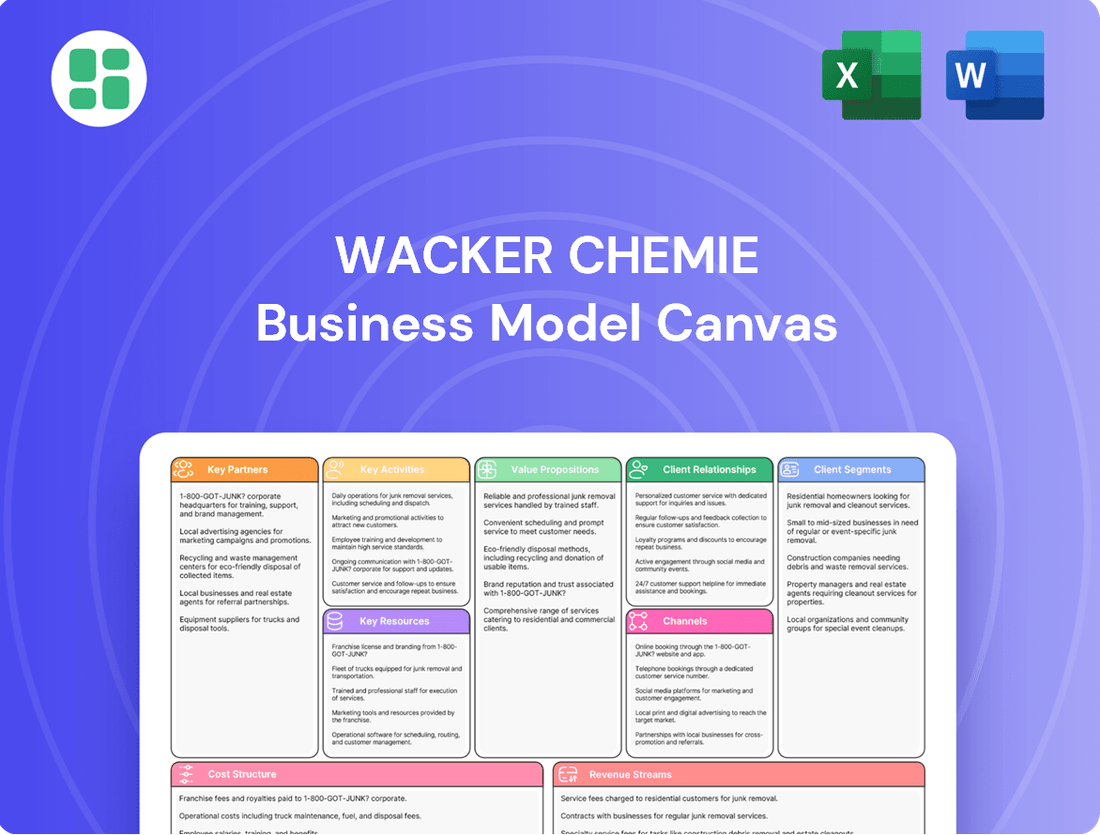

Wacker Chemie Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wacker Chemie Bundle

Unlock the core strategic blueprint of Wacker Chemie with our comprehensive Business Model Canvas. This detailed analysis dissects their customer relationships, revenue streams, and key resources, offering a clear view of their competitive advantage. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

Wacker Chemie actively cultivates strategic alliances with technology firms, universities, and key industry players to drive innovation and jointly develop advanced chemical solutions. These collaborations are crucial for Wacker to expand its capabilities, particularly in rapidly growing sectors such as electric vehicles, semiconductor manufacturing, and life sciences. In 2024, Wacker continued to emphasize these partnerships, announcing a new collaboration with a leading battery materials developer to enhance electrolyte performance, aiming to capture a larger share of the booming EV market.

Wacker Chemie's key partnerships with raw material suppliers are foundational to its operations, ensuring consistent access to essential inputs like silicon, methanol, and ethylene. In 2024, the company continued to focus on strengthening these relationships, aiming for both supply security and competitive pricing. This strategic approach helps Wacker mitigate the inherent risks of price fluctuations and potential shortages in these critical commodity markets.

Wacker Chemie leverages a robust global network of distributors and sales partners to ensure its extensive product range reaches customers efficiently across diverse markets. These collaborations are fundamental to penetrating new markets and providing exceptional customer service.

A prime example of this strategy is Wacker's new partnership with Nordmann, commencing April 1, 2025. This agreement specifically bolsters Wacker's sales and distribution efforts for silicone elastomers throughout Europe, underscoring the importance of these alliances for market access and customer engagement.

Academic and Research Collaborations

Wacker Chemie actively partners with universities and research institutes to drive foundational research and innovation in new chemical processes and materials. These collaborations are crucial for staying ahead of scientific breakthroughs and identifying emerging technologies relevant to global megatrends.

These academic engagements are vital for building a robust pipeline of future innovations, ensuring Wacker Chemie remains competitive. For instance, in 2024, Wacker Chemie continued its strong ties with leading German universities, contributing to joint research projects focused on sustainable chemistry and advanced materials. These partnerships often result in the co-publication of research papers and the development of intellectual property.

- University Partnerships: Wacker Chemie collaborates with over 20 universities globally on various research projects.

- Innovation Pipeline: These collaborations directly feed into Wacker's R&D efforts, targeting areas like bio-based materials and circular economy solutions.

- Talent Development: Academic partnerships also serve as a key channel for identifying and recruiting top scientific talent.

Industry Associations and Regulatory Bodies

Wacker Chemie actively participates in key industry associations, such as the German Chemical Industry Association (VCI) and the European Chemical Industry Council (CEFIC). This engagement allows them to stay ahead of evolving standards and contribute to shaping policies that impact the chemical sector. For instance, in 2024, Wacker Chemie was involved in discussions around the EU's Green Deal initiatives, aiming to influence regulations related to sustainability and chemical safety.

Their collaboration with regulatory bodies is crucial for ensuring compliance and advocating for responsible industry practices. This includes working with agencies like the European Chemicals Agency (ECHA) on REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) compliance. By actively participating, Wacker Chemie not only ensures adherence to current environmental, health, and safety regulations but also contributes to the development of future frameworks, fostering a more sustainable chemical industry.

- Industry Association Membership: Active participation in VCI and CEFIC provides insights into regulatory trends and advocacy opportunities.

- Regulatory Engagement: Collaboration with bodies like ECHA ensures compliance with chemical regulations, including REACH.

- Policy Influence: Contribution to discussions on initiatives like the EU Green Deal helps shape sustainable industry practices.

- Knowledge Acquisition: Staying informed about evolving standards is vital for maintaining a competitive edge and ensuring operational integrity.

Wacker Chemie's key partnerships extend to technology providers and equipment manufacturers, crucial for optimizing production processes and ensuring high-quality output. These collaborations are instrumental in adopting cutting-edge manufacturing technologies, particularly in their polysilicon and silicones divisions. In 2024, Wacker continued to invest in advanced automation and digitalization through strategic alliances with leading industrial automation firms, aiming to boost efficiency and reduce operational costs.

The company also actively engages with customers as partners, co-developing solutions tailored to specific industry needs, especially in sectors like construction and automotive. This customer-centric approach, exemplified by joint development projects initiated in 2024 with major automotive OEMs for advanced silicone applications, ensures Wacker’s products remain relevant and competitive.

| Partner Type | Focus Area | 2024 Impact/Example |

|---|---|---|

| Technology Firms | Process Innovation, Automation | New collaboration with battery materials developer for electrolyte enhancement. |

| Raw Material Suppliers | Supply Security, Cost Optimization | Strengthened relationships for silicon, methanol, and ethylene access. |

| Distributors & Sales Partners | Market Penetration, Customer Reach | New agreement with Nordmann for European silicone elastomer distribution (effective April 2025). |

| Universities & Research Institutes | Fundamental Research, Talent Development | Joint research projects with German universities on sustainable chemistry. |

| Industry Associations | Policy Advocacy, Standards | Engagement in VCI and CEFIC discussions on EU Green Deal initiatives. |

What is included in the product

A detailed examination of Wacker Chemie's business model, focusing on its specialty chemical offerings and global market reach.

It outlines key partnerships, cost structures, and revenue streams for its diverse product portfolio.

Wacker Chemie's Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies, acting as a pain point reliever by visualizing and streamlining complex value chains.

By providing a clear, one-page snapshot of Wacker Chemie's core business, the Business Model Canvas helps to quickly identify and resolve strategic pain points.

Activities

Wacker Chemie's commitment to innovation is a cornerstone of its business, with substantial investment channeled into research and development. This focus drives the creation of novel specialty chemical products and the enhancement of their existing portfolio.

The company prioritizes sustainable solutions and cutting-edge applications, exemplified by its work on advanced silicones crucial for the energy and mobility sectors, as well as developing next-generation medicines within its biosolutions division. In 2023, Wacker Chemie invested €338 million in R&D, representing 4.2% of its sales, and plans to expand its R&D facilities worldwide.

Wacker Chemie’s manufacturing and production activities are central to its business, involving a global network of highly integrated production sites. These facilities are designed for efficient and high-quality output across its four distinct divisions: Silicones, Polymers, Biosolutions, and Polysilicon. This extensive operational footprint ensures consistent product availability and supports diverse customer needs worldwide.

Recent strategic investments highlight Wacker's commitment to expanding its production capabilities. Notably, the company has invested in new silicone production facilities in Karlovy Vary, Czech Republic, and has significantly expanded its semiconductor-grade polysilicon production capacity at its Burghausen site in Germany. These expansions are crucial for meeting growing demand in key markets, particularly for advanced materials used in electronics and renewable energy sectors.

The emphasis on integrated production systems is a cornerstone of Wacker's manufacturing strategy. This approach allows for optimized resource utilization, from raw material sourcing to final product delivery, enhancing both cost-efficiency and environmental sustainability. For instance, byproducts from one process can often be fed into another, minimizing waste and maximizing value creation within the production chain.

Wacker Chemie's sales and marketing activities are central to its business, focusing on promoting and selling its specialty chemicals worldwide. This includes a direct sales force and a robust distribution network, all designed to understand and fulfill the unique requirements of various industries.

The company actively works to enhance its standing in promising market sectors. For instance, in 2023, Wacker Chemie reported sales of €6.3 billion, with a significant portion driven by its specialty chemical segments, underscoring the importance of these promotional and sales efforts.

Supply Chain Management

Wacker Chemie's key activities heavily rely on efficiently managing its global supply chain. This encompasses everything from securing raw materials to getting finished goods into customers' hands. Optimizing logistics and inventory are crucial for ensuring timely deliveries across its international customer base.

The company actively mitigates supply chain risks by sourcing from a diverse range of suppliers and establishing flexible contractual agreements. This strategic approach helps maintain operational continuity and product availability.

In 2024, Wacker continued to invest in its supply chain infrastructure, aiming for greater resilience and efficiency. For instance, Wacker's chemical segment, a significant part of its operations, depends on the stable supply of key intermediates like silicones and polymers.

- Global Logistics Optimization: Wacker focuses on streamlining transportation routes and methods to reduce costs and delivery times for its diverse product portfolio.

- Inventory Management: Strategic inventory levels are maintained across various global locations to meet customer demand while minimizing holding costs.

- Supplier Diversification: The company cultivates relationships with multiple suppliers for critical raw materials to prevent disruptions and enhance negotiation power.

- Risk Mitigation through Flexible Contracts: Contractual terms are structured to provide flexibility in sourcing and delivery, adapting to market fluctuations and potential supply chain challenges.

Sustainability Initiatives and Compliance

Wacker Chemie's commitment to sustainability is a core activity, driving efforts to minimize its environmental footprint and enhance resource efficiency. This focus translates into developing innovative, eco-friendly products that meet evolving market demands.

The company actively champions competitive industrial electricity prices in Europe, recognizing their crucial role in maintaining operational viability and fostering sustainable growth within the region's chemical sector. This advocacy is essential for balancing economic competitiveness with environmental responsibility.

Adherence to rigorous environmental and safety standards is paramount across all Wacker Chemie operations. This includes:

- Implementing advanced emission control technologies to reduce air and water pollution.

- Investing in renewable energy sources to power its facilities and lower carbon emissions.

- Prioritizing circular economy principles in product design and waste management.

- Ensuring compliance with global regulations like REACH and other chemical safety directives.

In 2024, Wacker Chemie continued its investment in sustainable solutions, aiming to increase the share of bio-based raw materials in its product portfolio. Their sustainability report highlighted a 15% reduction in CO2 emissions intensity compared to 2020 levels, demonstrating tangible progress.

Wacker Chemie's key activities encompass robust research and development, focusing on specialty chemicals and sustainable solutions, alongside efficient global manufacturing and production across its four divisions. The company also prioritizes strategic sales and marketing to promote its diverse product portfolio and actively manages its global supply chain for reliability and efficiency. A core activity is its commitment to sustainability, including advocating for competitive energy prices and implementing eco-friendly practices throughout its operations.

Preview Before You Purchase

Business Model Canvas

This preview offers a direct glimpse into the Wacker Chemie Business Model Canvas you will receive upon purchase. The content and structure you see here are precisely what you'll get in the complete, ready-to-use document. Rest assured, this is not a sample; it's an exact representation of the final deliverable, ensuring no surprises and full transparency.

Resources

Wacker Chemie's intellectual property, particularly its extensive patent portfolio, forms a cornerstone of its business model. These patents cover innovative chemical processes and unique specialty product formulations, especially in the silicone and polymer sectors. This proprietary technology is vital for its market leadership and competitive edge.

As of late 2023, Wacker Chemie reported a significant number of active patents globally, underscoring its commitment to research and development. This robust IP protection allows the company to command premium pricing for its specialized products and defend its market share against competitors, contributing substantially to its revenue streams and profitability.

Wacker Chemie's advanced production facilities are a cornerstone of its business model, enabling efficient, high-volume, and specialty chemical manufacturing. The company boasts a global network of state-of-the-art sites, including integrated hubs like Burghausen and Nünchritz in Germany. These facilities are crucial for maintaining product quality and driving operational efficiency across its diverse chemical portfolio.

The company continues to invest in expanding its production capabilities, as evidenced by new sites like Karlovy Vary in the Czech Republic. These modern facilities are equipped with cutting-edge technology, supporting Wacker's commitment to innovation and its ability to meet evolving market demands. By leveraging these advanced production assets, Wacker ensures a competitive edge in the global chemical industry.

Wacker Chemie's competitive edge is significantly fueled by its highly skilled workforce. This includes a robust team of chemists, engineers, and research and development experts who are the backbone of the company's innovation pipeline and operational efficiency. Their deep technical knowledge allows Wacker to develop advanced materials and tailor solutions to specific customer needs.

The company's commitment to its human capital is evident in its global employee count, which stood at over 16,000 dedicated individuals as of the end of 2023. This vast pool of talent is crucial for driving Wacker's R&D efforts, ensuring product quality, and maintaining its position as a leader in the chemical industry.

Global Sales and Distribution Network

Wacker Chemie's global sales and distribution network is a cornerstone of its business model. This extensive reach, built on direct sales forces and crucial partnerships, allows Wacker to effectively serve a wide array of customers across various geographical markets. It's the engine that drives market penetration and ensures robust customer engagement worldwide.

This network is not just about logistics; it's about market intelligence and customer proximity. By having teams on the ground and strong alliances, Wacker can better understand regional needs and tailor its offerings, leading to more efficient market access and stronger customer relationships. This capability is critical for a company operating in diverse chemical sectors.

- Global Presence: Wacker operates in over 100 countries, demonstrating the breadth of its distribution capabilities.

- Direct Sales Force: The company maintains a significant direct sales force, providing specialized technical support and fostering direct customer relationships.

- Strategic Partnerships: Collaborations with distributors and agents amplify Wacker's reach, particularly in markets where a direct presence is less feasible.

- Market Penetration: In 2023, Wacker reported sales of €7.2 billion, underscoring the effectiveness of its expansive sales and distribution infrastructure in generating revenue across its global operations.

Financial Capital

Wacker Chemie's robust financial capital is a cornerstone of its business model, enabling strategic investments and ensuring operational stability. The company prioritizes a strong balance sheet, which is crucial for weathering market fluctuations and pursuing ambitious growth initiatives.

This financial strength is demonstrated by Wacker's commitment to disciplined capital allocation. They actively invest in research and development to foster innovation, expand production capacities to meet growing demand, and pursue strategic growth projects that align with their long-term vision.

Key to this stability is Wacker's conservative financial management. The company consistently maintains a low net financial debt, which reduces financial risk. Furthermore, Wacker targets an equity ratio exceeding 50%, providing a substantial buffer and reinforcing its capacity for sustained long-term investments and operational resilience.

- Strong Balance Sheet: Wacker Chemie maintains a solid financial foundation, crucial for strategic investments.

- Disciplined Capital Allocation: Funds are directed towards growth projects, R&D, and capacity expansions.

- Low Net Financial Debt: This financial strategy reduces risk and enhances stability.

- Target Equity Ratio > 50%: This objective ensures long-term investment capacity and financial security.

Wacker Chemie's intellectual property, particularly its extensive patent portfolio, forms a cornerstone of its business model. These patents cover innovative chemical processes and unique specialty product formulations, especially in the silicone and polymer sectors. This proprietary technology is vital for its market leadership and competitive edge.

As of late 2023, Wacker Chemie reported a significant number of active patents globally, underscoring its commitment to research and development. This robust IP protection allows the company to command premium pricing for its specialized products and defend its market share against competitors, contributing substantially to its revenue streams and profitability.

Wacker Chemie's advanced production facilities are a cornerstone of its business model, enabling efficient, high-volume, and specialty chemical manufacturing. The company boasts a global network of state-of-the-art sites, including integrated hubs like Burghausen and Nünchritz in Germany. These facilities are crucial for maintaining product quality and driving operational efficiency across its diverse chemical portfolio.

The company continues to invest in expanding its production capabilities, as evidenced by new sites like Karlovy Vary in the Czech Republic. These modern facilities are equipped with cutting-edge technology, supporting Wacker's commitment to innovation and its ability to meet evolving market demands. By leveraging these advanced production assets, Wacker ensures a competitive edge in the global chemical industry.

Wacker Chemie's competitive edge is significantly fueled by its highly skilled workforce. This includes a robust team of chemists, engineers, and research and development experts who are the backbone of the company's innovation pipeline and operational efficiency. Their deep technical knowledge allows Wacker to develop advanced materials and tailor solutions to specific customer needs.

The company's commitment to its human capital is evident in its global employee count, which stood at over 16,000 dedicated individuals as of the end of 2023. This vast pool of talent is crucial for driving Wacker's R&D efforts, ensuring product quality, and maintaining its position as a leader in the chemical industry.

Wacker Chemie's global sales and distribution network is a cornerstone of its business model. This extensive reach, built on direct sales forces and crucial partnerships, allows Wacker to effectively serve a wide array of customers across various geographical markets. It's the engine that drives market penetration and ensures robust customer engagement worldwide.

This network is not just about logistics; it's about market intelligence and customer proximity. By having teams on the ground and strong alliances, Wacker can better understand regional needs and tailor its offerings, leading to more efficient market access and stronger customer relationships. This capability is critical for a company operating in diverse chemical sectors.

- Global Presence: Wacker operates in over 100 countries, demonstrating the breadth of its distribution capabilities.

- Direct Sales Force: The company maintains a significant direct sales force, providing specialized technical support and fostering direct customer relationships.

- Strategic Partnerships: Collaborations with distributors and agents amplify Wacker's reach, particularly in markets where a direct presence is less feasible.

- Market Penetration: In 2023, Wacker reported sales of €7.2 billion, underscoring the effectiveness of its expansive sales and distribution infrastructure in generating revenue across its global operations.

Wacker Chemie's robust financial capital is a cornerstone of its business model, enabling strategic investments and ensuring operational stability. The company prioritizes a strong balance sheet, which is crucial for weathering market fluctuations and pursuing ambitious growth initiatives.

This financial strength is demonstrated by Wacker's commitment to disciplined capital allocation. They actively invest in research and development to foster innovation, expand production capacities to meet growing demand, and pursue strategic growth projects that align with their long-term vision.

Key to this stability is Wacker's conservative financial management. The company consistently maintains a low net financial debt, which reduces financial risk. Furthermore, Wacker targets an equity ratio exceeding 50%, providing a substantial buffer and reinforcing its capacity for sustained long-term investments and operational resilience.

- Strong Balance Sheet: Wacker Chemie maintains a solid financial foundation, crucial for strategic investments.

- Disciplined Capital Allocation: Funds are directed towards growth projects, R&D, and capacity expansions.

- Low Net Financial Debt: This financial strategy reduces risk and enhances stability.

- Target Equity Ratio > 50%: This objective ensures long-term investment capacity and financial security.

Wacker Chemie's key resources include its substantial intellectual property, advanced production facilities, a highly skilled workforce, an extensive global sales and distribution network, and strong financial capital.

These resources collectively enable Wacker to innovate, manufacture efficiently, reach customers worldwide, and invest in future growth, solidifying its competitive position in the chemical industry.

The company's commitment to R&D, evidenced by its patent portfolio, and its investment in modern production sites are critical for maintaining its market leadership.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Intellectual Property | Extensive patent portfolio covering innovative processes and specialty products. | Significant number of active global patents; enables premium pricing and market defense. |

| Production Facilities | Global network of state-of-the-art manufacturing sites. | Integrated hubs like Burghausen and Nünchritz; new sites like Karlovy Vary expanding capacity. |

| Skilled Workforce | Team of chemists, engineers, and R&D experts. | Over 16,000 employees globally; crucial for innovation and operational efficiency. |

| Sales & Distribution Network | Global reach through direct sales and strategic partnerships. | Operates in over 100 countries; €7.2 billion in sales in 2023. |

| Financial Capital | Strong balance sheet and disciplined capital allocation. | Low net financial debt; targets equity ratio > 50% for investment capacity. |

Value Propositions

Wacker Chemie's value proposition centers on delivering innovative specialty chemical solutions that meet precise industry demands. They provide high-performance materials like advanced silicones for the burgeoning electric vehicle market and specialized polymers crucial for smart building technologies, driving customer innovation.

Wacker Chemie's commitment to sustainability is a core value proposition, offering products designed to lower CO2 emissions, boost resource efficiency, and utilize renewable feedstocks.

This focus is not just aspirational; it's a significant part of their current operations, with two-thirds of their product portfolio already categorized as sustainable solutions.

This strategic alignment directly addresses the increasing market demand for eco-friendly alternatives, positioning Wacker as a leader in responsible chemical innovation.

Wacker leverages its profound technical expertise to collaborate with customers, engaging in co-development to craft bespoke solutions. This customer-centric approach, a core value proposition, ensures products are meticulously tailored to meet precise performance demands and integrate flawlessly into client operations.

For instance, Wacker's silicones division actively partners with automotive manufacturers, developing specialized sealants and coatings that enhance vehicle durability and efficiency. In 2024, the company reported significant growth in its specialty chemicals segment, driven by such customized product development, contributing to a substantial portion of its overall revenue.

Reliable Supply and Global Presence

Wacker Chemie's commitment to a reliable supply and global presence is a cornerstone of its value proposition. With a robust production and distribution network spanning the globe, customers can depend on consistent product availability and unwavering quality, no matter their location. This expansive footprint, supported by an integrated production system, significantly bolsters supply chain resilience, leading to shorter lead times and dependable product access.

This global reach is not just about availability; it's about building trust. For instance, in 2024, Wacker continued to invest in expanding its production capacities, particularly in key growth regions like Asia and North America, reinforcing its ability to serve diverse markets effectively. Their strategically located production sites and logistics hubs ensure that disruptions are minimized, providing a crucial advantage for businesses that rely on timely material inputs.

- Global Production Network: Wacker operates numerous production sites across Europe, the Americas, and Asia, ensuring localized supply and reduced transportation costs.

- Integrated Value Chain: The company's control over its production processes, from raw materials to finished goods, enhances quality consistency and supply chain predictability.

- Supply Chain Resilience: Investments in logistics and inventory management in 2024 aimed to further strengthen resilience against potential global supply chain disruptions.

- Customer Accessibility: A worldwide sales and service organization ensures that customers receive timely support and access to Wacker's diverse product portfolio.

High-Purity and Performance-Critical Materials

Wacker Chemie's value proposition centers on providing ultra-high-purity and performance-critical materials essential for demanding industries. For the electronics sector, this includes hyperpure electronic-grade polysilicon, a fundamental component in semiconductor manufacturing. In 2024, the demand for advanced semiconductors continued to drive growth in this segment, with Wacker being a key supplier.

The pharmaceutical industry also benefits from Wacker's specialized offerings, particularly in biopharmaceuticals. These materials are crucial for producing life-saving medicines and vaccines, where stringent purity standards are non-negotiable. The global biopharmaceutical market saw significant expansion in recent years, underscoring the importance of reliable, high-quality material suppliers like Wacker.

These critical materials are indispensable for applications where even minute impurities can compromise performance and safety. Wacker's commitment to quality ensures consistent product integrity, making them a trusted partner for companies operating at the forefront of technological and medical innovation.

- Electronics: Supply of hyperpure electronic-grade polysilicon for semiconductor fabrication.

- Pharmaceuticals: Provision of high-purity biopharmaceuticals for drug manufacturing.

- Criticality: Materials essential for sensitive applications demanding exceptional purity and consistent performance.

Wacker Chemie offers a compelling value proposition through its advanced material solutions, particularly in silicones and polymers, catering to high-growth sectors like electric vehicles and smart buildings. Their focus on sustainability is a core differentiator, with a significant portion of their portfolio already aligned with eco-friendly demands.

The company’s collaborative approach, leveraging deep technical expertise for co-development, ensures tailored solutions that precisely meet customer performance needs. This customer-centricity was evident in 2024 with strong performance in their specialty chemicals segment, driven by these customized product developments.

A reliable global supply chain, supported by extensive production and logistics networks, guarantees consistent product availability and quality, crucial for international clients. Wacker's 2024 investments in expanding production capacities, especially in Asia and North America, further solidify this commitment to dependable access.

Wacker also provides ultra-high-purity, performance-critical materials vital for industries like electronics and pharmaceuticals. Their hyperpure polysilicon for semiconductors and high-purity biopharmaceuticals for drug manufacturing are indispensable, a fact underscored by the continued demand in these sectors throughout 2024.

Customer Relationships

Wacker Chemie places a strong emphasis on dedicated technical support and after-sales service, acting as a crucial element in their customer relationships. This commitment goes beyond just selling products; it involves actively assisting customers with product application, offering solutions for troubleshooting, and guiding them on how to optimize their processes using Wacker's offerings.

This hands-on, consultative approach is key to fostering robust, long-term relationships. By ensuring clients can effectively and efficiently utilize Wacker's innovative solutions, the company solidifies its position as a trusted partner. For instance, in 2023, Wacker reported a significant portion of its revenue derived from repeat business, underscoring the success of these customer-centric strategies.

Wacker Chemie actively engages its key customers in collaborative research and development, a cornerstone of its customer relationship strategy. This co-creation approach means Wacker works directly with clients to develop novel products and tailor-made solutions, ensuring offerings precisely meet market demands.

This deep dive into customer needs through collaborative development fosters robust partnerships. For instance, in 2024, Wacker highlighted successful joint projects in advanced materials for the electronics sector, demonstrating how this strategy directly translates into market-leading innovations and strengthens customer loyalty.

Wacker Chemie cultivates long-term strategic partnerships with key industrial clients, transforming transactional relationships into collaborative ventures. This approach focuses on becoming an indispensable solution provider through consistent dialogue and shared strategic planning.

This deep engagement fosters mutual growth, with Wacker actively contributing to clients' innovation pipelines. For instance, in 2024, Wacker's specialty silicones played a crucial role in enabling advancements in the electric vehicle battery sector, a testament to these enduring partnerships.

Digital Engagement and Information Sharing

Wacker Chemie actively uses digital channels to foster stronger customer connections, offering detailed product insights and simplifying the purchasing journey. This digital-first approach is crucial for their customer relationships.

The company is investing in digitalization and AI to pinpoint potential new customers more effectively and to enhance service for their current clientele. For example, in 2023, Wacker reported a significant increase in digital interactions across their customer service portals.

- Digital Platforms: Wacker employs online portals and mobile applications for customer interaction and transactions.

- AI Integration: Artificial intelligence is used for personalized customer service and lead generation.

- Data-Driven Engagement: Digital tools enable Wacker to gather insights and tailor their approach to customer needs.

- Streamlined Processes: Online ordering and information access improve the overall customer experience.

Global Account Management

Wacker Chemie leverages Global Account Management to cater to its large multinational clients, ensuring a unified experience. This strategy provides consistent service and product availability across diverse geographical locations, simplifying complex international operations for these key customers.

This dedicated approach allows Wacker to build deeper relationships with its most significant clients. By understanding their global needs, Wacker can proactively offer tailored solutions and maintain a reliable supply chain, crucial for clients with extensive international footprints.

- Dedicated Global Teams: Wacker assigns specialized teams to manage relationships with its largest multinational clients, ensuring a single point of contact and consistent communication.

- Coordinated Support: This framework facilitates coordinated technical, logistical, and sales support across all regions where the client operates, streamlining interactions.

- Strategic Alignment: Global Account Management aims to align Wacker's offerings with the overarching strategic objectives of its key global accounts, fostering long-term partnerships.

- Enhanced Efficiency: For clients with operations spanning multiple continents, this unified management system significantly enhances operational efficiency and reduces administrative burdens.

Wacker Chemie prioritizes deep, collaborative relationships, moving beyond transactional sales to become strategic partners. This is achieved through dedicated technical support, co-development initiatives, and tailored solutions for key clients.

The company actively engages customers in innovation, ensuring its products meet evolving market needs, a strategy that demonstrably drives loyalty and repeat business. For example, Wacker's 2024 reports highlighted successful joint ventures in advanced materials for the electronics industry, showcasing the tangible results of this customer-centric approach.

Digitalization plays a key role, enhancing customer access to information and support, while AI is being integrated to personalize service and identify new opportunities. This digital focus, coupled with global account management for multinational clients, ensures a consistent and high-value experience across all touchpoints.

In 2024, Wacker's silicones were instrumental in advancements within the electric vehicle battery sector, illustrating how these strong partnerships translate into industry-leading innovations.

Channels

Wacker Chemie leverages a direct sales force to connect with major industrial clients and strategically important accounts worldwide. This approach facilitates detailed technical consultations and the development of tailored solutions, fostering robust client partnerships.

In 2024, Wacker's direct sales force played a crucial role in securing significant contracts, contributing to their robust revenue streams. For instance, their specialty chemicals division saw continued growth driven by these direct customer relationships, which are vital for understanding and meeting complex industrial needs.

Wacker Chemie relies on a vast global distributor network, including independent agents, to access a wide array of customers, particularly in varied geographic regions and for smaller order sizes. This strategy is vital for effectively entering markets and providing localized assistance.

In 2023, Wacker Chemie reported sales of €6.3 billion, with its distribution channels playing a key role in achieving this revenue by reaching diverse customer segments that might otherwise be inaccessible through direct sales alone.

Wacker Chemie is actively expanding its digital footprint through online platforms and sophisticated sales tools. These digital channels serve as crucial hubs for customers seeking detailed product information, comprehensive technical data sheets, and application guidance.

The company's investment in these digital sales tools aims to significantly enhance customer accessibility and streamline the entire purchasing journey. This digital transformation is designed to make it easier for clients worldwide to engage with Wacker's offerings and complete transactions efficiently.

For instance, Wacker's digital initiatives in 2024 likely focus on improving user experience on their e-commerce portals and leveraging data analytics to personalize customer interactions. This strategic move allows for quicker response times and more tailored support, reflecting a commitment to digital innovation in customer service.

Technical Competence Centers

Wacker's Technical Competence Centers are crucial channels for innovation and customer engagement. These global hubs focus on advanced product development, rigorous application testing, and comprehensive customer training programs. For instance, in 2024, Wacker continued to invest in these centers to accelerate the launch of new specialty chemicals and materials.

These centers serve a dual purpose: they are engines for internal R&D and vital touchpoints for external stakeholders. They facilitate direct technical consultation, allowing customers to explore product functionalities and receive tailored solutions. This hands-on approach helps showcase Wacker's extensive product portfolio and its practical applications across various industries.

- Global Network: Wacker maintains a strategically located network of Technical Competence Centers worldwide.

- Innovation Hubs: These centers are central to Wacker's product development and application testing processes.

- Customer Engagement: They provide direct technical support and training, fostering strong customer relationships.

- Showcasing Capabilities: Centers effectively demonstrate the performance and versatility of Wacker's chemical solutions.

Industry Trade Fairs and Conferences

Wacker Chemie actively participates in key industry trade fairs and conferences, such as K Show for plastics and rubber, and ACHEMA for chemical engineering. These events are crucial for showcasing their innovative solutions, including new bio-based polymers and advanced silicones. For instance, at the 2022 K Show, Wacker highlighted its commitment to sustainability with a range of products designed for a circular economy.

These gatherings provide direct access to potential and existing customers, facilitating valuable networking and lead generation. Wacker uses these platforms to demonstrate its technological leadership and gather direct feedback on market needs. In 2024, Wacker is expected to continue its strong presence at major global events, aiming to solidify its position as a leader in specialty chemicals.

- Product Showcase: Wacker utilizes trade fairs to unveil new materials and technologies, driving innovation awareness.

- Customer Engagement: Direct interaction at conferences allows for relationship building and lead acquisition.

- Market Intelligence: Participation offers insights into emerging trends and competitor activities.

- Brand Reinforcement: Consistent presence at industry events strengthens Wacker's brand recognition and reputation.

Wacker Chemie employs a multi-faceted channel strategy, combining direct sales for key accounts with an extensive global distributor network to reach a broader customer base. This hybrid approach is complemented by a growing digital presence, offering online product information and sales tools, alongside specialized Technical Competence Centers for in-depth customer support and innovation. Participation in major industry trade fairs further amplifies their market reach and engagement.

In 2023, Wacker Chemie's sales reached €6.3 billion, underscoring the effectiveness of its diverse distribution channels in accessing varied market segments. The company's strategic investments in digital platforms and Technical Competence Centers in 2024 aim to enhance customer accessibility and accelerate product development, reflecting a commitment to innovation and customer-centricity.

| Channel Type | Key Function | 2023/2024 Relevance |

|---|---|---|

| Direct Sales Force | Key account management, tailored solutions | Secured significant contracts in 2024, vital for specialty chemicals growth. |

| Global Distributor Network | Broad market access, smaller orders | Reached diverse customer segments contributing to €6.3 billion sales in 2023. |

| Digital Platforms | Product info, technical data, e-commerce | Enhanced customer accessibility and streamlined purchasing in 2024 initiatives. |

| Technical Competence Centers | R&D, application testing, customer training | Continued investment in 2024 to accelerate new product launches. |

| Trade Fairs & Conferences | Product showcase, networking, lead generation | Strong presence expected in 2024 to solidify market leadership. |

Customer Segments

Wacker Chemie is a key supplier to the construction industry, offering a range of specialty polymers and silicones. These materials are essential components in adhesives, sealants, coatings, and binders, finding application across diverse building projects.

The company's products are instrumental in developing smart and sustainable construction solutions. By enhancing material performance and promoting resource efficiency, Wacker's innovations contribute to more environmentally conscious building practices.

In 2024, the global construction market continued its growth trajectory, with specialty chemicals playing an increasingly vital role. Wacker's focus on high-performance binders and durable sealants positions it well to capitalize on this demand for advanced building materials.

Wacker Chemie's high-tech silicones and polysilicon are crucial for the automotive sector, particularly in electromobility. These materials enable advanced components like battery seals and thermal management systems, contributing to the growing EV market. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, highlighting the demand for specialized materials.

In the electronics industry, Wacker's silicones and polysilicon are indispensable for semiconductors, LEDs, and displays. These applications demand high purity and specific performance characteristics, which Wacker's products provide. The semiconductor industry alone saw global sales reach around $583.7 billion in 2022, with continued investment in advanced manufacturing processes that rely on these materials.

Wacker Chemie's Personal Care and Healthcare segments are crucial, leveraging biosolutions and advanced silicones. They supply renewable bioingredients for cosmetics and vital components for medical devices and pharmaceuticals, including those for cutting-edge mRNA therapies.

In 2024, Wacker's life science division, which includes personal care and healthcare applications, is a significant contributor to their overall strategy, reflecting the growing demand for bio-based and high-performance materials in these sensitive industries.

Energy Sector (Solar and Renewable)

Wacker Chemie is a significant supplier of hyperpure polysilicon, a critical raw material for the solar industry, directly supporting the growth of renewable energy. In 2023, the global solar market saw substantial expansion, with installations reaching over 400 GW, underscoring the demand for Wacker's core product.

Despite market fluctuations and increased competition, Wacker's commitment to producing high-purity polysilicon remains central to its strategy for the energy sector. This focus ensures their continued relevance in the ongoing global energy transition, which is increasingly reliant on solar power.

- Polysilicon for Solar: Wacker supplies hyperpure polysilicon, essential for photovoltaic cells.

- Energy Transition Support: The company's products are integral to the global shift towards renewable energy sources.

- Market Dynamics: While facing challenges, the demand for high-quality polysilicon for solar applications remains robust, driven by energy independence goals and climate action.

Chemical and Manufacturing Industries

Wacker Chemie's customer base extends significantly into the chemical and manufacturing sectors, where it supplies essential intermediates and specialty chemicals. These products are crucial for a wide array of industrial applications and production processes for other chemical manufacturers.

The company's offerings support diverse manufacturing operations, including those in general industrial segments. For example, Wacker's silicones are utilized in everything from construction sealants to automotive components, highlighting their broad applicability in manufacturing.

- Intermediates for Chemical Production: Wacker provides foundational chemical components that other manufacturers use to create a vast range of finished goods.

- Specialty Chemicals for Manufacturing: These tailored chemicals enhance product performance and efficiency in sectors like automotive, electronics, and textiles.

- Industrial Applications: Wacker's materials are integral to numerous industrial processes, contributing to the functionality and durability of manufactured products.

- Broad Sector Reach: The company serves a wide spectrum of manufacturing industries, underscoring its role as a key supplier in the global industrial ecosystem.

Wacker Chemie serves a diverse range of industries with its specialized chemical products. Key customer segments include construction, automotive, electronics, personal care and healthcare, and the solar industry.

In 2024, Wacker's polysilicon is critical for the booming solar energy sector, with global solar installations projected to continue strong growth. The company's silicones and polymers are also vital for the automotive industry, particularly in electric vehicles, a market that saw significant expansion in 2023.

Furthermore, Wacker's high-purity materials are essential for the electronics industry, supporting semiconductor and LED manufacturing. The personal care and healthcare segments benefit from Wacker's biosolutions and advanced silicones, catering to growing demands for sustainable and medical-grade ingredients.

The company also supplies a broad spectrum of chemical intermediates and specialty chemicals to the wider chemical and manufacturing sectors, underpinning numerous industrial processes and product developments.

| Customer Segment | Key Wacker Products | 2024 Market Relevance/Data Point |

|---|---|---|

| Construction | Specialty Polymers, Silicones | Global construction market growth relies on advanced materials for sustainability and performance. |

| Automotive (esp. Electromobility) | High-Tech Silicones, Polysilicon | Global EV market valued at approx. $380 billion in 2023, driving demand for specialized materials. |

| Electronics | Silicones, Polysilicon | Semiconductor industry sales reached ~$583.7 billion in 2022, requiring high-purity materials. |

| Personal Care & Healthcare | Biosolutions, Advanced Silicones | Growing demand for bio-based ingredients and medical-grade silicones for devices and therapies. |

| Solar Industry | Hyperpure Polysilicon | Global solar installations exceeded 400 GW in 2023, underscoring demand for core product. |

| Chemical & Manufacturing | Intermediates, Specialty Chemicals | Broad applicability in diverse industrial processes and finished goods production. |

Cost Structure

Wacker Chemie's cost structure heavily relies on raw materials like silicon metal, methanol, and ethylene. For instance, in 2024, the price of silicon metal, a key input for polysilicon, experienced volatility due to energy costs and supply chain dynamics in major producing regions.

These raw material expenses represent a substantial part of their overall spending. The company actively manages these costs through strategic sourcing initiatives and by employing flexible contract structures to mitigate the impact of global commodity price swings.

Energy costs, primarily electricity and natural gas, are a significant expense for Wacker Chemie due to the energy-intensive nature of chemical manufacturing, particularly in its European operations. In 2024, the company continued to emphasize the need for competitive industrial electricity pricing to remain viable.

To manage these substantial costs, Wacker Chemie actively pursues and implements various energy efficiency measures across its production sites. This focus on efficiency is crucial for mitigating the impact of fluctuating energy prices and maintaining cost competitiveness in the global market.

Personnel expenses are a significant component of Wacker Chemie's cost structure. These include salaries, wages, and benefits for its more than 16,000 employees globally, covering manufacturing, research and development, sales, and administrative functions.

Research and Development Expenses

Wacker Chemie dedicates substantial resources to Research and Development, a critical component for its innovation-driven strategy. These investments are essential for creating novel products and enhancing current offerings, particularly in its specialty chemical segments. For instance, in 2023, Wacker Chemie reported Research and Development expenses totaling €352 million, underscoring its commitment to staying at the forefront of technological advancements.

- Innovation Focus: R&D spending fuels the development of new materials and solutions, crucial for Wacker's specialty chemicals business.

- Competitive Edge: Significant investment in R&D helps Wacker maintain its market position and differentiate its product portfolio.

- Product Improvement: These expenses also cover the enhancement of existing products, ensuring they meet evolving market demands and performance standards.

- Financial Commitment: The €352 million spent on R&D in 2023 highlights the company's strategic prioritization of innovation.

Capital Expenditures and Depreciation

Wacker Chemie's cost structure is significantly influenced by substantial capital expenditures. These costs are primarily tied to expanding and maintaining its extensive production facilities. This includes the construction of new plants and the ongoing upgrading of existing equipment to ensure efficiency and technological advancement.

These significant investments in physical assets translate directly into considerable depreciation and amortization expenses. These non-cash expenses are recognized over the useful life of the assets, impacting the company's profitability and financial statements. For instance, Wacker Chemie reported capital expenditures of approximately €787 million in 2023, highlighting the ongoing investment in its asset base.

- Capital Expenditures: Significant investments in new plants and equipment upgrades are a core cost.

- Depreciation and Amortization: These non-cash expenses arise from the company's large asset base.

- Asset Maintenance: Ongoing costs to maintain and modernize production facilities are substantial.

Wacker Chemie's cost structure is dominated by raw materials like silicon metal and methanol, with energy being another major expense due to its energy-intensive operations. Personnel costs and significant R&D investments for innovation also contribute substantially. Capital expenditures for plant expansion and maintenance, leading to depreciation, are key financial outlays.

| Cost Category | Key Components | 2023 Data/Notes |

|---|---|---|

| Raw Materials | Silicon metal, methanol, ethylene | Prices volatile in 2024; crucial for polysilicon and silicones. |

| Energy | Electricity, natural gas | Significant expense for energy-intensive processes; competitive pricing sought in 2024. |

| Personnel | Salaries, wages, benefits | Over 16,000 global employees across all functions. |

| Research & Development | New product development, process improvement | €352 million in 2023; vital for innovation strategy. |

| Capital Expenditures | Plant expansion, equipment upgrades | Approx. €787 million in 2023; leads to depreciation and amortization. |

Revenue Streams

Wacker Chemie's largest revenue source comes from selling a broad array of silicone products. This includes everything from silicone fluids and emulsions to resins and elastomers.

These silicones are essential for many different sectors, such as construction, the automotive industry, electronics, and personal care products. The company is increasingly concentrating on developing and selling more specialized silicone materials.

In 2024, the revenue generated specifically from Wacker's Silicones segment reached €2,805 million, highlighting its significant contribution to the company's overall financial performance.

Wacker Chemie's Polymers segment is a key contributor to its revenue, driven by the sale of advanced polymer products. These include dispersible polymer powders and dispersions, which are essential components in the construction, coatings, and adhesives sectors. The company emphasizes high-quality polymer binders and increasingly focuses on offering sustainable solutions within this product line.

In 2024, the Polymers segment demonstrated robust performance, generating sales of €1,463 million. This figure highlights the significant market demand for Wacker's polymer offerings and their critical role in various industrial applications, underscoring the segment's importance to the company's overall financial health.

Wacker Chemie's polysilicon sales represent a significant revenue stream, driven by demand from both the solar energy sector and the critical semiconductor industry. While the solar market has experienced fluctuations, the need for high-purity polysilicon for advanced electronics continues to grow.

In 2024, Wacker Chemie reported €949 million in revenue from polysilicon sales, underscoring its importance to the company's overall financial performance.

Biosolutions Sales

Wacker Chemie's Biosolutions division is a significant contributor to its overall revenue, generating income from a diverse range of products including biopharmaceuticals, bioingredients, and other advanced biotechnology offerings. This segment is experiencing robust growth, fueled by a rising global demand for sophisticated biotech solutions, especially within the critical healthcare industry.

In 2024, the Biosolutions segment achieved impressive sales figures, reaching €375 million. This performance underscores the division's strategic importance and its ability to capitalize on key market trends.

- Biosolutions Revenue: Income generated from biopharmaceuticals, bioingredients, and other biotech products.

- Growth Drivers: Increasing demand for advanced biotech solutions, particularly in healthcare.

- 2024 Performance: Biosolutions sales reached €375 million.

Specialty Product Sales and Services

Wacker Chemie's revenue streams extend beyond its primary chemical segments to include the sale of highly specialized products and associated technical services. These offerings are frequently customized to meet the unique requirements of individual clients, thereby fostering strong customer relationships and enabling premium pricing. This strategic emphasis on high-margin specialty items and value-added support is a significant contributor to the company's overall financial health and expansion trajectory.

In 2023, Wacker Chemie reported robust performance in its specialty chemical segments. For instance, the Silicones division, which heavily features specialized products, saw its sales reach approximately €3.5 billion. This highlights the substantial revenue generated from these niche markets.

- Specialty Silicones: High-performance silicones for industries like electronics, automotive, and healthcare.

- Advanced Polymers: Tailored polymer dispersions and resins for construction and coatings.

- Biotechnology Products: Fermentation-based products and fine chemicals for pharmaceutical and food industries.

- Technical Support Services: Application development, troubleshooting, and consulting for specialized product lines.

Wacker Chemie's revenue is diversified across several key segments, with silicones and polymers forming the largest pillars. The company also generates significant income from polysilicon, crucial for the solar and semiconductor industries, and a growing Biosolutions division focused on biotechnology products.

In 2024, the Silicones segment was the top earner, bringing in €2,805 million. The Polymers segment followed with €1,463 million, while polysilicon sales contributed €949 million. The Biosolutions segment added €375 million to the company's revenue, showing its increasing importance.

| Segment | 2024 Revenue (Millions €) |

|---|---|

| Silicones | 2,805 |

| Polymers | 1,463 |

| Polysilicon | 949 |

| Biosolutions | 375 |

Business Model Canvas Data Sources

The Wacker Chemie Business Model Canvas is constructed using a blend of Wacker's annual reports, investor presentations, and detailed market research on the chemical industry. These sources provide the foundation for understanding customer segments, value propositions, and revenue streams.