Wacker Chemie Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wacker Chemie Bundle

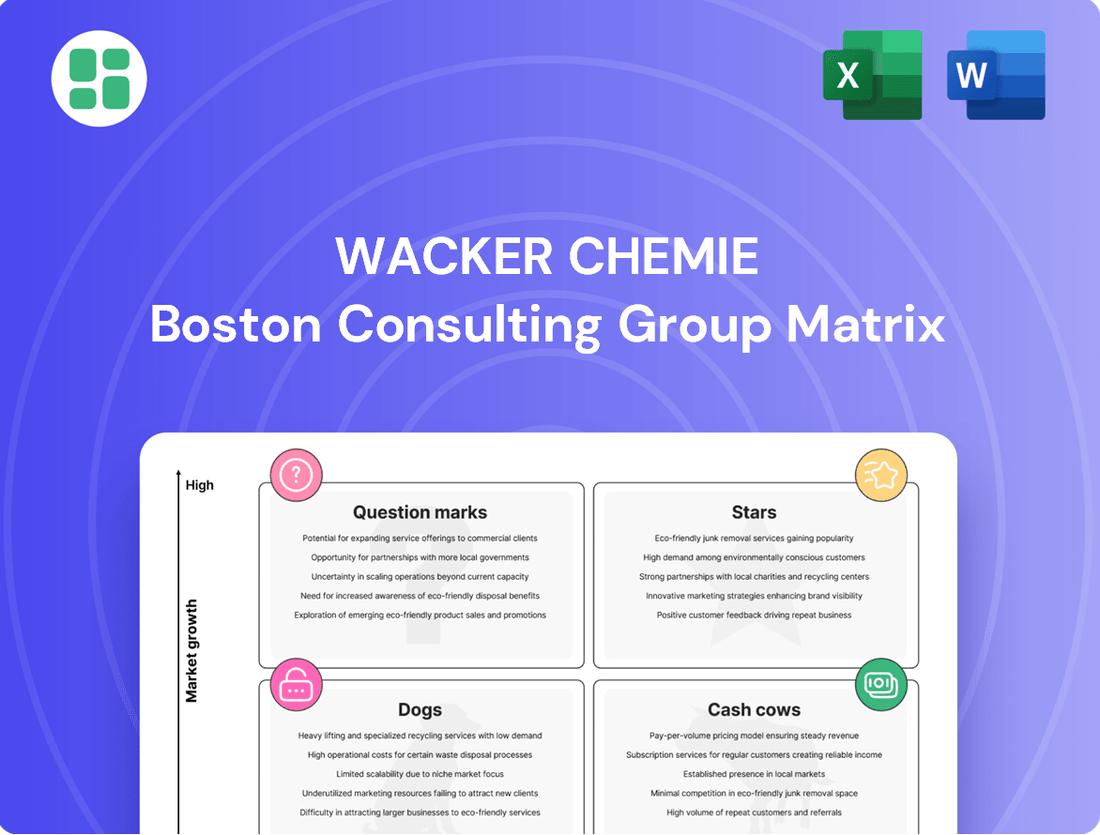

Curious about Wacker Chemie's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio stacks up, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix to unlock detailed quadrant analysis and actionable insights that will guide your investment decisions.

Stars

Wacker Chemie's high-purity semiconductor-grade polysilicon is a clear star in its BCG portfolio. This segment benefits from robust demand fueled by the ongoing digital transformation and the burgeoning AI sector. The company is making a substantial commitment, with its 'Etching Line Next' facility, a €300 million plus investment, set to boost capacity by over 50% by July 2025, targeting a doubling of semiconductor sales by 2030.

Wacker Chemie is strategically focusing on specialty silicones for electromobility, recognizing this as a key growth driver. They are investing in innovations like fire-resistant coatings for EV batteries and advanced silicone materials for high-voltage insulators.

These specialized products directly address the critical safety and performance demands within the booming EV market. Wacker's deep expertise in silicone chemistry positions them to secure a substantial share of this high-growth sector.

The company projects robust growth for its specialty products, with silicones anticipated to see a 10% sales increase in 2025. This uplift is largely attributed to expanding volumes within the electromobility segment.

Wacker Chemie's specialty silicones for healthcare are a strong performer, driven by robust volume growth in applications like wound care and medical devices. This segment leverages continuous innovation and the rising need for advanced, biocompatible materials, securing Wacker a significant market share in this expanding niche.

The company's strategic acquisition of Bio Med Sciences Inc.'s assets in 2024 significantly bolstered its capabilities in silicone-coated healthcare products, further solidifying its position. This move is expected to enhance Wacker's offerings and market penetration in the critical healthcare sector.

Advanced Silicone Materials for Electronics

Wacker Chemie's advanced silicone materials are pivotal in the electronics sector, enabling innovations like high-performance LEDs and flexible sensor laminates for wearables.

The electronics industry's significant demand for silicones fuels Wacker's strong market position and growth, reflecting a key market trend.

- Market Share: Wacker holds a leading position in the specialty silicones market for electronics.

- Growth Drivers: Innovation in areas like smart sensors and advanced LED encapsulation drives demand.

- Industry Contribution: The electronics sector is a substantial revenue contributor to Wacker's silicone business.

- Future Outlook: Continued advancements in smart devices and electronics are expected to bolster silicone demand.

Bio-based and Sustainable Silicone Grades

Wacker Chemie is actively investing in bio-based and sustainable silicone grades, aligning with global trends towards environmentally conscious materials. A prime example is their biomethanol-based silicone for injection molding, designed for food-contact applications without requiring additional post-treatment. This innovation directly addresses a surging market demand for sustainable alternatives.

These eco-friendly silicone grades are positioned to capture significant market share in a rapidly expanding high-growth segment. The ability to facilitate high automation further enhances their appeal to manufacturers seeking efficiency and sustainability. This strategic focus on sustainability serves as a crucial differentiator for Wacker in the dynamic chemical industry landscape.

- Market Growth: The global market for bio-based chemicals is projected to reach over $100 billion by 2027, with silicones being a key component.

- Sustainability Focus: Wacker's investment in bio-based silicones reflects a broader industry shift, with over 60% of consumers indicating a willingness to pay more for sustainable products in 2024.

- Innovation Driver: The development of food-contact approved bio-silicones without post-treatment streamlines manufacturing processes and reduces environmental impact.

- Competitive Advantage: This sustainable product line allows Wacker to tap into niche markets and establish a strong brand identity centered on environmental responsibility.

Wacker Chemie's semiconductor-grade polysilicon is a definite star, benefiting from the digital boom. The company's substantial investment in its Etching Line Next facility, exceeding €300 million, is set to boost capacity by over 50% by July 2025, aiming to double semiconductor sales by 2030.

Specialty silicones for electromobility are also stars, with Wacker's focus on innovations like fire-resistant EV battery coatings and advanced high-voltage insulators. The company projects a 10% sales increase for silicones in 2025, largely due to growth in this sector.

Wacker's specialty silicones for healthcare are performing strongly, driven by increased demand in wound care and medical devices. The 2024 acquisition of Bio Med Sciences Inc.'s assets further strengthens their position in this expanding niche.

Advanced silicone materials for the electronics sector are stars, enabling innovations in LEDs and wearables. The electronics industry's demand significantly contributes to Wacker's silicone business growth.

| Segment | BCG Classification | Key Growth Drivers | 2025 Outlook |

| Semiconductor Polysilicon | Star | Digital transformation, AI demand | Doubling sales by 2030 |

| Specialty Silicones (Electromobility) | Star | EV market growth, safety innovations | 10% sales increase |

| Specialty Silicones (Healthcare) | Star | Medical device demand, biocompatible materials | Strong volume growth |

| Specialty Silicones (Electronics) | Star | Smart devices, wearables, LEDs | Substantial revenue contribution |

What is included in the product

The Wacker Chemie BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, holding, or divestment for each business unit.

The Wacker Chemie BCG Matrix provides a clear, quadrant-based overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Wacker Chemie’s standard silicone fluids and emulsions are a prime example of a cash cow within their portfolio. These products hold a significant market share in established industrial sectors, consistently delivering reliable revenue and profit. For instance, in 2023, Wacker reported that its Silicones division, which heavily features these products, achieved sales of €3.1 billion, underscoring their substantial contribution.

Despite potential volume fluctuations during economic downturns, the widespread application of these silicones across diverse industries like automotive, construction, and textiles provides a baseline of stable demand. This broad utility mitigates significant risk, ensuring continued sales even in challenging market environments.

Wacker’s operational efficiency, particularly its integrated production capabilities and effective resource management, allows for cost-effective manufacturing of these high-volume standard products. This efficiency is crucial for maintaining profitability in a competitive market, allowing them to capitalize on their established market position.

Wacker Chemie's established VAE dispersions for adhesives and coatings are prime examples of cash cows. These products dominate mature markets, consistently delivering strong cash flow despite broader industry challenges. In 2023, the Polymers division, where these VAE dispersions reside, saw sales of €1.7 billion, underscoring their substantial contribution.

The vinyl acetate-ethylene dispersions are a bedrock for Wacker, serving essential roles in adhesives, coatings, and construction chemicals. Even with a slowdown in construction activity in 2023, which impacted some segments, these VAE dispersions maintained stable volumes, proving their resilience and dependable cash generation capabilities.

Wacker's commitment to these VAE dispersions is evident in their ongoing capacity expansions. For instance, a new VAE dispersion production facility in Zhenjiang, China, commenced operations in late 2023, further solidifying their market leadership and ensuring continued robust cash flow from these mature, yet vital, product lines.

Wacker Chemie's mature silicone elastomers for general industrial use are firmly positioned as cash cows. These products, vital for a broad spectrum of applications, enjoy a substantial market share due to consistent demand in established sectors.

The reliability of cash flow from these mature silicone elastomers is bolstered by Wacker's strategic emphasis on operational efficiency and optimizing plant utilization within its Silicones division. This focus ensures these foundational products remain highly profitable.

Polysilicon for Stable Semiconductor Applications

Wacker Chemie's polysilicon division, specifically its hyperpure polysilicon for semiconductor applications, functions as a robust cash cow. This segment benefits from consistent demand within the stable, ongoing electronics manufacturing sector. Wacker's leading market position in this essential material ensures a reliable revenue stream from its established customer base.

The company's commitment to supplying hyperpure polysilicon to the semiconductor industry underscores its cash cow status. This division generates steady income, even as Wacker strategically invests in expanding its capacity for future technologies.

- Leading Market Position: Wacker is a key global supplier of hyperpure polysilicon, a critical component for semiconductor fabrication.

- Stable Demand: The ongoing need for semiconductors in various industries provides a consistent and predictable revenue source for this division.

- Consistent Revenue Stream: Despite market fluctuations in other areas, the semiconductor polysilicon business offers a reliable income, supporting overall company performance.

- Strategic Investment Support: The cash generated from this segment allows Wacker to fund investments in new technologies and capacity expansions for next-generation polysilicon.

General Purpose Silicone Sealants

Wacker Chemie's general purpose silicone sealants represent a classic Cash Cow within its portfolio. These products, essential for construction and various industrial applications, boast a significant market share and consistently deliver robust cash flow. Their widespread use and Wacker's established brand reputation ensure a stable demand, even amidst market volatility.

The company's strategic investments in expanding production and cartridge filling capabilities for these sealants highlight their ongoing importance as a dependable income stream. For instance, Wacker reported that its Construction Chemicals division, which includes sealants, saw sales growth in the low single digits in early 2024, driven by steady demand in key regions.

- Mature Product Line: General purpose silicone sealants have a long history and are well-established in the market.

- High Market Share: Wacker holds a strong position in the silicone sealant market.

- Consistent Cash Flow: The products reliably generate substantial revenue and profits.

- Sustained Demand: Broad applicability and brand strength ensure ongoing customer need.

Wacker Chemie's standard silicone fluids and emulsions are a prime example of a cash cow. These products hold a significant market share in established industrial sectors, consistently delivering reliable revenue and profit. In 2023, Wacker's Silicones division achieved sales of €3.1 billion, underscoring their substantial contribution.

The widespread application of these silicones across diverse industries like automotive, construction, and textiles provides a baseline of stable demand, mitigating significant risk and ensuring continued sales even in challenging market environments.

Wacker's operational efficiency, particularly its integrated production capabilities, allows for cost-effective manufacturing of these high-volume standard products, maintaining profitability in a competitive market.

| Product Category | Division | 2023 Sales (EUR Billion) | Key Characteristics | BCG Matrix Status |

|---|---|---|---|---|

| Standard Silicone Fluids & Emulsions | Silicones | 3.1 | High market share, stable demand, operational efficiency | Cash Cow |

| VAE Dispersions | Polymers | 1.7 | Dominant in mature markets, reliable cash flow, capacity expansion | Cash Cow |

| Hyperpure Polysilicon | Polysilicon | N/A (Segmented within Division) | Critical for semiconductors, stable demand, market leadership | Cash Cow |

| General Purpose Silicone Sealants | Silicones / Construction Chemicals | N/A (Segmented within Division) | Significant market share, robust cash flow, sustained demand | Cash Cow |

Preview = Final Product

Wacker Chemie BCG Matrix

The preview you see is the identical, fully formatted Wacker Chemie BCG Matrix report you will receive upon purchase. This ensures complete transparency and guarantees that no watermarks or demo content will obscure the strategic insights within. You can be confident that the document is ready for immediate application in your business planning and analysis.

Dogs

Wacker Chemie's solar-grade polysilicon division is firmly placed in the 'Dog' category of the BCG matrix. This is a result of its dim growth outlook and shrinking market presence, largely due to a significant drop in demand. For instance, sales in this segment plummeted by 41% in 2024.

Persistent overcapacity in China and ongoing trade policy ambiguities, particularly concerning the US market, continue to exert downward pressure on this business. The expectation is that these challenging conditions will persist into 2025, further solidifying its 'Dog' status.

The solar-grade polysilicon segment consistently battles intense pricing pressure and a persistent oversupply situation. This makes it a considerable drain on the company's resources, demanding significant investment without commensurate returns.

Traditional polymer powders used in construction, especially in Europe and Asia, faced a tough 2024. Demand was sluggish, and prices dropped, causing sales and EBITDA for these specific products to fall. This segment is characterized by low growth and a smaller market share within the broader Polymers division.

Wacker Chemie's strategic direction involves a move towards more specialized, higher-value products. Consequently, these more commoditized traditional polymer powders are likely to see a decreased emphasis as the company reallocates resources. The overall Polymers division is still targeting modest volume increases, but these specific construction-related powders are a drag on that growth.

Within Wacker Chemie's Biosolutions division, the legacy general chemicals and certain bio-ingredients segments are experiencing contraction. This is happening even as the broader biopharmaceuticals area within Biosolutions shows growth.

These legacy product lines likely possess smaller market shares and face limited expansion opportunities compared to Wacker's more strategic, high-growth areas in biosolutions. For instance, in 2023, Wacker Chemie reported that its Biosolutions division's sales increased by 11.6% to €731.8 million, driven by strong performance in biopharmaceuticals and industrial biotechnology. However, within this, the legacy components are underperforming relative to the division's overall positive trajectory.

These less differentiated products may consume valuable resources without delivering substantial returns. Consequently, they are candidates for potential optimization strategies or even divestment in the future, allowing Wacker to concentrate its efforts on more promising growth segments.

Less Differentiated, Commodity Silicone Products

Wacker Chemie's Silicones division, while a powerhouse, includes certain commodity silicone products that are feeling the heat from intense competition. This pressure often leads to a downward trend in standard pricing, which can unfortunately weigh on the division's overall profitability.

Even as Wacker sees growth in its more specialized silicone volumes, the existence of these lower-margin, slower-growth items indicates segments where gaining or even holding onto market share requires considerable strategic focus and investment.

The company's overarching strategy clearly signals a move towards higher-value, specialized silicone products. This naturally means less emphasis on these more commoditized areas, suggesting a deliberate shift in resource allocation and market focus.

- Intensified Competition: Commodity silicones face numerous global competitors, driving down prices.

- Declining Standard Pricing: In 2023, the average selling price for some Wacker silicone products saw a notable decrease compared to previous years due to market saturation.

- Margin Pressure: The lower margins on these products can dilute the overall profitability of the Silicones segment.

- Strategic Shift: Wacker's investment in R&D and production capacity is heavily skewed towards specialty silicones, reflecting a clear strategic pivot.

Underperforming Niche Chemical Products

Underperforming niche chemical products within Wacker Chemie's diverse portfolio, particularly those not directly linked to key growth drivers like electromobility, digitalization, or sustainability, are likely candidates for the 'Dogs' category in a BCG Matrix analysis. These segments, characterized by low market share and limited growth potential, represent areas where Wacker's strategic focus on efficiency and active portfolio management might lead to divestment or restructuring. For instance, while Wacker reported strong performance in its Silicones and Polysilicon divisions in 2024, specific, smaller product lines within these or other segments could be lagging.

These 'Dogs' typically exhibit low profitability and do not align with the company's long-term strategic vision. Wacker's commitment to innovation in areas such as advanced materials for battery technologies and sustainable construction solutions means that older, less dynamic product lines may be deprioritized. The company's 2024 financial reports, while showcasing overall resilience, would likely contain segment-specific data that highlights these less competitive areas.

- Low Market Share: These niche products likely hold a minimal share of their respective markets, failing to achieve economies of scale.

- Limited Growth Prospects: The demand for these chemicals is not expanding significantly, hindering revenue growth.

- Strategic Misalignment: They do not contribute to Wacker's stated megatrend focus, such as sustainability or digitalization.

- Potential for Divestment: Wacker's portfolio management strategy may identify these as non-core assets suitable for sale or discontinuation.

Wacker Chemie's solar-grade polysilicon segment is a prime example of a 'Dog' in the BCG matrix. Its dim growth outlook and shrinking market presence, exacerbated by a significant 41% sales drop in 2024, firmly place it in this category. Persistent overcapacity in China and trade policy ambiguities continue to pressure this business, with challenging conditions expected to persist into 2025.

Traditional polymer powders for construction, particularly in Europe and Asia, also exhibit 'Dog' characteristics. Sluggish demand and price drops in 2024 led to falling sales and EBITDA for these products, which have low growth and a smaller market share within the Polymers division. Wacker's strategic shift towards specialized products means these commoditized powders will likely see reduced emphasis.

Certain legacy general chemicals and bio-ingredients within the Biosolutions division are also 'Dogs'. While the broader biopharmaceuticals area is growing, these older product lines have smaller market shares and limited expansion opportunities. They may consume resources without substantial returns, making them candidates for optimization or divestment.

Commodity silicone products within the Silicones division face intense competition, leading to declining standard pricing and margin pressure. Despite growth in specialized silicones, these lower-margin items require significant strategic focus. Wacker's investment in R&D and capacity is clearly skewed towards higher-value specialty silicones, indicating a deliberate pivot away from these commoditized areas.

| Segment | BCG Category | Key Challenges | 2024 Performance Indicators | Strategic Outlook |

| Solar-grade Polysilicon | Dog | Overcapacity, trade policy ambiguity, declining demand | Sales -41% | Resource reallocation, potential divestment |

| Traditional Polymer Powders (Construction) | Dog | Sluggish demand, price drops, low growth | Falling sales and EBITDA | Reduced emphasis, focus on specialty products |

| Legacy Biosolutions (General Chemicals, Bio-ingredients) | Dog | Limited market share, low growth prospects | Underperforming relative to division growth | Optimization, potential divestment |

| Commodity Silicones | Dog | Intense competition, declining prices, margin pressure | Average selling price decrease (2023) | Strategic pivot to specialty silicones |

Question Marks

Wacker Chemie's investment in its new mRNA competence center, operational in 2024, alongside broader biopharmaceutical ventures within its Biosolutions division, positions it in a high-growth market. The company is targeting €1 billion in Biosolutions sales by 2030, indicating ambitious growth expectations in this sector.

These areas are characterized by high demand and significant investment requirements, coupled with considerable future potential. However, Wacker's current market share in these nascent segments is relatively low, aligning with the characteristics of a 'Question Mark' in the BCG matrix.

While these ventures are currently cash-consuming, their strategic importance and market potential suggest they could evolve into future Stars for Wacker Chemie if successful.

Fermentation-based food ingredients represent a strategic focus for Wacker Chemie within its Biosolutions division. This area targets the growing consumer demand for sustainable and natural food options, positioning it as a high-growth market. Wacker is actively investing in research and development here, aiming to capture a significant share of this expanding sector.

While the market for these ingredients is robust, Wacker's current penetration might be nascent. This places fermentation-based food ingredients in the 'Question Mark' category of the BCG matrix. Success hinges on strong market adoption and Wacker's ability to scale its innovative production capabilities effectively.

Wacker is actively pushing into the digitalization megatrend with its new silicone technologies, particularly flexible silicone laminates designed for smart sensors in wearables and other connected devices. This positions them in a high-growth, innovative sector where their new product introductions signify significant potential.

While Wacker is pioneering these advanced materials, their market share in this nascent segment is still building. The company faces the challenge of establishing strong customer adoption and brand recognition in a competitive landscape.

To elevate these promising silicone sensor technologies from a 'Question Mark' to a 'Star' in the BCG matrix, Wacker requires substantial investment in marketing efforts and dedicated customer education. This will be crucial for driving market penetration and solidifying their position in the rapidly evolving digital ecosystem.

Emerging Specialty Silicones for New Applications

Wacker Chemie is actively exploring emerging specialty silicones for niche applications, such as their 'Powerseal 1900' designed for high-voltage insulators. These innovative products are aimed at markets with significant growth potential, but currently represent a small portion of Wacker's overall sales, necessitating considerable investment in research and development to gain market traction.

The strategic positioning of these emerging specialty silicones within Wacker's portfolio mirrors that of a Question Mark in the BCG matrix. Their future trajectory hinges on successful market penetration and adoption, which will ultimately determine whether they transition into Stars with high growth and market share, or stagnate as Dogs with low growth and market share.

- Emerging Applications: Focus on novel uses like high-voltage insulators and advanced electronics.

- Investment Needs: Significant R&D and market development funding are required.

- Market Share: Currently low, indicating early-stage product lifecycle.

- Future Potential: Success could lead to Star status, failure to Dog status.

Early-Stage Sustainable Chemical Innovations

Wacker Chemie is actively investing in early-stage sustainable chemical innovations, focusing on areas like bio-based raw materials and enhanced product recyclability. These advancements are crucial for meeting growing environmental demands and stricter regulations. For example, Wacker’s bio-based silicons are gaining traction, aligning with the global shift towards greener alternatives.

Many of these nascent technologies are positioned in rapidly expanding markets fueled by both regulatory pressures and increasing consumer preference for eco-friendly products. The global market for sustainable chemicals is projected to reach significant figures, with some estimates pointing to substantial compound annual growth rates in the coming years, driven by these very trends.

However, these promising innovations currently hold a modest market share. This is largely because they are still in the commercialization phase, requiring substantial ongoing investment to scale production and achieve widespread market acceptance. This positions them as Question Marks within a strategic framework, needing careful nurturing to transition into market leaders.

- Focus on Bio-based Materials: Wacker is developing alternatives using renewable resources, reducing reliance on fossil fuels.

- Degradability and Recycling: Innovations aim to improve the end-of-life management of chemical products.

- High-Growth Market Potential: Driven by environmental regulations and consumer demand for sustainable solutions.

- Early Commercialization Stage: Current low market share necessitates continued investment for future growth.

Wacker Chemie's ventures into biopharmaceuticals, fermentation-based food ingredients, silicone technologies for smart sensors, and bio-based chemical innovations all fit the profile of Question Marks. These areas are characterized by substantial growth potential and significant investment needs, yet Wacker's current market share is relatively low. Success in these segments, which are crucial for future growth and sustainability, will require continued strategic investment and effective market penetration to evolve into Stars.

| Business Area | Market Potential | Current Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Biopharmaceuticals (Biosolutions) | High (Targeting €1 billion sales by 2030) | Low | High (mRNA competence center operational in 2024) | Question Mark |

| Fermentation-based Food Ingredients | High (Growing demand for sustainable/natural options) | Nascent | High (R&D and scaling production) | Question Mark |

| Silicone Technologies for Smart Sensors | High (Digitalization megatrend) | Building | High (Marketing, customer education) | Question Mark |

| Emerging Specialty Silicones (e.g., Powerseal 1900) | High (Niche applications, e.g., high-voltage insulators) | Small | High (R&D, market development) | Question Mark |

| Sustainable Chemical Innovations (Bio-based) | High (Environmental demands, regulations) | Modest | High (Commercialization, scaling) | Question Mark |

BCG Matrix Data Sources

Our Wacker Chemie BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and industry expert analyses. This data integration ensures a robust understanding of market share and growth potential.