Wacker Chemie Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wacker Chemie Bundle

Wacker Chemie operates in a dynamic chemical industry characterized by moderate supplier power and significant competitive rivalry, particularly from established players. The threat of substitutes is a constant consideration, as alternative materials can emerge. Understanding these forces is crucial for navigating Wacker Chemie's strategic landscape.

The complete report reveals the real forces shaping Wacker Chemie’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Wacker Chemie's production hinges on key raw materials like silicon, ethylene, acetic acid, and methanol, along with substantial energy inputs. The limited number of suppliers for these essential components grants them considerable bargaining power.

For example, the elevated energy prices experienced across Europe in 2023 and continuing into 2024 have directly impacted Wacker Chemie's operational costs, demonstrating the significant leverage energy suppliers hold.

Wacker Chemie's reliance on specialized chemical inputs, such as silicones and polysilicon, means that finding and qualifying new suppliers can be a complex and costly undertaking. These high switching costs for raw materials significantly bolster the bargaining power of Wacker's existing, established suppliers.

While less common in the capital-intensive chemical sector, suppliers could theoretically integrate forward into Wacker Chemie's production or distribution, thereby enhancing their leverage. This threat, however, is significantly mitigated by Wacker's highly integrated production processes and its strategic focus on specialty chemicals, which present substantial entry barriers for raw material providers.

Wacker Chemie actively manages this risk through a diversified supplier base and the implementation of flexible procurement contracts. For instance, in 2024, Wacker continued to emphasize long-term partnerships with key raw material suppliers, ensuring supply chain stability while maintaining competitive pricing, a strategy that limits the potential for any single supplier to exert undue influence through forward integration.

Uniqueness and Differentiation of Inputs

The bargaining power of suppliers for Wacker Chemie is significantly influenced by the uniqueness and differentiation of its inputs. For highly specialized materials, such as the hyperpure polysilicon essential for semiconductor manufacturing, suppliers who can consistently deliver the required purity and specific properties hold considerable sway. If Wacker relies on a limited number of these specialized providers, its ability to negotiate favorable terms diminishes.

This reliance on unique inputs can be a substantial cost driver. For instance, the price of high-purity polysilicon is a critical factor in the cost structure of solar and semiconductor industries. Wacker's strategic investments in its own advanced production capabilities for these materials are a direct effort to mitigate this supplier power by internalizing critical supply chains.

Consider the market for semiconductor-grade polysilicon. In 2023, the global market was valued at approximately USD 15 billion, with demand driven by the burgeoning semiconductor industry. Suppliers who can meet the stringent quality standards for this market, often requiring years of R&D and specialized manufacturing processes, can command premium pricing. This highlights the leverage held by those with differentiated and unique input offerings.

- Uniqueness of Polysilicon: Suppliers of hyperpure polysilicon, crucial for semiconductor wafers, possess strong bargaining power due to the highly specialized production processes and stringent purity requirements.

- Limited Supplier Base: A concentrated market with few providers capable of meeting Wacker's advanced material specifications can reduce Wacker's negotiating leverage.

- Wacker's Mitigation Strategy: Wacker's investment in its own polysilicon production facilities aims to gain greater control over this critical input and reduce its dependence on external suppliers.

- Market Value of Specialized Inputs: The significant global market value for semiconductor-grade polysilicon underscores the pricing power of suppliers who can consistently deliver high-quality, differentiated products.

Importance of Wacker Chemie to Suppliers

Wacker Chemie's substantial global presence and high-volume procurement significantly influence its suppliers. For many chemical input providers, Wacker represents a substantial portion of their sales, which naturally tempers their ability to dictate terms. For instance, in 2023, Wacker Chemie reported total sales of €6.9 billion, indicating the scale of its purchasing power across its supply chain.

However, this dynamic shifts when Wacker relies on highly specialized or scarce raw materials. In such cases, where few suppliers can meet Wacker's stringent quality and volume requirements, the supplier's bargaining power can increase considerably. This is particularly relevant for unique catalysts or advanced chemical intermediates essential to Wacker's high-performance product lines.

- Wacker Chemie's 2023 revenue of €6.9 billion underscores its significant purchasing volume.

- Suppliers whose business is heavily reliant on Wacker may have reduced bargaining leverage.

- The availability and uniqueness of specialized inputs can grant suppliers greater power.

- Wacker's reliance on niche materials can shift the bargaining balance towards its suppliers.

The bargaining power of suppliers for Wacker Chemie is a significant factor, particularly for specialized raw materials like hyperpure polysilicon. Suppliers of these niche inputs, who can meet stringent purity and quality standards, hold considerable leverage, especially when Wacker has limited alternative sources.

For example, the market for semiconductor-grade polysilicon, a key input for Wacker, was valued at approximately USD 15 billion in 2023. Suppliers in this segment, often requiring substantial R&D and specialized manufacturing, can command premium pricing, impacting Wacker's cost structure.

Wacker's substantial purchasing volume, as evidenced by its 2023 revenue of €6.9 billion, does provide some leverage. However, this is counterbalanced when Wacker's operations depend on unique or scarce materials where the supplier base is limited, thereby increasing supplier influence.

| Key Input Material | Supplier Bargaining Power Factor | Wacker's Mitigation Strategy |

|---|---|---|

| Hyperpure Polysilicon | High (specialized production, stringent quality) | Investment in own polysilicon production |

| Ethylene, Methanol | Moderate (commodity chemicals, diversified suppliers) | Long-term partnerships, flexible contracts |

| Specialized Catalysts | High (unique properties, limited providers) | Supplier diversification, internal R&D |

What is included in the product

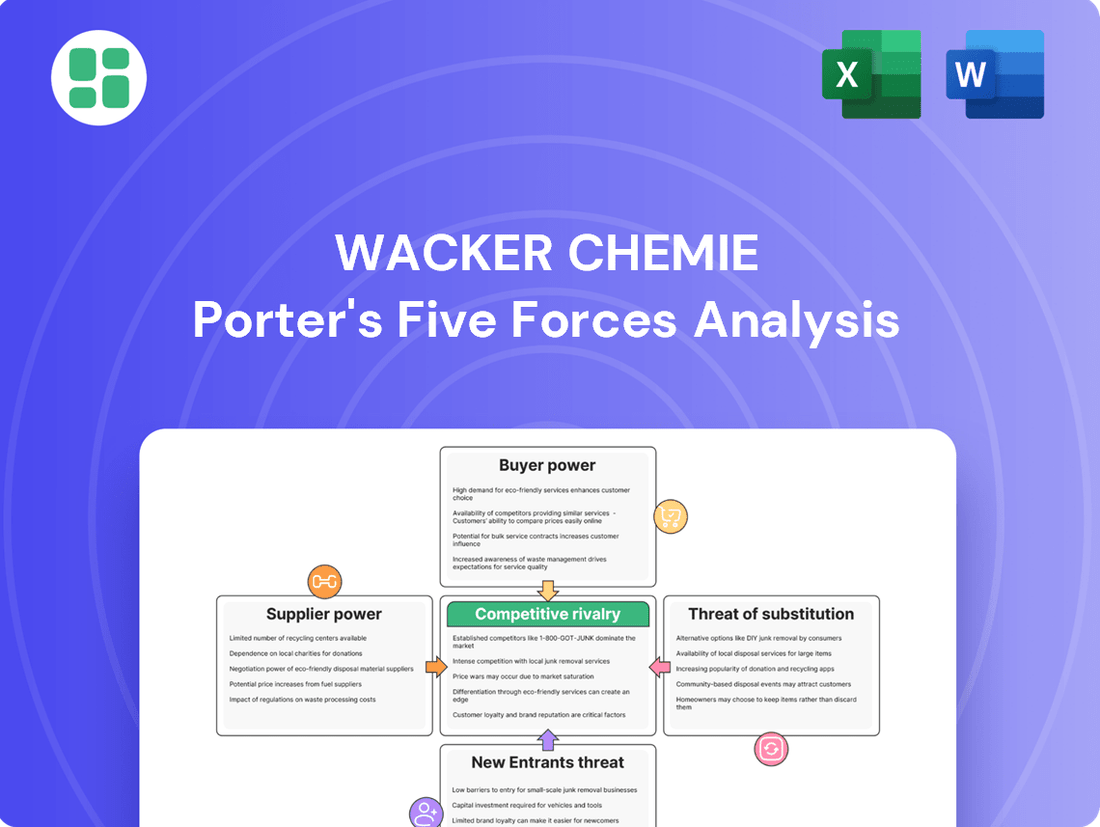

This analysis dissects the competitive forces impacting Wacker Chemie, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes within its chemical markets.

Instantly visualize competitive pressures from suppliers, buyers, new entrants, substitutes, and rivals, enabling targeted strategies to mitigate Wacker Chemie's market challenges.

Customers Bargaining Power

Wacker Chemie's customer base is spread across many sectors, including construction, automotive, electronics, and personal care. This diversity generally dilutes individual customer power. However, in certain niche markets, a few large industrial clients or major original equipment manufacturers (OEMs) might account for a significant portion of sales volume, granting them considerable bargaining leverage.

The bargaining power of these concentrated customers is amplified when demand falters. For instance, weak economic conditions in the construction and automotive industries in 2023 and early 2024 have already translated into increased pricing pressure on Wacker Chemie from its key buyers in these segments.

Wacker Chemie's strategic emphasis on specialty chemicals, including high-tech silicones and advanced polymers, creates products with unique performance characteristics. This differentiation makes it harder for customers to find direct substitutes, thereby reducing their bargaining power.

The specialized nature of Wacker's offerings often necessitates significant investment from customers for re-formulation or re-qualification if they were to switch suppliers. For instance, in the semiconductor industry, where Wacker's silicones are critical, changing materials can lead to lengthy and costly re-qualification processes, anchoring customers and diminishing their ability to bargain down prices.

Customers' ability to switch to substitute products directly influences their bargaining power. For Wacker Chemie, the existence of alternative materials or formulations, even if not perfectly equivalent, grants customers leverage in negotiations. For instance, in the construction chemicals sector, while Wacker offers advanced silicones, less sophisticated but cheaper alternatives might be available, impacting pricing discussions.

Customer Price Sensitivity

The prevailing weak macroeconomic climate and persistent geopolitical tensions have significantly dampened demand across various customer sectors. This has directly translated into heightened customer price sensitivity, impacting Wacker Chemie's sales and earnings projections for 2025. Consequently, the company has been compelled to accept reduced selling prices in certain product lines.

This increased price sensitivity amplifies the bargaining power of customers, as they are more inclined to switch suppliers or delay purchases if prices do not align with their expectations. For Wacker Chemie, this translates into more challenging negotiations and a greater need to justify its pricing strategies through value-added services or product differentiation.

- Increased Price Sensitivity: Customers are more likely to seek the lowest possible prices due to economic uncertainty.

- Impact on Wacker Chemie: Weakened demand and heightened price sensitivity forced Wacker to accept lower selling prices in some segments in 2024, affecting its earnings outlook for 2025.

- Negotiating Leverage: Customers gain stronger bargaining power, demanding better terms and potentially influencing Wacker's pricing strategies.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Wacker Chemie is generally limited, particularly in specialized chemical segments. While some large customers might possess the scale to consider producing critical components in-house, the substantial capital investment, intricate technical know-how, and stringent regulatory hurdles associated with chemical manufacturing present significant barriers. For instance, establishing a new chemical production facility often requires billions in investment and years of development, making it economically unfeasible for most downstream users.

This high barrier means that few customers can realistically undertake backward integration to produce the advanced silicones or polymers that Wacker specializes in. The complexity of Wacker's product lines, often requiring proprietary processes and extensive R&D, further solidifies this advantage. This protects Wacker from major customer disruptions, as the cost and difficulty of replicating Wacker's capabilities are prohibitive.

- High Capital Intensity: Building a chemical plant can cost hundreds of millions to billions of dollars, a significant deterrent for most customers.

- Technical Expertise Required: Wacker's advanced chemical processes demand specialized knowledge and skilled personnel, which customers may lack.

- Regulatory Compliance: The chemical industry is heavily regulated, adding complexity and cost to any new manufacturing venture.

The bargaining power of Wacker Chemie's customers is generally moderate, influenced by product differentiation and switching costs. While a diverse customer base limits the power of any single buyer, concentrated demand in niche markets can create leverage, especially during economic downturns. For example, the automotive and construction sectors, key markets for Wacker, experienced slowdowns in 2023 and early 2024, leading to increased price pressure from major clients.

Wacker's focus on specialized chemicals like high-tech silicones and advanced polymers significantly reduces customer bargaining power. These products often have few direct substitutes, and switching suppliers can involve costly re-qualification processes, particularly in industries like semiconductors. This technical barrier anchors customers and limits their ability to negotiate lower prices.

Economic conditions play a crucial role; the prevailing weak macroeconomic climate and geopolitical tensions have heightened customer price sensitivity. This has forced Wacker to accept reduced selling prices in some product lines during 2024, impacting its 2025 earnings outlook and strengthening customer negotiating positions.

| Factor | Impact on Wacker Chemie | Example/Data Point |

|---|---|---|

| Customer Concentration | Moderate to High in specific niches | Key OEMs in automotive and electronics can exert significant pressure. |

| Product Differentiation | Lowers bargaining power | Specialty silicones for semiconductors have high switching costs. |

| Economic Climate (2023-2024) | Increased customer price sensitivity | Weak demand in construction and automotive led to price concessions. |

| Threat of Backward Integration | Very Low | High capital and technical barriers deter customers from producing specialty chemicals in-house. |

What You See Is What You Get

Wacker Chemie Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Wacker Chemie's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive assessment provides actionable insights into the strategic positioning and future outlook of Wacker Chemie within the chemical industry.

Rivalry Among Competitors

The global chemical industry is a mature and crowded space, populated by a multitude of large, diversified giants as well as highly specialized niche players. This inherent diversity means Wacker Chemie encounters a broad spectrum of competitors, each with unique strengths and market focuses.

Key rivals for Wacker Chemie include formidable global chemical conglomerates such as Shin-Etsu Chemical, Evonik Industries, Dow Inc., and Covestro. These companies operate across various chemical segments, often with significant scale and R&D capabilities, directly challenging Wacker's market positions.

The sheer number and varied nature of these competitors create an intensely competitive environment. Companies are constantly vying for market share, talent, and innovation across different product lines and geographical regions, making the rivalry particularly fierce.

The chemical industry is seeing a moderate growth rate, with projections for 2024-2025 hovering around 2.3% to 3.5%. However, this overall picture masks significant challenges in specific sectors.

Polysilicon production, a key area for companies like Wacker Chemie, is particularly affected by overcapacity. This is largely driven by aggressive expansion and competition from Chinese manufacturers. This surplus capacity, combined with fluctuating demand across different end markets, creates intense pricing pressure throughout the industry.

In response to these conditions, chemical companies are prioritizing cost optimization and operational efficiency. Strategies to reduce production expenses and improve output are crucial for maintaining competitiveness and navigating the pricing pressures stemming from oversupply in certain segments.

Wacker Chemie distinguishes itself by focusing on innovation and sustainable solutions, particularly in its specialty chemical segments. This strategy allows the company to offer high-value, tailored products for demanding sectors like semiconductors and green construction, moving competition beyond mere price points. For instance, Wacker's investment in advanced silicones for electric vehicles highlights this commitment to performance-driven differentiation.

High Fixed Costs and Exit Barriers

The chemical industry, including players like Wacker Chemie, is inherently capital-intensive. Building and maintaining large-scale production facilities, essential for economies of scale, involves substantial upfront investment. For instance, a new ethylene cracker can cost billions of dollars, and these plants require continuous operation and maintenance to remain efficient and avoid costly shutdowns. This significant investment in specialized assets means that once a company is in the market, it's very difficult and expensive to leave.

These high fixed costs and specialized assets create substantial exit barriers. Companies are often compelled to continue production even when market demand is low or prices are unfavorable, simply to cover their ongoing operational expenses and avoid the massive costs associated with decommissioning plants. This situation can foster aggressive pricing strategies as firms try to maintain plant utilization rates, thereby intensifying competitive rivalry within the sector.

- High Capital Expenditure: Wacker Chemie's significant investments in production sites, such as its polysilicon facilities, represent a substantial fixed cost base.

- Operational Continuity: The need to keep complex chemical plants running to maintain efficiency and avoid costly shutdowns drives production even in weaker market conditions.

- Pricing Pressure: Companies may engage in price wars to ensure sufficient sales volume to cover fixed costs, amplifying competitive intensity.

Strategic Stakes and Global Ambitions

Major chemical companies, including Wacker Chemie, are actively pursuing global market leadership. This ambition is particularly evident in rapidly growing sectors such as biosolutions and advanced materials, where significant investment is being channeled. For instance, Wacker's focus on its life sciences division, which saw sales increase in 2023, highlights this strategic push.

The drive for growth and market share in these high-potential segments intensifies the competitive rivalry. Companies are making substantial capital expenditures to expand production capacity and enter new geographic markets. This strategic maneuvering means that competition is not just about current market positions but also about future dominance.

- Global Expansion: Companies like BASF and Dow are investing billions in new facilities, particularly in Asia, to capture growing demand.

- Specialization Investments: Wacker Chemie, for example, has been strategically investing in its polysilicon business for the semiconductor industry, a key area of specialization.

- Sustainability Focus: The increasing demand for sustainable chemical solutions is spurring innovation and investment, creating new competitive battlegrounds.

- R&D Spending: Major players consistently allocate significant portions of their revenue to research and development, aiming to gain a technological edge. In 2023, Wacker Chemie's R&D expenses were a critical component of its strategy.

Competitive rivalry within the chemical sector is intense, driven by numerous global players and the industry's capital-intensive nature. Overcapacity in key areas like polysilicon, exacerbated by Chinese manufacturers, leads to significant pricing pressure, forcing companies to focus on cost efficiency. Wacker Chemie counters this by emphasizing innovation and specialized, high-value products, particularly in sectors like semiconductors and sustainable solutions.

| Key Competitor | Primary Focus Areas | 2023 Revenue (Approx. USD Billion) |

| Shin-Etsu Chemical | Silicones, PVC, Semiconductor Silicon | 20.5 |

| Evonik Industries | Specialty Chemicals, Nutrition & Care | 15.3 |

| Dow Inc. | Performance Materials, Industrial Intermediates | 41.4 |

| Covestro | Polymer Materials, Coatings, Adhesives | 14.3 |

SSubstitutes Threaten

The threat of substitutes for Wacker Chemie's specialty chemicals hinges on whether alternative materials or technologies can match their performance at a similar cost. For instance, while silicones offer broad utility, new materials could arise as effective replacements in specific uses like sealants or coatings.

Wacker's proactive investment in research and development is a key strategy to preemptively address and mitigate these potential threats from emerging alternatives. This focus on innovation ensures they remain competitive and continue to offer superior solutions.

Customers are constantly on the lookout for alternatives that provide a superior balance of cost and quality. If a substitute can deliver comparable or even slightly lesser performance at a significantly lower price, it becomes a very attractive option.

In the polysilicon sector, where Wacker Chemie operates, this is a critical consideration. For example, solar-grade polysilicon produced at lower costs, particularly by Chinese manufacturers, presents a tangible threat to Wacker's premium, higher-purity products. This competitive pressure intensifies when the marginal performance difference of Wacker's polysilicon isn't a deal-breaker for the specific end-use application.

Consequently, Wacker must strategically position itself by concentrating on the high-purity, high-value segments of the market where its technological edge and product quality can justify a premium price. As of early 2024, the global polysilicon market saw significant price fluctuations, with Chinese producers often setting lower benchmarks, underscoring the importance of this price-performance dynamic.

The threat of substitutes for Wacker Chemie's products is largely determined by the costs and effort customers face when switching. If a customer must invest heavily in new machinery, redesign their processes, or undergo lengthy re-certification to use a substitute, they'll likely stick with Wacker unless the alternative offers truly exceptional advantages.

Wacker's strategy of providing integrated solutions and robust technical support actively raises these switching barriers. For instance, their specialized silicones used in advanced electronics often require specific application knowledge and integration into existing manufacturing lines, making a shift to a less supported competitor a complex undertaking.

In 2023, Wacker Chemie reported significant revenue from its Silicones division, underscoring the value customers place on these integrated solutions. The complexity of adapting alternative materials in sectors like automotive or construction, where Wacker holds strong positions, further solidifies customer loyalty by increasing the practical cost of switching.

Technological Advancements Enabling New Substitutes

The chemical industry faces disruption from emerging technologies that could offer viable alternatives to Wacker Chemie's products. For instance, advancements in material science might yield bio-based polymers that compete with traditional petrochemical derivatives, potentially impacting Wacker's silicones and polymers segments.

Biotechnology is also a significant factor, with innovations in fermentation and enzyme technology creating bio-alternatives for chemical synthesis. Wacker's investment in its biosolutions division, which focuses on areas like food ingredients and pharmaceutical intermediates, demonstrates a strategic response to this evolving landscape.

Consider the following potential substitute impacts:

- Bio-based materials: Growing demand for sustainable alternatives could see bio-polymers replace some conventional plastics and resins.

- Advanced manufacturing: New 3D printing or additive manufacturing techniques might reduce the need for certain Wacker chemical inputs in specific applications.

- Digitalization: Enhanced process simulation and optimization could lead to more efficient use of existing chemicals, indirectly reducing demand for new supply.

Regulatory and Sustainability Pressures Favoring Substitutes

Increasing regulatory scrutiny and a growing consumer preference for environmentally friendly options are significantly bolstering the threat of substitutes for Wacker Chemie's products. As governments worldwide implement stricter environmental standards, particularly concerning emissions and material sourcing, products with a lower ecological impact become more attractive. This trend is evident in the chemical industry, where companies are increasingly pressured to demonstrate sustainable practices.

For instance, in 2024, the European Union continued to strengthen its chemical regulations, such as REACH, pushing for safer and more sustainable alternatives. If Wacker's traditional product lines face heightened regulatory hurdles or if eco-conscious alternatives capture substantial market share due to perceived sustainability advantages, the threat of substitution intensifies. Wacker's strategic focus on developing sustainable solutions, such as bio-based silicones and advanced materials with reduced environmental footprints, directly addresses this escalating threat by aligning its offerings with evolving market demands and regulatory landscapes.

- Regulatory Shift: Stricter environmental regulations globally are making conventional chemical products less appealing.

- Customer Demand: A pronounced shift towards 'green' and sustainable products by consumers and B2B clients increases the attractiveness of substitutes.

- Competitive Response: Companies offering lower-impact alternatives can gain market share, posing a direct threat to incumbent products.

- Wacker's Strategy: Wacker's investment in sustainable innovation aims to mitigate this threat by offering competitive eco-friendly solutions.

The threat of substitutes for Wacker Chemie is influenced by the availability and attractiveness of alternative products or technologies. In the polysilicon market, lower-cost Chinese producers present a significant challenge to Wacker's high-purity offerings, especially when performance differences are marginal. For example, in early 2024, the global polysilicon market experienced price volatility with Chinese manufacturers often setting lower price points, highlighting the critical price-performance balance.

Switching costs also play a crucial role; if customers face substantial investments in new equipment or process re-engineering to adopt alternatives, they are less likely to switch. Wacker's strategy of providing integrated solutions and strong technical support, as seen in its silicones division which generated significant revenue in 2023, effectively raises these barriers.

Emerging technologies and a growing demand for sustainability further amplify this threat. Bio-based materials and advancements in biotechnology offer potential replacements for Wacker's traditional chemical products, prompting the company to invest in its biosolutions division. Stricter environmental regulations, like those in the EU in 2024, also favor greener alternatives, reinforcing Wacker's strategic focus on sustainable innovation.

Entrants Threaten

The chemical industry, especially for specialized products and polysilicon, demands enormous upfront investment in manufacturing facilities, advanced equipment, and continuous research and development. These significant financial hurdles act as a strong deterrent for potential new competitors looking to enter the market.

Wacker Chemie's own substantial capital expenditures, such as the approximately €300 million investment in a new polysilicon production facility, underscore the immense financial commitment required, effectively raising the barrier to entry.

Established players like Wacker Chemie leverage substantial economies of scale in their production processes, raw material sourcing, and distribution networks. For instance, Wacker's significant global production capacity in silicones and polysilicon allows them to spread fixed costs over a larger output, driving down per-unit costs. This inherent cost advantage makes it exceedingly difficult for new entrants to achieve comparable pricing and profitability from the outset.

Wacker Chemie's significant investment in proprietary technology and deep technical expertise, particularly in areas like silicones and hyperpure polysilicon, creates a substantial barrier for potential new competitors. Their long history of innovation has resulted in numerous patents and specialized know-how that are not easily replicated. For instance, Wacker's advancements in polysilicon production for the solar industry, a market that saw substantial growth and investment in 2024, require years of dedicated research and development to match.

Access to Distribution Channels and Customer Relationships

New entrants face considerable hurdles in replicating Wacker Chemie's deeply entrenched distribution channels and established customer relationships. Building these networks requires substantial investment and time, making it difficult for newcomers to gain comparable market access and trust. For instance, in 2023, Wacker Chemie reported a robust sales network spanning over 100 countries, a testament to years of cultivation.

The challenge for new players is not just about logistics but also about winning over a customer base accustomed to Wacker Chemie's reliability and product quality. Overcoming this inertia demands significant differentiation or competitive pricing, which can be difficult given the capital-intensive nature of the chemical industry. Wacker Chemie's long-standing partnerships with major automotive and construction firms, for example, provide a stable revenue stream that new entrants would struggle to disrupt.

- Established Distribution Networks: Wacker Chemie operates a global logistics and sales infrastructure, built over decades, which is expensive and time-consuming for new entrants to replicate.

- Customer Loyalty and Trust: The company enjoys high customer loyalty due to consistent product quality and reliable service, creating a significant barrier to entry for unproven competitors.

- Bargaining Power with Suppliers: Due to its scale, Wacker Chemie likely possesses greater bargaining power with its own suppliers, potentially leading to cost advantages that new entrants cannot match.

- Market Access and Acceptance: Gaining acceptance and market share in established industrial sectors requires overcoming existing supplier relationships and demonstrating superior value, a difficult feat for newcomers.

Regulatory Hurdles and Environmental Compliance

The chemical industry is heavily regulated, with stringent environmental, health, and safety standards worldwide. For instance, in 2024, the European Chemicals Agency (ECHA) continued to enforce REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, requiring extensive data submission and risk assessments for chemical substances. New companies entering this market must navigate these complex and costly compliance procedures, including obtaining numerous permits which can take years and significant investment to secure.

Wacker Chemie, as a well-established entity, has already invested heavily in ensuring its facilities and processes meet these demanding regulatory requirements. This includes substantial expenditure on pollution control technologies and safety protocols. For example, Wacker's commitment to sustainability is reflected in its 2023 report, highlighting ongoing investments in reducing emissions and improving resource efficiency, which are critical for compliance. These existing operational integrations create a substantial barrier to entry for any new competitor, who would need to replicate this level of investment and expertise from the outset.

- High Compliance Costs: New entrants face substantial upfront costs for environmental permits, safety certifications, and adherence to global chemical regulations like REACH and TSCA.

- Time-Consuming Permitting: Obtaining the necessary approvals can be a lengthy process, delaying market entry and requiring significant legal and technical expertise.

- Established Player Advantage: Incumbents like Wacker have already absorbed these compliance costs and have integrated safety and environmental management systems, creating a competitive disadvantage for newcomers.

- Reputational Risk: Failure to meet regulatory standards can lead to severe penalties and damage a new entrant's reputation, a risk that established players have largely mitigated.

The threat of new entrants for Wacker Chemie is generally low due to significant barriers. The immense capital required for specialized chemical production, particularly for polysilicon, acts as a major deterrent. For instance, Wacker's own substantial investments, like the €300 million for a new polysilicon facility, highlight these high entry costs.

Existing players benefit from economies of scale, driving down per-unit costs, making it hard for newcomers to compete on price. Wacker's global production capacity in silicones and polysilicon allows them to spread fixed costs efficiently. Furthermore, Wacker's proprietary technology and extensive R&D, especially in areas like polysilicon for the growing solar market in 2024, create a knowledge-based barrier that takes years to overcome.

Established distribution networks and customer loyalty are also key deterrents. Wacker's global sales network, reaching over 100 countries by 2023, and long-standing customer relationships are difficult and costly to replicate. New entrants must not only match Wacker's product quality but also build trust and market access, a challenge compounded by the industry's stringent regulatory environment. Compliance with regulations like REACH, enforced by bodies such as ECHA in 2024, adds significant cost and time delays for new companies.

| Barrier Type | Description | Wacker Chemie Relevance |

|---|---|---|

| Capital Requirements | High upfront investment in plants, equipment, and R&D. | Wacker's €300M polysilicon facility investment exemplifies this. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Wacker's large production capacity provides cost advantages. |

| Technology & Know-How | Proprietary processes and patents are difficult to replicate. | Wacker's advancements in polysilicon production are a key differentiator. |

| Distribution & Customer Relationships | Established networks and customer loyalty are hard to build. | Wacker's presence in over 100 countries (2023) shows network strength. |

| Regulatory Compliance | Costs and time associated with meeting stringent standards. | Navigating regulations like REACH (2024) is a significant hurdle for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Wacker Chemie leverages data from Wacker Chemie's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable chemical industry trade publications and market research reports, alongside relevant economic and regulatory filings.