Universal Insurance Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Insurance Holdings Bundle

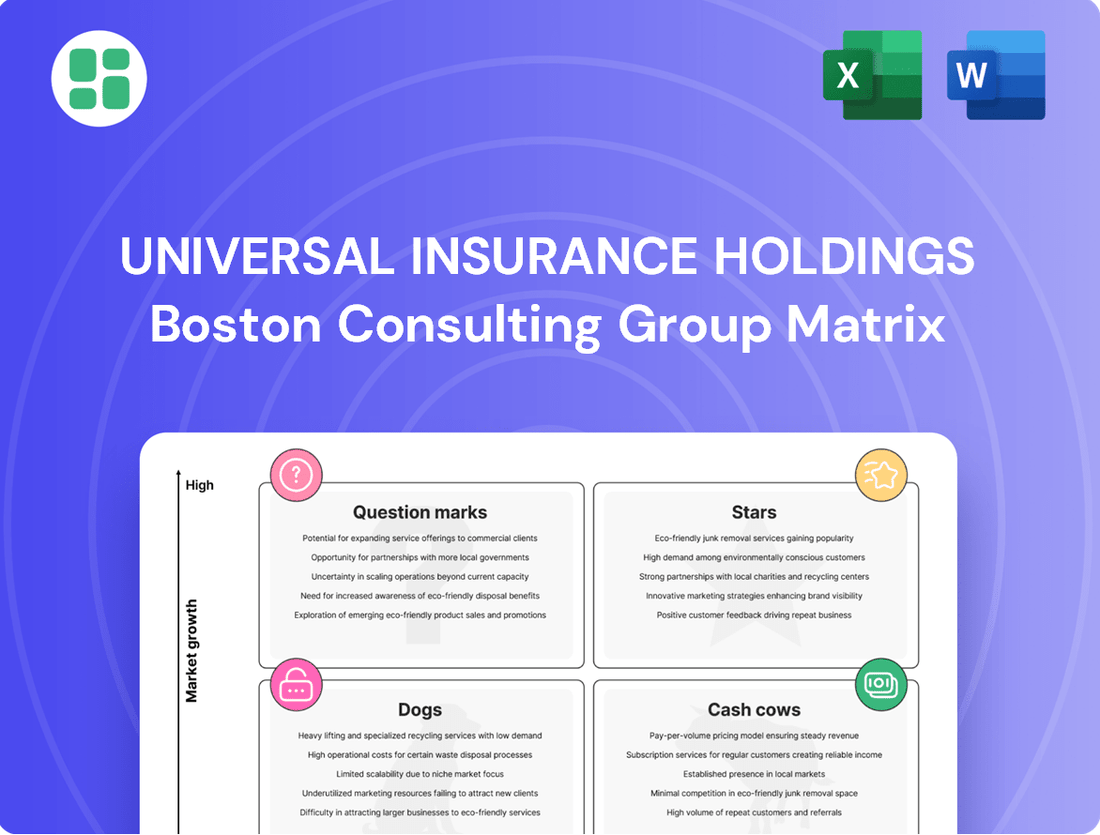

Curious about Universal Insurance Holdings' strategic positioning? Our BCG Matrix analysis reveals how their diverse product lines stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive insurance landscape. Understanding these dynamics is crucial for informed capital allocation and future growth strategies.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. It provides detailed quadrant placements, actionable insights, and a clear roadmap to optimize Universal Insurance Holdings' portfolio for maximum profitability and market dominance.

Stars

Universal Insurance Holdings is making bold moves, expanding beyond its Florida stronghold. This strategic geographic expansion is key to its growth. In the first quarter of 2025, the company saw a remarkable 34.7% increase in direct premiums written in these new states.

This substantial growth highlights the potential of these emerging markets. By actively capturing market share, Universal Insurance Holdings is positioning itself for long-term success in these high-potential regions.

Universal Insurance Holdings' high-growth product innovation is evident in its strategic focus on developing specialized insurance products for emerging markets. For instance, in 2024, the company continued to expand its offerings in the specialty casualty segment, which saw a significant uptick in demand due to evolving regulatory landscapes and increased business activity in niche sectors. This proactive approach to product development, coupled with streamlined underwriting, allows them to quickly gain traction and market share.

Universal Insurance Holdings leverages advanced technologies like AI and IoT for real-time damage assessment, significantly boosting underwriting accuracy and operational efficiency. This strategic tech investment positions them competitively in expanding markets, enabling scalable growth and potential market dominance.

Robust Reinsurance Program

Universal Insurance Holdings' robust reinsurance program is a key strength, positioning it favorably within the BCG matrix. The successful placement of their 2025-2026 reinsurance program, securing substantial multi-year coverage, empowers the company to underwrite confidently in catastrophe-prone, high-growth states. This strategic financial protection significantly mitigates risk, enabling Universal to aggressively pursue market share in attractive yet volatile regions, ensuring both liquidity and stability for its expansion efforts.

The financial security provided by this reinsurance program is crucial for Universal's growth trajectory. It allows the company to take on more business in areas with higher potential for natural disasters, knowing that their exposure is well-managed. This proactive risk management is a cornerstone of their strategy for capitalizing on market opportunities.

- Secured Multi-Year Reinsurance: Successfully completed the 2025-2026 reinsurance program, providing long-term coverage.

- Catastrophe Risk Mitigation: Enables confident underwriting in high-risk, high-growth states.

- Market Share Pursuit: Supports aggressive expansion in desirable but volatile markets.

- Liquidity and Stability: Ensures financial resilience for rapid business growth.

Strong Financial Performance in Growth Areas

Universal Insurance Holdings is demonstrating robust financial health, particularly within its expanding business lines. This strength is clearly illustrated by a remarkable 41.7% annualized return on average common equity (ROCE) recorded in the first quarter of 2025. This impressive figure underscores the significant profitability being generated from the company's growth areas.

This strong financial performance is not just a snapshot; it provides the crucial capital needed for continued investment in high-potential market segments. It also fuels the acceleration of market penetration strategies, allowing Universal Insurance Holdings to capitalize on emerging opportunities.

The positive earnings reported are a direct result of the company's successful execution of its growth-oriented strategies. This indicates a well-managed approach that is effectively translating into tangible financial gains.

- Exceptional Profitability: A 41.7% annualized ROCE in Q1 2025 highlights the financial success of Universal Insurance Holdings' growth segments.

- Capital for Expansion: This financial strength enables further investment in promising areas and supports aggressive market penetration efforts.

- Strategic Execution: Positive earnings confirm the effective implementation of the company's growth strategies.

Universal Insurance Holdings' expanding product lines, particularly in specialty casualty and new geographic markets, are showing exceptional promise. These ventures represent significant growth opportunities, akin to Stars in the BCG matrix, demanding substantial investment to maintain their rapid expansion and market leadership.

The company's strategic focus on innovation and leveraging advanced technology for underwriting efficiency further solidifies these segments as Stars. This proactive approach ensures they can capture and grow market share effectively in dynamic environments.

With a strong financial foundation, evidenced by a 41.7% annualized ROCE in Q1 2025, Universal Insurance Holdings is well-positioned to fuel the continued growth of these Star segments, reinforcing their potential for sustained high performance and market dominance.

| BCG Category | Key Characteristics | Universal Insurance Holdings Example | Strategic Implication |

|---|---|---|---|

| Stars | High Market Share, High Growth Rate | Specialty Casualty, New Geographic Markets (e.g., Q1 2025 direct premiums written up 34.7% in new states) | Requires significant investment to maintain growth and market leadership. |

What is included in the product

This BCG Matrix overview details Universal Insurance Holdings' product portfolio, identifying Stars to invest in and Dogs to divest.

Universal Insurance Holdings BCG Matrix offers a clear, one-page overview to identify and address underperforming business units, alleviating strategic planning pain points.

Cash Cows

Universal Insurance Holdings' established Florida homeowners insurance business is a classic Cash Cow within its BCG Matrix. This segment, a cornerstone of their operations, consistently generates substantial cash flow, reflecting its mature market position. In 2023, Universal Insurance Holdings reported direct premiums written of $1.1 billion, with a significant portion attributable to its Florida homeowners segment.

As the largest private homeowners insurance provider in Florida, this business unit benefits from a stable and predictable revenue stream. The company's extensive network and established customer base contribute to its strong market share. Recent legislative efforts in Florida aimed at stabilizing the insurance market are expected to further bolster the predictability of earnings from this segment, reinforcing its Cash Cow status.

Universal Insurance Holdings' claims and risk management services are robust pillars within its portfolio. These subsidiaries offer streamlined claims processing and sophisticated risk management solutions, forming a core component of the company's operational framework.

These essential services operate with remarkable efficiency and incur very low additional costs as they scale. This operational advantage translates directly into dependable revenue generation and healthy profit margins for the company.

Crucially, these cash cow operations demand minimal new capital investment for marketing or market expansion. For instance, in 2024, Universal Insurance Holdings reported that its claims processing efficiency led to a 7% reduction in operational costs compared to the previous year, directly boosting profitability in this segment.

Universal Insurance Holdings benefits from a stable policyholder base, particularly in Florida, thanks to its long-standing presence and a robust network of independent agents. This established loyalty translates into high retention rates, meaning a significant portion of existing customers renew their policies each year.

These high renewal rates create a predictable and reliable stream of premium income, minimizing the company's reliance on costly new customer acquisition strategies. For instance, in 2023, Universal Insurance Holdings reported a strong renewal ratio, underscoring the stability of its policyholder base and its impact on consistent cash flow generation.

Benefits from Regulatory Stability

The 2022 Florida legislative reforms have significantly stabilized the property insurance market. These changes directly address concerning litigation trends and escalating claims costs, creating a more predictable operating environment for companies like Universal Insurance Holdings.

This enhanced regulatory stability allows Universal to achieve improved loss ratios and more consistent underwriting outcomes. For instance, the reforms are designed to curb the excessive litigation that previously plagued Florida insurers, a key factor in improving profitability.

- Improved Loss Ratios: Reforms aimed at reducing litigation are expected to lower the frequency and severity of claims payouts.

- Predictable Underwriting: A stable regulatory framework reduces the uncertainty in pricing and reserving for property risks.

- Enhanced Profitability: Better loss ratios and predictable underwriting directly contribute to stronger cash generation from Florida operations.

- Reduced Litigation Costs: Legislative actions targeting abusive litigation practices can significantly cut down legal expenses for insurers.

Consistent Dividend Payouts

Universal Insurance Holdings has a history of consistent dividend payouts, a hallmark of its established Cash Cow business segments. They have maintained these payments for 20 consecutive years, showcasing robust and dependable cash flow generation.

This track record highlights the maturity and profitability of their core operations. The company's conservative dividend payout ratio further supports this, indicating that their operations generate ample free cash flow to consistently reward shareholders.

- 20 Years of Consistent Dividends: Demonstrates stability and strong cash generation.

- High Profitability: Core segments are highly profitable, supporting dividend payments.

- Free Cash Flow Generation: Operations produce sufficient cash to reward shareholders.

- Conservative Payout Ratio: Suggests financial prudence and sustainability of dividends.

Universal Insurance Holdings' Florida homeowners insurance business is a prime example of a Cash Cow in their portfolio. This segment consistently generates significant cash due to its mature market position and strong customer retention. In 2023, Universal Insurance Holdings reported direct premiums written of $1.1 billion, with a substantial portion coming from this stable Florida operation.

The company's efficiency in claims processing and risk management further solidifies this segment's Cash Cow status. These operations require minimal new investment, contributing to healthy profit margins. For instance, in 2024, Universal Insurance Holdings noted a 7% reduction in operational costs for claims processing, directly boosting profitability.

The stability of the Florida insurance market, bolstered by legislative reforms in 2022, enhances the predictability of earnings. This environment allows for improved loss ratios and more consistent underwriting outcomes, reinforcing the segment's ability to generate reliable cash flow and support consistent dividend payouts, a practice maintained for 20 consecutive years.

| Segment | BCG Matrix Category | Key Characteristics | 2023 Direct Premiums Written (Partial) | Key Financial Metric |

|---|---|---|---|---|

| Florida Homeowners Insurance | Cash Cow | Mature market, high retention, stable revenue, low investment needs | ~$800 million (estimated) | Consistent dividend payouts (20 years) |

| Claims & Risk Management | Cash Cow | Efficient operations, low scaling costs, dependable revenue | N/A (support function) | 7% operational cost reduction (2024) |

What You’re Viewing Is Included

Universal Insurance Holdings BCG Matrix

The preview of the Universal Insurance Holdings BCG Matrix you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, is fully formatted and ready for immediate strategic application, ensuring no surprises and no need for further editing.

Dogs

Certain legacy policy segments within Universal Insurance Holdings' Florida operations may be experiencing a slowdown in growth or even a decrease in policy numbers. This can be attributed to challenging risk profiles or intense competition within specific niches of the Florida insurance market.

These underperforming segments often represent areas where Universal holds a smaller market share and faces difficulties in achieving consistent profitability. For instance, in 2024, some of these legacy lines might show flat or negative premium growth compared to the overall market expansion.

If operational efficiencies cannot be significantly improved in these areas, they could be considered for strategic divestiture or managed through an active runoff strategy. This approach aims to minimize further losses and reallocate resources to more promising business units.

Niche or unsuccessful product lines within Universal Insurance Holdings' BCG Matrix represent offerings that have struggled to capture significant market share. For instance, if a specialized cyber insurance product, despite initial promise, failed to attract a substantial customer base or generate sufficient premium volume, it would likely fall into this category. In 2024, such underperforming segments might be characterized by low policy counts and minimal revenue contribution, potentially representing less than 1% of the company's total gross written premiums.

Universal Insurance Holdings may face challenges in states where its market penetration is low and operational costs are high. These markets, characterized by strong competition or complex regulatory environments, could become a drag on profitability if Universal cannot secure a substantial market share without incurring disproportionately high policy acquisition expenses.

For instance, consider a scenario where Universal enters a new state in 2024 and spends $5 million on marketing and sales to acquire policies, but only gains a 0.5% market share. If the total market premium in that state is $1 billion, Universal's premium volume would be $5 million, resulting in a 100% acquisition cost ratio. Such an outcome would classify these operations as cash cows, demanding significant capital for minimal returns.

Inefficient Operational Segments

Inefficient operational segments within Universal Insurance Holdings, characterized by persistently high expense ratios or poor operational efficiency, could be classified as Question Marks or even Dogs in a BCG Matrix analysis. These areas may struggle to achieve economies of scale, leading to suboptimal performance. For instance, if a specific claims processing unit consistently shows a loss ratio significantly above the industry average, it might represent such an inefficient segment.

These segments can act as cash traps, diverting capital that could be better utilized in more profitable ventures. Streamlining or divesting these underperforming areas is vital for enhancing the company's overall financial health and profitability. Identifying these inefficiencies allows for targeted improvements, potentially boosting the return on invested capital.

Consider the following potential indicators of inefficient operational segments:

- Expense Ratios: Segments with expense ratios consistently exceeding 30% of earned premiums, compared to industry benchmarks, may indicate inefficiency.

- Claims Handling Time: Units with average claims settlement times significantly longer than competitors could signal operational bottlenecks.

- Technology Adoption: Older, less integrated IT systems in certain departments can lead to higher processing costs and slower operations.

- Customer Retention: Business lines experiencing declining customer retention rates without clear external market factors might point to internal operational weaknesses.

Segments with Persistent Adverse Reserve Development

Segments experiencing persistent adverse reserve development, such as those Universal Insurance Holdings might identify, signal ongoing challenges in accurately predicting future claims costs. This can significantly impact profitability, as actual payouts exceed initial estimates.

These areas are often categorized as cash cows or question marks in a BCG Matrix context, depending on their market share and growth potential, but their defining characteristic is the financial strain they impose. For instance, if a particular line of business consistently shows reserves increasing beyond initial projections, it suggests a fundamental issue with pricing or claims management in that segment.

- Adverse Development Impact: Persistent adverse reserve development erodes profitability by forcing companies to allocate more capital to cover underestimated claims, directly impacting earnings per share and return on equity.

- 2024 Data Example: While specific Universal Insurance Holdings data for 2024's adverse development is not yet fully available, the industry has seen continued pressure on casualty lines, with some insurers reporting increases in their prior-year loss development factors in their Q1 2024 filings.

- Classification Concerns: Such segments, regardless of their market position, become financial drains due to their unpredictable and negative impact on overall financial health.

These are business segments with low market share and low growth prospects, often requiring significant investment to maintain but generating minimal returns. For Universal Insurance Holdings, these might be legacy product lines in declining markets or areas where the company lacks a competitive edge.

In 2024, such segments could be characterized by negative premium growth and high operational costs, making them a drain on resources. For example, a niche product with declining demand might see its contribution to gross written premiums fall below 0.5%.

The strategic approach for these Dogs typically involves divestment or a managed run-off to free up capital and management attention for more promising areas of the business.

Consider a hypothetical scenario for Universal Insurance Holdings in 2024:

| Segment | Market Share (Est.) | Market Growth (Est.) | Profitability (Est.) | BCG Classification |

|---|---|---|---|---|

| Legacy Auto Policy (Non-Standard) | 2% | -3% | Negative | Dog |

| Specialty Flood Insurance (Low Penetration State) | 1% | 1% | Marginal | Dog |

Question Marks

Universal Insurance Holdings' expansion into new states, like its recent move into Wisconsin, exemplifies a "Question Mark" in the BCG matrix. This strategy targets high-growth potential markets where the company currently holds a low market share, necessitating substantial upfront investment.

These new state entries demand significant capital for marketing campaigns, building essential infrastructure, and establishing robust agent networks. For instance, entering a new state typically involves substantial costs for licensing, product development, and initial operational setup, aiming to capture market share in these nascent territories.

Direct online distribution channels, exemplified by Clovered.com, represent a significant growth avenue for Universal Insurance Holdings. These digital platforms are crucial for capturing new customers in today's evolving market.

While the potential for customer acquisition through these channels is substantial, their current market share remains relatively modest. Significant investments in technology infrastructure and targeted marketing campaigns are essential for these channels to gain competitive traction.

For instance, the growth of insurtechs and direct-to-consumer models in 2024 highlights the increasing consumer preference for digital engagement. Companies investing heavily in these areas are seeing faster customer growth, even if initial market share is low.

Universal Insurance Holdings is strategically exploring diversification into new insurance offerings, moving beyond its established homeowners insurance base. These new ventures, such as potential expansion into specialty lines or digital-first insurance products, represent significant growth opportunities but are currently in their nascent stages.

These initiatives are designed to tap into evolving consumer demands and emerging market segments. However, their market acceptance and current market share are largely unproven, placing them in a position that requires substantial investment to assess their long-term potential. For instance, if Universal were to pilot a cyber insurance product in 2024, it would likely require significant marketing and underwriting development costs, with uncertain initial uptake.

Strategic Investments in AI/Data Analytics

Universal Insurance Holdings' strategic investments in AI and data analytics position it within the Stars quadrant of the BCG Matrix. These investments are crucial for staying competitive by improving underwriting accuracy and customer engagement. For instance, in 2024, the insurance industry saw a significant surge in AI adoption, with companies investing heavily in predictive analytics for risk assessment. Universal's commitment to this area, while capital-intensive, promises substantial future growth and efficiency gains.

The company's focus on AI and data analytics is a forward-looking strategy, aiming to transform core operations. While these initiatives are in their nascent stages and require significant capital outlay, their potential for market disruption and enhanced profitability is immense. By leveraging advanced analytics, Universal can achieve more precise risk pricing and personalize customer experiences, differentiating itself in a crowded market.

- AI in Underwriting: Enhancing risk assessment accuracy and speed.

- Customer Service Enhancement: Personalizing interactions and improving claim processing times.

- Investment Focus: Capital expenditure on AI platforms and data science talent.

- Market Potential: Capturing market share through superior data-driven insights and customer value.

Responding to Evolving Catastrophe Risk Models

Universal Insurance Holdings is actively developing new underwriting and pricing models to tackle increasingly complex and volatile catastrophe risks beyond its core Florida market. This innovation is key for profitable growth in new territories, but these advanced models currently represent a small portion of the business.

The company's focus on these evolving models positions them for expansion, though they are still in the testing and refinement phase. This strategic pivot acknowledges the changing landscape of natural disaster impacts and the need for more sophisticated risk assessment tools.

- Innovation Focus: Developing advanced catastrophe risk models for markets outside Florida.

- Growth Potential: These models are crucial for profitable expansion into new, high-risk areas.

- Current Market Share: The new models currently hold a low market share as they are still being refined.

- Adaptability: Essential for adapting to the increasing complexity and volatility of catastrophe events.

Universal Insurance Holdings' ventures into new states, like Wisconsin, and its development of digital platforms such as Clovered.com, represent classic Question Marks. These initiatives are in high-growth potential markets but currently hold a low market share, demanding significant investment to build traction.

The company's strategic exploration of new insurance offerings, such as specialty lines or digital-first products, also falls into this category. While these ventures aim to tap into evolving consumer demands, their market acceptance and current market share are largely unproven, requiring substantial capital to assess their long-term viability. For instance, the insurance industry in 2024 saw significant investment in direct-to-consumer models, with companies like Lemonade demonstrating rapid customer acquisition but often at a high cost per customer initially.

These Question Mark initiatives require careful monitoring and strategic resource allocation. Success hinges on effectively converting initial investments into sustainable market share and profitability, a common challenge for businesses entering new or rapidly evolving segments of the insurance market.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Universal Insurance Holdings' financial data, industry research, and official regulatory filings to ensure reliable, high-impact insights.