Universal Insurance Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Insurance Holdings Bundle

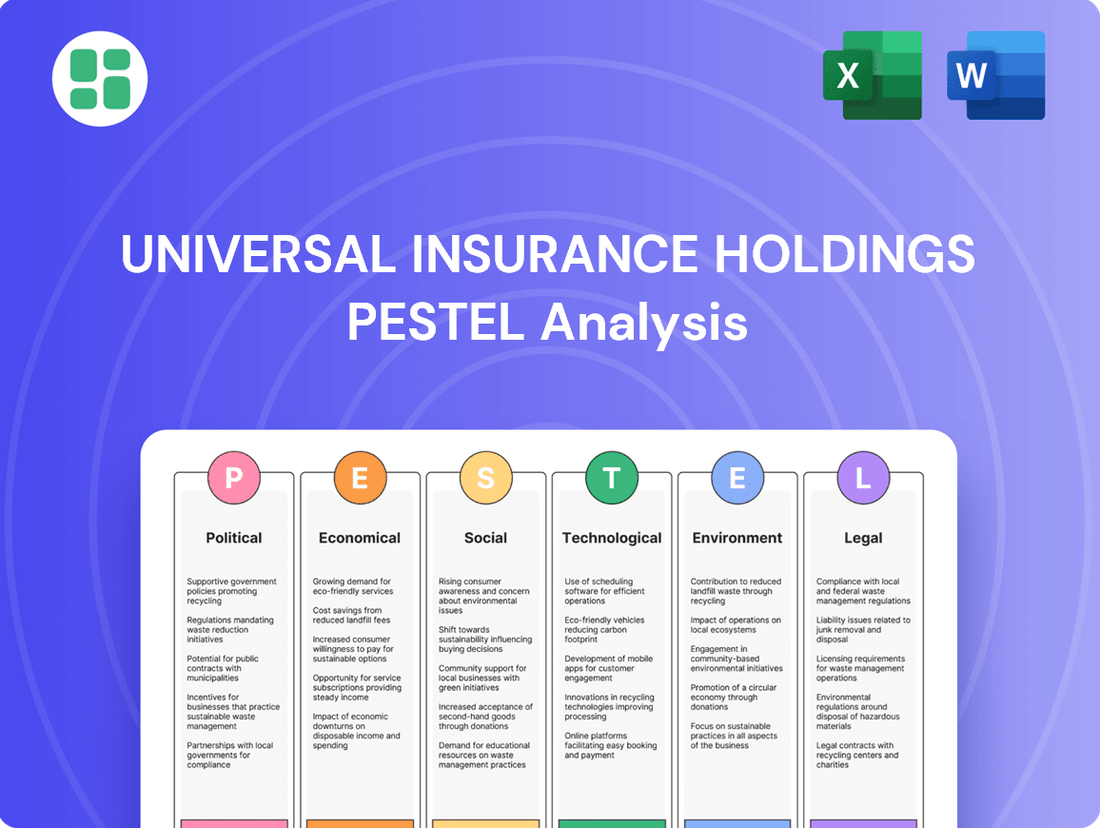

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Universal Insurance Holdings's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Gain a strategic advantage by understanding the forces that will define the company's future. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The regulatory environment in Florida, a key market for Universal Insurance Holdings, is heavily shaped by political decisions. Recent legislative sessions have seen debates around property insurance reforms, impacting how companies like Universal can set rates and manage risk. For instance, efforts to stabilize the market in 2023 included measures aimed at reducing litigation and increasing insurer solvency, which directly affects Universal's operational costs and strategic planning.

Florida's property insurance landscape is particularly sensitive to legislative changes, frequently influenced by hurricane activity and the prevalence of lawsuits. Recent reforms in 2023, such as those enacted by Senate Bill 7052, aimed to curb excessive litigation and fraud, a move designed to stabilize the market. These legislative efforts directly impact Universal Insurance Holdings by altering its claims handling costs and overall risk profile.

The success of these reforms in reducing litigation is a key factor for Universal. For instance, the state saw a significant decrease in new property insurance lawsuits filed in the first half of 2024 compared to the same period in 2023, a trend that could benefit insurers like Universal by lowering legal expenses. Future political decisions regarding tort reform and the regulation of assignment of benefits (AOB) will continue to be critical determinants of Universal's financial performance and market stability.

Government policies on disaster relief, such as those managed by FEMA, significantly shape the landscape for private insurers like Universal Insurance Holdings. These federal and state aid programs can influence consumer demand for private insurance by acting as a partial backstop, potentially reducing the perceived need for comprehensive private coverage in some instances.

The availability and generosity of disaster aid directly impact the speed and effectiveness of recovery in catastrophe-stricken areas, which in turn affects the claims environment for insurers. For example, in 2023, FEMA allocated over $30 billion in disaster relief funding, demonstrating the substantial role government assistance plays in post-event recovery.

Political decisions regarding the funding levels and eligibility criteria for these government programs are therefore critical. Changes in these policies can alter the risk profile for insurance companies and influence their pricing strategies and product offerings, especially in regions prone to natural disasters.

Political Stability and Governance

Universal Insurance Holdings' operations are significantly influenced by the political stability within its key operating states, particularly Florida. A stable political climate fosters investor confidence and allows for more predictable long-term business planning. For instance, Florida's political landscape, which saw Governor Ron DeSantis re-elected in 2022 with a significant margin, generally provides a consistent regulatory environment, although specific legislative changes can still introduce volatility.

Stable governance ensures consistency in regulatory enforcement and economic policies, which is crucial for insurers. In 2023, Florida lawmakers continued to address insurance market reforms, aiming to stabilize the sector after years of significant losses for insurers. These efforts, while intended to improve the market, can also introduce periods of adjustment and uncertainty for companies like Universal Insurance Holdings.

Political uncertainty or rapid leadership changes can introduce substantial risks. The impact of these changes on Universal Insurance Holdings can be seen in its financial performance, as regulatory shifts can affect pricing, claims handling, and capital requirements. For example, changes in property insurance regulations or disaster recovery funding policies directly affect profitability and operational strategies.

- Florida's political stability: Governor DeSantis's re-election in 2022 provides a degree of continuity in state leadership.

- Regulatory consistency: Stable governance aims for predictable enforcement of insurance laws and economic policies.

- Legislative reforms: Ongoing efforts in Florida to reform the insurance market, while beneficial long-term, create short-term adaptation needs for insurers.

- Impact on investor confidence: Political stability directly correlates with how investors perceive the risk and potential for growth of companies like Universal Insurance Holdings.

Public Policy on Climate Change

The current political landscape, particularly concerning climate change, significantly shapes the operational environment for Universal Insurance Holdings. Government bodies are increasingly implementing policies aimed at mitigating climate risks, which directly impacts property development and insurance underwriting. For instance, in 2024, the U.S. government continued to invest in climate resilience infrastructure, with projected federal spending on climate adaptation measures expected to reach tens of billions annually through 2025. These initiatives often translate into stricter building codes and updated land-use planning regulations in vulnerable areas.

These policy shifts, while not direct insurance regulations, fundamentally alter the risk profile of insured assets. Universal Insurance Holdings must therefore monitor evolving public policy on climate change, as it can lead to increased demand for certain types of coverage, such as flood or wildfire insurance, while potentially making other areas less insurable. For example, states like California and Florida, facing heightened wildfire and hurricane risks respectively, saw legislative action in 2024 to bolster building standards and mandate greater disclosure of climate-related risks to property owners.

The influence of political leaders and government bodies extends to public awareness campaigns and incentives for adaptation. As governments promote greater resilience, property owners may be more inclined to invest in protective measures. This can affect the frequency and severity of claims that Universal Insurance Holdings might face. For instance, federal grants and tax credits introduced in 2024 to encourage home retrofitting for disaster resilience could, over time, reduce the overall insurable risk for a portfolio of properties.

- Stricter Building Codes: Political mandates for more resilient construction in areas prone to extreme weather events.

- Land Use Planning: Government decisions on zoning and development in floodplains or wildfire-prone regions.

- Public Awareness Initiatives: Government-led campaigns to educate citizens on climate risks and adaptation strategies.

- Incentives for Resilience: Policy measures like tax credits or grants for property owners who implement climate-adaptive measures.

Government policies on disaster relief, such as those managed by FEMA, significantly shape the landscape for private insurers like Universal Insurance Holdings. These federal and state aid programs can influence consumer demand for private insurance by acting as a partial backstop, potentially reducing the perceived need for comprehensive private coverage in some instances.

The availability and generosity of disaster aid directly impact the speed and effectiveness of recovery in catastrophe-stricken areas, which in turn affects the claims environment for insurers. For example, in 2023, FEMA allocated over $30 billion in disaster relief funding, demonstrating the substantial role government assistance plays in post-event recovery.

Political decisions regarding the funding levels and eligibility criteria for these government programs are therefore critical. Changes in these policies can alter the risk profile for insurance companies and influence their pricing strategies and product offerings, especially in regions prone to natural disasters.

| Factor | Impact on Universal Insurance Holdings | 2023/2024 Data/Trend |

|---|---|---|

| Disaster Relief Funding (FEMA) | Influences demand for private insurance, affects claims environment. | FEMA allocated over $30 billion in disaster relief in 2023. |

| Climate Change Mitigation Policies | Shapes underwriting by influencing building codes and land-use planning. | U.S. federal spending on climate adaptation measures projected to reach tens of billions annually through 2025. |

| Legislative Reforms (e.g., Florida) | Affects operational costs, rate setting, and risk management. | Florida enacted reforms (e.g., SB 7052) in 2023 to reduce litigation and stabilize the market. |

| Political Stability | Impacts investor confidence and predictability of the regulatory environment. | Florida's political stability, with Governor DeSantis re-elected in 2022, generally supports a consistent regulatory climate. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Universal Insurance Holdings, providing a comprehensive overview of political, economic, social, technological, environmental, and legal influences.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identify potential opportunities and threats within the insurance industry.

This PESTLE analysis for Universal Insurance Holdings acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing and informed decision-making during strategic planning.

Economic factors

Inflation directly impacts Universal Insurance Holdings by increasing the cost of claims. For instance, if the cost of auto parts or construction materials rises due to inflation, the company will have to pay more to settle claims. This can significantly erode underwriting profits if premium rates are not adjusted quickly enough to offset these rising expenses.

As of early 2024, inflation in the United States has shown a moderating trend, with the Consumer Price Index (CPI) averaging around 3.4% year-over-year, down from its 2022 peaks. However, specific sectors like construction materials have seen more persistent price pressures.

Interest rate trends play a crucial role in Universal Insurance Holdings' investment income. As the Federal Reserve maintained higher interest rates through much of 2023 and into 2024, the yield on the company's investment portfolio, often referred to as premium float, has generally increased. This benefits profitability by generating higher returns on the premiums collected before they are paid out as claims.

The increasing frequency and severity of catastrophic events, especially hurricanes in Florida, pose a significant economic risk for Universal Insurance Holdings. For instance, the 2022 Atlantic hurricane season, while not as active as some, still saw insured losses estimated in the tens of billions globally, highlighting the potential for substantial claims payouts. This directly impacts underwriting profitability.

A surge in claims from these events necessitates greater reliance on reinsurance, which adds to Universal's operating costs. The economic fallout from a major hurricane can cripple regional economies, reducing premium collection and increasing the likelihood of policyholder defaults, further straining financial performance.

The global reinsurance market significantly impacts Universal Insurance Holdings' operational costs. When reinsurance markets harden, meaning prices rise and available coverage shrinks, Universal Insurance faces higher expenses for transferring its catastrophic risks. This trend, often driven by substantial global insured losses, puts direct pressure on Universal Insurance Holdings' underwriting profitability.

For instance, during the first half of 2024, reinsurance renewal rates for property catastrophe coverage saw increases ranging from 10% to 30% or more in certain regions, reflecting the ongoing impact of major natural disasters in 2023, such as Hurricane Idalia and significant wildfire events. These elevated costs for reinsurance directly translate to a higher cost of doing business for primary insurers like Universal Insurance Holdings, potentially squeezing their net underwriting margins if these costs cannot be fully passed on to policyholders.

Economic Growth and Consumer Spending

Broader economic growth directly impacts Universal Insurance Holdings by influencing property values and new construction activity in its operating states, which in turn expands the market for homeowners insurance. For instance, in 2024, many states are experiencing steady GDP growth, which typically correlates with increased real estate transactions and a greater need for property coverage.

Consumer spending power and financial stability are also critical. When consumers have more disposable income and feel financially secure, they are more likely to maintain their insurance policies and consider higher coverage limits. This financial health of policyholders directly supports Universal Insurance Holdings' ability to collect premiums and grow its revenue base.

A robust economy generally translates to premium growth for insurers like Universal Insurance Holdings. For example, if the U.S. economy continues its projected growth trajectory of approximately 2.5% to 3% in 2024 and into 2025, this positive economic climate would likely support increased demand for insurance products and the capacity for policyholders to afford them.

- Economic Growth: States with stronger GDP growth often see a rise in property values and new construction, expanding the potential customer base for homeowners insurance.

- Consumer Spending: Higher consumer spending power and financial stability allow policyholders to afford premiums and potentially opt for more comprehensive coverage.

- Premium Growth: A healthy economy generally supports an insurer's ability to grow its premium income due to increased demand and policyholder affordability.

- Market Expansion: Economic upturns create more opportunities for Universal Insurance Holdings to expand its market share through increased policy sales.

Unemployment Rates and Income Levels

Unemployment rates and general income levels significantly influence Universal Insurance Holdings' ability to retain existing policyholders and attract new ones. For instance, in the United States, the unemployment rate hovered around 3.9% in early 2024, a relatively low figure that generally supports consumer spending on insurance. However, fluctuations in these rates directly impact disposable income, affecting affordability.

When unemployment rises or incomes stagnate, consumers often re-evaluate their expenses, leading them to seek more budget-friendly insurance alternatives or, in some cases, to lapse their policies altogether. This directly curtails Universal Insurance Holdings' premium volume. For example, a 1% increase in unemployment could correlate with a measurable decrease in policy retention across certain segments.

The economic stability of consumers is therefore a critical determinant for the company's consistent revenue generation. A strong labor market and rising real wages, as seen with moderate wage growth in 2024, tend to bolster consumer confidence and their capacity to maintain insurance coverage. Conversely, economic downturns characterized by job losses and reduced purchasing power pose a substantial risk to the company's financial performance.

- US Unemployment Rate (Early 2024): Approximately 3.9%.

- Impact of Economic Downturns: Can lead to policy lapses and reduced premium volume.

- Consumer Stability: Vital for consistent revenue and policy retention.

- Wage Growth: Moderate wage growth in 2024 supports consumer spending on insurance.

Inflation's persistent upward pressure on claim costs, particularly in sectors like construction materials, directly impacts Universal Insurance Holdings' profitability if premiums don't keep pace. While the US CPI moderated to around 3.4% year-over-year in early 2024, specific cost increases remain a concern.

Rising interest rates, however, have boosted Universal's investment income on its premium float, with the Federal Reserve's higher rate policy through 2023 and into 2024 providing a tailwind. Conversely, the increasing frequency and severity of natural disasters, such as hurricanes, present a significant economic risk, driving up reinsurance costs and potentially impacting regional economies where Universal operates.

| Economic Factor | Impact on Universal Insurance Holdings | 2024/2025 Data/Trend |

|---|---|---|

| Inflation | Increased claims costs, potential margin squeeze | US CPI ~3.4% YoY (early 2024), but specific costs elevated |

| Interest Rates | Higher investment income on float | Fed rates remained elevated through 2023-2024 |

| Catastrophic Events | Higher reinsurance costs, potential regional economic disruption | Continued trend of costly natural disasters |

| Economic Growth | Expanded market for property insurance, increased premium potential | Projected US GDP growth ~2.5%-3% for 2024/2025 |

| Unemployment | Reduced policy retention and premium volume | US unemployment rate ~3.9% (early 2024) |

Full Version Awaits

Universal Insurance Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Universal Insurance Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides an in-depth examination of external influences shaping Universal Insurance Holdings, offering valuable insights for strategic planning and risk assessment.

Sociological factors

Demographic shifts, including an aging population and increased migration to coastal regions, directly impact Universal Insurance Holdings by altering the demand for homeowners insurance and the types of properties needing coverage. For instance, the U.S. Census Bureau reported that in 2023, the 65 and older population was projected to reach 77 million by 2034, a significant increase that may lead to different insurance needs, like coverage for properties with aging infrastructure.

Universal Insurance Holdings must adapt its product portfolio to meet the evolving needs of diverse household structures and property types within its service areas. This necessitates a deep understanding of the specific insurance requirements of new residents, particularly in areas experiencing population growth, such as Florida, where Universal Insurance Holdings is a major player and which saw a net domestic migration of over 300,000 people in 2023 according to the Florida Division of Emergency Management.

Public awareness of climate risk is significantly shaping the insurance landscape. Growing concern over climate change's impact on property values and safety is driving demand for more robust coverage against climate-related perils. For instance, a 2024 survey indicated that 65% of homeowners in coastal regions are now more concerned about flood risk than they were two years prior, directly influencing their insurance choices.

Modern consumers increasingly demand personalized, digital, and efficient insurance experiences. For instance, a 2024 Accenture survey found that 70% of insurance customers prefer self-service options for policy management and claims. Universal Insurance Holdings needs to integrate robust online platforms and streamline digital workflows to meet these evolving expectations, mirroring the success of digital-first insurers who saw a 15% increase in customer retention in 2023.

The shift towards digital interaction extends to claims processing and communication. Customers now expect swift, transparent updates throughout the claims journey, with many preferring mobile app notifications over traditional mail. Companies that fail to offer these conveniences risk losing customers to competitors who prioritize a seamless, user-friendly digital experience, a trend that contributed to a 10% rise in customer acquisition costs for less digitally-adept insurers in the past year.

Societal Attitudes Towards Litigation

Societal attitudes toward litigation significantly shape the claims landscape for Universal Insurance Holdings, especially in states like Florida. A high propensity to sue directly translates to increased defense expenses and larger claim payouts, thereby impacting the insurer's underwriting performance and the necessity for adjusted premium rates. For instance, Florida has historically been recognized for its litigious environment, which can elevate operational costs for insurance companies.

The prevalence of litigation is not static; it can be influenced by broader cultural shifts. A move towards alternative dispute resolution methods, such as mediation or arbitration, could potentially mitigate the frequency and cost of lawsuits. This would, in turn, offer a more favorable claims environment for insurers like Universal Insurance Holdings.

- Florida's Litigation Environment: Historically, Florida has been a focal point for insurance-related litigation, contributing to higher claims costs for insurers.

- Impact on Premiums: Increased litigation directly correlates with higher defense and settlement costs, necessitating adjustments in insurance premium pricing to maintain profitability.

- Dispute Resolution Trends: Shifting societal preferences towards less adversarial dispute resolution methods could lead to a reduction in claims costs.

- Underwriting Results: The propensity to litigate is a key factor influencing the accuracy of underwriting assumptions and the overall financial health of an insurance portfolio.

Urbanization and Housing Trends

Urbanization continues to reshape housing demand, with a notable increase in multi-family dwellings. In 2024, the U.S. saw a significant portion of new housing starts being apartments and condominiums, reflecting a growing preference for urban living and smaller footprints. This shift impacts Universal Insurance Holdings by altering the risk landscape, as densely populated areas and different construction materials in multi-family units necessitate updated underwriting standards and product development.

Suburbanization also plays a role, with some households seeking more space, though often with a focus on modern amenities. The rise of smart home technology, integrated into both urban apartments and suburban houses, introduces new considerations for coverage related to cybersecurity and the interconnectedness of home systems. Universal Insurance Holdings must adapt its policies to account for these evolving property types and the associated technological risks.

- Urban Growth: Cities are expanding, driving demand for diverse housing options.

- Multi-Family Focus: A growing percentage of new construction consists of apartments and condos. In 2024, apartment construction accounted for a substantial share of residential building permits.

- Smart Home Integration: The prevalence of connected devices in homes creates new insurance challenges and opportunities.

- Risk Profile Shifts: Population density and building types directly influence property insurance needs and underwriting accuracy.

Societal attitudes towards litigation can significantly affect Universal Insurance Holdings, particularly in states like Florida, known for its litigious environment. This propensity for lawsuits directly increases defense costs and claim payouts, impacting underwriting results and potentially leading to adjusted premium rates to maintain profitability.

Shifting preferences towards alternative dispute resolution methods, such as mediation or arbitration, could offer a more favorable claims environment by potentially reducing the frequency and cost of lawsuits. This trend is crucial for insurers to monitor as it can influence overall claims expenses and operational efficiency.

The increasing demand for personalized, digital, and efficient customer experiences is a critical sociological factor. A 2024 Accenture survey revealed that 70% of insurance customers prefer self-service options, highlighting the need for Universal Insurance Holdings to invest in robust online platforms and streamlined digital workflows to meet evolving consumer expectations.

Technological factors

Universal Insurance Holdings can leverage advanced data analytics and AI to significantly improve its operations. For instance, AI can analyze historical data to predict claim frequency and severity with greater accuracy, allowing for more precise risk assessment and underwriting. This is vital in a market where accurate pricing can be a key differentiator.

The integration of AI tools can also bolster fraud detection capabilities. By processing large datasets and identifying anomalous patterns, AI can flag potentially fraudulent claims more effectively than traditional methods. This directly impacts profitability by reducing payouts on illegitimate claims.

Furthermore, AI-driven insights can optimize pricing strategies and enhance customer segmentation, leading to more competitive product offerings. In 2024, the insurance industry saw a notable increase in AI adoption, with reports indicating that companies leveraging AI experienced an average of 15% reduction in claims processing costs.

The insurance industry is rapidly evolving with InsurTech innovations, introducing digital solutions for policy management, claims, and customer engagement. For instance, by the end of 2024, it's projected that over 60% of insurance consumers will prefer digital channels for policy purchases and service, a significant jump from previous years.

Universal Insurance Holdings needs to aggressively adopt digitalization to provide smooth online experiences, user-friendly mobile apps, and automated customer service. This digital transformation is crucial for meeting evolving consumer demands, as a recent survey indicated 75% of millennials expect instant digital interactions with their insurers.

These technological advancements are not just about convenience; they are vital for maintaining a competitive edge. Companies that effectively leverage InsurTech can achieve significant operational efficiencies, with some reporting a 20% reduction in claims processing times through automation by mid-2025.

Technologies like satellite imagery, drones, and telematics are revolutionizing how insurers assess risk and manage claims. For instance, satellite data can provide up-to-date property condition assessments, aiding in more accurate underwriting by identifying potential hazards before a policy is issued. This technology is becoming increasingly sophisticated, with advancements in resolution and data processing capabilities.

Universal Insurance Holdings can integrate these tools to streamline operations. Telematics, for example, in auto insurance, allows for real-time monitoring of driving behavior, leading to more personalized pricing and potentially reducing accident frequency. This shift towards data-driven insights can significantly improve underwriting accuracy and expedite the claims adjustment process, cutting down on manual inspections.

The adoption of these technologies can lead to substantial cost savings. By reducing the need for extensive physical inspections, insurers can lower operational expenses. Furthermore, enhanced risk assessment through remote sensing can lead to a more balanced risk portfolio, contributing to improved profitability. For example, the global drone services market was projected to reach $63.4 billion by 2025, indicating significant investment and growth in these capabilities.

Cybersecurity Risks and Data Protection

Universal Insurance Holdings' increasing reliance on digital platforms and the vast amounts of sensitive customer data it collects make robust cybersecurity measures absolutely critical. Protecting against data breaches and sophisticated cyberattacks is not just a technical necessity but a fundamental requirement for maintaining customer trust, ensuring compliance with evolving data privacy regulations, and preventing potentially devastating financial and reputational damage.

The threat landscape is constantly evolving, with cybercriminals developing new tactics. For instance, in 2024, the global average cost of a data breach reached $4.73 million, a figure that underscores the significant financial implications of inadequate security. Universal Insurance Holdings must therefore prioritize continuous investment in advanced cybersecurity infrastructure, including threat detection systems, employee training, and incident response plans, to safeguard its operations and customer information.

Key considerations for Universal Insurance Holdings in this area include:

- Data Encryption and Access Controls: Implementing strong encryption for all sensitive data, both in transit and at rest, and enforcing strict access controls to limit who can view and modify customer information.

- Regular Security Audits and Penetration Testing: Proactively identifying vulnerabilities through frequent security assessments and simulated cyberattacks to stay ahead of potential threats.

- Compliance with Data Protection Regulations: Adhering to regulations like GDPR and CCPA, which impose stringent requirements on how personal data is collected, processed, and stored, with significant penalties for non-compliance.

Automation in Claims Processing

Automation, particularly through robotic process automation (RPA), is revolutionizing how insurance companies handle claims. This technology can automate repetitive tasks in the claims lifecycle, from initial customer contact and data entry to fraud detection and payment processing. For Universal Insurance Holdings, implementing such solutions means a significant boost in efficiency.

By automating claims processing, Universal Insurance Holdings can expect to see a marked reduction in the time it takes to settle claims. This not only enhances customer satisfaction but also frees up valuable human capital. For instance, a 2024 report indicated that insurers leveraging RPA saw an average reduction of 30% in claims processing cycle times. Furthermore, automation minimizes human error, leading to greater accuracy in payouts and fewer disputes.

The administrative cost savings are also substantial. Automating routine tasks allows employees to focus on more complex, value-added activities such as customer service, complex case investigation, and building customer relationships. This strategic reallocation of resources is crucial for maintaining a competitive edge in the evolving insurance landscape. By 2025, it's projected that the global insurance automation market will reach over $10 billion, underscoring the widespread adoption and benefits.

- Streamlined Operations: RPA can automate up to 80% of routine claims handling tasks.

- Improved Accuracy: Automation reduces manual data entry errors, leading to more precise claim settlements.

- Cost Reduction: Companies can see administrative cost savings of up to 25% by automating claims processing.

- Enhanced Customer Experience: Faster claim payouts and reduced errors lead to higher policyholder satisfaction.

The insurance sector's technological advancement is accelerating, with AI and InsurTech driving significant operational improvements. By 2025, over 60% of consumers are expected to prefer digital channels for insurance transactions, highlighting the need for robust online platforms and mobile accessibility.

Advanced technologies like telematics and satellite imagery are transforming risk assessment and claims management, offering more accurate underwriting and faster processing. For example, the global drone services market was projected to reach $63.4 billion by 2025, indicating substantial investment in these capabilities.

Cybersecurity remains paramount due to increasing digital reliance and data collection, with the average cost of a data breach reaching $4.73 million in 2024. Automation, particularly RPA, is streamlining claims processing, with insurers leveraging it reporting up to a 30% reduction in processing times by 2024.

| Technology Area | Impact on Universal Insurance Holdings | Key Metric/Data Point (2024/2025) |

|---|---|---|

| AI & Machine Learning | Improved underwriting accuracy, enhanced fraud detection | Average 15% reduction in claims processing costs for AI adopters (2024) |

| InsurTech & Digitalization | Streamlined customer experience, efficient policy management | 75% of millennials expect instant digital interactions (2024) |

| Remote Sensing (Drones, Satellites) | Precise risk assessment, faster claims adjustments | Global drone services market projected at $63.4 billion by 2025 |

| Robotic Process Automation (RPA) | Reduced claims cycle times, lower administrative costs | Up to 30% reduction in claims processing cycle times (2024) |

| Cybersecurity | Protection of sensitive data, customer trust maintenance | Average cost of data breach $4.73 million (2024) |

Legal factors

Universal Insurance Holdings' heavy reliance on Florida means navigating a complex web of state-specific insurance regulations. These rules, enforced by the Florida Office of Insurance Regulation, dictate everything from pricing and policy forms to how claims are processed and the financial stability required. For instance, Florida’s approach to rate approvals can significantly influence Universal’s ability to adjust premiums in response to market conditions.

Recent legislative changes in Florida, such as those aimed at addressing property insurance market instability, directly impact Universal. In 2023, Florida enacted significant reforms, including measures to curb frivolous lawsuits and changes to the state's reinsurance program, which could affect Universal's reinsurance costs and overall profitability. The company must remain agile to adapt to these evolving legal landscapes.

Consumer protection laws, such as those governing fair claims handling and data privacy, place substantial legal responsibilities on Universal Insurance Holdings. For instance, the National Association of Insurance Commissioners (NAIC) continues to update its model laws, with recent discussions in 2024 focusing on enhanced consumer disclosures for cybersecurity risks, directly impacting how insurers like Universal must communicate with policyholders.

Strict adherence to these regulations is paramount to prevent costly fines and protect Universal's brand image. In 2023 alone, state insurance departments collected over $1.5 billion in fines, with a significant portion stemming from violations of consumer protection statutes. Failing to meet these standards can lead to severe financial penalties and a loss of public trust.

Evolving consumer advocacy and shifting legal interpretations can introduce new compliance challenges and potential litigation for Universal Insurance Holdings. For example, the increasing focus on algorithmic bias in underwriting and claims processing, a trend gaining momentum in 2024, may necessitate new legal frameworks and compliance strategies for insurers to ensure fairness and avoid discriminatory practices.

The legal landscape, especially concerning property insurance claims and the rise of assignment of benefits (AOB) lawsuits, heavily influences Universal Insurance Holdings' financial health. States like Florida have experienced a surge in litigation, leading to legislative pushes for tort reform.

The effectiveness of these reforms directly impacts Universal Insurance Holdings' claims expenses and legal costs. For instance, Florida's legislative session in 2023 saw significant changes aimed at curbing AOB abuse, with reports indicating a potential reduction in litigation rates, though the full impact will be clearer in 2024 and 2025 data.

Data Privacy and Security Laws

Universal Insurance Holdings operates under a complex web of data privacy and security laws. The California Consumer Privacy Act (CCPA), and its successor the California Privacy Rights Act (CPRA), along with similar state-level regulations enacted across the US, significantly shape how the company handles policyholder information. These laws mandate transparency and control over personal data, requiring Universal Insurance Holdings to implement stringent data governance practices.

Compliance with these regulations is not just a legal obligation but a critical operational necessity. For instance, the CCPA grants consumers rights regarding their personal information, including the right to know what data is collected, the right to request deletion, and the right to opt-out of the sale of their data. Failure to adhere can result in substantial penalties; California regulators have been actively enforcing these laws, with significant fines levied against non-compliant businesses.

- CCPA Enforcement: In 2023, California's Attorney General announced settlements totaling over $1.2 million for privacy violations.

- Data Protection Investment: Companies are projected to increase spending on data privacy compliance, with global cybersecurity spending expected to reach $267 billion in 2024.

- Impact on Strategy: Evolving privacy laws may necessitate adjustments to Universal Insurance Holdings' data analytics and marketing strategies, potentially limiting certain data utilization methods.

Contract Law and Policy Interpretation

The way insurance contracts and their specific clauses are legally interpreted is absolutely central to how Universal Insurance Holdings operates. Every decision made by courts on issues like what's covered, what's excluded, or even the precise wording of a policy can create new rules that impact how claims are handled and how policies are written, not just for Universal, but for the entire insurance sector.

For instance, in 2024, the insurance industry saw a notable increase in litigation surrounding business interruption clauses, particularly in the wake of evolving business models. This trend highlights the critical need for clear and unambiguous policy language to minimize disputes and potential financial liabilities. Universal Insurance Holdings, like its peers, must navigate these legal interpretations to ensure its underwriting and claims processes remain robust and compliant.

The clarity and enforceability of the policy language directly influence Universal's ability to manage its risk effectively and steer clear of costly legal battles. A well-defined policy not only protects the company but also builds trust with policyholders by setting clear expectations. In 2025, regulatory bodies are expected to further scrutinize policy clarity, pushing insurers to adopt more transparent language.

- Contract Interpretation: Legal rulings on policy wording directly shape Universal Insurance Holdings' claims and underwriting practices.

- Precedent Setting: Court decisions on coverage disputes and exclusions establish industry-wide precedents affecting future operations.

- Risk Management: Clear and enforceable policy language is vital for Universal to manage financial risk and avoid legal challenges.

- Industry Trends: Increased litigation in 2024 over specific clauses underscores the importance of precise policy drafting for insurers like Universal.

Legal and regulatory frameworks profoundly shape Universal Insurance Holdings' operations, particularly in its core Florida market. State-specific regulations, enforced by bodies like the Florida Office of Insurance Regulation, dictate crucial aspects from premium setting to claims handling, directly impacting profitability and market responsiveness. Recent legislative efforts in Florida, such as those enacted in 2023 to stabilize the property insurance market, including tort reform and reinsurance program adjustments, are designed to reduce litigation and potentially lower Universal's costs, though their full impact will be evident in 2024 and 2025 data.

Consumer protection laws and evolving data privacy mandates, such as CCPA/CPRA, impose significant compliance burdens. In 2023, California's Attorney General secured over $1.2 million in settlements for privacy violations, underscoring the financial risks of non-compliance. As global cybersecurity spending is projected to reach $267 billion in 2024, Universal must invest in robust data governance to meet these legal obligations and maintain consumer trust.

The interpretation of insurance contracts by courts creates binding precedents that influence Universal's underwriting and claims processes. Increased litigation in 2024 concerning specific policy clauses, like business interruption, highlights the critical need for clear policy language to mitigate financial risk and avoid disputes. Regulatory bodies are expected to intensify scrutiny of policy clarity in 2025, pushing insurers towards more transparent communication.

Environmental factors

Universal Insurance Holdings, with its core business in Florida homeowners insurance, faces substantial environmental risks due to the escalating frequency and intensity of natural disasters. Hurricanes, tropical storms, and flooding events directly translate into higher claims payouts, significantly affecting the company's underwriting performance. For instance, the 2022 hurricane season, despite not making a direct landfall in Florida, still resulted in numerous claims for Universal, impacting its financial results. The availability and cost of reinsurance, crucial for managing catastrophic risk, are also directly influenced by these events.

Climate change projections indicate a potential intensification of these weather-related threats, posing a long-term challenge to Universal's business model. The National Oceanic and Atmospheric Administration (NOAA) has noted an increase in the intensity of Atlantic hurricanes over recent decades. This trend suggests that the financial impact from severe weather events could grow, necessitating robust risk management strategies and potentially leading to higher premiums for policyholders in vulnerable regions.

Long-term environmental shifts like coastal erosion and rising sea levels present a significant and escalating risk to properties insured by Universal Insurance Holdings, especially considering its substantial exposure in Florida, a state highly susceptible to these changes. These ongoing processes heighten the vulnerability of coastal real estate to the damaging effects of storm surges and increased flooding.

The intensification of these environmental threats directly translates to a greater likelihood of elevated insurance claims for Universal Insurance Holdings. Furthermore, it could lead to a contraction in the availability of insurable properties within these increasingly hazardous coastal regions, impacting the company's overall market capacity and risk portfolio.

In response, Universal Insurance Holdings must continually refine its risk assessment models and adapt its underwriting approaches to accurately price and manage the growing exposure to these climate-related perils. For instance, by mid-century, projections suggest that Florida could see sea levels rise by as much as two feet, a factor that will undeniably reshape the insurance landscape.

Environmental regulations, from land use zoning to stringent building codes, directly impact the risk Universal Insurance Holdings assumes. For instance, in 2024, California's updated seismic building standards, designed to enhance resilience, are projected to increase construction costs by an average of 5-10% for new developments, potentially affecting the insurable value and premiums.

Stricter environmental protections, such as those targeting coastal development and flood mitigation, while raising initial building expenses, can significantly lower long-term claims. A 2025 report indicated that properties built to enhanced flood-resistant standards in Florida experienced 30% fewer water damage claims compared to older structures in similar areas.

Conversely, areas with less rigorous environmental oversight might present a higher latent risk for Universal Insurance Holdings. In regions with lax regulations concerning land development near wildfire-prone zones, the average insured loss from wildfires in 2024 was 40% higher than in areas with mandated defensible space requirements.

ESG Pressures and Sustainable Practices

Universal Insurance Holdings faces increasing pressure from investors, regulators, and the public to integrate Environmental, Social, and Governance (ESG) factors into its operations. This means closely examining the environmental footprint of its investment portfolio and promoting eco-friendly business practices. For instance, as of early 2024, a significant portion of institutional investors are actively seeking ESG-compliant investments, with global sustainable investment assets projected to exceed $50 trillion by 2025, according to various industry reports.

The company is also being pushed to enhance transparency regarding climate-related financial risks. This involves detailed reporting on how climate change could impact its assets and liabilities. A key aspect is evaluating the environmental impact of its investments, which could include divesting from fossil fuels or increasing allocations to renewable energy projects. This strategic shift is not just about compliance but also about building a stronger reputation and attracting capital from a growing pool of socially responsible investors.

- Investor Demand: Over 70% of institutional investors consider ESG factors when making investment decisions in 2024.

- Regulatory Scrutiny: Regulators worldwide are introducing stricter disclosure requirements for climate-related financial risks.

- Public Awareness: Consumer preference for companies with strong sustainability credentials continues to rise.

- Reputational Benefits: Companies with robust ESG frameworks often experience improved brand loyalty and market positioning.

Impact of Climate Change on Reinsurance Market

The escalating frequency and severity of climate-related events worldwide directly impact the global insured losses, a critical factor for reinsurers like those Universal Insurance Holdings partners with to manage catastrophic risks. For instance, 2023 saw insured losses from natural catastrophes estimated at $110 billion globally, according to Swiss Re, a figure that directly influences the reinsurance market's stability and pricing.

This trend of increasing climate events translates into higher reinsurance premiums and a potential reduction in available reinsurance capacity. Consequently, Universal Insurance Holdings faces increased costs for hedging against extreme weather, which can elevate its overall cost of capital and constrain its ability to expand operations in regions particularly vulnerable to climate change.

- Increased Reinsurance Costs: Higher premiums for catastrophic coverage directly affect Universal Insurance Holdings' operational expenses.

- Reduced Capacity: A tighter reinsurance market can limit the amount of risk Universal Insurance Holdings can transfer, increasing its retained exposure.

- Impact on Growth: Expansion into high-risk geographical areas may become less viable due to the prohibitive cost or unavailability of adequate reinsurance.

Environmental factors pose significant risks to Universal Insurance Holdings, primarily due to its Florida focus and the increasing intensity of natural disasters. Climate change projections, such as potential sea-level rise in Florida by up to two feet by mid-century, directly impact property vulnerability and insurance claims. Stricter environmental regulations, like enhanced building codes, can increase initial costs but reduce long-term claims, as seen with flood-resistant structures experiencing fewer water damage claims.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Universal Insurance Holdings is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry research firms. We incorporate economic indicators from the Bureau of Labor Statistics and the Federal Reserve, alongside legislative updates from state insurance departments and federal agencies.