VIA optronics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIA optronics Bundle

VIA optronics operates in a dynamic landscape shaped by intense competition, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for navigating its market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore VIA optronics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

VIA optronics' reliance on key suppliers for essential components such as display panels, specialized glass, and camera modules highlights a potential area of supplier power. If the number of suppliers for these critical inputs is limited and these suppliers possess unique technological expertise, they can command greater influence over pricing and terms.

The specialization of certain suppliers, particularly in areas like optical bonding materials, further concentrates bargaining power. This specialization means VIA optronics may have fewer viable alternatives, increasing the leverage of these specialized suppliers in negotiations.

Switching suppliers for VIA Optronics' highly integrated and customized display solutions presents significant hurdles. These aren't off-the-shelf components; they are often tailored to specific product designs. This customization means that changing a supplier isn't just a matter of placing a new order. It involves a complex requalification process, potentially requiring redesigns of VIA Optronics' own products, and can lead to production delays. These factors inherently increase the bargaining power of existing suppliers, as the cost and effort to switch are substantial.

Suppliers offering unique or highly specialized components, particularly those essential for VIA optronics’ advanced optical bonding solutions, wield significant bargaining power. The distinctiveness of these inputs means VIA optronics has fewer alternatives, increasing supplier leverage.

The quality and performance of these specialized inputs are paramount, directly influencing the final product's quality and VIA optronics' competitive standing in the market. For instance, a supplier of a proprietary adhesive crucial for high-clarity optical bonding can command higher prices due to its irreplaceability.

Threat of Forward Integration by Suppliers

The bargaining power of suppliers is amplified if they possess the capability or incentive to enter VIA optronics' core markets, such as display integration or system solutions. This potential for forward integration transforms suppliers into direct competitors, significantly enhancing their leverage and ability to dictate terms.

If key component suppliers, for instance, those providing advanced display panels or specialized optical components, were to develop their own integration services or complete system offerings, they could directly challenge VIA optronics. This scenario would allow them to capture more of the value chain, potentially leading to increased pricing pressure or reduced access to critical components for VIA optronics.

- Supplier Capability: Suppliers with strong R&D in display technology and system assembly could leverage existing expertise to enter VIA optronics' market.

- Market Incentives: If suppliers see higher margins or greater growth potential in offering integrated solutions rather than just components, they are more likely to pursue forward integration.

- Competitive Landscape: The presence of suppliers capable of forward integration increases the overall competitive intensity for VIA optronics, potentially impacting its market share and profitability.

Importance of VIA Optronics to Suppliers

VIA Optronics' significance as a customer impacts its suppliers' bargaining power. If VIA Optronics accounts for a substantial portion of a supplier's annual sales, that supplier may have less leverage. However, this is generally less of a factor for suppliers of commodity components, where VIA Optronics is just one of many buyers.

For specialized components crucial to VIA Optronics' advanced display solutions, the dynamic shifts. For instance, in 2023, the demand for high-brightness displays, a core VIA Optronics product, grew, potentially increasing the reliance of specialized component manufacturers on VIA Optronics' orders. This reliance can temper a supplier's ability to dictate terms.

- Customer Dependence: VIA Optronics' purchasing volume can reduce supplier power if it represents a significant revenue stream for the supplier.

- Component Specialization: The more unique or specialized a component is for VIA Optronics' products, the less bargaining power the supplier typically holds.

- Market Dynamics: In growing markets for VIA Optronics' technologies, like advanced automotive displays, suppliers may become more dependent on VIA Optronics, thus reducing their leverage.

The bargaining power of suppliers for VIA Optronics is significantly influenced by the concentration of suppliers for critical components like specialized glass and advanced display panels. If there are few suppliers capable of meeting VIA Optronics' stringent quality and technological requirements, these suppliers can exert considerable influence on pricing and terms. For example, in 2023, the automotive display market, a key sector for VIA Optronics, saw continued demand for high-resolution and high-brightness panels, potentially increasing the leverage of suppliers in this niche.

| Factor | Impact on VIA Optronics | Example Scenario |

|---|---|---|

| Supplier Concentration | High power if few suppliers for critical components. | A single supplier for a proprietary optical bonding material. |

| Switching Costs | High costs increase supplier power due to customization. | Requalification and potential redesigns for new display panel suppliers. |

| Supplier Forward Integration | Potential threat if suppliers offer integrated solutions. | A display panel manufacturer also offering integrated display modules. |

| Customer Dependence | Reduced supplier power if VIA Optronics is a major customer. | VIA Optronics representing a significant portion of a specialized glass supplier's revenue. |

What is included in the product

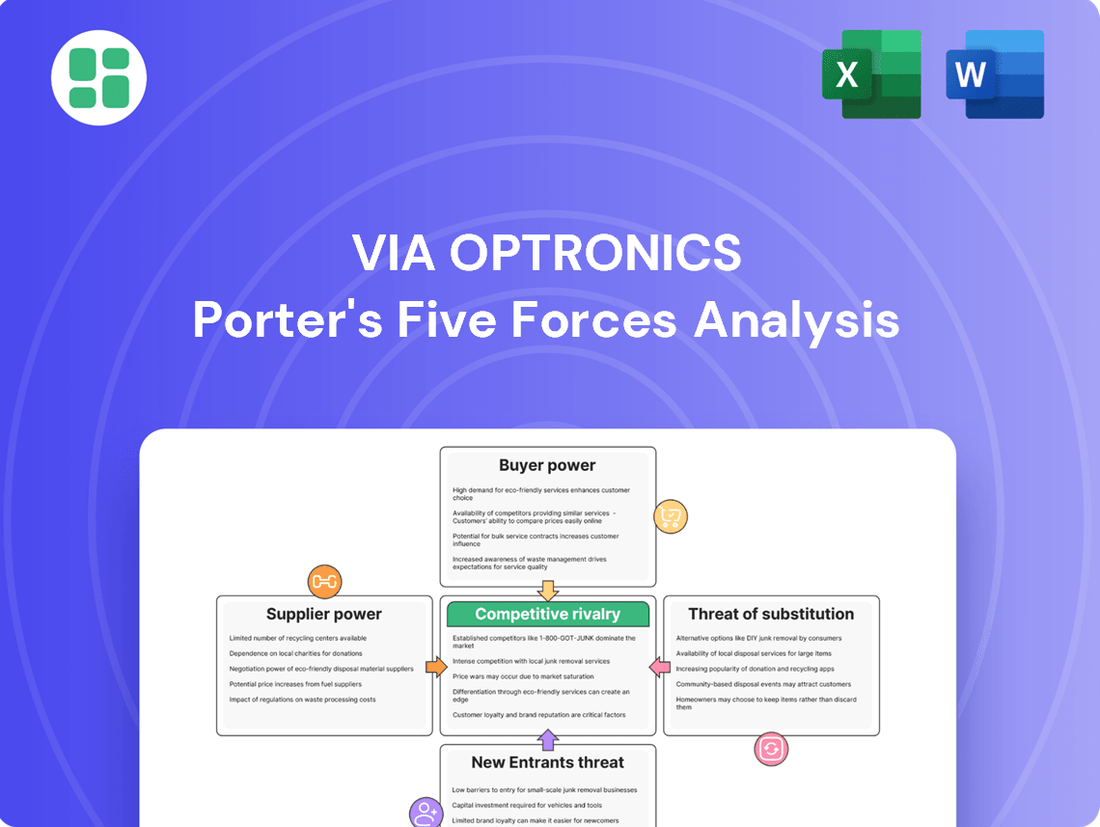

VIA optronics' Porter's Five Forces analysis examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the risk of substitutes impacting its market position.

Instantly identify and mitigate competitive threats with a visual overview of all five forces, empowering proactive strategic adjustments.

Customers Bargaining Power

VIA optronics operates in sectors like automotive and industrial, where key customers are often large original equipment manufacturers (OEMs). These major clients, particularly in the automotive industry, procure components in substantial quantities, giving them considerable leverage to negotiate pricing and favorable terms. For instance, a single large automotive OEM could represent a significant portion of VIA optronics' revenue, amplifying the customer's bargaining power.

Even though VIA optronics specializes in custom solutions and optical bonding, customers can still find alternative suppliers for integrated display solutions. Competitors also offer similar products, and some larger clients might even possess the internal capabilities to develop these solutions themselves. This means customers aren't solely reliant on VIA optronics, which inherently gives them more leverage.

Customer switching costs are a significant factor in the automotive sector, where VIA optronics operates. For instance, redesigning and re-testing display modules in vehicles can cost millions of dollars and extend development timelines by months. This complexity, coupled with the need for robust supply chain integration, makes it economically unfeasible for many automotive manufacturers to switch display providers frequently.

VIA optronics’ focus on customized, safety-critical display solutions further solidifies this. These highly integrated products require extensive validation and certification processes, making the cost and effort of switching extremely high for their clients. This inherently limits the bargaining power of customers, as the financial and operational hurdles to changing suppliers are substantial.

Price Sensitivity of Customers

Customers in highly competitive sectors like consumer electronics often exhibit significant price sensitivity. This means VIA optronics faces pressure to maintain competitive pricing strategies to secure sales. Even when purchasing premium products, the overall cost-efficiency of a deal remains a crucial element in the final decision-making process for these buyers.

The bargaining power of customers is a key consideration for VIA optronics, particularly in markets where product differentiation is less pronounced. For instance, in the consumer electronics segment, where numerous suppliers offer similar components, buyers can readily switch to alternatives if pricing is not aligned with their budget. This dynamic directly impacts VIA optronics' pricing flexibility and profit margins.

- Price Sensitivity in Consumer Electronics: In 2024, the consumer electronics market continued to be characterized by intense competition, with brands frequently engaging in price wars to capture market share. This environment inherently increases customer price sensitivity for components like those supplied by VIA optronics.

- Impact on VIA optronics' Pricing: The need to offer competitive pricing can limit VIA optronics' ability to command premium prices, even for technologically advanced products. This necessitates a strong focus on cost management throughout their value chain.

- Cost-Efficiency as a Driver: Across various end markets, including those perceived as premium, the underlying drive for cost-efficiency in purchasing decisions remains a constant. Customers evaluate the total cost of ownership, not just the initial price, making VIA optronics' operational efficiency critical.

Threat of Backward Integration by Customers

Large customers, especially those in demanding sectors like automotive and industrial markets, possess significant bargaining power. If display integration or optical bonding becomes strategically or economically feasible for them to handle internally, they may explore backward integration. This capability inherently strengthens their negotiating position with suppliers like VIA optronics.

The threat of backward integration by customers is a critical factor influencing VIA optronics' pricing and terms. For example, a major automotive OEM could potentially develop its own in-house capabilities for optical bonding, thereby reducing its reliance on external suppliers. This potential shift directly impacts the supplier's ability to dictate terms and pricing.

- Customer Leverage: The ability of large customers to consider in-house production of display integration or optical bonding significantly enhances their bargaining power.

- Strategic Viability: If bringing these processes in-house becomes strategically advantageous, such as for greater control over quality or supply chain security, customers are more likely to pursue it.

- Economic Feasibility: Cost considerations play a crucial role; if customers can achieve cost savings or efficiencies by integrating backward, this threat becomes more pronounced.

- Market Dynamics: In sectors like automotive, where component integration is complex, the potential for a major player to internalize these functions can reshape supplier relationships.

VIA optronics faces substantial bargaining power from its customers, particularly large original equipment manufacturers (OEMs) in the automotive and industrial sectors. These major clients, due to their sheer volume and the high switching costs associated with display integration, wield significant influence over pricing and terms. Furthermore, the potential for customers to develop in-house capabilities for optical bonding or display integration poses a direct threat, amplifying their negotiating leverage.

| Customer Segment | Key Leverage Factors | Impact on VIA optronics |

|---|---|---|

| Automotive OEMs | High volume procurement, significant switching costs (re-testing, certification), potential for backward integration | Pressure on pricing, need for strong supplier relationships, focus on long-term contracts |

| Industrial OEMs | Substantial order sizes, demand for custom solutions, integration complexity | Negotiating power on specifications and pricing, emphasis on reliability and support |

| Consumer Electronics | High price sensitivity, availability of alternative suppliers, lower switching costs | Need for competitive pricing, focus on cost-efficiency, potential margin compression |

Same Document Delivered

VIA optronics Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for VIA optronics, presenting the exact document you will receive immediately after purchase. You are viewing the complete, professionally formatted report, ensuring no surprises or placeholders, and it will be ready for your immediate use upon payment.

Rivalry Among Competitors

The market for customized display solutions, particularly in specialized areas like optical bonding, tends to have a more concentrated competitive landscape compared to mass-market displays. While the sheer number of competitors might be lower, the presence of established niche specialists and larger, diversified electronics manufacturers can significantly heighten rivalry.

For instance, in 2024, VIA optronics operates in a segment where key players often possess deep technical expertise and long-standing customer relationships. Companies like 3M, with its extensive history in optical films and bonding technologies, and manufacturers focusing on ruggedized or high-brightness displays for demanding environments, represent formidable competition. The intensity is further amplified by the need for significant R&D investment to stay ahead in areas like advanced bonding materials and display integration.

VIA optronics is strategically increasing its emphasis on the industrial display market, a sector anticipated to experience robust growth. This strategic shift is crucial as slower expansion in other business areas or a general market downturn can heighten competitive pressures, forcing companies to vie more aggressively for existing market share.

VIA optronics stands out through its deep expertise in optical bonding, offering highly customized solutions that set it apart from competitors. This specialization allows the company to command a premium and reduces the pressure of direct price wars. For instance, in 2024, VIA optronics continued to emphasize its advanced bonding techniques for demanding applications like automotive displays, where precision and durability are paramount.

However, this differentiation isn't a permanent shield. Competitors are actively working to replicate VIA optronics' technological advantages or develop innovative alternatives that could challenge its market position. The industry saw ongoing R&D investments in 2024 from various players aiming to achieve similar levels of optical clarity and environmental resistance in their display bonding processes.

High Fixed Costs and Exit Barriers

The display solution manufacturing sector demands considerable capital for research and development, specialized machinery, and extensive production facilities. This high level of upfront investment creates substantial exit barriers, meaning companies find it difficult and costly to leave the market.

Consequently, existing players often engage in fierce competition to ensure they maintain sufficient production volumes to cover their significant fixed costs. This dynamic can lead to price pressures and a relentless drive for market share among competitors.

- High Capital Intensity: The display industry requires significant investment in R&D and specialized manufacturing equipment.

- Substantial Exit Barriers: The specialized nature of the assets and high sunk costs make exiting the market challenging and expensive.

- Pressure to Maintain Volume: Companies must operate at high capacity to amortize fixed costs, intensifying rivalry.

- Impact on Pricing: The need to cover fixed costs can lead to aggressive pricing strategies to capture market share.

Strategic Alliances and Joint Ventures

VIA optronics' engagement in strategic alliances and joint ventures, such as its collaboration with Autolink, highlights a key aspect of its competitive environment. These partnerships are crucial for expanding market reach and developing integrated product offerings.

The company's strategic moves demonstrate a proactive approach to navigating a market where cooperation can be as significant as direct competition. For instance, VIA optronics reported revenue growth in its automotive segment, partly driven by such strategic partnerships, underscoring their commercial importance.

- Strategic Alliances: VIA optronics' agreement with Autolink exemplifies how companies form alliances to enhance their competitive positioning.

- Market Dynamics: These collaborations signal a shift in rivalry, moving towards integrated solutions and expanded market access.

- Revenue Impact: The automotive sector, a key area for VIA optronics, has seen positive contributions from these strategic ventures, reflecting their commercial viability.

Competitive rivalry in VIA optronics' specialized display sector is intense, driven by established niche players and large diversified companies. High capital requirements for R&D and manufacturing create significant barriers to entry, forcing existing firms to compete fiercely for market share to cover fixed costs. VIA optronics differentiates itself through advanced optical bonding expertise, but competitors are actively investing to match these capabilities.

For example, in 2024, VIA optronics' focus on the growing industrial display market intensified competition, as companies vied for a larger piece of this expanding pie. Strategic alliances, like the one with Autolink, are crucial for VIA optronics to expand its reach and offer integrated solutions, reflecting a dynamic where collaboration can be as important as direct competition.

| Competitor Type | Key Differentiator | 2024 Competitive Action Example |

|---|---|---|

| Niche Specialists | Deep technical expertise in optical bonding | Ongoing R&D to replicate VIA optronics' advanced bonding techniques |

| Diversified Electronics Manufacturers | Broad product portfolios and established customer bases | Leveraging existing infrastructure to enter specialized display segments |

| New Entrants (Potential) | Disruptive technologies or cost advantages | Seeking to challenge market incumbents with innovative solutions |

SSubstitutes Threaten

While VIA's optical bonding is a key strength, alternative display technologies pose a significant threat. For instance, advancements in micro-LED and OLED displays are offering enhanced brightness and contrast ratios, potentially reducing the perceived need for traditional optical bonding. Companies are exploring new lamination techniques for these emerging displays that could bypass VIA's specialized integration methods, thereby offering comparable or even superior performance without relying on VIA's core competencies. This innovation in display technology directly challenges the unique value proposition of VIA's current offerings.

Customers might choose simpler, readily available display components instead of VIA optronics' specialized, optically bonded solutions. This is especially likely if budget constraints are a major concern, and the need for highly integrated or unique performance is lower. For instance, a manufacturer looking for basic display functionality might source standard panels and assemble them in-house, bypassing the premium associated with VIA's advanced integration.

Large automotive and industrial original equipment manufacturers (OEMs) possess the financial and technical resources to bring display integration in-house. This strategic shift aims to secure greater control over their supply chains, protect proprietary technology, and potentially achieve better cost structures. For instance, a major automotive player might invest in specialized cleanroom facilities and hire experienced engineers to replicate VIA optronics' core competencies, thereby reducing their dependence on external providers.

Non-Display Human-Machine Interfaces (HMIs)

The long-term threat of substitutes for traditional display-based HMIs, like those VIA optronics might offer, is significant. These substitutes represent entirely new ways for humans to interact with machines, potentially bypassing the need for screens altogether.

Consider advancements in voice control; companies are investing heavily, with the global smart speaker market alone projected to reach over $15 billion by 2026. Similarly, augmented reality (AR) is gaining traction, with AR headset shipments expected to grow substantially in the coming years, offering visual information without a traditional display. Haptic feedback systems, which provide tactile responses, can also enhance interaction, reducing reliance on visual cues.

- Voice Control: Growing adoption in smart homes and automotive sectors reduces the need for visual interfaces.

- Augmented Reality (AR): AR overlays digital information onto the real world, potentially replacing standalone displays for certain tasks.

- Haptic Feedback: Tactile interfaces can provide crucial information, lessening dependence on visual HMIs.

Cost-Performance Trade-offs

Customers are always weighing the cost against the performance of different options. If alternative technologies or simpler integration methods can deliver acceptable results at a much lower price point, they present a significant challenge to VIA optronics' higher-priced products.

For instance, in the display technology market, advancements in standard LCD panels continue to improve their performance metrics, making them increasingly competitive against more advanced solutions like VIA optronics' specialized optical bonding for demanding applications. In 2023, the global market for standard LCD panels was valued at approximately $130 billion, showcasing the sheer scale of these potential substitutes.

- Cost Sensitivity: Many customers prioritize cost savings, especially in less critical applications where 'good enough' performance is sufficient.

- Technological Convergence: As standard technologies improve, the performance gap narrows, making them more attractive alternatives.

- Market Segmentation: VIA optronics' premium solutions face greater threat in market segments where price is a primary purchasing driver.

The threat of substitutes for VIA optronics' optically bonded displays is multifaceted, stemming from both evolving display technologies and entirely new interaction paradigms. Advancements in micro-LED and OLED offer improved brightness and contrast, potentially diminishing the need for traditional optical bonding. Furthermore, emerging human-machine interface (HMI) technologies like advanced voice control and augmented reality (AR) present a significant long-term threat by offering alternative interaction methods that bypass screens altogether.

| Substitute Technology | Key Characteristic | Potential Impact on VIA Optronics | 2024 Market Context/Projection |

|---|---|---|---|

| Advanced LCD Panels | Improved brightness, contrast, and cost-effectiveness | Erodes demand in cost-sensitive segments; narrows performance gap | Global LCD market valued around $125 billion in 2024, with ongoing performance improvements. |

| Micro-LED & OLED Displays | Superior brightness, contrast, and flexibility | Reduces perceived need for optical bonding; potential for new lamination techniques | OLED market projected to exceed $30 billion in 2024; Micro-LED is emerging with significant growth potential. |

| Voice Control & Haptics | Screen-less interaction | Disrupts traditional HMI reliance; bypasses display entirely | Smart speaker market alone projected to exceed $18 billion by 2027. |

| Augmented Reality (AR) | Overlaying digital information | Offers alternative information delivery, reducing reliance on standalone displays | AR headset shipments expected to grow by over 40% annually through 2025. |

Entrants Threaten

Entering the specialized market for customized display solutions and optical bonding demands significant upfront investment. Companies need to fund advanced manufacturing equipment, sophisticated research and development, and the setup of cleanroom facilities, often running into millions of dollars. For instance, the semiconductor and advanced display manufacturing sectors, which VIA optronics operates within, typically require capital expenditures in the tens to hundreds of millions for a new, state-of-the-art facility.

VIA optronics' strong intellectual property, particularly its process know-how in optical bonding and metal mesh touch sensors, acts as a substantial barrier to new entrants. This proprietary technology, often protected by patents, makes it difficult and costly for competitors to replicate their advanced manufacturing techniques and product performance, thereby limiting the threat of new companies entering the market.

Existing players like VIA optronics leverage significant economies of scale in their manufacturing processes and procurement of specialized components. This allows them to achieve lower per-unit costs that are difficult for newcomers to replicate. For instance, in 2023, VIA optronics' revenue of €102.4 million suggests a substantial operational footprint, enabling them to negotiate better terms with suppliers and optimize production efficiency.

Furthermore, VIA optronics has cultivated deep experience in handling complex, customized optical solutions and integrating them into various demanding applications. This accumulated know-how, built over years of operation, translates into a competitive advantage in product development and quality assurance that new entrants would find challenging to acquire rapidly. Their ability to manage intricate supply chains and deliver high-performance products is a testament to this experience curve.

Access to Distribution Channels and Customer Relationships

New companies entering the display technology market face significant hurdles in gaining access to established distribution channels and building strong customer relationships, particularly within the demanding automotive, industrial, and medical sectors. These industries require proven reliability and long-standing trust, making it difficult for newcomers to penetrate. VIA optronics benefits from its existing, robust partnerships, which represent a substantial barrier to entry for potential competitors.

Securing relationships with demanding customers in sectors like automotive, industrial, and medical is a time-consuming and resource-intensive process for new entrants. These industries often have stringent qualification processes and prefer suppliers with a track record of consistent quality and support. VIA optronics' established presence and the trust it has cultivated provide a critical competitive advantage, making it harder for new players to gain traction.

- Distribution Channel Access: New entrants struggle to secure shelf space or integration opportunities with major OEMs and Tier 1 suppliers who already have long-term agreements with established players like VIA optronics.

- Customer Relationship Inertia: High switching costs and the need for extensive validation cycles in target industries mean customers are reluctant to change suppliers, favoring existing relationships.

- VIA optronics' Advantage: VIA optronics' existing partnerships, such as those with leading automotive manufacturers, provide immediate access to market segments that are difficult and expensive for new entrants to penetrate.

Regulatory Hurdles and Industry Standards

The threat of new entrants for VIA Optronics is significantly shaped by regulatory hurdles and demanding industry standards, particularly within the automotive and medical sectors. New players must navigate complex certification processes and adhere to stringent quality benchmarks for display and system solutions. For instance, in the automotive industry, compliance with standards like IATF 16949 is crucial, demanding substantial investment in quality management systems and manufacturing processes. Similarly, the medical device sector requires adherence to ISO 13485, imposing rigorous controls on design, production, and post-market surveillance.

These requirements necessitate considerable financial investment and specialized technical expertise, acting as a substantial barrier to entry. Companies like VIA Optronics have already established these capabilities and relationships, making it difficult for newcomers to compete effectively. The ongoing evolution of these standards, driven by technological advancements and safety concerns, further compounds the challenge for potential entrants seeking to enter markets where VIA Optronics operates.

- Regulatory Compliance Costs: New entrants face substantial upfront costs for obtaining certifications and ensuring compliance with industry-specific regulations, such as IATF 16949 for automotive or ISO 13485 for medical devices.

- Technical Expertise Gap: Demonstrating the required technical proficiency and quality assurance processes to meet established industry standards is a significant hurdle for new companies.

- Market Access Restrictions: Stringent standards can limit market access for new entrants until they have proven their ability to meet or exceed existing benchmarks.

The threat of new entrants into VIA optronics' specialized display and optical bonding market is moderate to low. High capital requirements for advanced manufacturing, coupled with the need for sophisticated R&D, present significant financial barriers. For example, establishing a state-of-the-art cleanroom facility in this sector can easily cost tens to hundreds of millions of dollars.

VIA optronics' strong intellectual property, including proprietary process know-how in optical bonding and metal mesh touch sensors, further deters new competitors. This technological advantage, often protected by patents, makes replication costly and time-consuming. Additionally, established economies of scale, evidenced by VIA optronics' 2023 revenue of €102.4 million, allow for lower per-unit costs that newcomers struggle to match.

Deep customer relationships and access to distribution channels, especially in demanding sectors like automotive and medical, are also critical barriers. These industries require proven reliability and extensive validation, favoring established players with a track record. VIA optronics' existing partnerships provide immediate market access, making it difficult for new entrants to gain traction.

Stringent regulatory and industry standards, such as IATF 16949 for automotive and ISO 13485 for medical, impose substantial compliance costs and require significant technical expertise, further limiting new entrants. VIA optronics has already invested in these capabilities and relationships, creating a competitive moat.

Porter's Five Forces Analysis Data Sources

Our VIA Optronics Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including company annual reports, investor presentations, and market research reports from leading industry analysts.