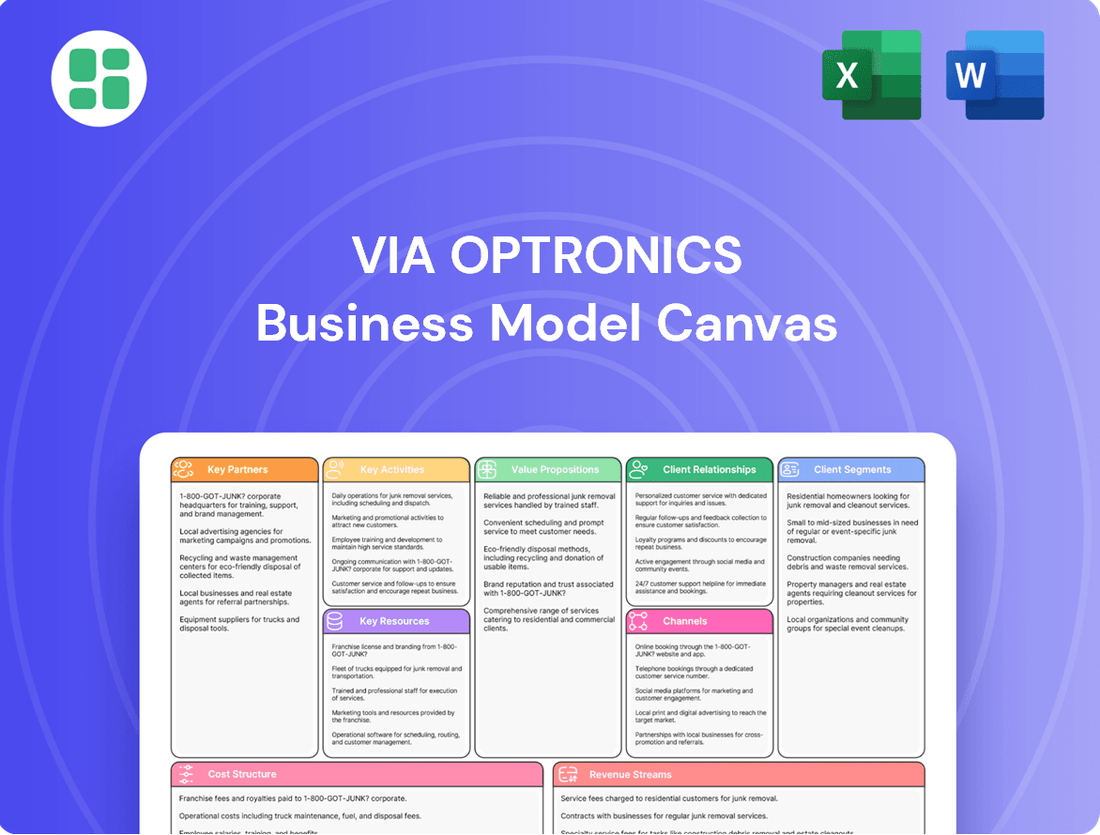

VIA optronics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIA optronics Bundle

Unlock the full strategic blueprint behind VIA optronics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

VIA optronics AG leverages strategic joint ventures to bolster its automotive system solutions. A prime example is the collaboration with Autolink to establish Wuxi Turing Intelligent Display Technology Co., Ltd. This partnership is designed to enhance their combined expertise in smart cockpit platforms, integrating both hardware and software strengths.

This joint venture is crucial for creating a more robust and comprehensive supply chain for automotive original equipment manufacturers (OEMs). By pooling resources and knowledge, VIA optronics and its partners can offer more integrated and advanced display solutions, meeting the evolving demands of the automotive industry.

VIA optronics actively pursues technology development collaborations to bolster its product innovation. A prime example is their contract with Immervision Inc., focusing on the design and development of next-generation automotive cameras. This partnership is key to enhancing VIA's camera offerings by incorporating Immervision's specialized lens technology, thereby accelerating the pace of innovation in the automotive sector.

These strategic alliances are crucial for VIA optronics as they help in reducing non-recurring engineering (NRE) costs. By sharing development efforts and expertise, VIA can more efficiently bring advanced camera solutions to market, expanding its overall product portfolio and strengthening its competitive position.

VIA optronics AG is strategically forging market expansion partnerships to broaden its customer base and enter new geographical territories. This diversification is key to its growth strategy, aiming to reduce reliance on any single market segment.

Recent collaborations, such as the one with JF Kilfoil, exemplify this approach by focusing on delivering advanced display and camera solutions. This specific partnership is designed to penetrate and grow within various industrial applications, showcasing VIA optronics’ commitment to tangible market penetration.

These alliances are vital for VIA optronics’ objective of expanding its market reach and solidifying its presence with a wider array of clients. By leveraging these partnerships, the company aims to accelerate its growth trajectory and enhance its competitive positioning.

Supplier and Component Alliances

VIA optronics cultivates crucial relationships with its suppliers, securing essential components such as high-quality displays, specialized glass, and other critical materials. These partnerships are fundamental to VIA optronics' ability to manufacture its bespoke display solutions, advanced touch screens, and integrated camera modules.

These supplier alliances are not just about acquiring parts; they are about building a resilient and dependable supply chain. This reliability is paramount for ensuring consistent production output and maintaining the high-quality standards that VIA optronics customers expect. For instance, in 2023, VIA optronics emphasized the strategic importance of its supplier network in navigating global component shortages, a testament to the value of these alliances.

- Display Suppliers: Securing consistent access to cutting-edge display technologies.

- Glass Manufacturers: Ensuring a steady supply of specialized optical glass for touch and display integration.

- Component Providers: Sourcing specialized materials and electronic components for camera modules and other integrated systems.

- Logistics Partners: Maintaining efficient and reliable inbound logistics for timely component delivery.

Investor and Financial Partners

VIA optronics AG is actively pursuing a new long-term strategic investor and partner to fuel its ongoing growth and innovation. This strategic pivot comes after a significant shareholder decided to divest, highlighting the company's commitment to securing robust financial backing for its future initiatives.

Securing these key partnerships is crucial for VIA optronics, as it provides the necessary capital infusion to drive strategic projects and ensures long-term financial stability. For instance, as of the first half of 2024, VIA optronics reported revenues of €86.9 million, underscoring the need for continued investment to maintain this momentum.

- Strategic Investor: Seeking a partner with a long-term vision aligned with VIA optronics' growth objectives.

- Financial Partners: Aiming to strengthen its capital structure and secure funding for R&D and market expansion.

- Synergistic Opportunities: Exploring partnerships that can offer technological or market access advantages.

VIA optronics AG fosters key partnerships across its value chain to ensure innovation and market reach. These include collaborations with technology providers like Immervision Inc. for advanced camera development and joint ventures such as the one with Autolink to strengthen smart cockpit platforms.

The company also strategically partners with market players like JF Kilfoil to expand into industrial applications, diversifying its customer base. Furthermore, VIA optronics is actively seeking a strategic investor to secure capital for growth and R&D, aiming for long-term financial stability.

These alliances are critical for reducing development costs and accelerating the introduction of new products. For example, in the first half of 2024, VIA optronics reported revenues of €86.9 million, highlighting the importance of these partnerships in sustaining and growing its business.

What is included in the product

VIA optronics' Business Model Canvas details its strategy for providing advanced display solutions, focusing on high-performance products for automotive and industrial markets.

It outlines key customer segments, value propositions centered on display enhancement technologies, and the channels used to reach these markets.

VIA optronics' Business Model Canvas provides a clear, one-page snapshot that quickly identifies core components, acting as a pain point reliever for understanding complex strategies.

This structured approach saves hours of formatting and structuring, offering a digestible format for quick review and adaptation, thereby alleviating the pain of lengthy analysis.

Activities

VIA optronics' key activities heavily revolve around the research and development of bespoke display and system solutions. This means they don't just provide components; they engineer integrated units. For instance, they combine advanced display technologies with touch functionality, robust protective glass, and camera modules. This intricate integration is crucial for meeting the unique demands of their diverse clientele.

The company's innovation is a driving force, focusing on both the aesthetic design and the practical functionality of these custom systems. They are constantly pushing boundaries to create solutions that are not only visually appealing but also highly performant and user-friendly. This commitment to innovation is what sets them apart in a competitive market, ensuring their offerings remain cutting-edge.

VIA optronics excels in optical bonding, a critical manufacturing process that significantly improves display clarity, brightness, and ruggedness by eliminating air gaps. This specialization is central to their value proposition, offering enhanced visual performance and durability for various electronic devices.

The company also manufactures advanced metal mesh touch sensors, a vital component for modern interactive displays. These sensors are engineered for high performance and responsiveness, enabling intuitive user interaction across a wide range of applications, from automotive to consumer electronics.

These proprietary manufacturing techniques, optical bonding and metal mesh touch sensor production, form the bedrock of VIA optronics' competitive edge. Their commitment to these specialized processes allows them to deliver superior display solutions that meet demanding industry standards.

VIA optronics manages production and assembly across Germany, Japan, and China, enabling a global reach for its display solutions. This distributed manufacturing strategy is key to efficiently serving various international markets and adapting to global trade complexities.

In 2024, VIA optronics continued to leverage these production sites to meet the increasing demand for its advanced display technologies. The company's ability to produce globally ensures timely delivery and cost-effectiveness for its diverse customer base.

Research and Development (R&D)

VIA optronics dedicates significant resources to continuous research and development, a cornerstone of their strategy. This focus is crucial for refining their current display and sensor technologies and for pioneering next-generation products. For instance, their work on advanced automotive cameras and sophisticated embedded vision solutions directly addresses evolving market demands.

Their commitment to innovation is underscored by their R&D facility located in the Philippines. This site plays a vital role in the ongoing development of display and sensor technologies, ensuring VIA optronics stays ahead of the curve in a rapidly advancing technological landscape.

- Focus on next-generation automotive cameras and embedded vision solutions

- Investment in R&D to enhance existing display and sensor technologies

- Utilizing the Philippines R&D site for continuous innovation

Business Transformation and Cost Optimization

VIA optronics has actively pursued business transformation and cost optimization, implementing efficiency programs to streamline operations and bolster financial health. These strategic moves are designed to enhance profitability and build greater resilience in its business model.

Key activities in this area include significant overhead cost reductions and efforts to improve overall financial flexibility. For instance, the company has focused on optimizing its manufacturing processes and supply chain management to drive down expenses.

- Operational Efficiency Programs: Implementing lean manufacturing principles and digital transformation initiatives to boost productivity and reduce waste.

- Overhead Cost Reduction: Streamlining administrative functions, renegotiating supplier contracts, and optimizing facility utilization.

- Financial Flexibility Enhancement: Managing working capital more effectively and exploring financing options to ensure a stable liquidity position.

VIA optronics' core activities center on the design, development, and manufacturing of advanced display and sensor solutions. This includes sophisticated optical bonding, a process that enhances display performance by eliminating air gaps, and the production of metal mesh touch sensors, crucial for interactive interfaces. Their global manufacturing footprint, spanning Germany, Japan, and China, ensures efficient production and delivery.

Innovation is a constant, with a strong emphasis on R&D for next-generation automotive cameras and embedded vision systems, supported by their R&D facility in the Philippines. Simultaneously, the company actively pursues business transformation through cost optimization and efficiency programs to strengthen its financial position.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| R&D and Innovation | Developing bespoke display and system solutions, including optical bonding and metal mesh touch sensors. Focus on automotive cameras and embedded vision. | Continued investment in next-gen automotive and vision technologies. |

| Manufacturing and Assembly | Global production sites in Germany, Japan, and China for integrated display units. | Meeting increased demand for advanced display technologies worldwide. |

| Business Transformation & Cost Optimization | Implementing efficiency programs, reducing overhead, and enhancing financial flexibility. | Streamlining operations to improve profitability and resilience. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of VIA optronics' strategic framework. This is not a sample or a mockup; it is a direct representation of the complete file you will gain access to. Upon completing your order, you will download this same, detailed Business Model Canvas, ready for your analysis and application.

Resources

VIA optronics' proprietary optical bonding technology, including VIA bond plus and MaxVU™, represents a cornerstone of its intellectual property. This patented innovation is crucial for improving display performance, making them more robust and readable, especially in tough conditions.

This advanced technology directly contributes to VIA optronics' competitive advantage. For instance, in 2024, the demand for displays with enhanced outdoor readability and ruggedness continued to grow across automotive and industrial sectors, areas where VIA optronics' technology excels.

VIA optronics' proprietary metal mesh touch sensor technology is a core resource, enabling high-resolution and highly conductive interactive displays. This in-house expertise is crucial for developing advanced touch functionalities that differentiate their product offerings in the market.

The company's ability to design and manufacture these metal mesh sensors internally provides a significant competitive advantage, allowing for greater control over performance and customization. This technological prowess underpins their interactive display solutions, catering to demanding applications.

VIA optronics' global manufacturing and R&D facilities are a cornerstone of its business model, enabling efficient production and innovation. The company operates production sites strategically located in Germany, China, and Japan, ensuring a robust supply chain and the capacity for large-scale manufacturing to meet global demand.

Complementing its production network, VIA optronics maintains an R&D facility in the Philippines. This setup allows for continuous product innovation and the development of cutting-edge optical solutions, crucial for staying competitive in the rapidly evolving technology sector.

This worldwide footprint is vital for VIA optronics to effectively serve its international customer base, offering localized service and support. For example, in 2023, the company reported that approximately 70% of its revenue was generated from outside of Europe, underscoring the importance of its global operational capabilities.

Skilled Engineering and R&D Personnel

VIA optronics’ success hinges on its highly skilled workforce, especially in engineering, optical design, and research and development. These experts are crucial for innovation in display technology and camera modules.

Their deep understanding of system integration allows VIA optronics to tailor solutions to specific customer needs, driving the creation of advanced visual systems. This specialized knowledge is fundamental to the company’s ability to tackle complex projects.

- Engineering Prowess: VIA optronics employs a significant number of engineers, with a focus on optical engineering and embedded systems, ensuring cutting-edge product development.

- R&D Investment: The company consistently invests in its R&D capabilities, aiming to stay at the forefront of display and camera technology advancements.

- Talent Acquisition: In 2024, VIA optronics continued its strategic hiring efforts to bolster its engineering teams, recognizing talent as a primary competitive advantage.

- Expertise Breadth: The team’s collective expertise spans from fundamental optical physics to advanced software development for imaging systems.

Intellectual Property Portfolio

VIA optronics' intellectual property portfolio is a cornerstone of its business model, encompassing a substantial collection of patents and proprietary process knowledge. This robust intellectual capital is critical for safeguarding their technological advancements in display and sensor solutions, creating a significant competitive advantage.

The company's commitment to innovation is reflected in its IP, which allows VIA optronics to deliver differentiated and high-performance products to the market. This protection is vital for maintaining their position in a rapidly evolving technological landscape.

- Patented Technologies: VIA optronics holds numerous patents covering key aspects of their optical bonding and display enhancement technologies.

- Process Know-How: Beyond patents, the company possesses deep expertise in manufacturing processes, which is not easily replicated.

- Competitive Barrier: This intellectual property acts as a strong deterrent to competitors, protecting their market share and pricing power.

- Innovation Engine: The IP portfolio directly supports the development of next-generation products and solutions, driving future growth.

VIA optronics' key resources include its proprietary optical bonding technology, such as VIA bond plus and MaxVU™, which enhances display robustness and readability. The company also leverages its in-house metal mesh touch sensor technology for high-resolution interactive displays. These technological assets are crucial for delivering differentiated products in demanding markets.

Value Propositions

VIA optronics crafts highly specialized display solutions, precisely engineered to meet the unique demands of challenging industries. This bespoke approach ensures clients receive components that integrate seamlessly into their specific applications.

Their expertise extends to integrating displays, touch screens, and camera modules into comprehensive, ready-to-deploy systems. This end-to-end customization significantly streamlines development for customers needing highly particular functionalities.

For instance, in 2023, VIA optronics reported a notable increase in orders for customized solutions in the automotive sector, a testament to their ability to deliver tailored performance for demanding environments.

VIA optronics' optical bonding technology significantly boosts display resilience, making them tough against harsh environments. This means better performance in bright sunlight, with less worry about vibration, shock, extreme temperatures, or moisture. For instance, their solutions are designed to withstand operating temperatures as low as -40°C and as high as +85°C, crucial for industrial and automotive applications.

This ruggedization ensures VIA optronics' displays remain reliable over the long haul. Their commitment to durability means products can endure demanding conditions, reducing downtime and replacement costs for businesses in sectors like agriculture, construction, and public transportation. This focus on robust design directly translates to enhanced product lifespan and customer satisfaction.

VIA optronics’ proprietary optical bonding process and advanced materials are central to their value proposition, offering displays with exceptional sunlight viewability and clarity. This means their products perform reliably and clearly, even in the harshest bright outdoor environments. For instance, in 2024, the demand for high-visibility displays in the automotive sector, particularly for infotainment systems and digital dashboards, continued to surge, with VIA optronics well-positioned to meet this need.

This superior optical performance directly translates to enhanced readability and functionality, which is paramount for demanding sectors like automotive and industrial applications. The ability to maintain visual quality under direct sunlight is a significant competitive advantage. In 2023, VIA optronics reported that its advanced bonding solutions contributed to a notable increase in customer satisfaction for ruggedized display solutions, highlighting the impact of this key feature.

Integrated System Solutions

VIA optronics offers integrated system solutions, combining displays with essential components like touch functionality, camera modules, and tailored hardware and software. This approach acts as a single point of contact for customers, streamlining the purchasing and implementation process. It's a true one-stop-shop for complex electronic systems.

By providing these complete systems, VIA optronics significantly enhances customer convenience and delivers a more robust, functional product. This end-to-end capability is a key differentiator in the market, simplifying the supply chain for clients.

For example, in 2024, VIA optronics reported a significant portion of its revenue stemming from these integrated solutions, demonstrating their market adoption. This strategy allows clients to focus on their core competencies rather than managing multiple component suppliers.

- Streamlined Procurement: Customers benefit from a single vendor for display, touch, camera, and other integrated hardware/software.

- Simplified Integration: VIA optronics' expertise ensures seamless compatibility and reduced complexity in system assembly.

- Enhanced Functionality: The combination of components creates cohesive, high-performance solutions tailored to specific application needs.

- Reduced Time-to-Market: By providing ready-to-deploy systems, VIA optronics helps clients accelerate their product development cycles.

Reduced Time-to-Market and Engineering Costs

VIA optronics significantly cuts down the time it takes for customers to bring new products to market. By using their deep knowledge and working with key partners, they help clients slash non-recurring engineering expenses. This means less upfront investment and a quicker path from concept to customer.

Their approach involves working closely with clients throughout the development process. They offer pre-designed solutions that already have much of the complex engineering sorted. This collaborative method and the use of pre-engineered components streamline everything, from initial design to final production.

- Accelerated Product Launch: VIA optronics' solutions enable faster development cycles, reducing the time from concept to commercialization.

- Lower NRE Costs: Customers benefit from reduced non-recurring engineering expenses due to VIA's expertise and pre-engineered modules.

- Streamlined Design Process: Collaborative development and ready-made components simplify and speed up the product design phase.

- Enhanced Efficiency: These efficiencies directly translate into cost savings and quicker deployment of new technologies for their clients.

VIA optronics provides highly integrated display solutions, combining displays, touch sensors, and camera modules into single, ready-to-deploy units. This offers clients a streamlined approach, reducing the complexity of sourcing and integrating multiple components. In 2024, VIA optronics saw a significant increase in demand for these integrated systems, particularly from automotive manufacturers seeking to simplify dashboard development.

Customer Relationships

VIA optronics actively engages in collaborative development and co-creation with its key customers, primarily Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. This partnership model goes beyond a simple supplier-client dynamic, focusing on jointly developing innovative display and camera solutions tailored to specific automotive and industrial applications.

By working hand-in-hand, VIA optronics integrates its advanced optical bonding and display enhancement technologies directly into the customer's product development cycle. This deep collaboration ensures that the resulting integrated solutions precisely meet the stringent technical requirements and performance expectations of the automotive industry, a sector where VIA optronics reported significant revenue growth in 2024.

VIA optronics actively cultivates long-term strategic partnerships with its core clientele, aiming to transcend simple product sales and establish itself as an indispensable technology ally. This commitment is clearly demonstrated through their engagement in joint ventures and sustained collaborative efforts on intricate system solutions. For instance, in 2023, VIA optronics reported that a significant portion of its revenue was derived from its top customers, underscoring the importance of these deep relationships.

VIA optronics prioritizes robust customer relationships through dedicated technical support and responsive after-sales service. This commitment is especially vital in high-stakes sectors like automotive and medical, where VIA optronics' display solutions are deployed. For instance, in the automotive sector, ensuring seamless integration and ongoing functionality of advanced driver-assistance systems (ADAS) displays is paramount. Their support helps clients maintain operational continuity and quickly resolve any post-installation issues.

This focus on excellent support directly translates into enhanced customer loyalty and trust. In 2024, companies that demonstrated superior customer service often saw higher retention rates. VIA optronics' approach ensures that clients, whether in the demanding automotive industry or the critical medical field, can rely on their technology and receive prompt assistance, thereby strengthening long-term partnerships.

Solution-Oriented Engagement

VIA optronics differentiates itself by acting as a problem solver, not just a component supplier. They tackle intricate display and integration issues, particularly for clients facing demanding operational conditions. This deep technical engagement is key to their customer relationships.

Their expertise lies in navigating complex optical and technical challenges. This consultative method enhances their value proposition, making them a trusted partner for specialized display solutions.

- Focus on Problem Solving VIA optronics prioritizes addressing customer-specific display and integration challenges.

- Technical Expertise They offer specialized knowledge to overcome optical and technical hurdles in demanding environments.

- Consultative Approach This engagement style builds stronger, more collaborative customer relationships.

Direct Communication Channels

VIA optronics leverages direct communication channels to foster strong customer relationships. This is primarily achieved through its strategically located sales offices across different regions, enabling face-to-face interactions and localized support.

These direct channels facilitate immediate engagement for sales inquiries, technical questions, and the collection of valuable customer feedback. This personalized approach ensures that customer needs are understood and addressed promptly, enhancing satisfaction and loyalty.

- Regional Sales Offices: VIA optronics maintains a physical presence in key markets, allowing for direct customer engagement and support.

- Investor Relations Contacts: Dedicated investor relations personnel serve as a direct point of contact for shareholders and the financial community.

- Personalized Service: Direct interaction enables tailored solutions and responsive handling of customer requests, from initial sales to post-technical support.

- Feedback Loop: Direct communication channels are crucial for gathering customer insights, which inform product development and service improvements.

VIA optronics cultivates deep, collaborative relationships with its OEM and Tier-1 customers, focusing on co-creation and integrated solutions. This partnership model, which includes joint ventures and sustained collaborative efforts, underscores a commitment to being a technology ally rather than just a supplier. In 2023, a substantial portion of VIA optronics' revenue was derived from its top customers, highlighting the critical nature of these long-term engagements.

Their customer relationship strategy emphasizes problem-solving and consultative engagement, leveraging technical expertise to address complex display and integration challenges. This approach, supported by dedicated technical assistance and responsive after-sales service, fosters customer loyalty and trust, crucial in sectors like automotive where VIA optronics saw significant revenue growth in 2024.

Direct communication through regional sales offices and investor relations contacts facilitates personalized service and efficient feedback loops. This direct interaction ensures customer needs are met promptly, enhancing satisfaction and reinforcing the company's role as a trusted partner.

| Customer Relationship Aspect | Description | Impact on VIA optronics | Supporting Data/Example |

|---|---|---|---|

| Collaborative Development | Jointly developing display and camera solutions with OEMs and Tier-1s. | Ensures tailored, high-performance products meeting industry needs. | Significant revenue growth reported from automotive sector in 2024. |

| Strategic Partnerships | Building long-term alliances beyond transactional sales. | Fosters customer loyalty and reliance on VIA optronics' technology. | A significant portion of 2023 revenue came from top customers. |

| Technical Support & Problem Solving | Providing dedicated support and addressing complex integration challenges. | Enhances customer satisfaction and strengthens trust. | Crucial for seamless integration of ADAS displays in automotive. |

| Direct Communication | Utilizing regional sales offices for face-to-face interaction and feedback. | Enables personalized service and responsive issue resolution. | Facilitates immediate engagement for sales and technical inquiries. |

Channels

VIA optronics leverages a direct sales force to cultivate relationships with major Original Equipment Manufacturers (OEMs) and Tier-1 suppliers across the automotive, industrial, and medical industries. This direct engagement is crucial for navigating the complexities of B2B sales, enabling in-depth technical discussions and the development of highly customized solutions.

This strategy facilitates a strong feedback loop, allowing VIA optronics to directly understand and address customer needs, thereby ensuring tailored product development and strengthening client partnerships. For instance, in 2023, VIA optronics reported a significant portion of its revenue derived from direct sales channels, underscoring the effectiveness of this approach in securing large, complex contracts.

VIA optronics strategically positions sales offices in key markets like Taiwan and the USA, complementing its German headquarters. These locations act as vital regional centers for driving sales, offering dedicated customer support, and gathering crucial market insights.

This global network of sales channels is essential for expanding VIA optronics' market reach. It ensures that the company can effectively serve a diverse international clientele and provide localized support tailored to specific regional needs and business practices.

Strategic joint ventures and collaborations are crucial channels for VIA optronics, exemplified by their venture with Autolink, Wuxi Turing Intelligent Display Technology. This partnership allows them to deliver integrated automotive system solutions, tapping into Autolink's established market presence and technical know-how.

These collaborations are designed to penetrate new market segments and offer more complete product portfolios by combining VIA optronics' display technology with partners' complementary strengths. For instance, in 2024, VIA optronics continued to focus on expanding its automotive solutions, with such partnerships playing a key role in reaching a wider customer base.

This approach effectively broadens VIA optronics' market footprint. By joining forces, they create synergistic effects that accelerate market penetration and enhance their competitive offering in the dynamic automotive sector.

Industry Events and Trade Shows

VIA optronics leverages industry events and trade shows as a vital channel for showcasing its cutting-edge technologies. For instance, participation in events like AutoSens USA and Display Week allows the company to demonstrate its latest advancements in optical solutions directly to a targeted audience of potential clients and partners.

These gatherings are instrumental in fostering new business relationships and nurturing existing ones. They provide invaluable opportunities for direct engagement, enabling VIA optronics to understand market needs and generate qualified leads. In 2023, for example, trade shows contributed significantly to the company's lead generation efforts, with a notable increase in qualified inquiries originating from these events.

- Market Visibility: Events like CES and embedded world are key for enhancing brand recognition and staying ahead of competitors.

- Customer Engagement: Direct interaction at shows allows for immediate feedback and strengthens client loyalty.

- Lead Generation: Trade shows are a primary source for new business opportunities, with many companies reporting a substantial portion of their annual pipeline originating from these events.

- Technology Showcase: Demonstrating new products and solutions, such as advanced display technologies, attracts significant interest and potential partnerships.

Online Presence and Investor Relations Portal

VIA optronics leverages its official website and a dedicated investor relations portal as crucial online channels for communication. These platforms are designed to reach a broad audience, offering comprehensive details on the company's innovative products, advanced technologies, recent press releases, and essential financial filings.

These digital touchpoints are vital for fostering transparency and ensuring easy access to information for potential customers, investors, and other stakeholders. For instance, by mid-2024, VIA optronics' investor relations section prominently featured its latest financial reports and strategic updates, reflecting a commitment to open communication.

- Website & Investor Portal: Central hubs for product, technology, and financial information.

- Audience Reach: Engages potential customers, investors, and the wider financial community.

- Transparency & Accessibility: Enhances understanding of the company's operations and performance.

- Information Dissemination: Key for sharing press releases, financial filings, and strategic updates.

VIA optronics utilizes a multi-faceted channel strategy, prioritizing direct sales to major OEMs and Tier-1 suppliers. This approach fosters deep client relationships and allows for the development of highly customized optical solutions, a critical factor in securing complex B2B contracts. Strategic partnerships and joint ventures, such as with Autolink, further expand market reach and product offerings, particularly in the automotive sector. Industry events and digital platforms like the company website and investor portal serve as vital conduits for showcasing technology, engaging with stakeholders, and disseminating crucial information, ensuring broad market visibility and accessibility.

| Channel | Key Activities | Target Audience | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Relationship building, technical discussions, customized solutions | OEMs, Tier-1 Suppliers (Automotive, Industrial, Medical) | Significant revenue driver, crucial for large contracts. |

| Strategic Partnerships/JVs | Market penetration, integrated solutions, complementary strengths | New market segments, broader customer base | Key for expanding automotive solutions and market access. |

| Industry Events/Trade Shows | Technology showcase, lead generation, customer engagement | Potential clients, partners, industry experts | Important for brand visibility and new business opportunities. |

| Website & Investor Portal | Information dissemination, transparency, stakeholder communication | Customers, investors, financial community | Central hubs for product, financial, and strategic updates. |

Customer Segments

VIA optronics' automotive segment primarily serves original equipment manufacturers (OEMs) and Tier-1 suppliers. These partners rely on VIA for advanced interactive display systems, camera modules, and smart cockpit solutions designed for vehicle interiors.

The automotive industry demands exceptional reliability and specific optical performance, especially for components operating in challenging in-car environments. VIA optronics' solutions are engineered to meet these rigorous standards, ensuring durability and functionality.

In 2024, the automotive industry continued its strong push towards digitalization, with in-car displays becoming central to the user experience. VIA optronics' commitment to high-quality, robust optical solutions positions them to capitalize on this trend, supporting the integration of increasingly sophisticated electronic features in new vehicle models.

VIA Optronics caters to the robust industrial sector, supplying display technologies for critical applications like human-machine interfaces (HMIs) and control panels. These solutions are engineered for resilience, ensuring high visibility and functionality even in challenging environments. This strategic move into a less volatile market segment is a key development for VIA.

The industrial market demands displays that can withstand harsh conditions, including extreme temperatures, vibration, and dust, making VIA's durable offerings particularly valuable. For instance, VIA's displays are integral to specialized equipment where reliability is paramount. This focus on industrial applications represents a significant part of VIA's strategy to diversify its revenue streams.

VIA optronics provides specialized display solutions for the medical device sector, crucial for applications like diagnostic imaging, patient monitoring, and surgical equipment. These displays demand exceptional clarity, unwavering reliability, and adherence to strict regulatory standards.

The company's advanced display technologies, known for their high brightness and contrast, are particularly valuable in medical settings where precise visual information is critical for patient care and accurate diagnoses. For instance, the global medical display market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly, indicating a robust demand for high-quality solutions like those VIA optronics offers.

Consumer Electronics (High-End/Specialized)

VIA optronics continues to cater to a select segment within consumer electronics, focusing on high-end and specialized applications. This means they provide custom display solutions where exceptional performance and resilience are paramount, rather than targeting the broad consumer market. This approach appeals to users who value premium quality and cutting-edge functionality.

These demanding consumers seek out products that offer a distinct advantage, making VIA optronics' tailored display components a key differentiator. For instance, in 2024, the market for specialized display technologies in areas like professional photography equipment and high-fidelity audio systems saw continued growth, with consumers willing to pay a premium for enhanced visual clarity and durability.

- Niche Focus: Serving premium segments like professional cameras or audiophile equipment.

- Customization: Offering tailored display solutions for specific, high-performance needs.

- Value Proposition: Prioritizing superior functionality, durability, and visual fidelity over mass appeal.

- Market Demand: Catering to users who understand and are willing to invest in advanced display technology for critical applications.

Specialized Applications and Military

VIA optronics’ advanced display technologies extend to highly specialized sectors, notably military and ruggedized applications. These demanding environments necessitate displays capable of performing reliably under extreme conditions, such as significant temperature fluctuations, vibration, and shock. For instance, in 2024, the global rugged device market, which includes military-grade equipment, was projected to reach over $7 billion, highlighting the significant demand for robust display solutions.

VIA optronics’ expertise in optical bonding and advanced materials development directly addresses these critical performance requirements. Their solutions are engineered for durability and clarity, ensuring vital information is accessible even in harsh operational settings. This segment values:

- Extreme environmental resilience: Displays designed to withstand wide temperature ranges, humidity, and physical impact.

- Enhanced readability: Anti-reflective and high-brightness technologies for optimal visibility in direct sunlight or challenging lighting.

- Customization for specific needs: Tailored solutions that integrate seamlessly into specialized military hardware and equipment.

VIA optronics serves a diverse customer base across several key sectors, each with unique demands for display technology. The company's primary focus is on the automotive industry, supplying OEMs and Tier-1 suppliers with interactive display systems and smart cockpit solutions. Additionally, VIA caters to the industrial sector, providing robust displays for HMIs and control panels, as well as the medical device market with high-clarity displays for diagnostic and monitoring equipment. A smaller, but significant, segment includes consumer electronics, specifically high-end and specialized applications requiring premium performance and durability, and the military sector, where ruggedized displays are essential for extreme environmental resilience.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Automotive | Reliability, optical performance, digitalization integration | Continued strong demand for advanced in-car displays. |

| Industrial | Durability, high visibility in harsh conditions | Essential for critical applications where reliability is paramount. |

| Medical Devices | Clarity, unwavering reliability, regulatory compliance | Growing market driven by demand for precise visual information. |

| Consumer Electronics (Niche) | Superior functionality, visual fidelity, durability | Growth in specialized tech like professional cameras and audio. |

| Military/Ruggedized | Extreme environmental resilience, enhanced readability | Significant demand within the global rugged device market. |

Cost Structure

VIA optronics faces significant manufacturing and production expenses. These include the cost of raw materials like glass for displays, touch sensors, and camera modules, alongside labor and overheads at their global facilities. The complexity and customization of their optical bonding solutions directly impact these figures.

For instance, in 2024, VIA optronics reported that its cost of sales, which encompasses these manufacturing expenses, was a substantial portion of its revenue. Managing these costs efficiently across its international production sites is crucial for profitability, especially given the specialized nature of their products.

VIA optronics dedicates significant resources to Research and Development, a cornerstone of its strategy to pioneer advanced display and camera technologies. This investment fuels innovation in areas like optical bonding and new display solutions, ensuring the company stays ahead in a rapidly evolving market.

In 2024, the company continued its commitment to R&D, recognizing it as essential for developing next-generation products and maintaining a competitive advantage. This ongoing financial commitment is vital for VIA optronics' long-term growth and its ability to offer cutting-edge solutions to its clientele.

VIA optronics incurs significant costs in its sales, marketing, and distribution efforts. These include the expenses associated with a direct sales force, the upkeep of global sales offices to manage international client relationships, and participation in crucial industry trade shows and events to showcase their advanced display solutions. For instance, in 2023, the company reported that selling, general, and administrative expenses, which encompass these activities, amounted to €44.6 million.

Furthermore, the logistical demands of shipping their specialized products worldwide contribute substantially to these costs. Effectively managing these distribution channels is paramount for VIA optronics to reach its diverse customer base across various industries and geographical locations, ultimately driving revenue generation and market penetration.

Personnel and Overhead Costs

Personnel and overhead costs are a substantial component of VIA optronics' expense base. This includes employee salaries, comprehensive benefits packages, and general administrative expenses that span all operational functions and global locations. For instance, in 2023, the company reported personnel expenses as a significant portion of its operating costs, reflecting its investment in skilled talent across R&D, manufacturing, and sales.

VIA optronics has actively pursued restructuring and cost-saving measures to streamline these overheads. These initiatives are crucial for enhancing operational efficiency and bolstering profitability. The company's focus on managing its human capital effectively and improving administrative processes directly impacts its bottom line.

- Employee Salaries and Benefits: A primary cost driver, reflecting the investment in a global workforce.

- General Administrative Overheads: Encompasses expenses for facilities, IT, legal, and other support functions worldwide.

- Cost-Saving Initiatives: Ongoing efforts to optimize personnel and administrative spending for improved financial performance.

- Impact on Profitability: Effective management of these costs is directly linked to the company's ability to achieve and sustain profitability.

Compliance and Public Company Costs

Historically, VIA optronics faced significant expenses tied to its NYSE listing and SEC registration. These costs were a notable component of its overall cost structure, impacting profitability.

In a strategic move to alleviate these financial pressures, VIA optronics announced its intention to delist from the NYSE. This decision reflects a clear effort to streamline operations and reduce the ongoing burden of public company compliance.

By shedding the requirements of a major exchange listing, the company anticipates a substantial reduction in regulatory and compliance expenses. This optimization is expected to enhance overall financial efficiency and allow for greater focus on core business activities.

- NYSE Listing Fees: Annual fees for maintaining a listing on the New York Stock Exchange.

- SEC Reporting Costs: Expenses related to filing annual and quarterly reports, and other regulatory disclosures.

- Legal and Audit Fees: Increased costs for legal counsel and independent auditors due to public company scrutiny.

- Investor Relations: Costs associated with communicating with shareholders and the broader investment community.

VIA optronics' cost structure is heavily influenced by its manufacturing and production expenses, including raw materials like glass and touch sensors, as well as labor and overheads. For instance, in 2024, the cost of sales represented a significant portion of its revenue, underscoring the importance of efficient management across its global facilities.

The company also invests substantially in Research and Development to drive innovation in display and camera technologies, a commitment that continued throughout 2024 to maintain its competitive edge. Additionally, sales, marketing, and distribution costs, including a global sales force and logistics for specialized product shipping, are key components. In 2023, selling, general, and administrative expenses alone amounted to €44.6 million.

Personnel and overhead costs, encompassing salaries, benefits, and general administrative expenses across its global operations, form another major part of its cost base. In 2023, personnel expenses were a significant operating cost, reflecting investment in skilled talent. The company has also focused on cost-saving initiatives to streamline these expenses and improve financial performance.

VIA optronics has also worked to reduce costs associated with its public company status. The decision to delist from the NYSE in 2023 was a strategic move aimed at significantly cutting regulatory, compliance, legal, audit, and investor relations expenses, thereby enhancing overall financial efficiency.

| Cost Category | Key Components | 2023 Data (if available) | 2024 Focus |

|---|---|---|---|

| Manufacturing & Production | Raw materials, labor, global overheads | Cost of Sales (substantial portion of revenue) | Efficiency improvements |

| Research & Development | Innovation in display/camera tech | Continued investment | Next-generation product development |

| Sales, Marketing & Distribution | Sales force, global offices, trade shows, logistics | SG&A: €44.6 million | Market penetration, client relationships |

| Personnel & Overheads | Salaries, benefits, administrative expenses | Significant operating cost | Cost-saving initiatives, operational efficiency |

| Public Company Costs | NYSE listing, SEC reporting, legal, investor relations | Reduced by NYSE delisting intention | Streamlining operations, reducing compliance burden |

Revenue Streams

VIA optronics' main way of making money is by selling custom-made display solutions. This includes things like LCD screens, touch panels, and tough protective glass. These products are specifically designed to meet the unique technical needs and harsh conditions faced by their customers. For instance, in 2023, VIA optronics reported sales of €106.6 million, with a significant portion driven by these specialized display offerings.

VIA optronics generates revenue by offering complete system solutions, combining displays, touch capabilities, and camera modules, often with integrated software. This approach is particularly valuable for customers in the automotive sector, especially those developing smart cockpit platforms.

This strategy allows VIA optronics to provide a more holistic product, moving beyond individual components to deliver a fully functional integrated system. For instance, in 2024, the demand for advanced in-car infotainment and driver assistance systems, which rely heavily on such integrated solutions, continued to grow, presenting significant revenue opportunities for VIA optronics.

VIA optronics generates revenue by selling individual camera modules and their advanced metal mesh touch sensors. These essential components are either built into VIA's own integrated solutions or supplied directly to clients for their product development.

In 2024, VIA optronics has been actively broadening its camera offerings, recognizing this as a significant avenue for future expansion and revenue growth. This strategic focus aims to capture a larger share of the market for sophisticated imaging and touch interface technologies.

Optical Bonding Manufacturing Services

VIA's optical bonding manufacturing services represent a significant revenue stream, allowing other companies to leverage VIA's specialized expertise and proprietary technology for their own display products. This B2B service taps into the demand for enhanced display durability and visual performance across various industries.

This offering diversifies VIA's income beyond its direct product sales, capitalizing on its manufacturing capabilities. For instance, in 2023, VIA reported a substantial portion of its revenue stemming from these manufacturing services, underscoring their importance to the company's financial health.

- Leveraging Core Competencies: VIA's optical bonding technology, a key differentiator, is offered as a service, enabling clients to achieve superior display quality and ruggedness.

- Market Access: This service allows VIA to serve a broader market, including companies that may not purchase VIA's finished products but require advanced bonding solutions for their own designs.

- Revenue Diversification: It provides a complementary income source, reducing reliance solely on VIA's branded display modules and enhancing overall business resilience.

Consignment Stock Business Model (Future)

VIA optronics is planning a significant shift in its revenue recognition strategy for 2025, moving towards a consignment stock model with a key customer. This change is projected to positively impact gross margins, even though it will alter how revenue is reported.

This strategic evolution in managing relationships with major clients is designed to enhance overall profitability. The company anticipates this move will streamline operations and potentially lead to improved financial performance in the long term.

- Consignment Stock Model Adoption: VIA optronics will implement a consignment stock business model with a major customer starting in 2025.

- Revenue Reporting Impact: This shift will affect how revenue is reported, moving from direct sales to a consignment basis.

- Gross Margin Improvement: The company anticipates an increase in gross margins as a direct benefit of this new model.

- Strategic Client Relationship Evolution: This represents a fundamental change in revenue management and operational strategy with key partners.

VIA optronics generates revenue through the sale of custom-designed display solutions, encompassing LCDs, touch panels, and protective glass, tailored for demanding environments. The company also offers integrated system solutions, combining displays, touch, and camera modules, particularly for automotive applications.

Additional revenue streams include the sale of individual camera modules and advanced metal mesh touch sensors, which can be integrated into VIA's systems or sold separately. Furthermore, VIA provides optical bonding manufacturing services, leveraging its proprietary technology for other companies' display products.

| Revenue Stream | Description | 2023 Data (Approximate) |

|---|---|---|

| Custom Display Solutions | Tailored LCDs, touch panels, protective glass | €106.6 million (Total Sales) |

| Integrated System Solutions | Displays, touch, cameras, and software for automotive | Growing demand in 2024 |

| Camera Modules & Touch Sensors | Individual components for integration | Broadening offerings in 2024 |

| Optical Bonding Services | Manufacturing services for clients' displays | Significant portion of 2023 revenue |

Business Model Canvas Data Sources

The VIA optronics Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and detailed competitive analysis. These sources ensure that each component of the canvas accurately reflects VIA optronics' operational realities and strategic objectives.