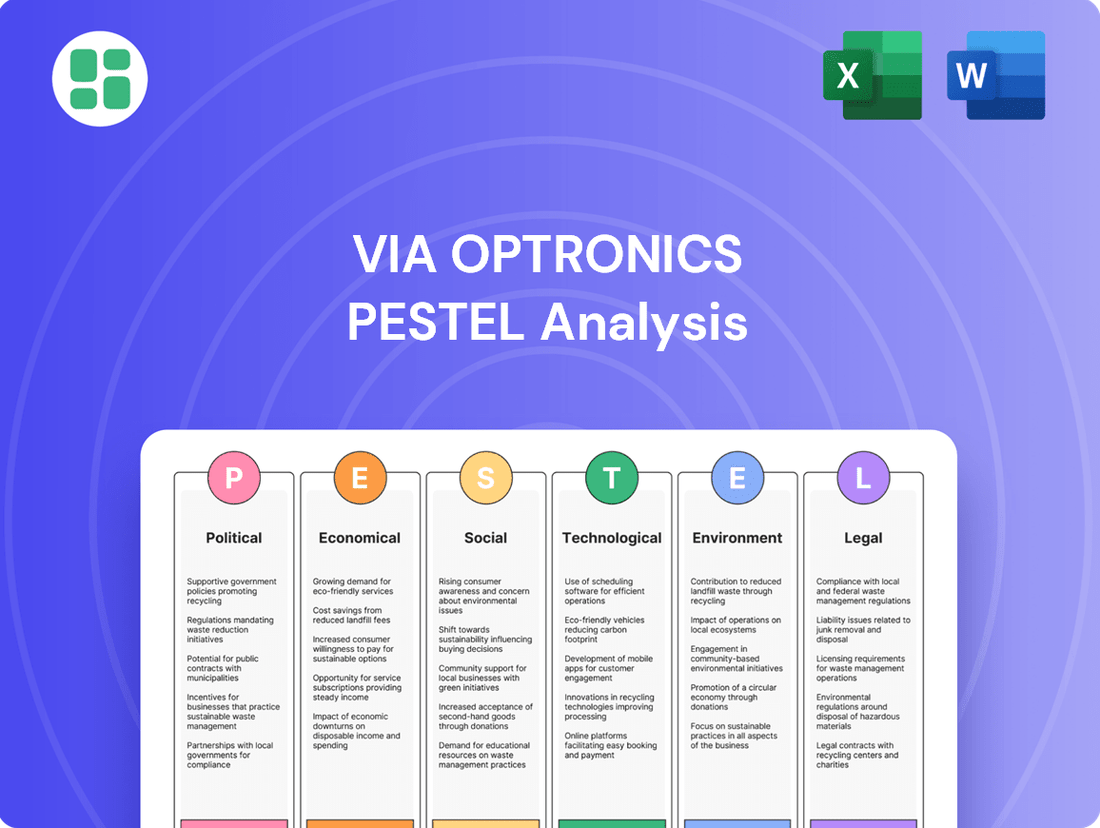

VIA optronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIA optronics Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping VIA optronics's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a strategic advantage.

Political factors

Geopolitical trade policies, especially ongoing tensions and protectionist measures between major economic powers like the US and China, directly influence VIA optronics' global operations. These policies can disrupt supply chains for essential components, as seen with semiconductor trade restrictions impacting the electronics industry. For VIA optronics, this means carefully navigating tariffs and potential import/export bans that could affect component sourcing or market access for their optical solutions.

Government support for domestic manufacturing and high-tech industries presents a dual-edged sword for VIA optronics. Subsidies aimed at boosting automotive and medical technology sectors in key markets, such as Germany's €10 billion investment in battery cell production announced in 2023, could significantly accelerate the adoption of VIA's advanced display solutions in these growing areas.

Conversely, a lack of targeted incentives in other regions might impede market penetration or inflate operational expenses for VIA optronics. For instance, if a major market does not offer R&D tax credits for display technology, VIA's investment in innovation there may face higher relative costs compared to regions with supportive policies.

VIA optronics' operations are significantly influenced by the regulatory stability and ease of doing business in its key markets, including Germany and China. Political stability in these regions directly impacts operational continuity and investment decisions. For instance, Germany's consistent regulatory framework generally supports business growth, while China's evolving policies require careful navigation.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws in VIA optronics' key markets are crucial for safeguarding its innovative optical bonding technologies and display solutions. Strong IP protection is essential for maintaining a competitive advantage and deterring the unauthorized copying of its specialized products. For instance, in 2024, the global IP market saw continued growth in patent filings, highlighting the increasing importance of protecting technological advancements. However, the effectiveness of these protections varies significantly by region, with some markets demonstrating more robust enforcement than others.

Weak IP enforcement presents a substantial risk to VIA optronics' proprietary technologies, potentially leading to market erosion and reduced profitability. Companies like VIA optronics rely on patents and trade secrets to secure their market position. In 2025, reports indicate that countries with strong legal frameworks and consistent enforcement of IP rights are more attractive for technology-intensive businesses. Conversely, regions with lax enforcement can lead to increased counterfeiting and the dilution of brand value, impacting revenue streams and R&D investment recovery.

- Global patent applications in technology sectors continued to rise through 2024, underscoring the value placed on innovation.

- VIA optronics' competitive edge is directly tied to its ability to protect its unique optical bonding processes.

- Regions with weaker IP enforcement pose a direct threat to the company's technological exclusivity.

- Effective IP strategy is a critical component of VIA optronics' long-term business sustainability and market differentiation.

Industry-Specific Regulations and Standards

VIA optronics operates within highly regulated sectors like automotive, industrial, and medical, where stringent standards directly shape product design and market access. For instance, automotive safety regulations, such as those from UNECE WP.29, are continuously updated, impacting display technology requirements. Compliance demands significant R&D investment and rigorous quality assurance, with failure to meet these standards blocking market entry.

The company must navigate evolving certification requirements and quality controls. For example, the medical device sector adheres to ISO 13485, emphasizing robust quality management systems. Changes in these regulations, like new electromagnetic compatibility (EMC) directives, can force VIA optronics to re-engineer products or implement new testing procedures, impacting development timelines and costs.

- Automotive: Adherence to ISO 26262 for functional safety and ECE R121 for interior controls.

- Industrial: Compliance with IEC 60079 for explosive atmospheres and IP ratings for dust/water resistance.

- Medical: Meeting FDA 21 CFR Part 820 for quality system regulation and IEC 60601 for medical electrical equipment safety.

- Data Protection: Navigating GDPR and similar privacy laws impacting data handling in smart display technologies.

Government policies on trade, such as tariffs and export controls, significantly impact VIA optronics' global supply chain and market access, particularly concerning US-China relations. Government incentives for high-tech manufacturing, like Germany's investments in automotive technology, can boost demand for VIA's display solutions, while a lack of such support in other regions may hinder market penetration.

The company's reliance on intellectual property protection is paramount, with global patent applications rising through 2024, yet varying enforcement across regions poses a risk to VIA's technological exclusivity. Regulatory compliance within the automotive, industrial, and medical sectors, including standards like ISO 26262 and FDA 21 CFR Part 820, necessitates continuous R&D investment and can affect product development timelines.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing VIA optronics across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how these forces create both threats and opportunities for the company's strategic planning.

Offers a clear, actionable roadmap by identifying and prioritizing external factors impacting VIA optronics, thereby alleviating the burden of navigating complex market dynamics.

Economic factors

The global economy's trajectory directly influences VIA opotronics' market. Strong economic growth, as seen with the IMF projecting 3.2% global growth for both 2024 and 2025, typically boosts demand for VIA's sophisticated display technologies in sectors like automotive and consumer electronics. This increased investment by clients translates to higher sales volumes for the company.

However, recessionary fears present a significant risk. A downturn could curb client spending on capital expenditures, directly impacting VIA's revenue streams. For instance, if key automotive markets experience a sharp contraction, orders for advanced displays might be postponed or canceled, affecting VIA's financial performance.

VIA optronics' profitability is directly tied to the costs of raw materials, components like semiconductors and specialized glass, and shipping. For instance, the average price of semiconductors saw significant increases in late 2023 and early 2024 due to persistent demand and supply chain disruptions, impacting companies reliant on these components.

Inflationary pressures pose a considerable risk, potentially squeezing VIA optronics' profit margins if they cannot fully pass on rising expenses to their customers. Consumer price inflation in key markets for VIA optronics, such as Europe and North America, remained elevated through much of 2023, though showing signs of moderation in early 2024.

Effectively managing these cost volatilities through strategic sourcing and robust inventory management is paramount for VIA optronics. Companies are increasingly exploring multi-year contracts for key materials and diversifying their supplier base to mitigate these risks.

VIA optronics, as a global player, faces significant risks from fluctuating currency exchange rates. For instance, if the Euro strengthens considerably against the US Dollar in 2024-2025, VIA optronics' products sold in the US would become more expensive for American buyers, potentially dampening demand. Conversely, a weaker Euro could increase the cost of raw materials or components imported from countries with stronger currencies, impacting VIA's production expenses.

To navigate this, VIA optronics likely employs currency hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. Effective financial management is crucial to mitigate the impact of currency volatility on pricing and profitability, ensuring VIA optronics can maintain its competitive edge in diverse international markets throughout the 2024-2025 period.

Interest Rates and Access to Capital

Changes in interest rates significantly impact VIA optronics' operational costs and its customers' purchasing power. For instance, if central banks like the US Federal Reserve or the European Central Bank continue to maintain or increase benchmark rates in 2024-2025, the cost of borrowing for VIA optronics to fund its research and development or expand manufacturing capacity will rise. This directly affects its cost of capital.

Higher interest rates also translate to increased financing costs for VIA optronics' clients. This can make it more expensive for customers to purchase new equipment or invest in projects that utilize VIA's advanced optical solutions, potentially slowing down demand. For example, a business looking to upgrade its production line with VIA's imaging technology might postpone the investment if loan rates become prohibitive.

- Federal Reserve Rate Hikes: The US Federal Reserve raised its benchmark interest rate multiple times in 2023, with rates hovering around 5.25%-5.50% by early 2024. Future decisions in 2024-2025 will be closely watched for their impact on borrowing costs globally.

- ECB Monetary Policy: The European Central Bank has also been adjusting its monetary policy. As of early 2024, their deposit facility rate was 4.00%, a significant increase from previous years, reflecting efforts to combat inflation.

- Impact on Investment: Higher borrowing costs can lead to a decrease in capital expenditures by businesses, potentially affecting demand for VIA optronics' products, especially for large-scale industrial or automotive applications.

Consumer and Industrial Spending Trends

Consumer and industrial spending patterns are pivotal for VIA optronics, as demand for their display solutions is directly tied to key sectors like automotive, industrial, medical, and consumer electronics. For instance, the automotive industry's push towards digital cockpits and advanced driver-assistance systems (ADAS) fuels the need for sophisticated display technologies. Globally, the automotive market for displays was projected to reach approximately $11.7 billion in 2024, with significant growth expected in the coming years.

Industrial automation and the increasing use of smart devices in manufacturing environments also create opportunities. The industrial automation market itself is anticipated to grow substantially, with some estimates placing its value over $300 billion by 2025, underscoring the demand for robust and integrated display solutions in factories and machinery. Similarly, advancements in medical imaging and diagnostic equipment rely heavily on high-quality displays, a sector also experiencing consistent investment.

Analyzing these sector-specific trends is essential for VIA optronics to forecast market demand accurately. The consumer electronics segment, while broad, also contributes significantly, with the global consumer electronics market size estimated to be in the trillions of dollars, indicating a vast potential for display integration in various devices.

- Automotive Display Market Growth: Expected to exceed $11.7 billion in 2024, driven by digital dashboards and ADAS.

- Industrial Automation Demand: Market projected to surpass $300 billion by 2025, increasing need for smart displays in manufacturing.

- Medical Technology Investment: Growing reliance on advanced displays for diagnostic and imaging equipment.

- Consumer Electronics Penetration: A trillion-dollar global market with extensive opportunities for display integration.

Global economic growth, projected at 3.2% for both 2024 and 2025 by the IMF, generally benefits VIA optronics by increasing demand for its display technologies in key sectors like automotive and consumer electronics. However, a potential economic downturn could significantly reduce client spending on capital expenditures, directly impacting VIA's sales volumes and overall financial performance.

Inflationary pressures and rising raw material costs, including semiconductors and specialized glass, continue to pose a risk to VIA optronics' profit margins. For instance, elevated consumer price inflation in major markets through 2023, while showing signs of moderation in early 2024, necessitates careful cost management and pricing strategies.

Fluctuating currency exchange rates, particularly between the Euro and the US Dollar, can impact VIA optronics' international pricing and profitability. Similarly, higher interest rates, with the US Federal Reserve's benchmark rate around 5.25%-5.50% in early 2024 and the ECB's deposit facility rate at 4.00%, increase borrowing costs for both VIA and its clients, potentially dampening investment and demand.

Demand for VIA optronics' products is closely tied to the performance of sectors like automotive, industrial automation, and medical technology. The automotive display market alone was expected to exceed $11.7 billion in 2024, driven by advancements in digital cockpits and ADAS, while industrial automation's projected growth to over $300 billion by 2025 highlights opportunities in manufacturing environments.

Preview the Actual Deliverable

VIA optronics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive VIA optronics PESTLE analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping VIA optronics' strategic landscape.

Sociological factors

Consumer preferences are shifting dramatically, demanding brighter, larger, and more interactive displays. This is evident in the automotive sector, where advanced in-car infotainment systems are becoming a key selling point, with consumer satisfaction ratings for these systems often influencing purchase decisions. VIA optronics' focus on optical bonding and advanced touch solutions directly addresses this trend.

The availability of skilled labor, especially engineers and technicians proficient in optical bonding and precision manufacturing, directly impacts VIA optronics' ability to innovate and scale. For instance, the global shortage of semiconductor engineers, a sector closely related to display technology, saw demand outstrip supply by an estimated 20% in 2024, driving up specialized labor costs.

A deficit in qualified personnel can significantly increase recruitment expenses and prolong product development cycles. In 2024, companies in advanced manufacturing sectors reported an average of 75 days to fill highly specialized roles, a 20% increase from the previous year, highlighting the challenge.

Consequently, VIA optronics' strategic focus on robust training initiatives and effective talent retention programs becomes paramount. Companies that invest in upskilling their existing workforce, such as through apprenticeships in advanced manufacturing, have shown a 15% lower employee turnover rate compared to those who don't, according to industry surveys from early 2025.

Societal expectations around health and safety are increasingly influencing product development, particularly in sensitive industries like healthcare and automotive. For VIA optronics, this translates into rigorous design and certification processes for its display technologies.

In the medical field, displays must not only be highly reliable but also meet strict hygiene standards to prevent contamination. For instance, the global medical device market was valued at approximately $510 billion in 2023 and is projected to grow, increasing the demand for compliant components. Similarly, the automotive sector mandates that displays are designed to minimize driver distraction and contribute to overall vehicle safety, a crucial aspect as advanced driver-assistance systems (ADAS) become more prevalent. In 2024, automotive safety regulations continue to tighten, requiring manufacturers to demonstrate robust performance under various conditions.

Aging Population and Healthcare Demands

Demographic shifts are a major factor, with the global population continuing to age. This trend is directly fueling a greater demand for sophisticated medical devices and cutting-edge healthcare technologies. For instance, the World Health Organization projects that by 2030, one in six people globally will be 60 years or older, a significant increase from one in ten in 2020. This growing senior population often requires more frequent and advanced medical care.

This presents a substantial opportunity for companies like VIA optronics. They can leverage this demand by supplying specialized, high-performance displays crucial for various medical applications. Think about the displays used in diagnostic imaging equipment, real-time patient monitoring systems, and even precision surgical tools. These are all areas where reliable and advanced display technology is paramount.

By focusing on tailoring their display solutions to meet these specific healthcare needs, VIA optronics can tap into new and expanding growth avenues. The increasing prevalence of chronic diseases among the elderly, coupled with advancements in medical technology, means the market for these specialized displays is expected to grow considerably. For example, the global medical display market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 2.5 billion by 2028, growing at a CAGR of around 10-12%.

- Aging Population Growth: By 2050, the number of people aged 65 and over is projected to more than double, reaching 1.6 billion worldwide.

- Increased Healthcare Spending: Developed nations, in particular, are seeing rising healthcare expenditures, with a significant portion allocated to medical equipment and technology.

- Demand for Diagnostic Displays: The market for medical imaging displays, essential for diagnostics like MRI and CT scans, is expanding due to higher disease detection rates.

- Patient Monitoring Systems: Advancements in remote patient monitoring and wearable health devices require robust and clear display interfaces.

Environmental and Ethical Consumerism

Consumers and businesses are increasingly prioritizing sustainability and ethical practices, directly impacting purchasing choices. This trend means companies like VIA optronics, which can showcase commitments to eco-friendly manufacturing, ethical sourcing, and minimizing their environmental footprint, are likely to gain favor. For instance, a growing number of consumers are actively seeking out products from companies with strong Environmental, Social, and Governance (ESG) ratings. In 2024, reports indicated that over 60% of consumers consider sustainability a key factor when making purchasing decisions, a figure projected to rise further in 2025.

VIA optronics' focus on advanced display technologies, which often aim for energy efficiency and reduced material waste, aligns well with these evolving consumer expectations. By adhering to ESG principles, the company can bolster its brand image and attract partnerships with environmentally aware organizations. This can translate into tangible benefits, such as securing contracts with clients who have stringent sustainability mandates. The demand for sustainable electronics, in particular, is experiencing significant growth, with market research pointing to a compound annual growth rate of over 10% for green electronics in the coming years.

- Growing Consumer Demand for Sustainability: Over 60% of consumers in 2024 factored sustainability into their buying decisions, a trend expected to accelerate.

- Preference for Ethical Sourcing: Clients increasingly favor suppliers demonstrating responsible sourcing and reduced environmental impact.

- ESG as a Brand Enhancer: Adherence to ESG principles improves brand reputation and attracts environmentally conscious partners.

- Market Growth in Green Electronics: The sustainable electronics sector is projected for robust growth, with a CAGR exceeding 10%.

Societal values are increasingly emphasizing health and safety, directly influencing VIA optronics' product development, especially in critical sectors like automotive and healthcare. The automotive industry, for instance, is seeing tighter regulations in 2024 and 2025, demanding displays that minimize driver distraction and enhance safety. Similarly, the medical field requires displays to meet stringent hygiene standards, a crucial factor as the global medical device market, valued at approximately $510 billion in 2023, continues its expansion.

Technological factors

Rapid advancements in display technologies like OLED, MicroLED, and flexible displays are reshaping the market. These innovations offer VIA optronics significant opportunities to leverage its optical bonding expertise in new product categories, potentially expanding its market reach.

However, these evolving display types necessitate ongoing research and development investment. VIA optronics must ensure its bonding solutions are compatible with and optimize performance for these next-generation displays, a challenge that requires dedicated resources and technical agility to maintain a competitive edge.

The ongoing advancement of touch screen technologies, such as multi-touch and gesture control, directly influences VIA optronics' product development. The integration of sophisticated haptic feedback systems is becoming increasingly crucial for creating immersive user experiences, a trend VIA optronics must address to remain competitive.

VIA optronics' ability to seamlessly incorporate these evolving touch and haptic functionalities into their display solutions and optical bonding processes is vital for meeting market demand for intuitive interfaces. For instance, the automotive sector, a key market for VIA optronics, saw the global automotive touch screen market valued at approximately USD 10.5 billion in 2023 and is projected to grow significantly, underscoring the importance of these technological integrations.

The growing incorporation of AI and IoT into automotive, industrial, and medical devices is significantly boosting the need for advanced, connected display technologies. VIA optronics' success hinges on its ability to provide displays that can handle intricate data visualization and seamless real-time interaction, essential for these smart systems.

This technological shift creates substantial opportunities for VIA optronics to develop specialized display solutions tailored for emerging smart applications. For instance, the automotive sector's embrace of AI for driver assistance systems, projected to reach a market size of $10.1 billion by 2025 according to some estimates, directly translates to a higher demand for sophisticated integrated displays.

Manufacturing Automation and Smart Factories

VIA optronics can significantly boost its production efficiency and precision by adopting advanced manufacturing automation and smart factory technologies. This includes integrating robotics and AI-driven systems to streamline operations. For example, in 2024, the global industrial robotics market was projected to reach over $60 billion, highlighting the widespread investment in automation.

These investments directly translate to reduced labor costs and improved quality consistency, crucial for VIA optronics' customized display solutions. Faster time-to-market is another key benefit. By embracing Industry 4.0 principles, VIA optronics can achieve greater operational excellence and maintain a competitive edge.

- Enhanced Efficiency: Automation reduces cycle times and minimizes human error in complex manufacturing processes.

- Cost Reduction: Lower labor expenses and less material waste contribute to improved profitability.

- Quality Improvement: Consistent precision in manufacturing leads to higher-quality, reliable products.

- Scalability: Smart factories allow for quicker adaptation to changing production demands and volumes.

Miniaturization and Performance Demands

The relentless pursuit of smaller, lighter, and more powerful electronic devices across consumer electronics, automotive, and industrial sectors directly impacts VIA optronics. This trend necessitates continuous innovation in display module design to achieve greater miniaturization without compromising optical performance. For instance, the smartphone market, a key segment, saw average device thickness decrease by approximately 0.2mm between 2023 and early 2024, pushing component suppliers to deliver thinner solutions.

VIA optronics must therefore focus on reducing the thickness and weight of its display modules while simultaneously improving optical clarity, brightness, and overall durability. This is crucial for maintaining competitiveness in a market where end-product form factor is a significant selling point. The demand for higher refresh rates and improved color accuracy, often linked to enhanced performance, also adds to these challenges.

Meeting these exacting performance and form factor demands is paramount for VIA optronics' product competitiveness. Failure to innovate in miniaturization and performance could lead to a loss of market share to competitors offering more compact and capable display solutions. For example, the automotive industry's push for integrated, larger, and thinner displays in dashboards requires advanced optical bonding techniques that VIA optronics excels at, but the pressure to further refine these remains intense.

- Miniaturization: Continued reduction in display module thickness and weight is essential.

- Performance Enhancement: Increased brightness, optical clarity, and durability are key demands.

- Market Driver: Consumer electronics, automotive, and industrial sectors drive these requirements.

- Competitive Necessity: Innovation in these areas is critical for VIA optronics' market position.

The rapid evolution of display technologies like OLED and MicroLED presents VIA optronics with opportunities to apply its optical bonding expertise to new product types, potentially broadening its market presence.

However, VIA optronics must invest in continuous research and development to ensure its bonding solutions are compatible with and enhance the performance of these next-generation displays, a crucial step for maintaining a competitive edge.

The increasing integration of artificial intelligence and the Internet of Things into automotive, industrial, and medical devices is driving demand for advanced, connected display solutions, a trend VIA optronics is well-positioned to capitalize on.

VIA optronics' success in these smart applications will depend on its ability to deliver displays capable of complex data visualization and seamless real-time interaction, essential for these interconnected systems.

Legal factors

VIA optronics operates under strict product safety and liability regulations across its global markets, especially critical for its automotive and medical display solutions. These regulations mandate rigorous testing and certification to ensure consumer safety.

For instance, in the automotive sector, compliance with standards like ISO 26262 for functional safety is paramount. In 2024, the automotive industry continued to see increased scrutiny on electronic component reliability, with manufacturers facing potential penalties for non-compliance.

Failure to meet these legal requirements can lead to costly product recalls, significant legal liabilities, and severe damage to VIA optronics' brand reputation. For example, a major automotive recall in 2023 related to electronic systems cost the involved manufacturer hundreds of millions of dollars.

Data privacy and security laws like GDPR and CCPA are increasingly critical for VIA optronics, especially as their displays are integrated into connected devices. These regulations are vital for solutions that include camera modules or touchscreens, which often process user input and potentially sensitive data.

VIA optronics must diligently ensure their systems and processes adhere to these data protection mandates. This compliance is particularly important for applications in sectors like medical or automotive, where the handling of personal or critical information requires stringent safeguards.

Protecting VIA optronics' core optical bonding technology and other innovations through robust patent filings and trademark registrations is fundamental to maintaining their competitive edge in the display market. As of early 2024, the global patent landscape continues to evolve, with significant filings in areas like advanced display materials and manufacturing processes, underscoring the importance of VIA optronics' IP strategy.

Navigating the intricacies of international patent laws presents a constant legal hurdle, requiring vigilance in both securing their own intellectual property and ensuring they do not infringe upon existing patents held by competitors. The cost of patent litigation can be substantial, making proactive IP management and avoidance of infringement paramount.

Engaging experienced legal counsel specializing in intellectual property is indispensable for VIA optronics to effectively manage its patent portfolio, pursue infringement actions when necessary, and strategically defend against potential claims, thereby safeguarding its technological advancements and market position.

Environmental and Waste Management Laws

Environmental and waste management laws significantly shape VIA optronics' operations. Regulations like the EU's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) impact the materials used in their display and optical products. For instance, RoHS restricts the use of specific hazardous materials, influencing VIA optronics' supply chain and product development to ensure compliance, which is crucial for market access in regions like the European Union.

Furthermore, evolving electronic waste (e-waste) management directives, such as the EU's Waste Electrical and Electronic Equipment (WEEE) directive, necessitate responsible end-of-life product handling. VIA optronics must consider product design for recyclability and potentially invest in or partner with recycling infrastructure. Failure to comply with these environmental mandates can result in substantial financial penalties, impacting profitability and potentially leading to operational disruptions, as seen with past enforcement actions against companies for non-compliance with waste disposal regulations.

Energy efficiency standards also play a role, particularly for products used in consumer electronics and automotive sectors. VIA optronics' display technologies must meet increasingly stringent energy consumption benchmarks set by regulatory bodies worldwide. For example, Energy Star certifications or similar regional standards can influence product design choices and manufacturing processes to reduce the environmental footprint of their offerings.

- RoHS and REACH compliance directly affects material selection in VIA optronics' manufacturing.

- WEEE directives mandate responsible e-waste management, impacting product lifecycle strategies.

- Energy efficiency standards influence product design and may offer competitive advantages.

Labor and Employment Laws

VIA optronics navigates a complex web of labor and employment laws across its global operations, impacting everything from minimum wage requirements to workplace safety standards. For instance, in Germany, where VIA optronics has a significant presence, recent legislative changes in 2024 have focused on enhancing worker protections and promoting flexible work arrangements, necessitating ongoing adjustments to company policies.

Compliance is not merely a legal obligation but a cornerstone of VIA optronics' operational integrity and reputation. Failure to adhere to these regulations can result in substantial fines, litigation, and damage to employee morale. The company's commitment to fair labor practices is crucial for attracting and retaining talent, particularly in competitive markets.

Key areas of compliance include:

- Wage and Hour Laws: Ensuring all employees are paid at least the statutory minimum wage and receive appropriate overtime compensation.

- Workplace Safety and Health: Adhering to regulations designed to prevent accidents and ensure a healthy working environment, with Germany’s Occupational Safety and Health Act setting stringent standards.

- Anti-Discrimination and Equal Opportunity: Implementing policies that prohibit discrimination based on age, gender, race, religion, or disability, aligning with EU directives and national legislation.

- Employee Benefits and Leave: Providing legally mandated benefits such as paid time off, sick leave, and parental leave, which vary significantly by country.

VIA optronics must ensure its products meet stringent safety standards, particularly for automotive and medical applications, with ISO 26262 compliance being critical. Non-compliance risks costly recalls and reputational damage, as demonstrated by a significant automotive recall in 2023 costing hundreds of millions. Data privacy laws like GDPR and CCPA are increasingly important for connected devices, demanding diligent adherence to protect user information.

Environmental factors

VIA optronics' reliance on specialized materials like rare earth elements, advanced glass, and specific metals for its display and touch screen technologies makes raw material sourcing a critical environmental concern. The availability and sustainable procurement of these components directly impact production continuity and environmental footprint.

Factors such as geopolitical tensions and surging global demand, particularly from the burgeoning electric vehicle and consumer electronics sectors, can exacerbate scarcity and drive price volatility for these essential inputs. For instance, the global market for rare earth elements, crucial for many advanced electronic components, saw significant price fluctuations in 2023 and early 2024 due to supply chain disruptions and increased demand from renewable energy technologies.

To mitigate these environmental and economic risks, VIA optronics must maintain exceptionally robust supply chain management. This includes diversifying suppliers, exploring alternative materials, and ensuring that sourcing practices align with environmental sustainability standards and ethical considerations, thereby securing a stable and responsible supply chain for its manufacturing operations.

The manufacturing of display components and the optical bonding processes VIA optronics utilizes are energy-intensive, directly impacting its carbon footprint. For instance, global manufacturing's electricity consumption reached an estimated 11,500 terawatt-hours (TWh) in 2023, a significant portion of which is attributed to processes like those VIA optronics undertakes.

There's mounting pressure from governments, investors, and consumers for companies to curb their energy usage. This trend means VIA optronics will likely need to invest in more energy-efficient equipment and explore renewable energy options to meet evolving environmental standards and stakeholder expectations.

Beyond regulatory compliance, reducing energy consumption presents a clear opportunity for VIA optronics to improve its bottom line. By optimizing production and adopting greener technologies, the company can achieve substantial cost savings, as energy costs represent a notable operational expense for manufacturers.

The increasing volume of electronic waste (e-waste) and manufacturing by-products presents a significant environmental hurdle for VIA optronics. Globally, e-waste is projected to reach 74 million tonnes by 2030, highlighting the scale of this challenge.

VIA optronics must navigate stringent e-waste directives and establish robust recycling programs for returned, defective, and scrap materials. In 2023, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive continued to drive compliance efforts across member states.

Embracing circular economy principles offers a strategic advantage, enabling VIA optronics to lessen its environmental footprint and potentially reclaim valuable resources from its waste streams.

Climate Change and Supply Chain Resilience

Climate change poses significant physical risks to VIA optronics' supply chain. Extreme weather events, like floods or droughts, can directly impact the availability and transportation of raw materials crucial for their optical components. For instance, a severe drought in a key agricultural region could affect the sourcing of certain chemicals used in manufacturing processes.

The company's manufacturing facilities and distribution networks are also vulnerable. Disruptions from hurricanes, wildfires, or rising sea levels could halt production or impede the movement of finished goods. This necessitates a proactive approach to risk assessment and mitigation. VIA optronics needs to identify critical nodes in its supply chain and develop contingency plans to ensure business continuity.

Adapting operations for greater climate resilience is no longer optional but a strategic imperative. This includes diversifying supplier bases, investing in more robust infrastructure, and potentially exploring alternative materials or production methods less susceptible to environmental shocks. For example, companies in similar sectors have begun mapping their supply chains to identify high-risk regions and are actively seeking suppliers in more stable climates.

VIA optronics' commitment to sustainability, as highlighted in their 2023 ESG report, is a step in the right direction, but the specific financial and operational impacts of climate-related disruptions need continuous monitoring and strategic adaptation. The increasing frequency of severe weather events globally, with economic losses from natural catastrophes reaching hundreds of billions of dollars annually in recent years, underscores the urgency.

Regulatory Pressure for Eco-Friendly Products

Regulatory bodies worldwide are increasingly mandating stricter environmental standards for electronic products, directly impacting VIA optronics. For instance, the European Union's Ecodesign Directive continues to evolve, pushing for greater energy efficiency and recyclability in displays. This means VIA optronics must prioritize materials and designs that facilitate longer product lifespans and easier end-of-life management, such as reducing the use of hazardous substances like lead and cadmium, which are already heavily restricted under regulations like RoHS.

The market is also aligning with these environmental shifts. Consumers and business clients alike are showing a preference for products that demonstrate a commitment to sustainability. VIA optronics' development of 'green' display solutions, such as those utilizing recycled materials or designed for reduced energy consumption, directly addresses this demand. For example, the push towards circular economy principles encourages the design of products that can be easily disassembled and their components reused or recycled, a trend VIA optronics is actively incorporating into its innovation pipeline.

- Extended Producer Responsibility (EPR) schemes are becoming more prevalent, requiring manufacturers like VIA optronics to manage the collection and recycling of their products at the end of their life.

- Carbon footprint reporting is becoming a standard expectation, with many B2B customers requesting data on the environmental impact of components throughout their lifecycle.

- Material restrictions, such as those related to conflict minerals and specific chemicals, are continuously being updated, necessitating ongoing vigilance in VIA optronics' supply chain management.

- Energy efficiency standards for displays are tightening, driving innovation in backlight technologies and panel design to reduce power consumption.

VIA optronics faces environmental challenges related to raw material sourcing, particularly for specialized components like rare earth elements and advanced glass, which are critical for their display technologies. Geopolitical factors and rising demand from sectors like electric vehicles can affect the availability and price of these materials, impacting production continuity and the company's environmental footprint.

The energy-intensive nature of manufacturing display components and optical bonding processes contributes to VIA optronics' carbon footprint, with global manufacturing's electricity consumption being a significant factor. Growing pressure from governments, investors, and consumers to reduce energy usage necessitates investment in more efficient equipment and renewable energy sources, offering potential cost savings.

Managing electronic waste (e-waste) and manufacturing by-products is a growing concern, with global e-waste projected to reach 74 million tonnes by 2030. VIA optronics must comply with stringent e-waste directives and implement robust recycling programs, with circular economy principles offering a strategic advantage for resource reclamation and footprint reduction.

Climate change presents physical risks to VIA optronics' supply chain through extreme weather events that can disrupt raw material availability and transportation. Facilities and distribution networks are also vulnerable, requiring proactive risk assessment, contingency planning, and investment in resilient infrastructure and alternative materials to ensure business continuity.

PESTLE Analysis Data Sources

Our PESTLE Analysis for VIA opTronics is informed by a comprehensive blend of data from leading market research firms, official government publications, and reputable financial news outlets. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscapes impacting the company.