-trust regulations concerning pricing, distribution, and potential market dominance to avoid substantial fines.

- Global competition authorities are increasingly vigilant, with significant fines being levied for violations, impacting market access and financial stability.

Intellectual Property Rights

Protecting its intellectual property, including patents for innovative chemical processes and products, is vital for Wacker Chemie's competitive advantage. In 2023, Wacker Chemie continued to invest heavily in research and development, a significant portion of which is aimed at securing new patents to shield its innovations.

Legal frameworks surrounding intellectual property rights enable the company to safeguard its R&D investments and proprietary technologies. For instance, strong patent protection allows Wacker Chemie to maintain exclusivity for its advanced silicones and polysilicon technologies, preventing competitors from easily replicating its breakthroughs.

The company actively monitors and enforces its intellectual property rights globally. As of early 2024, Wacker Chemie holds thousands of active patents across various jurisdictions, underscoring the importance of this legal protection in maintaining its market position and profitability.

Key aspects of Wacker Chemie's intellectual property strategy include:

- Patent Portfolio Expansion: Continuously filing new patent applications for novel materials and production methods.

- Enforcement Actions: Taking legal steps against infringements to protect its market share and technological edge.

- Trade Secret Management: Implementing robust internal controls to safeguard confidential R&D information.

- Licensing Opportunities: Strategically licensing its technologies where mutually beneficial, generating additional revenue streams.

Wacker Chemie operates under a strict regulatory environment, particularly concerning chemical safety and environmental protection. Regulations like REACH and CLP in Europe mandate extensive data submission and clear hazard communication for chemical substances, directly influencing product development and market access strategies. The company's commitment to net-zero emissions by 2045 is a direct response to evolving legal frameworks, especially those related to CO2 emissions trading systems prevalent in Europe.

Environmental factors

Climate change is a major environmental consideration for Wacker Chemie. The company has set ambitious targets to cut its absolute greenhouse gas emissions by 50% by 2030, using 2020 as a baseline. This aligns with broader global decarbonization efforts and necessitates significant investment in sustainable technologies and processes.

Achieving net-zero emissions by 2045 is a key long-term goal for Wacker Chemie. This commitment drives their strategic planning, focusing on developing and implementing climate-friendly innovations across their operations. Their transition plan outlines the necessary steps and capital expenditures to meet these environmental objectives.

Wacker Chemie is actively integrating resource efficiency and circular economy principles into its operations, driven by growing global demand for sustainable chemical solutions. This strategic shift is evident in their efforts to incorporate recycled feedstocks and minimize raw material usage across their product lines.

For instance, in 2023, Wacker reported a significant reduction in its waste generation by 15% compared to 2020 levels, demonstrating tangible progress in resource management. The company is also investing in technologies that enable the use of bio-based and recycled materials, aiming to decrease its reliance on virgin resources by 20% by 2028.

Environmental regulations governing water withdrawal and pollution control are critical for Wacker Chemie's global manufacturing operations. Stricter compliance standards, particularly in regions like Europe, necessitate careful management of water resources and wastewater discharge.

In 2023, Wacker Chemie reported a significant focus on water stewardship, aiming to reduce specific water consumption at its production facilities. The company's sustainability reports highlight investments in advanced wastewater treatment technologies to minimize the environmental impact of its chemical processes, aligning with its commitment to responsible resource management.

Sustainable Sourcing and Supply Chain

Wacker Chemie is increasingly scrutinizing the environmental footprint of its supply chain, particularly concerning emissions stemming from purchased raw materials. This focus is critical as approximately 60% of the company's Scope 3 emissions are linked to its supply chain.

To address this, Wacker Chemie actively participates in industry collaborations such as Together for Sustainability (TfS). This initiative aims to establish robust sustainability standards and drive continuous improvement in the environmental and social performance of suppliers across the chemical industry.

- Focus on Scope 3 Emissions: Wacker Chemie acknowledges that a significant portion of its environmental impact originates from its supply chain, particularly from purchased feedstocks.

- Collaboration for Standards: The company partners with initiatives like Together for Sustainability (TfS) to collectively set and uphold higher sustainability benchmarks for suppliers.

- Supplier Performance Improvement: Through these collaborations, Wacker Chemie seeks to enhance the overall sustainability performance of its supplier network, driving responsible practices throughout the value chain.

Biodiversity and Ecosystem Protection

While Wacker Chemie's direct impact on biodiversity isn't a primary focus in its publicly available data, the chemical industry inherently interacts with ecosystems. Minimizing this footprint is a key aspect of broader environmental responsibility. This involves stringent waste management protocols and careful handling of chemicals to prevent contamination of natural habitats.

Wacker Chemie's commitment to sustainability likely includes initiatives aimed at reducing its ecological impact. For instance, in 2023, the company reported a reduction in its specific greenhouse gas emissions intensity. While this is a climate-focused metric, it reflects a broader approach to operational efficiency that can extend to resource use and waste minimization, indirectly supporting ecosystem health.

The company's efforts in responsible chemical production and waste disposal are crucial for protecting biodiversity. For example, adherence to regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which Wacker Chemie complies with, aims to ensure chemicals are used safely, minimizing risks to both human health and the environment, including aquatic life and terrestrial ecosystems.

Key areas of focus for Wacker Chemie regarding biodiversity and ecosystem protection would include:

- Responsible Waste Management: Implementing advanced treatment technologies for chemical by-products and wastewater to prevent pollution of soil and water bodies.

- Sustainable Sourcing: Evaluating the environmental impact of raw material acquisition, considering biodiversity implications where applicable.

- Operational Efficiency: Optimizing production processes to reduce resource consumption and waste generation, thereby lessening the overall ecological footprint.

Wacker Chemie is actively addressing climate change with a goal to cut absolute greenhouse gas emissions by 50% by 2030 from a 2020 baseline, aiming for net-zero by 2045. This commitment drives investments in sustainable technologies and resource efficiency, including incorporating recycled and bio-based materials. For instance, waste generation decreased by 15% in 2023 compared to 2020.

Water management is crucial, with stricter regulations in Europe necessitating careful control of water withdrawal and wastewater discharge. Wacker Chemie reported a focus on reducing specific water consumption in 2023 and invests in advanced wastewater treatment.

The company also scrutinizes its supply chain's environmental footprint, as approximately 60% of its Scope 3 emissions are linked to purchased raw materials. Collaborations like Together for Sustainability (TfS) are key to improving supplier environmental performance.

Wacker Chemie's efforts in responsible chemical production and waste management, adhering to regulations like REACH, also contribute to protecting biodiversity by minimizing pollution risks to ecosystems.

| Environmental Factor | Wacker Chemie's Commitment/Action | Key Data/Target |

|---|---|---|

| Climate Change & Emissions | Reducing greenhouse gas emissions | 50% reduction by 2030 (vs. 2020 baseline), Net-zero by 2045 |

| Resource Efficiency & Circularity | Integrating recycled and bio-based materials | 15% waste reduction in 2023 (vs. 2020), 20% reduction in virgin resource reliance by 2028 |

| Water Management | Reducing water consumption and improving wastewater treatment | Focus on specific water consumption reduction (2023) |

| Supply Chain Sustainability | Addressing Scope 3 emissions through supplier collaboration | 60% of Scope 3 emissions from purchased raw materials, TfS participation |

PESTLE Analysis Data Sources

Our Wacker Chemie PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading industry analysis firms. We meticulously gather information on global economic trends, environmental regulations, technological advancements, and socio-political shifts to provide accurate insights.