VIA optronics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIA optronics Bundle

VIA optronics is navigating a dynamic market, and understanding its competitive edge and potential hurdles is crucial. Our comprehensive SWOT analysis delves into their unique strengths, such as innovative display technologies, and identifies potential weaknesses, like reliance on specific markets.

Want the full story behind VIA optronics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

VIA optronics AG's core strength lies in its specialized optical bonding expertise, a critical technology for improving display performance and durability, especially in challenging conditions. This deep understanding allows them to deliver visually superior solutions that excel in clarity, robustness, and overall optical quality, distinguishing them in the competitive display market.

Their intellectual property and proprietary process knowledge in optical bonding represent significant competitive advantages, enabling VIA optronics to offer unique and high-performing display enhancements. For instance, in 2023, the company reported a substantial increase in revenue, partly driven by demand for their advanced bonding solutions in sectors requiring high-reliability displays.

VIA optronics boasts a diverse product portfolio, encompassing displays, touch screens, protective glass, and camera modules. This allows them to offer integrated solutions, combining these components into complete systems for their clients. For instance, their ability to deliver customized, interactive display systems highlights their role as a holistic solution provider, not just a component supplier.

VIA optronics excels by focusing on demanding sectors like automotive, industrial, medical, and consumer electronics. These markets require exceptional performance and resilience, areas where VIA's technology shines. For instance, their solutions are engineered to perform reliably even in challenging conditions such as extreme temperatures and high vibration, a crucial advantage in automotive applications.

The company's expertise in creating display solutions that overcome environmental hurdles, like bright sunlight, has solidified its standing. This is particularly evident in the automotive sector, where clear visibility is paramount, and in the growing industrial display market, which increasingly demands robust and reliable visual interfaces. VIA's ability to customize its technology for these specific, high-stakes applications provides a significant competitive edge.

Global Manufacturing Footprint

VIA optronics leverages a strategic global manufacturing footprint, with key facilities located in Germany, Japan, and China. This diversification is a significant strength, enabling the company to adapt to fluctuating tariff environments and optimize its supply chain for efficient global customer service. For instance, having production capabilities in Asia is crucial for cost competitiveness in a global market.

This distributed manufacturing network offers VIA a distinct competitive edge by allowing for agile responses to market shifts and logistical challenges. It also plays a vital role in securing new business, particularly as smaller, less geographically diversified competitors may struggle to maintain market presence in certain regions.

- Diversified Production: Facilities in Germany, Japan, and China reduce reliance on any single region.

- Logistical Optimization: Enables efficient delivery and cost management for a worldwide customer base.

- Market Resilience: Provides an advantage in navigating trade policies and supporting customer needs globally.

Proactive Business Transformation and Financial Discipline

VIA optronics has actively pursued business transformation and cost reduction, successfully stabilizing its operations. These strategic moves are designed to boost financial performance, with projected significant improvements in gross margins and EBITDA for both 2024 and 2025. For instance, the company anticipates a substantial uplift in its adjusted EBITDA margin, potentially reaching double digits by the end of 2025, a testament to its efficiency programs and overhead management.

The company's commitment to financial discipline is further evidenced by its robust cash management strategies and the successful securing of credit lines. This ensures ample financial flexibility to navigate market dynamics and pursue growth opportunities. This proactive approach to financial health underpins its capacity for sustained operational improvement and strategic investment.

- Proactive Transformation: VIA optronics has implemented efficiency programs and reduced overhead costs.

- Improved Margins: Expect significant gross margin and EBITDA improvements in 2024-2025, with adjusted EBITDA margins potentially reaching double digits by year-end 2025.

- Financial Discipline: Maintained disciplined cash management and secured necessary credit lines.

- Financial Flexibility: These actions provide the company with enhanced financial maneuverability.

VIA optronics' core strength is its specialized optical bonding expertise, crucial for enhancing display performance and durability in demanding environments. This deep technical know-how allows them to deliver visually superior and robust display solutions, setting them apart in the market. Their intellectual property and proprietary processes further solidify this advantage, enabling unique, high-performing products.

The company offers a diverse product range, including displays, touch screens, and protective glass, allowing for integrated system solutions. This capability is vital for clients needing customized, interactive display systems, positioning VIA as a comprehensive solution provider. VIA's focus on high-demand sectors like automotive and industrial, which require exceptional resilience and clarity, highlights the effectiveness of their technology in challenging conditions.

VIA optronics benefits from a strategic global manufacturing presence in Germany, Japan, and China, enhancing supply chain efficiency and market responsiveness. This distributed network provides resilience against trade fluctuations and supports global customer service. The company has also successfully undertaken business transformation and cost reduction initiatives, projecting significant improvements in gross margins and EBITDA for 2024 and 2025, with adjusted EBITDA margins potentially reaching double digits by late 2025.

| Strength Area | Key Aspect | Impact |

|---|---|---|

| Optical Bonding Expertise | Proprietary processes and deep technical knowledge | Superior display clarity, durability, and performance |

| Product Portfolio | Integrated displays, touch screens, protective glass | Holistic system solutions and customization capabilities |

| Market Focus | Automotive, Industrial, Medical sectors | Reliable performance in extreme conditions (e.g., sunlight, vibration) |

| Global Manufacturing | Facilities in Germany, Japan, China | Supply chain resilience, cost competitiveness, market agility |

| Financial Transformation | Cost reduction, efficiency programs | Projected significant margin improvements (2024-2025), double-digit adjusted EBITDA potential by end of 2025 |

What is included in the product

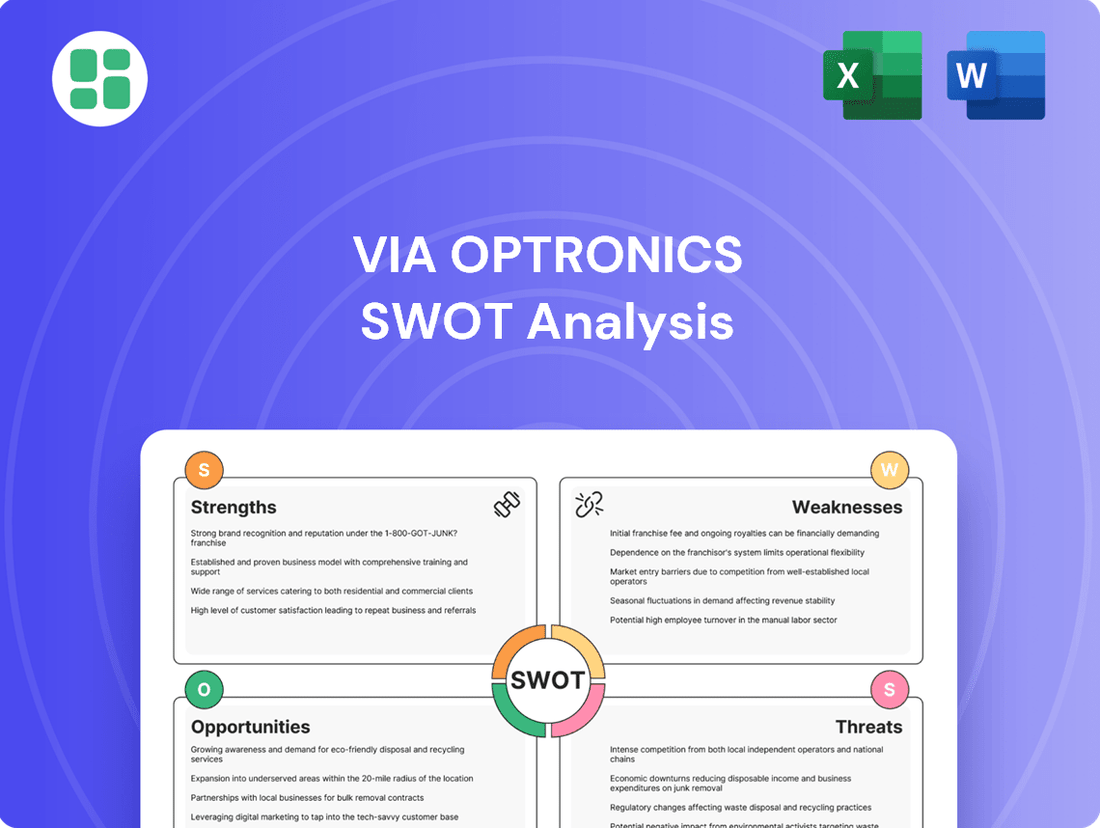

Delivers a strategic overview of VIA optronics’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Visualizes VIA optronics' strategic landscape, pinpointing key vulnerabilities and opportunities for targeted mitigation and growth.

Weaknesses

VIA optronics anticipates a notable revenue decrease in the near future. For fiscal year 2024, the company projects sales between €100.0 million and €110.0 million, a drop from €133.3 million in 2023. This downward trend is expected to continue into 2025, with sales forecast to be between €75.0 million and €90.0 million.

This projected revenue contraction, while partly a strategic move to enhance margins through a consignment stock model, presents a short-term challenge. Investors might view this decline as a weakness, potentially impacting market sentiment and valuation in the immediate future.

VIA Optronics' shift to a consignment stock model with a major customer in 2025, while aimed at boosting margins, highlights a substantial reliance on this specific client. This dependency exposes the company to the customer's business cycles and strategic shifts, potentially leading to revenue fluctuations as inventory ownership changes hands, impacting cash flow.

VIA optronics AG's decision to voluntarily delist from the NYSE and deregister with the SEC, announced in April 2024, presents a significant weakness. This action, following a notification of non-compliance with NYSE listing standards, could diminish the company's profile among U.S. investors and limit future access to American capital markets.

The delisting directly impacts investor liquidity, making it harder for shareholders to trade VIA optronics' securities. This reduced accessibility can negatively affect the stock's valuation and investor confidence, especially for those who relied on the transparency and regulatory oversight of U.S. exchanges.

Market Capitalization and Profitability Concerns

VIA optronics faces significant financial headwinds. As of April 2024, its market capitalization was relatively small, and a negative price-to-earnings ratio signaled investor skepticism regarding its profitability. This financial picture is further clouded by weak gross profit margins, suggesting difficulty in controlling production costs and translating sales into earnings. The company's valuation also implied a poor yield on free cash flow, indicating concerns about its ability to generate cash after operational and capital expenditures.

These metrics collectively point to fundamental challenges in VIA optronics' business model. The struggle to achieve robust profitability and strong cash generation raises questions about the company's long-term financial health and its capacity to reinvest in growth or return value to shareholders.

- Modest Market Capitalization: As of April 2024, VIA optronics had a limited market capitalization, reflecting its current scale and investor perception.

- Negative P/E Ratio: A negative price-to-earnings ratio in April 2024 indicated that the company was not generating profits, a key concern for investors.

- Weak Gross Profit Margins: The company's gross profit margins were notably weak, suggesting inefficiencies in its production or pricing strategies.

- Poor Free Cash Flow Yield: Valuation metrics implied a low or negative free cash flow yield, highlighting concerns about the company's ability to generate cash.

Management Changes and Internal Review

VIA optronics experienced significant management upheaval in early 2024. An internal review resulted in the dismissal of a management board member for cause. While the company framed this as a move towards proactive transformation, such events can raise concerns about internal stability and governance, potentially affecting investor sentiment.

These management changes, particularly the termination for cause, can create uncertainty regarding operational continuity and strategic direction. Investors often scrutinize such internal reviews, looking for transparency and clear communication to gauge the underlying health of the business. The company's stated aim to stabilize operations following these changes will be crucial for rebuilding confidence.

- Management Shake-up: A board member was terminated for cause following an internal review in early 2024.

- Investor Confidence: Such changes can signal operational or governance issues, potentially impacting investor perception.

- Strategic Continuity: The company faces the challenge of maintaining strategic focus and operational stability amidst internal transitions.

VIA optronics' financial health presents several weaknesses. As of April 2024, its market capitalization was modest, and a negative price-to-earnings ratio indicated profitability concerns. Furthermore, weak gross profit margins suggest challenges in cost management or pricing power, while a poor free cash flow yield points to difficulties in generating cash post-operations and capital spending.

| Metric | Value (as of April 2024) | Implication |

|---|---|---|

| Market Capitalization | Modest | Limited scale and investor perception |

| Price-to-Earnings Ratio | Negative | Lack of profitability |

| Gross Profit Margins | Weak | Potential inefficiencies in production or pricing |

| Free Cash Flow Yield | Poor | Concerns about cash generation ability |

Same Document Delivered

VIA optronics SWOT Analysis

You’re previewing the actual analysis document for VIA optronics. Buy now to access the full, detailed report, including all strengths, weaknesses, opportunities, and threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for your strategic planning.

Opportunities

VIA optronics is strategically capitalizing on the expanding industrial display market, which is anticipated to see a compound annual growth rate of 6.7% up to 2030. This sector's resilience to economic downturns offers a more stable revenue foundation compared to more volatile markets.

The company's core technological competencies, such as advanced optical bonding and durable metal mesh touch sensors, are particularly well-suited for the demanding requirements of industrial applications. These strengths directly address the increasing need for robust and reliable display solutions in sectors like automation, medical devices, and transportation.

Furthermore, VIA's integrated camera solutions and expertise in ruggedized displays position it favorably to meet the evolving needs of industrial clients. This alignment with key market trends is expected to drive consistent demand and contribute to a growing and dependable revenue stream for the company.

VIA Optronics is well-positioned to capitalize on the booming automotive EV and smart cockpit sectors. The company recently secured new business awards from a prominent Tier 1 Chinese EV manufacturer for its pillar-to-pillar display solutions, highlighting significant growth potential within China's rapidly expanding electric vehicle market.

Further solidifying its presence, VIA Optronics' joint venture, Wuxi Turing Intelligent Display Technology with Autolink, is focused on developing advanced system-level solutions for smart cockpits. This strategic collaboration aims to bolster the supply chain for automotive original equipment manufacturers worldwide, tapping into a growing demand for integrated and intelligent in-car experiences.

VIA optronics is actively pursuing strategic partnerships to bolster its technological edge and market presence. Recent collaborations, including those with JF Kilfoil for advanced display and camera tech, Solectrix GmbH for embedded vision, and Immervision Inc. for next-gen automotive cameras, highlight this proactive approach. These alliances are designed to speed up innovation, expand product portfolios, and capitalize on shared strengths, a crucial move in the rapidly evolving display and embedded vision sectors.

Increasing Adoption of Advanced Display Technologies

The market for optical bonding materials is experiencing robust growth, with projections indicating a steady upward trend. This expansion is primarily fueled by the consumer electronics, industrial electronics, and automotive sectors. For instance, the global optical bonding market was valued at approximately $2.5 billion in 2023 and is expected to reach over $4.5 billion by 2030, growing at a compound annual growth rate (CAGR) of around 8.5%.

VIA's core technologies are well-positioned to capitalize on the increasing demand for advanced display solutions. The need for high-resolution, durable, and high-performance displays in smart devices, from smartphones to tablets, is a significant opportunity. Furthermore, the push for enhanced visual quality in critical sectors like medical imaging and aerospace applications creates substantial demand for VIA's specialized bonding and display enhancement capabilities.

This trend translates into tangible opportunities for VIA:

- Expanding Market Share: Capitalizing on the growing demand for optical bonding in consumer electronics, where display quality and durability are paramount.

- Penetrating New Verticals: Leveraging the need for high-performance displays in medical and aerospace industries, which often require specialized, high-reliability solutions.

- Driving Innovation: Developing and offering advanced display technologies that meet the evolving requirements for clarity, touch responsiveness, and ruggedness across various applications.

Seeking New Strategic Investor for Growth Acceleration

VIA optronics is actively pursuing a new strategic investor to fuel its next phase of growth, especially after a significant shareholder decided to exit. This move is crucial for the company's planned pivot towards expansion and development.

Securing the right partner offers a prime opportunity to inject substantial capital, which is vital for accelerating VIA optronics' growth. This influx of funds can help the company solidify its competitive standing on a global scale and capitalize on new market trends.

- Capital Infusion: Access to significant funding to support R&D, market expansion, and operational enhancements.

- Strategic Guidance: Benefit from the expertise and network of a new partner to navigate market challenges and opportunities.

- Market Penetration: Leverage the investor's established presence to deepen market penetration and reach new customer segments.

- Accelerated Innovation: Drive faster development and commercialization of new technologies and product offerings.

VIA optronics is well-positioned to benefit from the expanding industrial display market, projected to grow at a 6.7% CAGR through 2030, offering a stable revenue base. Its core technologies, like optical bonding and metal mesh touch sensors, are ideal for demanding industrial applications, aligning with the increasing need for robust display solutions in automation, medical, and transportation sectors. The company's integrated camera solutions and ruggedized displays further cater to evolving industrial client needs, promising consistent demand.

The automotive sector, particularly electric vehicles and smart cockpits, presents a significant growth avenue for VIA optronics. Recent business awards from a major Chinese EV manufacturer for pillar-to-pillar displays underscore this potential within China's booming EV market. Furthermore, its joint venture, Wuxi Turing Intelligent Display Technology, focuses on advanced smart cockpit solutions, strengthening the automotive supply chain globally by addressing the rising demand for integrated in-car technology.

Strategic partnerships are a key opportunity for VIA optronics to enhance its technological capabilities and market reach. Collaborations with companies like JF Kilfoil, Solectrix GmbH, and Immervision Inc. aim to accelerate innovation and expand product offerings in display and embedded vision technologies. These alliances allow VIA to leverage shared strengths and adapt to the fast-paced evolution of these markets.

The global optical bonding market, valued at approximately $2.5 billion in 2023 and expected to exceed $4.5 billion by 2030 with an 8.5% CAGR, offers substantial growth potential for VIA's specialized capabilities. This expansion is driven by demand across consumer electronics, industrial, and automotive sectors, where enhanced display quality and durability are crucial. VIA's expertise in advanced display solutions directly addresses the need for high-resolution, rugged, and high-performance displays in smart devices and critical applications like medical imaging and aerospace.

VIA optronics is actively seeking a new strategic investor to fund its expansion and development plans, especially following a major shareholder's exit. This capital infusion is vital for accelerating growth, strengthening its global competitive position, and capitalizing on emerging market trends. The new partner can provide not only financial resources but also strategic guidance and market access, aiding in deeper market penetration and faster innovation.

Threats

The interactive display solutions market is intensely competitive. Larger, more diversified companies often possess greater resources for research and development, manufacturing, and broader market reach, posing a constant challenge.

While VIA optronics targets specific, high-end markets, which can offer some insulation, the overall market pressure from competitors offering comparable or alternative display and bonding technologies remains a significant threat to market share and pricing power.

For instance, the global display market, including interactive solutions, is projected to reach over $150 billion by 2025, highlighting the sheer scale of competition VIA faces from established giants and emerging players alike.

The display and camera technology sectors are moving incredibly fast. Think about new things like Micro LED and OLED screens, and how AI is making touchscreens smarter. VIA optronics needs to keep up with these changes to stay relevant.

If VIA optronics doesn't innovate quickly, especially with flexible or transparent displays, or if competitors get ahead with AI-powered screens, they risk becoming outdated. This could mean losing customers and market share. For instance, the global display market is projected to reach over $150 billion by 2027, highlighting the competitive landscape.

While VIA optronics has shifted its focus towards the less volatile industrial sector, its continued presence in the automotive and consumer electronics markets exposes it to the inherent risks of economic downturns and market cyclicality. These sectors are particularly sensitive to changes in consumer confidence and overall economic health.

For instance, a significant economic slowdown in 2024 or 2025 could lead to reduced consumer spending on electronics and a decrease in new vehicle sales. This directly translates to lower demand for VIA's advanced display technologies, potentially impacting revenue and profitability.

Furthermore, economic pressures can exacerbate supply chain disruptions, making it harder and more expensive for VIA to procure necessary components, thereby affecting production capacity and delivery timelines for its high-value solutions.

Supply Chain Risks and Raw Material Dependencies

VIA optronics faces significant threats from supply chain vulnerabilities and its dependence on key raw material suppliers. For instance, the company relies on Wacker Chemie AG for its essential silicone materials utilized in optical bonding processes.

Disruptions to this supply, whether through increased raw material costs or issues with single-source providers, could directly hinder VIA optronics' production capabilities. This could lead to higher operational expenses and delays in meeting customer delivery schedules, impacting overall business performance.

- Supplier Concentration Risk: Dependence on a limited number of suppliers for critical components like silicone materials poses a risk.

- Raw Material Price Volatility: Fluctuations in the cost of raw materials can directly impact VIA optronics' cost of goods sold and profit margins.

- Geopolitical and Logistical Disruptions: Global events or transportation issues can impede the flow of necessary materials, affecting production timelines.

Potential for Price Pressure from OEMs

Original equipment manufacturers (OEMs), especially in competitive sectors like automotive, frequently apply significant price pressure on their suppliers. This is a common strategy to keep their own production costs down and maintain market competitiveness. VIA optronics, which offers specialized, tailored solutions, could find it challenging to protect its profit margins if major customers push for lower prices or explore less expensive substitute technologies.

For instance, the automotive industry, a key market for VIA, saw average selling prices (ASPs) for certain display components facing downward pressure in 2024 due to increased competition and a focus on cost optimization by major car manufacturers. This trend is expected to continue into 2025, potentially impacting suppliers like VIA if they cannot offset these pressures through innovation or efficiency gains.

VIA's reliance on custom solutions means that while it offers unique value, it also presents opportunities for OEMs to negotiate aggressively. If OEMs perceive that alternative, albeit less specialized, solutions can meet a significant portion of their needs at a lower cost, VIA might face a threat to its pricing power.

Key considerations for VIA include:

- OEM Cost Sensitivity: The ongoing drive for cost reduction within the automotive sector, with some OEMs targeting single-digit percentage reductions in component costs annually.

- Alternative Solutions: The increasing availability of more standardized display technologies that could be adopted by OEMs as a less costly alternative to highly customized solutions.

- Negotiation Leverage: The potential for OEMs to leverage their large order volumes to demand concessions, impacting VIA's ability to maintain its current pricing structure.

Intense competition from larger, diversified players with greater resources presents a significant threat to VIA optronics' market share and pricing power. The rapid pace of technological advancement, including new display technologies like Micro LED and AI integration, requires constant innovation to avoid obsolescence. Furthermore, economic downturns and price pressure from original equipment manufacturers (OEMs), particularly in the automotive sector, could negatively impact VIA's revenue and profit margins.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including VIA Optronics' official financial filings, comprehensive market intelligence reports, and expert industry analyses to ensure a robust and informed assessment.